Acrylic Ester Market Size, Share, and Trends Analysis Report

CAGR :

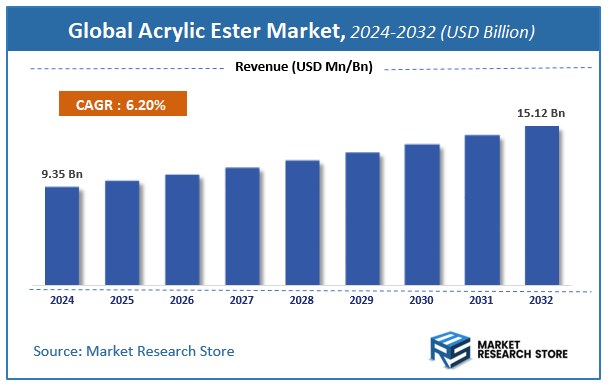

| Market Size 2024 (Base Year) | USD 9.35 Billion |

| Market Size 2032 (Forecast Year) | USD 15.12 Billion |

| CAGR | 6.2% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global acrylic ester market size was valued at approximately USD 9.35 Billion in 2024. The market is projected to grow significantly, reaching USD 15.12 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the acrylic ester industry.

Acrylic Ester Market: Overview

The growth of the acrylic ester market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The acrylic ester market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the acrylic ester market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Application, Type, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global acrylic ester market is estimated to grow annually at a CAGR of around 6.2% over the forecast period (2025-2032).

- In terms of revenue, the global acrylic ester market size was valued at around USD 9.35 Billion in 2024 and is projected to reach USD 15.12 Billion by 2032.

- The market is projected to grow at a significant rate due to Increasing demand from the paints and coatings industry, growing use in adhesives and sealants for construction and automotive applications, and rising industrialization and infrastructure development in emerging.

- Based on the Application, the Surface Coating segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Type, the Ethyl Acrylate segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Acrylic Ester Market: Report Scope

This report thoroughly analyzes the acrylic ester market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Acrylic Ester Market |

| Market Size in 2024 | USD 9.35 Billion |

| Market Forecast in 2032 | USD 15.12 Billion |

| Growth Rate | CAGR of 6.2% |

| Number of Pages | 201 |

| Key Companies Covered | LG Chem, Arkema, OJSC Sibur, Nippon Shokubai, DowDuPont, Mitsubishi Chemical |

| Segments Covered | By Application, By Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Acrylic Ester Market: Dynamics

Key Growth Drivers :

The acrylic ester market is experiencing significant growth, primarily driven by their extensive use as a key monomer in the production of polymers and resins across a wide range of industries. The most significant driver is the increasing demand from the paints and coatings sector, where acrylic esters provide essential properties like durability, weather resistance, and adhesion. This is further fueled by a global trend towards low-VOC (volatile organic compound) and water-based coatings, as environmental regulations and consumer health awareness rise. The burgeoning adhesives and sealants market, particularly in the construction, automotive, and packaging industries, is also a major catalyst, as acrylic esters are used to create high-performance bonding agents. Additionally, their use in the production of superabsorbent polymers (SAPs) for hygiene products like diapers and sanitary napkins is a strong and consistent growth factor, driven by population growth and rising living standards.

Restraints :

The market for acrylic esters faces several significant restraints. One of the most prominent is the volatility of raw material prices. Acrylic esters are derived from petrochemical feedstocks, and their price is directly tied to the fluctuating costs of crude oil, which can impact production costs and retail prices, thereby affecting the profitability of manufacturers. Additionally, the industry is subject to stringent environmental regulations and health concerns. As volatile organic compounds, some acrylic esters are subject to strict limits on air exposure and emissions, which can increase compliance costs and limit their application in certain industries. Furthermore, intense competition from other acrylate esters and alternative chemicals can put pressure on prices and market share.

Opportunities :

The acrylic ester market presents numerous opportunities for future growth. A key opportunity lies in the development of bio-based and sustainable acrylic esters from renewable resources, which can address environmental concerns and appeal to a growing segment of environmentally conscious consumers and regulatory bodies. The market can also capitalize on the rising demand for high-performance polymers in advanced applications such as aerospace, electronics, and medical devices, where the unique properties of acrylic esters are highly valued. Furthermore, the rapid industrialization and infrastructure development in emerging economies, particularly in the Asia-Pacific region, presents a vast and largely untapped market for products containing acrylic esters, such as paints, coatings, and adhesives.

Challenges :

Despite the opportunities, the market is not without its challenges. The primary one is the need to navigate a complex and varied regulatory landscape across different countries, which can affect everything from production processes to product labeling and safety data sheets. This creates significant hurdles for international trade and market expansion. The perception of health risks associated with the chemical can also be a challenge, requiring manufacturers to invest in public education and to demonstrate the safety of their products through extensive testing and certifications. The intense competition and market fragmentation, with many players vying for a share, can lead to price pressures and reduced profit margins. Finally, the high initial capital investment required to build and operate manufacturing facilities for acrylic esters can be a significant barrier to entry for new players.

Acrylic Ester Market: Segmentation Insights

The global acrylic ester market is segmented based on Application, Type, and Region. All the segments of the acrylic ester market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Application, the global acrylic ester market is divided into Surface Coating, Adhesives & Sealants, Plastic Adhesives, Textiles, Others.

On the basis of Type, the global acrylic ester market is bifurcated into Ethyl Acrylate, Methyl Acrylate, Butyl Acrylate, 2- Ethyl Hexyl Acrylate, Others.

Acrylic Ester Market: Regional Insights

The Asia-Pacific (APAC) region, with China as the undisputed production and consumption hub, is the dominant force in the global acrylic ester market. According to data from Grand View Research and the International Trade Centre, APAC accounts for the largest market share, driven by its massive manufacturing base for key downstream industries such as paints and coatings, adhesives and sealants, plastics, and textiles. China, in particular, leverages its extensive petrochemical infrastructure, cost-competitive production capabilities, and growing domestic demand to supply both regional and global markets.

While North America and Europe remain significant markets due to well-established industrial sectors and demand for high-value specialty acrylates, their growth rates are slower, and production has increasingly shifted toward APAC to capitalize on economies of scale and proximity to raw materials. The region’s unparalleled production capacity, rising local consumption, and role as a global export powerhouse solidify its position as the volume and growth leader in the acrylic ester market.

Acrylic Ester Market: Competitive Landscape

The acrylic ester market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Acrylic Ester Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- LG Chem

- Arkema

- OJSC Sibur

- Nippon Shokubai

- DowDuPont

- Mitsubishi Chemical

The Global Acrylic Ester Market is Segmented as Follows:

By Application

- Surface Coating

- Adhesives & Sealants

- Plastic Adhesives

- Textiles

- Others

By Type

- Ethyl Acrylate

- Methyl Acrylate

- Butyl Acrylate

- 2- Ethyl Hexyl Acrylate

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Acrylic Ester Market Share by Type (2020-2026) 1.5.2 Methyl Acrylate 1.5.3 Ethyl Acrylate 1.5.4 Butyl Acrylate 1.5.5 2-EH Acrylate 1.5.6 Other 1.6 Market by Application 1.6.1 Global Acrylic Ester Market Share by Application (2020-2026) 1.6.2 Surface Coatings 1.6.3 Adhesives & Sealants 1.6.4 Plastic Additives 1.6.5 Detergents 1.6.6 Textiles 1.6.7 Others 1.7 Acrylic Ester Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Acrylic Ester Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Acrylic Ester Market 3.1 Value Chain Status 3.2 Acrylic Ester Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Acrylic Ester 3.2.3 Labor Cost of Acrylic Ester 3.2.3.1 Labor Cost of Acrylic Ester Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 BASF 4.1.1 BASF Basic Information 4.1.2 Acrylic Ester Product Profiles, Application and Specification 4.1.3 BASF Acrylic Ester Market Performance (2015-2020) 4.1.4 BASF Business Overview 4.2 OJSC Sibur 4.2.1 OJSC Sibur Basic Information 4.2.2 Acrylic Ester Product Profiles, Application and Specification 4.2.3 OJSC Sibur Acrylic Ester Market Performance (2015-2020) 4.2.4 OJSC Sibur Business Overview 4.3 Momentive Specialty Chemicals 4.3.1 Momentive Specialty Chemicals Basic Information 4.3.2 Acrylic Ester Product Profiles, Application and Specification 4.3.3 Momentive Specialty Chemicals Acrylic Ester Market Performance (2015-2020) 4.3.4 Momentive Specialty Chemicals Business Overview 4.4 Arkema 4.4.1 Arkema Basic Information 4.4.2 Acrylic Ester Product Profiles, Application and Specification 4.4.3 Arkema Acrylic Ester Market Performance (2015-2020) 4.4.4 Arkema Business Overview 4.5 Sasol 4.5.1 Sasol Basic Information 4.5.2 Acrylic Ester Product Profiles, Application and Specification 4.5.3 Sasol Acrylic Ester Market Performance (2015-2020) 4.5.4 Sasol Business Overview 4.6 Dow Chemical Company 4.6.1 Dow Chemical Company Basic Information 4.6.2 Acrylic Ester Product Profiles, Application and Specification 4.6.3 Dow Chemical Company Acrylic Ester Market Performance (2015-2020) 4.6.4 Dow Chemical Company Business Overview 4.7 Evonik Industries 4.7.1 Evonik Industries Basic Information 4.7.2 Acrylic Ester Product Profiles, Application and Specification 4.7.3 Evonik Industries Acrylic Ester Market Performance (2015-2020) 4.7.4 Evonik Industries Business Overview 4.8 Nippon Shokubai 4.8.1 Nippon Shokubai Basic Information 4.8.2 Acrylic Ester Product Profiles, Application and Specification 4.8.3 Nippon Shokubai Acrylic Ester Market Performance (2015-2020) 4.8.4 Nippon Shokubai Business Overview 4.9 LG Chem 4.9.1 LG Chem Basic Information 4.9.2 Acrylic Ester Product Profiles, Application and Specification 4.9.3 LG Chem Acrylic Ester Market Performance (2015-2020) 4.9.4 LG Chem Business Overview 4.10 Hexion 4.10.1 Hexion Basic Information 4.10.2 Acrylic Ester Product Profiles, Application and Specification 4.10.3 Hexion Acrylic Ester Market Performance (2015-2020) 4.10.4 Hexion Business Overview 4.11 Mitsubishi Chemical 4.11.1 Mitsubishi Chemical Basic Information 4.11.2 Acrylic Ester Product Profiles, Application and Specification 4.11.3 Mitsubishi Chemical Acrylic Ester Market Performance (2015-2020) 4.11.4 Mitsubishi Chemical Business Overview 5 Global Acrylic Ester Market Analysis by Regions 5.1 Global Acrylic Ester Sales, Revenue and Market Share by Regions 5.1.1 Global Acrylic Ester Sales by Regions (2015-2020) 5.1.2 Global Acrylic Ester Revenue by Regions (2015-2020) 5.2 North America Acrylic Ester Sales and Growth Rate (2015-2020) 5.3 Europe Acrylic Ester Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Acrylic Ester Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Acrylic Ester Sales and Growth Rate (2015-2020) 5.6 South America Acrylic Ester Sales and Growth Rate (2015-2020) 6 North America Acrylic Ester Market Analysis by Countries 6.1 North America Acrylic Ester Sales, Revenue and Market Share by Countries 6.1.1 North America Acrylic Ester Sales by Countries (2015-2020) 6.1.2 North America Acrylic Ester Revenue by Countries (2015-2020) 6.1.3 North America Acrylic Ester Market Under COVID-19 6.2 United States Acrylic Ester Sales and Growth Rate (2015-2020) 6.2.1 United States Acrylic Ester Market Under COVID-19 6.3 Canada Acrylic Ester Sales and Growth Rate (2015-2020) 6.4 Mexico Acrylic Ester Sales and Growth Rate (2015-2020) 7 Europe Acrylic Ester Market Analysis by Countries 7.1 Europe Acrylic Ester Sales, Revenue and Market Share by Countries 7.1.1 Europe Acrylic Ester Sales by Countries (2015-2020) 7.1.2 Europe Acrylic Ester Revenue by Countries (2015-2020) 7.1.3 Europe Acrylic Ester Market Under COVID-19 7.2 Germany Acrylic Ester Sales and Growth Rate (2015-2020) 7.2.1 Germany Acrylic Ester Market Under COVID-19 7.3 UK Acrylic Ester Sales and Growth Rate (2015-2020) 7.3.1 UK Acrylic Ester Market Under COVID-19 7.4 France Acrylic Ester Sales and Growth Rate (2015-2020) 7.4.1 France Acrylic Ester Market Under COVID-19 7.5 Italy Acrylic Ester Sales and Growth Rate (2015-2020) 7.5.1 Italy Acrylic Ester Market Under COVID-19 7.6 Spain Acrylic Ester Sales and Growth Rate (2015-2020) 7.6.1 Spain Acrylic Ester Market Under COVID-19 7.7 Russia Acrylic Ester Sales and Growth Rate (2015-2020) 7.7.1 Russia Acrylic Ester Market Under COVID-19 8 Asia-Pacific Acrylic Ester Market Analysis by Countries 8.1 Asia-Pacific Acrylic Ester Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Acrylic Ester Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Acrylic Ester Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Acrylic Ester Market Under COVID-19 8.2 China Acrylic Ester Sales and Growth Rate (2015-2020) 8.2.1 China Acrylic Ester Market Under COVID-19 8.3 Japan Acrylic Ester Sales and Growth Rate (2015-2020) 8.3.1 Japan Acrylic Ester Market Under COVID-19 8.4 South Korea Acrylic Ester Sales and Growth Rate (2015-2020) 8.4.1 South Korea Acrylic Ester Market Under COVID-19 8.5 Australia Acrylic Ester Sales and Growth Rate (2015-2020) 8.6 India Acrylic Ester Sales and Growth Rate (2015-2020) 8.6.1 India Acrylic Ester Market Under COVID-19 8.7 Southeast Asia Acrylic Ester Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Acrylic Ester Market Under COVID-19 9 Middle East and Africa Acrylic Ester Market Analysis by Countries 9.1 Middle East and Africa Acrylic Ester Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Acrylic Ester Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Acrylic Ester Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Acrylic Ester Market Under COVID-19 9.2 Saudi Arabia Acrylic Ester Sales and Growth Rate (2015-2020) 9.3 UAE Acrylic Ester Sales and Growth Rate (2015-2020) 9.4 Egypt Acrylic Ester Sales and Growth Rate (2015-2020) 9.5 Nigeria Acrylic Ester Sales and Growth Rate (2015-2020) 9.6 South Africa Acrylic Ester Sales and Growth Rate (2015-2020) 10 South America Acrylic Ester Market Analysis by Countries 10.1 South America Acrylic Ester Sales, Revenue and Market Share by Countries 10.1.1 South America Acrylic Ester Sales by Countries (2015-2020) 10.1.2 South America Acrylic Ester Revenue by Countries (2015-2020) 10.1.3 South America Acrylic Ester Market Under COVID-19 10.2 Brazil Acrylic Ester Sales and Growth Rate (2015-2020) 10.2.1 Brazil Acrylic Ester Market Under COVID-19 10.3 Argentina Acrylic Ester Sales and Growth Rate (2015-2020) 10.4 Columbia Acrylic Ester Sales and Growth Rate (2015-2020) 10.5 Chile Acrylic Ester Sales and Growth Rate (2015-2020) 11 Global Acrylic Ester Market Segment by Types 11.1 Global Acrylic Ester Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Acrylic Ester Sales and Market Share by Types (2015-2020) 11.1.2 Global Acrylic Ester Revenue and Market Share by Types (2015-2020) 11.2 Methyl Acrylate Sales and Price (2015-2020) 11.3 Ethyl Acrylate Sales and Price (2015-2020) 11.4 Butyl Acrylate Sales and Price (2015-2020) 11.5 2-EH Acrylate Sales and Price (2015-2020) 11.6 Other Sales and Price (2015-2020) 12 Global Acrylic Ester Market Segment by Applications 12.1 Global Acrylic Ester Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Acrylic Ester Sales and Market Share by Applications (2015-2020) 12.1.2 Global Acrylic Ester Revenue and Market Share by Applications (2015-2020) 12.2 Surface Coatings Sales, Revenue and Growth Rate (2015-2020) 12.3 Adhesives & Sealants Sales, Revenue and Growth Rate (2015-2020) 12.4 Plastic Additives Sales, Revenue and Growth Rate (2015-2020) 12.5 Detergents Sales, Revenue and Growth Rate (2015-2020) 12.6 Textiles Sales, Revenue and Growth Rate (2015-2020) 12.7 Others Sales, Revenue and Growth Rate (2015-2020) 13 Acrylic Ester Market Forecast by Regions (2020-2026) 13.1 Global Acrylic Ester Sales, Revenue and Growth Rate (2020-2026) 13.2 Acrylic Ester Market Forecast by Regions (2020-2026) 13.2.1 North America Acrylic Ester Market Forecast (2020-2026) 13.2.2 Europe Acrylic Ester Market Forecast (2020-2026) 13.2.3 Asia-Pacific Acrylic Ester Market Forecast (2020-2026) 13.2.4 Middle East and Africa Acrylic Ester Market Forecast (2020-2026) 13.2.5 South America Acrylic Ester Market Forecast (2020-2026) 13.3 Acrylic Ester Market Forecast by Types (2020-2026) 13.4 Acrylic Ester Market Forecast by Applications (2020-2026) 13.5 Acrylic Ester Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Acrylic Ester

Request Sample

Acrylic Ester