Flame Retardant Chemicals Market Size, Share, and Trends Analysis Report

CAGR :

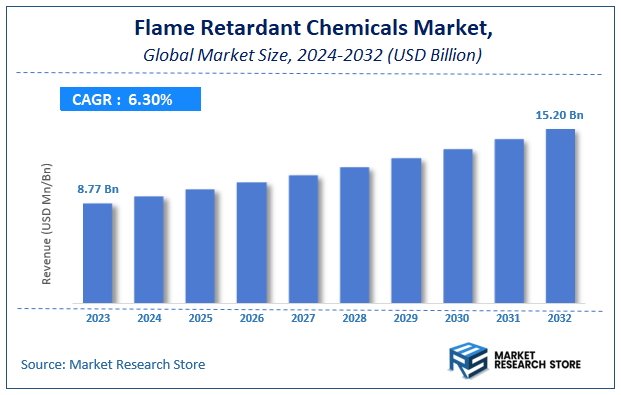

| Market Size 2023 (Base Year) | USD 8.77 Billion |

| Market Size 2032 (Forecast Year) | USD 15.20 Billion |

| CAGR | 6.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Flame Retardant Chemicals Market Insights

According to Market Research Store, the global flame retardant chemicals market size was valued at around USD 8.77 billion in 2023 and is estimated to reach USD 15.20 billion by 2032, to register a CAGR of approximately 6.3% in terms of revenue during the forecast period 2024-2032.

The flame retardant chemicals report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Flame Retardant Chemicals Market: Overview

Flame retardant chemicals are additives or reactive agents designed to reduce the flammability of materials and inhibit the spread of fire. These chemicals function by disrupting combustion processes through mechanisms such as creating a protective char layer, diluting flammable gases, or chemically interfering with heat and flame propagation. Common types include halogenated flame retardants, phosphorus-based compounds, nitrogen-based compounds, metal hydroxides, and inorganic salts. They are incorporated into a wide variety of materials such as plastics, textiles, foams, coatings, construction materials, and electronic components to comply with fire safety standards and regulatory requirements.

The growth of the flame retardant chemicals market is driven by stringent fire safety regulations across industries including construction, electronics, automotive, and aerospace. Rising demand for fire-resistant materials in building insulation, wiring, furnishings, and transportation components is further fueling adoption.

Key Highlights

- The flame retardant chemicals market is anticipated to grow at a CAGR of 6.3% during the forecast period.

- The global flame retardant chemicals market was estimated to be worth approximately USD 8.77 billion in 2023 and is projected to reach a value of USD 15.20 billion by 2032.

- The growth of the flame retardant chemicals market is being driven by increasing safety regulations, growing awareness of fire hazards, and rising demand across industries such as construction, electronics, automotive, textiles, and aerospace.

- Based on the product, the halogenated segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the polyolefins segment is projected to swipe the largest market share.

- In terms of end-use, the construction segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Flame Retardant Chemicals Market Dynamics

Key Growth Drivers:

- Stringent Fire Safety Regulations and Building Codes: Increasingly rigorous fire safety regulations and building codes mandated by governments and regulatory bodies globally, especially in construction, electronics, and automotive industries, are the primary drivers for the adoption of flame retardant chemicals.

- Increasing Incidence of Fire Accidents: A rising number of fire incidents, leading to significant property damage and loss of life, escalates the demand for materials with enhanced fire resistance, thereby boosting the use of flame retardant chemicals in various applications.

- Expansion of End-Use Industries: Rapid growth in key end-use sectors such as building & construction (for insulation, wiring, and roofing), electrical & electronics (for wires, cables, and circuit boards), and automotive & transportation (for interiors and components) directly fuels the demand for flame retardant chemicals.

- Growth in Electric Vehicles (EVs) and Renewable Energy: The surge in electric vehicle production and the expansion of renewable energy infrastructure (e.g., wind turbines, solar panels) drive demand for specialized flame retardants in high-performance plastics, battery systems, and cables to ensure safety and reliability.

Restraints:

- Environmental and Health Concerns with Halogenated Flame Retardants: Significant concerns regarding the environmental persistence, bioaccumulation, and potential health impacts (e.g., endocrine disruption, developmental issues) of traditional halogenated flame retardants are leading to stricter regulations and a shift away from their use.

- High Research and Development (R&D) Costs for Alternatives: Developing new, effective, and environmentally friendly non-halogenated flame retardants requires substantial R&D investment, long approval processes, and complex testing, which increases costs for manufacturers.

- Price Volatility of Raw Materials: The production of many flame retardant chemicals relies on petrochemical-derived raw materials, making the market susceptible to price fluctuations in crude oil and other basic chemicals, impacting manufacturing costs and profitability.

Opportunities:

- Shift Towards Non-Halogenated and Sustainable Solutions: The strong regulatory push and growing consumer preference for safer and environmentally friendlier alternatives present significant opportunities for the development and commercialization of inorganic, phosphorus, and nitrogen-based flame retardants.

- Technological Advancements in Formulation and Application: Innovation in flame retardant formulations (e.g., encapsulated systems, intumescent coatings) and advanced application techniques can improve efficiency, reduce required loadings, and expand their use into new materials and products.

- Growth in Emerging Economies' Infrastructure Development: Rapid urbanization, industrialization, and significant infrastructure projects in emerging economies (especially in Asia-Pacific) offer immense growth potential for flame retardant chemicals in construction, automotive, and electronics sectors.

Challenges:

- Navigating Evolving and Fragmented Regulations: The constantly changing and often disparate fire safety and chemical regulations across different countries and regions create a complex compliance landscape for manufacturers, impacting market access and product development.

- Performance Gap of Alternatives vs. Traditional Flame Retardants: While non-halogenated alternatives are gaining traction, a key challenge is consistently matching the cost-effectiveness and high-performance levels (e.g., broad compatibility, durability) of established halogenated flame retardants in all demanding applications.

- Public Perception and Consumer Acceptance: Negative media attention and public concerns regarding the safety of certain flame retardants can create a challenging environment for the entire industry, necessitating greater transparency and clear communication about product safety.

Flame Retardant Chemicals Market: Report Scope

This report thoroughly analyzes the Flame Retardant Chemicals Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Flame Retardant Chemicals Market |

| Market Size in 2023 | USD 8.77 Billion |

| Market Forecast in 2032 | USD 15.20 Billion |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 142 |

| Key Companies Covered | AkzoNobel N.V, BASF SE, Clariant AG, Albemarle Corp, Dow Chemical Company, DuPont, Lanxess AG, Israel Chemicals Ltd (ICL), Chemtura Corporation, Bayer Material science and Dic Corporation. |

| Segments Covered | By Product, By End-User, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Flame Retardant Chemicals Market: Segmentation Insights

The global flame retardant chemicals market is divided by type, application, end user, and region.

Based on type, the global flame retardant chemicals market is divided into halogenated and non-halogenated. Halogenated flame retardant chemicals are the dominant product segment in the Flame Retardant Chemicals Market due to their high effectiveness, cost-efficiency, and widespread use in a variety of applications. These chemicals typically contain chlorine or bromine, which disrupt the combustion process by releasing halogen radicals that inhibit flame propagation. Halogenated flame retardants are extensively used in electronics, textiles, plastics, and building materials due to their ability to provide strong flame resistance at relatively low loadings. Their effectiveness in both the gas and condensed phases makes them especially suitable for demanding fire safety standards in insulation foams, wire and cable coatings, and circuit boards. Despite growing environmental and health concerns associated with some halogenated compounds, they continue to dominate certain sectors where performance and cost considerations outweigh regulatory limitations.

On the basis of application, the global flame retardant chemicals market is bifurcated into polyolefins, epoxy resins, UPE, PVC, ETP, rubber, styrenics, and others. Polyolefins are the dominant application segment in the Flame Retardant Chemicals Market due to their extensive use in construction, electrical insulation, automotive parts, and consumer products. These polymers, primarily polyethylene (PE) and polypropylene (PP), are highly flammable in their natural form, making flame retardant additives critical to enhancing their fire resistance. Flame retardants used in polyolefins help reduce melt dripping, smoke production, and flammability, which are essential for compliance with fire safety standards. Halogenated and non-halogenated solutions are both applied, depending on the desired performance, cost, and toxicity profile. The versatility and volume of polyolefin usage across industries continue to support their dominance in this market.

In terms of end user, the global flame retardant chemicals market is bifurcated into construction, transportation, electrical & electronics, and others. Construction is the dominant end-use segment in the Flame Retardant Chemicals Market due to the critical need for fire-resistant materials in residential, commercial, and industrial buildings. Flame retardant chemicals are incorporated into insulation foams, structural panels, roofing membranes, paints, coatings, and sealants to enhance fire safety performance and comply with stringent building codes. These chemicals help reduce flammability, delay flame spread, and minimize toxic gas emissions during combustion. The focus on safer construction practices, increased urban infrastructure development, and regulatory compliance continues to drive the widespread adoption of flame retardants in building materials. Both halogenated and non-halogenated solutions are utilized depending on material type and fire resistance specifications.

Flame Retardant Chemicals Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the flame retardant chemicals market, largely due to strict fire safety regulations, high construction standards, and significant use in electrical, electronics, and transportation sectors. The United States leads regional demand, with flame retardants widely used in insulation materials, automotive components, consumer electronics, textiles, and furnishings to meet flammability codes like NFPA, CAL 117, and UL 94. There is a growing shift from halogenated flame retardants toward halogen-free, non-toxic alternatives such as aluminum hydroxide, magnesium hydroxide, and phosphorus-based compounds, driven by environmental and health concerns. The presence of major chemical manufacturers and strong enforcement of building safety codes further supports market dominance. Canada also contributes to demand, particularly in industrial and residential construction applications and cable insulation in power and communication infrastructure.

Europe holds a significant share of the flame retardant chemicals market, driven by stringent fire safety and environmental regulations. The EU enforces highly regulated standards such as REACH and RoHS, which limit the use of halogenated flame retardants and encourage the adoption of eco-friendly alternatives. Germany, France, the UK, and Italy are the leading consumers, primarily using flame retardants in construction materials, automotive interiors, electrical housings, and upholstered furniture. The region places a strong emphasis on sustainable and recyclable materials, prompting innovation in phosphorus- and nitrogen-based retardants. Europe also shows high demand for intumescent systems and reactive flame retardants used in coatings and plastics. The growing focus on circular economy principles and product safety continues to shape purchasing decisions and product development strategies.

Asia-Pacific is the fastest-growing region in the flame retardant chemicals market, fueled by rapid urbanization, industrial growth, and rising awareness of fire safety in construction, electronics, and transportation. China is the largest producer and consumer, with extensive use in electronics manufacturing, cables, household appliances, and synthetic textiles. Increasing adoption of national building codes and consumer product standards is supporting demand for both halogenated and halogen-free solutions. India is also witnessing rapid market expansion, driven by industrialization, infrastructure development, and the rising adoption of flame-retardant materials in electric vehicles and appliances. Japan and South Korea exhibit mature usage, with demand focused on high-performance, low-toxicity flame retardants for automotive, electronics, and aerospace applications. However, regulatory fragmentation and environmental concerns are encouraging a shift toward safer, more sustainable flame retardants.

Latin America is an emerging market for flame retardant chemicals, with Brazil and Mexico leading regional consumption. Demand is driven by construction growth, automotive assembly, and increasing production of electronics and appliances. Brazil, in particular, is seeing increased use of flame-retardant additives in building materials, cable insulation, and foams for furniture and transport applications. Mexico benefits from proximity to North American manufacturing and export networks, especially in automotive and electronics sectors. While the market is still developing, fire safety awareness and the adoption of global flammability standards are gradually rising, encouraging use of more effective and compliant flame retardant formulations.

Middle East & Africa represent developing regions in the flame retardant chemicals market, with demand supported by expanding infrastructure, industrial development, and fire safety requirements in construction and oil & gas sectors. In the Middle East, countries such as the UAE and Saudi Arabia are incorporating flame retardant materials into high-rise buildings, commercial complexes, and public infrastructure to meet international safety codes. South Africa leads in Africa, particularly in construction, automotive, and textiles. The adoption of halogen-free and environmentally friendly flame retardants is still limited but expected to rise due to increasing alignment with international standards and growing regulatory oversight. However, market expansion is challenged by limited local production and high import dependence.

Flame Retardant Chemicals Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the flame retardant chemicals market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global flame retardant chemicals market include:

- Albemarle Corporation

- ICL

- LANXESS

- CLARIANT

- Italmatch Chemicals S.p.A

- Huber Engineered Materials

- BASF SE

- THOR

- DSM

- FRX Innovations

- DuPont

- DOW

- Eastman Chemical Company

- Hangzhou Lingrui Chemical Co. Ltd.

- Hongbaoli Group Co. Ltd.

- Huntsman International Llc

- Muby Chemicals

- Sasol

The global flame retardant chemicals market is segmented as follows:

By Product

- Halogenated

- Non-Halogenated

By Application

- Polyolefins

- Epoxy Resins

- UPE

- PVC

- ETP

- Rubber

- Styrenics

- Others

By End-use

- Construction

- Transportation

- Electrical & Electronics

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global flame retardant chemicals market volume and revenue, 2014 - 2020 (Kilo Tons) (USD Million)

- 2.2. Global flame retardant chemicals market: Snapshot

- Chapter 3. Flame Retardant Chemicals Market –Industry Analysis

- 3.1. Flame retardant chemicals: Market dynamics

- 3.2. Value chain analysis

- 3.3. Market drivers

- 3.3.1. Global flame retardant chemicals market drivers: Impact analysis

- 3.3.2. Increasing demand from end-user industries

- 3.3.3. Safety Regulation

- 3.4. Market restraints

- 3.4.1. Global flame retardant chemicals market restraints: Impact analysis

- 3.4.2. Higher prices

- 3.4.3. Environmental regulation

- 3.5. Opportunities

- 3.5.1. Research and Development

- 3.6. Porter’s five forces analysis

- 3.6.1. Bargaining power of suppliers

- 3.6.2. Bargaining power of buyers

- 3.6.3. Threat from new entrants

- 3.6.4. Threat from new substitutes

- 3.6.5. Degree of competition

- 3.7. Market attractiveness analysis

- 3.7.1. Market attractiveness analysis by product segment

- 3.7.2. Market attractiveness analysis by end-user segment

- 3.7.3. Market attractiveness analysis by regional segment

- Chapter 4. Global Flame Retardant Chemicals Market – Competitive Landscape

- 4.1. Global flame retardant chemicals: company market share,2014

- 4.2. Global flame retardant chemicals market: Production capacity (subject to data availability)

- 4.3. Global flame retardant chemicals: Raw material analysis

- 4.4. Global flame retardant chemicals market : Price trend Analysis

- Chapter 5. Global Flame Retardant Chemicals Market – Product Segment Analysis

- 5.1. Global flame retardant chemicals market: Product overview

- 5.1.1. Global flame retardant chemicals market volume share by product, 2014 and 2020

- 5.2. Aluminum trihydrate (ATH)

- 5.2.1. Global aluminum trihydrate (ATH) market, 2014 – 2020 (Kilo Tons) (USD Million)

- 5.3. Antimony oxides

- 5.3.1. Global antimony oxides market, 2014 – 2020 (Kilo Tons) (USD Million)

- 5.4. Brominated

- 5.4.1. Global brominated market, 2014 – 2020 (Kilo Tons) (USD Million)

- 5.5. Chlorinated

- 5.5.1. Global chlorinated market, 2014 – 2020 (Kilo Tons) (USD Million)

- 5.6. Others

- 5.6.1. Global other flame retardant chemicals market, 2014 – 2020 ( Kilo Tons) (USD Million)

- 5.1. Global flame retardant chemicals market: Product overview

- Chapter 6. Global Flame Retardant Chemicals Market – End-user Segment Analysis

- 6.1. Global flame retardant chemicals market: End-user overview

- 6.1.1. Global flame retardant chemicals market volume share by end-user, 2014 and 2020

- 6.2. Building & construction

- 6.2.1. Global flame retardant chemicals market for building & construction, 2014 – 2020 (Kilo Tons) (USD Million)

- 6.3. Electronics

- 6.3.1. Global flame retardant chemicals market for electronics, 2014 – 2020 (Kilo Tons) (USD Million)

- 6.4. Automotive & transportation

- 6.4.1. Global flame retardant chemicals market for automotive & transportation, 2014 – 2020 (Kilo Tons) (USD Million)

- 6.5. Wires & cables

- 6.5.1. Global flame retardant chemicals market for wires & cables, 2014 – 2020 (Kilo Tons) (USD Million)

- 6.6. Textiles

- 6.6.1. Global flame retardant chemicals market for textiles, 2014 – 2020 (Kilo Tons) (USD Million)

- 6.7. Other

- 6.7.1. Global flame retardant chemicals market for other end-users, 2014 – 2020 (Kilo Tons) (USD Million)

- 6.1. Global flame retardant chemicals market: End-user overview

- Chapter 7. Global Flame Retardant Chemicals Market – Regional Segment Analysis

- 7.1. Global flame retardant chemicals market: Regional overview

- 7.1.1. Global flame retardant chemicals market volume share, by region, 2014 and 2020

- 7.2. North America

- 7.2.1. North America flame retardant chemicals market volume, by product, 2014 – 2020, ( Kilo Tons)

- 7.2.2. North America flame retardant chemicals market revenue, by product, 2014 – 2020, (USD Million)

- 7.2.3. North America flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.2.4. North America flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.2.5. U.S.

- 7.2.5.1. U.S. flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.2.5.2. U.S. flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.2.5.3. U.S. flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.2.5.4. U.S. flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.3. Europe

- 7.3.1. Europe flame retardant chemicals market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.3.2. Europe flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.3. Europe flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.3.4. Europe flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.3.5. Germany

- 7.3.5.1. Germany flame retardant chemicals market volume, by product, 2014 – 2020, ( Kilo Tons)

- 7.3.5.2. Germany flame retardant chemicals market revenue, by product, 2014 – 2020, (USD Million)

- 7.3.5.3. Germany flame retardant chemicals market volume, by end-user, 2014 – 2020, ( Kilo Tons)

- 7.3.5.4. Germany flame retardant chemicals market revenue, by end-user, 2014 – 2020, (USD Million)

- 7.3.6. France

- 7.3.6.1. France flame retardant chemicals market volume, by product, 2014 – 2020, ( Kilo Tons)

- 7.3.6.2. France flame retardant chemicals market revenue, by product, 2014 – 2020, (USD Million)

- 7.3.6.3. France flame retardant chemicals market volume, by end-user, 2014 – 2020, ( Kilo Tons)

- 7.3.6.4. France flame retardant chemicals market revenue, by end-user, 2014 – 2020, (USD Million)

- 7.3.7. UK

- 7.3.7.1. UK flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.3.7.2. UK flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.7.3. UK flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.3.7.4. UK flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.4.2. Asia Pacific flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.3. Asia Pacific flame retardant chemicals market volume, by end-user, 2014 – 2020, ( Kilo Tons)

- 7.4.4. Asia Pacific flame retardant chemicals market revenue, by end-user, 2014 – 2020, (USD Million)

- 7.4.5. China

- 7.4.5.1. China flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.4.5.2. China flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.5.3. China flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.4.5.4. China flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.4.6. Japan

- 7.4.6.1. Japan flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.4.6.2. Japan flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.6.3. Japan flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.4.6.4. Japan flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.4.7. India

- 7.4.7.1. India flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.4.7.2. India flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.7.3. India flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.4.7.4. India flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.5.2. Latin America flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.3. Latin America flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.5.4. Latin America flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.5.5. Brazil

- 7.5.5.1. Brazil flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.5.5.2. Brazil flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.5.3. Brazil flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.5.5.4. Brazil flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa flame retardant chemicals market volume, by product, 2014 – 2020 ( Kilo Tons)

- 7.6.2. Middle East and Africa flame retardant chemicals market revenue, by product, 2014 – 2020 (USD Million)

- 7.6.3. Middle East and Africa flame retardant chemicals market volume, by end-user, 2014 – 2020 ( Kilo Tons)

- 7.6.4. Middle East and Africa flame retardant chemicals market revenue, by end-user, 2014 – 2020 (USD Million)

- 7.1. Global flame retardant chemicals market: Regional overview

- Chapter 8. Company Profile

- 8.1. AkzoNobel N.V

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Product portfolio

- 8.1.4. Business strategy

- 8.1.5. Recent developments

- 8.2. BASF SE

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Product portfolio

- 8.2.4. Business strategy

- 8.2.5. Recent developments

- 8.3. Albemarle Corporation

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Product portfolio

- 8.3.4. Business strategy

- 8.3.5. Recent developments

- 8.4. Albemarle Corp

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Product portfolio

- 8.4.4. Business strategy

- 8.4.5. Recent developments

- 8.5. Dow Chemical Company

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Product portfolio

- 8.5.4. Business strategy

- 8.5.5. Recent developments

- 8.6. Bayer Material science

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Product portfolio

- 8.6.4. Business strategy

- 8.6.5. Recent developments

- 8.7. E.I. Du Pont De Nemours And Company

- 8.7.1. Overview

- 8.7.2. Financials

- 8.7.3. Product portfolio

- 8.7.4. Business strategy

- 8.7.5. Recent developments

- 8.8. Clariant Ag

- 8.8.1. Overview

- 8.8.2. Financials

- 8.8.3. Product portfolio

- 8.8.4. Business strategy

- 8.8.5. Recent developments

- 8.9. Chemtura Corporation

- 8.9.1. Overview

- 8.9.2. Financials

- 8.9.3. Product portfolio

- 8.9.4. Business strategy

- 8.9.5. Recent developments

- 8.10. Israel Chemicals Ltd (ICL)

- 8.10.1. Overview

- 8.10.2. Financials

- 8.10.3. Product portfolio

- 8.10.4. Business strategy

- 8.10.5. Recent developments

- 8.11. Sonoco Products Company

- 8.11.1. Overview

- 8.11.2. Financials

- 8.11.3. Product portfolio

- 8.11.4. Business strategy

- 8.11.5. Recent developments

- 8.12. Saint-Gobain

- 8.12.1. Overview

- 8.12.2. Financials

- 8.12.3. Product portfolio

- 8.12.4. Business strategy

- 8.12.5. Recent developments

- 8.1. AkzoNobel N.V

Inquiry For Buying

Flame Retardant Chemicals

Request Sample

Flame Retardant Chemicals