Avionics Market Size, Share, and Trends Analysis Report

CAGR :

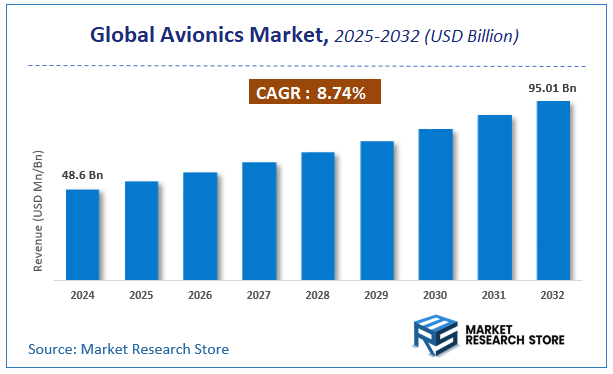

| Market Size 2024 (Base Year) | USD 48.6 Billion |

| Market Size 2032 (Forecast Year) | USD 95.01 Billion |

| CAGR | 8.74% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global avionics market, estimating its value at USD 48.6 Billion in 2024, with projections indicating it will reach USD 95.01 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 8.74% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the avionics industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Avionics Market: Overview

The growth of the avionics market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The avionics market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the avionics market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Application, Platform, Technology, End Use, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global avionics market is estimated to grow annually at a CAGR of around 8.74% over the forecast period (2025-2032).

- In terms of revenue, the global avionics market size was valued at around USD 48.6 Billion in 2024 and is projected to reach USD 95.01 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for advanced cockpit systems, increasing aircraft production, and rising adoption of next-generation navigation and communication technologies are fueling the Avionics market.

- Based on the Application, the Flight Control Systems segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Platform, the Commercial Aircraft segment is anticipated to command the largest market share.

- In terms of Technology, the Software segment is projected to lead the global market.

- By End Use, the Civil Aviation segment is predicted to dominate the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Avionics Market: Report Scope

This report thoroughly analyzes the avionics market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Avionics Market |

| Market Size in 2024 | USD 48.6 Billion |

| Market Forecast in 2032 | USD 95.01 Billion |

| Growth Rate | CAGR of 8.74% |

| Number of Pages | 233 |

| Key Companies Covered | Thales S.A., Honeywell International Inc., RTX Corporation, L3Harris Technologies Inc, Leonardo S.p.A., General Electric Company, BAE Systems plc, Northrop Grumman, Elbit Systems Ltd., Safran S.A. |

| Segments Covered | By Application, By Platform, By Technology, By End Use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Avionics Market: Dynamics

Key Growth Drivers :

The avionics market is experiencing significant growth, driven by the increasing demand for enhanced flight safety, operational efficiency, and a connected aviation ecosystem. Stricter regulatory mandates from global aviation authorities for systems like Automatic Dependent Surveillance-Broadcast (ADS-B) are compelling airlines to upgrade their fleets. The rapid increase in global air passenger traffic and the need for new, fuel-efficient aircraft also drive demand for advanced avionics. Furthermore, defense modernization initiatives and rising defense budgets worldwide are propelling the market for advanced military avionics. The integration of cutting-edge technologies like artificial intelligence (AI), machine learning, and satellite-based navigation systems is enhancing situational awareness and providing real-time data analytics for pilots and operators.

Restraints :

Despite the strong growth drivers, the avionics market faces several key restraints. A major challenge is the high cost associated with research, development, and integration of new avionics systems, which can be a significant financial burden for manufacturers and airlines. This is especially true for the retrofitting of older aircraft. Another significant restraint is the long and complex certification process for new technologies by regulatory bodies like the FAA and EASA. This can lead to lengthy delays and increase the overall cost of bringing a new product to market. The market is also vulnerable to supply chain disruptions, as the production of sophisticated avionics components relies on a global network of specialized suppliers.

Opportunities :

The avionics market presents numerous opportunities for innovation and expansion. The most significant opportunity lies in the burgeoning aftermarket segment, where aging aircraft fleets need to be upgraded with modern avionics to meet new safety regulations and improve efficiency. The increasing use of unmanned aerial systems (UAS), from military drones to commercial delivery drones, is creating a massive and largely untapped market for specialized, lightweight, and autonomous avionics. Furthermore, the rising demand for connected cockpits and in-flight connectivity offers a lucrative avenue for developing new products and services that provide real-time data, predictive maintenance analytics, and enhanced communication between aircraft and ground crews.

Challenges :

The market must navigate several complex challenges. The increasing digitization and connectivity of avionics systems create a major cybersecurity challenge. As systems become more interconnected, they become more vulnerable to hacking and cyberattacks, which could have catastrophic safety and security implications. The industry also faces a significant talent gap, with a shortage of skilled engineers and technicians in areas like AI, software development, and avionics integration. From a business perspective, the market is highly competitive and dominated by a few major global players, making it difficult for new entrants to gain a foothold. Finally, intellectual property rights can be a challenge, particularly in the maintenance, repair, and overhaul (MRO) segment, as OEMs often control access to proprietary manuals and technical literature.

Avionics Market: Segmentation Insights

The global avionics market is segmented based on Application, Platform, Technology, End Use, and Region. All the segments of the avionics market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Application, the global avionics market is divided into Flight Control Systems, Communication Systems, Navigation Systems, Surveillance Systems.

On the basis of Platform, the global avionics market is bifurcated into Commercial Aircraft, Military Aircraft, Helicopters, Drones.

In terms of Technology, the global avionics market is categorized into Software, Hardware, Integrated Systems.

Based on End Use, the global avionics market is split into Civil Aviation, Military Aviation .

Avionics Market: Regional Insights

North America, led by the United States, is the dominant region in the global avionics market. This leadership is driven by the presence of the world's largest aerospace and defense sectors, including major aircraft OEMs (Boeing, Lockheed Martin), avionics manufacturers (Collins Aerospace, Honeywell, Garmin), and a massive fleet of commercial, military, and general aviation aircraft. The region's dominance is further reinforced by high defense budgets, stringent regulatory standards from the FAA mandating advanced avionics for safety and modernization (e.g., ADS-B Out mandates), and early adoption of next-generation technologies like connected aircraft and flight deck digitalization.

While the Asia-Pacific region is the fastest-growing market due to rising air travel, fleet expansion, and increasing defense expenditures in countries like China and India, it remains largely dependent on North American and European technology and expertise. Europe is a strong competitor with a robust aerospace industry (Airbus, Thales, Safran), but North America's unparalleled investment in R&D, technological innovation, and scale of aviation activity cement its position as the global leader in avionics revenue and advancement.

Avionics Market: Competitive Landscape

The avionics market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Avionics Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Thales S.A.

- Honeywell International Inc.

- RTX Corporation

- L3Harris Technologies Inc

- Leonardo S.p.A.

- General Electric Company

- BAE Systems plc

- Northrop Grumman

- Elbit Systems Ltd.

- Safran S.A.

The Global Avionics Market is Segmented as Follows:

By Application

- Flight Control Systems

- Communication Systems

- Navigation Systems

- Surveillance Systems

By Platform

- Commercial Aircraft

- Military Aircraft

- Helicopters

- Drones

By Technology

- Software

- Hardware

- Integrated Systems

By End Use

- Civil Aviation

- Military Aviation

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Contents Section 1 Avionics Product Definition Section 2 Global Avionics Market Manufacturer Share and Market Overview 2.1 Global Manufacturer Avionics Shipments 2.2 Global Manufacturer Avionics Business Revenue 2.3 Global Avionics Market Overview Section 3 Manufacturer Avionics Business Introduction 3.1 Garmin Avionics Business Introduction 3.1.1 Garmin Avionics Shipments, Price, Revenue and Gross profit 2014-2018 3.1.2 Garmin Avionics Business Distribution by Region 3.1.3 Garmin Interview Record 3.1.4 Garmin Avionics Business Profile 3.1.5 Garmin Avionics Product Specification 3.2 GE Avionics Business Introduction 3.2.1 GE Avionics Shipments, Price, Revenue and Gross profit 2014-2018 3.2.2 GE Avionics Business Distribution by Region 3.2.3 Interview Record 3.2.4 GE Avionics Business Overview 3.2.5 GE Avionics Product Specification 3.3 Honeywell Avionics Business Introduction 3.3.1 Honeywell Avionics Shipments, Price, Revenue and Gross profit 2014-2018 3.3.2 Honeywell Avionics Business Distribution by Region 3.3.3 Interview Record 3.3.4 Honeywell Avionics Business Overview 3.3.5 Honeywell Avionics Product Specification 3.4 Rockwell Collins Avionics Business Introduction 3.5 Thales Avionics Business Introduction 3.6 United Technologies Avionics Business Introduction ? Section 4 Global Avionics Market Segmentation (Region Level) 4.1 North America Country 4.1.1 United States Avionics Market Size and Price Analysis 2014-2018 4.1.2 Canada Avionics Market Size and Price Analysis 2014-2018 4.2 South America Country 4.2.1 South America Avionics Market Size and Price Analysis 2014-2018 4.3 Asia Country 4.3.1 China Avionics Market Size and Price Analysis 2014-2018 4.3.2 Japan Avionics Market Size and Price Analysis 2014-2018 4.3.3 India Avionics Market Size and Price Analysis 2014-2018 4.3.4 Korea Avionics Market Size and Price Analysis 2014-2018 4.4 Europe Country 4.4.1 Germany Avionics Market Size and Price Analysis 2014-2018 4.4.2 UK Avionics Market Size and Price Analysis 2014-2018 4.4.3 France Avionics Market Size and Price Analysis 2014-2018 4.4.4 Italy Avionics Market Size and Price Analysis 2014-2018 4.4.5 Europe Avionics Market Size and Price Analysis 2014-2018 4.5 Other Country and Region 4.5.1 Middle East Avionics Market Size and Price Analysis 2014-2018 4.5.2 Africa Avionics Market Size and Price Analysis 2014-2018 4.5.3 GCC Avionics Market Size and Price Analysis 2014-2018 4.6 Global Avionics Market Segmentation (Region Level) Analysis 2014-2018 4.7 Global Avionics Market Segmentation (Region Level) Analysis Section 5 Global Avionics Market Segmentation (Product Type Level) 5.1 Global Avionics Market Segmentation (Product Type Level) Market Size 2014-2018 5.2 Different Avionics Product Type Price 2014-2018 5.3 Global Avionics Market Segmentation (Product Type Level) Analysis Section 6 Global Avionics Market Segmentation (Industry Level) 6.1 Global Avionics Market Segmentation (Industry Level) Market Size 2014-2018 6.2 Different Industry Price 2014-2018 6.3 Global Avionics Market Segmentation (Industry Level) Analysis Section 7 Global Avionics Market Segmentation (Channel Level) 7.1 Global Avionics Market Segmentation (Channel Level) Sales Volume and Share 2014-2018 7.2 Global Avionics Market Segmentation (Channel Level) Analysis Section 8 Avionics Market Forecast 2018-2023 8.1 Avionics Segmentation Market Forecast (Region Level) 8.2 Avionics Segmentation Market Forecast (Product Type Level) 8.3 Avionics Segmentation Market Forecast (Industry Level) 8.4 Avionics Segmentation Market Forecast (Channel Level) Section 9 Avionics Segmentation Product Type 9.1 Flight Control & Management System Product Introduction 9.2 Communication, Navigation & Surveillance Systems Product Introduction 9.3 Monitoring/Glass Cockpit Product Introduction 9.4 Electrical & Emergency Systems Product Introduction 9.5 Inflight Entertainment Product Introduction Section 10 Avionics Segmentation Industry 10.1 Commercial Clients 10.2 Defense Clients 10.3 UAV Clients Section 11 Avionics Cost of Production Analysis 11.1 Raw Material Cost Analysis 11.2 Technology Cost Analysis 11.3 Labor Cost Analysis 11.4 Cost Overview Section 12 Conclusion Chart and Figure Figure Avionics Product Picture from Garmin Chart 2014-2018 Global Manufacturer Avionics Shipments (Units) Chart 2014-2018 Global Manufacturer Avionics Shipments Share Chart 2014-2018 Global Manufacturer Avionics Business Revenue (Million USD) Chart 2014-2018 Global Manufacturer Avionics Business Revenue Share Chart Garmin Avionics Shipments, Price, Revenue and Gross profit 2014-2018 Chart Garmin Avionics Business Distribution Chart Garmin Interview Record (Partly) Figure Garmin Avionics Product Picture Chart Garmin Avionics Business Profile Table Garmin Avionics Product Specification Chart GE Avionics Shipments, Price, Revenue and Gross profit 2014-2018 Chart GE Avionics Business Distribution Chart GE Interview Record (Partly) Figure GE Avionics Product Picture Chart GE Avionics Business Overview Table GE Avionics Product Specification Chart Honeywell Avionics Shipments, Price, Revenue and Gross profit 2014-2018 Chart Honeywell Avionics Business Distribution Chart Honeywell Interview Record (Partly) Figure Honeywell Avionics Product Picture Chart Honeywell Avionics Business Overview Table Honeywell Avionics Product Specification 3.4 Rockwell Collins Avionics Business Introduction ? Chart United States Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart United States Avionics Sales Price ($/Unit) 2014-2018 Chart Canada Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Canada Avionics Sales Price ($/Unit) 2014-2018 Chart South America Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart South America Avionics Sales Price ($/Unit) 2014-2018 Chart China Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart China Avionics Sales Price ($/Unit) 2014-2018 Chart Japan Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Japan Avionics Sales Price ($/Unit) 2014-2018 Chart India Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart India Avionics Sales Price ($/Unit) 2014-2018 Chart Korea Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Korea Avionics Sales Price ($/Unit) 2014-2018 Chart Germany Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Germany Avionics Sales Price ($/Unit) 2014-2018 Chart UK Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart UK Avionics Sales Price ($/Unit) 2014-2018 Chart France Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart France Avionics Sales Price ($/Unit) 2014-2018 Chart Italy Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Italy Avionics Sales Price ($/Unit) 2014-2018 Chart Europe Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Europe Avionics Sales Price ($/Unit) 2014-2018 Chart Middle East Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Middle East Avionics Sales Price ($/Unit) 2014-2018 Chart Africa Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart Africa Avionics Sales Price ($/Unit) 2014-2018 Chart GCC Avionics Sales Volume (Units) and Market Size (Million $) 2014-2018 Chart GCC Avionics Sales Price ($/Unit) 2014-2018 Chart Global Avionics Market Segmentation (Region Level) Sales Volume 2014-2018 Chart Global Avionics Market Segmentation (Region Level) Market size 2014-2018 Chart Avionics Market Segmentation (Product Type Level) Volume (Units) 2014-2018 Chart Avionics Market Segmentation (Product Type Level) Market Size (Million $) 2014-2018 Chart Different Avionics Product Type Price ($/Unit) 2014-2018 Chart Avionics Market Segmentation (Industry Level) Market Size (Volume) 2014-2018 Chart Avionics Market Segmentation (Industry Level) Market Size (Share) 2014-2018 Chart Avionics Market Segmentation (Industry Level) Market Size (Value) 2014-2018 Chart Global Avionics Market Segmentation (Channel Level) Sales Volume (Units) 2014-2018 Chart Global Avionics Market Segmentation (Channel Level) Share 2014-2018 Chart Avionics Segmentation Market Forecast (Region Level) 2018-2023 Chart Avionics Segmentation Market Forecast (Product Type Level) 2018-2023 Chart Avionics Segmentation Market Forecast (Industry Level) 2018-2023 Chart Avionics Segmentation Market Forecast (Channel Level) 2018-2023 Chart Flight Control & Management System Product Figure Chart Flight Control & Management System Product Advantage and Disadvantage Comparison Chart Communication, Navigation & Surveillance Systems Product Figure Chart Communication, Navigation & Surveillance Systems Product Advantage and Disadvantage Comparison Chart Monitoring/Glass Cockpit Product Figure Chart Monitoring/Glass Cockpit Product Advantage and Disadvantage Comparison Chart Electrical & Emergency Systems Product Figure Chart Electrical & Emergency Systems Product Advantage and Disadvantage Comparison Chart Inflight Entertainment Product Figure Chart Inflight Entertainment Product Advantage and Disadvantage Comparison Chart Commercial Clients Chart Defense Clients Chart UAV Clients

Inquiry For Buying

Avionics

Request Sample

Avionics