Milk Alternatives Market Size, Share, and Trends Analysis Report

CAGR :

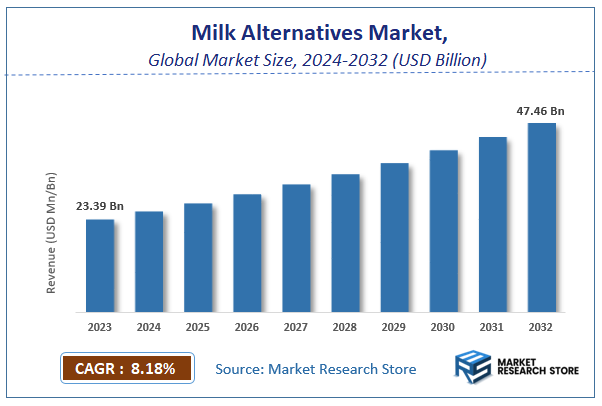

| Market Size 2023 (Base Year) | USD 23.39 Billion |

| Market Size 2032 (Forecast Year) | USD 47.46 Billion |

| CAGR | 8.18% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Milk Alternatives Market Insights

According to Market Research Store, the global milk alternatives market size was valued at around USD 23.39 billion in 2023 and is estimated to reach USD 47.46 billion by 2032, to register a CAGR of approximately 8.18% in terms of revenue during the forecast period 2024-2032.

The milk alternatives report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Milk Alternatives Market: Overview

The Milk Alternatives Market focuses on plant-based and non-dairy milk substitutes made from sources such as soy, almond, oat, coconut, rice, and pea. These alternatives cater to consumers with lactose intolerance, dairy allergies, or those following vegan and health-conscious diets. Available in various formulations, including unsweetened, flavored, and fortified options, milk alternatives are widely used in beverages, cooking, and baking applications.

Market growth is driven by increasing consumer awareness of plant-based nutrition, the rising prevalence of lactose intolerance, and growing environmental concerns associated with dairy farming. The expanding availability of fortified non-dairy milk with added vitamins, minerals, and protein content further supports adoption. Additionally, innovations in taste, texture, and functional ingredients, along with growing retail distribution in supermarkets and online channels, are fueling market expansion.

Key Highlights

- The milk alternatives market is anticipated to grow at a CAGR of 8.18% during the forecast period.

- The global milk alternatives market was estimated to be worth approximately USD 23.39 billion in 2023 and is projected to reach a value of USD 47.46 billion by 2032.

- The growth of the milk alternatives market is being driven by several key factors, including the increasing prevalence of MRSA infections, the rising demand for rapid and accurate diagnostic tools, and the increasing focus on infection control and antimicrobial stewardship.

- Based on the source, the soy segment is growing at a high rate and is projected to dominate the market.

- On the basis of product, the milk segment is projected to swipe the largest market share.

- Based on the distribution channels, the supermarket & hypermarkets segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Milk Alternatives Market: Dynamics

Key Drivers

- Growing Demand for Plant-Based Foods: The rising popularity of plant-based diets, driven by ethical, environmental, and health concerns, is a major driver.

- Lactose Intolerance and Allergies: The increasing prevalence of lactose intolerance and dairy allergies among consumers is fueling the demand for dairy alternatives.

- Health and Wellness Trends: Consumers are increasingly seeking healthier and more sustainable food options. Many plant-based milk alternatives are perceived as healthier options compared to cow's milk, being lower in saturated fat and cholesterol.

- Environmental Concerns: Concerns about the environmental impact of dairy farming, such as greenhouse gas emissions and water usage, are driving consumer interest in plant-based alternatives.

Restraints

- Price Sensitivity: Many plant-based milk alternatives can be more expensive than conventional cow's milk, which may limit their affordability for some consumers.

- Taste and Texture: Some consumers may find the taste and texture of certain plant-based milks less appealing compared to cow's milk.

- Nutritional Limitations: While fortified, some plant-based milks may not provide the same nutritional profile as cow's milk, particularly in terms of protein and certain vitamins.

- Sustainability Concerns: The production of some plant-based milks can also have environmental impacts, such as water usage and land use.

Opportunities

- Product Innovation: Developing new and innovative plant-based milk alternatives with improved taste, texture, and nutritional profiles.

- Focus on Sustainability: Emphasizing sustainability throughout the entire supply chain, from sourcing ingredients to production and packaging.

- Exploring New Applications: Expanding the applications of plant-based milks beyond beverages, such as in coffee, tea, baking, and cooking.

- Developing Value-Added Products: Developing value-added products, such as flavored milks, fortified milks, and plant-based creamers.

Challenges

- Maintaining Product Quality and Consistency: Ensuring consistent quality and taste across different batches and maintaining a consistent supply chain.

- Addressing Consumer Concerns: Addressing consumer concerns about taste, texture, price, and nutritional value.

- Staying Competitive: Remaining competitive in a dynamic market with increasing competition from other plant-based milk producers and traditional dairy products.

- Meeting Consumer Expectations: Meeting the evolving expectations of consumers for healthy, sustainable, and innovative plant-based products.

Milk Alternatives Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Milk Alternatives Market |

| Market Size in 2023 | USD 23.39 Billion |

| Market Forecast in 2032 | USD 47.46 Billion |

| Growth Rate | CAGR of 8.18% |

| Number of Pages | 140 |

| Key Companies Covered | Blue Diamond Growers, Dr Chung' S Food, Earth'S Own Food, Eden Foods, Freedom Foods, Leche Pascual, Living Harvest Foods, Maeil Dairies, Nutriops, Oatly, Organic Valley, Pacific Natural Foods, Panos Brands, Pureharvest, Sanitarium Health & Wellbeing, Stremicks Heritage Foods, Sunopta, The Bridge, The Hain Celestial, The Whitewave Foods, Turtle Mountain, Vitasoy International Holdings, VVFB |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Milk Alternatives Market: Segmentation Insights

The global milk alternatives market is divided by source, product, distribution channels, and region.

Segmentation Insights by Source

Based on source, the global milk alternatives market is divided into soy, almond, coconut, rice, oats, and others.

The Soy segment dominates the Milk Alternatives Market due to its high protein content, widespread availability, and long-standing consumer acceptance. Soy milk closely mimics the nutritional profile of dairy milk, making it a preferred choice for consumers seeking plant-based protein. Additionally, its versatility in various applications such as beverages, dairy alternatives, and infant formulas strengthens its market position. Growing awareness of lactose intolerance and vegan diets further boosts demand for soy-based milk alternatives.

The Almond segment holds a significant share, driven by its popularity as a low-calorie, dairy-free alternative with a mild, nutty flavor. Almond milk is widely used in coffee, smoothies, and cereals, appealing to health-conscious consumers. Rising demand for clean-label and fortified products with added vitamins and minerals also supports market growth.

The Coconut segment is expanding rapidly, favored for its rich texture and natural sweetness. Coconut milk is extensively used in cooking, baking, and dairy-free beverages. Its increasing adoption in tropical and Asian cuisines, along with the rising trend of plant-based diets, contributes to its market growth.

The Rice segment caters to consumers with nut allergies, offering a hypoallergenic alternative with a naturally sweet taste. Though it has a lower protein content compared to soy or almond milk, its easy digestibility and suitability for sensitive individuals drive its demand.

The Oats segment is gaining momentum due to its creamy texture, sustainability benefits, and high fiber content. Oat milk's popularity in coffee shops and dairy-free beverages has surged, especially in North America and Europe, making it one of the fastest-growing segments.

Segmentation Insights by Product

On the basis of product, the global milk alternatives market is bifurcated into milk, yogurt, cheese, ice cream, and creamer.

The Milk segment dominates the Milk Alternatives Market due to its widespread consumption as a direct dairy substitute. Plant-based milk options such as soy, almond, oat, and coconut milk have gained popularity among consumers seeking lactose-free, vegan, and allergen-friendly alternatives. The increasing prevalence of lactose intolerance, dairy allergies, and the rising adoption of plant-based diets further fuel the demand for alternative milk products. Additionally, innovations in fortification with vitamins, minerals, and protein enhance their nutritional appeal, strengthening market growth.

The Yogurt segment is growing rapidly, driven by increasing consumer preference for probiotic-rich, dairy-free options. Alternative yogurts made from almond, coconut, soy, and oat milk cater to health-conscious consumers looking for gut-friendly and functional foods. The rising demand for clean-label, organic, and flavored plant-based yogurts further boosts this segment.

The Cheese segment is expanding as plant-based cheese alternatives become more sophisticated in texture and taste. With advancements in food technology, manufacturers are creating dairy-free cheeses using cashews, almonds, and coconut oil that mimic traditional dairy cheese. Growing consumer interest in veganism and lactose-free diets is accelerating the demand for plant-based cheese in both retail and foodservice sectors.

The Ice Cream segment is witnessing significant growth, driven by the demand for dairy-free indulgence. Almond, coconut, and oat-based ice creams are popular choices, offering creamy textures and rich flavors without dairy. The expansion of premium, organic, and innovative flavors is further propelling market growth in this segment.

The Creamer segment is gaining traction as consumers seek dairy-free alternatives for coffee and beverages. Oat and almond-based creamers are particularly popular due to their smooth texture and ability to replicate traditional dairy creamers. The rising trend of plant-based coffee culture and functional creamers with added health benefits contributes to this segment’s expansion.

Segmentation Insights by Distribution Channels

On the basis of distribution channels, the global milk alternatives market is bifurcated into supermarket & hypermarkets, convenience stores, online retail, and others.

The Supermarket & Hypermarkets segment dominates the Milk Alternatives Market due to the extensive availability and accessibility of a wide range of plant-based dairy substitutes. These retail channels offer a diverse selection of soy, almond, oat, coconut, and rice-based milk alternatives, catering to health-conscious consumers and those with dietary restrictions. The presence of dedicated plant-based sections, promotional discounts, and brand variety further enhances consumer preference for supermarkets and hypermarkets as the primary purchasing channel. The ability to physically inspect products and compare options contributes to the segment's strong market share.

The Convenience Stores segment is growing steadily, driven by the increasing demand for on-the-go and impulse purchases of plant-based milk and related products. As more consumers adopt plant-based diets, convenience stores are expanding their product offerings to include single-serve, ready-to-drink plant-based milk, yogurt, and creamers. This segment benefits from urbanization, busy lifestyles, and the rising preference for quick and accessible healthy options.

The Online Retail segment is experiencing the fastest growth, fueled by the convenience of home delivery, subscription services, and the expanding digital marketplace. E-commerce platforms provide a broad assortment of plant-based milk alternatives, including niche and specialty brands that may not be readily available in physical stores. The growing preference for bulk purchases, discounts, and direct-to-consumer sales models further accelerates online retail growth. Additionally, increasing consumer reliance on digital shopping platforms for health-conscious and sustainable food choices strengthens this segment’s expansion.

Milk Alternatives Market: Regional Insights

- North America is expected to dominates the global market

North America holds a significant share in the milk alternatives market, led by the United States and Canada. The region has a strong consumer base for plant-based foods, driven by the rise of veganism, lactose intolerance awareness, and sustainability concerns. Almond milk and oat milk dominate the market, with growing demand for pea-based and hemp milk alternatives. The presence of major brands like Silk, Califia Farms, and Oatly, along with investments in new formulations and flavors, continues to drive growth. Retail expansion and the popularity of ready-to-drink plant-based beverages further support market demand.

Europe is another dominant region, with countries like the UK, Germany, France, and the Netherlands leading in milk alternative consumption. The European market is fueled by increasing health-conscious consumers, government initiatives promoting plant-based diets, and a strong retail presence of dairy-free products. Oat milk, in particular, has gained widespread popularity in coffee culture across the region, particularly in Scandinavian countries. Additionally, the European Union’s sustainability goals and stringent food labeling regulations ensure high product quality and transparency.

Asia-Pacific is the fastest-growing region in the milk alternatives market, with China, India, Japan, and Australia leading the trend. The increasing prevalence of lactose intolerance in Asian populations is a major driver, as traditional dairy consumption is lower compared to Western regions. Soy milk has been a long-standing staple, but newer alternatives like almond, oat, and coconut milk are gaining traction. The expansion of plant-based food industries and the influence of Western dietary trends further boost market growth. Australia has a particularly strong demand for plant-based milk, driven by health-conscious and environmentally aware consumers.

Latin America is witnessing steady growth, with Brazil, Mexico, and Argentina leading in milk alternative consumption. The rising health and wellness trend, along with increasing vegan and lactose-intolerant populations, is fueling demand for soy, almond, and coconut milk. However, economic factors and price sensitivity may limit widespread adoption compared to North America and Europe. Local manufacturers are expanding their offerings to cater to both premium and budget-conscious consumers.

Middle East and Africa region is an emerging market for milk alternatives, with increasing awareness of plant-based nutrition and lactose intolerance driving demand. The UAE and Saudi Arabia are key markets, benefiting from a growing expatriate population and rising demand for health-conscious food options. In Africa, demand is growing at a slower pace due to limited product availability and higher prices. However, local production of plant-based milk alternatives is increasing, particularly in South Africa.

Milk Alternatives Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the milk alternatives market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global milk alternatives market include:

- Blue Diamond Growers

- Dr Chung' S Food

- Earth'S Own Food

- Eden Foods

- Freedom Foods

- Leche Pascual

- Living Harvest Foods

- Maeil Dairies

- Nutriops

- Oatly

- Organic Valley

- Pacific Natural Foods

- Panos Brands

- Pureharvest

- Sanitarium Health & Wellbeing

- Stremicks Heritage Foods

- Sunopta

- The Bridge

- The Hain Celestial

- The Whitewave Foods

- Turtle Mountain

- Vitasoy International Holdings

- VVFB

The global milk alternatives market is segmented as follows:

By Source

- Soy

- Almond

- Coconut

- Rice

- Oats

- Others

By Product

- Milk

- Yogurt

- Cheese

- Ice Cream

- Creamer

- Others

By Distribution Channels

- Supermarket & Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global milk alternatives market size was projected at approximately US$ 23.39 billion in 2023. Projections indicate that the market is expected to reach around US$ 47.46 billion in revenue by 2032.

The global milk alternatives market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 8.18% during the forecast period from 2024 to 2032.

North America is expected to dominate the global milk alternatives market.

The global milk alternatives market is being driven by several factors, including the increasing prevalence of lactose intolerance and dairy allergies, growing vegan and flexitarian populations, rising consumer awareness about animal welfare and environmental issues, and advancements in technology that improve the sensory attributes and nutritional values of dairy-free products.

Some of the prominent players operating in the global milk alternatives market are; Blue Diamond Growers, Dr Chung' S Food, Earth'S Own Food, Eden Foods, Freedom Foods, Leche Pascual, Living Harvest Foods, Maeil Dairies, Nutriops, Oatly, Organic Valley, Pacific Natural Foods, Panos Brands, Pureharvest, Sanitarium Health & Wellbeing, Stremicks Heritage Foods, Sunopta, The Bridge, The Hain Celestial, The Whitewave Foods, Turtle Mountain, Vitasoy International Holdings, VVFB, and others.

Table Of Content

Inquiry For Buying

Milk Alternatives

Request Sample

Milk Alternatives