Antibody Market Size, Share, and Trends Analysis Report

CAGR :

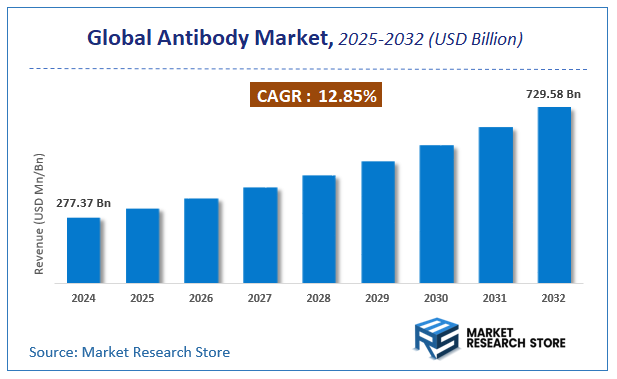

| Market Size 2024 (Base Year) | USD 277.37 Billion |

| Market Size 2032 (Forecast Year) | USD 729.58 Billion |

| CAGR | 12.85% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global antibody market, estimating its value at USD 277.37 Billion in 2024, with projections indicating it will reach USD 729.58 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 12.85% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the antibody industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Antibody Market: Overview

The growth of the antibody market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The antibody market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the antibody market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Disease Indication, Product Type, End User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global antibody market is estimated to grow annually at a CAGR of around 12.85% over the forecast period (2025-2032).

- In terms of revenue, the global antibody market size was valued at around USD 277.37 Billion in 2024 and is projected to reach USD 729.58 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing use of antibodies in diagnostics and therapeutics, increasing prevalence of infectious and chronic diseases, and rising biopharmaceutical R&D are fueling the global Antibody market.

- Based on the Disease Indication, the Cardiovascular Diseases segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Product Type, the Monoclonal Antibodies segment is anticipated to command the largest market share.

- In terms of End User, the Hospitals segment is projected to lead the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Antibody Market: Report Scope

This report thoroughly analyzes the antibody market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Antibody Market |

| Market Size in 2024 | USD 277.37 Billion |

| Market Forecast in 2032 | USD 729.58 Billion |

| Growth Rate | CAGR of 12.85% |

| Number of Pages | 220 |

| Key Companies Covered | Novartis AG, F. Hoffmann-La Roche AG, Johnson & Johnson, Takeda Pharmaceutical Company Limited, Amgen Inc. |

| Segments Covered | By Disease Indication, By Product Type, By End User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Antibody Market: Dynamics

Key Growth Drivers :

The Antibody market is experiencing robust and accelerated growth, primarily propelled by the increasing prevalence of chronic and infectious diseases, particularly cancer and autoimmune disorders. Antibodies, especially monoclonal antibodies (mAbs), have revolutionized therapeutics by offering highly specific and effective treatments with fewer side effects compared to traditional drugs. The continuous advancements in biotechnology and genetic engineering, enabling the development of novel antibody formats (e.g., bispecific antibodies, antibody-drug conjugates, biosimilars), significantly expand their therapeutic applications. Furthermore, the rising investment in research and development by pharmaceutical and biotechnology companies, coupled with supportive government funding for precision medicine and immunotherapy, fuels the discovery and commercialization of new antibody-based drugs. The growing demand for advanced diagnostic tools also contributes to market expansion, as antibodies are crucial reagents in various diagnostic assays.

Restraints :

Despite the compelling growth drivers, the Antibody market faces several notable restraints. A significant challenge is the extremely high cost associated with the research, development, clinical trials, and manufacturing of antibody therapeutics. This substantial investment translates into very high prices for antibody drugs, limiting patient access in some regions and putting pressure on healthcare systems. The complex and time-consuming regulatory approval processes for new antibody drugs, particularly for biosimilars, can extend market entry timelines and increase development costs. Furthermore, the potential for immunogenicity (the body developing an immune response against the therapeutic antibody) remains a concern, which can reduce drug efficacy or cause adverse reactions. The highly specialized manufacturing processes for antibodies, involving cell culture and purification, are complex and costly, requiring significant infrastructure and expertise, which can limit scalability and flexibility in production.

Opportunities :

The Antibody market is brimming with numerous opportunities for innovation and expansion. The ongoing advancements in antibody engineering, including the development of next-generation antibodies with improved specificity, reduced immunogenicity, and enhanced effector functions, promise to unlock new therapeutic frontiers. The increasing focus on personalized medicine and companion diagnostics offers significant opportunities, as antibodies can be tailored to specific patient populations or used to guide treatment decisions. The growing market for biosimilar antibodies, which offer cost-effective alternatives to originator biologics, is expanding patient access and driving market growth, particularly in emerging economies. Furthermore, the application of artificial intelligence (AI) and machine learning (ML) in antibody discovery and optimization promises to accelerate the drug development process and identify novel targets. Expanding antibody applications beyond traditional therapeutics into areas like diagnostics, drug delivery vehicles, and even agricultural uses (e.g., disease resistance in crops) also presents significant untapped market potential.

Challenges :

The Antibody market also confronts several critical challenges that demand continuous innovation and strategic adaptation. One key challenge is managing the intellectual property landscape, which is complex and highly competitive, with numerous patents covering antibody sequences, formulations, and manufacturing processes. The high manufacturing costs and complexities, particularly for large-scale production, require continuous efforts to optimize upstream and downstream processes to improve efficiency and reduce expenses. Ensuring equitable global access to expensive antibody therapies, especially in low- and middle-income countries, remains a significant societal and market challenge. Furthermore, the intense competition within the biopharmaceutical sector, coupled with the "patent cliff" phenomenon (where key antibody drug patents expire), drives the need for continuous R&D investment to maintain market leadership and introduce novel, differentiated products. Addressing these challenges through technological innovation, strategic partnerships, and sustainable pricing models will be crucial for the continued growth and impact of the antibody market.

Antibody Market: Segmentation Insights

The global antibody market is segmented based on Disease Indication, Product Type, End User, and Region. All the segments of the antibody market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Disease Indication, the global antibody market is divided into Cardiovascular Diseases, CNS Disorders, Cancer, Autoimmune Disorders, Other Disease Indications.

On the basis of Product Type, the global antibody market is bifurcated into Monoclonal Antibodies, Polyclonal Antibodies, Antibody-drug Complexes.

In terms of End User, the global antibody market is categorized into Hospitals, Long-term Care Facilities, Research Institutes, Other.

Antibody Market: Regional Insights

North America, led by the United States, dominates the global antibody market. This leadership is driven by a robust biotechnology and pharmaceutical sector, substantial government and private funding for life sciences research, and a high adoption rate of advanced therapeutics like monoclonal antibodies. The region's strong intellectual property laws, concentration of leading research institutions, and high healthcare expenditure further solidify its position as the largest and most innovative market for both research and therapeutic antibodies.

Antibody Market: Competitive Landscape

The antibody market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Antibody Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Novartis AG

- F. Hoffmann-La Roche AG

- Johnson & Johnson

- Takeda Pharmaceutical Company Limited

- Amgen Inc.

The Global Antibody Market is Segmented as Follows:

By Disease Indication

- Cardiovascular Diseases

- CNS Disorders

- Cancer

- Autoimmune Disorders

- Other Disease Indications

By Product Type

- Monoclonal Antibodies

- Polyclonal Antibodies

- Antibody-drug Complexes

By End User

- Hospitals

- Long-term Care Facilities

- Research Institutes

- Other

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Antibody Market Share by Type (2020-2026) 1.5.2 Monoclonal Antibodies 1.5.3 Polyclonal Antibodies 1.5.4 Antibody-drug Complexes (ADCs) 1.6 Market by Application 1.6.1 Global Antibody Market Share by Application (2020-2026) 1.6.2 Therapeutic 1.6.3 Research 1.6.4 Diagnostic 1.7 Antibody Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Antibody Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Antibody Market 3.1 Value Chain Status 3.2 Antibody Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Antibody 3.2.3 Labor Cost of Antibody 3.2.3.1 Labor Cost of Antibody Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Sigma-Aldrich Corporation (Germany) 4.1.1 Sigma-Aldrich Corporation (Germany) Basic Information 4.1.2 Antibody Product Profiles, Application and Specification 4.1.3 Sigma-Aldrich Corporation (Germany) Antibody Market Performance (2015-2020) 4.1.4 Sigma-Aldrich Corporation (Germany) Business Overview 4.2 Pall Corporation (U.S.) 4.2.1 Pall Corporation (U.S.) Basic Information 4.2.2 Antibody Product Profiles, Application and Specification 4.2.3 Pall Corporation (U.S.) Antibody Market Performance (2015-2020) 4.2.4 Pall Corporation (U.S.) Business Overview 4.3 INTEGRA Biosciences AG (Switzerland) 4.3.1 INTEGRA Biosciences AG (Switzerland) Basic Information 4.3.2 Antibody Product Profiles, Application and Specification 4.3.3 INTEGRA Biosciences AG (Switzerland) Antibody Market Performance (2015-2020) 4.3.4 INTEGRA Biosciences AG (Switzerland) Business Overview 4.4 GE Healthcare (U.S.) 4.4.1 GE Healthcare (U.S.) Basic Information 4.4.2 Antibody Product Profiles, Application and Specification 4.4.3 GE Healthcare (U.S.) Antibody Market Performance (2015-2020) 4.4.4 GE Healthcare (U.S.) Business Overview 4.5 FiberCell Systems Inc. (U.S.) 4.5.1 FiberCell Systems Inc. (U.S.) Basic Information 4.5.2 Antibody Product Profiles, Application and Specification 4.5.3 FiberCell Systems Inc. (U.S.) Antibody Market Performance (2015-2020) 4.5.4 FiberCell Systems Inc. (U.S.) Business Overview 4.6 Thermo Fisher Scientific, Inc. (U.S.) 4.6.1 Thermo Fisher Scientific, Inc. (U.S.) Basic Information 4.6.2 Antibody Product Profiles, Application and Specification 4.6.3 Thermo Fisher Scientific, Inc. (U.S.) Antibody Market Performance (2015-2020) 4.6.4 Thermo Fisher Scientific, Inc. (U.S.) Business Overview 4.7 Cellab GmbH (Germany) 4.7.1 Cellab GmbH (Germany) Basic Information 4.7.2 Antibody Product Profiles, Application and Specification 4.7.3 Cellab GmbH (Germany) Antibody Market Performance (2015-2020) 4.7.4 Cellab GmbH (Germany) Business Overview 4.8 Merck KGaA (Germany) 4.8.1 Merck KGaA (Germany) Basic Information 4.8.2 Antibody Product Profiles, Application and Specification 4.8.3 Merck KGaA (Germany) Antibody Market Performance (2015-2020) 4.8.4 Merck KGaA (Germany) Business Overview 4.9 Sartorius AG (Germany) 4.9.1 Sartorius AG (Germany) Basic Information 4.9.2 Antibody Product Profiles, Application and Specification 4.9.3 Sartorius AG (Germany) Antibody Market Performance (2015-2020) 4.9.4 Sartorius AG (Germany) Business Overview 4.10 Eppendorf AG (Germany) 4.10.1 Eppendorf AG (Germany) Basic Information 4.10.2 Antibody Product Profiles, Application and Specification 4.10.3 Eppendorf AG (Germany) Antibody Market Performance (2015-2020) 4.10.4 Eppendorf AG (Germany) Business Overview 5 Global Antibody Market Analysis by Regions 5.1 Global Antibody Sales, Revenue and Market Share by Regions 5.1.1 Global Antibody Sales by Regions (2015-2020) 5.1.2 Global Antibody Revenue by Regions (2015-2020) 5.2 North America Antibody Sales and Growth Rate (2015-2020) 5.3 Europe Antibody Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Antibody Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Antibody Sales and Growth Rate (2015-2020) 5.6 South America Antibody Sales and Growth Rate (2015-2020) 6 North America Antibody Market Analysis by Countries 6.1 North America Antibody Sales, Revenue and Market Share by Countries 6.1.1 North America Antibody Sales by Countries (2015-2020) 6.1.2 North America Antibody Revenue by Countries (2015-2020) 6.1.3 North America Antibody Market Under COVID-19 6.2 United States Antibody Sales and Growth Rate (2015-2020) 6.2.1 United States Antibody Market Under COVID-19 6.3 Canada Antibody Sales and Growth Rate (2015-2020) 6.4 Mexico Antibody Sales and Growth Rate (2015-2020) 7 Europe Antibody Market Analysis by Countries 7.1 Europe Antibody Sales, Revenue and Market Share by Countries 7.1.1 Europe Antibody Sales by Countries (2015-2020) 7.1.2 Europe Antibody Revenue by Countries (2015-2020) 7.1.3 Europe Antibody Market Under COVID-19 7.2 Germany Antibody Sales and Growth Rate (2015-2020) 7.2.1 Germany Antibody Market Under COVID-19 7.3 UK Antibody Sales and Growth Rate (2015-2020) 7.3.1 UK Antibody Market Under COVID-19 7.4 France Antibody Sales and Growth Rate (2015-2020) 7.4.1 France Antibody Market Under COVID-19 7.5 Italy Antibody Sales and Growth Rate (2015-2020) 7.5.1 Italy Antibody Market Under COVID-19 7.6 Spain Antibody Sales and Growth Rate (2015-2020) 7.6.1 Spain Antibody Market Under COVID-19 7.7 Russia Antibody Sales and Growth Rate (2015-2020) 7.7.1 Russia Antibody Market Under COVID-19 8 Asia-Pacific Antibody Market Analysis by Countries 8.1 Asia-Pacific Antibody Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Antibody Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Antibody Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Antibody Market Under COVID-19 8.2 China Antibody Sales and Growth Rate (2015-2020) 8.2.1 China Antibody Market Under COVID-19 8.3 Japan Antibody Sales and Growth Rate (2015-2020) 8.3.1 Japan Antibody Market Under COVID-19 8.4 South Korea Antibody Sales and Growth Rate (2015-2020) 8.4.1 South Korea Antibody Market Under COVID-19 8.5 Australia Antibody Sales and Growth Rate (2015-2020) 8.6 India Antibody Sales and Growth Rate (2015-2020) 8.6.1 India Antibody Market Under COVID-19 8.7 Southeast Asia Antibody Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Antibody Market Under COVID-19 9 Middle East and Africa Antibody Market Analysis by Countries 9.1 Middle East and Africa Antibody Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Antibody Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Antibody Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Antibody Market Under COVID-19 9.2 Saudi Arabia Antibody Sales and Growth Rate (2015-2020) 9.3 UAE Antibody Sales and Growth Rate (2015-2020) 9.4 Egypt Antibody Sales and Growth Rate (2015-2020) 9.5 Nigeria Antibody Sales and Growth Rate (2015-2020) 9.6 South Africa Antibody Sales and Growth Rate (2015-2020) 10 South America Antibody Market Analysis by Countries 10.1 South America Antibody Sales, Revenue and Market Share by Countries 10.1.1 South America Antibody Sales by Countries (2015-2020) 10.1.2 South America Antibody Revenue by Countries (2015-2020) 10.1.3 South America Antibody Market Under COVID-19 10.2 Brazil Antibody Sales and Growth Rate (2015-2020) 10.2.1 Brazil Antibody Market Under COVID-19 10.3 Argentina Antibody Sales and Growth Rate (2015-2020) 10.4 Columbia Antibody Sales and Growth Rate (2015-2020) 10.5 Chile Antibody Sales and Growth Rate (2015-2020) 11 Global Antibody Market Segment by Types 11.1 Global Antibody Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Antibody Sales and Market Share by Types (2015-2020) 11.1.2 Global Antibody Revenue and Market Share by Types (2015-2020) 11.2 Monoclonal Antibodies Sales and Price (2015-2020) 11.3 Polyclonal Antibodies Sales and Price (2015-2020) 11.4 Antibody-drug Complexes (ADCs) Sales and Price (2015-2020) 12 Global Antibody Market Segment by Applications 12.1 Global Antibody Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Antibody Sales and Market Share by Applications (2015-2020) 12.1.2 Global Antibody Revenue and Market Share by Applications (2015-2020) 12.2 Therapeutic Sales, Revenue and Growth Rate (2015-2020) 12.3 Research Sales, Revenue and Growth Rate (2015-2020) 12.4 Diagnostic Sales, Revenue and Growth Rate (2015-2020) 13 Antibody Market Forecast by Regions (2020-2026) 13.1 Global Antibody Sales, Revenue and Growth Rate (2020-2026) 13.2 Antibody Market Forecast by Regions (2020-2026) 13.2.1 North America Antibody Market Forecast (2020-2026) 13.2.2 Europe Antibody Market Forecast (2020-2026) 13.2.3 Asia-Pacific Antibody Market Forecast (2020-2026) 13.2.4 Middle East and Africa Antibody Market Forecast (2020-2026) 13.2.5 South America Antibody Market Forecast (2020-2026) 13.3 Antibody Market Forecast by Types (2020-2026) 13.4 Antibody Market Forecast by Applications (2020-2026) 13.5 Antibody Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Antibody

Request Sample

Antibody