Insurance Broker Tools Market Size, Share, and Trends Analysis Report

CAGR :

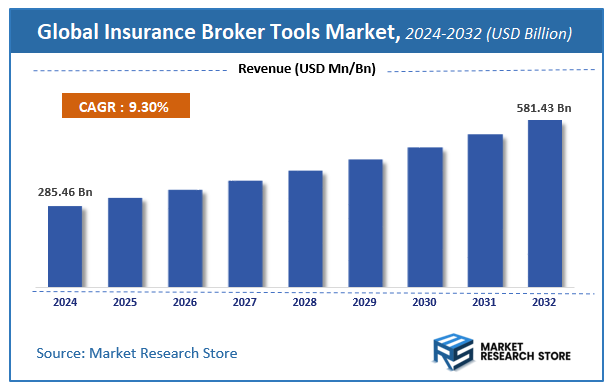

| Market Size 2024 (Base Year) | USD 285.46 Billion |

| Market Size 2032 (Forecast Year) | USD 581.43 Billion |

| CAGR | 9.3% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global insurance broker tools market, estimating its value at USD 285.46 Billion in 2024, with projections indicating it will reach USD 581.43 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 9.3% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the insurance broker tools industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Insurance Broker Tools Market: Overview

The growth of the insurance broker tools market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The insurance broker tools market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the insurance broker tools market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Enterprise Size, Component, Application, Deployment Mode, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global insurance broker tools market is estimated to grow annually at a CAGR of around 9.3% over the forecast period (2025-2032).

- In terms of revenue, the global insurance broker tools market size was valued at around USD 285.46 Billion in 2024 and is projected to reach USD 581.43 Billion by 2032.

- The market is projected to grow at a significant rate due to increasing adoption of digital tools to streamline policy comparison and sales.

- Based on the Enterprise Size, the Large Enterprises segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Component, the Software segment is anticipated to command the largest market share.

- In terms of Application, the Policy Quoting & Comparison segment is projected to lead the global market.

- By Deployment Mode, the Cloud segment is predicted to dominate the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Insurance Broker Tools Market: Report Scope

This report thoroughly analyzes the insurance broker tools market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Insurance Broker Tools Market |

| Market Size in 2024 | USD 285.46 Billion |

| Market Forecast in 2032 | USD 581.43 Billion |

| Growth Rate | CAGR of 9.3% |

| Number of Pages | 212 |

| Key Companies Covered | Zhilian Software, AllClients, InsuredHQ, AgencyBloc, Insurance Systems, Xdimensional Tech, EZLynx, Applied Systems, ITC, Zywave, Agency Matrix, ACS, Buckhill, HawkSoft, Sapiens/Maximum Processing, Vertafore, QQ Solutions, Jenesis Software, Impowersoft |

| Segments Covered | By Enterprise Size, By Component, By Application, By Deployment Mode, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Insurance Broker Tools Market: Dynamics

Key Growth Drivers :

The insurance broker tools market is experiencing a significant surge, primarily driven by the digital transformation of the insurance industry. Brokers are increasingly adopting these tools to move away from manual, paper-based processes and toward streamlined, efficient digital workflows. The market is also fueled by the rising consumer expectation for a seamless and personalized experience, which modern tools, like CRM and customer portals, enable by providing quick access to policy information and real-time communication. Additionally, the growing complexity of insurance products and the need for brokers to manage a diverse portfolio of clients and carriers are pushing the demand for sophisticated software solutions that can automate tasks, generate quotes, and manage commissions efficiently.

Restraints :

Despite the strong growth drivers, the insurance broker tools market faces several notable restraints. A major challenge is the high initial cost of implementing and integrating advanced software, which can be a significant barrier for smaller agencies and independent brokers with limited capital. The market also suffers from data fragmentation, where client information is often scattered across various legacy systems and platforms, making it difficult to achieve a unified customer view. This lack of a single source of truth can hinder the effectiveness of new tools. Furthermore, resistance to change from traditional agents who are accustomed to manual processes and a lack of skilled professionals to effectively operate and manage these complex systems can also limit market adoption.

Opportunities :

The insurance broker tools market is presented with several promising opportunities for innovation and growth. The increasing availability of cloud-based, SaaS solutions offers a key avenue for market expansion, as they provide scalability, cost-effectiveness, and remote accessibility, which is particularly appealing to small and medium-sized agencies. The integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) is a significant opportunity to create more intelligent and automated solutions. These technologies can enable brokers to gain deeper insights into client behavior, personalize policy recommendations, and automate routine tasks, thereby enhancing productivity and client satisfaction.

Challenges :

The market is not without its challenges. One of the primary concerns is data security and privacy, as brokers handle vast amounts of sensitive client information, including personal and financial data. Ensuring compliance with a complex and evolving regulatory landscape, such as GDPR and CCPA, is a continuous and costly challenge for both vendors and brokers. The market is also highly fragmented and competitive, with numerous vendors, which leads to pricing pressure and makes it difficult for new entrants to gain a foothold. Additionally, the challenge of achieving seamless integration with a company's existing technology stack, including a variety of legacy systems, can be a complex and time-consuming process that may result in data inconsistencies and operational disruptions.

Insurance Broker Tools Market: Segmentation Insights

The global insurance broker tools market is segmented based on Enterprise Size, Component, Application, Deployment Mode, and Region. All the segments of the insurance broker tools market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Enterprise Size, the global insurance broker tools market is divided into Large Enterprises, SMEs.

On the basis of Component, the global insurance broker tools market is bifurcated into Software, Services.

In terms of Application, the global insurance broker tools market is categorized into Policy Quoting & Comparison, Client Management, Claims Management, Reporting & Analytics, Commission Tracking.

Based on Deployment Mode, the global insurance broker tools market is split into Cloud, On-premise.

Insurance Broker Tools Market: Regional Insights

The North American region, dominated by the United States, is the unequivocal leader in the global insurance broker tools market, holding the largest revenue share, estimated at nearly 50%. This dominance is structurally rooted in the region's massive and mature insurance industry, which is one of the largest globally, and the early, widespread adoption of advanced InsurTech solutions. Stringent regulatory requirements and complex compliance needs necessitate sophisticated software for risk assessment, policy management, and customer relationship management (CRM).

The presence of a highly competitive brokerage landscape and the headquarters of most leading software vendors (e.g., Vertafore, Applied Systems, Salesforce) create a concentrated hub of innovation and demand. While Europe is a significant and regulated market and the Asia-Pacific region is experiencing rapid growth due to digitalization, their markets are more fragmented and earlier in the adoption curve for advanced, integrated broker platforms. North America's combination of a massive insurance sector, deep technology integration, and a culture that demands efficiency and data-driven decision-making solidifies its position as the dominant region for insurance broker tools.

Insurance Broker Tools Market: Competitive Landscape

The insurance broker tools market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Insurance Broker Tools Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Zhilian Software

- AllClients

- InsuredHQ

- AgencyBloc

- Insurance Systems

- Xdimensional Tech

- EZLynx

- Applied Systems

- ITC

- Zywave

- Agency Matrix

- ACS

- Buckhill

- HawkSoft

- Sapiens/Maximum Processing

- Vertafore

- QQ Solutions

- Jenesis Software

- Impowersoft

The Global Insurance Broker Tools Market is Segmented as Follows:

By Enterprise Size

- Large Enterprises

- SMEs

By Component

- Software

- Services

By Application

- Policy Quoting & Comparison

- Client Management

- Claims Management

- Reporting & Analytics

- Commission Tracking

By Deployment Mode

- Cloud

- On-premise

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Insurance Broker Tools Market Share by Type (2020-2026) 1.5.2 Cloud-Based 1.5.3 On-Premise 1.6 Market by Application 1.6.1 Global Insurance Broker Tools Market Share by Application (2020-2026) 1.6.2 Small Business 1.6.3 Medium-sized Business 1.6.4 Large Business 1.7 Insurance Broker Tools Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Insurance Broker Tools Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Insurance Broker Tools Market 3.1 Value Chain Status 3.2 Insurance Broker Tools Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Insurance Broker Tools 3.2.3 Labor Cost of Insurance Broker Tools 3.2.3.1 Labor Cost of Insurance Broker Tools Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Zhilian Software 4.1.1 Zhilian Software Basic Information 4.1.2 Insurance Broker Tools Product Profiles, Application and Specification 4.1.3 Zhilian Software Insurance Broker Tools Market Performance (2015-2020) 4.1.4 Zhilian Software Business Overview 4.2 AllClients 4.2.1 AllClients Basic Information 4.2.2 Insurance Broker Tools Product Profiles, Application and Specification 4.2.3 AllClients Insurance Broker Tools Market Performance (2015-2020) 4.2.4 AllClients Business Overview 4.3 InsuredHQ 4.3.1 InsuredHQ Basic Information 4.3.2 Insurance Broker Tools Product Profiles, Application and Specification 4.3.3 InsuredHQ Insurance Broker Tools Market Performance (2015-2020) 4.3.4 InsuredHQ Business Overview 4.4 AgencyBloc 4.4.1 AgencyBloc Basic Information 4.4.2 Insurance Broker Tools Product Profiles, Application and Specification 4.4.3 AgencyBloc Insurance Broker Tools Market Performance (2015-2020) 4.4.4 AgencyBloc Business Overview 4.5 Insurance Systems 4.5.1 Insurance Systems Basic Information 4.5.2 Insurance Broker Tools Product Profiles, Application and Specification 4.5.3 Insurance Systems Insurance Broker Tools Market Performance (2015-2020) 4.5.4 Insurance Systems Business Overview 4.6 Xdimensional Tech 4.6.1 Xdimensional Tech Basic Information 4.6.2 Insurance Broker Tools Product Profiles, Application and Specification 4.6.3 Xdimensional Tech Insurance Broker Tools Market Performance (2015-2020) 4.6.4 Xdimensional Tech Business Overview 4.7 EZLynx 4.7.1 EZLynx Basic Information 4.7.2 Insurance Broker Tools Product Profiles, Application and Specification 4.7.3 EZLynx Insurance Broker Tools Market Performance (2015-2020) 4.7.4 EZLynx Business Overview 4.8 Applied Systems 4.8.1 Applied Systems Basic Information 4.8.2 Insurance Broker Tools Product Profiles, Application and Specification 4.8.3 Applied Systems Insurance Broker Tools Market Performance (2015-2020) 4.8.4 Applied Systems Business Overview 4.9 ITC 4.9.1 ITC Basic Information 4.9.2 Insurance Broker Tools Product Profiles, Application and Specification 4.9.3 ITC Insurance Broker Tools Market Performance (2015-2020) 4.9.4 ITC Business Overview 4.10 Zywave 4.10.1 Zywave Basic Information 4.10.2 Insurance Broker Tools Product Profiles, Application and Specification 4.10.3 Zywave Insurance Broker Tools Market Performance (2015-2020) 4.10.4 Zywave Business Overview 4.11 Agency Matrix 4.11.1 Agency Matrix Basic Information 4.11.2 Insurance Broker Tools Product Profiles, Application and Specification 4.11.3 Agency Matrix Insurance Broker Tools Market Performance (2015-2020) 4.11.4 Agency Matrix Business Overview 4.12 ACS 4.12.1 ACS Basic Information 4.12.2 Insurance Broker Tools Product Profiles, Application and Specification 4.12.3 ACS Insurance Broker Tools Market Performance (2015-2020) 4.12.4 ACS Business Overview 4.13 Buckhill 4.13.1 Buckhill Basic Information 4.13.2 Insurance Broker Tools Product Profiles, Application and Specification 4.13.3 Buckhill Insurance Broker Tools Market Performance (2015-2020) 4.13.4 Buckhill Business Overview 4.14 HawkSoft 4.14.1 HawkSoft Basic Information 4.14.2 Insurance Broker Tools Product Profiles, Application and Specification 4.14.3 HawkSoft Insurance Broker Tools Market Performance (2015-2020) 4.14.4 HawkSoft Business Overview 4.15 Sapiens/Maximum Processing 4.15.1 Sapiens/Maximum Processing Basic Information 4.15.2 Insurance Broker Tools Product Profiles, Application and Specification 4.15.3 Sapiens/Maximum Processing Insurance Broker Tools Market Performance (2015-2020) 4.15.4 Sapiens/Maximum Processing Business Overview 4.16 Vertafore 4.16.1 Vertafore Basic Information 4.16.2 Insurance Broker Tools Product Profiles, Application and Specification 4.16.3 Vertafore Insurance Broker Tools Market Performance (2015-2020) 4.16.4 Vertafore Business Overview 4.17 QQ Solutions 4.17.1 QQ Solutions Basic Information 4.17.2 Insurance Broker Tools Product Profiles, Application and Specification 4.17.3 QQ Solutions Insurance Broker Tools Market Performance (2015-2020) 4.17.4 QQ Solutions Business Overview 4.18 Jenesis Software 4.18.1 Jenesis Software Basic Information 4.18.2 Insurance Broker Tools Product Profiles, Application and Specification 4.18.3 Jenesis Software Insurance Broker Tools Market Performance (2015-2020) 4.18.4 Jenesis Software Business Overview 4.19 Impowersoft 4.19.1 Impowersoft Basic Information 4.19.2 Insurance Broker Tools Product Profiles, Application and Specification 4.19.3 Impowersoft Insurance Broker Tools Market Performance (2015-2020) 4.19.4 Impowersoft Business Overview 5 Global Insurance Broker Tools Market Analysis by Regions 5.1 Global Insurance Broker Tools Sales, Revenue and Market Share by Regions 5.1.1 Global Insurance Broker Tools Sales by Regions (2015-2020) 5.1.2 Global Insurance Broker Tools Revenue by Regions (2015-2020) 5.2 North America Insurance Broker Tools Sales and Growth Rate (2015-2020) 5.3 Europe Insurance Broker Tools Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Insurance Broker Tools Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Insurance Broker Tools Sales and Growth Rate (2015-2020) 5.6 South America Insurance Broker Tools Sales and Growth Rate (2015-2020) 6 North America Insurance Broker Tools Market Analysis by Countries 6.1 North America Insurance Broker Tools Sales, Revenue and Market Share by Countries 6.1.1 North America Insurance Broker Tools Sales by Countries (2015-2020) 6.1.2 North America Insurance Broker Tools Revenue by Countries (2015-2020) 6.1.3 North America Insurance Broker Tools Market Under COVID-19 6.2 United States Insurance Broker Tools Sales and Growth Rate (2015-2020) 6.2.1 United States Insurance Broker Tools Market Under COVID-19 6.3 Canada Insurance Broker Tools Sales and Growth Rate (2015-2020) 6.4 Mexico Insurance Broker Tools Sales and Growth Rate (2015-2020) 7 Europe Insurance Broker Tools Market Analysis by Countries 7.1 Europe Insurance Broker Tools Sales, Revenue and Market Share by Countries 7.1.1 Europe Insurance Broker Tools Sales by Countries (2015-2020) 7.1.2 Europe Insurance Broker Tools Revenue by Countries (2015-2020) 7.1.3 Europe Insurance Broker Tools Market Under COVID-19 7.2 Germany Insurance Broker Tools Sales and Growth Rate (2015-2020) 7.2.1 Germany Insurance Broker Tools Market Under COVID-19 7.3 UK Insurance Broker Tools Sales and Growth Rate (2015-2020) 7.3.1 UK Insurance Broker Tools Market Under COVID-19 7.4 France Insurance Broker Tools Sales and Growth Rate (2015-2020) 7.4.1 France Insurance Broker Tools Market Under COVID-19 7.5 Italy Insurance Broker Tools Sales and Growth Rate (2015-2020) 7.5.1 Italy Insurance Broker Tools Market Under COVID-19 7.6 Spain Insurance Broker Tools Sales and Growth Rate (2015-2020) 7.6.1 Spain Insurance Broker Tools Market Under COVID-19 7.7 Russia Insurance Broker Tools Sales and Growth Rate (2015-2020) 7.7.1 Russia Insurance Broker Tools Market Under COVID-19 8 Asia-Pacific Insurance Broker Tools Market Analysis by Countries 8.1 Asia-Pacific Insurance Broker Tools Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Insurance Broker Tools Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Insurance Broker Tools Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Insurance Broker Tools Market Under COVID-19 8.2 China Insurance Broker Tools Sales and Growth Rate (2015-2020) 8.2.1 China Insurance Broker Tools Market Under COVID-19 8.3 Japan Insurance Broker Tools Sales and Growth Rate (2015-2020) 8.3.1 Japan Insurance Broker Tools Market Under COVID-19 8.4 South Korea Insurance Broker Tools Sales and Growth Rate (2015-2020) 8.4.1 South Korea Insurance Broker Tools Market Under COVID-19 8.5 Australia Insurance Broker Tools Sales and Growth Rate (2015-2020) 8.6 India Insurance Broker Tools Sales and Growth Rate (2015-2020) 8.6.1 India Insurance Broker Tools Market Under COVID-19 8.7 Southeast Asia Insurance Broker Tools Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Insurance Broker Tools Market Under COVID-19 9 Middle East and Africa Insurance Broker Tools Market Analysis by Countries 9.1 Middle East and Africa Insurance Broker Tools Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Insurance Broker Tools Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Insurance Broker Tools Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Insurance Broker Tools Market Under COVID-19 9.2 Saudi Arabia Insurance Broker Tools Sales and Growth Rate (2015-2020) 9.3 UAE Insurance Broker Tools Sales and Growth Rate (2015-2020) 9.4 Egypt Insurance Broker Tools Sales and Growth Rate (2015-2020) 9.5 Nigeria Insurance Broker Tools Sales and Growth Rate (2015-2020) 9.6 South Africa Insurance Broker Tools Sales and Growth Rate (2015-2020) 10 South America Insurance Broker Tools Market Analysis by Countries 10.1 South America Insurance Broker Tools Sales, Revenue and Market Share by Countries 10.1.1 South America Insurance Broker Tools Sales by Countries (2015-2020) 10.1.2 South America Insurance Broker Tools Revenue by Countries (2015-2020) 10.1.3 South America Insurance Broker Tools Market Under COVID-19 10.2 Brazil Insurance Broker Tools Sales and Growth Rate (2015-2020) 10.2.1 Brazil Insurance Broker Tools Market Under COVID-19 10.3 Argentina Insurance Broker Tools Sales and Growth Rate (2015-2020) 10.4 Columbia Insurance Broker Tools Sales and Growth Rate (2015-2020) 10.5 Chile Insurance Broker Tools Sales and Growth Rate (2015-2020) 11 Global Insurance Broker Tools Market Segment by Types 11.1 Global Insurance Broker Tools Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Insurance Broker Tools Sales and Market Share by Types (2015-2020) 11.1.2 Global Insurance Broker Tools Revenue and Market Share by Types (2015-2020) 11.2 Cloud-Based Sales and Price (2015-2020) 11.3 On-Premise Sales and Price (2015-2020) 12 Global Insurance Broker Tools Market Segment by Applications 12.1 Global Insurance Broker Tools Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Insurance Broker Tools Sales and Market Share by Applications (2015-2020) 12.1.2 Global Insurance Broker Tools Revenue and Market Share by Applications (2015-2020) 12.2 Small Business Sales, Revenue and Growth Rate (2015-2020) 12.3 Medium-sized Business Sales, Revenue and Growth Rate (2015-2020) 12.4 Large Business Sales, Revenue and Growth Rate (2015-2020) 13 Insurance Broker Tools Market Forecast by Regions (2020-2026) 13.1 Global Insurance Broker Tools Sales, Revenue and Growth Rate (2020-2026) 13.2 Insurance Broker Tools Market Forecast by Regions (2020-2026) 13.2.1 North America Insurance Broker Tools Market Forecast (2020-2026) 13.2.2 Europe Insurance Broker Tools Market Forecast (2020-2026) 13.2.3 Asia-Pacific Insurance Broker Tools Market Forecast (2020-2026) 13.2.4 Middle East and Africa Insurance Broker Tools Market Forecast (2020-2026) 13.2.5 South America Insurance Broker Tools Market Forecast (2020-2026) 13.3 Insurance Broker Tools Market Forecast by Types (2020-2026) 13.4 Insurance Broker Tools Market Forecast by Applications (2020-2026) 13.5 Insurance Broker Tools Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Insurance Broker Tools

Request Sample

Insurance Broker Tools