Employee Onboarding Software Market Size, Share, and Trends Analysis Report

CAGR :

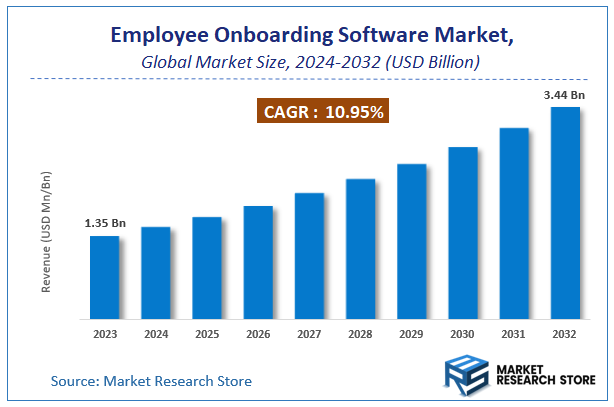

| Market Size 2023 (Base Year) | USD 1.35 Billion |

| Market Size 2032 (Forecast Year) | USD 3.44 Billion |

| CAGR | 10.95% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Employee Onboarding Software Market Insights

According to Market Research Store, the global employee onboarding software market size was valued at around USD 1.35 billion in 2023 and is estimated to reach USD 3.44 billion by 2032, to register a CAGR of approximately 10.95% in terms of revenue during the forecast period 2024-2032.

The employee onboarding software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032..

Global Employee Onboarding Software Market: Overview

Employee onboarding software refers to digital platforms designed to streamline and automate the process of integrating new hires into an organization. These tools facilitate tasks such as document completion, training, compliance tracking, and socialization, ensuring a consistent and engaging experience for new employees.

Key Highlights

- The employee onboarding software market is anticipated to grow at a CAGR of 10.95% during the forecast period.

- The global employee onboarding software market was estimated to be worth approximately USD 1.35 billion in 2023 and is projected to reach a value of USD 3.44 billion by 2032.

- The growth of the employee onboarding software market is being driven by increasing adoption of artificial intelligence (AI) and automation, the rise of remote and hybrid work models, and a heightened focus on enhancing employee experience and retention.

- Based on the deployment mode, the cloud-based segment is growing at a high rate and is projected to dominate the market.

- On the basis of end-user, the large enterprises segment is projected to swipe the largest market share.

- In terms of vertical, the BFSI segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Employee Onboarding Software Market: Dynamics

Key Growth Drivers

- Digital transformation in HR – Organizations are increasingly adopting digital tools to streamline onboarding, reduce manual paperwork, and enhance efficiency.

- Remote and hybrid work adoption – The rise of remote work has increased demand for software that can onboard employees virtually and maintain engagement.

- Focus on employee experience & retention – Companies are investing in onboarding software to improve first impressions, accelerate productivity, and reduce attrition.

- Integration with HR ecosystems – Seamless integration with HRMS, payroll, and learning management systems makes onboarding software more attractive to enterprises.

Restraints

- High implementation costs – Small and medium enterprises may find upfront costs and subscription fees prohibitive.

- Resistance to change – Organizations with traditional HR processes may hesitate to adopt digital onboarding solutions.

- Data security concerns – Handling personal employee data digitally requires robust security measures, which can complicate adoption.

Opportunities

- AI and automation – Incorporating AI-driven task automation, chatbots, and personalized onboarding paths can enhance efficiency and employee engagement.

- SME adoption – Expanding software offerings tailored to small and mid-sized businesses opens a new growth segment.

- Global workforce expansion – Companies hiring across geographies need multilingual, region-specific onboarding solutions.

- Analytics & insights – Advanced reporting and analytics help organizations measure onboarding effectiveness and optimize processes.

Challenges

- Integration complexity – Ensuring smooth connectivity with multiple HR and IT systems can be technically challenging.

- Keeping content engaging – Designing onboarding content that is interactive and retains employee attention remains difficult.

- Compliance across regions – Adhering to local labor laws, data protection, and regulatory requirements adds complexity.

- Continuous software updates – Regular updates and feature enhancements are needed to keep pace with evolving HR needs, which can be resource-intensive.

Employee Onboarding Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Employee Onboarding Software Market |

| Market Size in 2023 | USD 1.35 Billion |

| Market Forecast in 2032 | USD 3.44 Billion |

| Growth Rate | CAGR of 10.95% |

| Number of Pages | 150 |

| Key Companies Covered | Appical B.V., Automatic Payroll Systems, Inc., BambooHR LLC, Ceridian HCM, Inc., ClearCompany LLC, Enborad.Me Pty Ltd., IBM Corporation, Jobvite, Inc., Oracle Corporation, Paychex, Inc., Paycom Software, Inc., Paycor, Inc., Paylocity Holding Corporation, Saba Software Inc., SAP SE, SilkRoad Technology, Inc., Ultimate Software Group, Inc., Workday, Inc., Talmundo, and Zoho Corporation Pvt. Ltd |

| Segments Covered | By Deployment Mode, By End-User, By Vertical, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Employee Onboarding Software Market: Segmentation Insights

The global employee onboarding software market is divided by deployment mode, end-user, vertical, and region.

Based on deployment mode, the global employee onboarding software market is divided into on-premise and cloud-based. Cloud-based onboarding software has emerged as the preferred choice for many organizations due to its scalability, cost-effectiveness, and accessibility. These solutions eliminate the need for substantial upfront infrastructure investments, making them particularly attractive to small and medium-sized enterprises (SMEs). The cloud-based model allows employees to access onboarding materials and complete necessary tasks from any location with an internet connection, facilitating remote work and enhancing flexibility. On-premises onboarding software involves deploying the software on an organization's own servers and infrastructure. This deployment mode offers greater control over data security and customization, which can be crucial for large enterprises or organizations operating in highly regulated industries. On-premises solutions allow for tailored configurations to meet specific organizational needs and compliance requirements. However, they come with higher upfront costs, including hardware, software licenses, and dedicated IT staff for maintenance and support.

On the basis of end-user, the global employee onboarding software market is bifurcated into small medium-sized enterprises and large enterprises. Large Enterprises hold the dominant share of the market. These organizations often have complex, multi-departmental hiring processes that necessitate comprehensive onboarding solutions. The adoption of advanced technologies, such as artificial intelligence and machine learning, allows large enterprises to offer personalized onboarding experiences, enhancing employee engagement and retention. Small and Medium-Sized Enterprises (SMEs), while holding a smaller market share, are experiencing the fastest growth in the adoption of onboarding software. The increasing availability of cloud-based solutions has made these tools more accessible to SMEs, offering cost-effective and scalable options that align with their budget constraints.

On the basis of vertical, the global employee onboarding software market is bifurcated into automotive transportation, logistics, BFSI (banking financial services and insurance), government, media entertainment, energy utility, healthcare, it telecom manufacturing, retail, consumer goods, and others. Banking, Financial Services, and Insurance (BFSI) sectors lead in the adoption of onboarding software due to stringent regulatory compliance requirements and the necessity for secure, efficient employee integration processes. These institutions prioritize solutions that offer robust data security features and streamline the onboarding of numerous employees, often across multiple locations. Information Technology (IT) and Telecommunications industries follow closely, driven by rapid technological advancements and the need for scalable onboarding solutions. The dynamic nature of these sectors demands onboarding platforms that can quickly adapt to changing organizational structures and support a tech-savvy workforce.

Employee Onboarding Software Market: Regional Insights

- North America is expected to dominates the global market

North America is the most dominant market for employee onboarding software globally, driven by early adoption of advanced technologies, a high concentration of large enterprises, and a strong emphasis on enhancing employee experience. The presence of major vendors and a mature digital infrastructure further bolster the region's leadership in this sector.

Europe follows as the second-largest market, characterized by a robust regulatory environment and a diverse workforce. The region's focus on compliance, data protection, and employee engagement has led to widespread adoption of onboarding solutions, particularly in countries like Germany, the UK, and France.

Asia Pacific is experiencing the fastest growth in the employee onboarding software market. Emerging economies, notably India and China, are rapidly digitalizing their HR processes. The increasing need for efficient onboarding in these countries, coupled with the adoption of cloud-based solutions, is propelling the market forward.

Latin America exhibits moderate growth, with countries such as Brazil and Mexico showing a gradual shift towards digital HR solutions. Economic challenges and varying levels of technological infrastructure present hurdles, but the trend towards modernization in HR practices is evident.

Middle East and Africa (MEA) currently hold the smallest share of the market. However, there is a growing interest in automating HR processes, particularly in the Gulf Cooperation Council (GCC) countries. Investments in digital transformation are expected to drive future growth in this region.

Employee Onboarding Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the employee onboarding software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global employee onboarding software market include:

- Appical B.V.

- Automatic Payroll Systems Inc.

- BambooHR LLC

- Ceridian HCM Inc.

- ClearCompany LLC

- Enborad.Me Pty Ltd.

- IBM Corporation

- Jobvite Inc.

- Oracle Corporation

- Paychex Inc.

- Paycom Software Inc.

- Paycor Inc.

- Paylocity Holding Corporation

- Saba Software Inc.

- SAP SE

- SilkRoad Technology Inc.

- Ultimate Software Group Inc.

- Workday Inc.

- Talmundo

- Zoho Corporation Pvt. Ltd

The global employee onboarding software market is segmented as follows:

By Deployment Mode

- On-Premise

- Cloud-Based

By End-User

- Small Medium-Sized Enterprises

- Large Enterprises

By Vertical

- Automotive Transportation

- Logistics

- BFSI (Banking Financial Services and Insurance)

- Government

- Media Entertainment

- Energy Utility

- Healthcare

- IT Telecom Manufacturing

- Retail

- Consumer Goods

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

CHAPTER 1. Executive Summary 23

CHAPTER 2. Employee Onboarding Software market – Deployment Mode Analysis 26

2.1. Global Employee Onboarding Software Market – Deployment Mode Overview 26

2.2. Global Employee Onboarding Software Market Share, by Deployment Mode, 2018 & 2025 (USD Million) 26

2.3. On-Premise 28

2.3.1. Global On-Premise Employee Onboarding Software Market, 2015-2025 (USD Million) 28

2.4. Cloud-Based 29

2.4.1. Global Cloud-Based Employee Onboarding Software Market, 2015-2025 (USD Million) 29

CHAPTER 3. Employee Onboarding Software market – End-User Analysis 29

3.1. Global Employee Onboarding Software Market – End-User Overview 29

3.2. Global Employee Onboarding Software Market Share, by End-User, 2018 & 2025 (USD Million) 30

3.3. Small & Medium-Sized Enterprises 31

3.3.1. Global Small & Medium-Sized Enterprises Employee Onboarding Software Market, 2015-2025 (USD Million) 31

3.4. Large Enterprises 32

3.4.1. Global Large Enterprises Employee Onboarding Software Market, 2015-2025 (USD Million) 32

CHAPTER 4. Employee Onboarding Software market – Vertical Analysis 32

4.1. Global Employee Onboarding Software Market – Vertical Overview 32

4.2. Global Employee Onboarding Software Market Share, by Vertical, 2018 & 2025 (USD Million) 33

4.3. Automotive 35

4.3.1. Global Automotive Employee Onboarding Software Market, 2015-2025 (USD Million) 35

4.4. Transportation & Logistics 36

4.4.1. Global Transportation & Logistics Employee Onboarding Software Market, 2015-2025 (USD Million) 36

4.5. BFSI (Banking, Financial Services and Insurance) 37

4.5.1. Global BFSI (Banking, Financial Services and Insurance) Employee Onboarding Software Market, 2015-2025 (USD Million) 37

4.6. Government 38

4.6.1. Global Government Employee Onboarding Software Market, 2015-2025 (USD Million) 38

4.7. Media & Entertainment 39

4.7.1. Global Media & Entertainment Employee Onboarding Software Market, 2015-2025 (USD Million) 39

4.8. Energy & Utility 40

4.8.1. Global Energy & Utility Employee Onboarding Software Market, 2015-2025 (USD Million) 40

4.9. Healthcare 41

4.9.1. Global Healthcare Employee Onboarding Software Market, 2015-2025 (USD Million) 41

4.10. IT & Telecom 42

4.10.1. Global IT & Telecom Employee Onboarding Software Market, 2015-2025 (USD Million) 42

4.11. Manufacturing 43

4.11.1. Global Manufacturing Employee Onboarding Software Market, 2015-2025 (USD Million) 43

4.12. Retail & Consumer Goods 44

4.12.1. Global Retail & Consumer Goods Employee Onboarding Software Market, 2015-2025 (USD Million) 44

4.13. Others 45

4.13.1. Global Others Employee Onboarding Software Market, 2015-2025 (USD Million) 45

CHAPTER 5. Employee Onboarding Software market – Regional Analysis 46

5.1. Global Employee Onboarding Software Market Regional Overview 46

5.2. Global Employee Onboarding Software Market Share, by Region, 2018 & 2025 (Value) 46

5.3. North America 48

5.3.1. North America Employee Onboarding Software Market size and forecast, 2015-2025 48

5.3.2. North America Employee Onboarding Software Market, by Country, 2018 & 2025 (USD Million) 48

5.3.3. North America Employee Onboarding Software Market, by Deployment Mode, 2015-2025 50

5.3.3.1. North America Employee Onboarding Software Market, by Deployment Mode, 2015-2025 (USD Million) 50

5.3.4. North America Employee Onboarding Software Market, by End-User, 2015-2025 51

5.3.4.1. North America Employee Onboarding Software Market, by End-User, 2015-2025 (USD Million) 51

5.3.5. North America Employee Onboarding Software Market, by Vertical, 2015-2025 52

5.3.5.1. North America Employee Onboarding Software Market, by Vertical, 2015-2025 (USD Million) 52

5.3.6. U.S. 53

5.3.6.1. U.S. Market size and forecast, 2015-2025 (USD Million) 53

5.3.7. Canada 54

5.3.7.1. Canada Market size and forecast, 2015-2025 (USD Million) 54

5.3.8. Mexico 55

5.3.8.1. Mexico Market size and forecast, 2015-2025 (USD Million) 55

5.4. Europe 56

5.4.1. Europe Employee Onboarding Software Market size and forecast, 2015-2025 56

5.4.2. Europe Employee Onboarding Software Market, by Country, 2018 & 2025 (USD Million) 56

5.4.3. Europe Employee Onboarding Software Market, by Deployment Mode, 2015-2025 58

5.4.3.1. Europe Employee Onboarding Software Market, by Deployment Mode, 2015-2025 (USD Million) 58

5.4.4. Europe Employee Onboarding Software Market, by End-User, 2015-2025 59

5.4.4.1. Europe Employee Onboarding Software Market, by End-User, 2015-2025 (USD Million) 59

5.4.5. Europe Employee Onboarding Software Market, by Vertical, 2015-2025 60

5.4.5.1. Europe Employee Onboarding Software Market, by Vertical, 2015-2025 (USD Million) 60

5.4.6. Germany 61

5.4.6.1. Germany Market size and forecast, 2015-2025 (USD Million) 61

5.4.7. France 62

5.4.7.1. France Market size and forecast, 2015-2025 (USD Million) 62

5.4.8. U.K. 63

5.4.8.1. U.K. Market size and forecast, 2015-2025 (USD Million) 63

5.4.9. Italy 64

5.4.9.1. Italy Market size and forecast, 2015-2025 (USD Million) 64

5.4.10. Spain 65

5.4.10.1. Spain Market size and forecast, 2015-2025 (USD Million) 65

5.4.11. Nordic Countries 66

5.4.11.1. Nordic Countries Market size and forecast, 2015-2025 (USD Million) 66

5.4.12. Benelux Union 67

5.4.12.1. Benelux Union Market size and forecast, 2015-2025 (USD Million) 67

5.4.13. Rest of Europe 68

5.4.13.1. Rest of Europe Market size and forecast, 2015-2025 (USD Million) 68

5.5. Asia Pacific 69

5.5.1. Asia Pacific Employee Onboarding Software Market size and forecast, 2015-2025 69

5.5.2. Asia Pacific Employee Onboarding Software Market, by Country, 2018 & 2025 (USD Million) 69

5.5.3. Asia Pacific Employee Onboarding Software Market, by Deployment Mode, 2015-2025 71

5.5.3.1. Asia Pacific Employee Onboarding Software Market, by Deployment Mode, 2015-2025 (USD Million) 71

5.5.4. Asia Pacific Employee Onboarding Software Market, by End-User, 2015-2025 72

5.5.4.1. Asia Pacific Employee Onboarding Software Market, by End-User, 2015-2025 (USD Million) 72

5.5.5. Asia Pacific Employee Onboarding Software Market, by Vertical, 2015-2025 73

5.5.5.1. Asia Pacific Employee Onboarding Software Market, by Vertical, 2015-2025 (USD Million) 73

5.5.6. China 74

5.5.6.1. China Market size and forecast, 2015-2025 (USD Million) 74

5.5.7. Japan 75

5.5.7.1. Japan Market size and forecast, 2015-2025 (USD Million) 75

5.5.8. India 76

5.5.8.1. India Market size and forecast, 2015-2025 (USD Million) 76

5.5.9. New Zealand 77

5.5.9.1. New Zealand Market size and forecast, 2015-2025 (USD Million) 77

5.5.10. Australia 78

5.5.10.1. Australia Market size and forecast, 2015-2025 (USD Million) 78

5.5.11. South Korea 79

5.5.11.1. South Korea Market size and forecast, 2015-2025 (USD Million) 79

5.5.12. South-East Asia 80

5.5.12.1. South-East Asia Market size and forecast, 2015-2025 (USD Million) 80

5.5.13. Rest of Asia Pacific 81

5.5.13.1. Rest of Asia Pacific Market size and forecast, 2015-2025 (USD Million) 81

5.6. Latin America 82

5.6.1. Latin America Employee Onboarding Software Market size and forecast, 2015-2025 82

5.6.2. Latin America Employee Onboarding Software Market, by Country, 2018 & 2025 (USD Million) 82

5.6.3. Latin America Employee Onboarding Software Market, by Deployment Mode, 2015-2025 84

5.6.3.1. Latin America Employee Onboarding Software Market, by Deployment Mode, 2015-2025 (USD Million) 84

5.6.4. Latin America Employee Onboarding Software Market, by End-User, 2015-2025 85

5.6.4.1. Latin America Employee Onboarding Software Market, by End-User, 2015-2025 (USD Million) 85

5.6.5. Latin America Employee Onboarding Software Market, by Vertical, 2015-2025 86

5.6.5.1. Latin America Employee Onboarding Software Market, by Vertical, 2015-2025 (USD Million) 86

5.6.6. Brazil 87

5.6.6.1. Brazil Market size and forecast, 2015-2025 (USD Million) 87

5.6.7. Argentina 88

5.6.7.1. Argentina Market size and forecast, 2015-2025 (USD Million) 88

5.6.8. Rest of Latin America 89

5.6.8.1. Rest of Latin America Market size and forecast, 2015-2025 (USD Million) 89

5.7. The Middle-East and Africa 90

5.7.1. The Middle-East and Africa Employee Onboarding Software Market size and forecast, 2015-2025 90

5.7.2. The Middle-East and Africa Employee Onboarding Software Market, by Country, 2018 & 2025 (USD Million) 90

5.7.3. The Middle-East and Africa Employee Onboarding Software Market, by Deployment Mode, 2015-2025 92

5.7.3.1. The Middle-East and Africa Employee Onboarding Software Market, by Deployment Mode, 2015-2025 (USD Million) 92

5.7.4. The Middle-East and Africa Employee Onboarding Software Market, by End-User, 2015-2025 93

5.7.4.1. The Middle-East and Africa Employee Onboarding Software Market, by End-User, 2015-2025 (USD Million) 93

5.7.5. The Middle-East and Africa Employee Onboarding Software Market, by Vertical, 2015-2025 94

5.7.5.1. The Middle-East and Africa Employee Onboarding Software Market, by Vertical, 2015-2025 (USD Million) 94

5.7.6. Saudi Arabia 95

5.7.6.1. Saudi Arabia Market size and forecast, 2015-2025 (USD Million) 95

5.7.7. UAE 96

5.7.7.1. UAE Market size and forecast, 2015-2025 (USD Million) 96

5.7.8. Egypt 97

5.7.8.1. Egypt Market size and forecast, 2015-2025 (USD Million) 97

5.7.9. Kuwait 98

5.7.9.1. Kuwait Market size and forecast, 2015-2025 (USD Million) 98

5.7.10. South Africa 99

5.7.10.1. South Africa Market size and forecast, 2015-2025 (USD Million) 99

5.7.11. Rest of Middle-East Africa 100

5.7.11.1. Rest of Middle-East Africa Market size and forecast, 2015-2025 (USD Million) 100

CHAPTER 6. Employee Onboarding Software market – Competitive Landscape 101

6.1. Competitor Market Share – Revenue 101

6.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players 103

6.3. Strategic Development 104

6.3.1. Acquisitions and Mergers 104

6.3.2. New Products 104

6.3.3. Research & Development Activities 104

CHAPTER 7. Company Profiles 105

7.1. Appical B.V. 105

7.1.1. Company Overview 105

7.1.2. Appical B.V. Revenue and Gross Margin 105

7.1.3. Product portfolio 106

7.1.4. Recent initiatives 107

7.2. Automatic Payroll Systems Inc. 107

7.2.1. Company Overview 107

7.2.2. Automatic Payroll Systems Inc. Revenue and Gross Margin 107

7.2.3. Product portfolio 108

7.2.4. Recent initiatives 109

7.3. BambooHR LLC 109

7.3.1. Company Overview 109

7.3.2. BambooHR LLC Revenue and Gross Margin 109

7.3.3. Product portfolio 110

7.3.4. Recent initiatives 111

7.4. Ceridian HCM Inc. 111

7.4.1. Company Overview 111

7.4.2. Ceridian HCM Inc. Revenue and Gross Margin 111

7.4.3. Product portfolio 112

7.4.4. Recent initiatives 113

7.5. ClearCompany LLC 113

7.5.1. Company Overview 113

7.5.2. ClearCompany LLC Revenue and Gross Margin 113

7.5.3. Product portfolio 114

7.5.4. Recent initiatives 115

7.6. Enborad.Me Pty Ltd. 115

7.6.1. Company Overview 115

7.6.2. Enborad.Me Pty Ltd. Revenue and Gross Margin 115

7.6.3. Product portfolio 116

7.6.4. Recent initiatives 117

7.7. IBM Corporation 117

7.7.1. Company Overview 117

7.7.2. IBM Corporation Revenue and Gross Margin 117

7.7.3. Product portfolio 118

7.7.4. Recent initiatives 119

7.8. Jobvite Inc. 119

7.8.1. Company Overview 119

7.8.2. Jobvite Inc. Revenue and Gross Margin 119

7.8.3. Product portfolio 120

7.8.4. Recent initiatives 121

7.9. Oracle Corporation 121

7.9.1. Company Overview 121

7.9.2. Oracle Corporation Revenue and Gross Margin 121

7.9.3. Product portfolio 122

7.9.4. Recent initiatives 123

7.10. Paychex Inc. 123

7.10.1. Company Overview 123

7.10.2. Paychex Inc. Revenue and Gross Margin 123

7.10.3. Product portfolio 124

7.10.4. Recent initiatives 125

7.11. Paycom Software Inc. 125

7.11.1. Company Overview 125

7.11.2. Paycom Software Inc. Revenue and Gross Margin 125

7.11.3. Product portfolio 126

7.11.4. Recent initiatives 127

7.12. Paycor Inc. 127

7.12.1. Company Overview 127

7.12.2. Paycor Inc. Revenue and Gross Margin 127

7.12.3. Product portfolio 128

7.12.4. Recent initiatives 129

7.13. Paylocity Holding Corporation 129

7.13.1. Company Overview 129

7.13.2. Paylocity Holding Corporation Revenue and Gross Margin 129

7.13.3. Product portfolio 130

7.13.4. Recent initiatives 131

7.14. Saba Software Inc. 131

7.14.1. Company Overview 131

7.14.2. Saba Software Inc. Revenue and Gross Margin 131

7.14.3. Product portfolio 132

7.14.4. Recent initiatives 133

7.15. SAP SE 133

7.15.1. Company Overview 133

7.15.2. SAP SE Revenue and Gross Margin 133

7.15.3. Product portfolio 134

7.15.4. Recent initiatives 135

7.16. SilkRoad Technology Inc. 135

7.16.1. Company Overview 135

7.16.2. SilkRoad Technology Inc. Revenue and Gross Margin 135

7.16.3. Product portfolio 136

7.16.4. Recent initiatives 137

7.17. Ultimate Software Group Inc. 137

7.17.1. Company Overview 137

7.17.2. Ultimate Software Group Inc. Revenue and Gross Margin 137

7.17.3. Product portfolio 138

7.17.4. Recent initiatives 139

7.18. Workday Inc. 139

7.18.1. Company Overview 139

7.18.2. Workday Inc. Revenue and Gross Margin 139

7.18.3. Product portfolio 140

7.18.4. Recent initiatives 141

7.19. Talmundo 141

7.19.1. Company Overview 141

7.19.2. Talmundo Revenue and Gross Margin 141

7.19.3. Product portfolio 142

7.19.4. Recent initiatives 143

7.20. Zoho Corporation Pvt. Ltd. 143

7.20.1. Company Overview 143

7.20.2. Zoho Corporation Pvt. Ltd. Revenue and Gross Margin 143

7.20.3. Product portfolio 144

7.20.4. Recent initiatives 145

CHAPTER 8. Employee Onboarding Software — Industry Analysis 146

8.1. Employee Onboarding Software Market – Key Trends 146

8.1.1. Market Drivers 147

8.1.2. Market Restraints 147

8.1.3. Market Opportunities 148

8.2. Value Chain Analysis 149

8.3. Technology Roadmap and Timeline 150

8.4. Employee Onboarding Software Market – Attractiveness Analysis 151

8.4.1. By Deployment Mode 151

8.4.2. By End-User 151

8.4.3. By Vertical 152

8.4.4. By Region 154

CHAPTER 9. Marketing Strategy Analysis, Distributors 155

9.1. Marketing Channel 155

9.2. Direct Marketing 156

9.3. Indirect Marketing 156

9.4. Marketing Channel Development Trend 156

9.5. Economic/Political Environmental Change 157

CHAPTER 10. Report Conclusion 158

CHAPTER 11. Research Approach & Methodology 159

11.1. Report Description 159

11.2. Research Scope 160

11.3. Research Methodology 160

11.3.1. Secondary Research 161

11.3.2. Primary Research 162

11.3.3. Models 163

11.3.3.1. Company Share Analysis Model 163

11.3.3.2. Revenue Based Modeling 164

11.3.3.3. Research Limitations 164

Inquiry For Buying

Employee Onboarding Software

Request Sample

Employee Onboarding Software