Recycling Equipment and Machinery Market Size, Share, and Trends Analysis Report

CAGR :

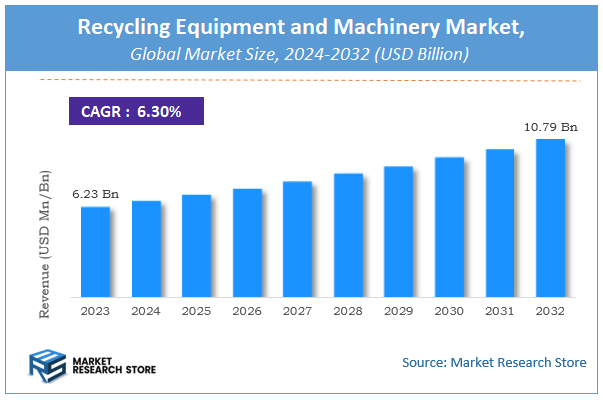

| Market Size 2023 (Base Year) | USD 6.23 Billion |

| Market Size 2032 (Forecast Year) | USD 10.79 Billion |

| CAGR | 6.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Recycling Equipment and Machinery Market Insights

According to Market Research Store, the global recycling equipment and machinery market size was valued at around USD 6.23 billion in 2023 and is estimated to reach USD 10.79 billion by 2032, to register a CAGR of approximately 6.3% in terms of revenue during the forecast period 2024-2032.

The recycling equipment and machinery report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Recycling Equipment and Machinery Market: Report Scope

This report thoroughly analyzes the Recycling Equipment and Machinery Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Recycling Equipment and Machinery Market |

| Market Size in 2023 | USD 6.23 Billion |

| Market Forecast in 2032 | USD 10.79 Billion |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 178 |

| Key Companies Covered | Lefort, Danieli Centro Recycling, Morita Holdings Corporation, Forrec srl Recycling, BHS-Sonthofen, Panchal Plastic Machinery Private Ltd., Mid Atlantic Waste, Suny Group, Roter Recycling, and Vecoplan AG. |

| Segments Covered | By Machines, By Material, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Global Recycling Equipment and Machinery Market: Overview

The recycling equipment and machinery market comprises industrial systems designed to process, sort, and repurpose waste materials, including metals, plastics, paper, glass, and e-waste. These machines—such as shredders, balers, separators, and sorting systems—play a critical role in waste management, circular economy initiatives, and resource recovery, driven by global sustainability mandates and stricter environmental regulations. The market serves municipal waste facilities, scrap recyclers, and manufacturing plants, with demand fueled by rising waste generation, corporate ESG commitments, and government policies promoting recycling. However, high capital costs and operational complexities pose challenges to adoption, particularly in developing regions.

The recycling equipment and machinery market is experiencing robust growth driven by global sustainability initiatives and increasing waste management challenges. This market encompasses a wide range of industrial systems including shredders, sorting lines, balers, and separation technologies designed to process diverse waste streams such as plastics, metals, paper, and electronic waste. Key growth drivers include stringent government regulations promoting circular economy practices, corporate sustainability commitments, and rising public awareness about environmental conservation. The market is further propelled by technological advancements incorporating AI-powered optical sorting, robotic automation, and smart sensor-based systems that significantly improve recycling efficiency and material purity rates.

Key Highlights

- The recycling equipment and machinery market is anticipated to grow at a CAGR of 6.3% during the forecast period.

- The global recycling equipment and machinery market was estimated to be worth approximately USD 6.23 billion in 2023 and is projected to reach a value of USD 10.79 billion by 2032.

- The growth of the recycling equipment and machinery market is being driven by increasing environmental awareness, stricter government regulations promoting recycling, and the rising demand for recycled materials across various industries.

- Based on the machines, the baler presses segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the plastic segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Recycling Equipment and Machinery Market: Dynamics

Key Growth Drivers

- Stricter Environmental Regulations and Policies: Governments worldwide are implementing more stringent regulations on waste management, landfill disposal, and promoting recycling targets, thereby driving the demand for recycling infrastructure and equipment.

- Growing Awareness of Environmental Sustainability: Increasing public and corporate awareness of environmental issues and the need for a circular economy is leading to greater emphasis on recycling and resource conservation, fueling the demand for related machinery.

- Economic Benefits of Resource Recovery: Recycling reduces the reliance on virgin raw materials, which can be economically advantageous due to fluctuating commodity prices and the energy savings associated with using recycled materials.

- Technological Advancements in Recycling Processes: Innovations in sorting technologies (e.g., AI-powered optical sorters), processing machinery (e.g., advanced shredders, balers), and material recovery techniques are improving efficiency and the quality of recycled materials.

- Increasing Waste Generation Globally: The continuous rise in global waste generation due to population growth and consumption patterns necessitates efficient recycling solutions and the equipment to handle the volume.

- Corporate Sustainability Initiatives: Many companies are setting ambitious sustainability goals, including increasing the use of recycled content in their products and improving waste management within their operations, driving demand for recycling equipment.

- Expansion of E-waste and Plastic Recycling: The rapidly growing volumes of electronic waste and plastic waste, coupled with environmental concerns, are creating specific demand for specialized recycling equipment and technologies.

- Government Incentives and Funding for Recycling Infrastructure: Many governments are offering financial incentives, subsidies, and grants to support the development and modernization of recycling infrastructure.

Restraints

- High Initial Investment Costs: The cost of purchasing and installing advanced recycling equipment can be substantial, posing a barrier for smaller recycling facilities and municipalities.

- Fluctuations in Commodity Prices for Recycled Materials: The economic viability of recycling can be affected by the volatility of prices for recovered materials, which can impact the return on investment for recycling equipment.

- Contamination and Quality Issues of Input Waste: Inconsistent quality and high levels of contamination in incoming waste streams can reduce the efficiency of recycling equipment and the quality of the output materials.

- Lack of Standardized Recycling Processes and Infrastructure in Some Regions: In many developing countries, the lack of well-established recycling infrastructure and standardized processes hinders the widespread adoption of advanced recycling equipment.

- Technical Complexity and Maintenance Requirements: Modern recycling machinery can be technically complex, requiring skilled personnel for operation, maintenance, and troubleshooting.

- Limited Availability of Skilled Labor: The recycling industry often faces a shortage of skilled technicians and operators to manage and maintain sophisticated recycling equipment.

- Resistance to Using Recycled Materials in Some Industries: Some industries may have concerns about the quality and consistency of recycled materials, limiting their willingness to use them and thus impacting the demand for high-quality recycling equipment.

- Economic Downturns Affecting Investment: Economic recessions can lead to reduced investment in capital-intensive projects like upgrading or expanding recycling facilities.

Opportunities

- Development of More Efficient and Cost-Effective Recycling Technologies: Innovations aimed at reducing energy consumption, increasing processing speed, and lowering the overall cost of recycling equipment.

- Specialized Equipment for Emerging Waste Streams: Designing and manufacturing equipment specifically for the recycling of complex waste streams like e-waste, batteries, and composite materials.

- Integration of Automation and Artificial Intelligence (AI): Implementing AI-powered sorting systems and automated processes to improve accuracy, efficiency, and reduce labor costs.

- Modular and Scalable Recycling Solutions: Offering modular and scalable equipment that can be adapted to the specific needs and capacities of different recycling facilities.

- Focus on Improving the Quality of Recycled Materials: Developing technologies that can remove contaminants and produce high-quality secondary resources that meet the standards of manufacturing industries.

- Expansion of Recycling Infrastructure in Developing Economies: Significant opportunities exist for deploying modern recycling equipment in developing countries as they improve their waste management systems.

- Circular Economy Initiatives Driving Demand for Advanced Recycling: The growing global focus on circular economy models will further increase the need for sophisticated recycling technologies to recover and reuse resources effectively.

- Digitalization and Data Analytics for Recycling Operations: Utilizing data analytics to optimize equipment performance, predict maintenance needs, and improve overall operational efficiency in recycling plants.

Challenges

- Improving the Quality and Consistency of Recycled Feedstock: Developing effective methods for sorting and processing waste to produce high-quality, consistent recycled materials that meet industry standards.

- Reducing Contamination in the Recycling Stream: Implementing better waste collection and pre-processing techniques to minimize contamination and improve the efficiency of recycling equipment.

- Ensuring the Economic Viability of Recycling Operations: Balancing the costs of equipment and operation with the fluctuating market prices for recycled commodities.

- Developing Infrastructure in Regions with Limited Recycling Capabilities: Building the necessary collection, sorting, and processing infrastructure in areas with underdeveloped waste management systems.

- Addressing the Skills Gap in the Recycling Industry: Investing in training and education programs to develop a skilled workforce capable of operating and maintaining advanced recycling equipment.

- Promoting Greater Use of Recycled Materials by Manufacturers: Encouraging and incentivizing manufacturers to incorporate higher percentages of recycled content in their products.

- Adapting to the Diverse and Evolving Nature of Waste Streams: Developing flexible recycling equipment that can handle a wide variety of materials and adapt to changes in waste composition.

- Harmonizing Recycling Standards and Regulations Globally: Establishing more consistent standards and regulations across different regions to facilitate international trade in recycled materials and equipment.

Recycling Equipment and Machinery Market: Segmentation Insights

The global recycling equipment and machinery market is divided by machines, material, and region.

Segmentation Insights by Machines

Based on machines, the global recycling equipment and machinery market is divided into baler presses, shredders, shears, granulators, agglomerators, and extruders.

Baler Presses are the most dominant machines in the recycling equipment and machinery market. These devices are essential for compressing recyclable waste—such as cardboard, paper, plastics, and metals—into compact, manageable bales for efficient storage, transportation, and resale. Their widespread use across municipal waste facilities, manufacturing plants, and recycling centers stems from their ability to reduce waste volume significantly, which lowers transportation costs and improves operational efficiency. As regulations around waste handling tighten and global recycling activities intensify, demand for vertical and horizontal baler presses continues to surge.

Shredders hold a substantial market share as they are critical in the initial stage of recycling operations. Shredding equipment breaks down bulk materials such as metal, plastic, rubber, wood, and electronic waste into smaller, uniform pieces that are easier to sort, clean, and reprocess. These machines are widely used across industries due to their adaptability to various waste streams. The rising e-waste problem and the need for resource recovery are also fueling investments in advanced shredding technologies, including single-shaft, dual-shaft, and four-shaft models.

Shears are heavily utilized in the metal recycling sector, particularly for cutting and downsizing scrap metal into pieces suitable for melting or further processing. Hydraulic alligator shears and guillotine shears are common in steel plants and automotive recycling yards. These machines enhance productivity and safety during metal processing and are critical in managing bulky and irregular scrap. The expansion of the construction and automotive sectors is indirectly supporting the demand for shearing equipment, especially in developing economies.

Granulators are designed for the secondary processing of plastics and rubber. They grind down pre-shredded materials into finer granules, which are ideal for melting, extrusion, or compounding. Granulators are essential in closed-loop recycling operations where plastic waste is processed back into usable resins or pellets. They are especially common in plastic packaging, textile, and automotive component recycling. As the plastics industry shifts towards circularity, the adoption of energy-efficient and low-noise granulation systems is increasing.

Agglomerators serve a niche but crucial role in recycling soft, lightweight materials such as plastic films, fibers, and foams that are otherwise difficult to process. These machines compress and densify such materials, often turning them into small pellets or agglomerates that can be reintroduced into extrusion lines. Commonly used in polyethylene and polypropylene film recycling, agglomerators help reduce bulk density and enhance the flowability of materials in downstream processes. Their use is expanding with increased demand for film recycling, especially in agricultural and packaging sectors.

Extruders are a cornerstone of plastic recycling, converting shredded or granulated plastic waste into continuous plastic strands, pellets, or sheets for reuse in manufacturing. Both single-screw and twin-screw extruders are used depending on material type and output requirements. They are key in turning post-consumer waste into functional polymers, which are then used in producing new products such as containers, piping, and textiles. As plastic sustainability gains traction, advanced extrusion technologies with filtration and degassing systems are becoming more popular.

Segmentation Insights by Material

On the basis of material, the global recycling equipment and machinery market is bifurcated into plastic, ferrous & non-ferrous, wood paper & cardboard, and rubber.

Plastic recycling equipment and machinery represents the dominant segment in the market due to the immense volume of global plastic waste and rising environmental concerns. The demand for shredders, granulators, agglomerators, and extruders for plastic processing is growing rapidly, especially in packaging, consumer goods, and automotive sectors. As nations implement stricter plastic usage regulations and corporations invest in circular economy models, plastic recycling machinery sees significant adoption. Moreover, the emergence of biodegradable plastics and the development of multi-layer recycling technologies are further influencing the evolution of this segment.

Ferrous & Non-Ferrous metal recycling equipment and machinery forms a vital component of the market, especially in automotive, construction, and electronics industries. Equipment such as shears, baler presses, and shredders are extensively used to handle steel, aluminum, copper, and other metal scrap. The high economic value of metals, combined with the energy savings from recycling them, drives the consistent demand for robust and automated systems. Technological advancements in metal sorting, magnetic separation, and sensor-based sorting are enhancing process efficiency, contributing to the growth of this segment.

Wood, Paper & Cardboard recycling machinery caters to municipal and commercial sectors handling bulk packaging and construction debris. Balers and shredders are widely used to compress and process these lightweight but voluminous materials. Although less capital-intensive than metal or plastic recycling, this segment plays a critical role in sustainability efforts, especially in paper manufacturing and logistics industries. Rising demand for recycled paper products and sustainable packaging is fueling investments in more energy-efficient and dust-controlled machinery tailored for fibrous materials.

Rubber recycling equipment primarily targets end-of-life tires and industrial rubber waste. Shredders, grinders, and cryogenic processing systems are commonly employed to break down rubber into crumb rubber or reclaimable material. While smaller in size compared to plastics and metals, this segment is gaining traction due to growing environmental issues associated with tire waste and rising demand for rubberized asphalt and recycled rubber products in construction, sports surfaces, and molded goods.

Recycling Equipment and Machinery Market: Regional Insights

- North America is expected to dominate the global market

North America is the dominant region in the global recycling equipment and machinery market, driven by a combination of strict environmental regulations, advanced recycling infrastructure, and high technology adoption. The United States leads the regional market with strong federal and state mandates supporting recycling goals across sectors such as municipal solid waste, construction and demolition, automotive scrap, and electronics. Innovations in automation, AI-powered sorting systems, and robotic material recovery facilities are widely implemented to improve efficiency and reduce labor costs. Canada also plays a key role through its emphasis on sustainability and zero-waste goals. Extended Producer Responsibility (EPR) policies are widely adopted, compelling manufacturers to invest in recycling machinery. Furthermore, corporate sustainability commitments and rising awareness among consumers push both public and private sectors to invest in high-performance, environmentally friendly recycling equipment.

Europe is a highly developed and regulation-intensive market, known for its advanced recycling standards and policies. The European Union's legislative frameworks, such as the Circular Economy Action Plan and the Waste Framework Directive, mandate ambitious recycling targets that fuel demand for innovative machinery. Germany, France, the Netherlands, and the Nordic countries are front-runners in deploying fully automated, AI-driven recycling plants. These countries prioritize circular resource utilization and strict landfill reduction, which increases investment in advanced shredders, balers, and granulators. While the region is highly competitive and technologically sophisticated, market saturation in some areas has shifted focus toward optimizing existing systems and upgrading older equipment.

Asia Pacific is experiencing rapid growth in the recycling equipment and machinery market, driven by increasing waste generation, industrial expansion, and supportive policy reforms. China has significantly scaled up its domestic recycling operations following its waste import ban, investing in local equipment manufacturing and closed-loop processing systems. India is expanding its recycling sector through national missions and state-level initiatives focusing on e-waste, plastic waste, and metal recovery. Japan and South Korea represent mature markets with advanced automation and robotics in recycling processes. Despite strong growth potential, the region still lags North America in terms of uniform regulatory enforcement, equipment standardization, and fully integrated recycling systems, especially in developing nations.

Latin America presents moderate growth potential, with recycling equipment adoption concentrated in larger economies such as Brazil, Mexico, and Argentina. Governments are beginning to prioritize sustainable waste management, especially in urban centers, by supporting infrastructure development and formalization of informal recycling sectors. There is increasing interest in affordable and regionally manufactured machinery, especially for metal, plastic, and municipal waste recycling. However, inconsistent regulatory frameworks, limited public investment, and logistical challenges continue to slow broader adoption of advanced recycling equipment across the region.

Middle East & Africa region is emerging in the global recycling equipment market, with key developments driven by environmental sustainability goals and urbanization. Gulf nations such as Saudi Arabia, the UAE, and Qatar are investing in large-scale recycling plants as part of national strategies to reduce landfill dependency and promote circular economies. South Africa is the leading player on the African continent, with a growing domestic recycling sector supported by EPR schemes and public-private partnerships. Nevertheless, across many parts of the region, challenges such as infrastructure gaps, limited technical expertise, and lower public awareness hinder market acceleration.

Recycling Equipment and Machinery Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the recycling equipment and machinery market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global recycling equipment and machinery market include:

- Lefort

- Danieli Centro Recycling

- Morita Holdings Corporation

- Forrec srl Recycling

- BHS-Sonthofen

- Panchal Plastic Machinery Private Ltd.

- Mid Atlantic Waste

- Suny Group

- Roter Recycling

- Vecoplan AG.

The global recycling equipment and machinery market is segmented as follows:

By Machines

- Baler Presses

- Shredders

- Shears

- Granulators

- Agglomerators

- Extruders

By Material

- Plastic

- Ferrous & Non-Ferrous

- Wood Paper & Cardboard

- Rubber

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Recycling Equipment and Machinery

Request Sample

Recycling Equipment and Machinery