Ceiling Supply Unit Market Size, Share, and Trends Analysis Report

CAGR :

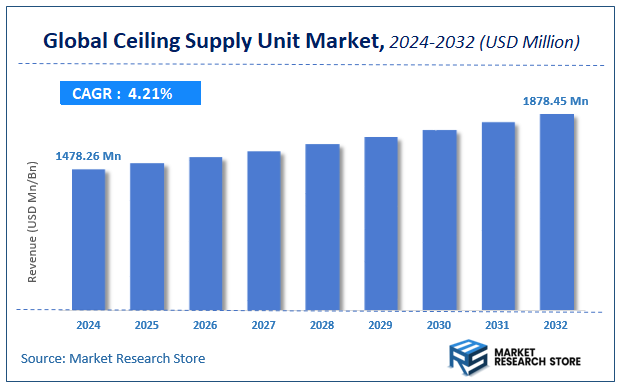

| Market Size 2024 (Base Year) | USD 1478.26 Million |

| Market Size 2032 (Forecast Year) | USD 1878.45 Million |

| CAGR | 4.21% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global ceiling supply unit market size was valued at approximately USD 1478.26 Million in 2024. The market is projected to grow significantly, reaching USD 1878.45 Million by 2032, growing at a compound annual growth rate (CAGR) of 4.21% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the ceiling supply unit industry.

Ceiling Supply Unit Market: Overview

The growth of the ceiling supply unit market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The ceiling supply unit market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the ceiling supply unit market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global ceiling supply unit market is estimated to grow annually at a CAGR of around 4.21% over the forecast period (2025-2032).

- In terms of revenue, the global ceiling supply unit market size was valued at around USD 1478.26 Million in 2024 and is projected to reach USD 1878.45 Million by 2032.

- The market is projected to grow at a significant rate due to rising demand for modular hospital infrastructure, advancements in operating room (OR) efficiency, and growth in minimally invasive surgical procedures.

- Based on the Products, the Fixed segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Surgery segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Ceiling Supply Unit Market: Report Scope

This report thoroughly analyzes the ceiling supply unit market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Ceiling Supply Unit Market |

| Market Size in 2024 | USD 1478.26 Million |

| Market Forecast in 2032 | USD 1878.45 Million |

| Growth Rate | CAGR of 4.21% |

| Number of Pages | 248 |

| Key Companies Covered | Drager, Novair Medical, MZ Liberec, Surgiris, TLV Healthcare, Tedisel Medical, Brandon Medical, Maquet, KLS Martin, Starkstrom, Trumpf, Pneumatik Berlin |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ceiling Supply Unit Market: Dynamics

Key Growth Drivers :

The ceiling supply unit market is experiencing robust growth driven by the increasing global demand for modern, efficient, and safe healthcare infrastructure. A primary driver is the rising number of surgical procedures and patient admissions, especially in critical care units and operating rooms, which require a clutter-free and highly organized environment. Ceiling supply units, often referred to as medical pendants, are a crucial solution as they centralize medical gas, power supply, and data communication, while keeping the floor clear of cables and equipment. The aging global population and rising prevalence of chronic diseases are also contributing to the need for advanced equipment in healthcare settings. Furthermore, investments in smart hospitals and a focus on improving clinical workflows and patient safety are compelling hospitals to adopt these advanced, ceiling-mounted systems for better space management and operational efficiency.

Restraints :

Despite the clear benefits, the market faces several significant restraints. The most prominent is the high initial investment and installation cost associated with ceiling supply units. These systems are complex and can be expensive to install, especially in older healthcare facilities that may require structural modifications, which can be a barrier for hospitals with tight budgets, particularly in developing economies. Another major restraint is the scarcity of skilled and certified technicians needed for the complex installation, maintenance, and repair of these advanced systems. The lack of standardization in design and features across different manufacturers can also create interoperability issues and make it difficult for facilities to upgrade or replace components.

Opportunities :

The ceiling supply unit market is ripe with opportunities for innovation and growth. A key opportunity lies in the development of smart and modular unit systems that can be easily customized and integrated with existing hospital management systems and electronic health records. The integration of advanced technologies like IoT and augmented reality can enhance real-time monitoring, improve workflow efficiency, and enable predictive maintenance. There is a strong opportunity to expand into emerging markets, where rapid healthcare infrastructure development is taking place, by offering scalable, cost-effective solutions that meet a variety of needs. Furthermore, the growing focus on infection control and hygiene in healthcare settings presents an opportunity to develop units with antimicrobial surfaces and easy-to-clean designs to improve patient outcomes and staff safety.

Challenges :

The market faces several challenges that can impact its trajectory. One major challenge is overcoming the structural limitations in older hospital buildings, where retrofitting a ceiling-mounted system can be complex, invasive, and costly, often requiring a halt in surgical schedules. The market is also challenged by the need to navigate a complex and varied regulatory landscape across different countries, which can affect everything from safety certifications to product claims. The risk of cybersecurity threats is an increasing challenge as units become more integrated with hospital IT networks. Finally, the intense competitive rivalry among a mix of large established players and smaller, innovative entrants can put pressure on pricing and necessitate continuous investment in research and development to maintain a competitive edge.

Ceiling Supply Unit Market: Segmentation Insights

The global ceiling supply unit market is segmented based on Products, Applications, and Region. All the segments of the ceiling supply unit market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global ceiling supply unit market is divided into Fixed, Fixed Retractable, Single Arm Movable, Double Multi Arm Movable.

On the basis of Applications, the global ceiling supply unit market is bifurcated into Surgery, Endoscopy, Anaesthesia, Intensive Care Units.

Ceiling Supply Unit Market: Regional Insights

North America, led by the United States, is the dominant region in the global ceiling supply unit (CSU) market. This dominance is driven by the region's high healthcare expenditure, stringent hospital safety and efficiency standards, and a robust volume of hospital construction, renovation, and operating room (OR) modernization projects. According to market data from Grand View Research and the American Hospital Association, North America held the largest revenue share (over 45% in 2023), attributable to its advanced healthcare infrastructure and the widespread adoption of integrated OR systems where CSUs are a critical component.

While the Asia-Pacific region is experiencing the fastest growth due to massive healthcare infrastructure investments in China and India, its market is still developing in terms of technology penetration. Europe is a mature and significant market, particularly in Western Europe, with strong demand for energy-efficient and ergonomic designs. North America's leadership is reinforced by the presence of major global CSU manufacturers, a high number of surgical procedures, and a focus on OR efficiency, solidifying its position as the innovation and value leader.

Ceiling Supply Unit Market: Competitive Landscape

The ceiling supply unit market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Ceiling Supply Unit Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Drager

- Novair Medical

- MZ Liberec

- Surgiris

- TLV Healthcare

- Tedisel Medical

- Brandon Medical

- Maquet

- KLS Martin

- Starkstrom

- Trumpf

- Pneumatik Berlin

The Global Ceiling Supply Unit Market is Segmented as Follows:

By Products

- Fixed

- Fixed Retractable

- Single Arm Movable

- Double Multi Arm Movable

By Applications

- Surgery

- Endoscopy

- Anaesthesia

- Intensive Care Units

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Global Ceiling Supply Unit Industry Market Research Report 1 Ceiling Supply Unit Introduction and Market Overview 1.1 Objectives of the Study 1.2 Definition of Ceiling Supply Unit 1.3 Ceiling Supply Unit Market Scope and Market Size Estimation 1.3.1 Market Concentration Ratio and Market Maturity Analysis 1.3.2 Global Ceiling Supply Unit Value ($) and Growth Rate from 2014-2024 1.4 Market Segmentation 1.4.1 Types of Ceiling Supply Unit 1.4.2 Applications of Ceiling Supply Unit 1.4.3 Research Regions 1.4.3.1 North America Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.4.3.2 Europe Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.4.3.3 China Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.4.3.4 Japan Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.4.3.5 Middle East & Africa Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.4.3.6 India Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.4.3.7 South America Ceiling Supply Unit Production Value ($) and Growth Rate (2014-2019) 1.5 Market Dynamics 1.5.1 Drivers 1.5.1.1 Emerging Countries of Ceiling Supply Unit 1.5.1.2 Growing Market of Ceiling Supply Unit 1.5.2 Limitations 1.5.3 Opportunities 1.6 Industry News and Policies by Regions 1.6.1 Industry News 1.6.2 Industry Policies 2 Industry Chain Analysis 2.1 Upstream Raw Material Suppliers of Ceiling Supply Unit Analysis 2.2 Major Players of Ceiling Supply Unit 2.2.1 Major Players Manufacturing Base and Market Share of Ceiling Supply Unit in 2018 2.2.2 Major Players Product Types in 2018 2.3 Ceiling Supply Unit Manufacturing Cost Structure Analysis 2.3.1 Production Process Analysis 2.3.2 Manufacturing Cost Structure of Ceiling Supply Unit 2.3.3 Raw Material Cost of Ceiling Supply Unit 2.3.4 Labor Cost of Ceiling Supply Unit 2.4 Market Channel Analysis of Ceiling Supply Unit 2.5 Major Downstream Buyers of Ceiling Supply Unit Analysis 3 Global Ceiling Supply Unit Market, by Type 3.1 Global Ceiling Supply Unit Value ($) and Market Share by Type (2014-2019) 3.2 Global Ceiling Supply Unit Production and Market Share by Type (2014-2019) 3.3 Global Ceiling Supply Unit Value ($) and Growth Rate by Type (2014-2019) 3.4 Global Ceiling Supply Unit Price Analysis by Type (2014-2019) 4 Ceiling Supply Unit Market, by Application 4.1 Global Ceiling Supply Unit Consumption and Market Share by Application (2014-2019) 4.2 Downstream Buyers by Application 4.3 Global Ceiling Supply Unit Consumption and Growth Rate by Application (2014-2019) 5 Global Ceiling Supply Unit Production, Value ($) by Region (2014-2019) 5.1 Global Ceiling Supply Unit Value ($) and Market Share by Region (2014-2019) 5.2 Global Ceiling Supply Unit Production and Market Share by Region (2014-2019) 5.3 Global Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.4 North America Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.5 Europe Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.6 China Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.7 Japan Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.8 Middle East & Africa Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.9 India Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 5.10 South America Ceiling Supply Unit Production, Value ($), Price and Gross Margin (2014-2019) 6 Global Ceiling Supply Unit Production, Consumption, Export, Import by Regions (2014-2019) 6.1 Global Ceiling Supply Unit Consumption by Regions (2014-2019) 6.2 North America Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 6.3 Europe Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 6.4 China Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 6.5 Japan Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 6.6 Middle East & Africa Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 6.7 India Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 6.8 South America Ceiling Supply Unit Production, Consumption, Export, Import (2014-2019) 7 Global Ceiling Supply Unit Market Status and SWOT Analysis by Regions 7.1 North America Ceiling Supply Unit Market Status and SWOT Analysis 7.2 Europe Ceiling Supply Unit Market Status and SWOT Analysis 7.3 China Ceiling Supply Unit Market Status and SWOT Analysis 7.4 Japan Ceiling Supply Unit Market Status and SWOT Analysis 7.5 Middle East & Africa Ceiling Supply Unit Market Status and SWOT Analysis 7.6 India Ceiling Supply Unit Market Status and SWOT Analysis 7.7 South America Ceiling Supply Unit Market Status and SWOT Analysis 8 Competitive Landscape 8.1 Competitive Profile 8.2 Drager 8.2.1 Company Profiles 8.2.2 Ceiling Supply Unit Product Introduction 8.2.3 Drager Production, Value ($), Price, Gross Margin 2014-2019 8.2.4 Drager Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.3 Novair Medical 8.3.1 Company Profiles 8.3.2 Ceiling Supply Unit Product Introduction 8.3.3 Novair Medical Production, Value ($), Price, Gross Margin 2014-2019 8.3.4 Novair Medical Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.4 MZ Liberec 8.4.1 Company Profiles 8.4.2 Ceiling Supply Unit Product Introduction 8.4.3 MZ Liberec Production, Value ($), Price, Gross Margin 2014-2019 8.4.4 MZ Liberec Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.5 Surgiris 8.5.1 Company Profiles 8.5.2 Ceiling Supply Unit Product Introduction 8.5.3 Surgiris Production, Value ($), Price, Gross Margin 2014-2019 8.5.4 Surgiris Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.6 TLV Healthcare 8.6.1 Company Profiles 8.6.2 Ceiling Supply Unit Product Introduction 8.6.3 TLV Healthcare Production, Value ($), Price, Gross Margin 2014-2019 8.6.4 TLV Healthcare Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.7 Tedisel Medical 8.7.1 Company Profiles 8.7.2 Ceiling Supply Unit Product Introduction 8.7.3 Tedisel Medical Production, Value ($), Price, Gross Margin 2014-2019 8.7.4 Tedisel Medical Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.8 Brandon Medical 8.8.1 Company Profiles 8.8.2 Ceiling Supply Unit Product Introduction 8.8.3 Brandon Medical Production, Value ($), Price, Gross Margin 2014-2019 8.8.4 Brandon Medical Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.9 Maquet 8.9.1 Company Profiles 8.9.2 Ceiling Supply Unit Product Introduction 8.9.3 Maquet Production, Value ($), Price, Gross Margin 2014-2019 8.9.4 Maquet Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.10 KLS Martin 8.10.1 Company Profiles 8.10.2 Ceiling Supply Unit Product Introduction 8.10.3 KLS Martin Production, Value ($), Price, Gross Margin 2014-2019 8.10.4 KLS Martin Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.11 Starkstrom 8.11.1 Company Profiles 8.11.2 Ceiling Supply Unit Product Introduction 8.11.3 Starkstrom Production, Value ($), Price, Gross Margin 2014-2019 8.11.4 Starkstrom Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.12 Trumpf 8.12.1 Company Profiles 8.12.2 Ceiling Supply Unit Product Introduction 8.12.3 Trumpf Production, Value ($), Price, Gross Margin 2014-2019 8.12.4 Trumpf Market Share of Ceiling Supply Unit Segmented by Region in 2018 8.13 Pneumatik Berlin 8.13.1 Company Profiles 8.13.2 Ceiling Supply Unit Product Introduction 8.13.3 Pneumatik Berlin Production, Value ($), Price, Gross Margin 2014-2019 8.13.4 Pneumatik Berlin Market Share of Ceiling Supply Unit Segmented by Region in 2018 9 Global Ceiling Supply Unit Market Analysis and Forecast by Type and Application 9.1 Global Ceiling Supply Unit Market Value ($) & Volume Forecast, by Type (2019-2024) 9.1.1 Fixed Market Value ($) and Volume Forecast (2019-2024) 9.1.2 Fixed Retractable Market Value ($) and Volume Forecast (2019-2024) 9.1.3 Single Arm Movable Market Value ($) and Volume Forecast (2019-2024) 9.1.4 Double Multi Arm Movable Market Value ($) and Volume Forecast (2019-2024) 9.2 Global Ceiling Supply Unit Market Value ($) & Volume Forecast, by Application (2019-2024) 9.2.1 Surgery Market Value ($) and Volume Forecast (2019-2024) 9.2.2 Endoscopy Market Value ($) and Volume Forecast (2019-2024) 9.2.3 Anaesthesia Market Value ($) and Volume Forecast (2019-2024) 9.2.4 Intensive Care Units Market Value ($) and Volume Forecast (2019-2024) 10 Ceiling Supply Unit Market Analysis and Forecast by Region 10.1 North America Market Value ($) and Consumption Forecast (2019-2024) 10.2 Europe Market Value ($) and Consumption Forecast (2019-2024) 10.3 China Market Value ($) and Consumption Forecast (2019-2024) 10.4 Japan Market Value ($) and Consumption Forecast (2019-2024) 10.5 Middle East & Africa Market Value ($) and Consumption Forecast (2019-2024) 10.6 India Market Value ($) and Consumption Forecast (2019-2024) 10.7 South America Market Value ($) and Consumption Forecast (2019-2024) 11 New Project Feasibility Analysis 11.1 Industry Barriers and New Entrants SWOT Analysis 11.2 Analysis and Suggestions on New Project Investment 12 Research Finding and Conclusion 13 Appendix 13.1 Discussion Guide 13.2 Knowledge Store: Maia Subscription Portal 13.3 Research Data Source 13.4 Research Assumptions and Acronyms Used

Inquiry For Buying

Ceiling Supply Unit

Request Sample

Ceiling Supply Unit