Anisic Aldehyde Market Size, Share, and Trends Analysis Report

CAGR :

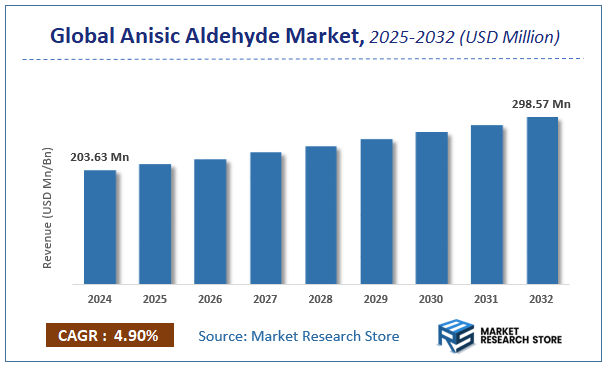

| Market Size 2024 (Base Year) | USD 203.63 Million |

| Market Size 2032 (Forecast Year) | USD 298.57 Million |

| CAGR | 4.9% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global anisic aldehyde market, estimating its value at USD 203.63 Million in 2024, with projections indicating it will reach USD 298.57 Million by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 4.9% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the anisic aldehyde industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Anisic Aldehyde Market: Overview

The growth of the anisic aldehyde market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The anisic aldehyde market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the anisic aldehyde market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Purity, Application, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global anisic aldehyde market is estimated to grow annually at a CAGR of around 4.9% over the forecast period (2025-2032).

- In terms of revenue, the global anisic aldehyde market size was valued at around USD 203.63 Million in 2024 and is projected to reach USD 298.57 Million by 2032.

- The market is projected to grow at a significant rate due to Rising demand in fragrances, cosmetics, and flavoring applications, increasing use in personal care products, and growing adoption in food and beverage industries are fueling the global Anisic Aldehyde market.

- Based on the Purity, the ?99% segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Fragrances segment is anticipated to command the largest market share.

- In terms of End-User, the Personal Care segment is projected to lead the global market.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Anisic Aldehyde Market: Report Scope

This report thoroughly analyzes the anisic aldehyde market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Anisic Aldehyde Market |

| Market Size in 2024 | USD 203.63 Million |

| Market Forecast in 2032 | USD 298.57 Million |

| Growth Rate | CAGR of 4.9% |

| Number of Pages | 200 |

| Key Companies Covered | Solvay S.A., Merck KGaA, BASF SE, Lanxess AG, Symrise AG, Givaudan SA, International Flavors & Fragrances Inc., Takasago International Corporation, Vigon International Inc., Fleurchem Inc., Penta Manufacturing Company, Elan Chemical Company Inc., Aurochemicals |

| Segments Covered | By Purity, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Anisic Aldehyde Market: Dynamics

Key Growth Drivers :

The Anisic Aldehyde market is primarily driven by its widespread application as a key ingredient in the fragrance and flavor industries due to its sweet, floral (hawthorn-like), and vanilla notes. The continuous expansion of the personal care and cosmetics sector, including perfumes, soaps, lotions, and deodorants, directly fuels the demand for anisic aldehyde as a popular fragrance component. The food and beverage industry also utilizes it as a flavoring agent in confectionery, baked goods, beverages, and desserts, leveraging its pleasant aromatic profile. Furthermore, the pharmaceutical industry employs anisic aldehyde as an intermediate in the synthesis of various drugs and as a diagnostic reagent. Its use as an intermediate in the production of other specialty chemicals and polymers also contributes to its market expansion. The increasing consumer demand for diverse and sophisticated fragrances and flavors in everyday products acts as a significant catalyst.

Restraints :

Despite its aromatic appeal, the Anisic Aldehyde market faces several notable restraints. A primary challenge is the volatility of raw material prices, particularly for anisole, p-cresol, or other petrochemical precursors, which can directly impact the production costs of anisic aldehyde and affect pricing stability for manufacturers. The availability of natural alternatives and other synthetic aroma chemicals that offer similar olfactory profiles or specific functional advantages can create competitive pressure and limit market share growth. Furthermore, the stringent regulatory approvals and safety assessments required for ingredients used in food, fragrances, and pharmaceuticals across different regions can be time-consuming and costly, hindering market entry for new applications or manufacturers. The potential for allergic reactions or sensitivities in some individuals to specific aroma chemicals, though generally low with anisic aldehyde, can also pose a perception challenge in the personal care sector.

Opportunities :

The Anisic Aldehyde market presents several compelling opportunities for growth and innovation. The continuous research and development into new applications for anisic aldehyde, particularly in the emerging nutraceutical and functional food sectors, can expand its market footprint beyond traditional flavors and fragrances. The increasing demand for natural and bio-based ingredients, driven by consumer preference and clean-label trends, creates opportunities for the development of bio-based anisic aldehyde through sustainable synthesis routes. The expansion of personal care and food industries in rapidly developing economies, where millions are gaining access to modern consumer products, offers vast untapped market potential. Furthermore, the development of specialized grades of anisic aldehyde with enhanced purity, stability, or unique olfactive nuances can cater to high-end fragrance formulations or specific industrial requirements. The use of advanced analytical techniques for precise quality control and customization of aroma chemical blends also provides a competitive edge.

Challenges :

The Anisic Aldehyde market also confronts several critical challenges that demand continuous innovation and strategic adaptation. One key challenge is ensuring consistent product quality, purity, and sensory profile, which is paramount for its use in sensitive fragrance and flavor formulations where even minor variations can impact the final product. Managing the complex supply chain for its chemical precursors and maintaining intellectual property protection for synthesis routes are continuous concerns for manufacturers. The need to continuously innovate and differentiate anisic aldehyde products from a wide array of alternative aroma chemicals, often through superior sensory performance or environmental attributes, is essential to secure and expand market share. Furthermore, fierce competition among specialty chemical manufacturers, coupled with pressure to reduce costs, can exert downward pressure on pricing and profit margins, making cost efficiency and scale of production critical for market players. Adhering to evolving global chemical regulations and product safety standards for use in consumer products also remains an ongoing challenge.

Anisic Aldehyde Market: Segmentation Insights

The global anisic aldehyde market is segmented based on Purity, Application, End-User, and Region. All the segments of the anisic aldehyde market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Purity, the global anisic aldehyde market is divided into ?99%, <99%.

On the basis of Application, the global anisic aldehyde market is bifurcated into Fragrances, Pharmaceuticals, Food & Beverages, Cosmetics, Others.

In terms of End-User, the global anisic aldehyde market is categorized into Personal Care, Food & Beverage, Pharmaceutical, Others.

Anisic Aldehyde Market: Regional Insights

The Asia-Pacific region, led by China and India, dominates the global anisic aldehyde market. This leadership is driven by the region's massive and growing fragrance and flavor industry, which uses the compound as a key ingredient in perfumes, cosmetics, and food products. The presence of large-scale chemical manufacturing facilities, cost-competitive production, and strong domestic demand from consumer goods companies solidify Asia-Pacific's position as the largest producer and consumer.

Anisic Aldehyde Market: Competitive Landscape

The anisic aldehyde market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Anisic Aldehyde Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Solvay S.A.

- Merck KGaA

- BASF SE

- Lanxess AG

- Symrise AG

- Givaudan SA

- International Flavors & Fragrances Inc.

- Takasago International Corporation

- Vigon International Inc.

- Fleurchem Inc.

- Penta Manufacturing Company

- Elan Chemical Company Inc.

- Aurochemicals

The Global Anisic Aldehyde Market is Segmented as Follows:

By Purity

- ?99%

- <99%

By Application

- Fragrances

- Pharmaceuticals

- Food & Beverages

- Cosmetics

- Others

By End-User

- Personal Care

- Food & Beverage

- Pharmaceutical

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Anisic Aldehyde Market Share by Type (2020-2026) 1.5.2 Pharmaceutical Grade 1.5.3 Chemical Grade 1.6 Market by Application 1.6.1 Global Anisic Aldehyde Market Share by Application (2020-2026) 1.6.2 Synthetic Spices 1.6.3 Pharmaceutical Manufacturing 1.6.4 Other 1.7 Anisic Aldehyde Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Anisic Aldehyde Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Anisic Aldehyde Market 3.1 Value Chain Status 3.2 Anisic Aldehyde Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Anisic Aldehyde 3.2.3 Labor Cost of Anisic Aldehyde 3.2.3.1 Labor Cost of Anisic Aldehyde Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 LYS Chem 4.1.1 LYS Chem Basic Information 4.1.2 Anisic Aldehyde Product Profiles, Application and Specification 4.1.3 LYS Chem Anisic Aldehyde Market Performance (2015-2020) 4.1.4 LYS Chem Business Overview 4.2 Atul 4.2.1 Atul Basic Information 4.2.2 Anisic Aldehyde Product Profiles, Application and Specification 4.2.3 Atul Anisic Aldehyde Market Performance (2015-2020) 4.2.4 Atul Business Overview 4.3 Nandolia Chemical 4.3.1 Nandolia Chemical Basic Information 4.3.2 Anisic Aldehyde Product Profiles, Application and Specification 4.3.3 Nandolia Chemical Anisic Aldehyde Market Performance (2015-2020) 4.3.4 Nandolia Chemical Business Overview 4.4 Vigon 4.4.1 Vigon Basic Information 4.4.2 Anisic Aldehyde Product Profiles, Application and Specification 4.4.3 Vigon Anisic Aldehyde Market Performance (2015-2020) 4.4.4 Vigon Business Overview 4.5 Neshiel 4.5.1 Neshiel Basic Information 4.5.2 Anisic Aldehyde Product Profiles, Application and Specification 4.5.3 Neshiel Anisic Aldehyde Market Performance (2015-2020) 4.5.4 Neshiel Business Overview 4.6 Hanhong Chemical 4.6.1 Hanhong Chemical Basic Information 4.6.2 Anisic Aldehyde Product Profiles, Application and Specification 4.6.3 Hanhong Chemical Anisic Aldehyde Market Performance (2015-2020) 4.6.4 Hanhong Chemical Business Overview 4.7 Charkit 4.7.1 Charkit Basic Information 4.7.2 Anisic Aldehyde Product Profiles, Application and Specification 4.7.3 Charkit Anisic Aldehyde Market Performance (2015-2020) 4.7.4 Charkit Business Overview 4.8 BASF 4.8.1 BASF Basic Information 4.8.2 Anisic Aldehyde Product Profiles, Application and Specification 4.8.3 BASF Anisic Aldehyde Market Performance (2015-2020) 4.8.4 BASF Business Overview 5 Global Anisic Aldehyde Market Analysis by Regions 5.1 Global Anisic Aldehyde Sales, Revenue and Market Share by Regions 5.1.1 Global Anisic Aldehyde Sales by Regions (2015-2020) 5.1.2 Global Anisic Aldehyde Revenue by Regions (2015-2020) 5.2 North America Anisic Aldehyde Sales and Growth Rate (2015-2020) 5.3 Europe Anisic Aldehyde Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Anisic Aldehyde Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Anisic Aldehyde Sales and Growth Rate (2015-2020) 5.6 South America Anisic Aldehyde Sales and Growth Rate (2015-2020) 6 North America Anisic Aldehyde Market Analysis by Countries 6.1 North America Anisic Aldehyde Sales, Revenue and Market Share by Countries 6.1.1 North America Anisic Aldehyde Sales by Countries (2015-2020) 6.1.2 North America Anisic Aldehyde Revenue by Countries (2015-2020) 6.1.3 North America Anisic Aldehyde Market Under COVID-19 6.2 United States Anisic Aldehyde Sales and Growth Rate (2015-2020) 6.2.1 United States Anisic Aldehyde Market Under COVID-19 6.3 Canada Anisic Aldehyde Sales and Growth Rate (2015-2020) 6.4 Mexico Anisic Aldehyde Sales and Growth Rate (2015-2020) 7 Europe Anisic Aldehyde Market Analysis by Countries 7.1 Europe Anisic Aldehyde Sales, Revenue and Market Share by Countries 7.1.1 Europe Anisic Aldehyde Sales by Countries (2015-2020) 7.1.2 Europe Anisic Aldehyde Revenue by Countries (2015-2020) 7.1.3 Europe Anisic Aldehyde Market Under COVID-19 7.2 Germany Anisic Aldehyde Sales and Growth Rate (2015-2020) 7.2.1 Germany Anisic Aldehyde Market Under COVID-19 7.3 UK Anisic Aldehyde Sales and Growth Rate (2015-2020) 7.3.1 UK Anisic Aldehyde Market Under COVID-19 7.4 France Anisic Aldehyde Sales and Growth Rate (2015-2020) 7.4.1 France Anisic Aldehyde Market Under COVID-19 7.5 Italy Anisic Aldehyde Sales and Growth Rate (2015-2020) 7.5.1 Italy Anisic Aldehyde Market Under COVID-19 7.6 Spain Anisic Aldehyde Sales and Growth Rate (2015-2020) 7.6.1 Spain Anisic Aldehyde Market Under COVID-19 7.7 Russia Anisic Aldehyde Sales and Growth Rate (2015-2020) 7.7.1 Russia Anisic Aldehyde Market Under COVID-19 8 Asia-Pacific Anisic Aldehyde Market Analysis by Countries 8.1 Asia-Pacific Anisic Aldehyde Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Anisic Aldehyde Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Anisic Aldehyde Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Anisic Aldehyde Market Under COVID-19 8.2 China Anisic Aldehyde Sales and Growth Rate (2015-2020) 8.2.1 China Anisic Aldehyde Market Under COVID-19 8.3 Japan Anisic Aldehyde Sales and Growth Rate (2015-2020) 8.3.1 Japan Anisic Aldehyde Market Under COVID-19 8.4 South Korea Anisic Aldehyde Sales and Growth Rate (2015-2020) 8.4.1 South Korea Anisic Aldehyde Market Under COVID-19 8.5 Australia Anisic Aldehyde Sales and Growth Rate (2015-2020) 8.6 India Anisic Aldehyde Sales and Growth Rate (2015-2020) 8.6.1 India Anisic Aldehyde Market Under COVID-19 8.7 Southeast Asia Anisic Aldehyde Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Anisic Aldehyde Market Under COVID-19 9 Middle East and Africa Anisic Aldehyde Market Analysis by Countries 9.1 Middle East and Africa Anisic Aldehyde Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Anisic Aldehyde Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Anisic Aldehyde Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Anisic Aldehyde Market Under COVID-19 9.2 Saudi Arabia Anisic Aldehyde Sales and Growth Rate (2015-2020) 9.3 UAE Anisic Aldehyde Sales and Growth Rate (2015-2020) 9.4 Egypt Anisic Aldehyde Sales and Growth Rate (2015-2020) 9.5 Nigeria Anisic Aldehyde Sales and Growth Rate (2015-2020) 9.6 South Africa Anisic Aldehyde Sales and Growth Rate (2015-2020) 10 South America Anisic Aldehyde Market Analysis by Countries 10.1 South America Anisic Aldehyde Sales, Revenue and Market Share by Countries 10.1.1 South America Anisic Aldehyde Sales by Countries (2015-2020) 10.1.2 South America Anisic Aldehyde Revenue by Countries (2015-2020) 10.1.3 South America Anisic Aldehyde Market Under COVID-19 10.2 Brazil Anisic Aldehyde Sales and Growth Rate (2015-2020) 10.2.1 Brazil Anisic Aldehyde Market Under COVID-19 10.3 Argentina Anisic Aldehyde Sales and Growth Rate (2015-2020) 10.4 Columbia Anisic Aldehyde Sales and Growth Rate (2015-2020) 10.5 Chile Anisic Aldehyde Sales and Growth Rate (2015-2020) 11 Global Anisic Aldehyde Market Segment by Types 11.1 Global Anisic Aldehyde Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Anisic Aldehyde Sales and Market Share by Types (2015-2020) 11.1.2 Global Anisic Aldehyde Revenue and Market Share by Types (2015-2020) 11.2 Pharmaceutical Grade Sales and Price (2015-2020) 11.3 Chemical Grade Sales and Price (2015-2020) 12 Global Anisic Aldehyde Market Segment by Applications 12.1 Global Anisic Aldehyde Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Anisic Aldehyde Sales and Market Share by Applications (2015-2020) 12.1.2 Global Anisic Aldehyde Revenue and Market Share by Applications (2015-2020) 12.2 Synthetic Spices Sales, Revenue and Growth Rate (2015-2020) 12.3 Pharmaceutical Manufacturing Sales, Revenue and Growth Rate (2015-2020) 12.4 Other Sales, Revenue and Growth Rate (2015-2020) 13 Anisic Aldehyde Market Forecast by Regions (2020-2026) 13.1 Global Anisic Aldehyde Sales, Revenue and Growth Rate (2020-2026) 13.2 Anisic Aldehyde Market Forecast by Regions (2020-2026) 13.2.1 North America Anisic Aldehyde Market Forecast (2020-2026) 13.2.2 Europe Anisic Aldehyde Market Forecast (2020-2026) 13.2.3 Asia-Pacific Anisic Aldehyde Market Forecast (2020-2026) 13.2.4 Middle East and Africa Anisic Aldehyde Market Forecast (2020-2026) 13.2.5 South America Anisic Aldehyde Market Forecast (2020-2026) 13.3 Anisic Aldehyde Market Forecast by Types (2020-2026) 13.4 Anisic Aldehyde Market Forecast by Applications (2020-2026) 13.5 Anisic Aldehyde Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Anisic Aldehyde

Request Sample

Anisic Aldehyde