Butter and Margarine Market Size, Share, and Trends Analysis Report

CAGR :

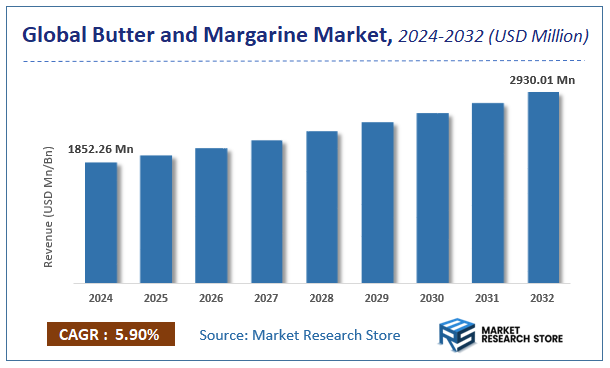

| Market Size 2024 (Base Year) | USD 1852.26 Million |

| Market Size 2032 (Forecast Year) | USD 2930.01 Million |

| CAGR | 5.9% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global butter and margarine market, estimating its value at USD 1852.26 Million in 2024, with projections indicating it will reach USD 2930.01 Million by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 5.9% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the butter and margarine industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Butter and Margarine Market: Overview

The growth of the butter and margarine market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The butter and margarine market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the butter and margarine market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Product Type, Source, Form, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global butter and margarine market is estimated to grow annually at a CAGR of around 5.9% over the forecast period (2025-2032).

- In terms of revenue, the global butter and margarine market size was valued at around USD 1852.26 Million in 2024 and is projected to reach USD 2930.01 Million by 2032.

- The market is projected to grow at a significant rate due to rising demand for bakery and home cooking ingredients.

- Based on the Product Type, the Butter segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Source, the Dairy segment is anticipated to command the largest market share.

- In terms of Form, the Solid segment is projected to lead the global market.

- By End-User, the Household segment is predicted to dominate the global market.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Butter and Margarine Market: Report Scope

This report thoroughly analyzes the butter and margarine market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Butter and Margarine Market |

| Market Size in 2024 | USD 1852.26 Million |

| Market Forecast in 2032 | USD 2930.01 Million |

| Growth Rate | CAGR of 5.9% |

| Number of Pages | 230 |

| Key Companies Covered | Arla Foods, AMUL (India), Farmers Cooperative Creamery, OJSC creative group., FrieslandCampina, Kraft Foods, Dean Foods Company |

| Segments Covered | By Product Type, By Source, By Form, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Butter and Margarine Market: Dynamics

Key Growth Drivers :

The market is primarily driven by a global increase in health consciousness. Consumers are actively seeking products that align with their dietary preferences, which has led to a split in the market. Butter is seeing a resurgence due to a preference for natural, minimally processed foods, while margarine is benefiting from the rising popularity of vegan and plant-based diets. Margarine's historical position as a lower-fat, lower-cholesterol alternative to butter also continues to drive its demand among health-conscious consumers. Innovations in product formulation, such as the addition of omega-3 fatty acids or the use of healthy oils like olive or avocado oil, further fuel this growth.

Restraints :

Several factors act as restraints on the market. A major challenge is the lingering negative perception of saturated and trans fats, which are historically associated with both butter and margarine. This has led to strict government regulations on trans fat content in many countries, forcing manufacturers to reformulate products, which can be costly. Furthermore, the market faces intense competition from alternative spreads and oils, such as coconut oil, ghee, and various plant-based spreads, which are marketed as healthier and more natural. The high cost of dairy production can also make butter a more expensive option, leading some price-sensitive consumers to opt for more affordable alternatives.

Opportunities :

The market presents significant opportunities for innovation. The rising demand for sustainable and clean-label products is a key opportunity, as brands can attract consumers by highlighting eco-friendly packaging, transparent sourcing, and the absence of artificial additives. The market for specialized products is also expanding, with opportunities in organic butter, grass-fed butter, and margarines with added functional benefits. The growth of e-commerce and direct-to-consumer models provides a new avenue for brands to reach a wider audience and build stronger relationships with their customers. Furthermore, the food service and bakery industries, which use these products as key ingredients, offer a consistent and large-scale market.

Challenges :

The butter and margarine market faces a number of significant challenges. Supply chain volatility is a constant threat, as the cost and availability of raw materials like vegetable oils and milk can fluctuate due to climate change and geopolitical events. The industry must also contend with a highly fragmented and competitive landscape, with numerous brands vying for a similar consumer base, leading to price pressure. Furthermore, brands must continuously invest in consumer education to overcome persistent negative perceptions about fat content and to differentiate their products in a crowded market. Finally, the industry must navigate an evolving global regulatory landscape regarding food safety, labeling, and fat content.

Butter and Margarine Market: Segmentation Insights

The global butter and margarine market is segmented based on Product Type, Source, Form, End-User, and Region. All the segments of the butter and margarine market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Product Type, the global butter and margarine market is divided into Butter, Margarine.

On the basis of Source, the global butter and margarine market is bifurcated into Dairy, Plant-Based.

In terms of Form, the global butter and margarine market is categorized into Solid, Spreadable, Liquid.

Based on End-User, the global butter and margarine market is split into Household, Foodservice, Industrial.

Butter and Margarine Market: Regional Insights

Europe is the dominant region in the global butter and margarine market, accounting for the largest consumption share, estimated at over 35% of global volume. This leadership is anchored in deeply ingrained culinary traditions, particularly in Western and Northern European countries like France, Germany, and the Netherlands, where butter is a staple in baking, cooking, and spreads. While margarine consumption has declined in some areas due to a consumer shift towards natural products, the region remains a key market for high-quality, premium, and plant-based spreads.

Although North America is a significant market, its per capita consumption of butter is lower, and margarine has seen a steeper decline. The Asia-Pacific region is the fastest-growing market, driven by urbanization and changing diets, but it has not yet surpassed Europe's established consumption levels. Europe's combination of traditional demand, product innovation, and high per capita usage solidifies its position as the world's leading market for butter and margarine.

Butter and Margarine Market: Competitive Landscape

The butter and margarine market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Butter and Margarine Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Arla Foods

- AMUL (India)

- Farmers Cooperative Creamery

- OJSC creative group.

- FrieslandCampina

- Kraft Foods

- Dean Foods Company

The Global Butter and Margarine Market is Segmented as Follows:

By Product Type

- Butter

- Margarine

By Source

- Dairy

- Plant-Based

By Form

- Solid

- Spreadable

- Liquid

By End-User

- Household

- Foodservice

- Industrial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Butter and Margarine Market Share by Type (2020-2026) 1.5.2 Traditional margarine 1.5.3 Liquid margarine 1.5.4 Salted Butter 1.5.5 Unsalted Butter 1.5.6 Others 1.6 Market by Application 1.6.1 Global Butter and Margarine Market Share by Application (2020-2026) 1.6.2 Supermarket 1.6.3 Online store 1.6.4 Food Service 1.6.5 Industrial 1.6.6 Others 1.7 Butter and Margarine Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Butter and Margarine Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Butter and Margarine Market 3.1 Value Chain Status 3.2 Butter and Margarine Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Butter and Margarine 3.2.3 Labor Cost of Butter and Margarine 3.2.3.1 Labor Cost of Butter and Margarine Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Arla Foods 4.1.1 Arla Foods Basic Information 4.1.2 Butter and Margarine Product Profiles, Application and Specification 4.1.3 Arla Foods Butter and Margarine Market Performance (2015-2020) 4.1.4 Arla Foods Business Overview 4.2 AMUL (India) 4.2.1 AMUL (India) Basic Information 4.2.2 Butter and Margarine Product Profiles, Application and Specification 4.2.3 AMUL (India) Butter and Margarine Market Performance (2015-2020) 4.2.4 AMUL (India) Business Overview 4.3 Farmers Cooperative Creamery 4.3.1 Farmers Cooperative Creamery Basic Information 4.3.2 Butter and Margarine Product Profiles, Application and Specification 4.3.3 Farmers Cooperative Creamery Butter and Margarine Market Performance (2015-2020) 4.3.4 Farmers Cooperative Creamery Business Overview 4.4 OJSC creative group. 4.4.1 OJSC creative group. Basic Information 4.4.2 Butter and Margarine Product Profiles, Application and Specification 4.4.3 OJSC creative group. Butter and Margarine Market Performance (2015-2020) 4.4.4 OJSC creative group. Business Overview 4.5 FrieslandCampina 4.5.1 FrieslandCampina Basic Information 4.5.2 Butter and Margarine Product Profiles, Application and Specification 4.5.3 FrieslandCampina Butter and Margarine Market Performance (2015-2020) 4.5.4 FrieslandCampina Business Overview 4.6 Kraft Foods 4.6.1 Kraft Foods Basic Information 4.6.2 Butter and Margarine Product Profiles, Application and Specification 4.6.3 Kraft Foods Butter and Margarine Market Performance (2015-2020) 4.6.4 Kraft Foods Business Overview 4.7 Dean Foods Company 4.7.1 Dean Foods Company Basic Information 4.7.2 Butter and Margarine Product Profiles, Application and Specification 4.7.3 Dean Foods Company Butter and Margarine Market Performance (2015-2020) 4.7.4 Dean Foods Company Business Overview 5 Global Butter and Margarine Market Analysis by Regions 5.1 Global Butter and Margarine Sales, Revenue and Market Share by Regions 5.1.1 Global Butter and Margarine Sales by Regions (2015-2020) 5.1.2 Global Butter and Margarine Revenue by Regions (2015-2020) 5.2 North America Butter and Margarine Sales and Growth Rate (2015-2020) 5.3 Europe Butter and Margarine Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Butter and Margarine Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Butter and Margarine Sales and Growth Rate (2015-2020) 5.6 South America Butter and Margarine Sales and Growth Rate (2015-2020) 6 North America Butter and Margarine Market Analysis by Countries 6.1 North America Butter and Margarine Sales, Revenue and Market Share by Countries 6.1.1 North America Butter and Margarine Sales by Countries (2015-2020) 6.1.2 North America Butter and Margarine Revenue by Countries (2015-2020) 6.1.3 North America Butter and Margarine Market Under COVID-19 6.2 United States Butter and Margarine Sales and Growth Rate (2015-2020) 6.2.1 United States Butter and Margarine Market Under COVID-19 6.3 Canada Butter and Margarine Sales and Growth Rate (2015-2020) 6.4 Mexico Butter and Margarine Sales and Growth Rate (2015-2020) 7 Europe Butter and Margarine Market Analysis by Countries 7.1 Europe Butter and Margarine Sales, Revenue and Market Share by Countries 7.1.1 Europe Butter and Margarine Sales by Countries (2015-2020) 7.1.2 Europe Butter and Margarine Revenue by Countries (2015-2020) 7.1.3 Europe Butter and Margarine Market Under COVID-19 7.2 Germany Butter and Margarine Sales and Growth Rate (2015-2020) 7.2.1 Germany Butter and Margarine Market Under COVID-19 7.3 UK Butter and Margarine Sales and Growth Rate (2015-2020) 7.3.1 UK Butter and Margarine Market Under COVID-19 7.4 France Butter and Margarine Sales and Growth Rate (2015-2020) 7.4.1 France Butter and Margarine Market Under COVID-19 7.5 Italy Butter and Margarine Sales and Growth Rate (2015-2020) 7.5.1 Italy Butter and Margarine Market Under COVID-19 7.6 Spain Butter and Margarine Sales and Growth Rate (2015-2020) 7.6.1 Spain Butter and Margarine Market Under COVID-19 7.7 Russia Butter and Margarine Sales and Growth Rate (2015-2020) 7.7.1 Russia Butter and Margarine Market Under COVID-19 8 Asia-Pacific Butter and Margarine Market Analysis by Countries 8.1 Asia-Pacific Butter and Margarine Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Butter and Margarine Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Butter and Margarine Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Butter and Margarine Market Under COVID-19 8.2 China Butter and Margarine Sales and Growth Rate (2015-2020) 8.2.1 China Butter and Margarine Market Under COVID-19 8.3 Japan Butter and Margarine Sales and Growth Rate (2015-2020) 8.3.1 Japan Butter and Margarine Market Under COVID-19 8.4 South Korea Butter and Margarine Sales and Growth Rate (2015-2020) 8.4.1 South Korea Butter and Margarine Market Under COVID-19 8.5 Australia Butter and Margarine Sales and Growth Rate (2015-2020) 8.6 India Butter and Margarine Sales and Growth Rate (2015-2020) 8.6.1 India Butter and Margarine Market Under COVID-19 8.7 Southeast Asia Butter and Margarine Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Butter and Margarine Market Under COVID-19 9 Middle East and Africa Butter and Margarine Market Analysis by Countries 9.1 Middle East and Africa Butter and Margarine Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Butter and Margarine Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Butter and Margarine Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Butter and Margarine Market Under COVID-19 9.2 Saudi Arabia Butter and Margarine Sales and Growth Rate (2015-2020) 9.3 UAE Butter and Margarine Sales and Growth Rate (2015-2020) 9.4 Egypt Butter and Margarine Sales and Growth Rate (2015-2020) 9.5 Nigeria Butter and Margarine Sales and Growth Rate (2015-2020) 9.6 South Africa Butter and Margarine Sales and Growth Rate (2015-2020) 10 South America Butter and Margarine Market Analysis by Countries 10.1 South America Butter and Margarine Sales, Revenue and Market Share by Countries 10.1.1 South America Butter and Margarine Sales by Countries (2015-2020) 10.1.2 South America Butter and Margarine Revenue by Countries (2015-2020) 10.1.3 South America Butter and Margarine Market Under COVID-19 10.2 Brazil Butter and Margarine Sales and Growth Rate (2015-2020) 10.2.1 Brazil Butter and Margarine Market Under COVID-19 10.3 Argentina Butter and Margarine Sales and Growth Rate (2015-2020) 10.4 Columbia Butter and Margarine Sales and Growth Rate (2015-2020) 10.5 Chile Butter and Margarine Sales and Growth Rate (2015-2020) 11 Global Butter and Margarine Market Segment by Types 11.1 Global Butter and Margarine Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Butter and Margarine Sales and Market Share by Types (2015-2020) 11.1.2 Global Butter and Margarine Revenue and Market Share by Types (2015-2020) 11.2 Traditional margarine Sales and Price (2015-2020) 11.3 Liquid margarine Sales and Price (2015-2020) 11.4 Salted Butter Sales and Price (2015-2020) 11.5 Unsalted Butter Sales and Price (2015-2020) 11.6 Others Sales and Price (2015-2020) 12 Global Butter and Margarine Market Segment by Applications 12.1 Global Butter and Margarine Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Butter and Margarine Sales and Market Share by Applications (2015-2020) 12.1.2 Global Butter and Margarine Revenue and Market Share by Applications (2015-2020) 12.2 Supermarket Sales, Revenue and Growth Rate (2015-2020) 12.3 Online store Sales, Revenue and Growth Rate (2015-2020) 12.4 Food Service Sales, Revenue and Growth Rate (2015-2020) 12.5 Industrial Sales, Revenue and Growth Rate (2015-2020) 12.6 Others Sales, Revenue and Growth Rate (2015-2020) 13 Butter and Margarine Market Forecast by Regions (2020-2026) 13.1 Global Butter and Margarine Sales, Revenue and Growth Rate (2020-2026) 13.2 Butter and Margarine Market Forecast by Regions (2020-2026) 13.2.1 North America Butter and Margarine Market Forecast (2020-2026) 13.2.2 Europe Butter and Margarine Market Forecast (2020-2026) 13.2.3 Asia-Pacific Butter and Margarine Market Forecast (2020-2026) 13.2.4 Middle East and Africa Butter and Margarine Market Forecast (2020-2026) 13.2.5 South America Butter and Margarine Market Forecast (2020-2026) 13.3 Butter and Margarine Market Forecast by Types (2020-2026) 13.4 Butter and Margarine Market Forecast by Applications (2020-2026) 13.5 Butter and Margarine Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Butter and Margarine

Request Sample

Butter and Margarine