Plastic Pipes Market Size, Share, and Trends Analysis Report

CAGR :

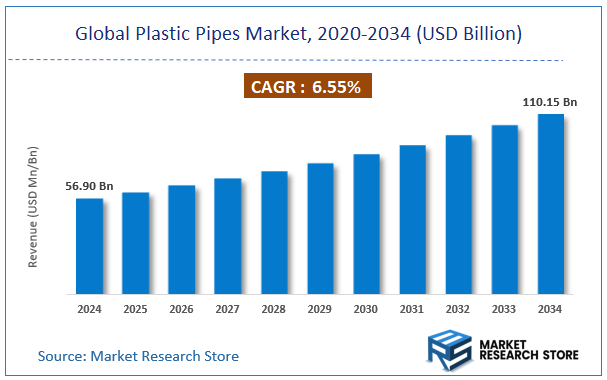

| Market Size 2024 (Base Year) | USD 56.90 Billion |

| Market Size 2034 (Forecast Year) | USD 110.15 Billion |

| CAGR | 6.55% |

| Forecast Period | 2025 - 2034 |

| Historical Period | 2019 - 2023 |

According to Market Research Report, the global plastic pipes market size was valued at around USD 56.90 billion in 2024 and is estimated to reach USD 110.15 billion by 2034, to register a CAGR of approximately 6.55% in terms of revenue during the forecast period 2025-2034.

To Get more Insights, Request a Free Sample

The plastic pipes report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2034.

Global Plastic Pipes Market: Overview

Plastic pipes are cylindrical hollow structures made from various polymer materials, such as polyvinyl chloride (PVC), polyethylene (PE), polypropylene (PP), and chlorinated polyvinyl chloride (CPVC). These pipes are widely used in applications like water supply, drainage systems, gas distribution, and industrial fluid transportation due to their lightweight, corrosion resistance, flexibility, and cost-effectiveness. Compared to metal pipes, plastic pipes offer better chemical resistance, longer lifespan, and ease of installation, making them a preferred choice in residential, commercial, and industrial sectors.

Key Highlights

- The plastic pipes market is anticipated to grow at a CAGR of 6.55% during the forecast period.

- The global plastic pipes market was estimated to be worth approximately USD 56.90 billion in 2024 and is projected to reach a value of USD 110.15 billion by 2034.

- The growth of the plastic pipes market is being driven by increasing urbanization, infrastructure development, and the rising demand for efficient water management systems.

- Based on the material, the polyvinyl chloride (PVC) segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the water supply segment is projected to swipe the largest market share.

- In terms of end-user, the building & construction segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period.

Plastic Pipes Market: Dynamics

Key Growth Drivers

- Infrastructure Development – The rapid expansion of urbanization and government investments in water supply, sewage systems, and irrigation projects boost the demand for plastic pipes.

- Superior Material Properties – Plastic pipes are lightweight, corrosion-resistant, and durable, making them a preferred choice over traditional metal pipes.

- Growing Demand in Construction & Agriculture – Increased construction activities and the need for efficient irrigation systems drive market growth.

- Rising Adoption of PVC & PEX Pipes – The shift toward PVC and PEX pipes due to their flexibility and ease of installation accelerates industry expansion.

Restraints

- Fluctuating Raw Material Prices – The dependency on crude oil-based polymers causes price volatility, affecting profit margins.

- Environmental Concerns – Plastic waste management and sustainability issues pose regulatory challenges, impacting market adoption.

- Competition from Alternative Materials – Metal and composite pipes offer strong competition, limiting the market expansion of plastic pipes in specific applications.

Opportunities

- Advancements in Recycling Technologies – Improved recycling methods and biodegradable plastic pipes create new growth avenues.

- Expansion in Emerging Markets – Increasing demand in Asia-Pacific, Latin America, and Africa due to rapid urbanization and industrialization presents lucrative opportunities.

- Smart Piping Solutions – Integration of IoT and leak detection systems in plastic pipelines opens innovative market prospects.

Challenges

- Stringent Regulations & Standards – Compliance with environmental laws and industry standards can increase production costs.

- Durability & Performance Concerns – Some plastic pipes may face limitations in high-temperature and high-pressure applications.

- Supply Chain Disruptions – Global supply chain constraints and raw material shortages can hinder market growth.

Plastic Pipes Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Plastic Pipes Market |

| Market Size in 2024 | USD 56.90 Billion |

| USD 110.15 Billion | |

| Growth Rate | CAGR of 6.55% |

| Number of Pages | 140 |

| Key Companies Covered | Mexichem SAB de CV, Chevron Phillips Chemical Company, Pipe Corporation, Finolex Industries Ltd, Aliaxis Group S.A., Wienerberger AG, ASTRAL POLYTECHNIK LIMITED, Tommur Industry (Shanghai) CO. LTD, Kubota ChemiX Co. Ltd, Kotec Corporation, Aalberts Industries N.V., Atkore Inc., Fletcher Building Ltd., Georg Fischer AG, Nan Ya Plastics Corp., Orbia Advance Corporation S.A.B de CV, Sekisui Chemical Co. Ltd., Tessenderlo Chemie NV., and others. |

| Segments Covered | By Material, By Applications, By End-user, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2019 to 2023 |

| Forecast Year | 2025 - 2034 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Plastic Pipes Market: Segmentation Insights

The global plastic pipes market is divided by material, application, end-user, and region.

Segmentation Insights by Material

Based on material, the global plastic pipes market is divided into polyvinyl chloride, polypropylene, polyethylene, and others.

Polyvinyl Chloride (PVC) dominates the plastic pipes market due to its extensive application in water supply, sewage, and irrigation systems. PVC pipes offer a balance of affordability, durability, and chemical resistance, making them the preferred choice in residential, commercial, and industrial sectors. Their lightweight nature and ease of installation further enhance their market appeal. Additionally, advancements in PVC formulations, such as CPVC (Chlorinated Polyvinyl Chloride), have expanded their usability in hot water applications, increasing their demand in plumbing and infrastructure projects.

Polyethylene (PE) follows as the second most dominant segment, particularly due to its flexibility, impact resistance, and ability to withstand extreme weather conditions. High-Density Polyethylene (HDPE) pipes are widely used in gas distribution, water transportation, and industrial applications due to their excellent strength and leak-proof joints. Low-Density Polyethylene (LDPE) is also used in irrigation and drainage systems, making PE a highly versatile material in the plastic pipes market.

Polypropylene (PP) ranks third, primarily used in high-temperature applications such as industrial drainage, HVAC systems, and chemical processing. PP pipes offer superior resistance to corrosion, abrasion, and aggressive chemicals, making them ideal for specialized industrial uses. However, their relatively higher cost and limited mechanical strength compared to PVC and PE restrict their widespread adoption in mainstream plumbing and infrastructure applications.

Segmentation Insights by Application

On the basis of application, the global plastic pipes market is bifurcated into irrigation, water supply, sewerage, plumbing, HVAC, and others.

Water Supply is the most dominant application segment in the plastic pipes market, driven by the extensive use of plastic pipes in municipal and residential water distribution systems. Polyvinyl Chloride (PVC) and High-Density Polyethylene (HDPE) pipes are widely used due to their corrosion resistance, durability, and cost-effectiveness. Governments and private entities continuously invest in upgrading water supply infrastructure, further boosting demand for plastic pipes in this segment.

Sewerage follows as the second most dominant segment, as plastic pipes are extensively used for wastewater management and drainage systems. The non-corrosive nature of PVC and Polypropylene (PP) makes them ideal for sewerage applications, preventing blockages and leakages. Many municipalities and industries are replacing aging metal and concrete sewer pipes with plastic alternatives, contributing to market growth.

Irrigation holds a significant share in the plastic pipes market, particularly in agricultural regions where efficient water management is essential. Polyethylene (PE) and PVC pipes are widely used for drip and sprinkler irrigation systems, as they offer flexibility, durability, and resistance to chemicals. With increasing water conservation efforts and government initiatives promoting modern irrigation techniques, this segment continues to expand.

Plumbing is another crucial application, with plastic pipes being preferred in residential, commercial, and industrial buildings. Chlorinated Polyvinyl Chloride (CPVC) and Polybutylene (PB) pipes are particularly popular for hot and cold water plumbing due to their ability to withstand high temperatures and pressure. The rapid urbanization and growth of the construction industry further propel the demand for plastic pipes in plumbing applications.

HVAC (Heating, Ventilation, and Air Conditioning) systems rely on plastic pipes, particularly PP and PE pipes, for transporting hot and chilled water. These pipes are lightweight, corrosion-resistant, and energy-efficient, making them suitable for HVAC networks in commercial and industrial buildings. However, their market share is relatively smaller compared to water supply and sewerage applications.

Segmentation Insights by End-User

On the basis of end-user, the global plastic pipes market is bifurcated into building & construction, agriculture, oil & gas, and others.

Building & Construction is the most dominant end-user segment in the plastic pipes market, driven by extensive applications in water supply, plumbing, sewerage, and drainage systems. The construction industry’s shift towards lightweight, corrosion-resistant, and cost-effective materials has significantly increased the adoption of PVC, CPVC, and HDPE pipes. Rapid urbanization, infrastructure development, and smart city projects further fuel demand, making this the leading segment in the market.

Agriculture follows as the second-largest end-user, with plastic pipes playing a crucial role in irrigation systems. Farmers rely on PE and PVC pipes for drip and sprinkler irrigation, helping to optimize water usage and improve crop yield. Government initiatives promoting efficient water management and sustainable farming practices continue to drive the demand for plastic pipes in this sector.

Oil & Gas is another significant segment, where HDPE and reinforced thermoplastic pipes are widely used for transporting crude oil, natural gas, and industrial fluids. These pipes offer high durability, chemical resistance, and flexibility, making them ideal for underground and offshore applications. However, compared to building & construction and agriculture, this segment holds a smaller share due to the dominance of metal pipes in high-pressure and extreme temperature environments.

Plastic Pipes Market: Regional Insights

- Asia-Pacific is expected to dominates the global market

Asia-Pacific leads the global plastic pipes market, driven by rapid urbanization, extensive infrastructure development, and the expansion of construction and utility sectors in countries such as China, India, and Japan. The growing population and rising disposable incomes in these nations have intensified the need for residential, commercial, and public infrastructure projects, thereby boosting the demand for plastic pipes. Additionally, initiatives to enhance water distribution, sanitation, and irrigation systems have further propelled market growth. The presence of major manufacturers and access to cost-competitive raw materials and production facilities also contribute to the region's leading position.

North America holds a significant share in the plastic pipes market, underpinned by robust construction, utilities, and industrial sectors in the United States and Canada. The region benefits from well-established manufacturing facilities and a strong emphasis on technological advancements and sustainable solutions. The demand for plastic pipes is expected to remain steady, driven by ongoing infrastructure development, water conservation efforts, and sustainable building practices. The commitment to modernizing water supply and sewage systems, coupled with the replacement of outdated pipelines, presents significant growth opportunities in this market.

Europe represents a mature market for plastic pipes, characterized by stringent environmental regulations and a focus on sustainable technologies. The region has gradually shifted towards eco-friendly and durable piping solutions across various sectors. While overall market growth may be slower compared to other regions, ongoing innovation and the development of advanced plastic pipe products support market expansion. Countries like Germany, France, and the UK lead the market, driven by robust construction activities and modern agricultural practices. The emphasis on quality standards and sustainability continues to sustain demand within the European market.

Latin America exhibits moderate growth in the plastic pipes market, fueled by infrastructure development projects in countries such as Brazil and Mexico. Initiatives aimed at improving water supply, sanitation, and irrigation systems contribute to the increasing adoption of plastic pipes. The region's focus on enhancing agricultural productivity and urban infrastructure supports market expansion. However, economic fluctuations and political uncertainties may pose challenges to sustained growth in this market.

Middle East & Africa shows promising potential in the plastic pipes market, driven by infrastructure development initiatives like Saudi Vision 2030. Investments in water supply, sewage systems, and oil & gas pipelines are key factors boosting demand. The region's efforts to diversify economies and develop sustainable infrastructure contribute to market growth. Nonetheless, factors such as economic dependence on oil revenues and regional conflicts may impact the pace of market development.

Plastic Pipes Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the plastic pipes market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global plastic pipes market include:

- Mexichem SAB de CV

- Chevron Phillips Chemical Company

- Pipe Corporation

- Finolex Industries Ltd

- Aliaxis Group S.A.

- Wienerberger AG

- ASTRAL POLYTECHNIK LIMITED

- Tommur Industry (Shanghai) CO. LTD

- Kubota ChemiX Co. Ltd

- Kotec Corporation

- Aalberts Industries N.V.

- Atkore Inc.

- Fletcher Building Ltd.

- Georg Fischer AG

- Nan Ya Plastics Corp.

- Orbia Advance Corporation S.A.B de CV

- Sekisui Chemical Co. Ltd.

- Tessenderlo Chemie NV.

The global plastic pipes market is segmented as follows:

By Material

- Polyvinyl Chloride

- Polypropylene

- Polyethylene

- Others

By Application

- Irrigation

- Water Supply

- Sewerage

- Plumbing

- HVAC

- Others

By End-user

- Building & Construction

- Agriculture

- Oil & Gas

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Plastic Pipes

Request Sample

Plastic Pipes