Ceramic Tiles Market Size, Share, and Trends Analysis Report

CAGR :

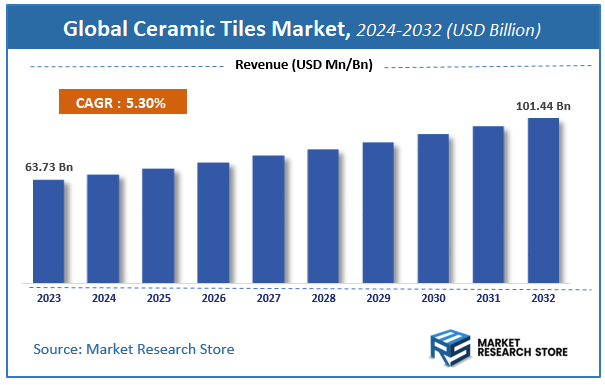

| Market Size 2023 (Base Year) | USD 63.73 Billion |

| Market Size 2032 (Forecast Year) | USD 101.44 Billion |

| CAGR | 5.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Ceramic Tiles Market Insights

According to Market Research Store, the global ceramic tiles market size was valued at around USD 63.73 billion in 2023 and is estimated to reach USD 101.44 billion by 2032, to register a CAGR of approximately 5.3% in terms of revenue during the forecast period 2024-2032.

The ceramic tiles report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Ceramic Tiles Market: Overview

Ceramic tiles are durable, hard-wearing surface coverings made from a mixture of natural clay, sand, and water that are molded into shape and fired at high temperatures in a kiln. Often coated with a glaze, ceramic tiles offer a wide range of colors, patterns, and finishes, making them a popular choice for both aesthetic and functional applications. They are widely used in residential, commercial, and industrial buildings for flooring, walls, countertops, and backsplashes due to their resistance to moisture, stains, fire, and wear.

The growth of the ceramic tiles market is driven by rapid urbanization, increasing construction activity, and rising consumer demand for stylish, low-maintenance, and cost-effective surface solutions. Advancements in digital printing technology and tile manufacturing have expanded design possibilities, allowing ceramic tiles to replicate the look of natural stone, wood, or metal with high realism.

Key Highlights

- The ceramic tiles market is anticipated to grow at a CAGR of 5.3% during the forecast period.

- The global ceramic tiles market was estimated to be worth approximately USD 63.73 billion in 2023 and is projected to reach a value of USD 101.44 billion by 2032.

- The growth of the ceramic tiles market is being driven by increasing construction and infrastructure development, rising demand for durable and aesthetic flooring solutions, and growing urbanization across both developed and emerging economies.

- Based on the product, the glazed ceramic tiles segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the wall tiles segment is projected to swipe the largest market share.

- In terms of end-use, the residential segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Ceramic Tiles Market: Dynamics

Key Growth Drivers:

- Rapid Urbanization and Infrastructure Development: The ongoing global trend of urbanization, particularly in emerging economies, leads to extensive construction of new residential buildings, commercial spaces (offices, retail, hospitality), and public infrastructure, significantly boosting the demand for ceramic tiles.

- Increasing Disposable Income and Aesthetic Preferences: Rising disposable incomes globally, especially in developing countries, enable consumers to invest more in home renovations, interior design, and aesthetically pleasing building materials. Ceramic tiles, with their wide variety of designs, colors, and textures, cater to this demand for enhanced living spaces.

- Durability, Low Maintenance, and Cost-Effectiveness: Ceramic tiles offer superior durability, resistance to wear and tear, moisture, and stains, along with easy cleaning and low maintenance requirements compared to other flooring options. These properties make them a cost-effective and long-lasting choice for both residential and commercial applications.

Restraints:

- Volatile Raw Material and Energy Prices: The ceramic tile manufacturing process is energy-intensive (especially firing kilns) and heavily relies on raw materials like clay, feldspar, and natural gas. Fluctuations in the prices of these raw materials and energy can significantly impact production costs and profit margins.

- Competition from Substitute Flooring Materials: The market faces strong competition from alternative flooring materials such as vinyl, laminate, hardwood, carpet, and natural stone, which may offer advantages in terms of installation ease, cost, or specific aesthetic preferences, potentially limiting ceramic tile market share.

- Environmental Concerns and High Carbon Footprint: The manufacturing process of ceramic tiles is energy-intensive and can result in significant carbon emissions, raising environmental concerns. Stricter environmental regulations and the industry's need to adopt more sustainable production methods pose a challenge.

Opportunities:

- Growing Demand for Sustainable and Eco-friendly Tiles: The increasing focus on green building practices and sustainable construction creates opportunities for manufacturers to develop and promote eco-friendly ceramic tiles made from recycled content, produced with lower energy consumption, or utilizing less harmful chemicals.

- Innovation in Anti-slip, Anti-bacterial, and Scratch-resistant Tiles: Research and development in specialized ceramic tiles with enhanced functionalities, suchs as improved anti-slip properties for safety, anti-bacterial surfaces for hygiene (e.g., in healthcare), and higher scratch resistance for high-traffic areas, offer significant market differentiation.

- Expansion of E-commerce and Online Retail Channels: The growing penetration of e-commerce platforms provides an effective channel for ceramic tile manufacturers and retailers to expand their market reach, offer a diverse product range, and enhance customer convenience, especially for consumers in remote locations.

Challenges:

- Addressing the Skill Gap in Installation: The proper installation of ceramic tiles, especially large-format and technically advanced ones, requires skilled labor. A shortage of trained masons and installers can lead to poor installation quality, affecting the aesthetic appeal and durability of the tiles, and potentially damaging the industry's reputation.

- Counterfeit Products and Unorganized Market: The presence of low-quality, often cheaper, counterfeit ceramic tiles, particularly in unorganized sectors in some developing markets, poses a challenge to established manufacturers by undermining quality standards and impacting pricing power.

- High Competition and Fragmented Market: The global ceramic tiles market is highly fragmented with numerous local and international players. Intense competition can lead to pricing pressures and necessitate continuous innovation and differentiation for companies to maintain market share and profitability.

Ceramic Tiles Market: Report Scope

This report thoroughly analyzes the Ceramic Tiles Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Ceramic Tiles Market |

| Market Size in 2023 | USD 63.73 Billion |

| Market Forecast in 2032 | USD 101.44 Billion |

| Growth Rate | CAGR of 5.3% |

| Number of Pages | 150 |

| Key Companies Covered | RAK Ceramics, Atlas Concorde, Crossville Inc., China Ceramics, Mohawk Industries, Florida Tile, Ceramica Saloni, Kajaria Ceramics, and Porcelanosa Grupo. |

| Segments Covered | By Product, By Application, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Ceramic Tiles Market: Segmentation Insights

The global ceramic tiles market is divided by type, application, end-user and region.

Based on type, the global ceramic tiles market is divided into glazed ceramic tiles, porcelain tiles, scratch free ceramic tiles, and others. Glazed Ceramic Tiles represent the dominant product segment in the Ceramic Tiles Market due to their aesthetic appeal, versatility, and cost-effectiveness. These tiles are coated with a layer of liquid glass and then fired in a kiln, giving them a shiny or matte finish along with water resistance and stain protection. Glazed ceramic tiles are widely used in both wall and floor applications across residential, commercial, and institutional settings. Their availability in a wide variety of colors, textures, and patterns makes them ideal for decorative and functional use in kitchens, bathrooms, hallways, and living spaces. The ease of maintenance and durability against spills and scratches further contribute to their widespread adoption in both new constructions and renovation projects.

On the basis of application, the global ceramic tiles market is bifurcated into wall tiles, floor tiles, and others. Wall Tiles dominate the application segment in the Ceramic Tiles Market due to their extensive use in both residential and commercial interiors. These tiles are primarily selected for their aesthetic qualities and ability to protect surfaces from moisture, stains, and chemicals. Commonly used in kitchens, bathrooms, laundry rooms, and commercial wash areas, wall tiles are lighter and thinner than floor tiles, making them easier to install vertically. Their availability in a vast range of colors, textures, sizes, and finishes allows designers and homeowners to create custom looks with decorative and functional benefits.

In terms of end-user, the global ceramic tiles market is bifurcated into residential and commercial. Residential is the dominant end-use segment in the Ceramic Tiles Market, driven by rising demand for durable, aesthetically pleasing, and cost-effective surfacing materials in homes. Ceramic tiles are widely used in residential flooring, bathrooms, kitchens, and walls due to their moisture resistance, ease of cleaning, and broad design flexibility. Homeowners prefer ceramic tiles for their longevity, low maintenance requirements, and the ability to mimic natural materials such as wood and stone at a lower cost. Increasing urbanization, home renovation trends, and the growing availability of customized designs and digitally printed tiles continue to fuel their demand in both new housing developments and remodeling projects.

Ceramic Tiles Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the ceramic tiles market, driven by strong demand from residential, commercial, and institutional construction projects. The United States leads regional consumption, supported by increasing home renovation activities, rising demand for aesthetically appealing interiors, and the growing preference for durable, low-maintenance flooring solutions. Ceramic tiles are extensively used in kitchens, bathrooms, and entryways due to their moisture resistance and design versatility. Commercial demand is also strong in retail, hospitality, and office spaces. Manufacturers in the region focus on advanced digital printing, large-format tiles, and eco-friendly production processes. Import volumes from countries like Mexico, Spain, and Italy complement domestic production, offering a wide variety of designs and finishes. Canada also sees rising adoption, particularly in urban housing and institutional buildings, fueled by green building codes and evolving design preferences.

Asia-Pacific is the fastest-growing region in the ceramic tiles market, driven by rapid urbanization, expanding middle-class populations, and large-scale infrastructure development. China is the largest producer and consumer, with strong domestic demand and robust export capacity. The Chinese market benefits from affordable labor, extensive raw material availability, and a high level of automation in tile manufacturing. India follows with significant growth, supported by government housing schemes, increasing disposable income, and the popularity of ceramic tiles in both urban and rural residential construction. Southeast Asian countries like Indonesia, Vietnam, and Thailand also show growing demand due to commercial real estate expansion and rising consumer focus on hygiene and aesthetics. Japan and South Korea emphasize premium, high-tech ceramic products with strong demand in interior remodeling and commercial installations.

Europe holds a significant share in the ceramic tiles market, characterized by mature demand, innovation in design, and strong environmental standards. Countries such as Italy, Spain, and Germany are both major producers and consumers. Italy and Spain, in particular, are globally recognized for their high-quality, design-rich tiles, which are widely used in residential and high-end commercial projects. The region’s focus on sustainability, coupled with EU building energy directives, supports the use of energy-efficient and recyclable ceramic materials. Renovation activities across Western Europe, driven by aging infrastructure and green housing incentives, continue to fuel demand. Eastern European countries like Poland and Romania are also seeing increased construction spending, boosting tile consumption in both new-build and refurbishment segments.

Latin America is an emerging market for ceramic tiles, with Brazil and Mexico leading regional production and consumption. Brazil is one of the top global producers and exporters of ceramic tiles, with strong domestic demand in residential and commercial sectors. Growth is supported by favorable climatic conditions, a large self-building culture, and the availability of local raw materials. Mexico shows stable consumption, particularly in urban housing and public infrastructure projects. Regional markets face challenges such as economic volatility and construction delays but benefit from a growing focus on low-cost, long-lasting flooring solutions. Design preferences often favor textured finishes and bold patterns, aligning with cultural aesthetics.

Middle East & Africa developing regions in the ceramic tiles market, with rising demand fueled by large-scale urban infrastructure, hospitality, and residential developments. In the Middle East, the UAE and Saudi Arabia are key markets, where ceramic tiles are widely used in luxury homes, malls, mosques, and commercial towers due to their durability, heat resistance, and decorative appeal. The region’s focus on mega infrastructure and smart city projects continues to support growth. In Africa, South Africa, Nigeria, and Egypt are experiencing increased demand driven by population growth, housing needs, and urban expansion. However, challenges such as high import dependency and infrastructure limitations affect consistent market performance. Nonetheless, regional investments in local manufacturing capacity and growing consumer interest in stylish, low-maintenance surfaces are expected to drive future demand

Ceramic Tiles Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the ceramic tiles market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global ceramic tiles market include:

- Atlas Concorde S.p.A.

- MOHAWK INDUSTRIES, INC.

- Crossville, Inc.

- RAK Ceramics

- Cerámica Saloni

- Florida Tile, Inc.

- PORCELANOSA Grupo A.I.E.

- Kajaria Ceramics Limited

- GRUPPO CERAMICHE RICCHETTI S.p.A.

- China Ceramics Co., Ltd.

- Guangdong Monalisa Industry Co.,

- Guangdong Newpearl Ceramics Group Co., Ltd.

- Florim Ceramiche S.p.A.

The global ceramic tiles market is segmented as follows:

By Product

- Glazed ceramic tiles

- Porcelain tiles

- Scratch free ceramic tiles

- Others

By Application

- Wall tiles

- Floor tiles

- Others

By End-use

- Residential

- Commercial

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global ceramic tiles market volume and revenue, 2014 - 2020 (Million Square Meters) (USD Million)

- 2.2. Global ceramic tiles market: Snapshot

- Chapter 3. Ceramic Tiles – Market Dynamics

- 3.1. Introduction

- 3.2. Value Chain Analysis

- 3.3. Market Drivers

- 3.3.1. Growing global ceramic tiles demand, especially from Asia Pacific to propel market for Floor tiles and wall tiles

- 3.3.2. Growing construction industry

- 3.3.3. Use of abundant raw material

- 3.4. Market Restraints

- 3.4.1. Unstablecosts of energy sources

- 3.4.2. Environmental regulations

- 3.5. Opportunities

- 3.5.1. Increasing use of ceramic tiles as a substitute over other home decorative materials

- 3.5.2. Focus residential replacement applications

- 3.6. Porter’s five forces analysis

- 3.7. Market attractiveness analysis

- 3.7.1. Market attractiveness analysis by product segment

- 3.7.2. Market attractiveness analysis by application segment

- 3.7.3. Market attractiveness analysis by regional segment

- Chapter 4. Global Ceramic Tiles market - Competitive Landscape

- 4.1. Company market share analysis

- 4.2. Production capacity (subject to data availability)

- 4.3. Company raw material analysis

- 4.4. Price trend analysis

- Chapter 5. Global Ceramic Tiles market - Product Segment Analysis

- 5.1. Global ceramic tiles market: Product segment overview

- 5.1.1. Global ceramic tiles market volumes share, by product segment, 2014 & 2020

- 5.2. Floor tiles

- 5.2.1. Global floor tiles market, 2014–2020 (Million Square Meters) (USD Million)

- 5.3. Wall tiles

- 5.3.1. Global wall tile market, 2014 – 2020 (Million Square Meters) (USD Million)

- 5.4. Other tiles

- 5.4.1. Global other type of ceramic tiles market, 2014–2020 (Million Square Meters) (USD Million)

- 5.1. Global ceramic tiles market: Product segment overview

- Chapter 6. Global ceramic tiles market –Application Segment Analysis

- 6.1. Global ceramic tiles market: Application overview

- 6.1.1. Global ceramic tiles market volume share by application, 2014 and 2020

- 6.2. Residential replacement

- 6.2.1. Global ceramic tiles market for residential replacement applications, 2014–2020 (Million Square Meters) (USD Million)

- 6.3. Commercial

- 6.3.1. Global ceramic tiles market for commercial applications, 2014–2020 (Million Square Meters) (USD Million)

- 6.4. New residential

- 6.4.1. Global ceramic tiles market for new residential applications, 2014–2020 (Million Square Meters) (USD Million)

- 6.5. Other applications

- 6.5.1. Global ceramic tiles market for other applications, 2014–2020 (Million Square Meters) (USD Million)

- 6.1. Global ceramic tiles market: Application overview

- Chapter 7. Global ceramic tiles market –Regional Segment Analysis

- 7.1. Global ceramic tiles market: Regional overview

- 7.1.1. Global ceramic tiles market volume share by regional, 2014 and 2020

- 7.2. North America

- 7.2.1. North America ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.2.2. North America ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.2.3. U.S.

- 7.2.3.1. U.S. ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.2.3.2. U.S. ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.3. Europe

- 7.3.1. Europe ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.2. Europe ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Germany ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.3.2. Germany ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.4. France

- 7.3.4.1. France ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.4.2. France ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.5. UK

- 7.3.5.1. UK ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.3.5.2. UK ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.2. Asia Pacific ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.3. China

- 7.4.3.1. China ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.3.2. China ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.4. Japan

- 7.4.4.1. Japan ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.4.2. Japan ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.5. India

- 7.4.5.1. India ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.4.5.2. India ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.5.2. Latin America ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.5.3. Brazil

- 7.5.3.1. Brazil ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.5.3.2. Brazil ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa ceramic tiles market by product, 2014–2020 (Million Square Meters), (USD Million)

- 7.6.2. Middle East and Africa ceramic tiles market by application, 2014–2020 (Million Square Meters), (USD Million)

- 7.1. Global ceramic tiles market: Regional overview

- Chapter 8. Company Profile

- 8.1. RAK Ceramics

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Product portfolio

- 8.1.4. Business strategy

- 8.1.5. Recent developments

- 8.2. Atlas Concorde

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Product portfolio

- 8.2.4. Business strategy

- 8.2.5. Recent developments

- 8.3. Crossville Inc.

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Product portfolio

- 8.3.4. Business strategy

- 8.3.5. Recent developments

- 8.4. Florida Tile

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Product portfolio

- 8.4.4. Business strategy

- 8.4.5. Recent developments

- 8.5. Saloni Ceramica

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Product portfolio

- 8.5.4. Business strategy

- 8.5.5. Recent developments

- 8.6. Kajaria Ceramics

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Product portfolio

- 8.6.4. Business strategy

- 8.6.5. Recent developments

- 8.7. Porcelanosa Grupo

- 8.7.1. Overview

- 8.7.2. Financials

- 8.7.3. Product portfolio

- 8.7.4. Business strategy

- 8.7.5. Recent developments

- 8.8. Gruppo Ceramiche Ricchetti

- 8.8.1. Overview

- 8.8.2. Financials

- 8.8.3. Product portfolio

- 8.8.4. Business strategy

- 8.8.5. Recent developments

- 8.9. China Ceramics Co., Ltd.

- 8.9.1. Overview

- 8.9.2. Financials

- 8.9.3. Product portfolio

- 8.9.4. Business strategy

- 8.9.5. Recent developments

- 8.10. Mohawk Industries

- 8.10.1. Overview

- 8.10.2. Financials

- 8.10.3. Product portfolio

- 8.10.4. Business strategy

- 8.10.5. Recent developments

- 8.1. RAK Ceramics

Inquiry For Buying

Ceramic Tiles

Request Sample

Ceramic Tiles