Glutamic Oxaloacetic Transaminase Test Market Size, Share, and Trends Analysis Report

CAGR :

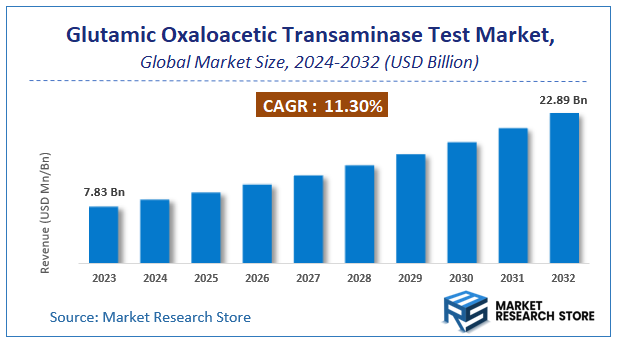

| Market Size 2023 (Base Year) | USD 7.83 Billion |

| Market Size 2032 (Forecast Year) | USD 22.89 Billion |

| CAGR | 11.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Glutamic Oxaloacetic Transaminase Test Market Insights

According to Market Research Store, the global glutamic oxaloacetic transaminase test market size was valued at around USD 7.83 billion in 2023 and is estimated to reach USD 22.89 billion by 2032, to register a CAGR of approximately 11.30% in terms of revenue during the forecast period 2024-2032.

The glutamic oxaloacetic transaminase test report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Glutamic Oxaloacetic Transaminase Test Market: Overview

The glutamic oxaloacetic transaminase (GOT) test, also known as the aspartate aminotransferase (AST) test, is a diagnostic tool used to measure the levels of the AST enzyme in the blood. AST is primarily found in the liver, heart, muscles, kidneys, and brain, and elevated levels typically indicate liver damage or disease, such as hepatitis, cirrhosis, or liver injury caused by medication or toxins. It is also used to diagnose and monitor heart conditions, muscle disorders, and other systemic diseases. The test is often conducted as part of a liver function panel to provide a comprehensive evaluation of liver health.

Key Highlights

- The glutamic oxaloacetic transaminase test market is anticipated to grow at a CAGR of 11.30% during the forecast period.

- The global glutamic oxaloacetic transaminase test market was estimated to be worth approximately USD 7.83 billion in 2023 and is projected to reach a value of USD 22.89 billion by 2032.

- The growth of the glutamic oxaloacetic transaminase test market is being driven by the rising prevalence of liver diseases and lifestyle disorders globally.

- Based on the type, the consumables segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the hospitals and clinics segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Glutamic Oxaloacetic Transaminase Test Market: Dynamics

Key Growth Drivers:

- Rising prevalence of chronic diseases: Conditions like heart disease, liver disease, and diabetes are on the rise globally, increasing the demand for diagnostic tests, including GOT.

- Technological advancements: Improved testing methods, automation, and point-of-care testing are making GOT testing more accessible and efficient.

- Growing healthcare infrastructure: Expansion of healthcare facilities in developing countries is increasing access to diagnostic services.

- Increasing awareness: Public awareness campaigns about the importance of early disease detection are driving demand for diagnostic tests.

Restraints:

- High cost of advanced testing: Some advanced GOT testing methods can be expensive, limiting access in certain regions.

- Lack of skilled professionals: Shortage of trained laboratory technicians in some areas can hinder the availability of accurate GOT testing.

- Stringent regulatory requirements: Obtaining regulatory approvals for new GOT testing technologies can be time-consuming and costly.

Opportunities:

- Development of point-of-care tests: Portable and easy-to-use point-of-care GOT tests can expand access to testing in remote areas and improve patient outcomes.

- Integration with telemedicine: Remote monitoring of GOT levels can improve patient care and reduce healthcare costs.

- Personalized medicine: GOT testing can play a role in personalized medicine approaches by helping to identify individuals at higher risk for certain diseases.

Challenges:

- Ensuring test accuracy and reliability: Maintaining the accuracy and reliability of GOT tests is crucial for accurate diagnosis and treatment.

- Keeping pace with technological advancements: The rapid pace of technological change in the diagnostics industry requires continuous investment in research and development.

- Addressing ethical concerns: Ensuring the ethical use of GOT testing data and protecting patient privacy are important considerations.

Glutamic Oxaloacetic Transaminase Test Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Glutamic Oxaloacetic Transaminase Test Market |

| Market Size in 2023 | USD 7.83 Billion |

| Market Forecast in 2032 | USD 22.89 Billion |

| Growth Rate | CAGR of 11.3% |

| Number of Pages | 140 |

| Key Companies Covered | Alpha Laboratories, Biobase Group, ELITechGroup, Horiba Medical., Laboratory Corporation of America Holdings, Randox Laboratories Ltd, Thermo Fisher Scientific Inc., Abbott Laboratories, Roche Diagnostics |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Glutamic Oxaloacetic Transaminase Test Market: Segmentation Insights

The global glutamic oxaloacetic transaminase test market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global glutamic oxaloacetic transaminase test market is divided into instruments, consumables, and other.

The consumables segment emerges as the most dominant in the glutamic oxaloacetic transaminase (GOT) test market. This prominence is attributed to the recurring demand for reagents, assay kits, and other disposable items essential for conducting these tests. The consumables segment benefits from the widespread use of GOT tests in diagnostic laboratories and healthcare facilities, driven by the increasing prevalence of liver and cardiac conditions. The consistent need for these products ensures a stable revenue stream, making consumables the largest segment in the market.

The instruments segment follows as the second most dominant, encompassing analyzers and other diagnostic equipment required to perform GOT tests. The market for instruments is supported by advancements in technology that improve accuracy, automation, and efficiency in testing. However, the demand for instruments is less frequent than consumables, as these products are capital investments with longer lifespans. The adoption of automated and high-throughput analyzers in large healthcare institutions contributes significantly to this segment's growth.

Segmentation Insights by Application

On the basis of application, the global glutamic oxaloacetic transaminase test market is bifurcated into hospitals & clinics and diagnostic laboratories.

The hospitals and clinics segment holds the most dominant position in the glutamic oxaloacetic transaminase (GOT) test market. This dominance is driven by the widespread use of GOT tests as part of routine diagnostics for liver and cardiac conditions in these settings. Hospitals and clinics serve as primary care centers where patients first seek medical attention, leading to high volumes of test requisitions. Additionally, the availability of skilled professionals and advanced equipment in hospitals further supports the growth of this segment, making it a critical hub for GOT testing.

The diagnostic laboratories segment follows closely as the second most dominant application. These specialized centers often receive referrals from hospitals, clinics, and independent practitioners for detailed analysis and large-scale testing. Diagnostic laboratories benefit from their ability to process high volumes of samples with precision, supported by advanced automation and technological integration. This segment is particularly prominent in regions with well-established healthcare infrastructure and rising adoption of specialized diagnostic services. However, its dependence on referrals and its specialized nature places it slightly behind hospitals and clinics in terms of overall market share.

Glutamic Oxaloacetic Transaminase Test Market: Regional Insights

- North America is expected to dominates the global market

The glutamic oxaloacetic transaminase (GOT) test market exhibits significant regional variations, with North America leading due to its advanced healthcare infrastructure and high prevalence of liver diseases. The United States, in particular, contributes substantially to market dominance, driven by increased health awareness and routine diagnostic practices.

Europe follows closely, with countries like Germany, France, and the United Kingdom playing pivotal roles. The region's robust healthcare systems and growing awareness of liver health contribute to market expansion. Additionally, supportive government policies promoting early diagnosis and treatment of liver diseases further bolster market growth.

The Asia-Pacific region is experiencing rapid growth in the GOT test market, propelled by rising healthcare investments and an increasing burden of liver diseases. Nations such as China, Japan, and India are at the forefront of this expansion, with improving diagnostic infrastructure and heightened health consciousness among populations.

Latin America presents moderate market potential, with Brazil and Mexico being key contributors. While the region may lack the advanced healthcare infrastructure of more developed markets, increasing public health awareness and government efforts to enhance healthcare access are driving demand for diagnostic tests.

The Middle East and Africa region is in the early stages of market development. Countries like South Africa, the UAE, and Saudi Arabia are making strides, but limited access to advanced healthcare technologies in rural areas poses challenges. Nonetheless, ongoing healthcare reforms and investments indicate potential for future growth.

Glutamic Oxaloacetic Transaminase Test Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the glutamic oxaloacetic transaminase test market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global glutamic oxaloacetic transaminase test market include:

- Alpha Laboratories

- Biobase Group

- ELITechGroup

- Horiba Medical.

- Laboratory Corporation of America Holdings

- Randox Laboratories Ltd

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Roche Diagnostics

The global glutamic oxaloacetic transaminase test market is segmented as follows:

By Type

- Instruments

- Consumables

- Others

By Application

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Glutamic Oxaloacetic Transaminase Test Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Glutamic Oxaloacetic Transaminase Test Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Glutamic Oxaloacetic Transaminase Test Overall Market Size 2.1 Global Glutamic Oxaloacetic Transaminase Test Market Size: 2021 VS 2028 2.2 Global Glutamic Oxaloacetic Transaminase Test Market Size, Prospects & Forecasts: 2017-2028 2.3 Key Market Trends, Opportunity, Drivers and Restraints 2.3.1 Market Opportunities & Trends 2.3.2 Market Drivers 2.3.3 Market Restraints 3 Company Landscape 3.1 Top Glutamic Oxaloacetic Transaminase Test Players in Global Market 3.2 Top Global Glutamic Oxaloacetic Transaminase Test Companies Ranked by Revenue 3.3 Global Glutamic Oxaloacetic Transaminase Test Revenue by Companies 3.4 Top 3 and Top 5 Glutamic Oxaloacetic Transaminase Test Companies in Global Market, by Revenue in 2021 3.5 Global Companies Glutamic Oxaloacetic Transaminase Test Product Type 3.6 Tier 1, Tier 2 and Tier 3 Glutamic Oxaloacetic Transaminase Test Players in Global Market 3.6.1 List of Global Tier 1 Glutamic Oxaloacetic Transaminase Test Companies 3.6.2 List of Global Tier 2 and Tier 3 Glutamic Oxaloacetic Transaminase Test Companies 4 Market Sights by Product 4.1 Overview 4.1.1 by Type - Global Glutamic Oxaloacetic Transaminase Test Market Size Markets, 2021 & 2028 4.1.2 Instruments 4.1.3 Consumables 4.1.4 Others 4.2 By Type - Global Glutamic Oxaloacetic Transaminase Test Revenue & Forecasts 4.2.1 By Type - Global Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2022 4.2.2 By Type - Global Glutamic Oxaloacetic Transaminase Test Revenue, 2023-2028 4.2.3 By Type - Global Glutamic Oxaloacetic Transaminase Test Revenue Market Share, 2017-2028 5 Sights by Application 5.1 Overview 5.1.1 By Application - Global Glutamic Oxaloacetic Transaminase Test Market Size, 2021 & 2028 5.1.2 Hospitals and Clinics 5.1.3 Diagnostic Laboratories 5.1.4 Others 5.2 By Application - Global Glutamic Oxaloacetic Transaminase Test Revenue & Forecasts 5.2.1 By Application - Global Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2022 5.2.2 By Application - Global Glutamic Oxaloacetic Transaminase Test Revenue, 2023-2028 5.2.3 By Application - Global Glutamic Oxaloacetic Transaminase Test Revenue Market Share, 2017-2028 6 Sights by Region 6.1 By Region - Global Glutamic Oxaloacetic Transaminase Test Market Size, 2021 & 2028 6.2 By Region - Global Glutamic Oxaloacetic Transaminase Test Revenue & Forecasts 6.2.1 By Region - Global Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2022 6.2.2 By Region - Global Glutamic Oxaloacetic Transaminase Test Revenue, 2023-2028 6.2.3 By Region - Global Glutamic Oxaloacetic Transaminase Test Revenue Market Share, 2017-2028 6.3 North America 6.3.1 By Country - North America Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2028 6.3.2 US Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.3.3 Canada Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.3.4 Mexico Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4 Europe 6.4.1 By Country - Europe Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2028 6.4.2 Germany Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4.3 France Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4.4 U.K. Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4.5 Italy Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4.6 Russia Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4.7 Nordic Countries Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.4.8 Benelux Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.5 Asia 6.5.1 By Region - Asia Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2028 6.5.2 China Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.5.3 Japan Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.5.4 South Korea Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.5.5 Southeast Asia Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.5.6 India Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.6 South America 6.6.1 By Country - South America Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2028 6.6.2 Brazil Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.6.3 Argentina Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.7 Middle East & Africa 6.7.1 By Country - Middle East & Africa Glutamic Oxaloacetic Transaminase Test Revenue, 2017-2028 6.7.2 Turkey Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.7.3 Israel Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.7.4 Saudi Arabia Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 6.7.5 UAE Glutamic Oxaloacetic Transaminase Test Market Size, 2017-2028 7 Players Profiles 7.1 Alpha Laboratories 7.1.1 Alpha Laboratories Corporate Summary 7.1.2 Alpha Laboratories Business Overview 7.1.3 Alpha Laboratories Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.1.4 Alpha Laboratories Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.1.5 Alpha Laboratories Key News 7.2 Biobase Group 7.2.1 Biobase Group Corporate Summary 7.2.2 Biobase Group Business Overview 7.2.3 Biobase Group Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.2.4 Biobase Group Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.2.5 Biobase Group Key News 7.3 ELITechGroup 7.3.1 ELITechGroup Corporate Summary 7.3.2 ELITechGroup Business Overview 7.3.3 ELITechGroup Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.3.4 ELITechGroup Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.3.5 ELITechGroup Key News 7.4 Horiba Medical. 7.4.1 Horiba Medical. Corporate Summary 7.4.2 Horiba Medical. Business Overview 7.4.3 Horiba Medical. Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.4.4 Horiba Medical. Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.4.5 Horiba Medical. Key News 7.5 Laboratory Corporation of America Holdings 7.5.1 Laboratory Corporation of America Holdings Corporate Summary 7.5.2 Laboratory Corporation of America Holdings Business Overview 7.5.3 Laboratory Corporation of America Holdings Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.5.4 Laboratory Corporation of America Holdings Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.5.5 Laboratory Corporation of America Holdings Key News 7.6 Randox Laboratories Ltd 7.6.1 Randox Laboratories Ltd Corporate Summary 7.6.2 Randox Laboratories Ltd Business Overview 7.6.3 Randox Laboratories Ltd Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.6.4 Randox Laboratories Ltd Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.6.5 Randox Laboratories Ltd Key News 7.7 Thermo Fisher Scientific Inc. 7.7.1 Thermo Fisher Scientific Inc. Corporate Summary 7.7.2 Thermo Fisher Scientific Inc. Business Overview 7.7.3 Thermo Fisher Scientific Inc. Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.7.4 Thermo Fisher Scientific Inc. Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.7.5 Thermo Fisher Scientific Inc. Key News 7.8 Abbott Laboratories 7.8.1 Abbott Laboratories Corporate Summary 7.8.2 Abbott Laboratories Business Overview 7.8.3 Abbott Laboratories Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.8.4 Abbott Laboratories Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.8.5 Abbott Laboratories Key News 7.9 Roche Diagnostics 7.9.1 Roche Diagnostics Corporate Summary 7.9.2 Roche Diagnostics Business Overview 7.9.3 Roche Diagnostics Glutamic Oxaloacetic Transaminase Test Major Product Offerings 7.9.4 Roche Diagnostics Glutamic Oxaloacetic Transaminase Test Revenue in Global Market (2017-2022) 7.9.5 Roche Diagnostics Key News 8 Conclusion 9 Appendix 9.1 Note 9.2 Examples of Clients 9.3 Disclaimer

Inquiry For Buying

Glutamic Oxaloacetic Transaminase Test

Request Sample

Glutamic Oxaloacetic Transaminase Test