Lysosomal Storage Diseases Market Size, Share, and Trends Analysis Report

CAGR :

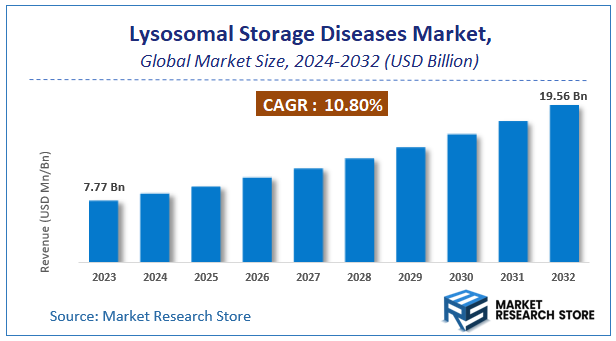

| Market Size 2023 (Base Year) | USD 7.77 Billion |

| Market Size 2032 (Forecast Year) | USD 19.56 Billion |

| CAGR | 10.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Lysosomal Storage Diseases Market Insights

According to Market Research Store, the global lysosomal storage diseases market size was valued at around USD 7.77 billion in 2023 and is estimated to reach USD 19.56 billion by 2032, to register a CAGR of approximately 10.8% in terms of revenue during the forecast period 2024-2032.

The lysosomal storage diseases report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Lysosomal Storage Diseases Market: Overview

Lysosomal storage diseases (LSDs) are a group of rare, inherited metabolic disorders caused by the malfunction or absence of specific enzymes within lysosomes—cellular organelles responsible for breaking down various macromolecules. When these enzymes are deficient or defective, undigested or partially digested substances accumulate within lysosomes, leading to cellular dysfunction and progressive damage in tissues and organs. There are over 50 known types of LSDs, including Gaucher disease, Fabry disease, Tay-Sachs disease, and Pompe disease, each associated with a distinct enzyme deficiency and clinical presentation. Symptoms vary widely depending on the specific disorder but often include developmental delays, organ enlargement, skeletal abnormalities, neurological decline, and reduced life expectancy.

The growth in research and development surrounding lysosomal storage diseases is driven by advancements in genetic diagnostics, enzyme replacement therapies (ERT), and gene therapy. Early and accurate diagnosis through newborn screening and molecular testing has improved disease management, while emerging therapeutic strategies aim to correct enzyme deficiencies or reduce substrate accumulation. Increased awareness among healthcare providers, expansion of rare disease registries, and government support for orphan drug development have further fueled investment in targeted treatments. As personalized medicine and biotechnology continue to evolve, novel therapies such as small molecule chaperones, substrate reduction therapies, and genome editing hold promise for more effective and long-lasting interventions in the treatment of LSDs.

Key Highlights

- The lysosomal storage diseases market is anticipated to grow at a CAGR of 10.8% during the forecast period.

- The global lysosomal storage diseases market was estimated to be worth approximately USD 7.77 billion in 2023 and is projected to reach a value of USD 19.56 billion by 2032.

- The growth of the lysosomal storage diseases market is being driven by increasing adoption in industrial material processing for cutting, welding, marking, and engraving due to its high beam quality and efficiency, particularly in the automotive.

- Based on the type, the enzyme replacement therapy segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the hospitals segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Lysosomal Storage Diseases Market: Dynamics

Key Growth Drivers:

- Increasing Awareness of Rare Diseases: Growing recognition of rare diseases by healthcare professionals, patient advocacy groups, and regulatory bodies is leading to earlier diagnosis and increased demand for treatment options for LSDs.

- Advancements in Diagnostic Technologies: Improved genetic testing, enzyme assays, and biomarker identification are enabling earlier and more accurate diagnosis of LSDs, expanding the treatable patient pool.

- Development of Novel Therapeutic Approaches: Significant progress in enzyme replacement therapy (ERT), substrate reduction therapy (SRT), gene therapy, and chaperone therapy is providing new treatment options and driving market growth.

- Growing Patient Advocacy and Awareness: Active patient organizations play a crucial role in raising awareness, supporting research, and advocating for access to diagnosis and treatment, thereby influencing market dynamics.

- Orphan Drug Designations and Incentives: Regulatory incentives such as orphan drug designation, tax credits, and market exclusivity encourage pharmaceutical companies to invest in the development of therapies for rare diseases like LSDs.

- Increasing Healthcare Expenditure in Developed Countries: Higher healthcare spending in developed nations allows for greater access to expensive therapies for rare diseases.

- Focus on Early Intervention and Improved Patient Outcomes: The understanding that early diagnosis and treatment can significantly improve the prognosis and quality of life for individuals with LSDs drives the demand for timely interventions.

Restraints:

- High Cost of Therapies: Treatments for LSDs, particularly ERT and gene therapy, are often very expensive, limiting patient access and creating reimbursement challenges for healthcare systems.

- Small Patient Populations: The rarity of individual LSDs results in small patient populations, which can make drug development less economically attractive and hinder large-scale clinical trials.

- Challenges in Diagnosis: Many LSDs have overlapping symptoms with other more common conditions, leading to delays or misdiagnosis, which can impact treatment outcomes.

- Limited Understanding of Disease Pathogenesis for Some LSDs: For certain less common LSDs, the underlying disease mechanisms are not fully understood, hindering the development of targeted therapies.

- Blood-Brain Barrier Penetration for CNS Involvement: Many LSDs affect the central nervous system (CNS), and developing therapies that can effectively cross the blood-brain barrier remains a significant challenge.

- Lack of Newborn Screening Programs for Many LSDs: The absence of widespread newborn screening for most LSDs delays early diagnosis and intervention.

- Heterogeneity of Disease Presentation: Even within the same LSD, the severity and progression of symptoms can vary significantly among patients, making treatment development and standardization complex.

Opportunities:

- Expansion of Newborn Screening Programs: Implementing broader newborn screening for more LSDs can lead to earlier diagnosis and treatment initiation, improving patient outcomes.

- Development of More Cost-Effective Therapies: Research into alternative treatment modalities and improvements in manufacturing processes could potentially lower the cost of LSD therapies.

- Advancements in Gene Therapy and Gene Editing: Gene therapy and gene editing technologies hold immense promise for providing curative treatments for LSDs.

- Development of Therapies Targeting the CNS: Innovative approaches to overcome the blood-brain barrier and deliver therapeutic agents to the CNS are crucial for treating neurological manifestations of LSDs.

- Use of Artificial Intelligence and Machine Learning for Diagnosis and Drug Discovery: AI and ML can aid in the early diagnosis of LSDs by analyzing complex patient data and accelerate the identification of potential drug targets and therapies.

- Collaboration and Data Sharing Initiatives: Increased collaboration among researchers, clinicians, and patient organizations, along with the sharing of patient data, can accelerate research and drug development.

- Personalized Medicine Approaches: Tailoring treatment strategies based on the specific genetic mutations and disease manifestations in individual patients could improve therapeutic efficacy.

Challenges:

- Achieving Early and Accurate Diagnosis: Improving diagnostic tools and raising awareness among healthcare professionals to facilitate timely diagnosis.

- Ensuring Access to Treatment for All Patients: Overcoming the financial and logistical barriers to ensure that all individuals with LSDs have access to necessary therapies.

- Developing Effective Treatments for All LSDs: Many LSDs still lack effective treatment options, highlighting the need for continued research and development.

- Conducting Robust Clinical Trials in Small Patient Populations: Designing and executing meaningful clinical trials for rare diseases with limited patient numbers presents significant methodological challenges.

- Understanding and Addressing the Long-Term Effects of Therapies: Long-term monitoring and research are needed to fully understand the safety and efficacy of LSD therapies over the lifespan of patients.

- Managing the Ethical Considerations of Gene Therapy and Gene Editing: Addressing the ethical implications associated with these novel therapeutic approaches.

- Coordinating Multidisciplinary Care for Patients: Individuals with LSDs often require care from multiple specialists, necessitating effective coordination and communication among healthcare providers.

Lysosomal Storage Diseases Market: Report Scope

This report thoroughly analyzes the Lysosomal Storage Diseases Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Lysosomal Storage Diseases Market |

| Market Size in 2023 | USD 7.77 Billion |

| Market Forecast in 2032 | USD 19.56 Billion |

| Growth Rate | CAGR of 10.8% |

| Number of Pages | 178 |

| Key Companies Covered | Actelion Pharmaceuticals, BioMarin, Genzyme, Takeda, Alexion Pharmaceuticals, Amicus Therapeutics, Chiesi Farmaceutici, Greenovation Biotech And FGK Clinical Research, Horizon Pharma, Leadiant Biosciences, Mylan |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Lysosomal Storage Diseases Market: Segmentation Insights

The global lysosomal storage diseases market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global lysosomal storage diseases market is divided into enzyme replacement therapy, substrate reduction therapy, and cystine depleting agents.

Enzyme Replacement Therapy (ERT) dominates the Lysosomal Storage Diseases (LSD) Market owing to its established efficacy and its use as the first-line treatment for many LSDs. ERT involves the intravenous infusion of recombinant enzymes to compensate for the deficiency of natural lysosomal enzymes, directly addressing the underlying cause of various LSDs, such as Gaucher disease, Fabry disease, and Pompe disease. The broad adoption of ERT is supported by several approved therapies in global markets, extensive clinical research, and continued innovation by leading pharmaceutical companies. The consistent improvement in patient outcomes, such as reduced organ enlargement, improved mobility, and increased life expectancy, further drives the dominance of this segment. However, challenges such as high treatment costs and limited penetration in underdeveloped regions remain hurdles. Nonetheless, ongoing advancements like intrathecal enzyme delivery and gene-edited enzymes are expected to reinforce ERT's market leadership.

Substrate Reduction Therapy (SRT) represents a growing segment in the market, focusing on decreasing the synthesis of the substances that accumulate in lysosomes due to enzyme deficiencies. Unlike ERT, SRT is typically administered orally, offering greater convenience and improved patient compliance. This approach is particularly beneficial for patients who do not respond well to ERT or who develop antibodies against infused enzymes. SRT is currently used in select conditions, such as Type 1 Gaucher disease and Niemann-Pick disease Type C. The segment is experiencing increased research activity and pipeline development, especially with small-molecule therapies designed to cross the blood-brain barrier—an area where ERT often falls short.

Cystine Depleting Agents form a niche segment focused primarily on the treatment of cystinosis, a rare LSD characterized by cystine crystal accumulation. This segment is currently limited in scope compared to ERT and SRT, with a small patient population and fewer approved products. However, it plays a critical role in improving renal outcomes and delaying the need for kidney transplantation in affected patients. Advances in formulation (such as delayed-release tablets) and emerging therapies targeting long-term disease control are expected to support steady growth in this specialized area.

Segmentation Insights by Application

On the basis of application, the global lysosomal storage diseases market is bifurcated into hospitals and ambulatory surgical centers.

Hospitals dominate the application segment of the Lysosomal Storage Diseases (LSD) Market due to their advanced infrastructure, access to specialized healthcare professionals, and capacity to administer complex and high-cost treatments such as Enzyme Replacement Therapy (ERT) and Substrate Reduction Therapy (SRT). Hospitals serve as primary centers for diagnosis, management, and long-term care of patients with LSDs, offering multidisciplinary services including genetic counseling, pediatric care, and metabolic disorder management. The availability of diagnostic laboratories, infusion facilities, and clinical trial networks within hospital settings further enhances their central role in the treatment landscape. Moreover, the high prevalence of rare disease centers within tertiary hospitals ensures early identification and timely intervention, making them the primary hub for managing these chronic conditions.

Ambulatory Surgical Centers (ASCs) represent a smaller but steadily growing application segment, driven by the increasing demand for outpatient treatment settings that offer cost-efficiency and convenience. ASCs are gradually expanding their services to include infusion therapies and supportive care for LSD patients, particularly in regions where healthcare systems are evolving toward decentralized care. However, their limited ability to manage complex or emergency LSD cases restricts their role compared to hospitals. As more therapies with improved safety profiles and oral administration routes enter the market, ASCs may see greater utilization, particularly for maintenance therapies and follow-up care.

Lysosomal Storage Diseases Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Lysosomal Storage Diseases Market due to its advanced healthcare infrastructure, high awareness levels, and strong presence of biopharmaceutical companies engaged in rare disease research. The United States plays a central role, benefiting from a robust regulatory framework that supports orphan drug development through the FDA’s Orphan Drug Act and priority review programs. Additionally, access to early diagnosis through genetic testing and newborn screening programs enhances treatment initiation for diseases such as Gaucher, Fabry, and Pompe. Major biotech firms like Sanofi Genzyme, Takeda, and Amicus Therapeutics operate heavily in this region, offering enzyme replacement therapies and advancing gene therapy pipelines.

Europe holds a significant share in the LSDs market, driven by supportive health policies, government funding for rare disease treatment, and strong collaboration between research institutions and pharmaceutical companies. Countries such as Germany, the UK, France, and the Netherlands are at the forefront, with widespread implementation of orphan drug legislation similar to North America. Europe also benefits from central databases and registries that track patient outcomes, thereby improving epidemiological understanding and treatment strategies. The presence of EMA-approved therapies and reimbursement frameworks enhances access to advanced LSD treatments across the region.

Asia-Pacific is witnessing rapid growth in the Lysosomal Storage Diseases Market due to improving healthcare access, growing awareness about genetic disorders, and rising investments in rare disease diagnostics. Japan, South Korea, and Australia are leading markets due to their established pharmaceutical sectors and implementation of national rare disease programs. China and India are expanding their diagnostic capabilities and have started developing localized treatment solutions, although access to costly enzyme replacement therapies remains limited for large parts of the population. Partnerships between global pharma companies and regional players are facilitating market expansion through clinical trials and technology transfer initiatives.

Latin America represents an emerging region with increasing focus on rare diseases, especially in Brazil, Mexico, and Argentina. Government efforts to expand universal healthcare and include orphan drugs under public health programs are gradually improving access to treatment. However, reimbursement delays, lack of disease awareness among general practitioners, and inadequate newborn screening programs limit early diagnosis and consistent therapy access. International partnerships and non-governmental initiatives are helping to bridge these gaps by supporting awareness campaigns and sponsoring genetic testing.

Middle East and Africa show limited but evolving participation in the LSDs market. In the Middle East, countries like Saudi Arabia and the UAE are developing national strategies for rare diseases, incorporating genetic screening and funding for enzyme therapies in tertiary care centers. Africa, in contrast, is at a very early stage due to infrastructural constraints, limited diagnostic facilities, and low public awareness. However, increasing collaborations with global health organizations and pharmaceutical companies are setting the foundation for future market development, particularly in urban centers and academic medical institutions.

Lysosomal Storage Diseases Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the lysosomal storage diseases market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global lysosomal storage diseases market include:

- Actelion Pharmaceuticals

- BioMarin

- Genzyme

- Takeda

- Alexion Pharmaceuticals

- Amicus Therapeutics

- Chiesi Farmaceutici

- Greenovation Biotech And FGK Clinical Research

- Horizon Pharma

- Leadiant Biosciences

- Mylan

The global lysosomal storage diseases market is segmented as follows:

By Type

- Enzyme Replacement Therapy

- Substrate Reduction Therapy

- Cystine Depleting Agents

By Application

- Hospitals

- Ambulatory Surgical Centers

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Lysosomal Storage Diseases Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Lysosomal Storage Diseases Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Lysosomal Storage Diseases Overall Market Size 2.1 Global Lysosomal Storage Diseases Market Size: 2021 VS 2028 2.2 Global Lysosomal Storage Diseases Market Size, Prospects & Forecasts: 2017-2028 2.3 Key Market Trends, Opportunity, Drivers and Restraints 2.3.1 Market Opportunities & Trends 2.3.2 Market Drivers 2.3.3 Market Restraints 3 Company Landscape 3.1 Top Lysosomal Storage Diseases Players in Global Market 3.2 Top Global Lysosomal Storage Diseases Companies Ranked by Revenue 3.3 Global Lysosomal Storage Diseases Revenue by Companies 3.4 Top 3 and Top 5 Lysosomal Storage Diseases Companies in Global Market, by Revenue in 2021 3.5 Global Companies Lysosomal Storage Diseases Product Type 3.6 Tier 1, Tier 2 and Tier 3 Lysosomal Storage Diseases Players in Global Market 3.6.1 List of Global Tier 1 Lysosomal Storage Diseases Companies 3.6.2 List of Global Tier 2 and Tier 3 Lysosomal Storage Diseases Companies 4 Market Sights by Product 4.1 Overview 4.1.1 by Type - Global Lysosomal Storage Diseases Market Size Markets, 2021 & 2028 4.1.2 Enzyme Replacement Therapy 4.1.3 Substrate Reduction Therapy 4.1.4 Cystine Depleting Agents 4.2 By Type - Global Lysosomal Storage Diseases Revenue & Forecasts 4.2.1 By Type - Global Lysosomal Storage Diseases Revenue, 2017-2022 4.2.2 By Type - Global Lysosomal Storage Diseases Revenue, 2023-2028 4.2.3 By Type - Global Lysosomal Storage Diseases Revenue Market Share, 2017-2028 5 Sights by Application 5.1 Overview 5.1.1 By Application - Global Lysosomal Storage Diseases Market Size, 2021 & 2028 5.1.2 Hospitals 5.1.3 Ambulatory Surgical Centers 5.2 By Application - Global Lysosomal Storage Diseases Revenue & Forecasts 5.2.1 By Application - Global Lysosomal Storage Diseases Revenue, 2017-2022 5.2.2 By Application - Global Lysosomal Storage Diseases Revenue, 2023-2028 5.2.3 By Application - Global Lysosomal Storage Diseases Revenue Market Share, 2017-2028 6 Sights by Region 6.1 By Region - Global Lysosomal Storage Diseases Market Size, 2021 & 2028 6.2 By Region - Global Lysosomal Storage Diseases Revenue & Forecasts 6.2.1 By Region - Global Lysosomal Storage Diseases Revenue, 2017-2022 6.2.2 By Region - Global Lysosomal Storage Diseases Revenue, 2023-2028 6.2.3 By Region - Global Lysosomal Storage Diseases Revenue Market Share, 2017-2028 6.3 North America 6.3.1 By Country - North America Lysosomal Storage Diseases Revenue, 2017-2028 6.3.2 US Lysosomal Storage Diseases Market Size, 2017-2028 6.3.3 Canada Lysosomal Storage Diseases Market Size, 2017-2028 6.3.4 Mexico Lysosomal Storage Diseases Market Size, 2017-2028 6.4 Europe 6.4.1 By Country - Europe Lysosomal Storage Diseases Revenue, 2017-2028 6.4.2 Germany Lysosomal Storage Diseases Market Size, 2017-2028 6.4.3 France Lysosomal Storage Diseases Market Size, 2017-2028 6.4.4 U.K. Lysosomal Storage Diseases Market Size, 2017-2028 6.4.5 Italy Lysosomal Storage Diseases Market Size, 2017-2028 6.4.6 Russia Lysosomal Storage Diseases Market Size, 2017-2028 6.4.7 Nordic Countries Lysosomal Storage Diseases Market Size, 2017-2028 6.4.8 Benelux Lysosomal Storage Diseases Market Size, 2017-2028 6.5 Asia 6.5.1 By Region - Asia Lysosomal Storage Diseases Revenue, 2017-2028 6.5.2 China Lysosomal Storage Diseases Market Size, 2017-2028 6.5.3 Japan Lysosomal Storage Diseases Market Size, 2017-2028 6.5.4 South Korea Lysosomal Storage Diseases Market Size, 2017-2028 6.5.5 Southeast Asia Lysosomal Storage Diseases Market Size, 2017-2028 6.5.6 India Lysosomal Storage Diseases Market Size, 2017-2028 6.6 South America 6.6.1 By Country - South America Lysosomal Storage Diseases Revenue, 2017-2028 6.6.2 Brazil Lysosomal Storage Diseases Market Size, 2017-2028 6.6.3 Argentina Lysosomal Storage Diseases Market Size, 2017-2028 6.7 Middle East & Africa 6.7.1 By Country - Middle East & Africa Lysosomal Storage Diseases Revenue, 2017-2028 6.7.2 Turkey Lysosomal Storage Diseases Market Size, 2017-2028 6.7.3 Israel Lysosomal Storage Diseases Market Size, 2017-2028 6.7.4 Saudi Arabia Lysosomal Storage Diseases Market Size, 2017-2028 6.7.5 UAE Lysosomal Storage Diseases Market Size, 2017-2028 7 Players Profiles 7.1 Actelion Pharmaceuticals 7.1.1 Actelion Pharmaceuticals Corporate Summary 7.1.2 Actelion Pharmaceuticals Business Overview 7.1.3 Actelion Pharmaceuticals Lysosomal Storage Diseases Major Product Offerings 7.1.4 Actelion Pharmaceuticals Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.1.5 Actelion Pharmaceuticals Key News 7.2 BioMarin 7.2.1 BioMarin Corporate Summary 7.2.2 BioMarin Business Overview 7.2.3 BioMarin Lysosomal Storage Diseases Major Product Offerings 7.2.4 BioMarin Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.2.5 BioMarin Key News 7.3 Genzyme 7.3.1 Genzyme Corporate Summary 7.3.2 Genzyme Business Overview 7.3.3 Genzyme Lysosomal Storage Diseases Major Product Offerings 7.3.4 Genzyme Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.3.5 Genzyme Key News 7.4 Takeda 7.4.1 Takeda Corporate Summary 7.4.2 Takeda Business Overview 7.4.3 Takeda Lysosomal Storage Diseases Major Product Offerings 7.4.4 Takeda Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.4.5 Takeda Key News 7.5 Alexion Pharmaceuticals 7.5.1 Alexion Pharmaceuticals Corporate Summary 7.5.2 Alexion Pharmaceuticals Business Overview 7.5.3 Alexion Pharmaceuticals Lysosomal Storage Diseases Major Product Offerings 7.5.4 Alexion Pharmaceuticals Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.5.5 Alexion Pharmaceuticals Key News 7.6 Amicus Therapeutics 7.6.1 Amicus Therapeutics Corporate Summary 7.6.2 Amicus Therapeutics Business Overview 7.6.3 Amicus Therapeutics Lysosomal Storage Diseases Major Product Offerings 7.6.4 Amicus Therapeutics Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.6.5 Amicus Therapeutics Key News 7.7 Chiesi Farmaceutici 7.7.1 Chiesi Farmaceutici Corporate Summary 7.7.2 Chiesi Farmaceutici Business Overview 7.7.3 Chiesi Farmaceutici Lysosomal Storage Diseases Major Product Offerings 7.7.4 Chiesi Farmaceutici Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.7.5 Chiesi Farmaceutici Key News 7.8 Greenovation Biotech And FGK Clinical Research 7.8.1 Greenovation Biotech And FGK Clinical Research Corporate Summary 7.8.2 Greenovation Biotech And FGK Clinical Research Business Overview 7.8.3 Greenovation Biotech And FGK Clinical Research Lysosomal Storage Diseases Major Product Offerings 7.8.4 Greenovation Biotech And FGK Clinical Research Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.8.5 Greenovation Biotech And FGK Clinical Research Key News 7.9 Horizon Pharma 7.9.1 Horizon Pharma Corporate Summary 7.9.2 Horizon Pharma Business Overview 7.9.3 Horizon Pharma Lysosomal Storage Diseases Major Product Offerings 7.9.4 Horizon Pharma Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.9.5 Horizon Pharma Key News 7.10 Leadiant Biosciences 7.10.1 Leadiant Biosciences Corporate Summary 7.10.2 Leadiant Biosciences Business Overview 7.10.3 Leadiant Biosciences Lysosomal Storage Diseases Major Product Offerings 7.10.4 Leadiant Biosciences Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.10.5 Leadiant Biosciences Key News 7.11 Mylan 7.11.1 Mylan Corporate Summary 7.11.2 Mylan Business Overview 7.11.3 Mylan Lysosomal Storage Diseases Major Product Offerings 7.11.4 Mylan Lysosomal Storage Diseases Revenue in Global Market (2017-2022) 7.11.5 Mylan Key News 8 Conclusion 9 Appendix 9.1 Note 9.2 Examples of Clients 9.3 Disclaimer

Inquiry For Buying

Lysosomal Storage Diseases

Request Sample

Lysosomal Storage Diseases