Car Rental and Leasing Market Size, Share, and Trends Analysis Report

CAGR :

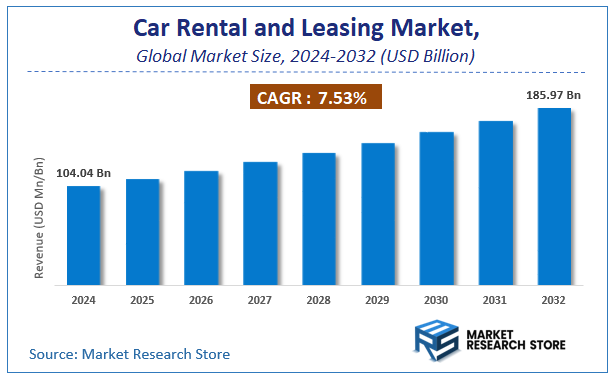

| Market Size 2024 (Base Year) | USD 104.04 Billion |

| Market Size 2032 (Forecast Year) | USD 185.97 Billion |

| CAGR | 7.53% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global car rental and leasing market size was valued at approximately USD 104.04 Billion in 2024. The market is projected to grow significantly, reaching USD 185.97 Billion by 2032, growing at a compound annual growth rate (CAGR) of 7.53% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the car rental and leasing industry.

Car Rental and Leasing Market: Overview

The growth of the car rental and leasing market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The car rental and leasing market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the car rental and leasing market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, End-User, Vehicle Type, Vehicle Type, Distribution Channel, Pricing Model, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global car rental and leasing market is estimated to grow annually at a CAGR of around 7.53% over the forecast period (2024-2032).

- In terms of revenue, the global car rental and leasing market size was valued at around USD 104.04 Billion in 2024 and is projected to reach USD 185.97 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for personal mobility solutions, increasing corporate and travel rentals, and rising adoption of subscription-based car leasing services are fueling the Car Rental and Leasing market.

- Based on the Type, the Short-Term Rentals segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of End-User, the Individual Consumers segment is anticipated to command the largest market share.

- In terms of Vehicle Type, the Individual Consumers segment is projected to lead the global market.

- By Vehicle Type, the Economy Cars segment is predicted to dominate the global market.

- Based on the Distribution Channel, the Online Platforms segment is expected to swipe the largest market share.

- Based on the Pricing Model, the Daily Rentals segment is expected to become the fastest-growing segment.

- Based on region, North America is projected to dominate the global market during the forecast period.

Car Rental and Leasing Market: Report Scope

This report thoroughly analyzes the car rental and leasing market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Car Rental and Leasing Market |

| Market Size in 2024 | USD 104.04 Billion |

| Market Forecast in 2032 | USD 185.97 Billion |

| Growth Rate | CAGR of 7.53% |

| Number of Pages | 229 |

| Key Companies Covered | Enterprise Holdings, Hertz Global Holdings, Avis Budget Group, Europcar Mobility Group, Sixt SE, Localiza Rent a Car, ALD Automotive, LeasePlan Corporation, Arval, Athlon Car Lease, National Car Rental, Alamo Rent a Car, Budget Rent a Car, Thrifty Car Rental, Dollar Rent A Car, Fox Rent A Car, Advantage Rent A Car, Green Motion, Movida, Easirent |

| Segments Covered | By Type, By End-User, By Vehicle Type, By Vehicle Type, By Distribution Channel, By Pricing Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Car Rental and Leasing Market: Dynamics

Key Growth Drivers :

The car rental and leasing market is driven by several key factors, most notably the growing preference for flexible and cost-effective mobility solutions, especially in urban areas. With rising urbanization and increasing costs of vehicle ownership, many consumers and businesses are choosing to lease or rent vehicles instead of buying them. The flourishing global tourism industry, for both leisure and business travel, is a significant catalyst for the car rental segment, particularly in airport locations. Furthermore, the rise of the "sharing economy" and the increasing popularity of ride-hailing services like Uber and Lyft have reshaped consumer behavior, leading to a greater acceptance of on-demand transportation and an asset-light lifestyle. The ongoing digitalization of the industry, with seamless online booking platforms and mobile apps, enhances customer convenience and accessibility, further propelling market growth.

Restraints :

Despite its growth, the market faces significant restraints. The most prominent is the intense competition from alternative mobility solutions, particularly ride-hailing services and car-sharing platforms, which offer a more convenient and often cheaper alternative for short-distance travel. The high operational costs associated with maintaining a large and diverse fleet, including vehicle acquisition, maintenance, insurance, and administrative expenses, can put pressure on profit margins. The market is also highly susceptible to economic downturns, as car rentals and leases are often considered discretionary expenses for both individuals and corporations. Additionally, seasonal fluctuations in demand, particularly in the tourism-driven rental segment, can lead to periods of underutilized fleet and financial instability.

Opportunities :

The car rental and leasing market is ripe with opportunities for innovation and expansion. The increasing focus on sustainability and the growing adoption of electric vehicles (EVs) present a major opportunity for companies to expand their fleets with eco-friendly options. This not only meets evolving consumer demand but also aligns with global environmental regulations. The expansion into emerging markets with rapid urbanization and a growing middle class offers significant growth potential. The development of subscription-based models, which provide a more flexible alternative to traditional leasing, caters to consumers who desire a variety of vehicles without the long-term commitment. The integration of advanced technologies like AI, IoT, and telematics for dynamic pricing, predictive maintenance, and enhanced customer experience is a key opportunity for players to gain a competitive edge.

Challenges :

The market is confronted by several complex challenges. The high capital expenditure required to acquire a new fleet, especially with the transition to more expensive EVs, is a significant financial challenge. The risk of vehicle damage, theft, and fraudulent activity is a constant operational concern that can lead to substantial financial losses. Managing a large and diverse fleet's logistics, including maintenance, repairs, and redeployment, is an ongoing operational challenge. Furthermore, the fragmented and often inconsistent regulatory landscape across different regions and countries, particularly regarding insurance and data privacy, can create compliance issues and complicate international operations. The intense price competition, driven by the proliferation of online booking platforms and aggregators, also puts continuous pressure on rental rates and profitability.

Car Rental and Leasing Market: Segmentation Insights

The global car rental and leasing market is segmented based on Type, End-User, Vehicle Type, Vehicle Type, Distribution Channel, Pricing Model, and Region. All the segments of the car rental and leasing market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global car rental and leasing market is divided into Short-Term Rentals, Long-Term Rentals, Leasing Services, Car Sharing Services, Luxury Rentals, Commercial Fleet Rentals, Open-End Leases, Closed-End Leases, Others.

On the basis of End-User, the global car rental and leasing market is bifurcated into Individual Consumers, Corporates, Government Agencies, Logistics & Transportation Companies, Tour Operators, Event Organizers, Others.

In terms of Vehicle Type, the global car rental and leasing market is categorized into Individual Consumers, Corporates, Government Agencies, Logistics & Transportation Companies, Tour Operators, Event Organizers, Others.

Based on Vehicle Type, the global car rental and leasing market is split into Economy Cars, SUVs, Vans, Luxury Cars, Electric Vehicles, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Others.

By Distribution Channel, the global car rental and leasing market is divided into Online Platforms, Travel Agencies, Direct Sales, Third-Party Aggregators, Others.

On the basis of Pricing Model, the global car rental and leasing market is segregated into Daily Rentals, Weekly Rentals, Monthly Rentals, Annual Rentals, Subscription Models, Others.

Car Rental and Leasing Market: Regional Insights

North America is the dominant region in the global car rental and leasing market, accounting for the largest revenue share of over 40% as of 2023. This leadership is primarily driven by the United States, which boasts a mature market characterized by high consumer and corporate demand, a strong travel and tourism industry, and the presence of global industry giants like Enterprise Holdings, Hertz, and Avis.

The high rate of airline passenger traffic, a cultural preference for car travel, and well-established infrastructure for rental services are key contributors. While the Europe region is a similarly mature and significant market, and the Asia-Pacific region is projected to be the fastest-growing due to rising disposable incomes and tourism, North America's established market size, density of operators, and volume of transactions solidify its position as the global leader.

Car Rental and Leasing Market: Competitive Landscape

The car rental and leasing market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Car Rental and Leasing Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Enterprise Holdings

- Hertz Global Holdings

- Avis Budget Group

- Europcar Mobility Group

- Sixt SE

- Localiza Rent a Car

- ALD Automotive

- LeasePlan Corporation

- Arval

- Athlon Car Lease

- National Car Rental

- Alamo Rent a Car

- Budget Rent a Car

- Thrifty Car Rental

- Dollar Rent A Car

- Fox Rent A Car

- Advantage Rent A Car

- Green Motion

- Movida

- Easirent

The Global Car Rental and Leasing Market is Segmented as Follows:

By Type

- Short-Term Rentals

- Long-Term Rentals

- Leasing Services

- Car Sharing Services

- Luxury Rentals

- Commercial Fleet Rentals

- Open-End Leases

- Closed-End Leases

- Others

By End-User

- Individual Consumers

- Corporates

- Government Agencies

- Logistics & Transportation Companies

- Tour Operators

- Event Organizers

- Others

By Vehicle Type

- Individual Consumers

- Corporates

- Government Agencies

- Logistics & Transportation Companies

- Tour Operators

- Event Organizers

- Others

By Vehicle Type

- Economy Cars

- SUVs

- Vans

- Luxury Cars

- Electric Vehicles

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Others

By Distribution Channel

- Online Platforms

- Travel Agencies

- Direct Sales

- Third-Party Aggregators

- Others

By Pricing Model

- Daily Rentals

- Weekly Rentals

- Monthly Rentals

- Annual Rentals

- Subscription Models

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Contents

1 Car Rental and Leasing Market Overview

1.1 Product Overview and Scope of Car Rental and Leasing

1.2 Classification of Car Rental and Leasing by Types

1.2.1 Global Car Rental and Leasing Revenue Comparison by Types (2017-2023)

1.2.2 Global Car Rental and Leasing Revenue Market Share by Types in 2017

1.2.3 Offline Access

1.2.4 Mobile Application

1.2.5 Others

1.3 Global Car Rental and Leasing Market by Application

1.3.1 Global Car Rental and Leasing Market Size and Market Share Comparison by Applications (2013-2023)

1.3.2 Intercity

1.3.3 Intracity

1.3.4 On-Airport

1.3.5 Others

1.4 Global Car Rental and Leasing Market by Regions

1.4.1 Global Car Rental and Leasing Market Size (Million ) Comparison by Regions (2013-2023)

1.4.1 North America (USA, Canada and Mexico) Car Rental and Leasing Status and Prospect (2013-2023)

1.4.2 Europe (Germany, France, UK, Russia and Italy) Car Rental and Leasing Status and Prospect (2013-2023)

1.4.3 Asia-Pacific (China, Japan, Korea, India and Southeast Asia) Car Rental and Leasing Status and Prospect (2013-2023)

1.4.4 South America (Brazil, Argentina, Colombia) Car Rental and Leasing Status and Prospect (2013-2023)

1.4.5 Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa) Car Rental and Leasing Status and Prospect (2013-2023)

1.5 Global Market Size of Car Rental and Leasing (2013-2023)

2 Manufacturers Profiles

2.1 Localiza-Rent a Car

2.1.1 Business Overview

2.1.2 Car Rental and Leasing Type and Applications

2.1.2.1 Product A

2.1.2.2 Product B

2.1.3 Localiza-Rent a Car Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.2 Eco Rent a Car

2.2.1 Business Overview

2.2.2 Car Rental and Leasing Type and Applications

2.2.2.1 Product A

2.2.2.2 Product B

2.2.3 Eco Rent a Car Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.3 The Hertz

2.3.1 Business Overview

2.3.2 Car Rental and Leasing Type and Applications

2.3.2.1 Product A

2.3.2.2 Product B

2.3.3 The Hertz Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.4 Europcar

2.4.1 Business Overview

2.4.2 Car Rental and Leasing Type and Applications

2.4.2.1 Product A

2.4.2.2 Product B

2.4.3 Europcar Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.5 Al Futtaim

2.5.1 Business Overview

2.5.2 Car Rental and Leasing Type and Applications

2.5.2.1 Product A

2.5.2.2 Product B

2.5.3 Al Futtaim Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.6 GlobalCARS

2.6.1 Business Overview

2.6.2 Car Rental and Leasing Type and Applications

2.6.2.1 Product A

2.6.2.2 Product B

2.6.3 GlobalCARS Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.7 Sixt

2.7.1 Business Overview

2.7.2 Car Rental and Leasing Type and Applications

2.7.2.1 Product A

2.7.2.2 Product B

2.7.3 Sixt Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.8 Avis Budget

2.8.1 Business Overview

2.8.2 Car Rental and Leasing Type and Applications

2.8.2.1 Product A

2.8.2.2 Product B

2.8.3 Avis Budget Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

2.9 Carzonrent

2.9.1 Business Overview

2.9.2 Car Rental and Leasing Type and Applications

2.9.2.1 Product A

2.9.2.2 Product B

2.9.3 Carzonrent Car Rental and Leasing Revenue, Gross Margin and Market Share (2016-2017)

3 Global Car Rental and Leasing Market Competition, by Players

3.1 Global Car Rental and Leasing Revenue and Share by Players (2013-2018)

3.2 Market Concentration Rate

3.2.1 Top 5 Car Rental and Leasing Players Market Share

3.2.2 Top 10 Car Rental and Leasing Players Market Share

3.3 Market Competition Trend

4 Global Car Rental and Leasing Market Size by Regions

4.1 Global Car Rental and Leasing Revenue and Market Share by Regions

4.2 North America Car Rental and Leasing Revenue and Growth Rate (2013-2018)

4.3 Europe Car Rental and Leasing Revenue and Growth Rate (2013-2018)

4.4 Asia-Pacific Car Rental and Leasing Revenue and Growth Rate (2013-2018)

4.5 South America Car Rental and Leasing Revenue and Growth Rate (2013-2018)

4.6 Middle East and Africa Car Rental and Leasing Revenue and Growth Rate (2013-2018)

5 North America Car Rental and Leasing Revenue by Countries

5.1 North America Car Rental and Leasing Revenue by Countries (2013-2018)

5.2 USA Car Rental and Leasing Revenue and Growth Rate (2013-2018)

5.3 Canada Car Rental and Leasing Revenue and Growth Rate (2013-2018)

5.4 Mexico Car Rental and Leasing Revenue and Growth Rate (2013-2018)

6 Europe Car Rental and Leasing Revenue by Countries

6.1 Europe Car Rental and Leasing Revenue by Countries (2013-2018)

6.2 Germany Car Rental and Leasing Revenue and Growth Rate (2013-2018)

6.3 UK Car Rental and Leasing Revenue and Growth Rate (2013-2018)

6.4 France Car Rental and Leasing Revenue and Growth Rate (2013-2018)

6.5 Russia Car Rental and Leasing Revenue and Growth Rate (2013-2018)

6.6 Italy Car Rental and Leasing Revenue and Growth Rate (2013-2018)

7 Asia-Pacific Car Rental and Leasing Revenue by Countries

7.1 Asia-Pacific Car Rental and Leasing Revenue by Countries (2013-2018)

7.2 China Car Rental and Leasing Revenue and Growth Rate (2013-2018)

7.3 Japan Car Rental and Leasing Revenue and Growth Rate (2013-2018)

7.4 Korea Car Rental and Leasing Revenue and Growth Rate (2013-2018)

7.5 India Car Rental and Leasing Revenue and Growth Rate (2013-2018)

7.6 Southeast Asia Car Rental and Leasing Revenue and Growth Rate (2013-2018)

8 South America Car Rental and Leasing Revenue by Countries

8.1 South America Car Rental and Leasing Revenue by Countries (2013-2018)

8.2 Brazil Car Rental and Leasing Revenue and Growth Rate (2013-2018)

8.3 Argentina Car Rental and Leasing Revenue and Growth Rate (2013-2018)

8.4 Colombia Car Rental and Leasing Revenue and Growth Rate (2013-2018)

9 Middle East and Africa Revenue Car Rental and Leasing by Countries

9.1 Middle East and Africa Car Rental and Leasing Revenue by Countries (2013-2018)

9.2 Saudi Arabia Car Rental and Leasing Revenue and Growth Rate (2013-2018)

9.3 UAE Car Rental and Leasing Revenue and Growth Rate (2013-2018)

9.4 Egypt Car Rental and Leasing Revenue and Growth Rate (2013-2018)

9.5 Nigeria Car Rental and Leasing Revenue and Growth Rate (2013-2018)

9.6 South Africa Car Rental and Leasing Revenue and Growth Rate (2013-2018)

10 Global Car Rental and Leasing Market Segment by Type

10.1 Global Car Rental and Leasing Revenue and Market Share by Type (2013-2018)

10.2 Global Car Rental and Leasing Market Forecast by Type (2018-2023)

10.3 Offline Access Revenue Growth Rate (2013-2023)

10.4 Mobile Application Revenue Growth Rate (2013-2023)

10.5 Others Revenue Growth Rate (2013-2023)

11 Global Car Rental and Leasing Market Segment by Application

11.1 Global Car Rental and Leasing Revenue Market Share by Application (2013-2018)

11.2 Car Rental and Leasing Market Forecast by Application (2018-2023)

11.3 Intercity Revenue Growth (2013-2018)

11.4 Intracity Revenue Growth (2013-2018)

11.5 On-Airport Revenue Growth (2013-2018)

11.6 Others Revenue Growth (2013-2018)

12 Global Car Rental and Leasing Market Size Forecast (2018-2023)

12.1 Global Car Rental and Leasing Market Size Forecast (2018-2023)

12.2 Global Car Rental and Leasing Market Forecast by Regions (2018-2023)

12.3 North America Car Rental and Leasing Revenue Market Forecast (2018-2023)

12.4 Europe Car Rental and Leasing Revenue Market Forecast (2018-2023)

12.5 Asia-Pacific Car Rental and Leasing Revenue Market Forecast (2018-2023)

12.6 South America Car Rental and Leasing Revenue Market Forecast (2018-2023)

12.7 Middle East and Africa Car Rental and Leasing Revenue Market Forecast (2018-2023)

13 Research Findings and Conclusion

14 Appendix

14.1 Methodology

14.2 Data Source

Inquiry For Buying

Car Rental and Leasing

Request Sample

Car Rental and Leasing