Cards and Payments Market Size, Share, and Trends Analysis Report

CAGR :

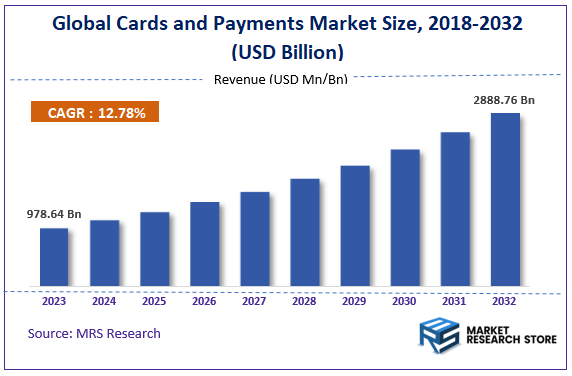

| Market Size 2023 (Base Year) | USD 978.64 Billion |

| Market Size 2032 (Forecast Year) | USD 2888.76 Billion |

| CAGR | 12.78% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global cards and payments market size was valued at around USD 978.64 billion in 2023 and is estimated to reach USD 2888.76 billion by 2032, to register a CAGR of approximately 12.78% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The cards and payments report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Cards and Payments Market: Overview

The cards and payments encompass a wide range of financial instruments and systems that facilitate transactions between consumers and merchants. It primarily includes credit cards, debit cards, prepaid cards, and mobile payment solutions. This sector has evolved significantly with the advent of digital payment technologies, making transactions faster, more secure, and convenient.

Key Highlights

- The cards and payments market is anticipated to grow at a CAGR of 12.78% during the forecast period.

- The global cards and payments market was estimated to be worth approximately USD 978.64 billion in 2023 and is projected to reach a value of USD 2888.76 billion by 2032.

- The growth of the cards and payments market is being driven by the rapid growth of e-commerce, increased adoption of contactless and mobile payment solutions, and rising consumer preference for cashless transactions due to convenience and security.

- Based on the type, the payment services segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the commercial segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Cards and Payments Market: Dynamics

Key Growth Drivers

- Digitalization and E-commerce: The increasing adoption of online shopping and digital transactions has fueled the demand for cards and payment solutions.

- Mobile Payments: The widespread use of smartphones and the development of mobile payment apps have made it convenient for consumers to make payments using cards.

- Financial Inclusion: Efforts to promote financial inclusion have led to a rise in the number of individuals with access to banking services, including card payments.

- Government Initiatives: Government policies and initiatives supporting digital payments have created a favorable environment for the growth of the cards and payments market.

Restraints

- Security Concerns: Concerns about data breaches and fraud have hindered the adoption of card payments, especially among consumers with limited digital literacy.

- Infrastructure Limitations: In some regions, inadequate infrastructure, such as limited internet connectivity and lack of POS terminals, can pose challenges to the adoption of card payments.

- Cost Factors: The costs associated with card issuance, processing, and acceptance can be a barrier for small businesses and individuals.

- Regulatory Hurdles: Complex regulations and compliance requirements can increase operational costs and slow down the growth of the market.

Opportunities

- Emerging Markets: The untapped potential of emerging markets, with growing populations and rising incomes, presents significant opportunities for the cards and payments industry.

- Innovation: Advancements in technology, such as biometric authentication and contactless payments, can drive innovation and enhance the user experience.

- Integration with Financial Services: The integration of card payments with other financial services, such as loans and insurance, can create new revenue streams and cross-selling opportunities.

- Data Analytics: The use of data analytics can help businesses better understand consumer behavior, improve risk management, and personalize offerings.

Challenges

- Competition: Intense competition from fintech startups and alternative payment methods, such as cryptocurrencies, can erode market share and profitability.

- Changing Consumer Preferences: Evolving consumer preferences and expectations can make it difficult for traditional card issuers to stay relevant.

- Economic Uncertainty: Economic downturns and fluctuations can impact consumer spending and affect the demand for card payments.

- Regulatory Changes: Changes in government policies and regulations can create uncertainty and impact the market dynamics.

Cards and Payments Market: Segmentation Insights

The global cards and payments market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global cards and payments market is divided into cards and payment services.

Payment services emerge as the most dominant segment in the cards and payments market. This category encompasses various platforms and technologies that facilitate electronic payments, including payment gateways, mobile payment applications, and digital wallets.

The significant growth in this segment is driven by the increasing shift toward e-commerce and mobile shopping, with consumers favoring seamless and efficient payment methods.

Payment services offer a range of features, such as fraud detection, transaction tracking, and multi-currency support, enhancing the overall user experience. The rise of fintech companies has intensified competition within this space, leading to innovation and improved service offerings. As businesses continue to adopt digital payment solutions, the demand for payment services is expected to remain strong.

Payment cards, including debit cards, credit cards, and prepaid cards, constitute another key segment of the cards and payments market. These cards are widely used for a variety of transactions, thanks to their convenience and accessibility. The increasing adoption of cashless transactions globally has significantly contributed to the growth of this segment.

Payment cards allow consumers to make purchases without the need to carry cash, enabling quicker and safer transactions. The rise of contactless payments has further boosted this segment's popularity, as users can complete transactions with a simple tap of their card. Enhanced security features, such as EMV chips and biometric authentication, have also increased consumer confidence in using payment cards.

Segmentation Insights by Application

On the basis of application, the global cards and payments market is bifurcated into commercial, bank, shopping, and others.

The commercial application segment is one of the most significant in the cards and payments market. This segment encompasses businesses and organizations that utilize payment cards and services for various operational transactions.

Commercial entities often rely on payment solutions for purchasing goods and services, processing employee expenses, and managing vendor payments. The growth of this segment is driven by the increasing demand for efficient and streamlined payment processes, which enhance cash flow management and reduce transaction costs. Moreover, the adoption of corporate cards and expense management solutions has further contributed to the rise of commercial applications, as businesses seek to gain better control over their spending.

The shopping application segment represents a substantial portion of the cards and payments market, driven by the rising trend of e-commerce and retail transactions. This segment includes both online and offline shopping, where consumers use payment cards and digital wallets to make purchases. The convenience and security offered by these payment methods have led to increased consumer preference for cashless transactions, particularly during the pandemic.

Retailers are also adopting advanced payment technologies, such as contactless payments and mobile wallets, to enhance the shopping experience and improve customer satisfaction. As consumers continue to embrace digital shopping, this segment is expected to grow further.

The bank application segment focuses on the utilization of cards and payment services by financial institutions. Banks leverage these payment solutions to facilitate transactions for their customers, offering services such as fund transfers, bill payments, and account management.

This segment is crucial for ensuring secure and efficient banking operations, as it enables customers to access their funds and make transactions easily. The increasing trend of digital banking and the rise of fintech solutions have driven banks to enhance their payment offerings, leading to improved customer engagement and satisfaction. As the financial landscape evolves, the bank application segment will continue to play a vital role in the overall cards and payments market.

Cards and Payments Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cards and Payments Market |

| Market Size in 2023 | USD 978.64 Billion |

| USD 2888.76 Billion | |

| Growth Rate | CAGR of 12.78% |

| Number of Pages | 226 |

| Key Companies Covered | Visa Inc., Mastercard Incorporated, American Express Company (Amex), PayPal Holdings Inc., Square Inc., Discover Financial Services, JCB Co. Ltd., Diners Club International, Adyen N.V., FIS (Fidelity National Information Services), Worldpay Inc., Alipay (Ant Group), WeChat Pay (Tencent), Samsung Pay, Apple Pay, Google Pay, Revolut Ltd., and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cards and Payments Market: Regional Insights

- North America is expected to dominates the global market

North America is a leader in the cards and payments market, driven primarily by the high adoption of advanced payment technologies, a well-established banking infrastructure, and a strong consumer preference for cashless transactions. The region boasts a significant number of credit and debit card users, supported by the rapid growth of contactless payments and mobile wallets.

Additionally, the presence of major payment processors and technology firms enhances innovation and competition, making it a hotspot for new payment solutions. The regulatory environment also fosters security and consumer protection, contributing to the overall growth of the market.

Europe holds a prominent position in the cards and payments market, characterized by a strong shift towards digital payment solutions. Countries like the United Kingdom, Germany, and France are at the forefront of this trend, supported by robust e-commerce growth and widespread smartphone penetration.

The European Union's regulatory initiatives, such as the Revised Payment Services Directive (PSD2), further stimulate competition and innovation in the payments landscape. The increasing consumer demand for seamless and secure payment options, combined with the rise of fintech companies, drives the growth of contactless payments and digital wallets across the region.

The Asia-Pacific region is experiencing rapid growth in the cards and payments market, largely due to the increasing population of digitally savvy consumers and the expansion of e-commerce. Countries like China and India are leading the charge, with China dominating the mobile payments segment thanks to platforms like Alipay and WeChat Pay.

The rise of fintech solutions and government initiatives promoting cashless economies are significantly contributing to the uptake of cards and digital payments. The region's diverse demographic and economic factors create a unique landscape for payment innovations, making it an attractive market for investment.

Latin America is gradually embracing the cards and payments market, driven by a growing middle class, increased internet penetration, and the proliferation of smartphones. Countries such as Brazil and Mexico are witnessing significant growth in card transactions, aided by government initiatives to promote financial inclusion and reduce reliance on cash. The expansion of e-commerce platforms and the rise of digital wallets are further facilitating the shift towards cashless transactions.

However, challenges such as varying levels of banking infrastructure and consumer trust in digital payments still persist, which may impact the overall growth trajectory in the region.

The Middle East and Africa are emerging markets for the cards and payments sector, marked by a growing interest in digital payment solutions. While mobile payments are gaining traction in countries like South Africa and Kenya, challenges related to infrastructure, regulatory environments, and economic instability hinder faster adoption.

However, initiatives aimed at improving financial inclusion and the rise of fintech companies are fostering innovation in payment solutions. As mobile and internet penetration continues to increase, the region is expected to see gradual growth in the cards and payments market, positioning itself as a developing hub for payment technologies.

Cards and Payments Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the cards and payments market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global cards and payments market include:

- Visa Inc.

- Mastercard Incorporated

- American Express Company (Amex)

- PayPal Holdings, Inc.

- Square Inc.

- Discover Financial Services

- JCB Co. Ltd.

- Diners Club International

- Adyen N.V.

- FIS (Fidelity National Information Services)

- Worldpay, Inc.

- Alipay (Ant Group)

- WeChat Pay (Tencent)

- Samsung Pay

- Apple Pay

- Google Pay

- Revolut Ltd.

The global cards and payments market is segmented as follows:

By Type

- Cards

- Payment Services

By Application

- Commercial

- Bank

- Shopping

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global cards and payments market size was projected at approximately US$ 978.64 billion in 2023. Projections indicate that the market is expected to reach around US$ 2888.76 billion in revenue by 2032.

The global cards and payments market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 12.78% during the forecast period from 2024 to 2032.

North America is expected to dominate the global cards and payments market.

Significant factors driving the global cards and payments market include the rapid growth of e-commerce, increased adoption of contactless and mobile payment solutions, and rising consumer preference for cashless transactions due to convenience and security.

Some of the prominent players operating in the global cards and payments market are; Visa Inc., Mastercard Incorporated, American Express Company (Amex), PayPal Holdings Inc., Square Inc., Discover Financial Services, JCB Co. Ltd., Diners Club International, Adyen N.V., FIS (Fidelity National Information Services), Worldpay Inc., Alipay (Ant Group), WeChat Pay (Tencent), Samsung Pay, Apple Pay, Google Pay, Revolut Ltd., and others.

Table Of Content

Inquiry For Buying

Cards and Payments

Request Sample

Cards and Payments