Heterogeneous Alcohol Market Size, Share, and Trends Analysis Report

CAGR :

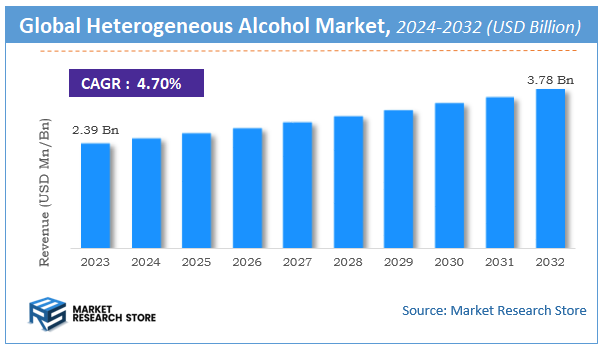

| Market Size 2023 (Base Year) | USD 2.39 Billion |

| Market Size 2032 (Forecast Year) | USD 3.78 Billion |

| CAGR | 4.7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Heterogeneous Alcohol Market Insights

According to Market Research Store, the global heterogeneous alcohol market size was valued at around USD 2.39 billion in 2023 and is estimated to reach USD 3.78 billion by 2032, to register a CAGR of approximately 4.70% in terms of revenue during the forecast period 2024-2032.

The heterogeneous alcohol report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Heterogeneous Alcohol Market: Overview

Heterogeneous alcohol refers to a class of alcohols with varying molecular structures, typically produced from diverse feedstocks through chemical or biochemical processes. These alcohols are characterized by differences in chain length, functional groups, or other molecular features, making them suitable for specific industrial applications such as biofuels, chemical intermediates, pharmaceuticals, and personal care products. Unlike homogeneous alcohols, which are uniform in composition, heterogeneous alcohols cater to a wide range of customized requirements, ensuring their relevance across various sectors.

Key Highlights

- The heterogeneous alcohol market is anticipated to grow at a CAGR of 4.70% during the forecast period.

- The global heterogeneous alcohol market was estimated to be worth approximately USD 2.39 billion in 2023 and is projected to reach a value of USD 3.78 billion by 2032.

- The growth of the heterogeneous alcohol market is being driven by the rising demand for sustainable and versatile chemical solutions.

- Based on the type, the 8C alcohols segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the detergent and cleaner segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Heterogeneous Alcohol Market: Dynamics

Key Growth Drivers:

- Rising disposable incomes: As incomes increase, consumers have more discretionary spending, leading to increased demand for premium and craft alcoholic beverages.

- Changing consumer preferences: A growing interest in unique flavors, experiences, and healthier options is driving innovation and demand for craft beers, artisanal spirits, and low-alcohol beverages.

- Socialization and cultural trends: Alcohol consumption remains a social activity, and cultural shifts, such as the rise of "experience economies," are influencing consumption patterns.

- Tourism and hospitality: The growth of the tourism and hospitality sectors creates demand for diverse alcoholic beverage offerings to cater to a globalized and discerning clientele.

Restraints:

- Government regulations: Strict regulations on alcohol production, distribution, and marketing can hinder market growth and innovation.

- Health concerns: Growing awareness of the health risks associated with excessive alcohol consumption can negatively impact demand, particularly among health-conscious consumers.

- Economic downturns: Economic recessions can lead to reduced consumer spending and a shift towards more affordable alcohol options.

- Competition: The market is highly competitive, with established brands and new entrants vying for market share.

Opportunities:

- Innovation and product diversification: Developing new and innovative products, such as low-alcohol options, flavored spirits, and cannabis-infused beverages, can capture new market segments.

- E-commerce and direct-to-consumer sales: Online platforms and direct-to-consumer channels provide opportunities for brands to reach wider audiences and bypass traditional distribution channels.

- Sustainability and ethical sourcing: Consumers are increasingly interested in sustainable and ethically produced products, creating opportunities for brands that prioritize these values.

- Experiential marketing: Creating unique and engaging brand experiences can enhance consumer engagement and loyalty.

Challenges:

- Maintaining brand differentiation: In a crowded market, it can be challenging to differentiate products and stand out from the competition.

- Managing supply chains: Ensuring consistent quality and availability of raw materials and ingredients can be complex, particularly for craft producers.

- Adapting to changing consumer preferences: The market is constantly evolving, and brands must be agile and responsive to changing consumer tastes and trends.

- Addressing social responsibility: The alcohol industry faces scrutiny regarding its social and environmental impact, and brands must demonstrate responsible practices.

Heterogeneous Alcohol Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Heterogeneous Alcohol Market |

| Market Size in 2023 | USD 2.39 Billion |

| Market Forecast in 2032 | USD 3.78 Billion |

| Growth Rate | CAGR of 4.7% |

| Number of Pages | 140 |

| Key Companies Covered | BASF SE, Dow Chemical Company, Eastman Chemical Company, ExxonMobil Chemical Company, Royal Dutch Shell plc, Sasol Limited, LyondellBasell Industries N.V., INEOS Group Holdings S.A., Mitsubishi Chemical Corporation, LG Chem Ltd., Celanese Corporation, SABIC (Saudi Basic Industries Corporation), Solvay S.A., Akzo Nobel N.V., Evonik Industries AG, Clariant AG, Arkema S.A., Honeywell International Inc., Chevron Phillips Chemical Company LLC, Huntsman Corporation |

| Segments Covered | By Product Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Heterogeneous Alcohol Market: Segmentation Insights

The global heterogeneous alcohol market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global heterogeneous alcohol market is divided into 8C, 10C, 13C, and other.

The 8C alcohols segment is the most dominant in the heterogeneous alcohol market. These medium-chain alcohols are widely used in the production of surfactants and lubricants due to their balanced properties of solvency and biodegradability. Industries such as personal care, detergents, and pharmaceuticals heavily rely on 8C alcohols for their efficient performance and environmentally friendly characteristics. Their widespread application and demand across diverse sectors solidify their leading position in the market.

10C alcohols come next in prominence, driven by their application in the production of industrial and specialty chemicals. They exhibit excellent viscosity and stability, making them ideal for use in lubricants, coatings, and certain polymer formulations. The rise in industrial activities and advancements in material sciences have significantly boosted the adoption of 10C alcohols, particularly in regions focused on manufacturing and technological innovation.

The 13C alcohols segment holds a notable share but ranks below 8C and 10C alcohols. These longer-chain alcohols are primarily utilized in the production of waxes, plasticizers, and high-performance lubricants. While their applications are critical in certain specialized industries, their limited production scale and higher costs compared to shorter-chain alcohols restrain their market dominance.

Segmentation Insights by Application

On the basis of application, the global heterogeneous alcohol market is bifurcated into detergent & cleaner, lubricant, paint & resin, and other.

The detergent and cleaner segment is the most dominant in the heterogeneous alcohol market. These alcohols are essential ingredients in the formulation of surfactants, which are the active agents in cleaning products. Their ability to emulsify grease, break down oils, and enhance foaming properties makes them indispensable in household and industrial cleaning products. With growing demand for eco-friendly and biodegradable cleaning agents, heterogeneous alcohols have gained prominence as sustainable alternatives, ensuring their leadership in this market.

The lubricant segment follows as a key application area for heterogeneous alcohols. These alcohols are used as base oils or additives in lubricants due to their superior viscosity and stability. They are particularly valued in automotive and industrial applications where performance and durability are crucial. The global expansion of the automotive and machinery sectors has driven significant demand for alcohol-based lubricants, securing this segment's strong position in the market.

Paint and resin applications rank third in market dominance. Heterogeneous alcohols are used as coalescing agents and solvents in paints and coatings, aiding in smooth application and improving the durability of the final product. In resin production, these alcohols contribute to enhanced adhesion and flexibility. Although vital to these industries, the demand is relatively lower compared to detergents and lubricants due to the specialized nature of their use.

Heterogeneous Alcohol Market: Regional Insights

- North America is expected to dominates the global market

In North America, the market is significantly driven by the automotive and pharmaceutical industries, which utilize alcohols like methanol and ethanol as solvents and intermediates. The region's focus on reducing carbon emissions has also led to increased adoption of biofuels, further propelling the demand for heterogeneous alcohols.

Europe's market is characterized by stringent environmental regulations and a strong emphasis on sustainability. This has resulted in a substantial demand for bio-based alcohols, particularly in the automotive sector for biofuel production. Additionally, the region's robust chemical industry utilizes various alcohols as key intermediates in manufacturing processes.

The Asia-Pacific region is experiencing rapid industrialization and urbanization, leading to a surge in demand for heterogeneous alcohols across multiple industries, including automotive, pharmaceuticals, and chemicals. Countries like China and India are investing heavily in biofuel production to reduce dependence on fossil fuels, thereby boosting the market.

Latin America's market growth is primarily driven by the abundance of raw materials for bioethanol production, particularly in countries like Brazil. The region's focus on renewable energy sources and the automotive industry's shift towards biofuels contribute significantly to the demand for heterogeneous alcohols.

In the Middle East and Africa, the market is gradually developing, with increasing investments in the chemical and pharmaceutical sectors. The region's efforts to diversify economies beyond oil and gas are leading to the establishment of industries that utilize heterogeneous alcohols, thereby creating new growth opportunities.

Heterogeneous Alcohol Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the heterogeneous alcohol market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global heterogeneous alcohol market include:

- ExxonMobil

- BASF

- Evonik

- Sasol

- KH Neochem

- Dow Inc.

- LyondellBasell Industries N.V.

- INEOS Group

- Reliance Industries Limited

- SABIC

- ArcelorMittal

- Shell Chemicals

- Eastman Chemical Company

- Huntsman Corporation

- LG Chem

- Mitsubishi Chemical Corporation

- Formosa Plastics Corporation

- Chevron Phillips Chemical Company

The global heterogeneous alcohol market is segmented as follows:

By Type

- 8C

- 10C

- 13C

- Others

By Application

- Detergent & Cleaner

- Lubricant

- Paint and Resin

- Other

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Heterogeneous Alcohol Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Heterogeneous Alcohol Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Heterogeneous Alcohol Overall Market Size 2.1 Global Heterogeneous Alcohol Market Size: 2021 VS 2028 2.2 Global Heterogeneous Alcohol Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Heterogeneous Alcohol Sales: 2017-2028 3 Company Landscape 3.1 Top Heterogeneous Alcohol Players in Global Market 3.2 Top Global Heterogeneous Alcohol Companies Ranked by Revenue 3.3 Global Heterogeneous Alcohol Revenue by Companies 3.4 Global Heterogeneous Alcohol Sales by Companies 3.5 Global Heterogeneous Alcohol Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Heterogeneous Alcohol Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Heterogeneous Alcohol Product Type 3.8 Tier 1, Tier 2 and Tier 3 Heterogeneous Alcohol Players in Global Market 3.8.1 List of Global Tier 1 Heterogeneous Alcohol Companies 3.8.2 List of Global Tier 2 and Tier 3 Heterogeneous Alcohol Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Heterogeneous Alcohol Market Size Markets, 2021 & 2028 4.1.2 8C 4.1.3 10C 4.1.4 13C 4.1.5 Others 4.2 By Type - Global Heterogeneous Alcohol Revenue & Forecasts 4.2.1 By Type - Global Heterogeneous Alcohol Revenue, 2017-2022 4.2.2 By Type - Global Heterogeneous Alcohol Revenue, 2023-2028 4.2.3 By Type - Global Heterogeneous Alcohol Revenue Market Share, 2017-2028 4.3 By Type - Global Heterogeneous Alcohol Sales & Forecasts 4.3.1 By Type - Global Heterogeneous Alcohol Sales, 2017-2022 4.3.2 By Type - Global Heterogeneous Alcohol Sales, 2023-2028 4.3.3 By Type - Global Heterogeneous Alcohol Sales Market Share, 2017-2028 4.4 By Type - Global Heterogeneous Alcohol Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Heterogeneous Alcohol Market Size, 2021 & 2028 5.1.2 Detergent & Cleaner 5.1.3 Lubricant 5.1.4 Paint and Resin 5.1.5 Other 5.2 By Application - Global Heterogeneous Alcohol Revenue & Forecasts 5.2.1 By Application - Global Heterogeneous Alcohol Revenue, 2017-2022 5.2.2 By Application - Global Heterogeneous Alcohol Revenue, 2023-2028 5.2.3 By Application - Global Heterogeneous Alcohol Revenue Market Share, 2017-2028 5.3 By Application - Global Heterogeneous Alcohol Sales & Forecasts 5.3.1 By Application - Global Heterogeneous Alcohol Sales, 2017-2022 5.3.2 By Application - Global Heterogeneous Alcohol Sales, 2023-2028 5.3.3 By Application - Global Heterogeneous Alcohol Sales Market Share, 2017-2028 5.4 By Application - Global Heterogeneous Alcohol Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Heterogeneous Alcohol Market Size, 2021 & 2028 6.2 By Region - Global Heterogeneous Alcohol Revenue & Forecasts 6.2.1 By Region - Global Heterogeneous Alcohol Revenue, 2017-2022 6.2.2 By Region - Global Heterogeneous Alcohol Revenue, 2023-2028 6.2.3 By Region - Global Heterogeneous Alcohol Revenue Market Share, 2017-2028 6.3 By Region - Global Heterogeneous Alcohol Sales & Forecasts 6.3.1 By Region - Global Heterogeneous Alcohol Sales, 2017-2022 6.3.2 By Region - Global Heterogeneous Alcohol Sales, 2023-2028 6.3.3 By Region - Global Heterogeneous Alcohol Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Heterogeneous Alcohol Revenue, 2017-2028 6.4.2 By Country - North America Heterogeneous Alcohol Sales, 2017-2028 6.4.3 US Heterogeneous Alcohol Market Size, 2017-2028 6.4.4 Canada Heterogeneous Alcohol Market Size, 2017-2028 6.4.5 Mexico Heterogeneous Alcohol Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Heterogeneous Alcohol Revenue, 2017-2028 6.5.2 By Country - Europe Heterogeneous Alcohol Sales, 2017-2028 6.5.3 Germany Heterogeneous Alcohol Market Size, 2017-2028 6.5.4 France Heterogeneous Alcohol Market Size, 2017-2028 6.5.5 U.K. Heterogeneous Alcohol Market Size, 2017-2028 6.5.6 Italy Heterogeneous Alcohol Market Size, 2017-2028 6.5.7 Russia Heterogeneous Alcohol Market Size, 2017-2028 6.5.8 Nordic Countries Heterogeneous Alcohol Market Size, 2017-2028 6.5.9 Benelux Heterogeneous Alcohol Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Heterogeneous Alcohol Revenue, 2017-2028 6.6.2 By Region - Asia Heterogeneous Alcohol Sales, 2017-2028 6.6.3 China Heterogeneous Alcohol Market Size, 2017-2028 6.6.4 Japan Heterogeneous Alcohol Market Size, 2017-2028 6.6.5 South Korea Heterogeneous Alcohol Market Size, 2017-2028 6.6.6 Southeast Asia Heterogeneous Alcohol Market Size, 2017-2028 6.6.7 India Heterogeneous Alcohol Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Heterogeneous Alcohol Revenue, 2017-2028 6.7.2 By Country - South America Heterogeneous Alcohol Sales, 2017-2028 6.7.3 Brazil Heterogeneous Alcohol Market Size, 2017-2028 6.7.4 Argentina Heterogeneous Alcohol Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Heterogeneous Alcohol Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Heterogeneous Alcohol Sales, 2017-2028 6.8.3 Turkey Heterogeneous Alcohol Market Size, 2017-2028 6.8.4 Israel Heterogeneous Alcohol Market Size, 2017-2028 6.8.5 Saudi Arabia Heterogeneous Alcohol Market Size, 2017-2028 6.8.6 UAE Heterogeneous Alcohol Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 ExxonMobil 7.1.1 ExxonMobil Corporate Summary 7.1.2 ExxonMobil Business Overview 7.1.3 ExxonMobil Heterogeneous Alcohol Major Product Offerings 7.1.4 ExxonMobil Heterogeneous Alcohol Sales and Revenue in Global (2017-2022) 7.1.5 ExxonMobil Key News 7.2 BASF 7.2.1 BASF Corporate Summary 7.2.2 BASF Business Overview 7.2.3 BASF Heterogeneous Alcohol Major Product Offerings 7.2.4 BASF Heterogeneous Alcohol Sales and Revenue in Global (2017-2022) 7.2.5 BASF Key News 7.3 Evonik 7.3.1 Evonik Corporate Summary 7.3.2 Evonik Business Overview 7.3.3 Evonik Heterogeneous Alcohol Major Product Offerings 7.3.4 Evonik Heterogeneous Alcohol Sales and Revenue in Global (2017-2022) 7.3.5 Evonik Key News 7.4 Sasol 7.4.1 Sasol Corporate Summary 7.4.2 Sasol Business Overview 7.4.3 Sasol Heterogeneous Alcohol Major Product Offerings 7.4.4 Sasol Heterogeneous Alcohol Sales and Revenue in Global (2017-2022) 7.4.5 Sasol Key News 7.5 KH Neochem 7.5.1 KH Neochem Corporate Summary 7.5.2 KH Neochem Business Overview 7.5.3 KH Neochem Heterogeneous Alcohol Major Product Offerings 7.5.4 KH Neochem Heterogeneous Alcohol Sales and Revenue in Global (2017-2022) 7.5.5 KH Neochem Key News 8 Global Heterogeneous Alcohol Production Capacity, Analysis 8.1 Global Heterogeneous Alcohol Production Capacity, 2017-2028 8.2 Heterogeneous Alcohol Production Capacity of Key Manufacturers in Global Market 8.3 Global Heterogeneous Alcohol Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Heterogeneous Alcohol Supply Chain Analysis 10.1 Heterogeneous Alcohol Industry Value Chain 10.2 Heterogeneous Alcohol Upstream Market 10.3 Heterogeneous Alcohol Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Heterogeneous Alcohol Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Heterogeneous Alcohol

Request Sample

Heterogeneous Alcohol