Drug Integrated Polymer Fibers Market Size, Share, and Trends Analysis Report

CAGR :

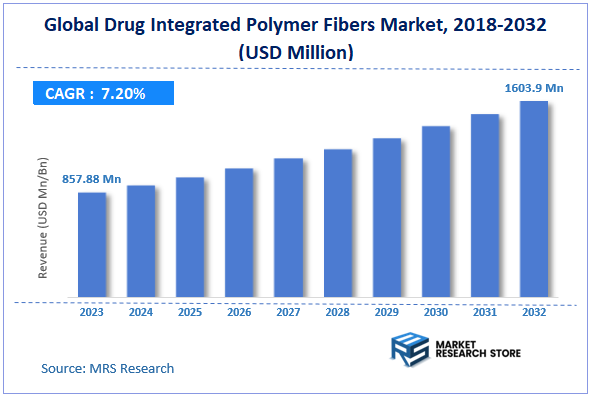

| Market Size 2023 (Base Year) | USD 857.88 Million |

| Market Size 2032 (Forecast Year) | USD 1603.91 Million |

| CAGR | 7.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Drug Integrated Polymer Fibers Market Insights

According to Market Research Store, the global drug integrated polymer fibers market size was valued at around USD 857.88 million in 2023 and is estimated to reach USD 1603.9 million by 2032, to register a CAGR of approximately 7.2% in terms of revenue during the forecast period 2024-2032.

The drug integrated polymer fibers report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Drug Integrated Polymer Fibers Market: Overview

The Drug Integrated Polymer Fibers Market focuses on the development and use of polymer fibers embedded with pharmaceutical compounds for controlled drug delivery. These fibers are engineered to release therapeutic agents at a regulated rate, making them ideal for applications in wound healing, surgical sutures, implantable devices, and transdermal patches. The integration of drugs within polymer fibers provides enhanced efficiency, targeted delivery, and improved patient compliance compared to traditional drug administration methods.

The market growth is driven by advancements in polymer science and the increasing demand for innovative drug delivery systems. Rising chronic diseases, growing geriatric populations, and the need for localized and sustained drug release drive the adoption of these technologies in healthcare.

Key Highlights

- The drug integrated polymer fibers market is anticipated to grow at a CAGR of 7.2% during the forecast period.

- The global drug integrated polymer fibers market was estimated to be worth approximately USD 857.88 million in 2023 and is projected to reach a value of USD 1603.9 million by 2032.

- The growth of the drug integrated polymer fibers market is being driven by the increasing demand for controlled drug delivery systems, advancements in polymer science, and the rising prevalence of chronic diseases.

- Based on the product, the polylactic acid segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the drug delivery segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Drug Integrated Polymer Fibers Market: Dynamics

Key Growth Drivers

- Targeted Drug Delivery: Drug-integrated polymer fibers offer precise and controlled drug release, improving therapeutic efficacy and reducing side effects.

- Advancements in Material Science: Innovations in polymer science enable the development of fibers with tailored properties for specific drug delivery applications.

- Aging Population: The aging population is associated with an increased incidence of chronic diseases, driving the demand for sustained drug delivery systems.

- Rising Healthcare Costs: Drug-integrated fibers can reduce healthcare costs by providing efficient and targeted drug delivery.

Restraints

- Complex Manufacturing Processes: The production of drug-integrated polymer fibers requires specialized techniques and quality control measures.

- Regulatory Hurdles: Obtaining regulatory approval for new drug delivery systems can be a lengthy and complex process.

- Limited Market Penetration: While the potential of drug-integrated fibers is significant, their widespread adoption may be hindered by factors like cost and technological challenges.

- Patient Acceptance and Compliance: Ensuring patient compliance with drug delivery regimens, especially for long-term therapies, can be challenging.

Opportunities

- Novel Drug Delivery Systems: Developing innovative drug delivery systems, such as implantable devices and wearable patches, can expand the market for drug-integrated fibers.

- Personalized Medicine: Tailoring drug delivery to individual patient needs can improve treatment outcomes and patient satisfaction.

- Combination Therapies: Integrating multiple drugs into a single fiber can simplify treatment regimens and enhance therapeutic efficacy.

- Emerging Markets: Expanding into emerging markets with growing healthcare needs can provide significant growth opportunities.

Challenges

- Biocompatibility and Toxicity: Ensuring the biocompatibility and safety of drug-integrated fibers is crucial for their clinical application.

- Stability and Shelf Life: Maintaining the stability and efficacy of drugs incorporated into polymer fibers over time is essential.

- Intellectual Property: Protecting intellectual property rights related to drug-integrated fiber technology is crucial for innovation and commercialization.

- Cost-Effective Manufacturing: Developing cost-effective manufacturing processes is essential to make drug-integrated fibers commercially viable.

Drug Integrated Polymer Fibers Market: Report Scope

0 , , ,

| Report Attributes | Report Details |

|---|---|

| Report Name | Drug Integrated Polymer Fibers Market |

| Market Size in 2023 | USD 857.88 Million |

| Market Forecast in 2032 | USD 1603.9 Million |

| Growth Rate | CAGR of 7.2% |

| Number of Pages | 150 |

| Key Companies Covered | Integrated Polymer Solutions, Micro Engineering Solutions, TissueGen, and others. |

| Segments Covered | By Product, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Drug Integrated Polymer Fibers Market: Segmentation Insights

The global drug integrated polymer fibers market is divided by product, application, and region.

Segmentation Insights by Product

Based on Product, the global drug integrated polymer fibers market is divided into polylactic acid, polydioxanone, polycaprolactone, and others.

Polylactic Acid dominates the Drug Integrated Polymer Fibers Market due to its renewable sourcing, biocompatibility, and versatility in various drug delivery applications. Polylactic Acid holds a significant share of the market, attributed to its renewable origins, biodegradability, and versatility in forming fibers that release drugs in a controlled manner.

Polydioxanone is particularly favored in surgical and wound healing applications due to its excellent degradation profile and mechanical properties. Polydioxanone is particularly favored in surgical and wound healing applications due to its excellent degradation profile and mechanical properties. Polydioxanone (PDO) is a synthetic, biodegradable polymer known for its flexibility and strength.

Polycaprolactone is gaining traction in the market for applications requiring extended drug release, particularly in chronic treatments or slow-releasing drug systems. Polycaprolactone (PCL) is a semi-crystalline, biodegradable polyester with excellent mechanical properties and a long degradation time, making it ideal for long-term drug delivery applications.

Segmentation Insights by Application

On the basis of Application, the global drug integrated polymer fibers market is bifurcated into drug delivery, orthopaedic sutures, vascular stents, vascular grafts, dermal wound healing, and others.

The Drug Delivery segment dominates in terms of market value, driven by the high demand for innovative and targeted drug delivery systems. Drug integrated polymer fibers are increasingly used as a platform for controlled drug delivery, enabling localized and sustained release of therapeutic agents over time.

However, Orthopaedic Sutures is rapidly growing due to their increasing applications in infection control and advanced wound care. In orthopaedics, polymer fibers integrated with drugs are used in sutures to prevent infections and promote healing in surgical procedures.

Vascular Stents segment holds substantial value due to the critical role of stents in managing cardiovascular diseases. Drug integrated polymer fibers are used in vascular stents to reduce restenosis (re-narrowing of blood vessels) and improve the long-term success of stent implants.

Vascular Grafts segment is growing as vascular grafts become more sophisticated with integrated drug functionalities. Polymer fibers integrated with drugs are used in vascular grafts to promote healing and reduce complications such as clotting or infections in vascular surgeries.

Dermal Wound Healing segment is expanding rapidly due to the increasing use of advanced wound care products in healthcare. Drug integrated polymer fibers are used in wound dressings and scaffolds for dermal applications, promoting healing and preventing infections.

Drug Integrated Polymer Fibers Market: Regional Insights

- North America currently leads the global drug integrated polymer fibers market

North America is a key player in the Drug Integrated Polymer Fibers Market, driven by advancements in medical technology, a strong healthcare infrastructure, and significant R&D investments in biopharmaceuticals. The U.S. leads this market due to its robust pharmaceutical and healthcare sector, as well as growing applications in chronic disease management and surgical implants. The region's regulatory framework supports the adoption of innovative drug delivery systems, further propelling growth.

Europe is another prominent region, with countries like Germany, the UK, and France at the forefront. The market is fueled by the high prevalence of chronic diseases, an aging population, and increasing demand for advanced wound care and drug delivery solutions. Europe's focus on sustainability and biocompatibility in medical products aligns with the growing use of biodegradable polymer fibers, further supporting market expansion.

The Asia Pacific region is witnessing rapid growth, driven by increasing healthcare expenditure, a growing patient population, and rising awareness of advanced drug delivery systems. Countries like China, India, and Japan are contributing significantly due to the expansion of their pharmaceutical industries and improvements in healthcare infrastructure. The region also benefits from cost-effective manufacturing capabilities, attracting global players for production and R&D.

In Latin America, the market is gradually emerging, with countries like Brazil and Mexico showing potential due to increasing healthcare awareness and investments in modern medical technologies. However, the adoption rate is slower compared to more developed regions due to economic constraints and limited access to advanced healthcare solutions.

The Middle East and Africa region exhibits moderate growth, primarily driven by improving healthcare systems in countries like the UAE and South Africa. While the market is still nascent, there is growing interest in innovative drug delivery mechanisms, particularly for wound care and localized treatments. However, challenges such as limited access to advanced technologies and lower R&D capabilities hinder faster growth.

Drug Integrated Polymer Fibers Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the drug integrated polymer fibers market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global drug integrated polymer fibers market include:

- Integrated Polymer Solutions

- Micro Engineering Solutions

- TissueGen

The global drug integrated polymer fibers market is segmented as follows:

By Product

- Polylactic Acid

- Polydioxanone

- Polycaprolactone

By Application

- Drug Delivery

- Orthopaedic Sutures

- Vascular Stents

- Vascular Grafts

- Dermal Wound Healing

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Drug Integrated Polymer Fibers Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Drug Integrated Polymer Fibers Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Drug Integrated Polymer Fibers Overall Market Size 2.1 Global Drug Integrated Polymer Fibers Market Size: 2021 VS 2028 2.2 Global Drug Integrated Polymer Fibers Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Drug Integrated Polymer Fibers Sales: 2017-2028 3 Company Landscape 3.1 Top Drug Integrated Polymer Fibers Players in Global Market 3.2 Top Global Drug Integrated Polymer Fibers Companies Ranked by Revenue 3.3 Global Drug Integrated Polymer Fibers Revenue by Companies 3.4 Global Drug Integrated Polymer Fibers Sales by Companies 3.5 Global Drug Integrated Polymer Fibers Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Drug Integrated Polymer Fibers Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Drug Integrated Polymer Fibers Product Type 3.8 Tier 1, Tier 2 and Tier 3 Drug Integrated Polymer Fibers Players in Global Market 3.8.1 List of Global Tier 1 Drug Integrated Polymer Fibers Companies 3.8.2 List of Global Tier 2 and Tier 3 Drug Integrated Polymer Fibers Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Drug Integrated Polymer Fibers Market Size Markets, 2021 & 2028 4.1.2 Polylactic Acid 4.1.3 Polydioxanone 4.1.4 Polycaprolactone 4.2 By Type - Global Drug Integrated Polymer Fibers Revenue & Forecasts 4.2.1 By Type - Global Drug Integrated Polymer Fibers Revenue, 2017-2022 4.2.2 By Type - Global Drug Integrated Polymer Fibers Revenue, 2023-2028 4.2.3 By Type - Global Drug Integrated Polymer Fibers Revenue Market Share, 2017-2028 4.3 By Type - Global Drug Integrated Polymer Fibers Sales & Forecasts 4.3.1 By Type - Global Drug Integrated Polymer Fibers Sales, 2017-2022 4.3.2 By Type - Global Drug Integrated Polymer Fibers Sales, 2023-2028 4.3.3 By Type - Global Drug Integrated Polymer Fibers Sales Market Share, 2017-2028 4.4 By Type - Global Drug Integrated Polymer Fibers Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Drug Integrated Polymer Fibers Market Size, 2021 & 2028 5.1.2 Drug Delivery 5.1.3 Orthopaedic Sutures 5.1.4 Vascular Stents 5.1.5 Vascular Grafts 5.1.6 Dermal Wound Healing 5.2 By Application - Global Drug Integrated Polymer Fibers Revenue & Forecasts 5.2.1 By Application - Global Drug Integrated Polymer Fibers Revenue, 2017-2022 5.2.2 By Application - Global Drug Integrated Polymer Fibers Revenue, 2023-2028 5.2.3 By Application - Global Drug Integrated Polymer Fibers Revenue Market Share, 2017-2028 5.3 By Application - Global Drug Integrated Polymer Fibers Sales & Forecasts 5.3.1 By Application - Global Drug Integrated Polymer Fibers Sales, 2017-2022 5.3.2 By Application - Global Drug Integrated Polymer Fibers Sales, 2023-2028 5.3.3 By Application - Global Drug Integrated Polymer Fibers Sales Market Share, 2017-2028 5.4 By Application - Global Drug Integrated Polymer Fibers Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Drug Integrated Polymer Fibers Market Size, 2021 & 2028 6.2 By Region - Global Drug Integrated Polymer Fibers Revenue & Forecasts 6.2.1 By Region - Global Drug Integrated Polymer Fibers Revenue, 2017-2022 6.2.2 By Region - Global Drug Integrated Polymer Fibers Revenue, 2023-2028 6.2.3 By Region - Global Drug Integrated Polymer Fibers Revenue Market Share, 2017-2028 6.3 By Region - Global Drug Integrated Polymer Fibers Sales & Forecasts 6.3.1 By Region - Global Drug Integrated Polymer Fibers Sales, 2017-2022 6.3.2 By Region - Global Drug Integrated Polymer Fibers Sales, 2023-2028 6.3.3 By Region - Global Drug Integrated Polymer Fibers Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Drug Integrated Polymer Fibers Revenue, 2017-2028 6.4.2 By Country - North America Drug Integrated Polymer Fibers Sales, 2017-2028 6.4.3 US Drug Integrated Polymer Fibers Market Size, 2017-2028 6.4.4 Canada Drug Integrated Polymer Fibers Market Size, 2017-2028 6.4.5 Mexico Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Drug Integrated Polymer Fibers Revenue, 2017-2028 6.5.2 By Country - Europe Drug Integrated Polymer Fibers Sales, 2017-2028 6.5.3 Germany Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5.4 France Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5.5 U.K. Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5.6 Italy Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5.7 Russia Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5.8 Nordic Countries Drug Integrated Polymer Fibers Market Size, 2017-2028 6.5.9 Benelux Drug Integrated Polymer Fibers Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Drug Integrated Polymer Fibers Revenue, 2017-2028 6.6.2 By Region - Asia Drug Integrated Polymer Fibers Sales, 2017-2028 6.6.3 China Drug Integrated Polymer Fibers Market Size, 2017-2028 6.6.4 Japan Drug Integrated Polymer Fibers Market Size, 2017-2028 6.6.5 South Korea Drug Integrated Polymer Fibers Market Size, 2017-2028 6.6.6 Southeast Asia Drug Integrated Polymer Fibers Market Size, 2017-2028 6.6.7 India Drug Integrated Polymer Fibers Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Drug Integrated Polymer Fibers Revenue, 2017-2028 6.7.2 By Country - South America Drug Integrated Polymer Fibers Sales, 2017-2028 6.7.3 Brazil Drug Integrated Polymer Fibers Market Size, 2017-2028 6.7.4 Argentina Drug Integrated Polymer Fibers Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Drug Integrated Polymer Fibers Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Drug Integrated Polymer Fibers Sales, 2017-2028 6.8.3 Turkey Drug Integrated Polymer Fibers Market Size, 2017-2028 6.8.4 Israel Drug Integrated Polymer Fibers Market Size, 2017-2028 6.8.5 Saudi Arabia Drug Integrated Polymer Fibers Market Size, 2017-2028 6.8.6 UAE Drug Integrated Polymer Fibers Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 TissueGen 7.1.1 TissueGen Corporate Summary 7.1.2 TissueGen Business Overview 7.1.3 TissueGen Drug Integrated Polymer Fibers Major Product Offerings 7.1.4 TissueGen Drug Integrated Polymer Fibers Sales and Revenue in Global (2017-2022) 7.1.5 TissueGen Key News 7.2 Micro Engineering Solutions 7.2.1 Micro Engineering Solutions Corporate Summary 7.2.2 Micro Engineering Solutions Business Overview 7.2.3 Micro Engineering Solutions Drug Integrated Polymer Fibers Major Product Offerings 7.2.4 Micro Engineering Solutions Drug Integrated Polymer Fibers Sales and Revenue in Global (2017-2022) 7.2.5 Micro Engineering Solutions Key News 7.3 Integrated Polymer Solutions 7.3.1 Integrated Polymer Solutions Corporate Summary 7.3.2 Integrated Polymer Solutions Business Overview 7.3.3 Integrated Polymer Solutions Drug Integrated Polymer Fibers Major Product Offerings 7.3.4 Integrated Polymer Solutions Drug Integrated Polymer Fibers Sales and Revenue in Global (2017-2022) 7.3.5 Integrated Polymer Solutions Key News 8 Global Drug Integrated Polymer Fibers Production Capacity, Analysis 8.1 Global Drug Integrated Polymer Fibers Production Capacity, 2017-2028 8.2 Drug Integrated Polymer Fibers Production Capacity of Key Manufacturers in Global Market 8.3 Global Drug Integrated Polymer Fibers Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Drug Integrated Polymer Fibers Supply Chain Analysis 10.1 Drug Integrated Polymer Fibers Industry Value Chain 10.2 Drug Integrated Polymer Fibers Upstream Market 10.3 Drug Integrated Polymer Fibers Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Drug Integrated Polymer Fibers Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Drug Integrated Polymer Fibers

Request Sample

Drug Integrated Polymer Fibers