Baby Diapers Market Size, Share, and Trends Analysis Report

CAGR :

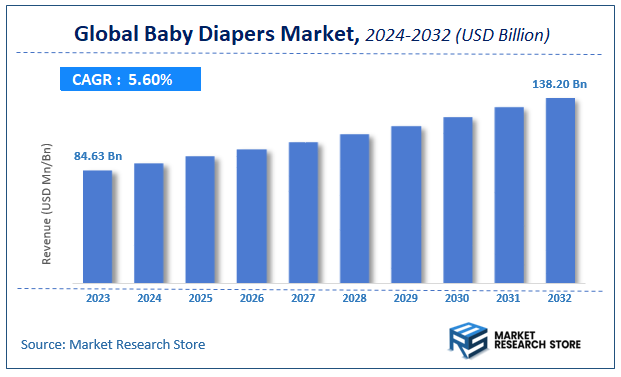

| Market Size 2023 (Base Year) | USD 84.63 Billion |

| Market Size 2032 (Forecast Year) | USD 138.20 Billion |

| CAGR | 5.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Baby Diapers Market Insights

According to Market Research Store, the global baby diapers market size was valued at around USD 84.63 billion in 2023 and is estimated to reach USD 138.20 billion by 2032, to register a CAGR of approximately 5.6% in terms of revenue during the forecast period 2024-2032.

The baby diapers report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Baby Diapers Market: Overview

Baby diapers are absorbent garments worn by infants and toddlers to contain urine and feces, providing hygiene, convenience, and comfort for both babies and caregivers. Typically made from a combination of nonwoven fabric, absorbent polymers like sodium polyacrylate, and breathable outer layers, baby diapers are designed to keep a baby’s skin dry while minimizing leaks and preventing diaper rash. Available in both disposable and cloth forms, modern diapers often feature elastic waistbands, adhesive fasteners or hook-and-loop closures, and wetness indicators to enhance usability and fit.

The baby diapers market is expanding steadily, driven by rising birth rates in developing regions, increasing urbanization, and improving hygiene awareness. Growth is further supported by product innovations such as biodegradable and eco-friendly diapers, thinner cores with better absorbency, and smart diapers that detect moisture or urinary infections.

Key Highlights

- The baby diapers market is anticipated to grow at a CAGR of 5.6% during the forecast period.

- The global baby diapers market was estimated to be worth approximately USD 84.63 billion in 2023 and is projected to reach a value of USD 138.20 billion by 2032.

- The growth of the baby diapers market is being driven by increasing birth rates in developing countries, rising awareness of infant hygiene, and growing consumer preference for high-performance, convenient diapering solutions.

- Based on the product, the non-disposable diapers segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the open baby diapers segment is projected to swipe the largest market share.

- By size, the large size baby diapers segment dominated the market with a share of over 40.9% in 2024

- In terms of distribution channel, the supermarkets & hypermarkets segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Baby Diapers Market: Dynamics

Key Growth Drivers:

- Rising Awareness of Infant Hygiene and Health

Parents globally are increasingly conscious of the importance of maintaining proper hygiene for their babies to prevent skin irritations, rashes, and infections. This heightened awareness drives the adoption of convenient and absorbent disposable diapers, which are perceived as more hygienic than traditional cloth options.

- Increasing Number of Working Women and Urbanization

The growing participation of women in the workforce, particularly in urban areas, has led to a higher demand for convenient and time-saving baby care solutions. Disposable diapers offer ease of use and reduce the time and effort required for cleaning and maintenance, making them an essential product for busy working parents.

- Growing Disposable Incomes in Emerging Economies

Rising disposable incomes, especially in developing countries, enable parents to afford premium baby care products, including disposable diapers. As economic conditions improve, families are more willing to invest in convenient and high-quality products for their infants, driving market expansion.

Restraints:

- Environmental Concerns and Waste Disposal Issues

Disposable diapers contribute significantly to landfill waste, as they are largely non-biodegradable and contain synthetic materials. Growing environmental awareness among consumers and stringent single-use plastic regulations in some regions are leading to concerns about the ecological impact of disposable diapers, posing a significant restraint on market growth.

- High Cost of Disposable Diapers

Compared to traditional cloth diapers, disposable diapers are a recurring expense, which can be a financial burden for low-income households, particularly in developing countries. This price sensitivity can limit penetration in price-conscious segments of the market.

Opportunities:

- Rise of Eco-friendly and Sustainable Diaper Options

The increasing environmental consciousness creates a substantial opportunity for the development and adoption of biodegradable, compostable, and plant-based disposable diapers, as well as improved, more convenient reusable cloth diapers. Manufacturers investing in sustainable materials and production processes can gain a competitive edge.

- Growth of E-commerce and Online Retail

The expanding e-commerce sector provides a convenient and accessible platform for parents to purchase diapers, offering a wide selection, detailed product information, subscription services, and competitive pricing. This channel is particularly effective in reaching a wider customer base, including those in remote areas.

Challenges:

- Intense Competition and Price Wars

The baby diapers market is highly competitive, dominated by a few large multinational players and a growing number of local and private-label brands. This fierce competition often leads to price wars and aggressive marketing strategies, which can squeeze profit margins for manufacturers.

- Managing Raw Material Price Volatility

The production of disposable diapers relies heavily on raw materials like wood pulp, super-absorbent polymers (SAPs), and non-woven fabrics, whose prices can fluctuate due to global supply chain disruptions or commodity market dynamics. Managing these volatile raw material costs while maintaining product quality and competitive pricing is a constant challenge.

Baby Diapers Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Baby Diapers Market |

| Market Size in 2023 | USD 84.63 Billion |

| Market Forecast in 2032 | USD 138.20 Billion |

| Growth Rate | CAGR of 5.6% |

| Number of Pages | 145 |

| Key Companies Covered | Unicharm, SCA Hygiene, Procter & Gamble, Bumkins, KAO Corporation, Kimberly-Clark, Hengan and Diapees and Wipees |

| Segments Covered | By Product Type, By Distribution Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Baby Diapers Market: Segmentation Insights

The global baby diapers market is divided by product, application, distribution channel, and region.

Based on product, the global baby diapers market is divided into non-disposable diapers and disposable diapers. Non-Disposable Diapers segment dominates the baby diapers market due to growing environmental concerns and increasing parental preference for sustainable and reusable diapering options. These cloth-based or washable diapers are made from cotton, bamboo, or microfiber fabrics that are gentle on a baby's skin, reduce the risk of rashes, and offer long-term cost savings. The increasing awareness about the ecological impact of single-use diapers such as landfill burden and slow degradation has driven many consumers to adopt non-disposable alternatives. Government and NGO campaigns promoting eco-friendly baby care, as well as innovations like pre-folded and all-in-one cloth diapers with leak-resistant designs, are further propelling this segment’s expansion.

On the basis of application, the global baby diapers market is bifurcated into open diapers and closed diapers. Open Diapers segment dominates the baby diapers market due to their widespread use, ease of application, and high demand across both developing and developed regions. Open diapers, commonly known as taped or fastenable diapers, offer adjustable fits for babies of various sizes, ensuring comfort and leakage protection. These are widely preferred for newborns and infants who require frequent diaper changes, as they allow easy removal without the need to undress the baby completely. Manufacturers continue to enhance this product type with ultra-absorbent cores, skin-friendly liners, and breathable back sheets. The open diaper format is often the default choice in hospitals and by caregivers due to its adaptability and proven reliability.

By size, the global baby diapers market is split into new born, small, medium, large, and extra-large. In 2024, large-size baby diapers held a significant market share of approximately 40.9%. Designed for older infants and toddlers, these diapers provide better value per unit, appealing to cost-conscious parents seeking to minimize frequent purchases. As babies grow, the need for diaper changes decreases, making larger sizes a practical choice for extended wear and reduced replacement frequency. The trend toward bulk buying for greater convenience and savings is further fueled by busy parents prioritizing efficiency. Meanwhile, medium-size baby diapers are projected to grow at a compound annual growth rate (CAGR) of 8.9% from 2024 to 2032. This growth is driven by their relevance during the transitional phase between newborn and toddler stages, where infants experience variable growth rates, making medium sizes an essential option for parents.

In terms of distribution channel, the global baby diapers market is divided into supermarkets & hypermarkets, pharmacies & drug stores, specialty stores, online, and others. Supermarkets & Hypermarkets dominate the baby diapers distribution channel due to their widespread accessibility, expansive product variety, and consumer preference for in-person selection. These retail formats offer an extensive assortment of baby diaper brands, sizes, and promotional packages all in one place, making them a one-stop solution for busy parents. The availability of private-label diapers alongside global brands provides pricing flexibility, and physical visibility allows parents to evaluate the quality and quantity of diapers firsthand. Supermarkets and hypermarkets also frequently offer bulk discounts and promotional deals, further driving their dominance in this segment.

Baby Diapers Market: Regional Insights

- North America is expected to dominates the global market

North America dominates the global baby diapers market due to high product penetration, premium brand availability, and strong consumer purchasing power. The United States leads in both volume and value sales, driven by well-established retail infrastructure and widespread use of disposable and eco-friendly diapers. Parents in the region show a strong preference for high-absorbency, hypoallergenic, and biodegradable options, leading to increased demand for premium and organic diaper variants. Technological innovations, such as smart diapers with moisture indicators and improved fit, also contribute to market growth.

Asia-Pacific is the fastest-growing region in the baby diapers market due to a large infant population and increasing urbanization. Countries like China, India, Indonesia, and Japan are the major contributors, with growing middle-class incomes and expanding awareness of hygiene and baby care practices. The demand for disposable diapers is surging as parents shift from traditional cloth options to more convenient and hygienic alternatives. In Japan and South Korea, innovation and premium quality drive sales, while in emerging markets like India and Indonesia, affordability and distribution reach are critical success factors. E-commerce penetration and rural outreach programs are also accelerating market access.

Europe represents a significant share of the baby diapers market, supported by countries such as Germany, France, the UK, and Italy. The region is characterized by increasing demand for sustainable and biodegradable diaper products, aligning with environmental regulations and consumer preference for eco-friendly options. The market benefits from high parental awareness, strong healthcare systems, and advanced retail distribution. Manufacturers focus on product innovations such as breathable materials, organic cotton linings, and chemical-free designs.

Latin America presents a growing baby diapers market, with Brazil and Mexico leading in consumption. Urbanization, rising disposable incomes, and increasing awareness of hygiene are key drivers. The market is gradually moving from cloth diapers to disposables, with a rising demand for cost-effective yet high-quality products. While, Middle East & Africa region is witnessing gradual growth in the baby diapers market, fueled by rising birth rates, urban development, and improving economic conditions. Countries such as South Africa, Saudi Arabia, and the UAE are key contributors. The increasing participation of women in the workforce and growing awareness of baby hygiene are supporting the adoption of disposable diapers.

Baby Diapers Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the baby diapers market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global baby diapers market include:

- The Procter & Gamble Company (P&G)

- Kimberly-Clark Corporation

- Hengan International

- Unicharm Corporation

- Johnson & Johnson

- First Quality Enterprises

- Ontex Group

- The Hain Celestial Group, Inc.

- The Honest Company, Inc.

- Essity AB

- SCA Hygiene

- Bumkins

- KAO Corporation

- Hengan

- Wipees

The global baby diapers market is segmented as follows:

By Product

- Non-Disposable Diapers

- Disposable Diapers

By Application

- Open Diapers

- Closed Diapers

By Size

- New Born

- Small

- Medium

- Large

- Extra Large

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacies & Drug Stores

- Specialty Stores

- Online

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global market revenue, 2015 - 2021(USD Million)

- 2.2. Global baby diapers market: Snapshot

- Chapter 3. Baby diapers Market – Global and Industry Analysis

- 3.1. Baby diapers: Market dynamics

- 3.2. Market drivers

- 3.2.1. Drivers of global baby diapers market: Impact analysis

- 3.2.2. Surging number of new born in the developing countries

- 3.2.3. Increasing disposable and dual household income

- 3.2.4. Growing literacy rate of women

- 3.3. Market restraints

- 3.3.1. Restraints of global baby diapers market: Impact analysis

- 3.3.2. Dropping birth rate in the developed countries

- 3.4. Opportunities

- 3.4.1. Growing demand from emerging countries

- 3.4.2. Increasing demand for technical advancement

- 3.5. Porter’s five forces analysis

- 3.6. Market Attractiveness Analysis

- 3.6.1. Market attractiveness analysis by type segment

- 3.6.2. Market attractiveness analysis by applications segment

- 3.6.3. Market attractiveness analysis by regional segment

- Chapter 4. Global Baby Diapers Market - Competitive Landscape

- 4.1. Company market share, 2015

- 4.1.1. Global baby diapers market : company market share, 2015

- 4.2. Strategic Development

- 4.2.1. Acquisitions & Mergers

- 4.2.2. New Type Launch

- 4.2.3. Agreements, Partnerships, Collaborations and Joint Ventures

- 4.2.4. Research and Development, Type and Regional Expansion

- 4.3. Type Portfolio

- 4.4. Price trend analysis

- 4.5. Patent Analysis (2011-2016)

- 4.5.1. Patent Trend

- 4.5.2. Patent Share by company

- 4.5.3. By Region

- 4.1. Company market share, 2015

- Chapter 5. Global Baby diapers Market – Type Segment Analysis

- 5.1. Global baby diapers market: type overview

- 5.1.1. Global baby diapers market revenue share, by type, 2015 - 2021

- 5.2. Biodegradable diapers

- 5.2.1. Global biodegradable diapers market, 2015 – 2021 (USD Million)

- 5.3. Training nappy

- 5.3.1. Global training nappy market, 2015 – 2021 (USD Million)

- 5.4. Cloth diapers

- 5.4.1. Global cloth diapers market, 2015 – 2021 (USD Million)

- 5.5. Swim pants

- 5.5.1. Global swim pants market, 2015 – 2021 (USD Million)

- 5.6. Disposable diapers

- 5.6.1. Global disposable diapers market, 2015 – 2021 (USD Million)

- 5.1. Global baby diapers market: type overview

- Chapter 6. Global Baby diapers market – Regional Segment Analysis

- 6.1. Global baby diapers market: Regional overview

- 6.1.1. Global baby diapers market revenue share by region, 2015 - 2021

- 6.2. North America

- 6.2.1. North America baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.2.2. U.S.

- 6.2.2.1. U.S. baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.3. Europe

- 6.3.1. Europe baby diapers market revenue, by a type, 2015 – 2021 (USD Million)

- 6.3.2. Germany

- 6.3.2.1. Germany baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.3.3. France

- 6.3.3.1. France baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.3.4. UK

- 6.3.4.1. UK baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Asia Pacific baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.4.2. China

- 6.4.2.1. China baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.4.3. Japan

- 6.4.3.1. Japan baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.4.4. India

- 6.4.4.1. India baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.5. Latin America

- 6.5.1. Latin America baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.5.2. Brazil

- 6.5.2.1. Brazil baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.6. Middle East and Africa

- 6.6.1. Middle East and Africa baby diapers market revenue, by type, 2015 – 2021 (USD Million)

- 6.1. Global baby diapers market: Regional overview

- Chapter 7. Company Profile

- 7.1. Unicharm

- 7.1.1. Overview

- 7.1.2. Financials

- 7.1.3. Product portfolio

- 7.1.4. Business strategy

- 7.1.5. Recent developments

- 7.2. SCA Hygiene

- 7.2.1. Overview

- 7.2.2. Financials

- 7.2.3. Product portfolio

- 7.2.4. Business strategy

- 7.2.5. Recent developments

- 7.3. Procter & Gamble

- 7.3.1. Overview

- 7.3.2. Financials

- 7.3.3. Product portfolio

- 7.3.4. Business strategy

- 7.3.5. Recent developments

- 7.4. Bumkins

- 7.4.1. Overview

- 7.4.2. Financials

- 7.4.3. Product portfolio

- 7.4.4. Business strategy

- 7.4.5. Recent developments

- 7.5. KAO Corporation

- 7.5.1. Overview

- 7.5.2. Financials

- 7.5.3. Product portfolio

- 7.5.4. Business strategy

- 7.5.5. Recent developments

- 7.6. Kimberly-Clark

- 7.6.1. Overview

- 7.6.2. Financials

- 7.6.3. Product portfolio

- 7.6.4. Business strategy

- 7.6.5. Recent developments

- 7.7. Hengan

- 7.7.1. Overview

- 7.7.2. Financials

- 7.7.3. Product portfolio

- 7.7.4. Business strategy

- 7.7.5. Recent developments

- 7.8. Diapees and Wipees

- 7.8.1. Overview

- 7.8.2. Financials

- 7.8.3. Product portfolio

- 7.8.4. Business strategy

- 7.8.5. Recent developments

- 7.1. Unicharm

- Chapter 8. Patents

- 8.1. U.S. (US Patents)

- 8.2. Europe (EP documents)

- 8.3. Japan (Abstracts of Japan)

- 8.4. Global (WIPO (PCT))

Inquiry For Buying

Baby Diapers

Request Sample

Baby Diapers