Aerospace Bearings Market Size, Share, and Trends Analysis Report

CAGR :

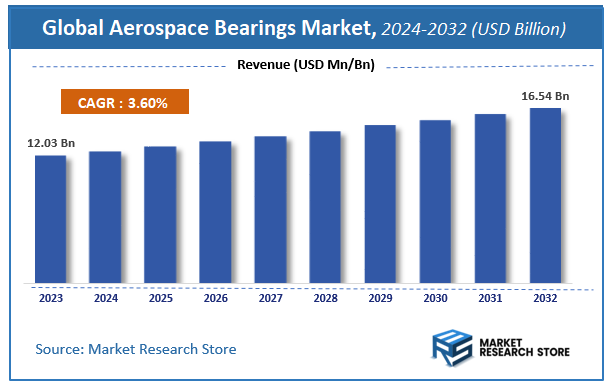

| Market Size 2023 (Base Year) | USD 12.03 Billion |

| Market Size 2032 (Forecast Year) | USD 16.54 Billion |

| CAGR | 3.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerospace Bearings Market Insights

According to Market Research Store, the global aerospace bearings market size was valued at around USD 12.03 billion in 2023 and is estimated to reach USD 16.54 billion by 2032, to register a CAGR of approximately 3.6% in terms of revenue during the forecast period 2024-2032.

The aerospace bearings report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Aerospace Bearings Market: Overview

Aerospace bearings are precision-engineered components designed to support rotational or linear movement while minimizing friction and handling extreme loads in aircraft and aerospace systems. These bearings are critical in enabling the smooth operation of various moving parts in aircraft, including engines, landing gear, flight control systems, and navigation instruments. Unlike standard industrial bearings, aerospace bearings are made from high-performance materials such as stainless steel, titanium alloys, and ceramics to withstand extreme temperatures, high speeds, and harsh environmental conditions, including vacuum and radiation in space applications. Their durability, reliability, and precision are vital for ensuring safety, performance, and efficiency in both commercial and military aviation as well as spacecraft.

Key Highlights

- The aerospace bearings market is anticipated to grow at a CAGR of 3.6% during the forecast period.

- The global aerospace bearings market was estimated to be worth approximately USD 12.03 billion in 2023 and is projected to reach a value of USD 16.54 billion by 2032.

- The growth of the aerospace bearings market is being driven by the increasing production of commercial aircraft, rising defense expenditure, and expanding space exploration initiatives.

- Based on the product type, the ball bearings segment is growing at a high rate and is projected to dominate the market.

- On the basis of aircraft type, the narrow-body aircraft segment is projected to swipe the largest market share.

- In terms of material type, the stainless steel segment is expected to dominate the market.

- Based on the application, the landing gear segment is expected to dominate the market.

- In terms of sales channel, the OEM segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Aerospace Bearings Market: Dynamics

Key Growth Drivers:

- Rising Aircraft Production and Fleet Expansion: The increasing number of commercial, military, and cargo aircraft worldwide is directly driving the demand for aerospace bearings in engines, landing gear, and flight systems.

- Growing Emphasis on Fuel Efficiency and Performance: Bearings play a critical role in reducing friction and improving mechanical efficiency, making them essential in advanced aircraft design.

- Increased Defense Spending and Modernization Programs: Expansion of military aircraft programs globally is fueling the need for high-performance, durable aerospace bearings.

- Technological Advancements in Bearing Materials and Coatings: The development of hybrid ceramic bearings, advanced lubrication systems, and corrosion-resistant coatings is enhancing durability and performance in extreme environments.

Restraints:

- High Manufacturing and Material Costs: Aerospace-grade bearings require precision engineering and advanced materials like titanium or ceramics, which significantly increase production costs.

- Complex Certification and Regulatory Requirements: Bearings must meet stringent industry and safety standards, leading to lengthy approval processes and increased R&D costs.

- Supply Chain Constraints and Lead Times: Limited suppliers of aerospace-grade materials and components can cause production delays and affect overall project timelines.

Opportunities:

- Growth of the Commercial Aviation Sector in Emerging Markets: Rapid expansion of airline services in Asia-Pacific, Latin America, and the Middle East creates new demand for aerospace components, including bearings.

- Increased Focus on Electric and Hybrid Aircraft Development: As aviation transitions toward electric propulsion systems, specialized bearings are needed for new engines and systems.

- Expansion of the Aftermarket and MRO Industry: Aging aircraft fleets and increased focus on maintenance, repair, and overhaul (MRO) activities offer growth prospects for replacement bearings and spare parts.

Challenges:

- Need for Extreme Precision and Zero Defect Manufacturing: Aerospace applications require bearings with ultra-high precision and reliability, making manufacturing and quality control highly demanding.

- Exposure to Harsh Operating Conditions: Bearings in aerospace environments must withstand high loads, extreme temperatures, and vibrations, which can affect lifespan and performance.

- Risk of Counterfeit and Low-Quality Products: The presence of counterfeit parts in the supply chain poses a significant safety risk and regulatory concern for OEMs and airlines.

Aerospace Bearings Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Bearings Market |

| Market Size in 2023 | USD 12.03 Billion |

| Market Forecast in 2032 | USD 16.54 Billion |

| Growth Rate | CAGR of 3.6% |

| Number of Pages | 167 |

| Key Companies Covered | AST Bearings LLC, AB SKF, BC Bearings, Aurora Bearing, JTEKT Corp., GGB Bearings, Minebea Co., Ltd., Kaman Corporation, New Hampshire Ball Bearings, Inc., National Precision Bearing, NTN Bearing Corporation, NSK Ltd., RBC Bearings, Pacamor Kubar Bearings, Rexnord Corporation, Regal Beloit Corporation, Schaeffler AG, and The Timken Company among others |

| Segments Covered | By Product Type, By Aircraft Type, By Material Type, By Application, By Sales Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Bearings Market: Segmentation Insights

The global aerospace bearings market is divided by product type, aircraft type, material type, application, sales channel, and region.

Based on product type, the global aerospace bearings market is divided into roller bearing, ball bearing, and plain bearing. In the aerospace bearings market, ball bearings are the most dominant product type due to their versatility, precision, and widespread application in both commercial and military aircraft. Ball bearings are primarily used in critical aircraft components such as engines, landing gear, control surfaces, and avionics systems, where smooth rotational motion, low friction, and long service life are essential. Their ability to handle both radial and axial loads, combined with their relatively compact size and high-speed performance, makes them suitable for a wide range of aircraft systems. Advancements in material coatings and design have further enhanced their durability and resistance to extreme operating conditions, cementing their leading position in the market. Roller bearings hold the second-largest market share and are typically used in applications that require support for heavy radial loads, such as jet engines, gearboxes, and transmission systems. These bearings offer greater load-carrying capacity than ball bearings due to the larger contact area between the rollers and races. They are essential in systems that experience high mechanical stress and demand high performance under intense vibration and pressure.

On the basis of aircraft type, the global aerospace bearings market is bifurcated into narrow body aircraft, wide body aircraft, regional transport aircraft, very large aircraft, business jet, fighter jet, helicopter, and others. Narrow-body aircraft represent the most dominant aircraft type segment, largely due to their widespread use in short- to medium-haul commercial aviation. These aircraft, such as the Boeing 737 and Airbus A320 families, are produced in high volumes and are widely adopted by both full-service and low-cost carriers globally. Bearings are used extensively across the airframe, engines, landing gear, and control systems, and with airlines continuously expanding and renewing their narrow-body fleets to meet growing passenger demand, this segment drives consistent and significant bearing consumption. Wide-body aircraft follow as the second-largest segment, used primarily for long-haul international travel. These aircraft require larger and more complex bearing systems to support heavy payloads, powerful engines, and advanced flight control systems.

Based on material type, the global aerospace bearings market is divided into stainless steel, fiber-reinforced composites, metal-backed, engineered plastics, aluminum alloys, and others. Stainless steel is the most dominant material type due to its superior strength, corrosion resistance, and high performance under extreme temperature and pressure conditions. It is widely used in critical aircraft components such as engines, landing gear, and control systems, where durability, load-bearing capacity, and long lifecycle are essential. Stainless steel bearings are suitable for both commercial and military applications, offering consistent reliability in harsh environments, which makes them the preferred choice across various aircraft platforms. Fiber-reinforced composites represent the second-most significant material segment, gaining popularity due to their lightweight nature, excellent fatigue resistance, and ability to reduce overall aircraft weight. These materials are primarily used in non-critical and high-speed applications where reducing mass is vital for improving fuel efficiency and performance.

In terms of application, the global aerospace bearings market is bifurcated into landing gear, engine, flight control system, aerostructure, and others. Landing gear is the most dominant application segment due to the critical role bearings play in managing the high loads, shocks, and stresses experienced during takeoff, landing, and taxiing. Bearings used in landing gear systems must offer exceptional durability, corrosion resistance, and load-carrying capacity while operating under varying temperature and pressure conditions. Given the mechanical complexity and safety-critical nature of landing gear, high-performance bearings are essential to ensure reliable and maintenance-efficient operation throughout an aircraft’s service life. Engine applications represent the second-largest segment, where bearings are used in high-speed, high-temperature environments to support rotating shafts, turbines, and compressors. These bearings must exhibit exceptional thermal stability, fatigue resistance, and precision to ensure uninterrupted engine performance. Any failure in engine bearings can lead to catastrophic consequences, making this a segment with extremely stringent quality and safety standards. The growing demand for more efficient and powerful aircraft engines continues to drive innovations in high-performance bearing materials and designs.

Based on sales channel, the global aerospace bearings market is bifurcated into OEM and aftermarket. The OEM (Original Equipment Manufacturer) segment is the most dominant sales channel, primarily driven by the continuous production of new commercial, military, and business aircraft. OEMs source aerospace bearings directly from manufacturers to integrate them into engines, landing gear, flight control systems, and other critical components during the aircraft assembly process. This channel benefits from long-term contracts, stringent quality assurance protocols, and strong collaborations between aircraft and bearing manufacturers. With increasing aircraft deliveries and the development of next-generation aerospace platforms, the OEM segment maintains a strong and stable demand for high-precision bearings. The aftermarket segment, while smaller in comparison, plays a crucial role in supporting maintenance, repair, and overhaul (MRO) activities across the aviation industry. As aircraft age and undergo regular servicing, the need to replace worn-out or degraded bearings ensures consistent aftermarket demand. Airlines and defense agencies prioritize operational readiness and safety, driving the need for high-quality replacement parts. The aftermarket segment is also supported by regulatory requirements for scheduled inspections and part replacements.

Aerospace Bearings Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant region in the aerospace bearings market, primarily due to the presence of major aircraft manufacturers such as Boeing, Lockheed Martin, and Raytheon Technologies, along with a strong network of suppliers and component manufacturers. The region benefits from high defense spending by the U.S. government, continuous technological innovation, and the growing production of both commercial and military aircraft. Additionally, the expansion of space programs, including satellite launches and crewed missions, contributes to consistent demand for high-performance bearings capable of operating in extreme conditions. North America’s advanced aerospace infrastructure and focus on maintaining air superiority solidify its leading position in the global market.

Europe ranks as the second-largest market, supported by a well-established aerospace ecosystem that includes key players like Airbus, Rolls-Royce, and Safran. The region places a strong emphasis on sustainable aviation and lightweight components, which has increased the adoption of precision-engineered bearings in both new aircraft development and retrofitting programs. European countries also invest heavily in research and innovation, particularly in next-generation aircraft systems and green aviation technologies. The rise in defense collaborations within the EU and modernization of military fleets further supports the growing demand for high-performance aerospace bearings across the continent.

Asia Pacific is emerging as one of the fastest-growing regions in the aerospace bearings market, driven by rising aircraft production, increasing air passenger traffic, and expanding defense budgets. Countries such as China, India, and Japan are significantly investing in domestic aviation capabilities and defense modernization programs. The growth of low-cost carriers, infrastructure development, and the emergence of regional aircraft manufacturers are boosting demand for aircraft components, including bearings. Additionally, government-backed space exploration initiatives in the region are creating new opportunities for specialized bearings designed for satellite and rocket systems.

Latin America represents a developing market with moderate growth, largely led by Brazil and Mexico, which are actively involved in aircraft component manufacturing and maintenance services. The region’s growth is supported by increased regional air travel, tourism, and fleet expansion by local carriers. However, limited domestic aerospace manufacturing capabilities and reliance on imports pose challenges to market scalability. While demand for aerospace bearings is gradually increasing, particularly for commercial and business aviation, the region remains dependent on global suppliers for advanced bearing technologies.

The Middle East and Africa currently hold the smallest share in the aerospace bearings market, although the region shows potential, particularly in the Middle East with countries like the UAE, Saudi Arabia, and Qatar investing in expanding their aviation sectors. These nations are upgrading airport infrastructure, expanding national carrier fleets, and placing large aircraft orders from global OEMs. However, the lack of significant aerospace manufacturing and R&D activity limits localized bearing production. In Africa, the market is still at a nascent stage, with growth mainly driven by increasing commercial air connectivity and aviation sector reforms in select countries.

Aerospace Bearings Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerospace bearings market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerospace bearings market include:

- AST Bearings LLC

- AB SKF

- BC Bearings

- Aurora Bearing

- JTEKT Corp.

- GGB Bearings

- Minebea Co., Ltd.

- Kaman Corporation

- New Hampshire Ball Bearings, Inc.

- National Precision Bearing

- NTN Bearing Corporation

- NSK Ltd.

- RBC Bearings

- Pacamor Kubar Bearings

- Rexnord Corporation

- Regal Beloit Corporation

- Schaeffler AG

- The Timken Company

The global aerospace bearings market is segmented as follows:

By Product Type

- Roller Bearing

- Ball Bearing

- Plain Bearing

By Aircraft Type

- Narrow Body Aircraft

- Wide Body Aircraft

- Regional Transport Aircraft

- Very Large Aircraft

- Business Jet

- Fighter Jet

- Helicopter

- Others

By Material Type

- Stainless Steel

- Fiber-Reinforced Composites

- Metal-Backed

- Engineered Plastics

- Aluminum Alloys

- Others

By Application

- Landing Gear

- Engine

- Flight Control System

- Aerostructure

- Others

By Sales Channel

- OEM

- Aftermarket

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerospace Bearings

- 1.2. Global Aerospace Bearings Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerospace Bearings Market, 2016 – 2026 (USD Million) (Units)

- 1.4. Global Aerospace Bearings Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerospace Bearings Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerospace Bearings Market – Product Type Analysis

- 2.1. Global Aerospace Bearings Market – Product Type Overview

- 2.2. Global Aerospace Bearings Market Share, by Product Type, 2019 & 2026 (USD Million)

- 2.3. Global Aerospace Bearings Market share, by Product Type, 2019 & 2026 (Units)

- 2.4. Ruller Bearing

- 2.4.1. Global Ruller Bearing Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Ruller Bearing Aerospace Bearings Market, 2016 – 2026 (Units)

- 2.5. Ball Bearing

- 2.5.1. Global Ball Bearing Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Ball Bearing Aerospace Bearings Market, 2016 – 2026 (Units)

- 2.6. Plain Bearing

- 2.6.1. Global Plain Bearing Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Plain Bearing Aerospace Bearings Market, 2016 – 2026 (Units)

- Chapter 3 Aerospace Bearings Market – Aircraft Type Analysis

- 3.1. Global Aerospace Bearings Market – Aircraft Type Overview

- 3.2. Global Aerospace Bearings Market Share, by Aircraft Type, 2019 & 2026 (USD Million)

- 3.3. Global Aerospace Bearings Market share, by Aircraft Type, 2019 & 2026 (Units)

- 3.4. Narrow Body Aircraft

- 3.4.1. Global Narrow Body Aircraft Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Narrow Body Aircraft Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.5. Wide Body Aircraft

- 3.5.1. Global Wide Body Aircraft Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.5.2. Global Wide Body Aircraft Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.6. Regional Transport Aircraft

- 3.6.1. Global Regional Transport Aircraft Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Regional Transport Aircraft Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.7. Very Large Aircraft

- 3.7.1. Global Very Large Aircraft Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Very Large Aircraft Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.8. Business Jet

- 3.8.1. Global Business Jet Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.8.2. Global Business Jet Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.9. Fighter Jet

- 3.9.1. Global Fighter Jet Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.9.2. Global Fighter Jet Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.10. Helicopter

- 3.10.1. Global Helicopter Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.10.2. Global Helicopter Aerospace Bearings Market, 2016 – 2026 (Units)

- 3.11. Others

- 3.11.1. Global Others Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 3.11.2. Global Others Aerospace Bearings Market, 2016 – 2026 (Units)

- Chapter 4 Aerospace Bearings Market – Material Type Analysis

- 4.1. Global Aerospace Bearings Market – Material Type Overview

- 4.2. Global Aerospace Bearings Market Share, by Material Type, 2019 & 2026 (USD Million)

- 4.3. Global Aerospace Bearings Market share, by Material Type, 2019 & 2026 (Units)

- 4.4. Stainless Steel

- 4.4.1. Global Stainless Steel Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Stainless Steel Aerospace Bearings Market, 2016 – 2026 (Units)

- 4.5. Fiber-Reinforced Composites

- 4.5.1. Global Fiber-Reinforced Composites Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Fiber-Reinforced Composites Aerospace Bearings Market, 2016 – 2026 (Units)

- 4.6. Metal-Backed

- 4.6.1. Global Metal-Backed Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 4.6.2. Global Metal-Backed Aerospace Bearings Market, 2016 – 2026 (Units)

- 4.7. Engineered Plastics

- 4.7.1. Global Engineered Plastics Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 4.7.2. Global Engineered Plastics Aerospace Bearings Market, 2016 – 2026 (Units)

- 4.8. Aluminum Alloys

- 4.8.1. Global Aluminum Alloys Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 4.8.2. Global Aluminum Alloys Aerospace Bearings Market, 2016 – 2026 (Units)

- 4.9. Others

- 4.9.1. Global Others Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 4.9.2. Global Others Aerospace Bearings Market, 2016 – 2026 (Units)

- Chapter 5 Aerospace Bearings Market – Application Analysis

- 5.1. Global Aerospace Bearings Market – Application Overview

- 5.2. Global Aerospace Bearings Market Share, by Application, 2019 & 2026 (USD Million)

- 5.3. Global Aerospace Bearings Market share, by Application, 2019 & 2026 (Units)

- 5.4. Landing Gear

- 5.4.1. Global Landing Gear Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 5.4.2. Global Landing Gear Aerospace Bearings Market, 2016 – 2026 (Units)

- 5.5. Engine

- 5.5.1. Global Engine Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 5.5.2. Global Engine Aerospace Bearings Market, 2016 – 2026 (Units)

- 5.6. Flight Contrul System

- 5.6.1. Global Flight Contrul System Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 5.6.2. Global Flight Contrul System Aerospace Bearings Market, 2016 – 2026 (Units)

- 5.7. Aerostructure

- 5.7.1. Global Aerostructure Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 5.7.2. Global Aerostructure Aerospace Bearings Market, 2016 – 2026 (Units)

- 5.8. Others

- 5.8.1. Global Others Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 5.8.2. Global Others Aerospace Bearings Market, 2016 – 2026 (Units)

- Chapter 6 Aerospace Bearings Market – Sales Channel Analysis

- 6.1. Global Aerospace Bearings Market – Sales Channel Overview

- 6.2. Global Aerospace Bearings Market Share, by Sales Channel, 2019 & 2026 (USD Million)

- 6.3. Global Aerospace Bearings Market share, by Sales Channel, 2019 & 2026 (Units)

- 6.4. OEM

- 6.4.1. Global OEM Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 6.4.2. Global OEM Aerospace Bearings Market, 2016 – 2026 (Units)

- 6.5. Aftermarket

- 6.5.1. Global Aftermarket Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 6.5.2. Global Aftermarket Aerospace Bearings Market, 2016 – 2026 (Units)

- Chapter 7 Aerospace Bearings Market – Regional Analysis

- 7.1. Global Aerospace Bearings Market Regional Overview

- 7.2. Global Aerospace Bearings Market Share, by Region, 2019 & 2026 (USD Million)

- 7.3. Global Aerospace Bearings Market Share, by Region, 2019 & 2026 (Units)

- 7.4. North America

- 7.4.1. North America Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.4.1.1. North America Aerospace Bearings Market, by Country, 2016 – 2026 (USD Million)

- 7.4.2. North America Market, 2016 – 2026 (Units)

- 7.4.2.1. North America Aerospace Bearings Market, by Country, 2016 – 2026 (Units)

- 7.4.3. North America Aerospace Bearings Market, by Product Type, 2016 – 2026

- 7.4.3.1. North America Aerospace Bearings Market, by Product Type, 2016 – 2026 (USD Million)

- 7.4.3.2. North America Aerospace Bearings Market, by Product Type, 2016 – 2026 (Units)

- 7.4.4. North America Aerospace Bearings Market, by Aircraft Type, 2016 – 2026

- 7.4.4.1. North America Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 7.4.4.2. North America Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (Units)

- 7.4.5. North America Aerospace Bearings Market, by Material Type, 2016 – 2026

- 7.4.5.1. North America Aerospace Bearings Market, by Material Type, 2016 – 2026 (USD Million)

- 7.4.5.2. North America Aerospace Bearings Market, by Material Type, 2016 – 2026 (Units)

- 7.4.6. North America Aerospace Bearings Market, by Application, 2016 – 2026

- 7.4.6.1. North America Aerospace Bearings Market, by Application, 2016 – 2026 (USD Million)

- 7.4.6.2. North America Aerospace Bearings Market, by Application, 2016 – 2026 (Units)

- 7.4.7. North America Aerospace Bearings Market, by Sales Channel, 2016 – 2026

- 7.4.7.1. North America Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (USD Million)

- 7.4.7.2. North America Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (Units)

- 7.4.8. U.S.

- 7.4.8.1. U.S. Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.4.8.2. U.S. Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.4.9. Canada

- 7.4.9.1. Canada Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.4.9.2. Canada Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.4.1. North America Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5. Europe

- 7.5.1. Europe Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.1.1. Europe Aerospace Bearings Market, by Country, 2016 – 2026 (USD Million)

- 7.5.2. Europe Market, 2016 – 2026 (Units)

- 7.5.2.1. Europe Aerospace Bearings Market, by Country, 2016 – 2026 (Units)

- 7.5.3. Europe Aerospace Bearings Market, by Product Type, 2016 – 2026

- 7.5.3.1. Europe Aerospace Bearings Market, by Product Type, 2016 – 2026 (USD Million)

- 7.5.3.2. Europe Aerospace Bearings Market, by Product Type, 2016 – 2026 (Units)

- 7.5.4. Europe Aerospace Bearings Market, by Aircraft Type, 2016 – 2026

- 7.5.4.1. Europe Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 7.5.4.2. Europe Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (Units)

- 7.5.5. Europe Aerospace Bearings Market, by Material Type, 2016 – 2026

- 7.5.5.1. Europe Aerospace Bearings Market, by Material Type, 2016 – 2026 (USD Million)

- 7.5.5.2. Europe Aerospace Bearings Market, by Material Type, 2016 – 2026 (Units)

- 7.5.6. Europe Aerospace Bearings Market, by Application, 2016 – 2026

- 7.5.6.1. Europe Aerospace Bearings Market, by Application, 2016 – 2026 (USD Million)

- 7.5.6.2. Europe Aerospace Bearings Market, by Application, 2016 – 2026 (Units)

- 7.5.7. Europe Aerospace Bearings Market, by Sales Channel, 2016 – 2026

- 7.5.7.1. Europe Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (USD Million)

- 7.5.7.2. Europe Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (Units)

- 7.5.8. Germany

- 7.5.8.1. Germany Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.8.2. Germany Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.5.9. France

- 7.5.9.1. France Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.9.2. France Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.5.10. U.K.

- 7.5.10.1. U.K. Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.10.2. U.K. Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.5.11. Italy

- 7.5.11.1. Italy Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.11.2. Italy Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.5.12. Spain

- 7.5.12.1. Spain Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.12.2. Spain Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.5.13. Rest of Europe

- 7.5.13.1. Rest of Europe Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.5.13.2. Rest of Europe Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.5.1. Europe Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6. Asia Pacific

- 7.6.1. Asia Pacific Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.1.1. Asia Pacific Aerospace Bearings Market, by Country, 2016 – 2026 (USD Million)

- 7.6.2. Asia Pacific Market, 2016 – 2026 (Units)

- 7.6.2.1. Asia Pacific Aerospace Bearings Market, by Country, 2016 – 2026 (Units)

- 7.6.3. Asia Pacific Aerospace Bearings Market, by Product Type, 2016 – 2026

- 7.6.3.1. Asia Pacific Aerospace Bearings Market, by Product Type, 2016 – 2026 (USD Million)

- 7.6.3.2. Asia Pacific Aerospace Bearings Market, by Product Type, 2016 – 2026 (Units)

- 7.6.4. Asia Pacific Aerospace Bearings Market, by Aircraft Type, 2016 – 2026

- 7.6.4.1. Asia Pacific Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 7.6.4.2. Asia Pacific Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (Units)

- 7.6.5. Asia Pacific Aerospace Bearings Market, by Material Type, 2016 – 2026

- 7.6.5.1. Asia Pacific Aerospace Bearings Market, by Material Type, 2016 – 2026 (USD Million)

- 7.6.5.2. Asia Pacific Aerospace Bearings Market, by Material Type, 2016 – 2026 (Units)

- 7.6.6. Asia Pacific Aerospace Bearings Market, by Application, 2016 – 2026

- 7.6.6.1. Asia Pacific Aerospace Bearings Market, by Application, 2016 – 2026 (USD Million)

- 7.6.6.2. Asia Pacific Aerospace Bearings Market, by Application, 2016 – 2026 (Units)

- 7.6.7. Asia Pacific Aerospace Bearings Market, by Sales Channel, 2016 – 2026

- 7.6.7.1. Asia Pacific Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (USD Million)

- 7.6.7.2. Asia Pacific Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (Units)

- 7.6.8. China

- 7.6.8.1. China Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.8.2. China Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.6.9. Japan

- 7.6.9.1. Japan Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.9.2. Japan Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.6.10. India

- 7.6.10.1. India Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.10.2. India Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.6.11. South Korea

- 7.6.11.1. South Korea Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.11.2. South Korea Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.6.12. South-East Asia

- 7.6.12.1. South-East Asia Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.12.2. South-East Asia Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.6.13. Rest of Asia Pacific

- 7.6.13.1. Rest of Asia Pacific Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.6.13.2. Rest of Asia Pacific Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.6.1. Asia Pacific Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.7. Latin America

- 7.7.1. Latin America Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.7.1.1. Latin America Aerospace Bearings Market, by Country, 2016 – 2026 (USD Million)

- 7.7.2. Latin America Market, 2016 – 2026 (Units)

- 7.7.2.1. Latin America Aerospace Bearings Market, by Country, 2016 – 2026 (Units)

- 7.7.3. Latin America Aerospace Bearings Market, by Product Type, 2016 – 2026

- 7.7.3.1. Latin America Aerospace Bearings Market, by Product Type, 2016 – 2026 (USD Million)

- 7.7.3.2. Latin America Aerospace Bearings Market, by Product Type, 2016 – 2026 (Units)

- 7.7.4. Latin America Aerospace Bearings Market, by Aircraft Type, 2016 – 2026

- 7.7.4.1. Latin America Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 7.7.4.2. Latin America Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (Units)

- 7.7.5. Latin America Aerospace Bearings Market, by Material Type, 2016 – 2026

- 7.7.5.1. Latin America Aerospace Bearings Market, by Material Type, 2016 – 2026 (USD Million)

- 7.7.5.2. Latin America Aerospace Bearings Market, by Material Type, 2016 – 2026 (Units)

- 7.7.6. Latin America Aerospace Bearings Market, by Application, 2016 – 2026

- 7.7.6.1. Latin America Aerospace Bearings Market, by Application, 2016 – 2026 (USD Million)

- 7.7.6.2. Latin America Aerospace Bearings Market, by Application, 2016 – 2026 (Units)

- 7.7.7. Latin America Aerospace Bearings Market, by Sales Channel, 2016 – 2026

- 7.7.7.1. Latin America Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (USD Million)

- 7.7.7.2. Latin America Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (Units)

- 7.7.8. Brazil

- 7.7.8.1. Brazil Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.7.8.2. Brazil Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.7.9. Mexico

- 7.7.9.1. Mexico Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.7.9.2. Mexico Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.7.10. Rest of Latin America

- 7.7.10.1. Rest of Latin America Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.7.10.2. Rest of Latin America Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.7.1. Latin America Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.8. The Middle-East and Africa

- 7.8.1. The Middle-East and Africa Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.8.1.1. The Middle-East and Africa Aerospace Bearings Market, by Country, 2016 – 2026 (USD Million)

- 7.8.2. The Middle-East and Africa Market, 2016 – 2026 (Units)

- 7.8.2.1. The Middle-East and Africa Aerospace Bearings Market, by Country, 2016 – 2026 (Units)

- 7.8.3. The Middle-East and Africa Aerospace Bearings Market, by Product Type, 2016 – 2026

- 7.8.3.1. The Middle-East and Africa Aerospace Bearings Market, by Product Type, 2016 – 2026 (USD Million)

- 7.8.3.2. The Middle-East and Africa Aerospace Bearings Market, by Product Type, 2016 – 2026 (Units)

- 7.8.4. The Middle-East and Africa Aerospace Bearings Market, by Aircraft Type, 2016 – 2026

- 7.8.4.1. The Middle-East and Africa Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 7.8.4.2. The Middle-East and Africa Aerospace Bearings Market, by Aircraft Type, 2016 – 2026 (Units)

- 7.8.5. The Middle-East and Africa Aerospace Bearings Market, by Material Type, 2016 – 2026

- 7.8.5.1. The Middle-East and Africa Aerospace Bearings Market, by Material Type, 2016 – 2026 (USD Million)

- 7.8.5.2. The Middle-East and Africa Aerospace Bearings Market, by Material Type, 2016 – 2026 (Units)

- 7.8.6. The Middle-East and Africa Aerospace Bearings Market, by Application, 2016 – 2026

- 7.8.6.1. The Middle-East and Africa Aerospace Bearings Market, by Application, 2016 – 2026 (USD Million)

- 7.8.6.2. The Middle-East and Africa Aerospace Bearings Market, by Application, 2016 – 2026 (Units)

- 7.8.7. The Middle-East and Africa Aerospace Bearings Market, by Sales Channel, 2016 – 2026

- 7.8.7.1. The Middle-East and Africa Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (USD Million)

- 7.8.7.2. The Middle-East and Africa Aerospace Bearings Market, by Sales Channel, 2016 – 2026 (Units)

- 7.8.8. GCC Countries

- 7.8.8.1. GCC Countries Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.8.8.2. GCC Countries Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.8.9. South Africa

- 7.8.9.1. South Africa Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.8.9.2. South Africa Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.8.10. Rest of Middle-East Africa

- 7.8.10.1. Rest of Middle-East Africa Aerospace Bearings Market, 2016 – 2026 (USD Million)

- 7.8.10.2. Rest of Middle-East Africa Aerospace Bearings Market, 2016 – 2026 (Units)

- 7.8.1. The Middle-East and Africa Aerospace Bearings Market, 2016 – 2026 (USD Million)

- Chapter 8 Aerospace Bearings Production, Consumption, Export, Import by Regions

- 8.1. Global Aerospace Bearings Production and Consumption, 2016 – 2026 (Units)

- 8.2. Global Import and Export Analysis, by Region

- Chapter 9 Aerospace Bearings Market – Competitive Landscape

- 9.1. Competitor Market Share – Revenue

- 9.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 9.3. Competitor Market Share – Vulume

- 9.4. Strategic Developments

- 9.4.1. Acquisitions and Mergers

- 9.4.2. New Products

- 9.4.3. Research & Development Activities

- Chapter 10 Company Profiles

- 10.1. AB SKF

- 10.1.1. Company Overview

- 10.1.2. Product/Service Portfulio

- 10.1.3. AB SKF Sales, Revenue, Price, and Gross Margin

- 10.1.4. AB SKF Revenue and Growth Rate

- 10.1.5. AB SKF Market Share

- 10.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.2. AST Bearings LLC

- 10.2.1. Company Overview

- 10.2.2. Product/Service Portfulio

- 10.2.3. AST Bearings LLC Sales, Revenue, Price, and Gross Margin

- 10.2.4. AST Bearings LLC Revenue and Growth Rate

- 10.2.5. AST Bearings LLC Market Share

- 10.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.3. Aurora Bearing

- 10.3.1. Company Overview

- 10.3.2. Product/Service Portfulio

- 10.3.3. Aurora Bearing Sales, Revenue, Price, and Gross Margin

- 10.3.4. Aurora Bearing Revenue and Growth Rate

- 10.3.5. Aurora Bearing Market Share

- 10.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.4. BC Bearings

- 10.4.1. Company Overview

- 10.4.2. Product/Service Portfulio

- 10.4.3. BC Bearings Sales, Revenue, Price, and Gross Margin

- 10.4.4. BC Bearings Revenue and Growth Rate

- 10.4.5. BC Bearings Market Share

- 10.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.5. GGB Bearings

- 10.5.1. Company Overview

- 10.5.2. Product/Service Portfulio

- 10.5.3. GGB Bearings Sales, Revenue, Price, and Gross Margin

- 10.5.4. GGB Bearings Revenue and Growth Rate

- 10.5.5. GGB Bearings Market Share

- 10.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.6. JTEKT Corp.

- 10.6.1. Company Overview

- 10.6.2. Product/Service Portfulio

- 10.6.3. JTEKT Corp. Sales, Revenue, Price, and Gross Margin

- 10.6.4. JTEKT Corp. Revenue and Growth Rate

- 10.6.5. JTEKT Corp. Market Share

- 10.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.7. Kaman Corporation

- 10.7.1. Company Overview

- 10.7.2. Product/Service Portfulio

- 10.7.3. Kaman Corporation Sales, Revenue, Price, and Gross Margin

- 10.7.4. Kaman Corporation Revenue and Growth Rate

- 10.7.5. Kaman Corporation Market Share

- 10.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.8. Minebea Co., Ltd.

- 10.8.1. Company Overview

- 10.8.2. Product/Service Portfulio

- 10.8.3. Minebea Co., Ltd. Sales, Revenue, Price, and Gross Margin

- 10.8.4. Minebea Co., Ltd. Revenue and Growth Rate

- 10.8.5. Minebea Co., Ltd. Market Share

- 10.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.9. National Precision Bearing

- 10.9.1. Company Overview

- 10.9.2. Product/Service Portfulio

- 10.9.3. National Precision Bearing Sales, Revenue, Price, and Gross Margin

- 10.9.4. National Precision Bearing Revenue and Growth Rate

- 10.9.5. National Precision Bearing Market Share

- 10.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.10. New Hampshire Ball Bearings, Inc.

- 10.10.1. Company Overview

- 10.10.2. Product/Service Portfulio

- 10.10.3. New Hampshire Ball Bearings, Inc. Sales, Revenue, Price, and Gross Margin

- 10.10.4. New Hampshire Ball Bearings, Inc. Revenue and Growth Rate

- 10.10.5. New Hampshire Ball Bearings, Inc. Market Share

- 10.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.11. NSK Ltd.

- 10.11.1. Company Overview

- 10.11.2. Product/Service Portfulio

- 10.11.3. NSK Ltd. Sales, Revenue, Price, and Gross Margin

- 10.11.4. NSK Ltd. Revenue and Growth Rate

- 10.11.5. NSK Ltd. Market Share

- 10.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.12. NTN Bearing Corporation

- 10.12.1. Company Overview

- 10.12.2. Product/Service Portfulio

- 10.12.3. NTN Bearing Corporation Sales, Revenue, Price, and Gross Margin

- 10.12.4. NTN Bearing Corporation Revenue and Growth Rate

- 10.12.5. NTN Bearing Corporation Market Share

- 10.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.13. Pacamor Kubar Bearings

- 10.13.1. Company Overview

- 10.13.2. Product/Service Portfulio

- 10.13.3. Pacamor Kubar Bearings Sales, Revenue, Price, and Gross Margin

- 10.13.4. Pacamor Kubar Bearings Revenue and Growth Rate

- 10.13.5. Pacamor Kubar Bearings Market Share

- 10.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.14. RBC Bearings

- 10.14.1. Company Overview

- 10.14.2. Product/Service Portfulio

- 10.14.3. RBC Bearings Sales, Revenue, Price, and Gross Margin

- 10.14.4. RBC Bearings Revenue and Growth Rate

- 10.14.5. RBC Bearings Market Share

- 10.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.15. Regal Beloit Corporation

- 10.15.1. Company Overview

- 10.15.2. Product/Service Portfulio

- 10.15.3. Regal Beloit Corporation Sales, Revenue, Price, and Gross Margin

- 10.15.4. Regal Beloit Corporation Revenue and Growth Rate

- 10.15.5. Regal Beloit Corporation Market Share

- 10.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.16. Rexnord Corporation

- 10.16.1. Company Overview

- 10.16.2. Product/Service Portfulio

- 10.16.3. Rexnord Corporation Sales, Revenue, Price, and Gross Margin

- 10.16.4. Rexnord Corporation Revenue and Growth Rate

- 10.16.5. Rexnord Corporation Market Share

- 10.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.17. Schaeffler AG

- 10.17.1. Company Overview

- 10.17.2. Product/Service Portfulio

- 10.17.3. Schaeffler AG Sales, Revenue, Price, and Gross Margin

- 10.17.4. Schaeffler AG Revenue and Growth Rate

- 10.17.5. Schaeffler AG Market Share

- 10.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.18. The Timken Company

- 10.18.1. Company Overview

- 10.18.2. Product/Service Portfulio

- 10.18.3. The Timken Company Sales, Revenue, Price, and Gross Margin

- 10.18.4. The Timken Company Revenue and Growth Rate

- 10.18.5. The Timken Company Market Share

- 10.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 10.1. AB SKF

- Chapter 11 Aerospace Bearings — Industry Analysis

- 11.1. Introduction and Taxonomy

- 11.2. Aerospace Bearings Market – Key Trends

- 11.2.1. Market Drivers

- 11.2.2. Market Restraints

- 11.2.3. Market Opportunities

- 11.3. Value Chain Analysis

- 11.4. Key Mandates and Regulations

- 11.5. Technulogy Roadmap and Timeline

- 11.6. Aerospace Bearings Market – Attractiveness Analysis

- 11.6.1. By Product Type

- 11.6.2. By Aircraft Type

- 11.6.3. By Material Type

- 11.6.4. By Application

- 11.6.5. By Sales Channel

- 11.6.6. By Region

- Chapter 12 Raw Material Analysis

- 12.1. Aerospace Bearings Key Raw Material Analysis

- 12.1.1. Key Raw Materials

- 12.1.2. Price Trend of Key Raw Materials

- 12.2. Key Suppliers of Raw Materials

- 12.3. Proportion of Manufacturing Cost Structure

- 12.3.1. Raw Materials Cost

- 12.3.2. Labor Cost

- 12.3.3. Manufacturing Expenses

- 12.3.4. Miscellaneous Expenses

- 12.4. Manufacturing Cost Analysis of Aerospace Bearings

- 12.1. Aerospace Bearings Key Raw Material Analysis

- Chapter 13 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 13.1. Aerospace Bearings Industrial Chain Analysis

- 13.2. Upstream Raw Materials Sourcing

- 13.2.1. Risk Mitigation:

- 13.2.2. Supplier Relationships:

- 13.2.3. Business Processes:

- 13.2.4. Securing the Product:

- 13.3. Raw Materials Sources of Aerospace Bearings Major Manufacturers

- 13.4. Downstream Buyers

- 13.5. Distributors/Traders List

- Chapter 14 Marketing Strategy Analysis, Distributors

- 14.1. Marketing Channel

- 14.2. Direct Marketing

- 14.3. Indirect Marketing

- 14.4. Marketing Channel Development Trends

- 14.5. Economic/Pulitical Environmental Change

- Chapter 15 Report Conclusion & Key Insights

- 15.1. Key Insights from Primary Interviews & Surveys Respondents

- 15.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 16 Research Approach & Methodulogy

- 16.1. Report Description

- 16.2. Research Scope

- 16.3. Research Methodulogy

- 16.3.1. Secondary Research

- 16.3.2. Primary Research

- 16.3.3. Statistical Models

- 16.3.3.1. Company Share Analysis Model

- 16.3.3.2. Revenue Based Modeling

- 16.3.4. Research Limitations

Inquiry For Buying

Aerospace Bearings

Request Sample

Aerospace Bearings