Enterprise Application Integration Market Size, Share, and Trends Analysis Report

CAGR :

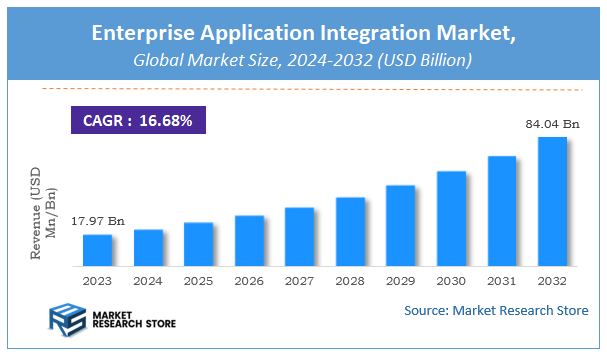

| Market Size 2023 (Base Year) | USD 17.97 Billion |

| Market Size 2032 (Forecast Year) | USD 84.04 Billion |

| CAGR | 16.68% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Market Research Store has published a report on the global enterprise application integration market, estimating its value at USD 17.97 Billion in 2023, with projections indicating it will reach USD 84.04 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 16.68% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the enterprise application integration industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Enterprise Application Integration Market: Overview

The growth of the enterprise application integration market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The enterprise application integration market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the enterprise application integration market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Deployment, Organization Size, Application, End-User, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global enterprise application integration market is estimated to grow annually at a CAGR of around 16.68% over the forecast period (2024-2032).

- In terms of revenue, the global enterprise application integration market size was valued at around USD 17.97 Billion in 2023 and is projected to reach USD 84.04 Billion by 2032.

- The market is projected to grow at a significant rate due to Rising complexity of business operations and digital transformation initiatives fuel adoption.

- Based on the Deployment, the On-Premise segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Organization Size, the SMEs segment is anticipated to command the largest market share.

- In terms of Application, the Supply Chain Management segment is projected to lead the global market.

- By End-User, the BFSI segment is predicted to dominate the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Enterprise Application Integration Market: Report Scope

This report thoroughly analyzes the enterprise application integration market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Enterprise Application Integration Market |

| Market Size in 2023 | USD 17.97 Billion |

| Market Forecast in 2032 | USD 84.04 Billion |

| Growth Rate | CAGR of 16.68% |

| Number of Pages | 241 |

| Key Companies Covered | IBM Corporation, Oracle Corporation, SAP SE, Microsoft Corporation, Software AG, Dell Boomi, MuleSoft (Salesforce), TIBCO Software, Informatica, Axway |

| Segments Covered | By Deployment, By Organization Size, By Application, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Enterprise Application Integration Market: Dynamics

Key Growth Drivers:

The most significant driver for the Enterprise Application Integration (EAI) market is the accelerating digital transformation initiatives across virtually all industries. As organizations increasingly adopt multiple disparate software applications (e.g., ERP, CRM, SCM, HR systems) to manage various business functions, the need for seamless data flow and process automation between these systems becomes critical for operational efficiency and informed decision-making. The pervasive shift towards cloud computing and hybrid IT environments, where businesses utilize both on-premise and cloud-based applications, further amplifies the complexity of integration and drives demand for robust EAI solutions. The growing emphasis on real-time data access and analytics for competitive advantage also necessitates efficient integration to consolidate data from various sources and provide a unified view of business operations.

Restraints:

The market faces significant restraints primarily due to the inherent complexity and high cost associated with implementing and maintaining sophisticated EAI solutions. Integrating legacy systems with modern applications often involves intricate customization, extensive coding, and specialized technical expertise, leading to lengthy implementation cycles and substantial upfront investment. The shortage of skilled integration specialists and developers capable of designing, deploying, and managing complex EAI architectures acts as a significant bottleneck, increasing project costs and timelines. Additionally, ensuring data security and compliance with stringent regulatory requirements (e.g., GDPR, HIPAA) across integrated systems, especially when dealing with sensitive information, poses a continuous challenge and can deter some organizations.

Opportunities:

Significant opportunities lie in the continuous innovation of Integration Platform as a Service (iPaaS) solutions, which offer cloud-native, low-code/no-code integration capabilities. iPaaS democratizes integration, making it more accessible, scalable, and cost-effective for businesses of all sizes, reducing the reliance on extensive coding and specialized IT teams. The increasing adoption of AI and Machine Learning (ML) within EAI platforms presents a lucrative avenue, enabling intelligent automation of integration processes, predictive analytics for system performance, and enhanced error resolution. Furthermore, the expansion into specialized integration needs for emerging technologies like IoT, blockchain, and big data analytics, as well as the growing demand for API-led connectivity to create reusable integration assets, offers substantial untapped market potential.

Challenges:

A key challenge is ensuring seamless interoperability and standardization between a multitude of disparate applications and data formats across an enterprise, as a lack of common standards can lead to significant integration hurdles and data inconsistencies. The market also faces intense competition from various integration approaches, including custom coding, point-to-point integrations, and specialized middleware solutions, necessitating continuous product differentiation and value proposition. Managing the complexity of change management within organizations and securing buy-in from various departments to adopt new integrated workflows remains a significant hurdle. Additionally, the need for continuous monitoring, maintenance, and upgrading of EAI systems to keep pace with evolving application versions and security threats poses an ongoing operational challenge for IT departments.

Enterprise Application Integration Market: Segmentation Insights

The global enterprise application integration market is segmented based on Deployment, Organization Size, Application, End-User, and Region. All the segments of the enterprise application integration market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Deployment, the global enterprise application integration market is divided into On-Premise, Cloud.

On the basis of Organization Size, the global enterprise application integration market is bifurcated into SMEs, Large Enterprises.

In terms of Application, the global enterprise application integration market is categorized into Supply Chain Management, CRM, HRM, ERP, Business Intelligence, Others.

Based on End-User, the global enterprise application integration market is split into BFSI, Healthcare, Retail, Manufacturing, IT & Telecom, Others.

Enterprise Application Integration Market: Regional Insights

The North American region dominates the global enterprise application integration (EAI) market, accounting for the largest revenue share due to rapid digital transformation, high cloud adoption rates, and the presence of major technology vendors. The United States is the primary growth engine, driven by demand for seamless data exchange across hybrid IT environments, with key players like IBM, Microsoft, and Oracle headquartered in the region.

Europe represents the second-largest market, with growth fueled by strict GDPR compliance requirements and Industry 4.0 initiatives in manufacturing-heavy economies like Germany and France. The Asia-Pacific (APAC) region is experiencing the fastest growth, particularly in China, India, and Japan, where expanding e-commerce ecosystems and government smart city projects are accelerating integration needs. Latin America and Middle East/Africa show emerging potential as organizations modernize legacy systems. North America's leadership position is reinforced by increasing investments in API-led connectivity and AI-powered integration platforms.

Enterprise Application Integration Market: Competitive Landscape

The enterprise application integration market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Enterprise Application Integration Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- IBM Corporation

- Oracle Corporation

- SAP SE

- Microsoft Corporation

- Software AG

- Dell Boomi

- MuleSoft (Salesforce)

- TIBCO Software

- Informatica

- Axway

The Global Enterprise Application Integration Market is Segmented as Follows:

By Deployment

- On-Premise

- Cloud

By Organization Size

- SMEs

- Large Enterprises

By Application

- Supply Chain Management

- CRM

- HRM

- ERP

- Business Intelligence

- Others

By End-User

- BFSI

- Healthcare

- Retail

- Manufacturing

- IT & Telecom

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the enterprise application integration industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-Export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Enterprise Application Integration Market: Company Profiles

The report identifies key players in the enterprise application integration market through a competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the enterprise application integration report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the enterprise application integration market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data were sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

Table Of Content

Global Enterprise Application Integration Industry Market Research Report 1 Enterprise Application Integration Introduction and Market Overview 1.1 Objectives of the Study 1.2 Definition of Enterprise Application Integration 1.3 Enterprise Application Integration Market Scope and Market Size Estimation 1.3.1 Market Concentration Ratio and Market Maturity Analysis 1.3.2 Global Enterprise Application Integration Value ($) and Growth Rate from 2013-2023 1.4 Market Segmentation 1.4.1 Types of Enterprise Application Integration 1.4.2 Applications of Enterprise Application Integration 1.4.3 Research Regions 1.4.3.1 North America Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.4.3.2 Europe Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.4.3.3 China Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.4.3.4 Japan Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.4.3.5 Middle East & Africa Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.4.3.6 India Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.4.3.7 South America Enterprise Application Integration Production Value ($) and Growth Rate (2013-2018) 1.5 Market Dynamics 1.5.1 Drivers 1.5.1.1 Emerging Countries of Enterprise Application Integration 1.5.1.2 Growing Market of Enterprise Application Integration 1.5.2 Limitations 1.5.3 Opportunities 1.6 Industry News and Policies by Regions 1.6.1 Industry News 1.6.2 Industry Policies 2 Industry Chain Analysis 2.1 Upstream Raw Material Suppliers of Enterprise Application Integration Analysis 2.2 Major Players of Enterprise Application Integration 2.2.1 Major Players Manufacturing Base and Market Share of Enterprise Application Integration in 2017 2.2.2 Major Players Product Types in 2017 2.3 Enterprise Application Integration Manufacturing Cost Structure Analysis 2.3.1 Production Process Analysis 2.3.2 Manufacturing Cost Structure of Enterprise Application Integration 2.3.3 Raw Material Cost of Enterprise Application Integration 2.3.4 Labor Cost of Enterprise Application Integration 2.4 Market Channel Analysis of Enterprise Application Integration 2.5 Major Downstream Buyers of Enterprise Application Integration Analysis 3 Global Enterprise Application Integration Market, by Type 3.1 Global Enterprise Application Integration Value ($) and Market Share by Type (2013-2018) 3.2 Global Enterprise Application Integration Production and Market Share by Type (2013-2018) 3.3 Global Enterprise Application Integration Value ($) and Growth Rate by Type (2013-2018) 3.4 Global Enterprise Application Integration Price Analysis by Type (2013-2018) 4 Enterprise Application Integration Market, by Application 4.1 Global Enterprise Application Integration Consumption and Market Share by Application (2013-2018) 4.2 Downstream Buyers by Application 4.3 Global Enterprise Application Integration Consumption and Growth Rate by Application (2013-2018) 5 Global Enterprise Application Integration Production, Value ($) by Region (2013-2018) 5.1 Global Enterprise Application Integration Value ($) and Market Share by Region (2013-2018) 5.2 Global Enterprise Application Integration Production and Market Share by Region (2013-2018) 5.3 Global Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.4 North America Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.5 Europe Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.6 China Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.7 Japan Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.8 Middle East & Africa Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.9 India Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 5.10 South America Enterprise Application Integration Production, Value ($), Price and Gross Margin (2013-2018) 6 Global Enterprise Application Integration Production, Consumption, Export, Import by Regions (2013-2018) 6.1 Global Enterprise Application Integration Consumption by Regions (2013-2018) 6.2 North America Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 6.3 Europe Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 6.4 China Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 6.5 Japan Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 6.6 Middle East & Africa Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 6.7 India Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 6.8 South America Enterprise Application Integration Production, Consumption, Export, Import (2013-2018) 7 Global Enterprise Application Integration Market Status and SWOT Analysis by Regions 7.1 North America Enterprise Application Integration Market Status and SWOT Analysis 7.2 Europe Enterprise Application Integration Market Status and SWOT Analysis 7.3 China Enterprise Application Integration Market Status and SWOT Analysis 7.4 Japan Enterprise Application Integration Market Status and SWOT Analysis 7.5 Middle East & Africa Enterprise Application Integration Market Status and SWOT Analysis 7.6 India Enterprise Application Integration Market Status and SWOT Analysis 7.7 South America Enterprise Application Integration Market Status and SWOT Analysis 8 Competitive Landscape 8.1 Competitive Profile 8.2 Tibco Software 8.2.1 Company Profiles 8.2.2 Enterprise Application Integration Product Introduction 8.2.3 Tibco Software Production, Value ($), Price, Gross Margin 2013-2018E 8.2.4 Tibco Software Market Share of Enterprise Application Integration Segmented by Region in 2017 8.3 Fujitsu 8.3.1 Company Profiles 8.3.2 Enterprise Application Integration Product Introduction 8.3.3 Fujitsu Production, Value ($), Price, Gross Margin 2013-2018E 8.3.4 Fujitsu Market Share of Enterprise Application Integration Segmented by Region in 2017 8.4 Hewlett-Packard 8.4.1 Company Profiles 8.4.2 Enterprise Application Integration Product Introduction 8.4.3 Hewlett-Packard Production, Value ($), Price, Gross Margin 2013-2018E 8.4.4 Hewlett-Packard Market Share of Enterprise Application Integration Segmented by Region in 2017 8.5 Sap 8.5.1 Company Profiles 8.5.2 Enterprise Application Integration Product Introduction 8.5.3 Sap Production, Value ($), Price, Gross Margin 2013-2018E 8.5.4 Sap Market Share of Enterprise Application Integration Segmented by Region in 2017 8.6 Red Hat 8.6.1 Company Profiles 8.6.2 Enterprise Application Integration Product Introduction 8.6.3 Red Hat Production, Value ($), Price, Gross Margin 2013-2018E 8.6.4 Red Hat Market Share of Enterprise Application Integration Segmented by Region in 2017 8.7 Oracle 8.7.1 Company Profiles 8.7.2 Enterprise Application Integration Product Introduction 8.7.3 Oracle Production, Value ($), Price, Gross Margin 2013-2018E 8.7.4 Oracle Market Share of Enterprise Application Integration Segmented by Region in 2017 8.8 Ibm 8.8.1 Company Profiles 8.8.2 Enterprise Application Integration Product Introduction 8.8.3 Ibm Production, Value ($), Price, Gross Margin 2013-2018E 8.8.4 Ibm Market Share of Enterprise Application Integration Segmented by Region in 2017 8.9 Mulesoft 8.9.1 Company Profiles 8.9.2 Enterprise Application Integration Product Introduction 8.9.3 Mulesoft Production, Value ($), Price, Gross Margin 2013-2018E 8.9.4 Mulesoft Market Share of Enterprise Application Integration Segmented by Region in 2017 8.10 Software Ag 8.10.1 Company Profiles 8.10.2 Enterprise Application Integration Product Introduction 8.10.3 Software Ag Production, Value ($), Price, Gross Margin 2013-2018E 8.10.4 Software Ag Market Share of Enterprise Application Integration Segmented by Region in 2017 8.11 Microsoft 8.11.1 Company Profiles 8.11.2 Enterprise Application Integration Product Introduction 8.11.3 Microsoft Production, Value ($), Price, Gross Margin 2013-2018E 8.11.4 Microsoft Market Share of Enterprise Application Integration Segmented by Region in 2017 9 Global Enterprise Application Integration Market Analysis and Forecast by Type and Application 9.1 Global Enterprise Application Integration Market Value ($) & Volume Forecast, by Type (2018-2023) 9.1.1 Hosted Market Value ($) and Volume Forecast (2018-2023) 9.1.2 On-Premises Market Value ($) and Volume Forecast (2018-2023) 9.1.3 Hybrid Market Value ($) and Volume Forecast (2018-2023) 9.2 Global Enterprise Application Integration Market Value ($) & Volume Forecast, by Application (2018-2023) 9.2.1 Small Businesses Market Value ($) and Volume Forecast (2018-2023) 9.2.2 Medium Businesses Market Value ($) and Volume Forecast (2018-2023) 9.2.3 Enterprises Market Value ($) and Volume Forecast (2018-2023) 9.2.4 Large Enterprises Market Value ($) and Volume Forecast (2018-2023) 10 Enterprise Application Integration Market Analysis and Forecast by Region 10.1 North America Market Value ($) and Consumption Forecast (2018-2023) 10.2 Europe Market Value ($) and Consumption Forecast (2018-2023) 10.3 China Market Value ($) and Consumption Forecast (2018-2023) 10.4 Japan Market Value ($) and Consumption Forecast (2018-2023) 10.5 Middle East & Africa Market Value ($) and Consumption Forecast (2018-2023) 10.6 India Market Value ($) and Consumption Forecast (2018-2023) 10.7 South America Market Value ($) and Consumption Forecast (2018-2023) 11 New Project Feasibility Analysis 11.1 Industry Barriers and New Entrants SWOT Analysis 11.2 Analysis and Suggestions on New Project Investment 12 Research Finding and Conclusion 13 Appendix 13.1 Discussion Guide 13.2 Knowledge Store: Maia Subscription Portal 13.3 Research Data Source 13.4 Research Assumptions and Acronyms Used

Inquiry For Buying

Enterprise Application Integration

Request Sample

Enterprise Application Integration