Aerial Work Platforms (AWPs) Market Size, Share, and Trends Analysis Report

CAGR :

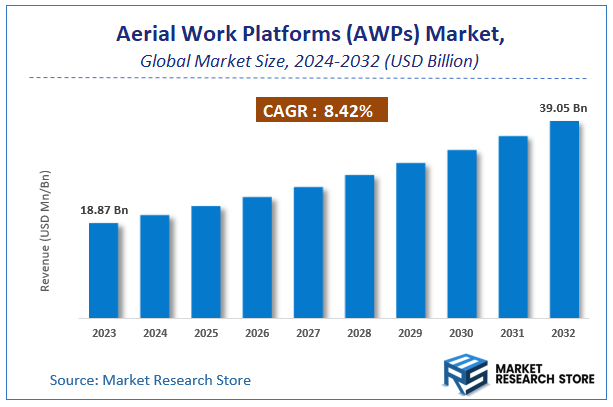

| Market Size 2023 (Base Year) | USD 18.87 Billion |

| Market Size 2032 (Forecast Year) | USD 39.05 Billion |

| CAGR | 8.42% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerial Work Platforms (AWPs) Market Insights

According to Market Research Store, the global aerial work platforms (AWPs) market size was valued at around USD 18.87 billion in 2023 and is estimated to reach USD 39.05 billion by 2032, to register a CAGR of approximately 8.42% in terms of revenue during the forecast period 2024-2032.

The aerial work platforms (AWPs) report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Aerial Work Platforms (AWPs) Market: Overview

Aerial Work Platforms (AWPs), also known as mobile elevating work platforms (MEWPs) or elevating work platforms (EWPs), are mechanical devices used to provide temporary access to elevated and inaccessible areas for personnel, tools, or equipment. These platforms are commonly used in construction, maintenance, inspection, and repair tasks across industries such as building, logistics, telecommunications, and aviation. AWPs are designed for mobility, flexibility, and safety, and come in various types including scissor lifts, boom lifts, vertical mast lifts, and truck-mounted platforms. They are equipped with safety features like guardrails, emergency controls, and fall protection systems, allowing workers to operate at heights efficiently and securely.

Key Highlights

- The aerial work platforms (AWPs) market is anticipated to grow at a CAGR of 8.42% during the forecast period.

- The global aerial work platforms (AWPs) market was estimated to be worth approximately USD 18.87 billion in 2023 and is projected to reach a value of USD 39.05 billion by 2032.

- The growth of the aerial work platforms (AWPs) market is being driven by increasing demand for safe and efficient height-access solutions across construction, maintenance, and industrial sectors.

- Based on the type, the engine-powered segment is growing at a high rate and is projected to dominate the market.

- On the basis of product type, the boom lifts segment is projected to swipe the largest market share.

- In terms of platform working height, the 10 to 20 meters segment is expected to dominate the market.

- Based on the end user, the construction segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Aerial Work Platforms (AWPs) Market: Dynamics

Key Growth Drivers:

- Rising Demand for Safe and Efficient Access Equipment: Growing concerns over worker safety and the need for efficient operations in elevated work environments are driving AWP adoption across industries.

- Increasing Infrastructure Development and Construction Activities: Expanding urbanization, smart city projects, and road and building construction are fueling the demand for AWPs for tasks such as maintenance, painting, and installation.

- Rapid Industrialization in Emerging Economies: Developing countries are witnessing a surge in industrial facilities, warehouses, and logistics hubs, which require AWPs for material handling and elevated work.

- Advancements in AWP Technology: The introduction of electric, hybrid, and automated AWPs is improving efficiency, reducing emissions, and enhancing usability across different terrains and applications.

Restraints:

- High Initial Investment and Maintenance Costs: The upfront cost of AWPs, along with regular maintenance and operator training, may deter small and medium-sized businesses from adoption.

- Limited Usage in Certain Environments: AWPs are less suitable for extremely uneven or rugged terrain without significant customization, restricting their use in specific applications.

- Availability of Alternative Access Solutions: In some markets, traditional scaffolding or ladders are still preferred due to lower costs or local availability, slowing the shift to AWPs.

Opportunities:

- Growing Rental Market for AWPs: Construction companies increasingly prefer renting equipment to reduce capital expenditure, opening lucrative opportunities for AWP rental providers.

- Increased Demand in Maintenance and Facility Management: Regular inspection and maintenance tasks in airports, commercial buildings, and factories are boosting the need for versatile access platforms.

- Sustainability Trends Driving Electric AWPs: The shift towards zero-emission equipment in urban construction and indoor applications is accelerating the adoption of electric and hybrid AWP models.

Challenges:

- Stringent Safety and Regulatory Compliance: Manufacturers and operators must comply with various national and international safety standards, which increases the complexity and cost of operations.

- Shortage of Skilled Operators: Operating AWPs requires certified and trained personnel, and a lack of skilled operators can limit deployment and productivity.

- Economic Downturns Impacting Construction Activity: The AWP market is sensitive to economic cycles, and slowdowns in construction or infrastructure spending can significantly impact demand.

Aerial Work Platforms (AWPs) Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerial Work Platforms (AWPs) Market |

| Market Size in 2023 | USD 18.87 Billion |

| Market Forecast in 2032 | USD 39.05 Billion |

| Growth Rate | CAGR of 8.42% |

| Number of Pages | 188 |

| Key Companies Covered | EdmoLift AB, Zhejiang Dingli Machinery Co, Ltd., Mantall Heavy Industry Co., Ltd., IMER International SpA, Haulotte Group, Advance Lifts, Inc., Dinolift OY, Linamar Corporation, MEC Aerial Work Platforms, Oshkosh Corporation, Aichi Corporation, JLG Industries, Noblelift Intelligent Equipment Co., Ltd., Galmon (S) Pte Ltd, Shandong Qiyun Group Co., Ltd., Wiese USA, Terex Corporation, LGMG North America, Inc., and Palfinger AG among others |

| Segments Covered | By Type, By Product Type, By Platform Working Height, By End User, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerial Work Platforms (AWPs) Market: Segmentation Insights

The global aerial work platforms (AWPs) market is divided by type, product type, platform working height, end user, and region.

Based on type, the global aerial work platforms (AWPs) market is divided into electric, engine-powered, and hybrid. In the aerial work platforms (AWPs) market, engine-powered platforms are the most dominant segment, primarily due to their widespread use in outdoor construction, infrastructure development, and industrial maintenance projects. These AWPs, typically powered by diesel or gasoline engines, offer greater lifting capacity, mobility, and height reach, making them ideal for rugged terrains and large-scale outdoor applications. Their robust performance in demanding environments such as high-rise building construction, bridge work, and oil & gas installations has made them the preferred choice for contractors and industrial users, especially where access to electric power is limited. Electric-powered AWPs are the second most significant segment and are rapidly gaining popularity, especially for indoor and urban applications. These platforms are powered by rechargeable batteries and are valued for their quiet operation, zero emissions, and compact design, making them suitable for confined spaces such as warehouses, factories, shopping malls, and airports.

On the basis of product type, the global aerial work platforms (AWPs) market is bifurcated into boom lifts, scissor lifts, vertical mast lifts, personal portable lifts, and others. Boom lifts are the most dominant product type due to their superior height reach, horizontal extension, and versatility in accessing difficult or obstructed areas. Commonly used in construction, industrial maintenance, and utility applications, boom lifts especially articulating and telescopic variants are ideal for tasks that require workers to reach elevated positions over barriers or across uneven terrain. Their robust structure and flexibility make them indispensable for high-rise building work, bridge inspections, and outdoor infrastructure projects, where precision and range of motion are critical. Scissor lifts follow as the second most widely used AWP product, particularly in indoor construction, maintenance, and warehousing applications. These platforms provide vertical elevation using a crisscrossing (scissor-like) mechanism, offering stability and higher weight capacity for lifting multiple workers and equipment simultaneously.

Based on platform working height, the global aerial work platforms (AWPs) market is divided into below 10 meters, 10 to 20 meters, 20 to 30 meters, and above 30 meters. 10 to 20 meters is the most dominant platform working height segment, as it covers the most common height range required for a wide variety of construction, maintenance, and industrial tasks. AWPs in this range offer a balance of vertical reach, maneuverability, and load capacity, making them highly versatile for both indoor and outdoor applications. This height category is particularly favored for tasks such as commercial building maintenance, warehouse operations, electrical installations, and infrastructure development, where mid-level elevation access is frequently needed. The 20 to 30 meters segment follows closely, primarily used in high-rise construction, heavy industrial facilities, and large-scale infrastructure projects like bridges and transmission towers. These platforms, often boom lifts or truck-mounted AWPs, provide extended reach and are designed for use in challenging environments that require precise elevation at significant heights. Demand in this segment is driven by sectors requiring safe and reliable access to elevated work areas beyond standard building heights.

On the basis of end user, the global aerial work platforms (AWPs) market is bifurcated into construction, retail, storage & warehouses, transportation & logistics, manufacturing, mining, utility, and others. Construction is the most dominant end-user segment, accounting for the largest share due to the widespread need for elevated access in both residential and commercial building projects. AWPs are extensively used for tasks such as façade work, roofing, cladding, painting, and installation of mechanical systems. The ability of boom and scissor lifts to provide safe, flexible, and time-efficient height access has made them a standard in construction operations, especially as urbanization and infrastructure development projects accelerate globally. Storage & warehouses represent the second-largest end-user segment, where AWPs particularly vertical mast lifts and compact electric scissor lifts are used for inventory management, shelf maintenance, and facility upkeep. Their ability to navigate narrow aisles and confined spaces makes them ideal for modern logistics and e-commerce operations, where speed, safety, and efficiency in high-reach environments are critical.

Aerial Work Platforms (AWPs) Market: Regional Insights

- North America is expected to dominates the global market

North America leads the global aerial work platforms (AWPs) market, driven by high demand from the construction, industrial maintenance, and utilities sectors. The region benefits from a mature infrastructure development framework, strict worker safety regulations, and a strong rental equipment culture, especially in the United States and Canada. The presence of major AWP manufacturers and widespread use of advanced equipment for high-rise construction and facility management further supports market dominance. Additionally, the focus on automation, energy-efficient electric platforms, and fleet modernization across rental companies contributes to sustained growth and innovation in this region.

Europe holds the second-largest share in the AWP market, supported by stringent workplace safety regulations, increasing renovation and infrastructure development projects, and the expansion of smart city initiatives. Countries like Germany, the UK, France, and Italy are key contributors, where aerial platforms are extensively used in building maintenance, public infrastructure, and renewable energy installations. The adoption of compact electric models suitable for urban and indoor environments is particularly strong in this region. Europe's well-established rental ecosystem and the emphasis on reducing manual labor risks continue to drive demand for technologically advanced and sustainable aerial work platforms.

Asia Pacific is one of the fastest-growing regions in the aerial work platforms market, fueled by rapid urbanization, booming construction activity, and growing industrialization in countries such as China, India, Japan, and Southeast Asia. The need for safer alternatives to traditional scaffolding, coupled with rising awareness of workplace safety standards, is prompting greater adoption of AWPs across residential, commercial, and infrastructure projects. Government investments in large-scale development, smart city programs, and transportation infrastructure are creating significant opportunities for market expansion. However, high equipment costs and limited awareness in some developing nations still pose challenges to widespread penetration.

Latin America shows moderate growth potential in the AWP market, led by countries like Brazil and Mexico where construction, oil & gas, and industrial sectors are increasingly turning to mechanized solutions for working at height. While the overall adoption of AWPs remains lower than in more developed regions, the rental model is gaining traction, allowing companies to access advanced equipment without large capital investment. Improvements in worker safety awareness, combined with infrastructure upgrades and foreign investments in energy and logistics, are gradually supporting market development across the region.

The Middle East and Africa represent the smallest share of the aerial work platforms market, although growth is steadily increasing, particularly in the Gulf Cooperation Council (GCC) countries. Construction of large-scale infrastructure, airports, stadiums, and high-rise buildings in nations like the UAE, Saudi Arabia, and Qatar is driving demand for AWPs, especially boom and scissor lifts. In Africa, adoption remains limited due to budget constraints and limited access to advanced equipment, but urban development and international infrastructure projects are slowly expanding market opportunities. The market remains heavily reliant on imports and rental services for accessing modern aerial equipment.

Aerial Work Platforms (AWPs) Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerial work platforms (AWPs) market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerial work platforms (AWPs) market include:

- EdmoLift AB

- Zhejiang Dingli Machinery Co., Ltd.

- Mantall Heavy Industry Co., Ltd.

- IMER International SpA

- Haulotte Group

- Advance Lifts Inc.

- Dinolift OY

- Linamar Corporation

- MEC Aerial Work Platforms

- Oshkosh Corporation

- Aichi Corporation

- JLG Industries

- Noblelift Intelligent Equipment Co. Ltd.

- Galmon (S) Pte Ltd

- Shandong Qiyun Group Co.,Ltd.

- Wiese USA

- Terex Corporation

- LGMG North America Inc.

- Palfinger AG

The global aerial work platforms (AWPs) market is segmented as follows:

By Type

- Electric

- Engine-Powered

- Hybrid

By Product Type

- Boom Lifts

- Scissor Lifts

- Vertical Mast Lifts

- Personal Portable Lifts

- Others

By Platform Working Height

- Below 10 Meters

- 10 to 20 Meters

- 20 to 30 Meters

- Above 30 Meters

By End User

- Construction

- Retail

- Storage

- Warehouses

- Transportation and Logistics

- Manufacturing

- Mining

- Utility

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerial Work Platforms (AWPs)

- 1.2. Global Aerial Work Platforms (AWPs) Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million) (Units)

- 1.4. Global Aerial Work Platforms (AWPs) Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerial Work Platforms (AWPs) Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerial Work Platforms (AWPs) Market – Type Analysis

- 2.1. Global Aerial Work Platforms (AWPs) Market – Type Overview

- 2.2. Global Aerial Work Platforms (AWPs) Market Share, by Type, 2019 & 2026 (USD Million)

- 2.3. Global Aerial Work Platforms (AWPs) Market share, by Type, 2019 & 2026 (Units)

- 2.4. Electric

- 2.4.1. Global Electric Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Electric Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 2.5. Engine-Powered

- 2.5.1. Global Engine-Powered Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Engine-Powered Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 2.6. Hybrid

- 2.6.1. Global Hybrid Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Hybrid Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- Chapter 3 Aerial Work Platforms (AWPs) Market – Product Type Analysis

- 3.1. Global Aerial Work Platforms (AWPs) Market – Product Type Overview

- 3.2. Global Aerial Work Platforms (AWPs) Market Share, by Product Type, 2019 & 2026 (USD Million)

- 3.3. Global Aerial Work Platforms (AWPs) Market share, by Product Type, 2019 & 2026 (Units)

- 3.4. Boom Lifts

- 3.4.1. Global Boom Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Boom Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 3.5. Scissor Lifts

- 3.5.1. Global Scissor Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 3.5.2. Global Scissor Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 3.6. Vertical Mast Lifts

- 3.6.1. Global Vertical Mast Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Vertical Mast Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 3.7. Personal Portable Lifts

- 3.7.1. Global Personal Portable Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Personal Portable Lifts Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 3.8. Others

- 3.8.1. Global Others Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 3.8.2. Global Others Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- Chapter 4 Aerial Work Platforms (AWPs) Market – Platform Working Height Analysis

- 4.1. Global Aerial Work Platforms (AWPs) Market – Platform Working Height Overview

- 4.2. Global Aerial Work Platforms (AWPs) Market Share, by Platform Working Height, 2019 & 2026 (USD Million)

- 4.3. Global Aerial Work Platforms (AWPs) Market share, by Platform Working Height, 2019 & 2026 (Units)

- 4.4. Below 10 Meters

- 4.4.1. Global Below 10 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Below 10 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 4.5. 10 to 20 Meters

- 4.5.1. Global 10 to 20 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 4.5.2. Global 10 to 20 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 4.6. 20 to 30 Meters

- 4.6.1. Global 20 to 30 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 4.6.2. Global 20 to 30 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 4.7. Above 30 Meters

- 4.7.1. Global Above 30 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 4.7.2. Global Above 30 Meters Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- Chapter 5 Aerial Work Platforms (AWPs) Market – End User Analysis

- 5.1. Global Aerial Work Platforms (AWPs) Market – End User Overview

- 5.2. Global Aerial Work Platforms (AWPs) Market Share, by End User, 2019 & 2026 (USD Million)

- 5.3. Global Aerial Work Platforms (AWPs) Market share, by End User, 2019 & 2026 (Units)

- 5.4. Construction

- 5.4.1. Global Construction Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.4.2. Global Construction Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 5.5. Retail, Storage, and Warehouses

- 5.5.1. Global Retail, Storage, and Warehouses Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.5.2. Global Retail, Storage, and Warehouses Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 5.6. Transportation and Logistics

- 5.6.1. Global Transportation and Logistics Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.6.2. Global Transportation and Logistics Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 5.7. Manufacturing

- 5.7.1. Global Manufacturing Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.7.2. Global Manufacturing Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 5.8. Mining

- 5.8.1. Global Mining Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.8.2. Global Mining Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 5.9. Utility

- 5.9.1. Global Utility Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.9.2. Global Utility Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 5.10. Others

- 5.10.1. Global Others Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 5.10.2. Global Others Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- Chapter 6 Aerial Work Platforms (AWPs) Market – Regional Analysis

- 6.1. Global Aerial Work Platforms (AWPs) Market Regional Overview

- 6.2. Global Aerial Work Platforms (AWPs) Market Share, by Region, 2019 & 2026 (USD Million)

- 6.3. Global Aerial Work Platforms (AWPs) Market Share, by Region, 2019 & 2026 (Units)

- 6.4. North America

- 6.4.1. North America Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.4.1.1. North America Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (USD Million)

- 6.4.2. North America Market, 2016 – 2026 (Units)

- 6.4.2.1. North America Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (Units)

- 6.4.3. North America Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026

- 6.4.3.1. North America Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (USD Million)

- 6.4.3.2. North America Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (Units)

- 6.4.4. North America Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026

- 6.4.4.1. North America Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (USD Million)

- 6.4.4.2. North America Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (Units)

- 6.4.5. North America Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026

- 6.4.5.1. North America Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (USD Million)

- 6.4.5.2. North America Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (Units)

- 6.4.6. North America Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026

- 6.4.6.1. North America Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (USD Million)

- 6.4.6.2. North America Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (Units)

- 6.4.7. U.S.

- 6.4.7.1. U.S. Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.4.7.2. U.S. Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.4.8. Canada

- 6.4.8.1. Canada Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.4.8.2. Canada Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.4.1. North America Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5. Europe

- 6.5.1. Europe Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.1.1. Europe Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (USD Million)

- 6.5.2. Europe Market, 2016 – 2026 (Units)

- 6.5.2.1. Europe Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (Units)

- 6.5.3. Europe Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026

- 6.5.3.1. Europe Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (USD Million)

- 6.5.3.2. Europe Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (Units)

- 6.5.4. Europe Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026

- 6.5.4.1. Europe Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (USD Million)

- 6.5.4.2. Europe Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (Units)

- 6.5.5. Europe Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026

- 6.5.5.1. Europe Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (USD Million)

- 6.5.5.2. Europe Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (Units)

- 6.5.6. Europe Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026

- 6.5.6.1. Europe Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (USD Million)

- 6.5.6.2. Europe Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (Units)

- 6.5.7. Germany

- 6.5.7.1. Germany Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.7.2. Germany Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.5.8. France

- 6.5.8.1. France Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.8.2. France Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.5.9. U.K.

- 6.5.9.1. U.K. Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.9.2. U.K. Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.5.10. Italy

- 6.5.10.1. Italy Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.10.2. Italy Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.5.11. Spain

- 6.5.11.1. Spain Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.11.2. Spain Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.5.12. Rest of Europe

- 6.5.12.1. Rest of Europe Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.5.12.2. Rest of Europe Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.5.1. Europe Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6. Asia Pacific

- 6.6.1. Asia Pacific Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.1.1. Asia Pacific Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (USD Million)

- 6.6.2. Asia Pacific Market, 2016 – 2026 (Units)

- 6.6.2.1. Asia Pacific Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (Units)

- 6.6.3. Asia Pacific Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026

- 6.6.3.1. Asia Pacific Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (USD Million)

- 6.6.3.2. Asia Pacific Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (Units)

- 6.6.4. Asia Pacific Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026

- 6.6.4.1. Asia Pacific Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (USD Million)

- 6.6.4.2. Asia Pacific Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (Units)

- 6.6.5. Asia Pacific Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026

- 6.6.5.1. Asia Pacific Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (USD Million)

- 6.6.5.2. Asia Pacific Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (Units)

- 6.6.6. Asia Pacific Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026

- 6.6.6.1. Asia Pacific Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (USD Million)

- 6.6.6.2. Asia Pacific Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (Units)

- 6.6.7. China

- 6.6.7.1. China Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.7.2. China Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.6.8. Japan

- 6.6.8.1. Japan Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.8.2. Japan Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.6.9. India

- 6.6.9.1. India Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.9.2. India Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.6.10. South Korea

- 6.6.10.1. South Korea Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.10.2. South Korea Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.6.11. South-East Asia

- 6.6.11.1. South-East Asia Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.11.2. South-East Asia Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.6.12. Rest of Asia Pacific

- 6.6.12.1. Rest of Asia Pacific Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.6.12.2. Rest of Asia Pacific Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.6.1. Asia Pacific Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.7. Latin America

- 6.7.1. Latin America Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.7.1.1. Latin America Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (USD Million)

- 6.7.2. Latin America Market, 2016 – 2026 (Units)

- 6.7.2.1. Latin America Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (Units)

- 6.7.3. Latin America Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026

- 6.7.3.1. Latin America Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (USD Million)

- 6.7.3.2. Latin America Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (Units)

- 6.7.4. Latin America Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026

- 6.7.4.1. Latin America Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (USD Million)

- 6.7.4.2. Latin America Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (Units)

- 6.7.5. Latin America Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026

- 6.7.5.1. Latin America Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (USD Million)

- 6.7.5.2. Latin America Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (Units)

- 6.7.6. Latin America Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026

- 6.7.6.1. Latin America Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (USD Million)

- 6.7.6.2. Latin America Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (Units)

- 6.7.7. Brazil

- 6.7.7.1. Brazil Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.7.7.2. Brazil Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.7.8. Mexico

- 6.7.8.1. Mexico Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.7.8.2. Mexico Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.7.9. Rest of Latin America

- 6.7.9.1. Rest of Latin America Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.7.9.2. Rest of Latin America Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.7.1. Latin America Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.8. The Middle-East and Africa

- 6.8.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.8.1.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (USD Million)

- 6.8.2. The Middle-East and Africa Market, 2016 – 2026 (Units)

- 6.8.2.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Country, 2016 – 2026 (Units)

- 6.8.3. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026

- 6.8.3.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (USD Million)

- 6.8.3.2. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Type, 2016 – 2026 (Units)

- 6.8.4. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026

- 6.8.4.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (USD Million)

- 6.8.4.2. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Product Type, 2016 – 2026 (Units)

- 6.8.5. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026

- 6.8.5.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (USD Million)

- 6.8.5.2. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by Platform Working Height, 2016 – 2026 (Units)

- 6.8.6. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026

- 6.8.6.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (USD Million)

- 6.8.6.2. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, by End User, 2016 – 2026 (Units)

- 6.8.7. GCC Countries

- 6.8.7.1. GCC Countries Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.8.7.2. GCC Countries Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.8.8. South Africa

- 6.8.8.1. South Africa Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.8.8.2. South Africa Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.8.9. Rest of Middle-East Africa

- 6.8.9.1. Rest of Middle-East Africa Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- 6.8.9.2. Rest of Middle-East Africa Aerial Work Platforms (AWPs) Market, 2016 – 2026 (Units)

- 6.8.1. The Middle-East and Africa Aerial Work Platforms (AWPs) Market, 2016 – 2026 (USD Million)

- Chapter 7 Aerial Work Platforms (AWPs) Production, Consumption, Export, Import by Regions

- 7.1. Global Aerial Work Platforms (AWPs) Production and Consumption, 2016 – 2026 (Units)

- 7.2. Global Import and Export Analysis, by Region

- Chapter 8 Aerial Work Platforms (AWPs) Market – Competitive Landscape

- 8.1. Competitor Market Share – Revenue

- 8.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 8.3. Competitor Market Share – Vulume

- 8.4. Strategic Developments

- 8.4.1. Acquisitions and Mergers

- 8.4.2. New Products

- 8.4.3. Research & Development Activities

- Chapter 9 Company Profiles

- 9.1. Aichi Corporation

- 9.1.1. Company Overview

- 9.1.2. Product/Service Portfulio

- 9.1.3. Aichi Corporation Sales, Revenue, Price, and Gross Margin

- 9.1.4. Aichi Corporation Revenue and Growth Rate

- 9.1.5. Aichi Corporation Market Share

- 9.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.2. EdmoLift AB

- 9.2.1. Company Overview

- 9.2.2. Product/Service Portfulio

- 9.2.3. EdmoLift AB Sales, Revenue, Price, and Gross Margin

- 9.2.4. EdmoLift AB Revenue and Growth Rate

- 9.2.5. EdmoLift AB Market Share

- 9.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.3. JLG Industries

- 9.3.1. Company Overview

- 9.3.2. Product/Service Portfulio

- 9.3.3. JLG Industries Sales, Revenue, Price, and Gross Margin

- 9.3.4. JLG Industries Revenue and Growth Rate

- 9.3.5. JLG Industries Market Share

- 9.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.4. Zhejiang Dingli Machinery Co, Ltd.

- 9.4.1. Company Overview

- 9.4.2. Product/Service Portfulio

- 9.4.3. Zhejiang Dingli Machinery Co, Ltd. Sales, Revenue, Price, and Gross Margin

- 9.4.4. Zhejiang Dingli Machinery Co, Ltd. Revenue and Growth Rate

- 9.4.5. Zhejiang Dingli Machinery Co, Ltd. Market Share

- 9.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.5. IMER International SpA

- 9.5.1. Company Overview

- 9.5.2. Product/Service Portfulio

- 9.5.3. IMER International SpA Sales, Revenue, Price, and Gross Margin

- 9.5.4. IMER International SpA Revenue and Growth Rate

- 9.5.5. IMER International SpA Market Share

- 9.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.6. Mantall Heavy Industry Co., Ltd.

- 9.6.1. Company Overview

- 9.6.2. Product/Service Portfulio

- 9.6.3. Mantall Heavy Industry Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 9.6.4. Mantall Heavy Industry Co., Ltd. Revenue and Growth Rate

- 9.6.5. Mantall Heavy Industry Co., Ltd. Market Share

- 9.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.7. Noblelift Intelligent Equipment Co.,Ltd.

- 9.7.1. Company Overview

- 9.7.2. Product/Service Portfulio

- 9.7.3. Noblelift Intelligent Equipment Co.,Ltd. Sales, Revenue, Price, and Gross Margin

- 9.7.4. Noblelift Intelligent Equipment Co.,Ltd. Revenue and Growth Rate

- 9.7.5. Noblelift Intelligent Equipment Co.,Ltd. Market Share

- 9.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.8. Haulotte Group

- 9.8.1. Company Overview

- 9.8.2. Product/Service Portfulio

- 9.8.3. Haulotte Group Sales, Revenue, Price, and Gross Margin

- 9.8.4. Haulotte Group Revenue and Growth Rate

- 9.8.5. Haulotte Group Market Share

- 9.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.9. Galmon (S) Pte Ltd

- 9.9.1. Company Overview

- 9.9.2. Product/Service Portfulio

- 9.9.3. Galmon (S) Pte Ltd Sales, Revenue, Price, and Gross Margin

- 9.9.4. Galmon (S) Pte Ltd Revenue and Growth Rate

- 9.9.5. Galmon (S) Pte Ltd Market Share

- 9.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.10. Advance Lifts, Inc.

- 9.10.1. Company Overview

- 9.10.2. Product/Service Portfulio

- 9.10.3. Advance Lifts, Inc. Sales, Revenue, Price, and Gross Margin

- 9.10.4. Advance Lifts, Inc. Revenue and Growth Rate

- 9.10.5. Advance Lifts, Inc. Market Share

- 9.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.11. Shandong Qiyun Group Co., Ltd.

- 9.11.1. Company Overview

- 9.11.2. Product/Service Portfulio

- 9.11.3. Shandong Qiyun Group Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 9.11.4. Shandong Qiyun Group Co., Ltd. Revenue and Growth Rate

- 9.11.5. Shandong Qiyun Group Co., Ltd. Market Share

- 9.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.12. Dinulift OY

- 9.12.1. Company Overview

- 9.12.2. Product/Service Portfulio

- 9.12.3. Dinulift OY Sales, Revenue, Price, and Gross Margin

- 9.12.4. Dinulift OY Revenue and Growth Rate

- 9.12.5. Dinulift OY Market Share

- 9.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.13. Wiese USA

- 9.13.1. Company Overview

- 9.13.2. Product/Service Portfulio

- 9.13.3. Wiese USA Sales, Revenue, Price, and Gross Margin

- 9.13.4. Wiese USA Revenue and Growth Rate

- 9.13.5. Wiese USA Market Share

- 9.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.14. Linamar Corporation

- 9.14.1. Company Overview

- 9.14.2. Product/Service Portfulio

- 9.14.3. Linamar Corporation Sales, Revenue, Price, and Gross Margin

- 9.14.4. Linamar Corporation Revenue and Growth Rate

- 9.14.5. Linamar Corporation Market Share

- 9.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.15. Terex Corporation

- 9.15.1. Company Overview

- 9.15.2. Product/Service Portfulio

- 9.15.3. Terex Corporation Sales, Revenue, Price, and Gross Margin

- 9.15.4. Terex Corporation Revenue and Growth Rate

- 9.15.5. Terex Corporation Market Share

- 9.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.16. MEC Aerial Work Platforms

- 9.16.1. Company Overview

- 9.16.2. Product/Service Portfulio

- 9.16.3. MEC Aerial Work Platforms Sales, Revenue, Price, and Gross Margin

- 9.16.4. MEC Aerial Work Platforms Revenue and Growth Rate

- 9.16.5. MEC Aerial Work Platforms Market Share

- 9.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.17. LGMG North America, Inc.

- 9.17.1. Company Overview

- 9.17.2. Product/Service Portfulio

- 9.17.3. LGMG North America, Inc. Sales, Revenue, Price, and Gross Margin

- 9.17.4. LGMG North America, Inc. Revenue and Growth Rate

- 9.17.5. LGMG North America, Inc. Market Share

- 9.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.18. Oshkosh Corporation

- 9.18.1. Company Overview

- 9.18.2. Product/Service Portfulio

- 9.18.3. Oshkosh Corporation Sales, Revenue, Price, and Gross Margin

- 9.18.4. Oshkosh Corporation Revenue and Growth Rate

- 9.18.5. Oshkosh Corporation Market Share

- 9.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.19. Palfinger AG

- 9.19.1. Company Overview

- 9.19.2. Product/Service Portfulio

- 9.19.3. Palfinger AG Sales, Revenue, Price, and Gross Margin

- 9.19.4. Palfinger AG Revenue and Growth Rate

- 9.19.5. Palfinger AG Market Share

- 9.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.20. Others

- 9.20.1. Company Overview

- 9.20.2. Product/Service Portfulio

- 9.20.3. Others Sales, Revenue, Price, and Gross Margin

- 9.20.4. Others Revenue and Growth Rate

- 9.20.5. Others Market Share

- 9.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.1. Aichi Corporation

- Chapter 10 Aerial Work Platforms (AWPs) — Industry Analysis

- 10.1. Introduction and Taxonomy

- 10.2. Aerial Work Platforms (AWPs) Market – Key Trends

- 10.2.1. Market Drivers

- 10.2.2. Market Restraints

- 10.2.3. Market Opportunities

- 10.3. Value Chain Analysis

- 10.4. Key Mandates and Regulations

- 10.5. Technulogy Roadmap and Timeline

- 10.6. Aerial Work Platforms (AWPs) Market – Attractiveness Analysis

- 10.6.1. By Type

- 10.6.2. By Product Type

- 10.6.3. By Platform Working Height

- 10.6.4. By End User

- 10.6.5. By Region

- Chapter 11 Raw Material Analysis

- 11.1. Aerial Work Platforms (AWPs) Key Raw Material Analysis

- 11.1.1. Key Raw Materials

- 11.1.2. Price Trend of Key Raw Materials

- 11.2. Key Suppliers of Raw Materials

- 11.3. Proportion of Manufacturing Cost Structure

- 11.3.1. Raw Materials Cost

- 11.3.2. Labor Cost

- 11.3.3. Manufacturing Expenses

- 11.3.4. Miscellaneous Expenses

- 11.4. Manufacturing Cost Analysis of Aerial Work Platforms (AWPs)

- 11.1. Aerial Work Platforms (AWPs) Key Raw Material Analysis

- Chapter 12 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 12.1. Aerial Work Platforms (AWPs) Industrial Chain Analysis

- 12.2. Upstream Raw Materials Sourcing

- 12.2.1. Risk Mitigation:

- 12.2.2. Supplier Relationships:

- 12.2.3. Business Processes:

- 12.2.4. Securing the Product:

- 12.3. Raw Materials Sources of Aerial Work Platforms (AWPs) Major Manufacturers

- 12.4. Downstream Buyers

- 12.5. Distributors/Traders List

- Chapter 13 Marketing Strategy Analysis, Distributors

- 13.1. Marketing Channel

- 13.2. Direct Marketing

- 13.3. Indirect Marketing

- 13.4. Marketing Channel Development Trends

- 13.5. Economic/Pulitical Environmental Change

- Chapter 14 Report Conclusion & Key Insights

- 14.1. Key Insights from Primary Interviews & Surveys Respondents

- 14.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 15 Research Approach & Methodulogy

- 15.1. Report Description

- 15.2. Research Scope

- 15.3. Research Methodulogy

- 15.3.1. Secondary Research

- 15.3.2. Primary Research

- 15.3.3. Statistical Models

- 15.3.3.1. Company Share Analysis Model

- 15.3.3.2. Revenue Based Modeling

- 15.3.4. Research Limitations

Inquiry For Buying

Aerial Work Platforms (AWPs)

Request Sample

Aerial Work Platforms (AWPs)