Managed Office Market Size, Share, and Trends Analysis Report

CAGR :

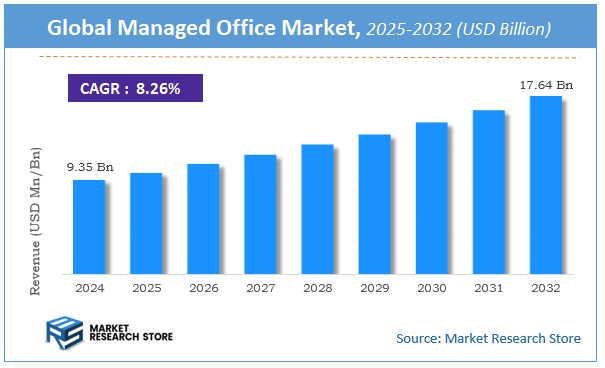

| Market Size 2024 (Base Year) | USD 9.35 Billion |

| Market Size 2032 (Forecast Year) | USD 17.64 Billion |

| CAGR | 8.26% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global managed office market size was valued at approximately USD 9.35 Billion in 2024. The market is projected to grow significantly, reaching USD 17.64 Billion by 2032, growing at a compound annual growth rate (CAGR) of 8.26% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the managed office industry.

Managed Office Market: Overview

The growth of the managed office market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The managed office market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the managed office market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on End-User, Service Type, Industry, Type of Facility, Organization Size, Pricing Model, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global managed office market is estimated to grow annually at a CAGR of around 8.26% over the forecast period (2024-2032).

- In terms of revenue, the global managed office market size was valued at around USD 9.35 Billion in 2024 and is projected to reach USD 17.64 Billion by 2032.

- The market is projected to grow at a significant rate due to increasing adoption of hybrid and remote work models, the growing demand for flexible and cost-effective workspace solutions, and the desire of businesses to focus on core operations by outsourcing office management.

- Based on the End-User, the Small and Medium Enterprises (SMEs) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Service Type, the Private Offices segment is anticipated to command the largest market share.

- In terms of Industry, the Information Technology (IT) and Software segment is projected to lead the global market.

- By Type of Facility, the Flexibility Offices segment is predicted to dominate the global market.

- Based on the Organization Size, the Small Enterprises segment is expected to swipe the largest market share.

- Based on the Pricing Model, the Pay-per-Use segment is expected to become the fastest-growing segment.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Managed Office Market: Report Scope

This report thoroughly analyzes the managed office market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Managed Office Market |

| Market Size in 2024 | USD 9.35 Billion |

| Market Forecast in 2032 | USD 17.64 Billion |

| Growth Rate | CAGR of 8.26% |

| Number of Pages | 239 |

| Key Companies Covered | Allwork.Space, Regus, CSO, Servcorp, Instant, Startups, Gorilla Property Solutions, OREGA MANAGEMENT LTD, Clockwise Offices |

| Segments Covered | By End-User, By Service Type, By Industry, By Type of Facility, By Organization Size, By Pricing Model, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Managed Office Market: Dynamics

key growth drivers:

The managed office market is booming due to the growing preference for flexible, cost-effective, and agile workspace solutions. Businesses, from startups to large enterprises, are shifting away from rigid, long-term traditional leases and embracing managed offices to optimize costs and reduce capital expenditure. The rise of hybrid work models and the need for scalable office space to accommodate fluctuating workforce sizes are also significant drivers. Furthermore, managed offices offer a comprehensive suite of services and amenities, such as IT infrastructure, maintenance, and reception services, allowing companies to focus on their core business activities.

restraints:

Despite strong growth, the managed office market faces several restraints. A primary challenge is the high initial cost for providers to set up and furnish premium spaces with advanced technology and amenities. This investment risk can be significant, especially in an unpredictable economic climate. Another restraint is the intense competition from both traditional real estate and a crowded field of flexible workspace providers, which can lead to pricing pressures and a race to the bottom. Additionally, some organizations may still prefer the control and customizability of a traditional, self-managed office, viewing managed spaces as a short-term solution rather than a long-term strategy.

opportunities:

The market is full of opportunities for innovation and expansion. There's a significant opportunity to cater to the growing demand for "smart offices" that integrate technologies like IoT and AI to optimize space, improve energy efficiency, and enhance the employee experience. The expansion into Tier 2 and Tier 3 cities presents a new frontier for providers, as businesses look to establish a presence in these regions with lower operational costs. Furthermore, there's a chance to offer highly customized solutions for specific industries, such as life sciences or technology, that have unique infrastructure and security requirements, thus capturing a niche but high-value segment of the market.

challenges:

The managed office market faces challenges in maintaining consistent quality and a unique brand identity across multiple locations and a diverse client base. The need to balance high-quality service with competitive pricing is a constant struggle. Another challenge is the risk of economic downturns, which can lead to a reduction in demand for office space and increase tenant turnover. Additionally, attracting and retaining top-tier talent in a competitive labor market requires providers to offer not just a physical space, but a vibrant community and a positive work environment, which can be a complex and demanding task.

Managed Office Market: Segmentation Insights

The global managed office market is segmented based on End-User, Service Type, Industry, Type of Facility, Organization Size, Pricing Model, and Region. All the segments of the managed office market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on End-User, the global managed office market is divided into Small and Medium Enterprises (SMEs), Large Enterprises, Start-ups, Government and Public Sector, Non-profit Organizations.

On the basis of Service Type, the global managed office market is bifurcated into Private Offices, Shared Offices, Virtual Offices, Co-working Spaces, Meeting Rooms.

In terms of Industry, the global managed office market is categorized into Information Technology (IT) and Software, Financial Services, Legal Services, Healthcare, Retail, Consulting, Media and Advertising.

Based on Type of Facility, the global managed office market is split into Flexibility Offices, Full-Service Offices, Hot Desking, Dedicated Desks.

By Organization Size, the global managed office market is divided into Small Enterprises, Medium-Sized Enterprises, Large Enterprises.

On the basis of Pricing Model, the global managed office market is segregated into Pay-per-Use, Fixed Monthly Rent, Membership-Based.

Managed Office Market: Regional Insights

The managed office market is experiencing significant growth, with North America dominating the region due to high demand for flexible workspaces, strong corporate presence, and rapid adoption of hybrid work models. According to recent market reports, North America held over 40% of the global market share in 2023, driven by major hubs like the U.S. and Canada, where businesses prioritize cost efficiency and scalability. The Asia-Pacific region is the fastest-growing market, fueled by urbanization, startup expansion, and increasing foreign investments in cities like Bangalore, Singapore, and Sydney.

Europe follows closely, with the UK and Germany leading due to stringent workplace regulations and a surge in co-working spaces. Latin America and the Middle East & Africa are emerging markets, with growth concentrated in Brazil, Mexico, and the UAE. North America’s dominance is expected to persist, supported by tech advancements and a robust commercial real estate sector.

Managed Office Market: Competitive Landscape

The managed office market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Managed Office Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Allwork.Space

- Regus

- CSO

- Servcorp

- Instant

- Startups

- Gorilla Property Solutions

- OREGA MANAGEMENT LTD

- Clockwise Offices

The Global Managed Office Market is Segmented as Follows:

By End-User

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Start-ups

- Government and Public Sector

- Non-profit Organizations

By Service Type

- Private Offices

- Shared Offices

- Virtual Offices

- Co-working Spaces

- Meeting Rooms

By Industry

- Information Technology (IT) and Software

- Financial Services

- Legal Services

- Healthcare

- Retail

- Consulting

- Media and Advertising

By Type of Facility

- Flexibility Offices

- Full-Service Offices

- Hot Desking

- Dedicated Desks

By Organization Size

- Small Enterprises

- Medium-Sized Enterprises

- Large Enterprises

By Pricing Model

- Pay-per-Use

- Fixed Monthly Rent

- Membership-Based

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Managed Office Market Share by Type (2020-2026) 1.5.2 Flexible Lease 1.5.3 Long Lease 1.6 Market by Application 1.6.1 Global Managed Office Market Share by Application (2020-2026) 1.6.2 Start-up 1.6.3 Small Business 1.7 Managed Office Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Managed Office Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Managed Office Market 3.1 Value Chain Status 3.2 Managed Office Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Managed Office 3.2.3 Labor Cost of Managed Office 3.2.3.1 Labor Cost of Managed Office Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Clockwise Offices 4.1.1 Clockwise Offices Basic Information 4.1.2 Managed Office Product Profiles, Application and Specification 4.1.3 Clockwise Offices Managed Office Market Performance (2015-2020) 4.1.4 Clockwise Offices Business Overview 4.2 Startups 4.2.1 Startups Basic Information 4.2.2 Managed Office Product Profiles, Application and Specification 4.2.3 Startups Managed Office Market Performance (2015-2020) 4.2.4 Startups Business Overview 4.3 Servcorp 4.3.1 Servcorp Basic Information 4.3.2 Managed Office Product Profiles, Application and Specification 4.3.3 Servcorp Managed Office Market Performance (2015-2020) 4.3.4 Servcorp Business Overview 4.4 Allwork.Space 4.4.1 Allwork.Space Basic Information 4.4.2 Managed Office Product Profiles, Application and Specification 4.4.3 Allwork.Space Managed Office Market Performance (2015-2020) 4.4.4 Allwork.Space Business Overview 4.5 Instant 4.5.1 Instant Basic Information 4.5.2 Managed Office Product Profiles, Application and Specification 4.5.3 Instant Managed Office Market Performance (2015-2020) 4.5.4 Instant Business Overview 4.6 Regus 4.6.1 Regus Basic Information 4.6.2 Managed Office Product Profiles, Application and Specification 4.6.3 Regus Managed Office Market Performance (2015-2020) 4.6.4 Regus Business Overview 4.7 CSO 4.7.1 CSO Basic Information 4.7.2 Managed Office Product Profiles, Application and Specification 4.7.3 CSO Managed Office Market Performance (2015-2020) 4.7.4 CSO Business Overview 4.8 Gorilla Property Solutions 4.8.1 Gorilla Property Solutions Basic Information 4.8.2 Managed Office Product Profiles, Application and Specification 4.8.3 Gorilla Property Solutions Managed Office Market Performance (2015-2020) 4.8.4 Gorilla Property Solutions Business Overview 4.9 OREGA MANAGEMENT LTD 4.9.1 OREGA MANAGEMENT LTD Basic Information 4.9.2 Managed Office Product Profiles, Application and Specification 4.9.3 OREGA MANAGEMENT LTD Managed Office Market Performance (2015-2020) 4.9.4 OREGA MANAGEMENT LTD Business Overview 5 Global Managed Office Market Analysis by Regions 5.1 Global Managed Office Sales, Revenue and Market Share by Regions 5.1.1 Global Managed Office Sales by Regions (2015-2020) 5.1.2 Global Managed Office Revenue by Regions (2015-2020) 5.2 North America Managed Office Sales and Growth Rate (2015-2020) 5.3 Europe Managed Office Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Managed Office Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Managed Office Sales and Growth Rate (2015-2020) 5.6 South America Managed Office Sales and Growth Rate (2015-2020) 6 North America Managed Office Market Analysis by Countries 6.1 North America Managed Office Sales, Revenue and Market Share by Countries 6.1.1 North America Managed Office Sales by Countries (2015-2020) 6.1.2 North America Managed Office Revenue by Countries (2015-2020) 6.1.3 North America Managed Office Market Under COVID-19 6.2 United States Managed Office Sales and Growth Rate (2015-2020) 6.2.1 United States Managed Office Market Under COVID-19 6.3 Canada Managed Office Sales and Growth Rate (2015-2020) 6.4 Mexico Managed Office Sales and Growth Rate (2015-2020) 7 Europe Managed Office Market Analysis by Countries 7.1 Europe Managed Office Sales, Revenue and Market Share by Countries 7.1.1 Europe Managed Office Sales by Countries (2015-2020) 7.1.2 Europe Managed Office Revenue by Countries (2015-2020) 7.1.3 Europe Managed Office Market Under COVID-19 7.2 Germany Managed Office Sales and Growth Rate (2015-2020) 7.2.1 Germany Managed Office Market Under COVID-19 7.3 UK Managed Office Sales and Growth Rate (2015-2020) 7.3.1 UK Managed Office Market Under COVID-19 7.4 France Managed Office Sales and Growth Rate (2015-2020) 7.4.1 France Managed Office Market Under COVID-19 7.5 Italy Managed Office Sales and Growth Rate (2015-2020) 7.5.1 Italy Managed Office Market Under COVID-19 7.6 Spain Managed Office Sales and Growth Rate (2015-2020) 7.6.1 Spain Managed Office Market Under COVID-19 7.7 Russia Managed Office Sales and Growth Rate (2015-2020) 7.7.1 Russia Managed Office Market Under COVID-19 8 Asia-Pacific Managed Office Market Analysis by Countries 8.1 Asia-Pacific Managed Office Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Managed Office Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Managed Office Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Managed Office Market Under COVID-19 8.2 China Managed Office Sales and Growth Rate (2015-2020) 8.2.1 China Managed Office Market Under COVID-19 8.3 Japan Managed Office Sales and Growth Rate (2015-2020) 8.3.1 Japan Managed Office Market Under COVID-19 8.4 South Korea Managed Office Sales and Growth Rate (2015-2020) 8.4.1 South Korea Managed Office Market Under COVID-19 8.5 Australia Managed Office Sales and Growth Rate (2015-2020) 8.6 India Managed Office Sales and Growth Rate (2015-2020) 8.6.1 India Managed Office Market Under COVID-19 8.7 Southeast Asia Managed Office Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Managed Office Market Under COVID-19 9 Middle East and Africa Managed Office Market Analysis by Countries 9.1 Middle East and Africa Managed Office Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Managed Office Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Managed Office Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Managed Office Market Under COVID-19 9.2 Saudi Arabia Managed Office Sales and Growth Rate (2015-2020) 9.3 UAE Managed Office Sales and Growth Rate (2015-2020) 9.4 Egypt Managed Office Sales and Growth Rate (2015-2020) 9.5 Nigeria Managed Office Sales and Growth Rate (2015-2020) 9.6 South Africa Managed Office Sales and Growth Rate (2015-2020) 10 South America Managed Office Market Analysis by Countries 10.1 South America Managed Office Sales, Revenue and Market Share by Countries 10.1.1 South America Managed Office Sales by Countries (2015-2020) 10.1.2 South America Managed Office Revenue by Countries (2015-2020) 10.1.3 South America Managed Office Market Under COVID-19 10.2 Brazil Managed Office Sales and Growth Rate (2015-2020) 10.2.1 Brazil Managed Office Market Under COVID-19 10.3 Argentina Managed Office Sales and Growth Rate (2015-2020) 10.4 Columbia Managed Office Sales and Growth Rate (2015-2020) 10.5 Chile Managed Office Sales and Growth Rate (2015-2020) 11 Global Managed Office Market Segment by Types 11.1 Global Managed Office Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Managed Office Sales and Market Share by Types (2015-2020) 11.1.2 Global Managed Office Revenue and Market Share by Types (2015-2020) 11.2 Flexible Lease Sales and Price (2015-2020) 11.3 Long Lease Sales and Price (2015-2020) 12 Global Managed Office Market Segment by Applications 12.1 Global Managed Office Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Managed Office Sales and Market Share by Applications (2015-2020) 12.1.2 Global Managed Office Revenue and Market Share by Applications (2015-2020) 12.2 Start-up Sales, Revenue and Growth Rate (2015-2020) 12.3 Small Business Sales, Revenue and Growth Rate (2015-2020) 13 Managed Office Market Forecast by Regions (2020-2026) 13.1 Global Managed Office Sales, Revenue and Growth Rate (2020-2026) 13.2 Managed Office Market Forecast by Regions (2020-2026) 13.2.1 North America Managed Office Market Forecast (2020-2026) 13.2.2 Europe Managed Office Market Forecast (2020-2026) 13.2.3 Asia-Pacific Managed Office Market Forecast (2020-2026) 13.2.4 Middle East and Africa Managed Office Market Forecast (2020-2026) 13.2.5 South America Managed Office Market Forecast (2020-2026) 13.3 Managed Office Market Forecast by Types (2020-2026) 13.4 Managed Office Market Forecast by Applications (2020-2026) 13.5 Managed Office Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Managed Office

Request Sample

Managed Office