Acrylate Monomer Market Size, Share, and Trends Analysis Report

CAGR :

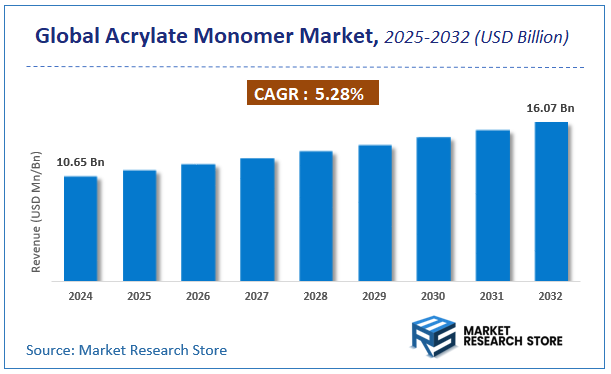

| Market Size 2024 (Base Year) | USD 10.65 Billion |

| Market Size 2032 (Forecast Year) | USD 16.07 Billion |

| CAGR | 5.28% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global acrylate monomer market, estimating its value at USD 10.65 Billion in 2024, with projections indicating it will reach USD 16.07 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 5.28% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the acrylate monomer industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Acrylate Monomer Market: Overview

The growth of the acrylate monomer market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The acrylate monomer market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the acrylate monomer market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Application, End-user, Production Process, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global acrylate monomer market is estimated to grow annually at a CAGR of around 5.28% over the forecast period (2025-2032).

- In terms of revenue, the global acrylate monomer market size was valued at around USD 10.65 Billion in 2024 and is projected to reach USD 16.07 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand from the paints, coatings, and adhesives industries due to their properties like UV curability, weather resistance, and excellent adhesion is a primary driver. Rising application in the construction and automotive sectors for lightweight an.

- Based on the Type, the Methyl Acrylate segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Adhesives & Sealants segment is anticipated to command the largest market share.

- In terms of End-user, the Packaging segment is projected to lead the global market.

- By Production Process, the Direct Esterification segment is predicted to dominate the global market.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Acrylate Monomer Market: Report Scope

This report thoroughly analyzes the acrylate monomer market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Acrylate Monomer Market |

| Market Size in 2024 | USD 10.65 Billion |

| Market Forecast in 2032 | USD 16.07 Billion |

| Growth Rate | CAGR of 5.28% |

| Number of Pages | 201 |

| Key Companies Covered | Arkema, BASF SE, Dow, Evonik Industries AG, Hitachi, Ltd., KURARAY CO., LTD., LG Chem, Mitsubishi Chemical Group Corporation, NIPPON SHOKUBAI CO., LTD., Pallav Chemicals, and Solvents Company |

| Segments Covered | By Type, By Application, By End-user, By Production Process, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Acrylate Monomer Market: Dynamics

Key Growth Drivers :

The Acrylate Monomer market is experiencing robust growth, primarily driven by the expanding demand from the paints and coatings industry, where acrylates are crucial for producing high-performance, durable, and weather-resistant formulations. The increasing adoption of adhesives and sealants in construction, automotive, and packaging sectors, where acrylate-based solutions offer strong bonding and flexibility, further fuels market expansion. Furthermore, the burgeoning demand for superabsorbent polymers (SAPs) in hygiene products (diapers, feminine care) and agriculture, which are predominantly derived from acrylates, significantly contributes to market growth. The versatility and customizable properties of acrylate monomers also make them integral to various other applications, including textiles, plastics, and water treatment.

Restraints :

Despite the strong growth drivers, the Acrylate Monomer market faces several restraints. The volatility of raw material prices, particularly propylene and acrylic acid, which are petrochemical derivatives, can significantly impact production costs and profit margins. Stringent environmental regulations concerning the production, handling, and emissions of certain acrylate monomers, due to their potential health hazards (e.g., skin irritation, respiratory issues), impose significant compliance costs and operational challenges. Intense competition from numerous global and regional manufacturers, especially for commodity-grade acrylates, can lead to price wars and pressure on profitability. Additionally, the growing consumer and industrial demand for bio-based or "green" alternatives, though still nascent, presents a long-term challenge to traditional petroleum-derived acrylates.

Opportunities :

Opportunities in the Acrylate Monomer market are substantial, particularly in the development of bio-based and sustainable acrylate monomers derived from renewable resources, aligning with eco-friendly trends and reducing reliance on fossil fuels. Innovations in high-performance and specialty acrylates designed for demanding applications, such as UV-curable coatings for 3D printing, advanced electronics, and medical devices, offer significant growth potential. Expanding into emerging economies with rapidly industrializing sectors and increasing demand for infrastructure and consumer goods presents vast untapped markets. Furthermore, strategic collaborations with end-user industries to develop customized acrylate solutions for specific performance requirements and application challenges can create strong competitive advantages.

Challenges :

The Acrylate Monomer market confronts several challenges. Ensuring safe handling, storage, and transportation of acrylate monomers, which can be volatile and reactive, requires strict adherence to safety protocols and significant investment in infrastructure. The need for continuous research and development to create new monomer structures with enhanced properties (e.g., lower toxicity, improved cure speed, better adhesion) while balancing cost-effectiveness is a demanding task. Managing the global supply chain for raw materials and finished products, especially amid geopolitical instabilities and logistical disruptions, poses a persistent operational challenge. Additionally, adapting to evolving regulatory landscapes and consumer preferences for safer and more sustainable chemical ingredients remains a continuous and critical challenge for market participants.

Acrylate Monomer Market: Segmentation Insights

The global acrylate monomer market is segmented based on Type, Application, End-user, Production Process, and Region. All the segments of the acrylate monomer market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global acrylate monomer market is divided into Methyl Acrylate, Acrylic Acid, Ethyl Acrylate, Butyl Acrylate, 2-ethylhexyl Acrylate, and Others.

On the basis of Application, the global acrylate monomer market is bifurcated into Adhesives & Sealants, Plastics, Printing Inks, Acrylic Rubber, Acrylic Fibers, and Others.

In terms of End-user, the global acrylate monomer market is categorized into Packaging, Paints & Coatings, Construction, Automotive, and Others.

Based on Production Process, the global acrylate monomer market is split into Direct Esterification, Olefin Oxidation, and Others.

Acrylate Monomer Market: Regional Insights

The Asia-Pacific (APAC) region is the dominant force in the global acrylate monomer market. This leadership is driven by the massive and growing production of paints & coatings, adhesives & sealants, and plastics within China, India, and Southeast Asia. The region's robust construction, automotive, and packaging industries, combined with cost-competitive manufacturing and strong raw material availability, create unparalleled demand and production capacity, solidifying APAC as both the largest consumer and producer globally.

Acrylate Monomer Market: Competitive Landscape

The acrylate monomer market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Acrylate Monomer Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Arkema

- BASF SE

- Dow

- Evonik Industries AG

- Hitachi

- Ltd.

- KURARAY CO.

- LTD.

- LG Chem

- Mitsubishi Chemical Group Corporation

- NIPPON SHOKUBAI CO.

- LTD.

- Pallav Chemicals

- and Solvents Company

The Global Acrylate Monomer Market is Segmented as Follows:

By Type

- Methyl Acrylate

- Acrylic Acid

- Ethyl Acrylate

- Butyl Acrylate

- 2-ethylhexyl Acrylate

- and Others

By Application

- Adhesives & Sealants

- Plastics

- Printing Inks

- Acrylic Rubber

- Acrylic Fibers

- and Others

By End-user

- Packaging

- Paints & Coatings

- Construction

- Automotive

- and Others

By Production Process

- Direct Esterification

- Olefin Oxidation

- and Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

List of Tables and Figures Figure Product Picture of Acrylate Monomer Table Product Specification of Acrylate Monomer Figure Market Concentration Ratio and Market Maturity Analysis of Acrylate Monomer Figure Global Acrylate Monomer Value ($) and Growth Rate from 2014-2024 Table Different Types of Acrylate Monomer Figure Global Acrylate Monomer Value ($) Segment by Type from 2014-2019 Figure 2-Ethylhexyl Acrylate Picture Figure Butyl Acrylate Picture Figure Ethyl Acrylate Picture Figure Methyl Acrylate Picture Table Different Applications of Acrylate Monomer Figure Global Acrylate Monomer Value ($) Segment by Applications from 2014-2019 Figure Textiles Picture Figure Plastics Picture Figure Coatings Picture Figure Adhesives Picture Table Research Regions of Acrylate Monomer Figure North America Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Figure Europe Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Table China Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Table Japan Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Table Middle East & Africa Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Table India Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Table South America Acrylate Monomer Production Value ($) and Growth Rate (2014-2019) Table Emerging Countries of Acrylate Monomer Table Growing Market of Acrylate Monomer Figure Industry Chain Analysis of Acrylate Monomer Table Upstream Raw Material Suppliers of Acrylate Monomer with Contact Information Table Major Players Manufacturing Base and Market Share ($) of Acrylate Monomer in 2018 Table Major Players Acrylate Monomer Product Types in 2018 Figure Production Process of Acrylate Monomer Figure Manufacturing Cost Structure of Acrylate Monomer Figure Channel Status of Acrylate Monomer Table Major Distributors of Acrylate Monomer with Contact Information Table Major Downstream Buyers of Acrylate Monomer with Contact Information Table Global Acrylate Monomer Value ($) by Type (2014-2019) Table Global Acrylate Monomer Value ($) Share by Type (2014-2019) Figure Global Acrylate Monomer Value ($) Share by Type (2014-2019) Table Global Acrylate Monomer Production by Type (2014-2019) Table Global Acrylate Monomer Production Share by Type (2014-2019) Figure Global Acrylate Monomer Production Share by Type (2014-2019) Figure Global Acrylate Monomer Value ($) and Growth Rate of 2-Ethylhexyl Acrylate Figure Global Acrylate Monomer Value ($) and Growth Rate of Butyl Acrylate Figure Global Acrylate Monomer Value ($) and Growth Rate of Ethyl Acrylate Figure Global Acrylate Monomer Value ($) and Growth Rate of Methyl Acrylate Figure Global Acrylate Monomer Price by Type (2014-2019) Table Global Acrylate Monomer Consumption by Application (2014-2019) Table Global Acrylate Monomer Consumption Market Share by Application (2014-2019) Figure Global Acrylate Monomer Consumption Market Share by Application (2014-2019) Table Downstream Buyers Introduction by Application Figure Global Acrylate Monomer Consumption and Growth Rate of Textiles (2014-2019) Figure Global Acrylate Monomer Consumption and Growth Rate of Plastics (2014-2019) Figure Global Acrylate Monomer Consumption and Growth Rate of Coatings (2014-2019) Figure Global Acrylate Monomer Consumption and Growth Rate of Adhesives (2014-2019) Table Global Acrylate Monomer Value ($) by Region (2014-2019) Table Global Acrylate Monomer Value ($) Market Share by Region (2014-2019) Figure Global Acrylate Monomer Value ($) Market Share by Region (2014-2019) Table Global Acrylate Monomer Production by Region (2014-2019) Table Global Acrylate Monomer Production Market Share by Region (2014-2019) Figure Global Acrylate Monomer Production Market Share by Region (2014-2019) Table Global Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table North America Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table Europe Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table China Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table Japan Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table Middle East & Africa Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table India Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table South America Acrylate Monomer Production, Value ($), Price and Gross Margin (2014-2019) Table Global Acrylate Monomer Consumption by Regions (2014-2019) Figure Global Acrylate Monomer Consumption Share by Regions (2014-2019) Table North America Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Table Europe Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Table China Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Table Japan Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Table Middle East & Africa Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Table India Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Table South America Acrylate Monomer Production, Consumption, Export, Import (2014-2019) Figure North America Acrylate Monomer Production and Growth Rate Analysis Figure North America Acrylate Monomer Consumption and Growth Rate Analysis Figure North America Acrylate Monomer SWOT Analysis Figure Europe Acrylate Monomer Production and Growth Rate Analysis Figure Europe Acrylate Monomer Consumption and Growth Rate Analysis Figure Europe Acrylate Monomer SWOT Analysis Figure China Acrylate Monomer Production and Growth Rate Analysis Figure China Acrylate Monomer Consumption and Growth Rate Analysis Figure China Acrylate Monomer SWOT Analysis Figure Japan Acrylate Monomer Production and Growth Rate Analysis Figure Japan Acrylate Monomer Consumption and Growth Rate Analysis Figure Japan Acrylate Monomer SWOT Analysis Figure Middle East & Africa Acrylate Monomer Production and Growth Rate Analysis Figure Middle East & Africa Acrylate Monomer Consumption and Growth Rate Analysis Figure Middle East & Africa Acrylate Monomer SWOT Analysis Figure India Acrylate Monomer Production and Growth Rate Analysis Figure India Acrylate Monomer Consumption and Growth Rate Analysis Figure India Acrylate Monomer SWOT Analysis Figure South America Acrylate Monomer Production and Growth Rate Analysis Figure South America Acrylate Monomer Consumption and Growth Rate Analysis Figure South America Acrylate Monomer SWOT Analysis Figure Top 3 Market Share of Acrylate Monomer Companies Figure Top 6 Market Share of Acrylate Monomer Companies Table Mergers, Acquisitions and Expansion Analysis Table Company Profiles Table Product Introduction Table SIBUR Production, Value ($), Price, Gross Margin 2014-2019 Figure SIBUR Production and Growth Rate Figure SIBUR Value ($) Market Share 2014-2019 Figure SIBUR Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table Hexion Production, Value ($), Price, Gross Margin 2014-2019 Figure Hexion Production and Growth Rate Figure Hexion Value ($) Market Share 2014-2019 Figure Hexion Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table Dow Chemical Company Production, Value ($), Price, Gross Margin 2014-2019 Figure Dow Chemical Company Production and Growth Rate Figure Dow Chemical Company Value ($) Market Share 2014-2019 Figure Dow Chemical Company Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table Evonik Production, Value ($), Price, Gross Margin 2014-2019 Figure Evonik Production and Growth Rate Figure Evonik Value ($) Market Share 2014-2019 Figure Evonik Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table Sartomer (Arkema) Production, Value ($), Price, Gross Margin 2014-2019 Figure Sartomer (Arkema) Production and Growth Rate Figure Sartomer (Arkema) Value ($) Market Share 2014-2019 Figure Sartomer (Arkema) Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table BASF Production, Value ($), Price, Gross Margin 2014-2019 Figure BASF Production and Growth Rate Figure BASF Value ($) Market Share 2014-2019 Figure BASF Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table ExxonMobil Production, Value ($), Price, Gross Margin 2014-2019 Figure ExxonMobil Production and Growth Rate Figure ExxonMobil Value ($) Market Share 2014-2019 Figure ExxonMobil Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table DuPont Production, Value ($), Price, Gross Margin 2014-2019 Figure DuPont Production and Growth Rate Figure DuPont Value ($) Market Share 2014-2019 Figure DuPont Market Share of Acrylate Monomer Segmented by Region in 2018 Table Company Profiles Table Product Introduction Table Allnex Production, Value ($), Price, Gross Margin 2014-2019 Figure Allnex Production and Growth Rate Figure Allnex Value ($) Market Share 2014-2019 Figure Allnex Market Share of Acrylate Monomer Segmented by Region in 2018 Table Global Acrylate Monomer Market Value ($) Forecast, by Type Table Global Acrylate Monomer Market Volume Forecast, by Type Figure Global Acrylate Monomer Market Value ($) and Growth Rate Forecast of 2-Ethylhexyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Volume and Growth Rate Forecast of 2-Ethylhexyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Value ($) and Growth Rate Forecast of Butyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Volume and Growth Rate Forecast of Butyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Value ($) and Growth Rate Forecast of Ethyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Volume and Growth Rate Forecast of Ethyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Value ($) and Growth Rate Forecast of Methyl Acrylate (2019-2024) Figure Global Acrylate Monomer Market Volume and Growth Rate Forecast of Methyl Acrylate (2019-2024) Table Global Market Value ($) Forecast by Application (2019-2024) Table Global Market Volume Forecast by Application (2019-2024) Figure Global Acrylate Monomer Consumption and Growth Rate of Textiles (2014-2019) Figure Global Acrylate Monomer Consumption and Growth Rate of Plastics (2014-2019) Figure Global Acrylate Monomer Consumption and Growth Rate of Coatings (2014-2019) Figure Global Acrylate Monomer Consumption and Growth Rate of Adhesives (2014-2019) Figure Market Value ($) and Growth Rate Forecast of Adhesives (2019-2024) Figure Market Volume and Growth Rate Forecast of Adhesives (2019-2024) Figure North America Market Value ($) and Growth Rate Forecast (2019-2024) Table North America Consumption and Growth Rate Forecast (2019-2024) Figure Europe Market Value ($) and Growth Rate Forecast (2019-2024) Table Europe Consumption and Growth Rate Forecast (2019-2024) Figure China Market Value ($) and Growth Rate Forecast (2019-2024) Table China Consumption and Growth Rate Forecast (2019-2024) Figure Japan Market Value ($) and Growth Rate Forecast (2019-2024) Table Japan Consumption and Growth Rate Forecast (2019-2024) Figure Middle East & Africa Market Value ($) and Growth Rate Forecast (2019-2024) Table Middle East & Africa Consumption and Growth Rate Forecast (2019-2024) Figure India Market Value ($) and Growth Rate Forecast (2019-2024) Table India Consumption and Growth Rate Forecast (2019-2024) Figure South America Market Value ($) and Growth Rate Forecast (2019-2024) Table South America Consumption and Growth Rate Forecast (2019-2024) Figure Industry Resource/Technology/Labor Importance Analysis Table New Entrants SWOT Analysis Table New Project Analysis of Investment Recovery

Inquiry For Buying

Acrylate Monomer

Request Sample

Acrylate Monomer