Aerospace Foams Market Size, Share, and Trends Analysis Report

CAGR :

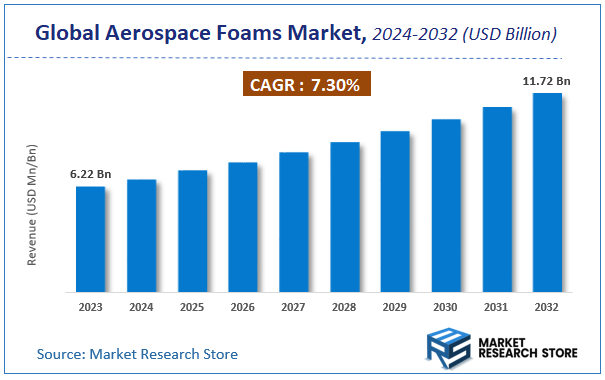

| Market Size 2023 (Base Year) | USD 6.22 Billion |

| Market Size 2032 (Forecast Year) | USD 11.72 Billion |

| CAGR | 7.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerospace Foams Market Insights

According to Market Research Store, the global aerospace foams market size was valued at around USD 6.22 billion in 2023 and is estimated to reach USD 11.72 billion by 2032, to register a CAGR of approximately 7.3% in terms of revenue during the forecast period 2024-2032.

The aerospace foams report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Aerospace Foams Market: Overview

Aerospace foams are lightweight, high-performance materials designed to meet the stringent requirements of the aerospace industry. These foams are typically made from materials like polyurethane, polyethylene, metal, or melamine and are engineered to provide insulation, cushioning, vibration dampening, and soundproofing within aircraft, spacecraft, and satellites. Due to their exceptional strength-to-weight ratio, thermal resistance, fire retardancy, and ability to withstand extreme environmental conditions, aerospace foams are widely used in cabin interiors, seating, insulation panels, gaskets, and structural components. Their use helps enhance fuel efficiency by reducing overall aircraft weight while maintaining structural integrity and passenger comfort.

Key Highlights

- The aerospace foams market is anticipated to grow at a CAGR of 7.3% during the forecast period.

- The global aerospace foams market was estimated to be worth approximately USD 6.22 billion in 2023 and is projected to reach a value of USD 11.72 billion by 2032.

- The growth of the aerospace foams market is being driven by increasing air travel demand, rising aircraft production, and a growing focus on lightweight materials to improve fuel efficiency.

- Based on the type, the flexible foams segment is growing at a high rate and is projected to dominate the market.

- On the basis of material, the polyurethane (PU) foams segment is projected to swipe the largest market share.

- In terms of end use, the commercial aircraft segment is expected to dominate the market.

- Based on the application, the aircraft seats segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Aerospace Foams Market: Dynamics

Key Growth Drivers:

- Increasing Demand for Lightweight Materials in Aircraft: Aerospace foams contribute to weight reduction without compromising structural integrity, enhancing fuel efficiency and performance.

- Rising Air Passenger Traffic and Fleet Expansion: The growth of commercial aviation, especially in developing countries, is driving the demand for aircraft, which boosts the need for aerospace foams in seating, insulation, and interiors.

- Advancements in Foam Technologies and Materials: Innovations in polyurethane, polyethylene, and metal foams with better fire resistance and durability are enhancing product performance and widening applications.

- Growing Use in Military and Space Applications: Aerospace foams are increasingly used in defense and space sectors for shock absorption, vibration dampening, and thermal insulation.

Restraints:

- High Cost of Specialty Foams: Advanced aerospace foams with fire-retardant and high-performance properties are expensive to produce, limiting adoption among cost-sensitive buyers.

- Environmental and Regulatory Restrictions: The production and disposal of certain foam types may involve hazardous chemicals, facing increasing scrutiny under environmental regulations.

- Volatility in Raw Material Prices: Foam production is dependent on petrochemical derivatives, which are prone to price fluctuations and can impact manufacturing costs.

Opportunities:

- Growing Demand for Sustainable and Recyclable Materials: The aerospace industry’s shift towards eco-friendly materials is driving R&D in recyclable or bio-based foams.

- Increased Focus on Cabin Comfort and Noise Reduction: Passenger experience improvements are encouraging the use of advanced foams for acoustic insulation and ergonomic seating.

- Emerging Markets and Low-Cost Carrier Expansion: Growth of aviation in regions like Asia-Pacific, Latin America, and the Middle East offers significant opportunities for foam manufacturers.

Challenges:

- Stringent Fire Safety and Flammability Standards: Aerospace foams must meet strict regulatory norms, which increases testing costs and limits material choices.

- Limited Lifecycle and Degradation Risk: Some foam materials may degrade under prolonged exposure to extreme temperatures, moisture, or chemicals, impacting performance over time.

- Complexity in Recycling and Waste Management: Disposal of used aerospace foams poses environmental challenges due to their non-biodegradable nature and limited recyclability.

Aerospace Foams Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Foams Market |

| Market Size in 2023 | USD 6.22 Billion |

| Market Forecast in 2032 | USD 11.72 Billion |

| Growth Rate | CAGR of 7.3% |

| Number of Pages | 188 |

| Key Companies Covered | FoamPartner, ERG Materials and Aerospace Corp, Greiner AG, Aerofoam Industries, LLC, Evonik Industries AG, Rogers Corporation, Sinfo, Spol. S R.O., UFP Technologies, Inc., Dupont De Nemours, Inc., Sekisui Voltek, LLC, Armacell International S.A., Saudi Basic Industries Corporation, Solvay SA, General Plastics Manufacturing Company, BASF SE, Boyd Corporation, Pyrotek Inc., 3A Composites Holding AG, Zotefoams Plc, NCFI Polyurethanes, and Polyformes Ltd among others |

| Segments Covered | By Type, By Material, By End Use, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Foams Market: Segmentation Insights

The global aerospace foams market is divided by type, material, end use, application, and region.

Based on type, the global aerospace foams market is divided into rigid and flexible. Flexible foams represent the most dominant segment, owing to their widespread application across various aircraft components, especially in cabin interiors, seating, insulation, and vibration dampening. These foams are highly adaptable, lightweight, and offer excellent cushioning, noise reduction, and thermal insulation properties making them ideal for improving passenger comfort and overall aircraft performance. Their versatility allows them to be molded into complex shapes and easily integrated into interior panels, headrests, armrests, and acoustic liners. The growing focus on enhancing passenger experience and safety in both commercial and military aircraft continues to fuel demand for flexible foams, solidifying their leadership in the market. On the other hand, rigid foams hold a smaller but vital share of the aerospace foams market. These foams are primarily used in structural and insulation applications where strength, dimensional stability, and fire resistance are crucial. Common uses include insulation panels for cargo areas, bulkheads, and ducting systems, where maintaining form under stress is essential. Rigid foams, often made from materials like polyurethane and phenolic resins, offer superior load-bearing capabilities and are especially valued for their ability to provide thermal protection in extreme temperature conditions.

On the basis of material, the global aerospace foams market is bifurcated into pu foams, pe foams, melamine foams, metal foams, pmi/polyimide foams, and others. Polyurethane (PU) foams are the most dominant material segment, widely used due to their excellent cushioning, insulation, and vibration dampening properties. PU foams are highly versatile, cost-effective, and lightweight, making them ideal for applications in aircraft seating, cabin insulation, armrests, and noise reduction components. Their adaptability to both flexible and rigid forms further enhance their utility across multiple interior and structural aerospace applications. The combination of comfort, safety, and fire resistance has made PU foams the go-to choose for commercial and military aircraft manufacturers globally. Polyethylene (PE) foams follow as the second most significant segment, primarily valued for their high impact resistance, chemical inertness, and closed-cell structure, which offers superior moisture and thermal insulation. These properties make PE foams suitable for protective packaging, gaskets, and thermal insulation within aircraft fuselages and cargo areas. PE foams are especially favored in applications where durability and resistance to harsh environments are critical, though their stiffness limits use in highly flexible interior applications.

Based on end use, the global aerospace foams market is divided into commercial aircraft, military aircraft, and general aviation. Commercial aircraft constitute the most dominant end-use segment in the aerospace foams market, driven by the rapid expansion of global air travel, rising passenger expectations, and the continuous push for fuel-efficient, lightweight aircraft. Foams are extensively used in this segment for seating, cabin insulation, noise reduction, and interior trim components. Airlines prioritize comfort, safety, and compliance with stringent fire safety standards, all of which are effectively addressed by advanced aerospace foams. With major aircraft manufacturers like Boeing and Airbus leading large-scale production, and with frequent retrofitting and refurbishment of fleets, the demand for foams in commercial aviation remains consistently high. Military aircraft form the second-largest end-use segment, where foams are used in more specialized applications, including thermal insulation, vibration dampening, radar-absorbing materials, and structural reinforcement. These aircraft operate in extreme environments and demand high-performance, durable materials that can withstand intense pressure, heat, and mechanical stress. Foams used in this segment often include advanced materials like polyimide or metal foams, offering superior thermal and structural capabilities.

In terms of application, the global aerospace foams market is bifurcated into aircraft seats, aircraft floor carpets, flight deck pads, cabin walls and ceilings, overhead stow bins, and others. Aircraft seats represent the most dominant application segment, accounting for a significant share due to the high volume of foam required for cushioning, passenger comfort, and safety compliance. Seating foam must meet strict aviation standards for fire resistance, low smoke and toxicity, and durability under repetitive stress. Both flexible and specialty foams are used extensively in seat bases, backrests, headrests, and armrests across commercial, military, and general aviation sectors. With increasing demand for ergonomic designs and enhanced passenger experience, the use of advanced foams in seating continues to grow. Aircraft floor carpets follow as a major application area, where foams are used as underlays to provide padding, sound insulation, and thermal comfort. These foam layers not only enhance passenger comfort but also contribute to noise reduction and fire safety. Their lightweight nature supports overall weight reduction of the aircraft, which is crucial for improving fuel efficiency. Foam underlays must be highly durable to withstand heavy foot traffic and meet stringent aviation standards, making this a consistently high-demand segment.

Aerospace Foams Market: Regional Insights

- North America is expected to dominates the global market

North America holds the dominant position in the global aerospace foams market, driven by the presence of major aircraft manufacturers such as Boeing and Lockheed Martin, along with an extensive network of aerospace component suppliers. The region benefits from high defense spending, continuous investment in R&D for advanced materials, and a strong commercial aviation sector. Moreover, the U.S. government’s consistent focus on upgrading military aircraft fleets and increasing space exploration programs fuels demand for lightweight, fire-retardant foam materials. The mature aerospace industry ecosystem in North America enables faster adoption of innovative foam technologies, making it the leading contributor to global market share.

Europe ranks as the second most significant market for aerospace foams, primarily supported by the strong presence of aircraft manufacturing giants like Airbus and Dassault Aviation. The region’s strict aviation safety regulations and growing emphasis on environmentally sustainable materials have led to a rise in demand for high-performance, eco-friendly foams. In addition, several EU initiatives aimed at modernizing aircraft fleets and enhancing fuel efficiency are boosting foam usage in insulation, seating, and structural applications. Countries like Germany, France, and the UK serve as key hubs for innovation and export, further strengthening Europe’s role in the global aerospace foams landscape.

Asia Pacific is emerging as one of the fastest-growing markets, with substantial investments in aviation infrastructure, rising air passenger traffic, and increasing aircraft procurement by both commercial and military sectors. Countries like China, India, and Japan are investing heavily in domestic aircraft production and defense modernization programs, which has triggered a surge in demand for lightweight and durable foam materials. The presence of low-cost manufacturing hubs, supportive government policies, and a growing aerospace supplier base are accelerating regional growth, positioning APAC as a future hotspot for aerospace foam consumption.

Latin America represents a developing market for aerospace foams, with growth largely centered around Brazil and Mexico due to their involvement in aircraft assembly and maintenance activities. While the region lacks large-scale aerospace manufacturing compared to global leaders, increasing investments in aviation infrastructure and regional connectivity are slowly driving demand. The market is still in its nascent stage but is expected to see gradual growth as commercial airlines modernize fleets and regional air travel gains momentum.

The Middle East and Africa currently contribute the least to the aerospace foams market, though the region holds long-term potential, particularly in the Middle East due to the presence of leading airline carriers and expanding air travel demand. Countries such as the UAE, Saudi Arabia, and Qatar are investing in new aircraft and airport infrastructure to support tourism and international connectivity. However, limited aerospace manufacturing capabilities and relatively lower R&D activity restrict the region’s current market impact, making it the least dominant globally in terms of aerospace foam adoption.

Aerospace Foams Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerospace foams market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerospace foams market include:

- FoamPartner

- ERG Materials and Aerospace Corp

- Greiner AG

- Aerofoam Industries, LLC

- Evonik Industries AG

- Rogers Corporation

- Sinfo

- Spol. S R.O.

- UFP Technologies., Inc.

- Dupont De Nemours.,Inc.

- Sekisui Voltek., LLC

- Armacell International S.A.

- Saudi Basic Industries Corporation

- Solvay SA

- General Plastics Manufacturing Company

- BASF SE

- Boyd Corporation

- Pyrotek Inc.

- 3A Composites Holding AG

- Zotefoams Plc

- NCFI Polyurethanes

- Polyformes Ltd.

The global aerospace foams market is segmented as follows:

By Type

- Rigid

- Flexible

By Material

- PU Foams

- PE Foams

- Melamine Foams

- Metal Foams

- PMI/Polyimide Foams

- Others

By End Use

- Commercial Aircraft

- Military Aircraft

- General Aviation

By Application

- Aircraft Seats

- Aircraft Floor Carpets

- Flight Deck Pads

- Cabin Walls and Ceilings

- Overhead Stow Bins

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerospace Foams

- 1.2. Global Aerospace Foams Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerospace Foams Market, 2016 – 2026 (USD Million) (Kilo Tons)

- 1.4. Global Aerospace Foams Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerospace Foams Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerospace Foams Market – Type Analysis

- 2.1. Global Aerospace Foams Market – Type Overview

- 2.2. Global Aerospace Foams Market Share, by Type, 2019 & 2026 (USD Million)

- 2.3. Global Aerospace Foams Market share, by Type, 2019 & 2026 (Kilo Tons)

- 2.4. Rigid

- 2.4.1. Global Rigid Aerospace Foams Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Rigid Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 2.5. Flexible

- 2.5.1. Global Flexible Aerospace Foams Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Flexible Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- Chapter 3 Aerospace Foams Market – Material Analysis

- 3.1. Global Aerospace Foams Market – Material Overview

- 3.2. Global Aerospace Foams Market Share, by Material, 2019 & 2026 (USD Million)

- 3.3. Global Aerospace Foams Market share, by Material, 2019 & 2026 (Kilo Tons)

- 3.4. PU Foams

- 3.4.1. Global PU Foams Aerospace Foams Market, 2016 – 2026 (USD Million)

- 3.4.2. Global PU Foams Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 3.5. PE Foams

- 3.5.1. Global PE Foams Aerospace Foams Market, 2016 – 2026 (USD Million)

- 3.5.2. Global PE Foams Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 3.6. Melamine Foams

- 3.6.1. Global Melamine Foams Aerospace Foams Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Melamine Foams Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 3.7. Metal Foams

- 3.7.1. Global Metal Foams Aerospace Foams Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Metal Foams Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 3.8. PMI/Pulyimide Foams

- 3.8.1. Global PMI/Pulyimide Foams Aerospace Foams Market, 2016 – 2026 (USD Million)

- 3.8.2. Global PMI/Pulyimide Foams Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 3.9. Others

- 3.9.1. Global Others Aerospace Foams Market, 2016 – 2026 (USD Million)

- 3.9.2. Global Others Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- Chapter 4 Aerospace Foams Market – End Use Analysis

- 4.1. Global Aerospace Foams Market – End Use Overview

- 4.2. Global Aerospace Foams Market Share, by End Use, 2019 & 2026 (USD Million)

- 4.3. Global Aerospace Foams Market share, by End Use, 2019 & 2026 (Kilo Tons)

- 4.4. Commercial Aircraft

- 4.4.1. Global Commercial Aircraft Aerospace Foams Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Commercial Aircraft Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 4.5. Military Aircraft

- 4.5.1. Global Military Aircraft Aerospace Foams Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Military Aircraft Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 4.6. General Aviation

- 4.6.1. Global General Aviation Aerospace Foams Market, 2016 – 2026 (USD Million)

- 4.6.2. Global General Aviation Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- Chapter 5 Aerospace Foams Market – Application Analysis

- 5.1. Global Aerospace Foams Market – Application Overview

- 5.2. Global Aerospace Foams Market Share, by Application, 2019 & 2026 (USD Million)

- 5.3. Global Aerospace Foams Market share, by Application, 2019 & 2026 (Kilo Tons)

- 5.4. Aircraft Seats

- 5.4.1. Global Aircraft Seats Aerospace Foams Market, 2016 – 2026 (USD Million)

- 5.4.2. Global Aircraft Seats Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 5.5. Aircraft Floor Carpets

- 5.5.1. Global Aircraft Floor Carpets Aerospace Foams Market, 2016 – 2026 (USD Million)

- 5.5.2. Global Aircraft Floor Carpets Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 5.6. Flight Deck Pads

- 5.6.1. Global Flight Deck Pads Aerospace Foams Market, 2016 – 2026 (USD Million)

- 5.6.2. Global Flight Deck Pads Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 5.7. Cabin Walls and Ceilings

- 5.7.1. Global Cabin Walls and Ceilings Aerospace Foams Market, 2016 – 2026 (USD Million)

- 5.7.2. Global Cabin Walls and Ceilings Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 5.8. Overhead Stow Bins

- 5.8.1. Global Overhead Stow Bins Aerospace Foams Market, 2016 – 2026 (USD Million)

- 5.8.2. Global Overhead Stow Bins Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 5.9. Others

- 5.9.1. Global Others Aerospace Foams Market, 2016 – 2026 (USD Million)

- 5.9.2. Global Others Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- Chapter 6 Aerospace Foams Market – Regional Analysis

- 6.1. Global Aerospace Foams Market Regional Overview

- 6.2. Global Aerospace Foams Market Share, by Region, 2019 & 2026 (USD Million)

- 6.3. Global Aerospace Foams Market Share, by Region, 2019 & 2026 (Kilo Tons)

- 6.4. North America

- 6.4.1. North America Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.4.1.1. North America Aerospace Foams Market, by Country, 2016 – 2026 (USD Million)

- 6.4.2. North America Market, 2016 – 2026 (Kilo Tons)

- 6.4.2.1. North America Aerospace Foams Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.4.3. North America Aerospace Foams Market, by Type, 2016 – 2026

- 6.4.3.1. North America Aerospace Foams Market, by Type, 2016 – 2026 (USD Million)

- 6.4.3.2. North America Aerospace Foams Market, by Type, 2016 – 2026 (Kilo Tons)

- 6.4.4. North America Aerospace Foams Market, by Material, 2016 – 2026

- 6.4.4.1. North America Aerospace Foams Market, by Material, 2016 – 2026 (USD Million)

- 6.4.4.2. North America Aerospace Foams Market, by Material, 2016 – 2026 (Kilo Tons)

- 6.4.5. North America Aerospace Foams Market, by End Use, 2016 – 2026

- 6.4.5.1. North America Aerospace Foams Market, by End Use, 2016 – 2026 (USD Million)

- 6.4.5.2. North America Aerospace Foams Market, by End Use, 2016 – 2026 (Kilo Tons)

- 6.4.6. North America Aerospace Foams Market, by Application, 2016 – 2026

- 6.4.6.1. North America Aerospace Foams Market, by Application, 2016 – 2026 (USD Million)

- 6.4.6.2. North America Aerospace Foams Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.4.7. U.S.

- 6.4.7.1. U.S. Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.4.7.2. U.S. Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.4.8. Canada

- 6.4.8.1. Canada Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.4.8.2. Canada Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.4.1. North America Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5. Europe

- 6.5.1. Europe Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.1.1. Europe Aerospace Foams Market, by Country, 2016 – 2026 (USD Million)

- 6.5.2. Europe Market, 2016 – 2026 (Kilo Tons)

- 6.5.2.1. Europe Aerospace Foams Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.5.3. Europe Aerospace Foams Market, by Type, 2016 – 2026

- 6.5.3.1. Europe Aerospace Foams Market, by Type, 2016 – 2026 (USD Million)

- 6.5.3.2. Europe Aerospace Foams Market, by Type, 2016 – 2026 (Kilo Tons)

- 6.5.4. Europe Aerospace Foams Market, by Material, 2016 – 2026

- 6.5.4.1. Europe Aerospace Foams Market, by Material, 2016 – 2026 (USD Million)

- 6.5.4.2. Europe Aerospace Foams Market, by Material, 2016 – 2026 (Kilo Tons)

- 6.5.5. Europe Aerospace Foams Market, by End Use, 2016 – 2026

- 6.5.5.1. Europe Aerospace Foams Market, by End Use, 2016 – 2026 (USD Million)

- 6.5.5.2. Europe Aerospace Foams Market, by End Use, 2016 – 2026 (Kilo Tons)

- 6.5.6. Europe Aerospace Foams Market, by Application, 2016 – 2026

- 6.5.6.1. Europe Aerospace Foams Market, by Application, 2016 – 2026 (USD Million)

- 6.5.6.2. Europe Aerospace Foams Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.5.7. Germany

- 6.5.7.1. Germany Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.7.2. Germany Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.5.8. France

- 6.5.8.1. France Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.8.2. France Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.5.9. U.K.

- 6.5.9.1. U.K. Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.9.2. U.K. Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.5.10. Italy

- 6.5.10.1. Italy Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.10.2. Italy Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.5.11. Spain

- 6.5.11.1. Spain Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.11.2. Spain Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.5.12. Rest of Europe

- 6.5.12.1. Rest of Europe Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.5.12.2. Rest of Europe Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.5.1. Europe Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6. Asia Pacific

- 6.6.1. Asia Pacific Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.1.1. Asia Pacific Aerospace Foams Market, by Country, 2016 – 2026 (USD Million)

- 6.6.2. Asia Pacific Market, 2016 – 2026 (Kilo Tons)

- 6.6.2.1. Asia Pacific Aerospace Foams Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.6.3. Asia Pacific Aerospace Foams Market, by Type, 2016 – 2026

- 6.6.3.1. Asia Pacific Aerospace Foams Market, by Type, 2016 – 2026 (USD Million)

- 6.6.3.2. Asia Pacific Aerospace Foams Market, by Type, 2016 – 2026 (Kilo Tons)

- 6.6.4. Asia Pacific Aerospace Foams Market, by Material, 2016 – 2026

- 6.6.4.1. Asia Pacific Aerospace Foams Market, by Material, 2016 – 2026 (USD Million)

- 6.6.4.2. Asia Pacific Aerospace Foams Market, by Material, 2016 – 2026 (Kilo Tons)

- 6.6.5. Asia Pacific Aerospace Foams Market, by End Use, 2016 – 2026

- 6.6.5.1. Asia Pacific Aerospace Foams Market, by End Use, 2016 – 2026 (USD Million)

- 6.6.5.2. Asia Pacific Aerospace Foams Market, by End Use, 2016 – 2026 (Kilo Tons)

- 6.6.6. Asia Pacific Aerospace Foams Market, by Application, 2016 – 2026

- 6.6.6.1. Asia Pacific Aerospace Foams Market, by Application, 2016 – 2026 (USD Million)

- 6.6.6.2. Asia Pacific Aerospace Foams Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.6.7. China

- 6.6.7.1. China Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.7.2. China Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.6.8. Japan

- 6.6.8.1. Japan Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.8.2. Japan Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.6.9. India

- 6.6.9.1. India Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.9.2. India Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.6.10. South Korea

- 6.6.10.1. South Korea Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.10.2. South Korea Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.6.11. South-East Asia

- 6.6.11.1. South-East Asia Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.11.2. South-East Asia Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.6.12. Rest of Asia Pacific

- 6.6.12.1. Rest of Asia Pacific Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.6.12.2. Rest of Asia Pacific Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.6.1. Asia Pacific Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.7. Latin America

- 6.7.1. Latin America Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.7.1.1. Latin America Aerospace Foams Market, by Country, 2016 – 2026 (USD Million)

- 6.7.2. Latin America Market, 2016 – 2026 (Kilo Tons)

- 6.7.2.1. Latin America Aerospace Foams Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.7.3. Latin America Aerospace Foams Market, by Type, 2016 – 2026

- 6.7.3.1. Latin America Aerospace Foams Market, by Type, 2016 – 2026 (USD Million)

- 6.7.3.2. Latin America Aerospace Foams Market, by Type, 2016 – 2026 (Kilo Tons)

- 6.7.4. Latin America Aerospace Foams Market, by Material, 2016 – 2026

- 6.7.4.1. Latin America Aerospace Foams Market, by Material, 2016 – 2026 (USD Million)

- 6.7.4.2. Latin America Aerospace Foams Market, by Material, 2016 – 2026 (Kilo Tons)

- 6.7.5. Latin America Aerospace Foams Market, by End Use, 2016 – 2026

- 6.7.5.1. Latin America Aerospace Foams Market, by End Use, 2016 – 2026 (USD Million)

- 6.7.5.2. Latin America Aerospace Foams Market, by End Use, 2016 – 2026 (Kilo Tons)

- 6.7.6. Latin America Aerospace Foams Market, by Application, 2016 – 2026

- 6.7.6.1. Latin America Aerospace Foams Market, by Application, 2016 – 2026 (USD Million)

- 6.7.6.2. Latin America Aerospace Foams Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.7.7. Brazil

- 6.7.7.1. Brazil Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.7.7.2. Brazil Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.7.8. Mexico

- 6.7.8.1. Mexico Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.7.8.2. Mexico Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.7.9. Rest of Latin America

- 6.7.9.1. Rest of Latin America Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.7.9.2. Rest of Latin America Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.7.1. Latin America Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.8. The Middle-East and Africa

- 6.8.1. The Middle-East and Africa Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.8.1.1. The Middle-East and Africa Aerospace Foams Market, by Country, 2016 – 2026 (USD Million)

- 6.8.2. The Middle-East and Africa Market, 2016 – 2026 (Kilo Tons)

- 6.8.2.1. The Middle-East and Africa Aerospace Foams Market, by Country, 2016 – 2026 (Kilo Tons)

- 6.8.3. The Middle-East and Africa Aerospace Foams Market, by Type, 2016 – 2026

- 6.8.3.1. The Middle-East and Africa Aerospace Foams Market, by Type, 2016 – 2026 (USD Million)

- 6.8.3.2. The Middle-East and Africa Aerospace Foams Market, by Type, 2016 – 2026 (Kilo Tons)

- 6.8.4. The Middle-East and Africa Aerospace Foams Market, by Material, 2016 – 2026

- 6.8.4.1. The Middle-East and Africa Aerospace Foams Market, by Material, 2016 – 2026 (USD Million)

- 6.8.4.2. The Middle-East and Africa Aerospace Foams Market, by Material, 2016 – 2026 (Kilo Tons)

- 6.8.5. The Middle-East and Africa Aerospace Foams Market, by End Use, 2016 – 2026

- 6.8.5.1. The Middle-East and Africa Aerospace Foams Market, by End Use, 2016 – 2026 (USD Million)

- 6.8.5.2. The Middle-East and Africa Aerospace Foams Market, by End Use, 2016 – 2026 (Kilo Tons)

- 6.8.6. The Middle-East and Africa Aerospace Foams Market, by Application, 2016 – 2026

- 6.8.6.1. The Middle-East and Africa Aerospace Foams Market, by Application, 2016 – 2026 (USD Million)

- 6.8.6.2. The Middle-East and Africa Aerospace Foams Market, by Application, 2016 – 2026 (Kilo Tons)

- 6.8.7. GCC Countries

- 6.8.7.1. GCC Countries Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.8.7.2. GCC Countries Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.8.8. South Africa

- 6.8.8.1. South Africa Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.8.8.2. South Africa Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.8.9. Rest of Middle-East Africa

- 6.8.9.1. Rest of Middle-East Africa Aerospace Foams Market, 2016 – 2026 (USD Million)

- 6.8.9.2. Rest of Middle-East Africa Aerospace Foams Market, 2016 – 2026 (Kilo Tons)

- 6.8.1. The Middle-East and Africa Aerospace Foams Market, 2016 – 2026 (USD Million)

- Chapter 7 Aerospace Foams Production, Consumption, Export, Import by Regions

- 7.1. Global Aerospace Foams Production and Consumption, 2016 – 2026 (Kilo Tons)

- 7.2. Global Import and Export Analysis, by Region

- Chapter 8 Aerospace Foams Market – Competitive Landscape

- 8.1. Competitor Market Share – Revenue

- 8.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 8.3. Competitor Market Share – Vulume

- 8.4. Strategic Developments

- 8.4.1. Acquisitions and Mergers

- 8.4.2. New Products

- 8.4.3. Research & Development Activities

- Chapter 9 Company Profiles

- 9.1. Armacell International S.A.

- 9.1.1. Company Overview

- 9.1.2. Product/Service Portfulio

- 9.1.3. Armacell International S.A. Sales, Revenue, Price, and Gross Margin

- 9.1.4. Armacell International S.A. Revenue and Growth Rate

- 9.1.5. Armacell International S.A. Market Share

- 9.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.2. FoamPartner

- 9.2.1. Company Overview

- 9.2.2. Product/Service Portfulio

- 9.2.3. FoamPartner Sales, Revenue, Price, and Gross Margin

- 9.2.4. FoamPartner Revenue and Growth Rate

- 9.2.5. FoamPartner Market Share

- 9.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.3. Saudi Basic Industries Corporation

- 9.3.1. Company Overview

- 9.3.2. Product/Service Portfulio

- 9.3.3. Saudi Basic Industries Corporation Sales, Revenue, Price, and Gross Margin

- 9.3.4. Saudi Basic Industries Corporation Revenue and Growth Rate

- 9.3.5. Saudi Basic Industries Corporation Market Share

- 9.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.4. ERG Materials and Aerospace Corp

- 9.4.1. Company Overview

- 9.4.2. Product/Service Portfulio

- 9.4.3. ERG Materials and Aerospace Corp Sales, Revenue, Price, and Gross Margin

- 9.4.4. ERG Materials and Aerospace Corp Revenue and Growth Rate

- 9.4.5. ERG Materials and Aerospace Corp Market Share

- 9.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.5. Sulvay SA

- 9.5.1. Company Overview

- 9.5.2. Product/Service Portfulio

- 9.5.3. Sulvay SA Sales, Revenue, Price, and Gross Margin

- 9.5.4. Sulvay SA Revenue and Growth Rate

- 9.5.5. Sulvay SA Market Share

- 9.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.6. Greiner AG

- 9.6.1. Company Overview

- 9.6.2. Product/Service Portfulio

- 9.6.3. Greiner AG Sales, Revenue, Price, and Gross Margin

- 9.6.4. Greiner AG Revenue and Growth Rate

- 9.6.5. Greiner AG Market Share

- 9.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.7. General Plastics Manufacturing Company

- 9.7.1. Company Overview

- 9.7.2. Product/Service Portfulio

- 9.7.3. General Plastics Manufacturing Company Sales, Revenue, Price, and Gross Margin

- 9.7.4. General Plastics Manufacturing Company Revenue and Growth Rate

- 9.7.5. General Plastics Manufacturing Company Market Share

- 9.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.8. Aerofoam Industries, LLC

- 9.8.1. Company Overview

- 9.8.2. Product/Service Portfulio

- 9.8.3. Aerofoam Industries, LLC Sales, Revenue, Price, and Gross Margin

- 9.8.4. Aerofoam Industries, LLC Revenue and Growth Rate

- 9.8.5. Aerofoam Industries, LLC Market Share

- 9.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.9. BASF SE

- 9.9.1. Company Overview

- 9.9.2. Product/Service Portfulio

- 9.9.3. BASF SE Sales, Revenue, Price, and Gross Margin

- 9.9.4. BASF SE Revenue and Growth Rate

- 9.9.5. BASF SE Market Share

- 9.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.10. Evonik Industries AG

- 9.10.1. Company Overview

- 9.10.2. Product/Service Portfulio

- 9.10.3. Evonik Industries AG Sales, Revenue, Price, and Gross Margin

- 9.10.4. Evonik Industries AG Revenue and Growth Rate

- 9.10.5. Evonik Industries AG Market Share

- 9.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.11. Boyd Corporation

- 9.11.1. Company Overview

- 9.11.2. Product/Service Portfulio

- 9.11.3. Boyd Corporation Sales, Revenue, Price, and Gross Margin

- 9.11.4. Boyd Corporation Revenue and Growth Rate

- 9.11.5. Boyd Corporation Market Share

- 9.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.12. Rogers Corporation

- 9.12.1. Company Overview

- 9.12.2. Product/Service Portfulio

- 9.12.3. Rogers Corporation Sales, Revenue, Price, and Gross Margin

- 9.12.4. Rogers Corporation Revenue and Growth Rate

- 9.12.5. Rogers Corporation Market Share

- 9.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.13. Pyrotek Inc.

- 9.13.1. Company Overview

- 9.13.2. Product/Service Portfulio

- 9.13.3. Pyrotek Inc. Sales, Revenue, Price, and Gross Margin

- 9.13.4. Pyrotek Inc. Revenue and Growth Rate

- 9.13.5. Pyrotek Inc. Market Share

- 9.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.14. Sinfo, Spul. S R.O.

- 9.14.1. Company Overview

- 9.14.2. Product/Service Portfulio

- 9.14.3. Sinfo, Spul. S R.O. Sales, Revenue, Price, and Gross Margin

- 9.14.4. Sinfo, Spul. S R.O. Revenue and Growth Rate

- 9.14.5. Sinfo, Spul. S R.O. Market Share

- 9.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.15. 3A Composites Hulding AG

- 9.15.1. Company Overview

- 9.15.2. Product/Service Portfulio

- 9.15.3. 3A Composites Hulding AG Sales, Revenue, Price, and Gross Margin

- 9.15.4. 3A Composites Hulding AG Revenue and Growth Rate

- 9.15.5. 3A Composites Hulding AG Market Share

- 9.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.16. UFP Technulogies, Inc.

- 9.16.1. Company Overview

- 9.16.2. Product/Service Portfulio

- 9.16.3. UFP Technulogies, Inc. Sales, Revenue, Price, and Gross Margin

- 9.16.4. UFP Technulogies, Inc. Revenue and Growth Rate

- 9.16.5. UFP Technulogies, Inc. Market Share

- 9.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.17. Zotefoams Plc

- 9.17.1. Company Overview

- 9.17.2. Product/Service Portfulio

- 9.17.3. Zotefoams Plc Sales, Revenue, Price, and Gross Margin

- 9.17.4. Zotefoams Plc Revenue and Growth Rate

- 9.17.5. Zotefoams Plc Market Share

- 9.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.18. Dupont De Nemours, Inc.

- 9.18.1. Company Overview

- 9.18.2. Product/Service Portfulio

- 9.18.3. Dupont De Nemours, Inc. Sales, Revenue, Price, and Gross Margin

- 9.18.4. Dupont De Nemours, Inc. Revenue and Growth Rate

- 9.18.5. Dupont De Nemours, Inc. Market Share

- 9.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.19. NCFI Pulyurethanes

- 9.19.1. Company Overview

- 9.19.2. Product/Service Portfulio

- 9.19.3. NCFI Pulyurethanes Sales, Revenue, Price, and Gross Margin

- 9.19.4. NCFI Pulyurethanes Revenue and Growth Rate

- 9.19.5. NCFI Pulyurethanes Market Share

- 9.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.20. Sekisui Vultek, LLC

- 9.20.1. Company Overview

- 9.20.2. Product/Service Portfulio

- 9.20.3. Sekisui Vultek, LLC Sales, Revenue, Price, and Gross Margin

- 9.20.4. Sekisui Vultek, LLC Revenue and Growth Rate

- 9.20.5. Sekisui Vultek, LLC Market Share

- 9.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.21. Pulyformes Ltd

- 9.21.1. Company Overview

- 9.21.2. Product/Service Portfulio

- 9.21.3. Pulyformes Ltd Sales, Revenue, Price, and Gross Margin

- 9.21.4. Pulyformes Ltd Revenue and Growth Rate

- 9.21.5. Pulyformes Ltd Market Share

- 9.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 9.1. Armacell International S.A.

- Chapter 10 Aerospace Foams — Industry Analysis

- 10.1. Introduction and Taxonomy

- 10.2. Aerospace Foams Market – Key Trends

- 10.2.1. Market Drivers

- 10.2.2. Market Restraints

- 10.2.3. Market Opportunities

- 10.3. Value Chain Analysis

- 10.4. Key Mandates and Regulations

- 10.5. Technulogy Roadmap and Timeline

- 10.6. Aerospace Foams Market – Attractiveness Analysis

- 10.6.1. By Type

- 10.6.2. By Material

- 10.6.3. By End Use

- 10.6.4. By Application

- 10.6.5. By Region

- Chapter 11 Raw Material Analysis

- 11.1. Aerospace Foams Key Raw Material Analysis

- 11.1.1. Key Raw Materials

- 11.1.2. Price Trend of Key Raw Materials

- 11.2. Key Suppliers of Raw Materials

- 11.3. Proportion of Manufacturing Cost Structure

- 11.3.1. Raw Materials Cost

- 11.3.2. Labor Cost

- 11.3.3. Manufacturing Expenses

- 11.3.4. Miscellaneous Expenses

- 11.4. Manufacturing Cost Analysis of Aerospace Foams

- 11.1. Aerospace Foams Key Raw Material Analysis

- Chapter 12 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 12.1. Aerospace Foams Industrial Chain Analysis

- 12.2. Upstream Raw Materials Sourcing

- 12.2.1. Risk Mitigation:

- 12.2.2. Supplier Relationships:

- 12.2.3. Business Processes:

- 12.2.4. Securing the Product:

- 12.3. Raw Materials Sources of Aerospace Foams Major Manufacturers

- 12.4. Downstream Buyers

- 12.5. Distributors/Traders List

- Chapter 13 Marketing Strategy Analysis, Distributors

- 13.1. Marketing Channel

- 13.2. Direct Marketing

- 13.3. Indirect Marketing

- 13.4. Marketing Channel Development Trends

- 13.5. Economic/Pulitical Environmental Change

- Chapter 14 Report Conclusion & Key Insights

- 14.1. Key Insights from Primary Interviews & Surveys Respondents

- 14.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 15 Research Approach & Methodulogy

- 15.1. Report Description

- 15.2. Research Scope

- 15.3. Research Methodulogy

- 15.3.1. Secondary Research

- 15.3.2. Primary Research

- 15.3.3. Statistical Models

- 15.3.3.1. Company Share Analysis Model

- 15.3.3.2. Revenue Based Modeling

- 15.3.4. Research Limitations

Inquiry For Buying

Aerospace Foams

Request Sample

Aerospace Foams