Aerospace Battery Technology Market Size, Share, and Trends Analysis Report

CAGR :

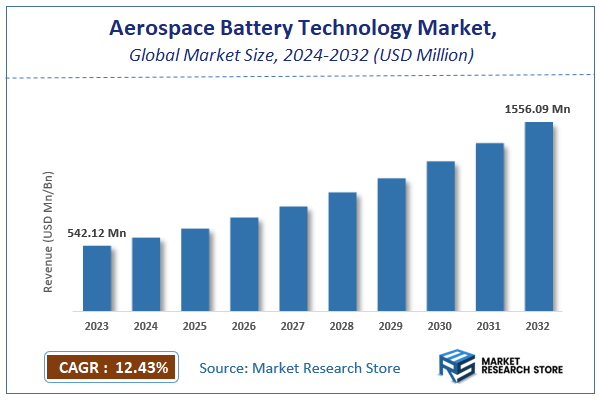

| Market Size 2023 (Base Year) | USD 542.12 Million |

| Market Size 2032 (Forecast Year) | USD 1556.09 Million |

| CAGR | 12.43% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerospace Battery Technology Market Insights

According to Market Research Store, the global aerospace battery technology market size was valued at around USD 542.12 million in 2023 and is estimated to reach USD 1556.09 million by 2032, to register a CAGR of approximately 12.43% in terms of revenue during the forecast period 2024-2032.

The aerospace battery technology report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Aerospace Battery Technology Market: Overview

Aerospace battery technology refers to the development and application of advanced energy storage systems specifically designed for use in aircraft, spacecraft, satellites, and drones. These batteries must meet stringent requirements for weight, energy density, safety, reliability, and performance under extreme conditions such as high altitudes, temperature fluctuations, and vibration. Common battery types used include lithium-ion, nickel-cadmium (Ni-Cd), nickel-metal hydride (NiMH), and increasingly, solid-state batteries. They power a range of critical systems including avionics, emergency systems, onboard electronics, propulsion systems for electric aircraft, and more. Aerospace batteries are engineered to deliver consistent power, long operational life, and minimal maintenance while adhering to strict aerospace safety and certification standards.

Key Highlights

- The aerospace battery technology market is anticipated to grow at a CAGR of 12.43% during the forecast period.

- The global aerospace battery technology market was estimated to be worth approximately USD 542.12 million in 2023 and is projected to reach a value of USD 1556.09 million by 2032.

- The growth of the aerospace battery technology market is being driven by rising demand for more electric and hybrid-electric aircraft, growing satellite launches, and increasing adoption of unmanned aerial vehicles (UAVs).

- Based on the offering, the lithium-ion batteries segment is growing at a high rate and is projected to dominate the market.

- On the basis of aircraft type, the narrow-body aircraft segment is projected to swipe the largest market share.

- In terms of aircraft technology, the more electric aircraft (MEA) segment is expected to dominate the market.

- Based on the power density, the less than 300 Wh/kg segment is expected to dominate the market.

- In terms of application, the propulsion segment is expected to dominate the market.

- On the basis of end-use, the civil aviation segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Aerospace Battery Technology Market: Dynamics

Key Growth Drivers:

- Growing Demand for Electrification in Aviation: The shift toward electric and hybrid-electric aircraft to reduce carbon emissions is increasing the need for advanced battery technologies.

- Advancements in Battery Chemistry and Design: Innovations in lithium-ion, solid-state, and high-energy-density batteries are enhancing performance, safety, and weight-efficiency for aerospace applications.

- Rising Investment in Urban Air Mobility (UAM) and eVTOL Aircraft: The development of electric vertical takeoff and landing (eVTOL) vehicles is creating a new and significant demand for aerospace-grade batteries.

- Supportive Government Policies and Sustainability Goals: International regulations and green initiatives promoting sustainable aviation are encouraging the adoption of electric propulsion systems powered by batteries.

Restraints:

- High Cost of Advanced Battery Systems: Aerospace-grade batteries require high energy density, lightweight construction, and stringent safety features, all of which increase cost.

- Limited Energy Density Compared to Fuel-Based Systems: Current battery technologies still fall short in delivering the same range and power as traditional aviation fuel systems.

- Complex Certification and Safety Regulations: Meeting aviation safety standards for batteries involves extensive testing and validation, lengthening the time to market for new technologies.

Opportunities:

- Emergence of All-Electric Aircraft Platforms: The development of all-electric aircraft for short-haul and regional travel presents a major opportunity for battery innovation and commercialization.

- Integration with Smart and Connected Systems: Advanced battery management systems (BMS) and smart diagnostics are creating value-added functionalities and improving operational efficiency.

- Expansion in Spacecraft and Satellite Applications: The increasing number of satellite launches and space exploration missions is driving demand for reliable, lightweight, and long-duration battery technologies.

Challenges:

- Thermal Management and Safety Risks: Aerospace batteries must operate within tight thermal margins, and overheating or thermal runaway can pose serious safety hazards.

- Weight Constraints and Space Limitations: Designing batteries that are both lightweight and compact while maintaining power output is a persistent engineering challenge.

- Short Lifecycle and Degradation Over Time: Batteries degrade over time due to charge-discharge cycles, which can affect long-term reliability and increase maintenance requirements.

Aerospace Battery Technology Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Battery Technology Market |

| Market Size in 2023 | USD 542.12 Million |

| Market Forecast in 2032 | USD 1556.09 Million |

| Growth Rate | CAGR of 12.43% |

| Number of Pages | 162 |

| Key Companies Covered | Concorde Battery Corporation, Cella Energy, EaglePicher Technologies, Enersys, Kokam, GS Yuasa International Ltd, Marathonnorco Aerospace, Marvel Aero International, Saft Groupe S.A., Mid-Continent Instruments and Avionics, Teledyne Battery Products (Teledyne Technologies), Sichuan Changhong Battery Co. Ltd, TransDigm Group, Quallion LLC, Aero Lithium Batteries, Securaplane Technologies Inc, HBL Power Systems Ltd, Gill Battery, Tesla, True Blue Power, Meggitt PLC, among others |

| Segments Covered | By Offering, By Aircraft Type, By Aircraft Technology, By Power Density, By Application, By End-Use, By End Market, By Sales Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Battery Technology Market: Segmentation Insights

The global aerospace battery technology market is divided by offering, aircraft type, aircraft technology, power density, application, end-use, and region.

Based on offering, the global aerospace battery technology market is divided into nickel-cadmium battery, lead acid battery, lithium-ion battery, and battery management system. In the aerospace battery technology market, lithium-ion batteries are the most dominant segment due to their high energy density, lightweight structure, and long cycle life, which are critical for modern aerospace applications. These batteries are widely used in both commercial and military aircraft, satellites, and unmanned aerial vehicles (UAVs), offering superior performance in powering onboard electronics, emergency systems, and electric propulsion. Their ability to deliver high power output in compact, lightweight designs makes them the preferred choice as the aerospace industry shifts toward electrification and sustainability. Continuous advancements in safety, thermal management, and energy storage capacity further reinforce their leadership in the market.

On the basis of aircraft type, the global aerospace battery technology market is bifurcated into narrow body aircraft, wide-body aircraft, very large aircraft, general aviation, helicopter, and others. Narrow-body aircraft represent the most dominant segment due to their high production volume, frequent short-to-medium-haul operations, and increasing integration of electric systems to reduce fuel consumption and emissions. Airlines and manufacturers are focusing on electrifying more systems within these aircraft such as avionics, lighting, and auxiliary power units which has significantly boosted the demand for high-performance battery technologies, especially lithium-ion. The growing global passenger traffic and expansion of low-cost carriers further drive the need for efficient and lightweight energy storage solutions in this aircraft type. Wide-body aircraft follow as the second-largest segment, primarily used for long-haul international travel and equipped with advanced systems that require reliable power backup and support for auxiliary operations. These aircraft typically utilize more complex battery systems to manage a broader range of electrical loads.

Based on aircraft technology, the global aerospace battery technology market is divided into traditional aircraft, more electric aircraft, hybrid aircraft, and electric aircraft. More electric aircraft (MEA) constitute the most dominant segment, reflecting the industry’s transition from traditional mechanical and hydraulic systems toward electrically powered subsystems. MEAs use batteries to power critical components such as flight control, environmental control, braking, and auxiliary systems, significantly reducing aircraft weight and improving fuel efficiency. This shift has driven strong demand for advanced battery systems that offer high energy density, reliability, and safety. The MEA approach is widely adopted in both commercial and military aviation, making it a key growth area for aerospace battery technology. Hybrid aircraft are gaining momentum as the next step toward full electrification, combining traditional jet engines with electric propulsion systems. These aircraft rely on high-performance batteries to support partial electric thrust, reduce emissions, and improve fuel economy during takeoff, taxiing, and cruising. The growing focus on sustainable aviation and government-backed initiatives for clean energy are accelerating R&D and investment in this segment. While still in the early stages of commercialization, hybrid aircraft present substantial growth potential for battery manufacturers as they prepare for larger-scale deployment in the near future.

In terms of power density, the global aerospace battery technology market is bifurcated into less than 300 wh/kg and more than 300 wh/kg. Batteries with a power density of less than 300 Wh/kg currently dominate, largely due to their proven reliability, safety, and widespread availability. These batteries, which include most traditional lithium-ion and nickel-based chemistries, are commonly used in commercial and military aircraft for applications such as emergency systems, avionics, lighting, and auxiliary functions. Their stable performance under varying atmospheric and operational conditions, along with established certification standards, makes them the preferred choice for mainstream aerospace systems. Although they offer lower energy-to-weight ratios compared to emerging technologies, their balance of cost, performance, and safety keeps them widely adopted across existing platforms. On the other hand, batteries with a power density of more than 300 Wh/kg represent an emerging and high-potential segment, driven by the growing need for lightweight, high-capacity energy solutions in electric and hybrid-electric aircraft. These advanced batteries often based on next-generation chemistries such as solid-state or lithium-sulfur enable longer flight times, greater payload capacities, and higher energy efficiency, making them ideal for electric vertical takeoff and landing (eVTOL) aircraft, UAVs, and regional electric flights.

On the basis of application, the global aerospace battery technology market is bifurcated into propulsion, auxiliary power unit (APU), emergency, and others. Propulsion is becoming the most transformative and rapidly growing application segment, particularly with the development of electric and hybrid-electric aircraft. This segment involves the use of high-capacity batteries to provide primary or supplemental thrust for flight. As the industry shifts toward sustainable aviation, propulsion applications are driving demand for advanced battery systems with high power density, thermal stability, and long cycle life. Although currently limited to smaller aircraft, drones, and eVTOL platforms, the propulsion segment is set to dominate future growth as battery technology evolves.

By end-use, the global aerospace battery technology market is bifurcated into civil aviation, military aviation, and UAV. Civil aviation is the most dominant end-use segment, driven by the increasing electrification of commercial aircraft systems, growing demand for more electric aircraft (MEA), and the aviation industry's push toward sustainable and fuel-efficient operations. Batteries are widely used in civil aviation for auxiliary power, emergency systems, avionics, cabin lighting, and increasingly for electric and hybrid-electric propulsion in regional aircraft and urban air mobility (UAM) solutions. As commercial airlines and manufacturers prioritize weight reduction, emissions control, and operational efficiency, the role of advanced batteries in civil aviation continues to expand rapidly. Military aviation holds the second-largest share, supported by the need for robust, high-performance battery systems that can operate reliably in extreme environments. Batteries in military aircraft are used for a range of mission-critical systems including radar, communication, guidance, emergency backup, and increasingly in electric ground support equipment and auxiliary systems. The military also leads in adopting advanced technologies such as solid-state batteries for enhanced safety, longer life cycles, and higher power density, particularly in next-generation fighter jets, surveillance aircraft, and tactical support platforms.

Aerospace Battery Technology Market: Regional Insights

- North America is expected to dominates the global market

North America leads the global aerospace battery technology market, primarily driven by the presence of major aerospace and defense companies, extensive R&D activities, and strong government support for electric and hybrid-electric aviation. The United States, in particular, has witnessed growing investments in next-generation aircraft programs, satellite launches, and electric vertical take-off and landing (eVTOL) aircraft, all of which demand advanced battery systems. Companies like Boeing, Lockheed Martin, and NASA are collaborating with battery manufacturers to develop lightweight, high-capacity power solutions for military and commercial applications. The region's mature aerospace infrastructure, robust supply chain, and rapid adoption of technological innovations make it the most dominant in the global market.

Europe ranks as the second-largest market, supported by strong initiatives toward green aviation, climate-neutral air mobility, and the electrification of aircraft. Leading aerospace companies such as Airbus, Safran, and Rolls-Royce are heavily investing in electric propulsion systems and energy storage technologies. The European Union’s ambitious targets for reducing aviation emissions and its funding for aerospace innovation projects contribute significantly to the region’s growth. Additionally, the increasing focus on developing battery-powered regional aircraft and UAVs across Germany, France, and the UK further strengthens Europe’s position in the market.

Asia Pacific is emerging as one of the fastest-growing regions in the aerospace battery technology market, fueled by expanding aviation sectors in China, India, and Japan. Government-backed aerospace development programs, rising investments in satellite technology, and growing demand for commercial drones are creating new opportunities for battery manufacturers. China’s push to become a global leader in both aerospace and electric mobility is also accelerating the integration of advanced battery technologies into domestic aircraft and space missions. The region’s growing manufacturing capabilities and increasing domestic air travel further support its rapid market expansion.

Latin America represents a developing but gradually expanding market, with countries like Brazil and Mexico investing in aerospace production and research, particularly in satellite and UAV development. While the region lacks the large-scale aerospace infrastructure found in North America or Europe, regional efforts to modernize defense capabilities and adopt electric aviation solutions are slowly driving demand for aerospace-grade batteries. Collaborative projects with international aerospace firms and universities are contributing to knowledge transfer and technological growth in the region.

The Middle East and Africa currently hold the smallest share of the aerospace battery technology market, although interest is growing in satellite programs, space exploration, and drone-based services for surveillance and logistics. The Middle East, especially the UAE and Saudi Arabia, has launched national space agencies and invested in satellite technology, which may lead to increased battery demand in the future. However, limited aerospace manufacturing and R&D infrastructure currently constrain the region's contribution to the global market, positioning it as the least dominant.

Aerospace Battery Technology Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerospace battery technology market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerospace battery technology market include:

- Concorde Battery Corporation

- Cella Energy

- EaglePicher Technologies

- Enersys

- Kokam

- GS Yuasa International Ltd

- Marathonnorco Aerospace

- Marvel Aero International

- Saft Groupe S.A.

- Mid-Continent Instruments and Avionics

- Teledyne Battery Products (Teledyne Technologies)

- Sichuan Changhong Battery Co. Ltd

- TransDigm Group

- Quallion LLC

- Aero Lithium Batteries

- Securaplane Technologies Inc

- HBL Power Systems Ltd

- Gill Battery

- Tesla

- True Blue Power

- Meggitt PLC

The global aerospace battery technology market is segmented as follows:

By Offering

- Nickel-Cadmium Battery

- Lead Acid Battery

- Lithium-Ion Battery

- Battery Management System

By Aircraft Type

- Narrow Body Aircraft

- Wide-Body Aircraft

- Very Large Aircraft

- General Aviation

- Helicopter

- and Others

By Aircraft Technology

- Traditional Aircraft

- More Electric Aircraft

- Hybrid Aircraft

- Electric Aircraft

- By Power Density

- Less Than 300 Wh/Kg

- More Than 300 Wh/Kg

By Application

- Propulsion

- Auxiliary Power Unit (APU)

- Emergency

- Others

By End-Use

- Civil Aviation

- Military Aviation

- UAV

- By End Market

- OEM

- Aftermarket

By Sales Channel

- Direct Sales

- Distributor Sales

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerospace Battery Technulogy

- 1.2. Global Aerospace Battery Technulogy Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 1.4. Global Aerospace Battery Technulogy Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerospace Battery Technulogy Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerospace Battery Technulogy Market – Offering Analysis

- 2.1. Global Aerospace Battery Technulogy Market – Offering Overview

- 2.2. Global Aerospace Battery Technulogy Market Share, by Offering, 2019 & 2026 (USD Million)

- 2.3. Nickel-Cadmium Battery

- 2.3.1. Global Nickel-Cadmium Battery Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 2.4. Lead Acid Battery

- 2.4.1. Global Lead Acid Battery Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 2.5. Lithium-Ion Battery

- 2.5.1. Global Lithium-Ion Battery Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 2.6. Battery Management System

- 2.6.1. Global Battery Management System Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 3 Aerospace Battery Technulogy Market – Aircraft Type Analysis

- 3.1. Global Aerospace Battery Technulogy Market – Aircraft Type Overview

- 3.2. Global Aerospace Battery Technulogy Market Share, by Aircraft Type, 2019 & 2026 (USD Million)

- 3.3. Narrow Body Aircraft

- 3.3.1. Global Narrow Body Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 3.4. Wide Body Aircraft

- 3.4.1. Global Wide Body Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 3.5. Very Large Aircraft

- 3.5.1. Global Very Large Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 3.6. General Aviation

- 3.6.1. Global General Aviation Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 3.7. Helicopter

- 3.7.1. Global Helicopter Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 3.8. Others

- 3.8.1. Global Others Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 4 Aerospace Battery Technulogy Market – Aircraft Technulogy Analysis

- 4.1. Global Aerospace Battery Technulogy Market – Aircraft Technulogy Overview

- 4.2. Global Aerospace Battery Technulogy Market Share, by Aircraft Technulogy, 2019 & 2026 (USD Million)

- 4.3. Traditional Aircraft

- 4.3.1. Global Traditional Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 4.4. More Electric Aircraft

- 4.4.1. Global More Electric Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 4.5. Hybrid Aircraft

- 4.5.1. Global Hybrid Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 4.6. Electric Aircraft

- 4.6.1. Global Electric Aircraft Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 5 Aerospace Battery Technulogy Market – Power Density Analysis

- 5.1. Global Aerospace Battery Technulogy Market – Power Density Overview

- 5.2. Global Aerospace Battery Technulogy Market Share, by Power Density, 2019 & 2026 (USD Million)

- 5.3. Less Than 300 Wh/Kg

- 5.3.1. Global Less Than 300 Wh/Kg Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 5.4. More Than 300 Wh/Kg

- 5.4.1. Global More Than 300 Wh/Kg Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 6 Aerospace Battery Technulogy Market – Application Analysis

- 6.1. Global Aerospace Battery Technulogy Market – Application Overview

- 6.2. Global Aerospace Battery Technulogy Market Share, by Application, 2019 & 2026 (USD Million)

- 6.3. Propulsion

- 6.3.1. Global Propulsion Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 6.4. Auxiliary Power Unit (APU)

- 6.4.1. Global Auxiliary Power Unit (APU) Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 6.5. Emergency

- 6.5.1. Global Emergency Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 6.6. Others

- 6.6.1. Global Others Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 7 Aerospace Battery Technulogy Market – End-Use Analysis

- 7.1. Global Aerospace Battery Technulogy Market – End-Use Overview

- 7.2. Global Aerospace Battery Technulogy Market Share, by End-Use, 2019 & 2026 (USD Million)

- 7.3. Civil Aviation

- 7.3.1. Global Civil Aviation Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 7.4. Military Aviation

- 7.4.1. Global Military Aviation Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 7.5. UAV

- 7.5.1. Global UAV Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 8 Aerospace Battery Technulogy Market – End Market Analysis

- 8.1. Global Aerospace Battery Technulogy Market – End Market Overview

- 8.2. Global Aerospace Battery Technulogy Market Share, by End Market, 2019 & 2026 (USD Million)

- 8.3. OEM

- 8.3.1. Global OEM Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 8.4. Aftermarket

- 8.4.1. Global Aftermarket Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 9 Aerospace Battery Technulogy Market – Sales Channel Analysis

- 9.1. Global Aerospace Battery Technulogy Market – Sales Channel Overview

- 9.2. Global Aerospace Battery Technulogy Market Share, by Sales Channel, 2019 & 2026 (USD Million)

- 9.3. Direct Sales

- 9.3.1. Global Direct Sales Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 9.4. Distributor Sales

- 9.4.1. Global Distributor Sales Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 10 Aerospace Battery Technulogy Market – Regional Analysis

- 10.1. Global Aerospace Battery Technulogy Market Regional Overview

- 10.2. Global Aerospace Battery Technulogy Market Share, by Region, 2019 & 2026 (USD Million)

- 10.3. North America

- 10.3.1. North America Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.3.1.1. North America Aerospace Battery Technulogy Market, by Country, 2016 - 2026 (USD Million)

- 10.3.2. North America Aerospace Battery Technulogy Market, by Offering, 2016 – 2026

- 10.3.2.1. North America Aerospace Battery Technulogy Market, by Offering, 2016 – 2026 (USD Million)

- 10.3.3. North America Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026

- 10.3.3.1. North America Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 10.3.4. North America Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026

- 10.3.4.1. North America Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026 (USD Million)

- 10.3.5. North America Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026

- 10.3.5.1. North America Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026 (USD Million)

- 10.3.6. North America Aerospace Battery Technulogy Market, by Application, 2016 – 2026

- 10.3.6.1. North America Aerospace Battery Technulogy Market, by Application, 2016 – 2026 (USD Million)

- 10.3.7. North America Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026

- 10.3.7.1. North America Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026 (USD Million)

- 10.3.8. North America Aerospace Battery Technulogy Market, by End Market, 2016 – 2026

- 10.3.8.1. North America Aerospace Battery Technulogy Market, by End Market, 2016 – 2026 (USD Million)

- 10.3.9. North America Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026

- 10.3.9.1. North America Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026 (USD Million)

- 10.3.10. U.S.

- 10.3.10.1. U.S. Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.3.11. Canada

- 10.3.11.1. Canada Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.3.1. North America Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4. Europe

- 10.4.1. Europe Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.1.1. Europe Aerospace Battery Technulogy Market, by Country, 2016 - 2026 (USD Million)

- 10.4.2. Europe Aerospace Battery Technulogy Market, by Offering, 2016 – 2026

- 10.4.2.1. Europe Aerospace Battery Technulogy Market, by Offering, 2016 – 2026 (USD Million)

- 10.4.3. Europe Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026

- 10.4.3.1. Europe Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 10.4.4. Europe Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026

- 10.4.4.1. Europe Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026 (USD Million)

- 10.4.5. Europe Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026

- 10.4.5.1. Europe Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026 (USD Million)

- 10.4.6. Europe Aerospace Battery Technulogy Market, by Application, 2016 – 2026

- 10.4.6.1. Europe Aerospace Battery Technulogy Market, by Application, 2016 – 2026 (USD Million)

- 10.4.7. Europe Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026

- 10.4.7.1. Europe Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026 (USD Million)

- 10.4.8. Europe Aerospace Battery Technulogy Market, by End Market, 2016 – 2026

- 10.4.8.1. Europe Aerospace Battery Technulogy Market, by End Market, 2016 – 2026 (USD Million)

- 10.4.9. Europe Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026

- 10.4.9.1. Europe Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026 (USD Million)

- 10.4.10. Germany

- 10.4.10.1. Germany Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.11. France

- 10.4.11.1. France Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.12. U.K.

- 10.4.12.1. U.K. Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.13. Italy

- 10.4.13.1. Italy Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.14. Spain

- 10.4.14.1. Spain Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.15. Rest of Europe

- 10.4.15.1. Rest of Europe Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.4.1. Europe Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5. Asia Pacific

- 10.5.1. Asia Pacific Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.1.1. Asia Pacific Aerospace Battery Technulogy Market, by Country, 2016 - 2026 (USD Million)

- 10.5.2. Asia Pacific Aerospace Battery Technulogy Market, by Offering, 2016 – 2026

- 10.5.2.1. Asia Pacific Aerospace Battery Technulogy Market, by Offering, 2016 – 2026 (USD Million)

- 10.5.3. Asia Pacific Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026

- 10.5.3.1. Asia Pacific Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 10.5.4. Asia Pacific Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026

- 10.5.4.1. Asia Pacific Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026 (USD Million)

- 10.5.5. Asia Pacific Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026

- 10.5.5.1. Asia Pacific Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026 (USD Million)

- 10.5.6. Asia Pacific Aerospace Battery Technulogy Market, by Application, 2016 – 2026

- 10.5.6.1. Asia Pacific Aerospace Battery Technulogy Market, by Application, 2016 – 2026 (USD Million)

- 10.5.7. Asia Pacific Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026

- 10.5.7.1. Asia Pacific Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026 (USD Million)

- 10.5.8. Asia Pacific Aerospace Battery Technulogy Market, by End Market, 2016 – 2026

- 10.5.8.1. Asia Pacific Aerospace Battery Technulogy Market, by End Market, 2016 – 2026 (USD Million)

- 10.5.9. Asia Pacific Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026

- 10.5.9.1. Asia Pacific Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026 (USD Million)

- 10.5.10. China

- 10.5.10.1. China Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.11. Japan

- 10.5.11.1. Japan Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.12. India

- 10.5.12.1. India Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.13. South Korea

- 10.5.13.1. South Korea Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.14. South-East Asia

- 10.5.14.1. South-East Asia Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.15. Rest of Asia Pacific

- 10.5.15.1. Rest of Asia Pacific Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.5.1. Asia Pacific Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.6. Latin America

- 10.6.1. Latin America Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.6.1.1. Latin America Aerospace Battery Technulogy Market, by Country, 2016 - 2026 (USD Million)

- 10.6.2. Latin America Aerospace Battery Technulogy Market, by Offering, 2016 – 2026

- 10.6.2.1. Latin America Aerospace Battery Technulogy Market, by Offering, 2016 – 2026 (USD Million)

- 10.6.3. Latin America Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026

- 10.6.3.1. Latin America Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 10.6.4. Latin America Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026

- 10.6.4.1. Latin America Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026 (USD Million)

- 10.6.5. Latin America Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026

- 10.6.5.1. Latin America Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026 (USD Million)

- 10.6.6. Latin America Aerospace Battery Technulogy Market, by Application, 2016 – 2026

- 10.6.6.1. Latin America Aerospace Battery Technulogy Market, by Application, 2016 – 2026 (USD Million)

- 10.6.7. Latin America Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026

- 10.6.7.1. Latin America Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026 (USD Million)

- 10.6.8. Latin America Aerospace Battery Technulogy Market, by End Market, 2016 – 2026

- 10.6.8.1. Latin America Aerospace Battery Technulogy Market, by End Market, 2016 – 2026 (USD Million)

- 10.6.9. Latin America Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026

- 10.6.9.1. Latin America Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026 (USD Million)

- 10.6.10. Brazil

- 10.6.10.1. Brazil Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.6.11. Mexico

- 10.6.11.1. Mexico Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.6.12. Rest of Latin America

- 10.6.12.1. Rest of Latin America Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.6.1. Latin America Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.7. The Middle-East and Africa

- 10.7.1. The Middle-East and Africa Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.7.1.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Country, 2016 - 2026 (USD Million)

- 10.7.2. The Middle-East and Africa Aerospace Battery Technulogy Market, by Offering, 2016 – 2026

- 10.7.2.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Offering, 2016 – 2026 (USD Million)

- 10.7.3. The Middle-East and Africa Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026

- 10.7.3.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 10.7.4. The Middle-East and Africa Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026

- 10.7.4.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Aircraft Technulogy, 2016 – 2026 (USD Million)

- 10.7.5. The Middle-East and Africa Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026

- 10.7.5.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Power Density, 2016 – 2026 (USD Million)

- 10.7.6. The Middle-East and Africa Aerospace Battery Technulogy Market, by Application, 2016 – 2026

- 10.7.6.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Application, 2016 – 2026 (USD Million)

- 10.7.7. The Middle-East and Africa Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026

- 10.7.7.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by End-Use, 2016 – 2026 (USD Million)

- 10.7.8. The Middle-East and Africa Aerospace Battery Technulogy Market, by End Market, 2016 – 2026

- 10.7.8.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by End Market, 2016 – 2026 (USD Million)

- 10.7.9. The Middle-East and Africa Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026

- 10.7.9.1. The Middle-East and Africa Aerospace Battery Technulogy Market, by Sales Channel, 2016 – 2026 (USD Million)

- 10.7.10. GCC Countries

- 10.7.10.1. GCC Countries Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.7.11. South Africa

- 10.7.11.1. South Africa Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.7.12. Rest of Middle-East Africa

- 10.7.12.1. Rest of Middle-East Africa Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- 10.7.1. The Middle-East and Africa Aerospace Battery Technulogy Market, 2016 – 2026 (USD Million)

- Chapter 11 Aerospace Battery Technulogy Market – Competitive Landscape

- 11.1. Competitor Market Share – Revenue

- 11.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 11.3. Strategic Developments

- 11.3.1. Acquisitions and Mergers

- 11.3.2. New Products

- 11.3.3. Research & Development Activities

- Chapter 12 Company Profiles

- 12.1. Cella Energy

- 12.1.1. Company Overview

- 12.1.2. Product/Service Portfulio

- 12.1.3. Cella Energy Sales, Revenue, and Gross Margin

- 12.1.4. Cella Energy Revenue and Growth Rate

- 12.1.5. Cella Energy Market Share

- 12.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.2. Concorde Battery Corporation

- 12.2.1. Company Overview

- 12.2.2. Product/Service Portfulio

- 12.2.3. Concorde Battery Corporation Sales, Revenue, and Gross Margin

- 12.2.4. Concorde Battery Corporation Revenue and Growth Rate

- 12.2.5. Concorde Battery Corporation Market Share

- 12.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.3. Enersys

- 12.3.1. Company Overview

- 12.3.2. Product/Service Portfulio

- 12.3.3. Enersys Sales, Revenue, and Gross Margin

- 12.3.4. Enersys Revenue and Growth Rate

- 12.3.5. Enersys Market Share

- 12.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.4. EaglePicher Technulogies

- 12.4.1. Company Overview

- 12.4.2. Product/Service Portfulio

- 12.4.3. EaglePicher Technulogies Sales, Revenue, and Gross Margin

- 12.4.4. EaglePicher Technulogies Revenue and Growth Rate

- 12.4.5. EaglePicher Technulogies Market Share

- 12.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.5. GS Yuasa International Ltd

- 12.5.1. Company Overview

- 12.5.2. Product/Service Portfulio

- 12.5.3. GS Yuasa International Ltd Sales, Revenue, and Gross Margin

- 12.5.4. GS Yuasa International Ltd Revenue and Growth Rate

- 12.5.5. GS Yuasa International Ltd Market Share

- 12.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.6. Kokam

- 12.6.1. Company Overview

- 12.6.2. Product/Service Portfulio

- 12.6.3. Kokam Sales, Revenue, and Gross Margin

- 12.6.4. Kokam Revenue and Growth Rate

- 12.6.5. Kokam Market Share

- 12.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.7. Marvel Aero International

- 12.7.1. Company Overview

- 12.7.2. Product/Service Portfulio

- 12.7.3. Marvel Aero International Sales, Revenue, and Gross Margin

- 12.7.4. Marvel Aero International Revenue and Growth Rate

- 12.7.5. Marvel Aero International Market Share

- 12.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.8. Marathonnorco Aerospace

- 12.8.1. Company Overview

- 12.8.2. Product/Service Portfulio

- 12.8.3. Marathonnorco Aerospace Sales, Revenue, and Gross Margin

- 12.8.4. Marathonnorco Aerospace Revenue and Growth Rate

- 12.8.5. Marathonnorco Aerospace Market Share

- 12.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.9. Mid-Continent Instruments and Avionics

- 12.9.1. Company Overview

- 12.9.2. Product/Service Portfulio

- 12.9.3. Mid-Continent Instruments and Avionics Sales, Revenue, and Gross Margin

- 12.9.4. Mid-Continent Instruments and Avionics Revenue and Growth Rate

- 12.9.5. Mid-Continent Instruments and Avionics Market Share

- 12.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.10. Saft Groupe S.A.

- 12.10.1. Company Overview

- 12.10.2. Product/Service Portfulio

- 12.10.3. Saft Groupe S.A. Sales, Revenue, and Gross Margin

- 12.10.4. Saft Groupe S.A. Revenue and Growth Rate

- 12.10.5. Saft Groupe S.A. Market Share

- 12.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.11. Sichuan Changhong Battery Co. Ltd

- 12.11.1. Company Overview

- 12.11.2. Product/Service Portfulio

- 12.11.3. Sichuan Changhong Battery Co. Ltd Sales, Revenue, and Gross Margin

- 12.11.4. Sichuan Changhong Battery Co. Ltd Revenue and Growth Rate

- 12.11.5. Sichuan Changhong Battery Co. Ltd Market Share

- 12.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.12. Teledyne Battery Products (Teledyne Technulogies)

- 12.12.1. Company Overview

- 12.12.2. Product/Service Portfulio

- 12.12.3. Teledyne Battery Products (Teledyne Technulogies) Sales, Revenue, and Gross Margin

- 12.12.4. Teledyne Battery Products (Teledyne Technulogies) Revenue and Growth Rate

- 12.12.5. Teledyne Battery Products (Teledyne Technulogies) Market Share

- 12.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.13. Quallion LLC

- 12.13.1. Company Overview

- 12.13.2. Product/Service Portfulio

- 12.13.3. Quallion LLC Sales, Revenue, and Gross Margin

- 12.13.4. Quallion LLC Revenue and Growth Rate

- 12.13.5. Quallion LLC Market Share

- 12.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.14. TransDigm Group

- 12.14.1. Company Overview

- 12.14.2. Product/Service Portfulio

- 12.14.3. TransDigm Group Sales, Revenue, and Gross Margin

- 12.14.4. TransDigm Group Revenue and Growth Rate

- 12.14.5. TransDigm Group Market Share

- 12.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.15. Securaplane Technulogies Inc

- 12.15.1. Company Overview

- 12.15.2. Product/Service Portfulio

- 12.15.3. Securaplane Technulogies Inc Sales, Revenue, and Gross Margin

- 12.15.4. Securaplane Technulogies Inc Revenue and Growth Rate

- 12.15.5. Securaplane Technulogies Inc Market Share

- 12.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.16. Aero Lithium Batteries

- 12.16.1. Company Overview

- 12.16.2. Product/Service Portfulio

- 12.16.3. Aero Lithium Batteries Sales, Revenue, and Gross Margin

- 12.16.4. Aero Lithium Batteries Revenue and Growth Rate

- 12.16.5. Aero Lithium Batteries Market Share

- 12.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.17. Gill Battery

- 12.17.1. Company Overview

- 12.17.2. Product/Service Portfulio

- 12.17.3. Gill Battery Sales, Revenue, and Gross Margin

- 12.17.4. Gill Battery Revenue and Growth Rate

- 12.17.5. Gill Battery Market Share

- 12.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.18. HBL Power Systems Ltd

- 12.18.1. Company Overview

- 12.18.2. Product/Service Portfulio

- 12.18.3. HBL Power Systems Ltd Sales, Revenue, and Gross Margin

- 12.18.4. HBL Power Systems Ltd Revenue and Growth Rate

- 12.18.5. HBL Power Systems Ltd Market Share

- 12.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.19. True Blue Power

- 12.19.1. Company Overview

- 12.19.2. Product/Service Portfulio

- 12.19.3. True Blue Power Sales, Revenue, and Gross Margin

- 12.19.4. True Blue Power Revenue and Growth Rate

- 12.19.5. True Blue Power Market Share

- 12.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.20. Tesla

- 12.20.1. Company Overview

- 12.20.2. Product/Service Portfulio

- 12.20.3. Tesla Sales, Revenue, and Gross Margin

- 12.20.4. Tesla Revenue and Growth Rate

- 12.20.5. Tesla Market Share

- 12.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.21. Meggitt PLC

- 12.21.1. Company Overview

- 12.21.2. Product/Service Portfulio

- 12.21.3. Meggitt PLC Sales, Revenue, and Gross Margin

- 12.21.4. Meggitt PLC Revenue and Growth Rate

- 12.21.5. Meggitt PLC Market Share

- 12.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 12.1. Cella Energy

- Chapter 13 Aerospace Battery Technulogy — Industry Analysis

- 13.1. Introduction and Taxonomy

- 13.2. Aerospace Battery Technulogy Market – Key Trends

- 13.2.1. Market Drivers

- 13.2.2. Market Restraints

- 13.2.3. Market Opportunities

- 13.3. Value Chain Analysis

- 13.4. Key Mandates and Regulations

- 13.5. Technulogy Roadmap and Timeline

- 13.6. Aerospace Battery Technulogy Market – Attractiveness Analysis

- 13.6.1. By Offering

- 13.6.2. By Aircraft Type

- 13.6.3. By Aircraft Technulogy

- 13.6.4. By Power Density

- 13.6.5. By Application

- 13.6.6. By End-Use

- 13.6.7. By End Market

- 13.6.8. By Sales Channel

- 13.6.9. By Region

- Chapter 14 Marketing Strategy Analysis

- 14.1. Marketing Channel

- 14.2. Direct Marketing

- 14.3. Indirect Marketing

- 14.4. Marketing Channel Development Trends

- 14.5. Economic/Pulitical Environmental Change

- Chapter 15 Report Conclusion & Key Insights

- 15.1. Key Insights from Primary Interviews & Surveys Respondents

- 15.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 16 Research Approach & Methodulogy

- 16.1. Report Description

- 16.2. Research Scope

- 16.3. Research Methodulogy

- 16.3.1. Secondary Research

- 16.3.2. Primary Research

- 16.3.3. Statistical Models

- 16.3.3.1. Company Share Analysis Model

- 16.3.3.2. Revenue Based Modeling

- 16.3.4. Research Limitations

Inquiry For Buying

Aerospace Battery Technology

Request Sample

Aerospace Battery Technology