Aircraft Braking System Market Size, Share, and Trends Analysis Report

CAGR :

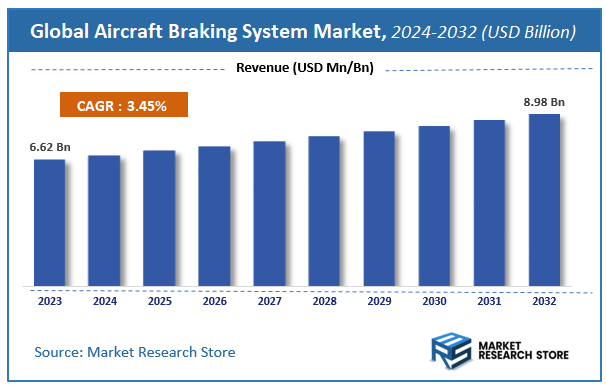

| Market Size 2023 (Base Year) | USD 6.62 Billion |

| Market Size 2032 (Forecast Year) | USD 8.98 Billion |

| CAGR | 3.45% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aircraft Braking System Market Insights

According to Market Research Store, the global aircraft braking system market size was valued at around USD 6.62 billion in 2023 and is estimated to reach USD 8.98 billion by 2032, to register a CAGR of approximately 3.45% in terms of revenue during the forecast period 2024-2032.

The aircraft braking system report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Aircraft Braking System Market: Overview

An aircraft braking system is a critical safety and control mechanism designed to slow down, stop, and hold an aircraft during landing, taxiing, or emergency situations. It typically consists of components such as brake discs, brake pads, actuators, hydraulic systems, electronic brake control units, and increasingly advanced technologies like carbon brakes and anti-skid systems that enhance performance, reduce wear, and improve safety. Modern aircraft braking systems are engineered to withstand high energy loads generated during landing while ensuring precise control and shorter stopping distances.

Key Highlights

- The aircraft braking system market is anticipated to grow at a CAGR of 3.45% during the forecast period.

- The global aircraft braking system market was estimated to be worth approximately USD 6.62 billion in 2023 and is projected to reach a value of USD 8.98 billion by 2032.

- The growth of the aircraft braking system market is being driven by increasing air travel, expansion of commercial fleets, and the rising demand for lightweight, durable, and fuel-efficient braking solutions.

- Based on the type, the carbon brakes segment is growing at a high rate and is projected to dominate the market.

- On the basis of actuation, the power brakes segment is projected to swipe the largest market share.

- In terms of point of sale, the original equipment manufacturers (OEMs) segment is expected to dominate the market.

- Based on the components, the brake discs segment is expected to dominate the market.

- On the basis of end-use, the commercial aircraft segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Aircraft Braking System Market: Dynamics

Key Growth Drivers

- Rising Commercial Air Traffic – Increasing global air travel and expanding airline fleets are boosting the demand for efficient and reliable aircraft braking systems.

- Modernization of Aircraft Fleets – Airlines and defense forces are replacing aging aircraft with advanced models, which require next-generation braking technologies.

- Technological Advancements – Innovations such as carbon brakes, electric braking systems, and advanced materials improve performance, reduce weight, and extend lifespan.

- Growth in Military Aviation – Rising defense budgets and growing military aircraft procurement programs drive demand for high-performance braking systems.

Restraints

- High Initial Costs – Advanced braking systems involve significant R&D and manufacturing expenses, making them costly for OEMs and operators.

- Complex Certification Processes – Strict aviation safety standards and regulatory requirements increase time and cost for product approval.

- Maintenance and Overhaul Costs – Regular maintenance and expensive component replacements limit adoption, especially among smaller airlines and operators.

Opportunities

- Adoption of Electric & Smart Braking Systems – Transition toward electric braking and sensor-based smart systems offers new growth avenues for manufacturers.

- Emerging Markets Expansion – Rapid aviation growth in regions like Asia-Pacific and the Middle East creates strong demand for modern braking systems.

- Retrofit and Upgrade Programs – Rising focus on upgrading existing aircraft with advanced braking technologies presents significant aftermarket opportunities.

- Lightweight Material Innovations – Development of composite and carbon-based braking components enhances fuel efficiency and opens premium market segments.

Challenges

- Supply Chain Disruptions – Shortages of critical components and materials can delay production and affect delivery schedules.

- Intense Market Competition – The presence of a few dominant players and high entry barriers make it challenging for new entrants to compete.

- Integration with Next-Gen Aircraft Systems – Ensuring compatibility of braking systems with advanced avionics and landing gear technologies is technically complex.

- Stringent Safety and Performance Requirements – Meeting evolving regulatory standards while maintaining reliability and performance adds development challenges.

Aircraft Braking System Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aircraft Braking System Market |

| Market Size in 2023 | USD 6.62 Billion |

| Market Forecast in 2032 | USD 8.98 Billion |

| Growth Rate | CAGR of 3.45% |

| Number of Pages | 150 |

| Key Companies Covered | Advent Aircraft Systems, Inc., Crane Aerospace & Electronics, Honeywell International Inc., Jay-Em Aerospace & Machine, Inc., Grove Aircraft Landing Gear Systems Inc., Safran S.A., Meggitt Aircraft Braking Systems Corporation, Aeroned, Aviation Brake Service Inc., Bauer, Inc., UNITED TECHNOLOGIES, Nasco Aircraft Brake, Inc., Parker Hannifin Corp, Zlin Aircraft, MATCO mfg, and Beringer-aero |

| Segments Covered | By Brake Type, By Actuating System Type, By End-Use, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aircraft Braking System Market: Segmentation Insights

The global aircraft braking system market is divided by type, actuation, point of sale, components, end-use, and region.

Based on type, the global aircraft braking system market is divided into single disc brakes, floating disc brakes, dual-disc brakes, multiple disc brakes, segmented rotor-disc brakes, carbon brakes, and expander tube brakes. Carbon brakes are the most dominant segment in the aircraft braking system market, primarily due to their lightweight properties, high heat resistance, and long service life, which make them ideal for commercial aviation where fuel efficiency and durability are critical. These brakes can withstand the extreme energy loads generated during landing while reducing overall aircraft weight, directly contributing to cost savings and improved performance. Their adoption is widespread in modern commercial and military aircraft, supported by continuous advancements in carbon composite materials. Multiple disc brakes follow closely, widely used in both commercial and military aircraft for their ability to deliver strong braking power within a compact design. By stacking several discs together, these systems can handle significant braking energy, making them reliable for larger aircraft with high landing weights.

On the basis of actuation, the global aircraft braking system market is bifurcated into independent brake, boosted brake, and power brake. Power brakes are the most dominant actuation type in the aircraft braking system market, as they are widely adopted in commercial and military aircraft that require high braking force and precise control. These systems use hydraulic or electric power to provide the necessary pressure, enabling aircraft to manage the intense loads generated during landing. Their reliability, efficiency, and ability to integrate with advanced technologies such as anti-skid systems make them the preferred choice for modern fleets, especially larger and heavier aircraft. Boosted brakes represent the next significant segment, commonly found in medium-sized aircraft where the pilot’s input is supplemented by hydraulic or pneumatic assistance. They provide greater braking force than independent systems without requiring the full complexity of power brakes, making them a cost-effective solution for certain aircraft categories.

Based on point of sale, the global aircraft braking system market is divided into original equipment manufacturers and aftermarket. Original Equipment Manufacturers (OEMs) dominate the aircraft braking system market as they supply braking solutions integrated directly into new aircraft during production. Demand in this segment is driven by continuous growth in global air travel, rising aircraft deliveries, and fleet expansion by both commercial airlines and defense forces. OEMs focus on providing advanced, lightweight, and durable braking systems such as carbon brakes, often customized to specific aircraft models. The integration of electronic brake control systems and compliance with stringent aviation safety standards further strengthen the dominance of OEMs in the market. Aftermarket represents a significant but smaller segment, largely supported by the need for regular maintenance, repair, and replacement of braking components due to high wear and safety-critical usage. Airlines and operators depend on reliable aftermarket services to minimize downtime and ensure compliance with regulatory standards.

In terms of components, the global aircraft braking system market is bifurcated into wheels, brake discs, actuators, valves, and others. Brake discs are the most dominant component in the aircraft braking system market, as they are the core elements responsible for absorbing and dissipating the immense kinetic energy generated during landing. Carbon composite discs, in particular, are in high demand due to their durability, lightweight structure, and ability to withstand extreme temperatures, making them essential for both commercial and military aircraft. Their frequent replacement cycles compared to other components also make them the largest revenue-generating segment. Wheels follow as another critical component, serving as the structural base for mounting brake systems and absorbing loads during takeoff, landing, and taxiing. Aircraft wheels must be highly durable and lightweight, often made from advanced alloys, and designed to integrate seamlessly with braking components.

On the basis of end-use, the global aircraft braking system market is bifurcated into commercial aircraft, private aircraft, and military aircraft. Commercial aircraft represent the most dominant end-use segment in the aircraft braking system market, driven by the continuous expansion of global air travel, rising passenger traffic, and large-scale fleet modernization programs. Airlines prioritize advanced braking solutions such as carbon brakes and electronic brake control systems to enhance safety, reduce maintenance costs, and improve fuel efficiency. The high frequency of operations and larger fleet sizes ensure consistent demand for both OEM installations and aftermarket replacements, keeping this segment at the forefront of market growth. Military aircraft form the second-largest segment, supported by defense modernization initiatives, increasing procurement of advanced fighter jets, transport aircraft, and helicopters. Military applications require braking systems that can withstand extreme conditions, including rapid deceleration during short runway landings and operations on rugged terrains.

Aircraft Braking System Market: Regional Insights

- North America is expected to dominates the global market

North America dominates the aircraft braking system market thanks to a dense concentration of OEMs, MRO providers, large commercial and military fleets, and advanced aerospace supply chains. Demand is driven by a steady replacement and upgrade cycle, strong aftermarket spending, and rapid adoption of high-performance materials and electronic brake control systems to improve safety, reduce weight, and lower life-cycle costs. The region’s stringent certification standards and high investment in predictive maintenance and fleet modernization further support demand for next-generation braking technologies.

Europe holds a leading position characterized by the presence of major airframe manufacturers, a mature MRO ecosystem, and tight regulatory focus on safety and environmental performance. Operators and suppliers emphasize lightweight carbon and composite brake materials, braking energy management, and sustainable manufacturing practices, while airlines and defense customers push for solutions that reduce fuel burn and maintenance downtime. Strong collaboration between OEMs, suppliers, and research institutions accelerates technology transfer and regulatory compliance.

Asia Pacific (APAC) is a rapidly expanding market driven by accelerating air travel growth, large aircraft orders, expanding low-cost carriers, and extensive airport infrastructure development. Fleet expansion and the need to service quickly growing numbers of narrowbody and widebody aircraft create substantial opportunities for both OEM brakes and aftermarket services, with retrofit and MRO activity rising as older fleets modernize. Suppliers targeting APAC focus on scalable solutions, localized support, and partnerships to meet diverse operational environments and climatic challenges.

Middle East and Africa (MEA) together form an emerging but less dominant market characterized by a mix of strong hub carriers in the Gulf and fragmented operators across Africa. The Middle East shows steady demand driven by large, long-haul fleets, premium carrier expectations, and significant investment in airports and fleet expansion, fueling the need for advanced braking technologies and efficient MRO support. In contrast, Africa’s market remains modest, constrained by limited MRO capacity and aging fleets, though rising air travel and infrastructure investment create long-term potential. Combined, MEA presents opportunities for suppliers offering cost-effective, reliable solutions and localized services, with growth hinging on partnerships and regulatory adaptation.

Latin America is a smaller but steadily modernizing market where demand is centered on fleet renewal, increased regional air connectivity, and growth of low-cost operators. Opportunities exist in replacing aging equipment, expanding MRO capabilities, and supplying cost-effective braking solutions adapted to varied operational conditions across the region. Progress is somewhat constrained by uneven infrastructure and budget pressures, so aftermarket growth is often tied to targeted retrofit programs and partnerships with global service providers.

Recent Developments:

- In December 2024, GA Telesis, LLC, a global provider of integrated aviation services, announced that it had signed a definitive agreement to acquire AAR CORP.’s Landing Gear Overhaul business along with its Wheels & Brakes business unit. Following the completion of the transaction, the acquired operations will be integrated into the GA Telesis MRO Services Division under the leadership of group president Pastor Lopez, and will operate under the new brand name GA Telesis Landing Gear Services.

Aircraft Braking System Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aircraft braking system market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aircraft braking system market include:

- Advent Aircraft Systems Inc.

- Crane Aerospace & Electronics

- Honeywell International Inc.

- Jay-Em Aerospace & Machine Inc.

- Grove Aircraft Landing Gear Systems Inc.

- Safran S.A.

- Meggitt Aircraft Braking Systems Corporation

- Aeroned

- Aviation Brake Service Inc.

- Bauer Inc.

- UNITED TECHNOLOGIES

- Nasco Aircraft Brake Inc.

- Parker Hannifin Corp

- Zlin Aircraft

- MATCO mfg

- Beringer-aero

The global aircraft braking system market is segmented as follows:

By Type

- Single Disc Brakes

- Floating Disc Brakes

- Dual-Disc Brakes

- Multiple Disc Brakes

- Segmented Rotor-Disc Brakes

- Carbon Brakes

- Expander Tube Brakes

By Actuation

- Independent Brake

- Boosted Brake

- Power Brake

By Point of Sale

- OEM

- Aftermarket

By Components

- Wheels

- Brake Discs

- Actuators

- Valves

- Others

By End-Use

- Commercial Aircraft

- Private Aircraft

- Military Aircraft

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 21

CHAPTER 2. Aircraft Braking System market – Brake Type Analysis 23

2.1. Global Aircraft Braking System Market – Brake Type Overview 23

2.2. Global Aircraft Braking System Market Share, by Brake Type, 2018 & 2025 (USD Million) 23

2.3. Carbon Brakes 25

2.3.1. Global Carbon Brakes Aircraft Braking System Market, 2015-2025 (USD Million) 25

2.4. Segmented Rotor Brakes 26

2.4.1. Global Segmented Rotor Brakes Aircraft Braking System Market, 2015-2025 (USD Million) 26

2.5. Disc-Brakes 27

2.5.1. Global Disc-Brakes Aircraft Braking System Market, 2015-2025 (USD Million) 27

2.6. Expander Tube Brakes 28

2.6.1. Global Expander Tube Brakes Aircraft Braking System Market, 2015-2025 (USD Million) 28

CHAPTER 3. Aircraft Braking System market – Actuating System Type Analysis 28

3.1. Global Aircraft Braking System Market – Actuating System Type Overview 28

3.2. Global Aircraft Braking System Market Share, by Actuating System Type, 2018 & 2025 (USD Million) 29

3.3. Booster 30

3.3.1. Global Booster Aircraft Braking System Market, 2015-2025 (USD Million) 30

3.4. Power Brake 31

3.4.1. Global Power Brake Aircraft Braking System Market, 2015-2025 (USD Million) 31

3.5. Independent 32

3.5.1. Global Independent Aircraft Braking System Market, 2015-2025 (USD Million) 32

CHAPTER 4. Aircraft Braking System market – End-Use Analysis 32

4.1. Global Aircraft Braking System Market – End-Use Overview 32

4.2. Global Aircraft Braking System Market Share, by End-Use, 2018 & 2025 (USD Million) 33

4.3. Commercial Aircraft 34

4.3.1. Global Commercial Aircraft Aircraft Braking System Market, 2015-2025 (USD Million) 34

4.4. Private Aircraft 35

4.4.1. Global Private Aircraft Aircraft Braking System Market, 2015-2025 (USD Million) 35

4.5. Military Aircraft 36

4.5.1. Global Military Aircraft Aircraft Braking System Market, 2015-2025 (USD Million) 36

CHAPTER 5. Aircraft Braking System market – Regional Analysis 37

5.1. Global Aircraft Braking System Market Regional Overview 37

5.2. Global Aircraft Braking System Market Share, by Region, 2018 & 2025 (Value) 37

5.3. North America 39

5.3.1. North America Aircraft Braking System Market size and forecast, 2015-2025 39

5.3.2. North America Aircraft Braking System Market, by Country, 2018 & 2025 (USD Million) 39

5.3.3. North America Aircraft Braking System Market, by Brake Type, 2015-2025 41

5.3.3.1. North America Aircraft Braking System Market, by Brake Type, 2015-2025 (USD Million) 41

5.3.4. North America Aircraft Braking System Market, by Actuating System Type, 2015-2025 42

5.3.4.1. North America Aircraft Braking System Market, by Actuating System Type, 2015-2025 (USD Million) 42

5.3.5. North America Aircraft Braking System Market, by End-Use, 2015-2025 43

5.3.5.1. North America Aircraft Braking System Market, by End-Use, 2015-2025 (USD Million) 43

5.3.6. U.S. 44

5.3.6.1. U.S. Market size and forecast, 2015-2025 (USD Million) 44

5.3.7. Canada 45

5.3.7.1. Canada Market size and forecast, 2015-2025 (USD Million) 45

5.3.8. Mexico 46

5.3.8.1. Mexico Market size and forecast, 2015-2025 (USD Million) 46

5.4. Europe 47

5.4.1. Europe Aircraft Braking System Market size and forecast, 2015-2025 47

5.4.2. Europe Aircraft Braking System Market, by Country, 2018 & 2025 (USD Million) 47

5.4.3. Europe Aircraft Braking System Market, by Brake Type, 2015-2025 49

5.4.3.1. Europe Aircraft Braking System Market, by Brake Type, 2015-2025 (USD Million) 49

5.4.4. Europe Aircraft Braking System Market, by Actuating System Type, 2015-2025 50

5.4.4.1. Europe Aircraft Braking System Market, by Actuating System Type, 2015-2025 (USD Million) 50

5.4.5. Europe Aircraft Braking System Market, by End-Use, 2015-2025 51

5.4.5.1. Europe Aircraft Braking System Market, by End-Use, 2015-2025 (USD Million) 51

5.4.6. Germany 52

5.4.6.1. Germany Market size and forecast, 2015-2025 (USD Million) 52

5.4.7. France 53

5.4.7.1. France Market size and forecast, 2015-2025 (USD Million) 53

5.4.8. U.K. 54

5.4.8.1. U.K. Market size and forecast, 2015-2025 (USD Million) 54

5.4.9. Italy 55

5.4.9.1. Italy Market size and forecast, 2015-2025 (USD Million) 55

5.4.10. Spain 56

5.4.10.1. Spain Market size and forecast, 2015-2025 (USD Million) 56

5.4.11. Nordic Countries 57

5.4.11.1. Nordic Countries Market size and forecast, 2015-2025 (USD Million) 57

5.4.12. Benelux Union 58

5.4.12.1. Benelux Union Market size and forecast, 2015-2025 (USD Million) 58

5.4.13. Rest of Europe 59

5.4.13.1. Rest of Europe Market size and forecast, 2015-2025 (USD Million) 59

5.5. Asia Pacific 60

5.5.1. Asia Pacific Aircraft Braking System Market size and forecast, 2015-2025 60

5.5.2. Asia Pacific Aircraft Braking System Market, by Country, 2018 & 2025 (USD Million) 60

5.5.3. Asia Pacific Aircraft Braking System Market, by Brake Type, 2015-2025 62

5.5.3.1. Asia Pacific Aircraft Braking System Market, by Brake Type, 2015-2025 (USD Million) 62

5.5.4. Asia Pacific Aircraft Braking System Market, by Actuating System Type, 2015-2025 63

5.5.4.1. Asia Pacific Aircraft Braking System Market, by Actuating System Type, 2015-2025 (USD Million) 63

5.5.5. Asia Pacific Aircraft Braking System Market, by End-Use, 2015-2025 64

5.5.5.1. Asia Pacific Aircraft Braking System Market, by End-Use, 2015-2025 (USD Million) 64

5.5.6. China 65

5.5.6.1. China Market size and forecast, 2015-2025 (USD Million) 65

5.5.7. Japan 66

5.5.7.1. Japan Market size and forecast, 2015-2025 (USD Million) 66

5.5.8. India 67

5.5.8.1. India Market size and forecast, 2015-2025 (USD Million) 67

5.5.9. New Zealand 68

5.5.9.1. New Zealand Market size and forecast, 2015-2025 (USD Million) 68

5.5.10. Australia 69

5.5.10.1. Australia Market size and forecast, 2015-2025 (USD Million) 69

5.5.11. South Korea 70

5.5.11.1. South Korea Market size and forecast, 2015-2025 (USD Million) 70

5.5.12. South-East Asia 71

5.5.12.1. South-East Asia Market size and forecast, 2015-2025 (USD Million) 71

5.5.13. Rest of Asia Pacific 72

5.5.13.1. Rest of Asia Pacific Market size and forecast, 2015-2025 (USD Million) 72

5.6. Latin America 73

5.6.1. Latin America Aircraft Braking System Market size and forecast, 2015-2025 73

5.6.2. Latin America Aircraft Braking System Market, by Country, 2018 & 2025 (USD Million) 73

5.6.3. Latin America Aircraft Braking System Market, by Brake Type, 2015-2025 75

5.6.3.1. Latin America Aircraft Braking System Market, by Brake Type, 2015-2025 (USD Million) 75

5.6.4. Latin America Aircraft Braking System Market, by Actuating System Type, 2015-2025 76

5.6.4.1. Latin America Aircraft Braking System Market, by Actuating System Type, 2015-2025 (USD Million) 76

5.6.5. Latin America Aircraft Braking System Market, by End-Use, 2015-2025 77

5.6.5.1. Latin America Aircraft Braking System Market, by End-Use, 2015-2025 (USD Million) 77

5.6.6. Brazil 78

5.6.6.1. Brazil Market size and forecast, 2015-2025 (USD Million) 78

5.6.7. Argentina 79

5.6.7.1. Argentina Market size and forecast, 2015-2025 (USD Million) 79

5.6.8. Rest of Latin America 80

5.6.8.1. Rest of Latin America Market size and forecast, 2015-2025 (USD Million) 80

5.7. The Middle-East and Africa 81

5.7.1. The Middle-East and Africa Aircraft Braking System Market size and forecast, 2015-2025 81

5.7.2. The Middle-East and Africa Aircraft Braking System Market, by Country, 2018 & 2025 (USD Million) 81

5.7.3. The Middle-East and Africa Aircraft Braking System Market, by Brake Type, 2015-2025 83

5.7.3.1. The Middle-East and Africa Aircraft Braking System Market, by Brake Type, 2015-2025 (USD Million) 83

5.7.4. The Middle-East and Africa Aircraft Braking System Market, by Actuating System Type, 2015-2025 84

5.7.4.1. The Middle-East and Africa Aircraft Braking System Market, by Actuating System Type, 2015-2025 (USD Million) 84

5.7.5. The Middle-East and Africa Aircraft Braking System Market, by End-Use, 2015-2025 85

5.7.5.1. The Middle-East and Africa Aircraft Braking System Market, by End-Use, 2015-2025 (USD Million) 85

5.7.6. Saudi Arabia 86

5.7.6.1. Saudi Arabia Market size and forecast, 2015-2025 (USD Million) 86

5.7.7. UAE 87

5.7.7.1. UAE Market size and forecast, 2015-2025 (USD Million) 87

5.7.8. Egypt 88

5.7.8.1. Egypt Market size and forecast, 2015-2025 (USD Million) 88

5.7.9. Kuwait 89

5.7.9.1. Kuwait Market size and forecast, 2015-2025 (USD Million) 89

5.7.10. South Africa 90

5.7.10.1. South Africa Market size and forecast, 2015-2025 (USD Million) 90

5.7.11. Rest of Middle-East Africa 91

5.7.11.1. Rest of Middle-East Africa Market size and forecast, 2015-2025 (USD Million) 91

CHAPTER 6. Aircraft Braking System market – Competitive Landscape 92

6.1. Competitor Market Share – Revenue 92

6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 94

6.3. Strategic Development 95

6.3.1. Acquisitions and Mergers 95

6.3.2. New Products 95

6.3.3. Research & Development Activities 95

CHAPTER 7. Company Profiles 96

7.1. Advent Aircraft Systems Inc. 96

7.1.1. Company Overview 96

7.1.2. Advent Aircraft Systems Inc. Revenue and Gross Margin 96

7.1.3. Product portfolio 97

7.1.4. Recent initiatives 98

7.2. Crane Aerospace & Electronics 98

7.2.1. Company Overview 98

7.2.2. Crane Aerospace & Electronics Revenue and Gross Margin 98

7.2.3. Product portfolio 99

7.2.4. Recent initiatives 100

7.3. Honeywell International Inc. 100

7.3.1. Company Overview 100

7.3.2. Honeywell International Inc. Revenue and Gross Margin 100

7.3.3. Product portfolio 101

7.3.4. Recent initiatives 102

7.4. Jay-Em Aerospace & Machine Inc. 102

7.4.1. Company Overview 102

7.4.2. Jay-Em Aerospace & Machine Inc. Revenue and Gross Margin 102

7.4.3. Product portfolio 103

7.4.4. Recent initiatives 104

7.5. Grove Aircraft Landing Gear Systems Inc. 104

7.5.1. Company Overview 104

7.5.2. Grove Aircraft Landing Gear Systems Inc. Revenue and Gross Margin 104

7.5.3. Product portfolio 105

7.5.4. Recent initiatives 106

7.6. Safran S.A. 106

7.6.1. Company Overview 106

7.6.2. Safran S.A. Revenue and Gross Margin 106

7.6.3. Product portfolio 107

7.6.4. Recent initiatives 108

7.7. Meggitt Aircraft Braking Systems Corporation 108

7.7.1. Company Overview 108

7.7.2. Meggitt Aircraft Braking Systems Corporation Revenue and Gross Margin 108

7.7.3. Product portfolio 109

7.7.4. Recent initiatives 110

7.8. Aeroned 110

7.8.1. Company Overview 110

7.8.2. Aeroned Revenue and Gross Margin 110

7.8.3. Product portfolio 111

7.8.4. Recent initiatives 112

7.9. Aviation Brake Service Inc. 112

7.9.1. Company Overview 112

7.9.2. Aviation Brake Service Inc. Revenue and Gross Margin 112

7.9.3. Product portfolio 113

7.9.4. Recent initiatives 114

7.10. Bauer Inc. 114

7.10.1. Company Overview 114

7.10.2. Bauer Inc. Revenue and Gross Margin 114

7.10.3. Product portfolio 115

7.10.4. Recent initiatives 116

7.11. UNITED TECHNOLOGIES 116

7.11.1. Company Overview 116

7.11.2. UNITED TECHNOLOGIES Revenue and Gross Margin 116

7.11.3. Product portfolio 117

7.11.4. Recent initiatives 118

7.12. Nasco Aircraft Brake Inc. 118

7.12.1. Company Overview 118

7.12.2. Nasco Aircraft Brake Inc. Revenue and Gross Margin 118

7.12.3. Product portfolio 119

7.12.4. Recent initiatives 120

7.13. Parker Hannifin Corp. 120

7.13.1. Company Overview 120

7.13.2. Parker Hannifin Corp. Revenue and Gross Margin 120

7.13.3. Product portfolio 121

7.13.4. Recent initiatives 122

7.14. Zlin Aircraft 122

7.14.1. Company Overview 122

7.14.2. Zlin Aircraft Revenue and Gross Margin 122

7.14.3. Product portfolio 123

7.14.4. Recent initiatives 124

7.15. MATCO mfg 124

7.15.1. Company Overview 124

7.15.2. MATCO mfg Revenue and Gross Margin 124

7.15.3. Product portfolio 125

7.15.4. Recent initiatives 126

7.16. Beringeraero 126

7.16.1. Company Overview 126

7.16.2. Beringeraero Revenue and Gross Margin 126

7.16.3. Product portfolio 127

7.16.4. Recent initiatives 128

CHAPTER 8. Aircraft Braking System — Industry Analysis 129

8.1. Aircraft Braking System Market – Key Trends 129

8.1.1. Market Drivers 130

8.1.2. Market Restraints 130

8.1.3. Market Opportunities 131

8.2. Value Chain Analysis 132

8.3. Technology Roadmap and Timeline 133

8.4. Aircraft Braking System Market – Attractiveness Analysis 134

8.4.1. By Brake Type 134

8.4.2. By Actuating System Type 134

8.4.3. By End-Use 135

8.4.4. By Region 137

CHAPTER 9. Marketing Strategy Analysis, Distributors 138

9.1. Marketing Channel 138

9.2. Direct Marketing 139

9.3. Indirect Marketing 139

9.4. Marketing Channel Development Trend 139

9.5. Economic/Political Environmental Change 140

CHAPTER 10. Report Conclusion 141

CHAPTER 11. Research Approach & Methodology 142

11.1. Report Description 142

11.2. Research Scope 143

11.3. Research Methodology 143

11.3.1. Secondary Research 144

11.3.2. Primary Research 145

11.3.3. Models 146

11.3.3.1. Company Share Analysis Model 146

11.3.3.2. Revenue Based Modeling 147

11.3.3.3. Research Limitations 147

Inquiry For Buying

Aircraft Braking System

Request Sample

Aircraft Braking System