Adventure Travel Market Size, Share, and Trends Analysis Report

CAGR :

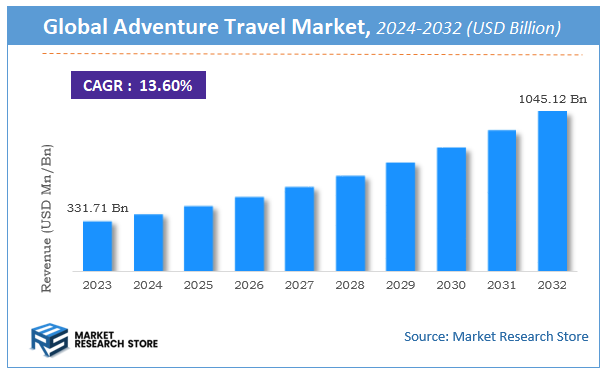

| Market Size 2023 (Base Year) | USD 331.71 Billion |

| Market Size 2032 (Forecast Year) | USD 1045.12 Billion |

| CAGR | 13.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Adventure Travel Market Insights

According to Market Research Store, the global adventure travel market size was valued at around USD 331.71 billion in 2023 and is estimated to reach USD 1045.12 billion by 2032, to register a CAGR of approximately 13.6% in terms of revenue during the forecast period 2024-2032.

The adventure travel report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Adventure Travel Market: Overview

Adventure travel refers to tourism activities that involve exploration, physical exertion, and a degree of risk or challenge, often in natural or remote settings. This type of travel typically includes experiences such as trekking, mountaineering, scuba diving, wildlife safaris, white-water rafting, zip-lining, and cultural immersion in less-developed or offbeat destinations. Adventure travelers seek authentic, adrenaline-filled, and meaningful experiences that go beyond traditional sightseeing, often with a focus on personal growth, environmental awareness, and cultural connection. The activities can range from soft adventures like hiking and kayaking to extreme adventures like bungee jumping and rock climbing.

Key Highlights

- The adventure travel market is anticipated to grow at a CAGR of 13.6% during the forecast period.

- The global adventure travel market was estimated to be worth approximately USD 331.71 billion in 2023 and is projected to reach a value of USD 1045.12 billion by 2032.

- The growth of the adventure travel market is being driven by shifting consumer preferences toward experiential and sustainable tourism.

- Based on the activity type, the soft adventure segment is growing at a high rate and is projected to dominate the market.

- On the basis of traveler type, the group segment is projected to swipe the largest market share.

- In terms of booking mode, the direct booking segment is expected to dominate the market.

- Based on the age group, the 25–40 years segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Adventure Travel Market: Dynamics

Key Growth Drivers:

- Rising Interest in Experiential and Authentic Travel: Modern travelers, especially millennials and Gen Z, are seeking meaningful and immersive experiences, driving demand for adventure-based trips.

- Growing Popularity of Wellness and Nature-Based Activities: Activities such as hiking, kayaking, eco-tourism, and mountain biking are becoming popular as travelers focus more on health, fitness, and nature.

- Social Media Influence and Digital Exposure: Social media platforms and travel influencers are playing a major role in promoting remote and exotic adventure destinations, encouraging spontaneous travel decisions.

- Expansion of Infrastructure in Remote Destinations: Improvements in transportation, accommodation, and digital connectivity in offbeat locations are making adventure travel more accessible and safer.

Restraints:

- High Cost of Adventure Travel Experiences: Adventure travel often involves specialized equipment, trained guides, and remote logistics, making it relatively expensive and less accessible to budget travelers.

- Safety and Health Risks in Adventure Activities: The inherent risk involved in certain activities like trekking, diving, or paragliding may deter cautious travelers or those with health concerns.

- Seasonal and Weather Dependency: Many adventure activities are seasonal and highly dependent on weather conditions, leading to fluctuating demand throughout the year.

Opportunities:

- Rise in Solo and Female Adventure Travelers: Increasing confidence and supportive travel communities have encouraged solo and female travelers to participate more in adventure tourism, opening new market segments.

- Emergence of Sustainable and Responsible Travel Trends: Travelers are showing growing interest in eco-conscious and community-based adventures, creating opportunities for local and sustainable tourism models.

- Integration of Technology in Travel Planning: The use of apps, AI, and virtual reality for itinerary planning, safety, and navigation enhances the adventure travel experience and streamlines booking processes.

Challenges:

- Regulatory and Permitting Barriers in Some Regions: Strict visa policies, permit requirements, or local restrictions in adventure-prone areas can limit accessibility and operational ease for tour operators.

- Environmental Impact and Over-Tourism Risks: Popular adventure destinations are facing ecological degradation and crowding, raising concerns about sustainability and conservation.

- Need for Skilled Guides and Quality Standards: The lack of trained professionals and inconsistent service quality in some regions can negatively affect customer satisfaction and safety.

Adventure Travel Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Adventure Travel Market |

| Market Size in 2023 | USD 331.71 Billion |

| Market Forecast in 2032 | USD 1045.12 Billion |

| Growth Rate | CAGR of 13.6% |

| Number of Pages | 177 |

| Key Companies Covered | Abercrombie & Kent USA, LLC, Tauck, Urban Adventures, Butterfield & Robinson Inc., TCS World Travel, Cox & Kings Ltd., Thomas Cook Group, Jet2holidays.com, G Adventures, Lindblad Expeditions, Audley Travel, Oku Japan, Exodus Travel, Scott Dunn Ltd., Intrepid Group, and Others |

| Segments Covered | By Type, By Activities, By Type Of Traveler, By Sales Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Adventure Travel Market: Segmentation Insights

The global adventure travel market is divided by activity type, traveler type, booking mode, age group, and region.

Based on activity type, the global adventure travel market is divided into hard, soft, and others. The soft adventure segment holds the dominant position, accounting for the largest share of traveler participation globally. These activities are characterized by lower risk and require minimal to moderate physical effort, making them suitable for a broader demographic including families, older adults, and casual travelers. Popular soft adventure activities include hiking, wildlife safaris, cultural tours, kayaking, and hot-air ballooning. The appeal of these experiences lies in their balance between excitement and safety, allowing travelers to engage with nature and local cultures without extreme physical demands. This accessibility has made soft adventure the preferred choice for first-time and repeat adventure tourists alike, driving steady market growth. Following closely is the hard adventure segment, which caters to thrill-seekers and experienced travelers looking for high-adrenaline experiences. Hard adventure involves physically demanding and risk-intensive activities such as rock climbing, mountaineering, deep-sea diving, white-water rafting, and paragliding. These activities often require specialized equipment, guided supervision, and a higher level of fitness.

On the basis of traveler type, the global adventure travel market is bifurcated into solo, couples, family, and groups. The group traveler segment is the most dominant, accounting for the largest share of the market. Group adventure travel is popular among friends, corporate teams, student organizations, and special interest clubs, as it offers cost-sharing benefits, safety in numbers, and a shared experience that enhances the enjoyment of challenging or remote adventures. Tour operators often design customized group packages, making logistics easier and more affordable for participants. This segment continues to thrive due to its structured approach, social appeal, and growing popularity of themed and guided group expeditions. The couples segment follows as the second most dominant, driven by the rising trend of adventure honeymoons, romantic getaways, and active vacations for partners. Couples often seek a mix of soft and hard adventure activities such as hiking, scuba diving, or cultural exploration that allows them to bond through shared experiences. The demand for personalized and luxurious adventure travel packages among couples has seen notable growth, especially in exotic and nature-based destinations.

Based on booking mode, the global adventure travel market is divided into direct, travel agent, and marketplace booking. The direct booking segment currently dominates the adventure travel market, with a majority of travelers preferring to book trips directly through tour operators’ websites, destination providers, or local service partners. This method offers better price transparency, customization options, and direct communication, which many adventure travelers value especially experienced ones. The rise of user-friendly websites, mobile apps, and integrated payment systems has made direct booking more accessible. Additionally, travelers booking directly often benefit from personalized itineraries and local insights, strengthening loyalty to specific operators or brands. The marketplace booking segment is the second most dominant and growing rapidly, fueled by the digital transformation of the travel industry. Online travel marketplaces and aggregators such as Viator, GetYourGuide, and Klook provide travelers with access to a wide variety of adventure experiences across the globe. These platforms offer user reviews, instant booking options, and curated packages, making it convenient for travelers especially first-timers to explore and compare multiple options in one place.

In terms of of age group, the global adventure travel market is bifurcated into below 25 years, 25 - 40 years, 41 - 50 years, 51 - 60 years, 61 - 70 years, and 71 years & above. The 25–40 years age group is the most dominant segment in the adventure travel market. These travelers are typically young professionals, digital nomads, or newly married couples with sufficient disposable income and physical stamina to explore both soft and hard adventure activities. They are highly influenced by social media, sustainability, and cultural immersion, and often seek unique experiences such as trekking, diving, cycling tours, or nature-based expeditions. This segment also shows a high tendency to book through digital channels and prefers flexibility and customization in their travel itineraries. Next is the below 25 years age group, primarily consisting of students, recent graduates, and backpackers. Despite limited spending power, this segment is highly adventurous and often engages in budget-friendly travel such as hiking, camping, and cultural exchanges. Youth-focused adventure trips, volunteer tourism, and gap-year programs have seen strong uptake within this demographic.

Adventure Travel Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the global adventure travel market, driven by its vast and diverse landscapes, well-developed tourism infrastructure, and a high concentration of adventure seekers. The region offers a wide range of activities such as hiking in national parks, skiing in the Rockies, kayaking in Alaska, and cultural immersion across Native American and frontier heritage sites. Strong support for outdoor recreation, coupled with high consumer spending on experiential travel, positions North America as the leading market for adventure tourism.

Europe follows as the second-largest region, benefiting from its rich mix of natural beauty, historical landmarks, and advanced transportation networks. Adventure travelers in Europe are drawn to activities like alpine skiing, cycling tours, hiking the Dolomites, and exploring rugged coastlines. The region’s focus on sustainable and eco-friendly tourism, combined with diverse cross-border experiences, makes it a highly attractive destination for both soft and hard adventure activities.

Asia Pacific is the fastest-growing region in the adventure travel market, fueled by rising disposable incomes, increasing domestic tourism, and expanding middle-class populations. Countries like Nepal, India, Thailand, and Indonesia offer travelers unique opportunities for trekking, jungle exploration, diving, and spiritual tourism. Government initiatives to promote tourism, coupled with growing interest from international travelers, are rapidly elevating Asia Pacific’s presence in the global adventure tourism landscape.

Latin America holds a modest share of the adventure travel market, with growth centered around destinations like Brazil, Peru, Chile, and Costa Rica. The region is known for its biodiversity, rainforests, ancient ruins, and vibrant cultures, attracting travelers seeking nature-based and culturally immersive experiences. However, limited infrastructure and safety concerns in some areas have slightly restrained its growth compared to leading regions.

The Middle East and Africa represent the smallest portion of the adventure travel market, but offer growing potential due to unique desert landscapes, wildlife reserves, and emerging tourism strategies. Countries like the UAE, South Africa, and Morocco are promoting eco-tourism and cultural heritage experiences. While infrastructure and accessibility remain challenges, rising investments in tourism development are expected to gradually expand the region’s role in adventure travel.

Recent Developments:

- In October 2024, G Adventures launched new solo travel trips for 2025, targeting the growing demand among independent travelers. These small-group adventures are tailored for solo explorers seeking connection, flexibility, and shared experiences with like-minded individuals, especially younger travelers.

- In December 2022, Active Adventures and Austin Adventures unveiled a unified rebrand to reflect their merger and shared commitment to sustainable, community-based travel. The refreshed identity aims to offer more immersive, curated global adventures for a wider audience of responsible travelers.

Adventure Travel Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the adventure travel market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global adventure travel market include:

- Abercrombie & Kent USA LLC

- Austin Adventures Inc.

- Geographic Expeditions Inc.

- Tauck

- Urban Adventures

- Butterfield & Robinson Inc.

- TCS World Travel

- Cox & Kings Ltd.

- Thomas Cook Group

- Jet2holidays.com

- G Adventures

- Lindblad Expeditions

- Audley Travel

- Oku Japan

- Exodus Travel

- Scott Dunn Ltd.

- Intrepid Group

- Mountain Travel Sobek

- Discovery Nomads

- Row Adventures

- TUI Group

The global adventure travel market is segmented as follows:

By Activity Type

- Hard

- Soft

- Others

By Traveler Type

- Solo

- Couples

- Family

- Groups

By Booking Mode

- Direct

- Travel Agent

- Marketplace Booking

By Age Group

- Below 25 Years

- 25 - 40 Years

- 41 - 50 Years

- 51 - 60 Years

- 61 - 70 Years

- 71 Years & Above

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Adventure Travel

- 1.2. Global Adventure Travel Market, 2019 – 2026 (USD Million)

- 1.4. Global Adventure Travel Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Adventure Travel Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Adventure Travel Market – Type Analysis

- 2.1. Global Adventure Travel Market – Type Overview

- 2.2. Global Adventure Travel Market Share, by Type, 2019 & 2026 (USD Million)

- 2.3. Soft

- 2.3.1. Global Soft Adventure Travel Market, 2016 – 2026 (USD Million)

- 2.4. Hard

- 2.4.1. Global Hard Adventure Travel Market, 2016 – 2026 (USD Million)

- 2.5. Others

- 2.5.1. Global Others Adventure Travel Market, 2016 – 2026 (USD Million)

- Chapter 3 Adventure Travel Market – Activities Analysis

- 3.1. Global Adventure Travel Market – Activities Overview

- 3.2. Global Adventure Travel Market Share, by Activities, 2019 & 2026 (USD Million)

- 3.3. Water-based Activities

- 3.3.1. Global Water-based Activities Adventure Travel Market, 2016 – 2026 (USD Million)

- 3.4. Land-based Activities

- 3.4.1. Global Land-based Activities Adventure Travel Market, 2016 – 2026 (USD Million)

- 3.5. Air-based Activities

- 3.5.1. Global Air-based Activities Adventure Travel Market, 2016 – 2026 (USD Million)

- Chapter 4 Adventure Travel Market – Type of Traveler Analysis

- 4.1. Global Adventure Travel Market – Type of Traveler Overview

- 4.2. Global Adventure Travel Market Share, by Type of Traveler, 2019 & 2026 (USD Million)

- 4.3. Sulo

- 4.3.1. Global Sulo Adventure Travel Market, 2016 – 2026 (USD Million)

- 4.4. Couple

- 4.4.1. Global Couple Adventure Travel Market, 2016 – 2026 (USD Million)

- 4.5. Friends/Group

- 4.5.1. Global Friends/Group Adventure Travel Market, 2016 – 2026 (USD Million)

- 4.6. Family

- 4.6.1. Global Family Adventure Travel Market, 2016 – 2026 (USD Million)

- Chapter 5 Adventure Travel Market – Sales Channel Analysis

- 5.1. Global Adventure Travel Market – Sales Channel Overview

- 5.2. Global Adventure Travel Market Share, by Sales Channel, 2019 & 2026 (USD Million)

- 5.3. Direct

- 5.3.1. Global Direct Adventure Travel Market, 2016 – 2026 (USD Million)

- 5.4. Travel Agents

- 5.4.1. Global Travel Agents Adventure Travel Market, 2016 – 2026 (USD Million)

- Chapter 6 Adventure Travel Market – Regional Analysis

- 6.1. Global Adventure Travel Market Regional Overview

- 6.2. Global Adventure Travel Market Share, by Region, 2019 & 2026 (USD Million)

- 6.3. North America

- 6.3.1. North America Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.3.1.1. North America Adventure Travel Market, by Country, 2016 - 2026 (USD Million)

- 6.3.2. North America Adventure Travel Market, by Type, 2016 – 2026

- 6.3.2.1. North America Adventure Travel Market, by Type, 2016 – 2026 (USD Million)

- 6.3.3. North America Adventure Travel Market, by Activities, 2016 – 2026

- 6.3.3.1. North America Adventure Travel Market, by Activities, 2016 – 2026 (USD Million)

- 6.3.4. North America Adventure Travel Market, by Type of Traveler, 2016 – 2026

- 6.3.4.1. North America Adventure Travel Market, by Type of Traveler, 2016 – 2026 (USD Million)

- 6.3.5. North America Adventure Travel Market, by Sales Channel, 2016 – 2026

- 6.3.5.1. North America Adventure Travel Market, by Sales Channel, 2016 – 2026 (USD Million)

- 6.3.6. U.S.

- 6.3.6.1. U.S. Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.3.7. Canada

- 6.3.7.1. Canada Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.3.1. North America Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4. Europe

- 6.4.1. Europe Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.1.1. Europe Adventure Travel Market, by Country, 2016 - 2026 (USD Million)

- 6.4.2. Europe Adventure Travel Market, by Type, 2016 – 2026

- 6.4.2.1. Europe Adventure Travel Market, by Type, 2016 – 2026 (USD Million)

- 6.4.3. Europe Adventure Travel Market, by Activities, 2016 – 2026

- 6.4.3.1. Europe Adventure Travel Market, by Activities, 2016 – 2026 (USD Million)

- 6.4.4. Europe Adventure Travel Market, by Type of Traveler, 2016 – 2026

- 6.4.4.1. Europe Adventure Travel Market, by Type of Traveler, 2016 – 2026 (USD Million)

- 6.4.5. Europe Adventure Travel Market, by Sales Channel, 2016 – 2026

- 6.4.5.1. Europe Adventure Travel Market, by Sales Channel, 2016 – 2026 (USD Million)

- 6.4.6. Germany

- 6.4.6.1. Germany Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.7. France

- 6.4.7.1. France Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.8. U.K.

- 6.4.8.1. U.K. Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.9. Italy

- 6.4.9.1. Italy Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.10. Spain

- 6.4.10.1. Spain Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.11. Rest of Europe

- 6.4.11.1. Rest of Europe Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.4.1. Europe Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5. Asia Pacific

- 6.5.1. Asia Pacific Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.1.1. Asia Pacific Adventure Travel Market, by Country, 2016 - 2026 (USD Million)

- 6.5.2. Asia Pacific Adventure Travel Market, by Type, 2016 – 2026

- 6.5.2.1. Asia Pacific Adventure Travel Market, by Type, 2016 – 2026 (USD Million)

- 6.5.3. Asia Pacific Adventure Travel Market, by Activities, 2016 – 2026

- 6.5.3.1. Asia Pacific Adventure Travel Market, by Activities, 2016 – 2026 (USD Million)

- 6.5.4. Asia Pacific Adventure Travel Market, by Type of Traveler, 2016 – 2026

- 6.5.4.1. Asia Pacific Adventure Travel Market, by Type of Traveler, 2016 – 2026 (USD Million)

- 6.5.5. Asia Pacific Adventure Travel Market, by Sales Channel, 2016 – 2026

- 6.5.5.1. Asia Pacific Adventure Travel Market, by Sales Channel, 2016 – 2026 (USD Million)

- 6.5.6. China

- 6.5.6.1. China Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.7. Japan

- 6.5.7.1. Japan Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.8. India

- 6.5.8.1. India Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.9. South Korea

- 6.5.9.1. South Korea Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.10. South-East Asia

- 6.5.10.1. South-East Asia Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.11. Rest of Asia Pacific

- 6.5.11.1. Rest of Asia Pacific Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.5.1. Asia Pacific Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.6. Latin America

- 6.6.1. Latin America Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.6.1.1. Latin America Adventure Travel Market, by Country, 2016 - 2026 (USD Million)

- 6.6.2. Latin America Adventure Travel Market, by Type, 2016 – 2026

- 6.6.2.1. Latin America Adventure Travel Market, by Type, 2016 – 2026 (USD Million)

- 6.6.3. Latin America Adventure Travel Market, by Activities, 2016 – 2026

- 6.6.3.1. Latin America Adventure Travel Market, by Activities, 2016 – 2026 (USD Million)

- 6.6.4. Latin America Adventure Travel Market, by Type of Traveler, 2016 – 2026

- 6.6.4.1. Latin America Adventure Travel Market, by Type of Traveler, 2016 – 2026 (USD Million)

- 6.6.5. Latin America Adventure Travel Market, by Sales Channel, 2016 – 2026

- 6.6.5.1. Latin America Adventure Travel Market, by Sales Channel, 2016 – 2026 (USD Million)

- 6.6.6. Brazil

- 6.6.6.1. Brazil Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.6.7. Mexico

- 6.6.7.1. Mexico Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.6.8. Rest of Latin America

- 6.6.8.1. Rest of Latin America Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.6.1. Latin America Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.7. The Middle-East and Africa

- 6.7.1. The Middle-East and Africa Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.7.1.1. The Middle-East and Africa Adventure Travel Market, by Country, 2016 - 2026 (USD Million)

- 6.7.2. The Middle-East and Africa Adventure Travel Market, by Type, 2016 – 2026

- 6.7.2.1. The Middle-East and Africa Adventure Travel Market, by Type, 2016 – 2026 (USD Million)

- 6.7.3. The Middle-East and Africa Adventure Travel Market, by Activities, 2016 – 2026

- 6.7.3.1. The Middle-East and Africa Adventure Travel Market, by Activities, 2016 – 2026 (USD Million)

- 6.7.4. The Middle-East and Africa Adventure Travel Market, by Type of Traveler, 2016 – 2026

- 6.7.4.1. The Middle-East and Africa Adventure Travel Market, by Type of Traveler, 2016 – 2026 (USD Million)

- 6.7.5. The Middle-East and Africa Adventure Travel Market, by Sales Channel, 2016 – 2026

- 6.7.5.1. The Middle-East and Africa Adventure Travel Market, by Sales Channel, 2016 – 2026 (USD Million)

- 6.7.6. GCC Countries

- 6.7.6.1. GCC Countries Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.7.7. South Africa

- 6.7.7.1. South Africa Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.7.8. Rest of Middle-East Africa

- 6.7.8.1. Rest of Middle-East Africa Adventure Travel Market, 2016 – 2026 (USD Million)

- 6.7.1. The Middle-East and Africa Adventure Travel Market, 2016 – 2026 (USD Million)

- Chapter 7 Adventure Travel Market – Competitive Landscape

- 7.1. Competitor Market Share – Revenue

- 7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 7.3. Strategic Developments

- 7.3.1. Acquisitions and Mergers

- 7.3.2. New Products

- 7.3.3. Research & Development Activities

- Chapter 8 Company Profiles

- 8.1. Abercrombie & Kent USA, LLC

- 8.1.1. Company Overview

- 8.1.2. Product/Service Portfulio

- 8.1.3. Abercrombie & Kent USA, LLC Sales, Revenue, and Gross Margin

- 8.1.4. Abercrombie & Kent USA, LLC Revenue and Growth Rate

- 8.1.5. Abercrombie & Kent USA, LLC Market Share

- 8.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.2. Tauck

- 8.2.1. Company Overview

- 8.2.2. Product/Service Portfulio

- 8.2.3. Tauck Sales, Revenue, and Gross Margin

- 8.2.4. Tauck Revenue and Growth Rate

- 8.2.5. Tauck Market Share

- 8.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.3. Urban Adventures

- 8.3.1. Company Overview

- 8.3.2. Product/Service Portfulio

- 8.3.3. Urban Adventures Sales, Revenue, and Gross Margin

- 8.3.4. Urban Adventures Revenue and Growth Rate

- 8.3.5. Urban Adventures Market Share

- 8.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.4. Butterfield & Robinson Inc.

- 8.4.1. Company Overview

- 8.4.2. Product/Service Portfulio

- 8.4.3. Butterfield & Robinson Inc. Sales, Revenue, and Gross Margin

- 8.4.4. Butterfield & Robinson Inc. Revenue and Growth Rate

- 8.4.5. Butterfield & Robinson Inc. Market Share

- 8.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.5. TCS World Travel

- 8.5.1. Company Overview

- 8.5.2. Product/Service Portfulio

- 8.5.3. TCS World Travel Sales, Revenue, and Gross Margin

- 8.5.4. TCS World Travel Revenue and Growth Rate

- 8.5.5. TCS World Travel Market Share

- 8.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.6. Cox & Kings Ltd.

- 8.6.1. Company Overview

- 8.6.2. Product/Service Portfulio

- 8.6.3. Cox & Kings Ltd. Sales, Revenue, and Gross Margin

- 8.6.4. Cox & Kings Ltd. Revenue and Growth Rate

- 8.6.5. Cox & Kings Ltd. Market Share

- 8.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.7. Thomas Cook Group

- 8.7.1. Company Overview

- 8.7.2. Product/Service Portfulio

- 8.7.3. Thomas Cook Group Sales, Revenue, and Gross Margin

- 8.7.4. Thomas Cook Group Revenue and Growth Rate

- 8.7.5. Thomas Cook Group Market Share

- 8.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.8. Jet2hulidays.com

- 8.8.1. Company Overview

- 8.8.2. Product/Service Portfulio

- 8.8.3. Jet2hulidays.com Sales, Revenue, and Gross Margin

- 8.8.4. Jet2hulidays.com Revenue and Growth Rate

- 8.8.5. Jet2hulidays.com Market Share

- 8.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.9. G Adventures

- 8.9.1. Company Overview

- 8.9.2. Product/Service Portfulio

- 8.9.3. G Adventures Sales, Revenue, and Gross Margin

- 8.9.4. G Adventures Revenue and Growth Rate

- 8.9.5. G Adventures Market Share

- 8.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.10. Lindblad Expeditions

- 8.10.1. Company Overview

- 8.10.2. Product/Service Portfulio

- 8.10.3. Lindblad Expeditions Sales, Revenue, and Gross Margin

- 8.10.4. Lindblad Expeditions Revenue and Growth Rate

- 8.10.5. Lindblad Expeditions Market Share

- 8.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.11. Audley Travel

- 8.11.1. Company Overview

- 8.11.2. Product/Service Portfulio

- 8.11.3. Audley Travel Sales, Revenue, and Gross Margin

- 8.11.4. Audley Travel Revenue and Growth Rate

- 8.11.5. Audley Travel Market Share

- 8.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.12. Oku Japan

- 8.12.1. Company Overview

- 8.12.2. Product/Service Portfulio

- 8.12.3. Oku Japan Sales, Revenue, and Gross Margin

- 8.12.4. Oku Japan Revenue and Growth Rate

- 8.12.5. Oku Japan Market Share

- 8.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.13. Exodus Travel

- 8.13.1. Company Overview

- 8.13.2. Product/Service Portfulio

- 8.13.3. Exodus Travel Sales, Revenue, and Gross Margin

- 8.13.4. Exodus Travel Revenue and Growth Rate

- 8.13.5. Exodus Travel Market Share

- 8.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.14. Scott Dunn Ltd.

- 8.14.1. Company Overview

- 8.14.2. Product/Service Portfulio

- 8.14.3. Scott Dunn Ltd. Sales, Revenue, and Gross Margin

- 8.14.4. Scott Dunn Ltd. Revenue and Growth Rate

- 8.14.5. Scott Dunn Ltd. Market Share

- 8.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.15. Intrepid Group

- 8.15.1. Company Overview

- 8.15.2. Product/Service Portfulio

- 8.15.3. Intrepid Group Sales, Revenue, and Gross Margin

- 8.15.4. Intrepid Group Revenue and Growth Rate

- 8.15.5. Intrepid Group Market Share

- 8.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.16. Others

- 8.16.1. Company Overview

- 8.16.2. Product/Service Portfulio

- 8.16.3. Others Sales, Revenue, and Gross Margin

- 8.16.4. Others Revenue and Growth Rate

- 8.16.5. Others Market Share

- 8.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.1. Abercrombie & Kent USA, LLC

- Chapter 9 Adventure Travel — Industry Analysis

- 9.1. Introduction and Taxonomy

- 9.2. Adventure Travel Market – Key Trends

- 9.2.1. Market Drivers

- 9.2.2. Market Restraints

- 9.2.3. Market Opportunities

- 9.3. Value Chain Analysis

- 9.4. Key Mandates and Regulations

- 9.5. Technulogy Roadmap and Timeline

- 9.6. Adventure Travel Market – Attractiveness Analysis

- 9.6.1. By Type

- 9.6.2. By Activities

- 9.6.3. By Type of Traveler

- 9.6.4. By Sales Channel

- 9.6.5. By Region

- Chapter 10 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 10.1. Adventure Travel Industrial Chain Analysis

- 10.2. Downstream Buyers

- 10.3. Distributors/Traders List

- Chapter 11 Marketing Strategy Analysis

- 11.1. Marketing Channel

- 11.2. Direct Marketing

- 11.3. Indirect Marketing

- 11.4. Marketing Channel Development Trends

- 11.5. Economic/Pulitical Environmental Change

- Chapter 12 Report Conclusion & Key Insights

- 12.1. Key Insights from Primary Interviews & Surveys Respondents

- 12.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 13 Research Approach & Methodulogy

- 13.1. Report Description

- 13.2. Research Scope

- 13.3. Research Methodulogy

- 13.3.1. Secondary Research

- 13.3.2. Primary Research

- 13.3.3. Statistical Models

- 13.3.3.1. Company Share Analysis Model

- 13.3.3.2. Revenue Based Modeling

- 13.3.4. Research Limitations

Inquiry For Buying

Adventure Travel

Request Sample

Adventure Travel