10% F2N2 Gas Mixture Market Size, Share, and Trends Analysis Report

CAGR :

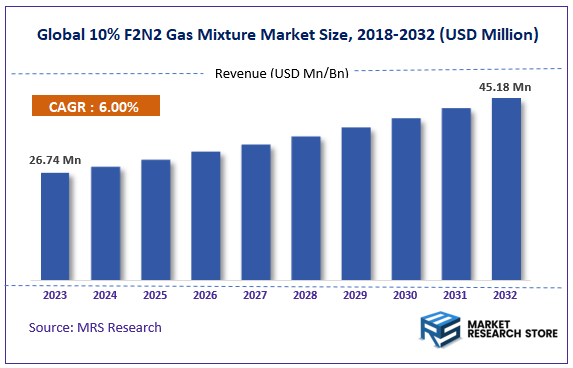

| Market Size 2023 (Base Year) | USD 26.74 Million |

| Market Size 2032 (Forecast Year) | USD 45.18 Million |

| CAGR | 6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

[219+ Pages Report] According to Market Research Store, the global 10% F2N2 gas mixture market size was valued at around USD 26.74 million in 2023 and is estimated to reach USD 45.18 million by 2032, to register a CAGR of approximately 6.00% in terms of revenue during the forecast period 2024-2032.

The 10% F2N2 gas mixture report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global 10% F2N2 Gas Mixture Market: Overview

A 10% F2/N2 gas mixture consists of 10% fluorine (F2) and 90% nitrogen (N2). This specialized gas blend is primarily used in semiconductor processing and plastic manufacturing industries. Fluorine, being highly reactive, is employed in etching processes for semiconductors and surface treatments in plastics, making this mixture essential in these high-tech applications. The nitrogen component acts as a diluent, ensuring the fluorine's reactivity is controlled and safe for industrial use.

The global market for 10% F2/N2 gas mixtures is is driven by the increasing demand for semiconductors, particularly in regions like North America and Asia-Pacific, where technological advancements are rapidly progressing. The gas mixture is also gaining traction in the plastics industry due to its role in surface treatment applications.

Key Highlights

- The 10% F2N2 gas mixture market is anticipated to grow at a CAGR of 6.00% during the forecast period.

- The global 10% F2N2 gas mixture market was estimated to be worth approximately USD 26.74 million in 2023 and is projected to reach a value of USD 45.18 million by 2032.

- The growth of the 10% F2N2 gas mixture market is being driven by growing semiconductor industry, advancements in plastic processing, and stringent environmental regulations that guide safe handling and production practices.

- Based on the product, the industrial grade gas mixture segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the electronics manufacturing segment is expected to dominate the market in terms of value while plastic processing likely leads in terms of volume.

- In terms of end-use industry, the electronics & semiconductor segment is expected to dominate the market.

- By region, Asia-Pacific is expected to dominate the global market during the forecast period due to its strong semiconductor and electronics manufacturing sectors.

10% F2/N2 Gas Mixture Market Dynamics:

Key Growth Drivers

- Growing semiconductor industry: The increasing demand for advanced semiconductor devices is driving the need for high-purity gases like 10% F2/N2 mixtures for etching and cleaning processes.

- Expanding applications in plasma etching: The use of 10% F2/N2 mixtures in plasma etching processes for various materials, including silicon, silicon dioxide, and aluminum, is driving market growth.

- Advancements in manufacturing technologies: Innovations in semiconductor manufacturing, such as 3D NAND and EUV lithography, are increasing the demand for high-purity gases like 10% F2/N2 mixtures.

- Rising awareness of gas purity and safety: The focus on ensuring high gas purity and safety standards in semiconductor manufacturing is driving the demand for reliable suppliers of 10% F2/N2 mixtures.

Restraints

- High production costs: The production of 10% F2/N2 gas mixtures involves complex processes and stringent quality control measures, leading to relatively high production costs.

- Safety and environmental concerns: The handling and storage of fluorine-containing gases require stringent safety measures due to their potential hazards.

- Limited availability and supply chain challenges: The availability of 10% F2/N2 gas mixtures can be influenced by factors such as production capacity and supply chain disruptions.

- Competition from alternative gases: Other gases, such as SF6 and CF4, may compete with 10% F2/N2 mixtures in certain applications.

Opportunities

- Expanding applications in other industries: 10% F2/N2 gas mixtures can be used in various industries, such as aerospace, medical devices, and research, creating new market opportunities.

- Development of new semiconductor technologies: Advancements in semiconductor manufacturing, such as gate-all-around transistors and quantum computing, may increase the demand for 10% F2/N2 gas mixtures.

- Increasing focus on sustainability: The growing focus on sustainable manufacturing practices and reduced environmental impact is driving the demand for gases with lower global warming potentials, such as 10% F2/N2 mixtures.

- Growing demand for high-purity gases: The increasing demand for high-purity gases in various industries, driven by factors such as miniaturization and advanced manufacturing, presents opportunities for 10% F2/N2 gas mixtures.

Challenges

- Market volatility: The market for 10% F2/N2 gas mixtures can be subject to fluctuations due to economic conditions, technological advancements, and changes in demand.

- Regulatory compliance: Adherence to environmental regulations and safety standards can be complex and costly for manufacturers of 10% F2/N2 gas mixtures.

- Technological advancements: The development of new manufacturing processes or alternative gases may present challenges to the use of 10% F2/N2 gas mixtures.

- Supply chain disruptions: Disruptions in the supply chain, such as shortages of raw materials or transportation issues, can impact the availability and pricing of 10% F2/N2 gas mixtures.

10% F2N2 Gas Mixture Market: Segmentation Insights

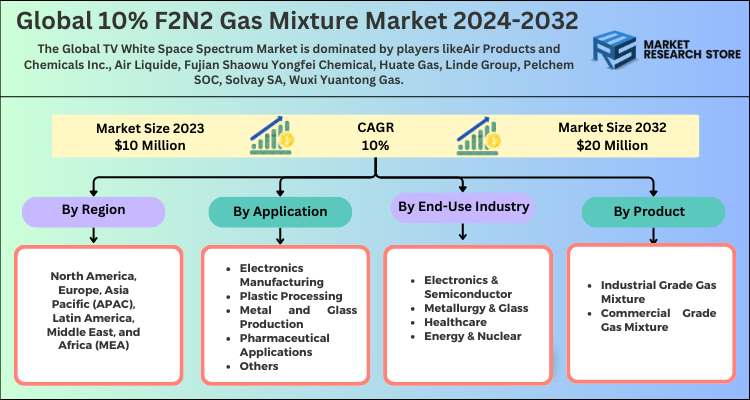

The global 10% F2N2 gas mixture market is divided by product, application, end-use industry, and region.

Segmentation Insights by Product

Based on Product, the global 10% F2N2 gas mixture market is divided into industrial grade gas mixture and commercial grade gas mixture.

Industrial grade gas mixtures segment tends to dominate in terms of market value due to the high-purity requirements and critical applications in industries such as semiconductors and advanced manufacturing. Industrial grade gas mixtures are typically used in manufacturing processes and applications where the purity and consistency of the gas mixture are crucial for achieving optimal performance. In the case of a 10% F2N2 gas mixture, industrial-grade products are often used in applications that require high precision and reliability. In the semiconductor industry, industrial-grade F2N2 mixtures are used in etching and cleaning processes, plasma processing and chemical synthesis.

While Commercial grade gas mixtures segment might lead in terms of volume due to its use in a broader range of applications, it typically offers lower margins compared to the industrial-grade segment. Commercial grade gas mixtures, while still maintaining a level of quality and consistency, are generally used in less critical applications where ultra-high purity is not necessary. These mixtures are often used in applications that are more cost-sensitive. Commercial-grade F2N2 mixtures are used in a variety of manufacturing processes, Maintenance and Servicing, and in certain chemical processes.

Segmentation Insights by Application

On the basis of Application, the global 10% F2N2 gas mixture market is bifurcated into electronics manufacturing, plastic processing, metal and glass production, pharmaceutical applications, and others.

The electronics manufacturing industry is a significant consumer of high-purity gases, including 10% F2N2 mixtures, due to the precision required in processes like etching, cleaning, and deposition. This segment is likely the most significant in terms of value, driven by the high purity requirements and the critical role F2N2 plays in semiconductor and microelectronics manufacturing. The continuous advancement in electronics technology supports sustained demand.

Plastic processing segment may dominate in terms of volume, as the use of F2N2 for surface treatment is widespread in various industries. However, it is more cost-sensitive compared to electronics manufacturing. In plastic processing, 10% F2N2 gas mixtures are used in surface treatment applications to modify the properties of plastic surfaces, such as improving adhesion, wettability, and chemical resistance.

While Metal and Glass Production segment might not be as large as electronics or plastic processing, it is important due to the specialized applications in high-value industries like automotive and construction. In metal and glass production, 10% F2N2 gas mixtures are used in various processing steps, including cleaning, surface treatment, and etching.

Pharmaceutical Applications segment may represent a smaller portion of the overall market, it is significant due to the critical nature of pharmaceuticals and the high standards required, which often command premium pricing. In the pharmaceutical industry, 10% F2N2 gas mixtures are used in specialized chemical synthesis and processing, particularly where fluorination is required to create active pharmaceutical ingredients (APIs) and other critical compounds.

Segmentation Insights by End-Use Industry

In terms of end-use industry, the global 10% F2N2 gas mixture market is categorized into electronics & semiconductor, metallurgy & glass, healthcare, and energy & nuclear.

Electronics & Semiconductor segment is expected to dominate the market in terms of value due to the critical role 10% F2N2 gas mixtures play in semiconductor fabrication and other high-tech applications. The rapid growth of the electronics industry and advancements in technology are key drivers. The electronics and semiconductor industry is a major consumer of high-purity gases, including F2N2 mixtures. This industry relies heavily on precise gas mixtures for processes such as etching, cleaning, and deposition.

While not as high in value as the electronics sector, Metallurgy & Glass segment is important due to the broad range of applications in industries like automotive and construction. The demand for treated metals and specialty glass products supports steady growth in this area. The metallurgy and glass industries use F2N2 gas mixtures primarily for surface treatment, etching, and cleaning applications. These processes are essential for producing high-quality metal and glass products with specific surface properties.

Healthcare is significant due to the high standards required in pharmaceutical and medical applications, often commanding premium pricing for high-purity gases. In the healthcare industry, F2N2 gas mixtures are used in pharmaceutical manufacturing, sterilization, and other specialized applications where fluorination is required.

Energy & Nuclear segment is more niche but critical due to the specialized applications in nuclear fuel processing and advanced energy systems. The energy and nuclear industries use F2N2 gas mixtures in specialized applications, particularly in processes involving fluorination and cleaning within high-temperature and high-pressure environments.

10% F2N2 Gas Mixture Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | 10% F2N2 Gas Mixture Market |

| Market Size in 2023 | USD 26.74 Million |

| Market Forecast in 2032 | USD 45.18 Million |

| Growth Rate | CAGR of 6.00% |

| Number of Pages | 219 |

| Key Companies Covered | Air Products and Chemicals Inc., Air Liquide, Fujian Shaowu Yongfei Chemical, Huate Gas, Linde Group, Pelchem SOC, Solvay SA, Wuxi Yuantong Gas, and others. |

| Segments Covered | By Product, By Application, By End-Use Industry, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

10% F2N2 Gas Mixture Market: Regional Insights

- Asia-Pacific is the dominating region with the highest growth rate

Asia-Pacific is the fastest-growing and largest regional market. This is due to the rapid industrialization in countries like China, Japan, and South Korea, where semiconductor and electronics manufacturing is booming. Asia-Pacific is expected to witness the highest CAGR among all regions. The expansion of the electronics industry, particularly in China, is a major growth driver. The region's dominance is bolstered by increasing investments in semiconductor technology and growing demand for advanced materials in manufacturing.

North America is a significant player in this market, particularly due to the strong demand from the semiconductor industry in the United States. The region benefits from a well-established industrial infrastructure and technological advancements. The U.S. dominates the North American market, followed by Canada and Mexico. While the growth rate is moderate compared to Asia-Pacific, North America maintains a steady expansion due to continuous advancements in the semiconductor and pharmaceutical sectors.

Europe is another key region, with Germany, France, and the UK being major contributors. The demand is driven by the region's strong industrial base, especially in chemicals and electronics. The market in Europe is expected to grow steadily, with Germany leading due to its robust manufacturing sector. The presence of stringent environmental regulations also pushes innovation in gas mixtures. The semiconductor and plastic processing industries are the primary consumers of the 10% F2/N2 gas mixture in Europe.

Latin America shows moderate growth potential, driven by the expansion of industrial activities in Brazil and Argentina. However, the region's overall contribution to the global market remains smaller compared to North America and Asia-Pacific. Growing industrialization and increasing adoption of advanced materials in manufacturing processes are key drivers in this region.

The Middle East & Africa (MEA) region has the smallest share of the global market, primarily due to limited industrial infrastructure. However, the region's growing focus on industrial diversification could present future opportunities. Countries like Saudi Arabia and South Africa are expected to lead in this region, with growth driven by investments in manufacturing and industrial gases.

10% F2N2 Gas Mixture Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the 10% F2N2 gas mixture market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global 10% F2N2 gas mixture market include:

- Air Products and Chemicals Inc.

- Air Liquide

- Fujian Shaowu Yongfei Chemical

- Huate Gas

- Linde Group

- Pelchem SOC

- Solvay SA

- Wuxi Yuantong Gas

The global 10% F2N2 gas mixture market is segmented as follows:

By Product

- Industrial Grade Gas Mixture

- Commercial Grade Gas Mixture

By Application

- Electronics Manufacturing

- Plastic Processing

- Metal and Glass Production

- Pharmaceutical Applications

- Others

By End-Use Industry

- Electronics & Semiconductor

- Metallurgy & Glass

- Healthcare

- Energy & Nuclear

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global 10% F2N2 gas mixture market size was projected at approximately US$ 26.74 million in 2023. Projections indicate that the market is expected to reach around US$ 45.18 million in revenue by 2032.

The global 10% F2N2 gas mixture market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 6.00% during the forecast period from 2024 to 2032.

Asia-Pacific is expected to dominate the global 10% F2N2 gas mixture market.

The global 10% F2N2 gas mixture market is driven by factors such as increasing demand for semiconductor manufacturing, growth in the chemical industry, and advancements in plasma etching processes.

Some of the prominent players operating in the global 10% F2N2 gas mixture market are Air Products and Chemicals Inc., Air Liquide, Fujian Shaowu Yongfei Chemical, Huate Gas, Linde Group, Pelchem SOC, Solvay SA, Wuxi Yuantong Gas, and others.

Table Of Content

Chapter 1. Preface 1.1 Report Description and Scope 1.2 Research scope 1.3 Research methodology 1.3.1 Market Research Type 1.3.2 Market research methodology Chapter 2. Executive Summary 2.1 Global 10% F2N2 Gas Mixture Market, (2024 - 2032) (USD Million) 2.2 Global 10% F2N2 Gas Mixture Market : snapshot Chapter 3. Global 10% F2N2 Gas Mixture Market - Industry Analysis 3.1 10% F2N2 Gas Mixture Market: Market Dynamics 3.2 Market Drivers 3.2.1 Growing semiconductor industry 3.3 Market Restraints 3.3.1. Safety and environmental concerns 3.4 Market Opportunities 3.4.1. Expanding applications in other industries 3.5 Market Challenges 3.5.1. Expanding applications in other industries 3.6 Porter’s Five Forces Analysis 3.7 Market Attractiveness Analysis 3.7.1 Market attractiveness analysis By Product 3.7.2 Market attractiveness analysis By Application 3.7.3 Market attractiveness analysis By End-Use Industry Chapter 4. Global 10% F2N2 Gas Mixture Market- Competitive Landscape 4.1 Company market share analysis 4.1.1 Global 10% F2N2 Gas Mixture Market: company market share, 2023 4.2 Strategic development 4.2.1 Acquisitions & mergers 4.2.2 New Product launches 4.2.3 Agreements, partnerships, cullaborations, and joint ventures 4.2.4 Research and development and Regional expansion 4.3 Price trend analysis Chapter 5. Global 10% F2N2 Gas Mixture Market - Product Analysis 5.1 Global 10% F2N2 Gas Mixture Market overview: By Product 5.1.1 Global 10% F2N2 Gas Mixture Market share, By Product, 2023 and 2032 5.2 Industrial Grade Gas Mixture 5.2.1 Global 10% F2N2 Gas Mixture Market by Industrial Grade Gas Mixture, 2024 - 2032 (USD Million) 5.3 Commercial Grade Gas Mixture 5.3.1 Global 10% F2N2 Gas Mixture Market by Commercial Grade Gas Mixture, 2024 - 2032 (USD Million) Chapter 6. Global 10% F2N2 Gas Mixture Market - Application Analysis 6.1 Global 10% F2N2 Gas Mixture Market overview: By Application 6.1.1 Global 10% F2N2 Gas Mixture Market share, By Application, 2023 and 2032 6.2 Electronics Manufacturing 6.2.1 Global 10% F2N2 Gas Mixture Market by Electronics Manufacturing, 2024 - 2032 (USD Million) 6.3 Plastic Processing 6.3.1 Global 10% F2N2 Gas Mixture Market by Plastic Processing, 2024 - 2032 (USD Million) 6.4 Metal and Glass Production 6.4.1 Global 10% F2N2 Gas Mixture Market by Metal and Glass Production, 2024 - 2032 (USD Million) 6.5 Pharmaceutical Applications 6.5.1 Global 10% F2N2 Gas Mixture Market by Pharmaceutical Applications, 2024 - 2032 (USD Million) 6.6 Others 6.6.1 Global 10% F2N2 Gas Mixture Market by Others, 2024 - 2032 (USD Million) Chapter 7. Global 10% F2N2 Gas Mixture Market - End-Use Industry Analysis 7.1 Global 10% F2N2 Gas Mixture Market overview: By End-Use Industry 7.1.1 Global 10% F2N2 Gas Mixture Market share, By End-Use Industry, 2023 and 2032 7.2 Electronics & Semiconductor 7.2.1 Global 10% F2N2 Gas Mixture Market by Electronics & Semiconductor, 2024 - 2032 (USD Million) 7.3 Metallurgy & Glass 7.3.1 Global 10% F2N2 Gas Mixture Market by Metallurgy & Glass, 2024 - 2032 (USD Million) 7.4 Healthcare 7.4.1 Global 10% F2N2 Gas Mixture Market by Healthcare, 2024 - 2032 (USD Million) 7.5 Energy & Nuclear 7.5.1 Global 10% F2N2 Gas Mixture Market by Energy & Nuclear, 2024 - 2032 (USD Million) Chapter 8. 10% F2N2 Gas Mixture Market - Regional Analysis 8.1 Global 10% F2N2 Gas Mixture Market Regional Overview 8.2 Global 10% F2N2 Gas Mixture Market Share, by Region, 2023 & 2032 (USD Million) 8.3. North America 8.3.1 North America 10% F2N2 Gas Mixture Market, 2024 - 2032 (USD Million) 8.3.1.1 North America 10% F2N2 Gas Mixture Market, by Country, 2024 - 2032 (USD Million) 8.4 North America 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 8.4.1 North America 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 (USD Million) 8.5 North America 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 8.5.1 North America 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 (USD Million) 8.6 North America 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 8.6.1 North America 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 (USD Million) 8.7. Europe 8.7.1 Europe 10% F2N2 Gas Mixture Market, 2024 - 2032 (USD Million) 8.7.1.1 Europe 10% F2N2 Gas Mixture Market, by Country, 2024 - 2032 (USD Million) 8.8 Europe 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 8.8.1 Europe 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 (USD Million) 8.9 Europe 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 8.9.1 Europe 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 (USD Million) 8.10 Europe 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 8.10.1 Europe 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 (USD Million) 8.11. Asia Pacific 8.11.1 Asia Pacific 10% F2N2 Gas Mixture Market, 2024 - 2032 (USD Million) 8.11.1.1 Asia Pacific 10% F2N2 Gas Mixture Market, by Country, 2024 - 2032 (USD Million) 8.12 Asia Pacific 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 8.12.1 Asia Pacific 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 (USD Million) 8.13 Asia Pacific 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 8.13.1 Asia Pacific 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 (USD Million) 8.14 Asia Pacific 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 8.14.1 Asia Pacific 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 (USD Million) 8.15. Latin America 8.15.1 Latin America 10% F2N2 Gas Mixture Market, 2024 - 2032 (USD Million) 8.15.1.1 Latin America 10% F2N2 Gas Mixture Market, by Country, 2024 - 2032 (USD Million) 8.16 Latin America 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 8.16.1 Latin America 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 (USD Million) 8.17 Latin America 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 8.17.1 Latin America 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 (USD Million) 8.18 Latin America 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 8.18.1 Latin America 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 (USD Million) 8.19. The Middle-East and Africa 8.19.1 The Middle-East and Africa 10% F2N2 Gas Mixture Market, 2024 - 2032 (USD Million) 8.19.1.1 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by Country, 2024 - 2032 (USD Million) 8.20 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 8.20.1 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by Product, 2024 - 2032 (USD Million) 8.21 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 8.21.1 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by Application, 2024 - 2032 (USD Million) 8.22 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 8.22.1 The Middle-East and Africa 10% F2N2 Gas Mixture Market, by End-Use Industry, 2024 - 2032 (USD Million) Chapter 9. Company Profiles 9.1 Air Products and Chemicals Inc. 9.1.1 Overview 9.1.2 Financials 9.1.3 Product Portfolio 9.1.4 Business Strategy 9.1.5 Recent Developments 9.2 Air Liquide 9.2.1 Overview 9.2.2 Financials 9.2.3 Product Portfolio 9.2.4 Business Strategy 9.2.5 Recent Developments 9.3 Fujian Shaowu Yongfei Chemical 9.3.1 Overview 9.3.2 Financials 9.3.3 Product Portfolio 9.3.4 Business Strategy 9.3.5 Recent Developments 9.4 Huate Gas 9.4.1 Overview 9.4.2 Financials 9.4.3 Product Portfolio 9.4.4 Business Strategy 9.4.5 Recent Developments 9.5 Linde Group 9.5.1 Overview 9.5.2 Financials 9.5.3 Product Portfolio 9.5.4 Business Strategy 9.5.5 Recent Developments 9.6 Pelchem SOC 9.6.1 Overview 9.6.2 Financials 9.6.3 Product Portfolio 9.6.4 Business Strategy 9.6.5 Recent Developments 9.7 Solvay SA 9.7.1 Overview 9.7.2 Financials 9.7.3 Product Portfolio 9.7.4 Business Strategy 9.7.5 Recent Developments 9.8 Wuxi Yuantong Gas 9.8.1 Overview 9.8.2 Financials 9.8.3 Product Portfolio 9.8.4 Business Strategy 9.8.5 Recent Developments

Inquiry For Buying

10% F2N2 Gas Mixture

Request Sample

10% F2N2 Gas Mixture