Medium-chain Triglycerides Market Size, Share, and Trends Analysis Report

CAGR :

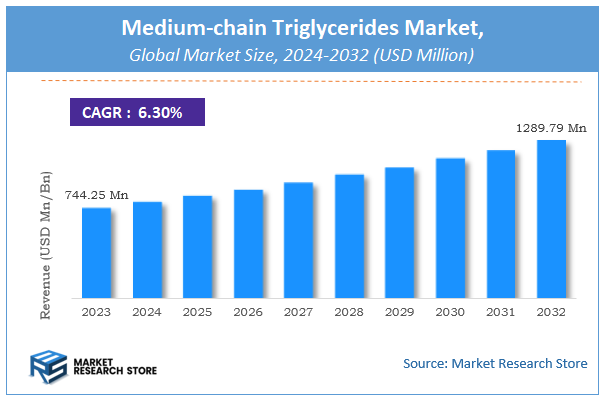

| Market Size 2023 (Base Year) | USD 744.25 Million |

| Market Size 2032 (Forecast Year) | USD 1289.79 Million |

| CAGR | 6.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Medium-chain Triglycerides Market Insights

According to Market Research Store, the global medium-chain triglycerides market size was valued at around USD 744.25 million in 2023 and is estimated to reach USD 1289.79 million by 2032, to register a CAGR of approximately 6.3% in terms of revenue during the forecast period 2024-2032.

The medium-chain triglycerides report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Medium-chain Triglycerides Market: Overview

Medium-chain triglycerides (MCTs) are a type of fat composed of fatty acids with a medium-length carbon chain, typically ranging from 6 to 12 carbon atoms. Commonly derived from coconut oil, palm kernel oil, and dairy products, MCTs are more rapidly absorbed and metabolized by the body compared to long-chain triglycerides (LCTs), providing a quick and efficient source of energy. Unlike LCTs, MCTs bypass the typical digestive process and are transported directly to the liver, where they are readily converted into ketones or used as fuel.

The growth of the medium-chain triglycerides market is driven by increasing consumer awareness of functional and health-focused ingredients, particularly in the areas of weight management, sports nutrition, and ketogenic diets. MCTs are widely used in dietary supplements, energy drinks, infant nutrition, medical nutrition, and functional foods due to their benefits in enhancing energy levels, supporting cognitive function, and aiding in fat metabolism.

Key Highlights

- The medium-chain triglycerides market is anticipated to grow at a CAGR of 6.3% during the forecast period.

- The global medium-chain triglycerides market was estimated to be worth approximately USD 744.25 million in 2023 and is projected to reach a value of USD 1289.79 million by 2032.

- The growth of the medium-chain triglycerides market is being driven by increasing consumer demand for health-oriented and functional food products, especially those targeting weight management, cognitive health, and sports nutrition.

- Based on the type, the caproic acid segment is growing at a high rate and is projected to dominate the market.

- On the basis of source, the palm kernel oil segment is projected to swipe the largest market share.

- In terms of application, the dietary & health supplements segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Medium-chain Triglycerides Market: Dynamics

Key Growth Drivers:

- Rising Popularity of Health-Centric Diets and Lifestyles: The increasing global adoption of ketogenic, low-carb, and other health-focused diets, coupled with a general surge in health and wellness awareness, is a primary driver. Consumers are seeking natural, functional ingredients like MCTs for weight management, energy enhancement, and cognitive support, given their rapid absorption and conversion into ketones.

- Expanding Applications in Sports Nutrition and Medical Foods: Athletes and fitness enthusiasts are increasingly using MCTs for quick energy during workouts, improved endurance, and recovery. Simultaneously, in clinical settings, MCTs are crucial in medical nutrition for patients with malabsorption issues, and as carriers for certain medications, due to their easy digestibility and rapid energy supply.

- Technological Advancements and Product Innovation: Continuous innovation in developing new MCT product forms (e.g., powders, emulsions, gummies) beyond traditional oils, coupled with advancements in flavor masking and formulation, enhances consumer convenience and allows for broader integration into various food, beverage, and supplement products.

Restraints:

- Volatile Raw Material Prices and Supply Chain Reliance: The market's dependence on agricultural commodities like coconut oil and palm kernel oil, whose prices can fluctuate due to weather patterns, geopolitical events, and supply chain disruptions, directly impacts production costs and market stability.

- Misconceptions and Consumer Confusion with Saturated Fats: Despite their unique metabolic pathway, some consumers still associate MCTs with the negative perceptions of general saturated fats. Confusion between pure MCT oil and coconut oil (which contains some MCTs but also long-chain fats) can hinder wider acceptance and market growth.

- Stringent Quality Control and Purity Standards: Ensuring consistent purity, specific fatty acid composition (e.g., C8 vs. C10 ratio), and safety of MCT products is critical but can be challenging given varied sourcing and manufacturing processes. Adherence to strict quality standards adds to production complexity and cost.

Opportunities:

- Expansion in Emerging Economies with Rising Health Awareness: Developing regions, particularly in Asia Pacific, are witnessing a significant increase in health consciousness, disposable incomes, and the adoption of modern dietary trends. This presents a vast, untapped market for MCT products, especially given the local availability of coconut oil as a raw material.

- Integration into Carbon Credit Markets and Sustainable Sourcing Initiatives: As the focus on sustainability grows, there's an opportunity for MCT producers to engage in ethical sourcing practices (e.g., certified sustainable palm oil) and potentially explore generating carbon credits if their production processes contribute to carbon sequestration or reduced emissions, appealing to environmentally conscious consumers.

- Continued Research into Novel Therapeutic Applications: Ongoing scientific research into the potential therapeutic uses of MCTs, such as their role in gut health, specific metabolic disorders (e.g., diabetes management), and neurological conditions beyond established uses, could unlock new, high-value medical and pharmaceutical market segments.

Challenges:

- Consumer Education on Proper Dosage and Potential Side Effects: A key challenge is to effectively educate consumers on the appropriate dosage of MCTs to avoid potential side effects like digestive upset. Proper guidance is crucial to ensure positive user experiences and maintain the product's favorable reputation.

- Regulatory Scrutiny on Health Claims and Labeling: As MCTs gain popularity and new health benefits are explored, regulatory bodies worldwide are increasing their scrutiny on the scientific substantiation of health claims and the accuracy of product labeling. This requires manufacturers to invest in robust research and ensure strict compliance.

- Ensuring Traceability and Ethical Sourcing Across the Supply Chain: With the increasing demand for sustainable and ethically produced ingredients, a significant challenge for MCT manufacturers is to ensure full traceability of their raw materials (coconut and palm oil) and verify ethical labor practices throughout their complex global supply chains.

Medium-chain Triglycerides Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Medium-chain Triglycerides Market |

| Market Size in 2023 | USD 744.25 Million |

| Market Forecast in 2032 | USD 1289.79 Million |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 145 |

| Key Companies Covered | Cremer, Elementis, Oleon, Stepan, Basf, Klk Oleo, Croda, Emery, Musim Mas, Britz, Dr.Straetmans, Acme-Hardesty, Lonza, Magna-Kron, Avicpharmaceutical, Wumei Etc. |

| Segments Covered | By Product, By Application, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Medium-chain Triglycerides Market: Segmentation Insights

The global medium-chain triglycerides market is divided by type, source, application, and region.

Based on type, the global medium-chain triglycerides market is divided into caproic acid, caprylic acid, capric acid, and lauric acid. Caproic Acid dominates the MCT market due to its rapid metabolic conversion into ketones, making it highly desirable for energy-boosting applications in nutritional and therapeutic formulations. Also known as hexanoic acid, Caproic Acid is the shortest chain among MCTs and is quickly absorbed in the gastrointestinal tract without requiring bile salts for digestion. Its efficient conversion into immediate energy enhances its popularity in ketogenic diets, sports nutrition, and clinical nutrition products. Furthermore, it contributes significantly to the formulation of functional beverages and dietary supplements aimed at improving cognitive performance and endurance. Despite its potent flavor and aroma, advanced processing techniques have enabled its broader commercial use.

On the basis of source, the global medium-chain triglycerides market is bifurcated into palm kernel oil, coconut oil, and others. Palm Kernel Oil dominates the MCT market as the primary source of medium-chain triglycerides due to its high yield, cost-efficiency, and consistent supply. Extracted from the seed of the oil palm fruit, Palm Kernel Oil contains significant concentrations of Caprylic, Capric, and Lauric acids, making it ideal for industrial-scale MCT production. Its relatively stable pricing and wide cultivation support its dominance, particularly in large-scale food processing, pharmaceutical, and personal care applications. Palm Kernel Oil–derived MCTs are preferred for their neutral flavor, high oxidative stability, and versatility across nutritional supplements, clinical formulations, and cosmetic emulsions.

In terms of application, the global medium-chain triglycerides market is bifurcated into dietary & health supplements, personal care & cosmetics, pharmaceuticals, and others. Dietary & Health Supplements dominate the MCT market due to the increasing global emphasis on functional nutrition, weight management, and energy-boosting formulations. MCTs are widely used in sports nutrition, ketogenic diets, and meal replacement products owing to their unique ability to rapidly convert into ketones, providing quick and sustained energy without spiking blood glucose. They enhance endurance, cognitive performance, and satiety, making them especially popular among athletes, fitness enthusiasts, and individuals seeking metabolic health benefits. MCT oils and powders are also integral to high-fat, low-carb dietary protocols, and their compatibility with vegan, paleo, and gluten-free regimens continues to drive product innovation across nutritional categories.

Medium-chain Triglycerides Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the medium-chain triglycerides market, driven by rising demand for functional foods, ketogenic diets, sports nutrition, and personal care products. The United States leads regional consumption, where MCTs are widely used in dietary supplements, weight management formulations, and energy-enhancing food products. The region also shows significant usage of MCTs in clinical nutrition and medical food, especially for patients with fat absorption disorders. The personal care and cosmetics sector contributes to growth through demand for MCTs as emollients and carriers in lotions, creams, and hair products. Strong consumer awareness regarding clean-label ingredients and the rise of bio-based, plant-derived oils are supporting continued expansion. Canada complements demand with niche applications in nutraceuticals and natural skincare products.

Asia-Pacific is the fastest-growing region in the medium-chain triglycerides market, fueled by rising disposable income, expanding health supplement sectors, and abundant availability of raw materials. Countries like China and India are experiencing significant growth due to increasing consumer focus on fitness, weight loss, and preventive healthcare. In Southeast Asia, particularly Indonesia, Malaysia, and the Philippines, large-scale production of palm kernel and coconut oil ensures a stable feedstock supply for MCT manufacturing. Japan and South Korea show demand for high-quality MCTs in beauty and anti-aging formulations, medical nutrition, and functional snacks. Regional producers are also expanding exports to North America and Europe, strengthening Asia-Pacific’s role in global supply.

Europe holds a substantial share of the MCT market, supported by health-conscious consumers, growing adoption of vegan and keto dietary trends, and increasing demand for functional food ingredients. Countries like Germany, the UK, France, and the Netherlands are major consumers of MCT oil in energy drinks, weight loss supplements, and bakery products. The region's food and beverage industry is actively incorporating MCTs into plant-based dairy alternatives and sports beverages. MCTs also have widespread application in pharmaceutical formulations and personal care items, including massage oils and natural cosmetics. Regulatory support for food-grade and organic ingredients is further driving the adoption of MCTs derived from coconut and palm kernel oil.

Latin America is an emerging market for MCTs, led by Brazil and Mexico. The market is supported by increasing demand for sports nutrition products, plant-based dietary supplements, and beauty care formulations. Brazil, with its growing natural health industry and preference for herbal and clean-label products, shows potential for MCT adoption in nutritional beverages and energy-boosting oils. Mexico benefits from rising consumer interest in ketogenic and low-carb diets. However, limited domestic processing capacity and reliance on imported raw materials pose challenges. Nevertheless, partnerships with global suppliers and local expansion of the nutraceutical sector are expected to drive steady demand.

Middle East & Africa are developing regions in the MCT market, with increasing application in dietary supplements, personal care, and clinical nutrition. In the Middle East, countries such as the UAE and Saudi Arabia are experiencing rising demand for MCT-based products due to growing fitness trends, interest in ketogenic diets, and a high prevalence of lifestyle-related disorders. In Africa, South Africa shows gradual adoption in nutraceuticals and personal care items, although overall market penetration remains limited. Challenges such as low consumer awareness and distribution inefficiencies persist, but with increasing health consciousness and retail expansion, the region offers long-term growth potential.

Medium-chain Triglycerides Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the medium-chain triglycerides market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global medium-chain triglycerides market include:

- BASF SE

- DSM

- Croda International Plc.

- Sternchemie Lipid Technology

- KLK OLEO

- Wilmar International Limited

- Cremer

- Elementis

- Oleon

- Stepan

- Emery

- Musim Mas

- Britz

- Dr.Straetmans

- Acme-Hardesty

- Lonza

- Magna-Kron

- Avicpharmaceutical

- Wumei Etc

The global medium-chain triglycerides market is segmented as follows:

By Type

- Caproic Acid

- Caprylic Acid

- Capric Acid

- Lauric Acid

By Source

- Palm Kernel Oil

- Coconut Oil

- Others

By Application

- Dietary & Health Supplements

- Personal Care & Cosmetics

- Pharmaceuticals

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global medium-chain triglycerides market, 2014 - 2020 (Kilo Tons) (USD Billion)

- 2.2. Global medium-chain triglycerides market : Snapshot

- Chapter 3. Medium-Chain Triglycerides – Market Dynamics

- 3.1. Introduction

- 3.2. Value chain analysis

- 3.3. Market drivers

- 3.3.1. Global medium-chain triglycerides market drivers: Impact analysis

- 3.3.2. Increasing Demand In Food Industry

- 3.4. Market restraints

- 3.4.1. Global medium-chain triglycerides market restraints: Impact analysis

- 3.4.2. Volatile Raw Material Prices

- 3.5. Opportunities

- 3.5.1. Rising Popularity Of MCT

- 3.6. Porter’s five forces analysis

- 3.6.1. Bargaining power of suppliers

- 3.6.2. Bargaining power of buyers

- 3.6.3. Threat from new entrants

- 3.6.4. Threat from new substitutes

- 3.6.5. Degree of competition

- 3.7. Market attractiveness analysis

- 3.7.1. Market attractiveness analysis, by product segment

- 3.7.2. Market attractiveness analysis, by application segment

- 3.7.3. Market attractiveness analysis, by regional segment

- Chapter 4. Global Medium-Chain Triglycerides Market – Competitive Landscape

- 4.1. Company market share, 2014

- 4.2. Price trend analysis

- Chapter 5. Global Medium-Chain Triglycerides Market – Product Segment Analysis

- 5.1. Global medium-chain triglycerides market: Product overview

- 5.1.1. Global medium-chain triglycerides market revenue share, by product, 2014 and 2020

- 5.2. Lauric Acid

- 5.2.1. Global lauric acid market , 2014 – 2020 (Kilo Tons) (USD Billion)

- 5.3. Caprylic Acid

- 5.3.1. Global caprylic acid market, 2014 – 2020 (Kilo Tons) (USD Billion)

- 5.4. Caproic Acid

- 5.4.1. Global caproic acid market, 2014 – 2020 (Kilo Tons) (USD Billion)

- 5.5. Capric Acid

- 5.5.1. Global capric acid market, 2014 – 2020 (Kilo Tons) (USD Billion)

- 5.1. Global medium-chain triglycerides market: Product overview

- Chapter 6. Global Medium-Chain Triglycerides Market – Application Segment Analysis

- 6.1. Global medium-chain triglycerides market: Product overview

- 6.1.1. Global medium-chain triglycerides market revenue share, by product, 2014 and 2020

- 6.2. Food

- 6.2.1. Global medium-chain triglycerides market for food, 2014 – 2020 (Kilo Tons) (USD Billion)

- 6.3. Medical

- 6.3.1. Global medium-chain triglycerides market for medical, 2014 – 2020 (Kilo Tons) (USD Billion)

- 6.4. Others

- 6.4.1. Global medium-chain triglycerides market for other applications, 2014 – 2020 (Kilo Tons) (USD Billion)

- 6.1. Global medium-chain triglycerides market: Product overview

- Chapter 7. Global Medium-Chain Triglycerides Market – Regional Segment Analysis

- 7.1. Global medium-chain triglycerides market: Regional overview

- 7.1.1. Global medium-chain triglycerides market volume share, by region, 2014 and 2020

- 7.2. North America

- 7.2.1. North America medium-chain triglycerides market volume, by product, 2014 – 2020, (Kilo Tons)

- 7.2.2. North America medium-chain triglycerides market revenue, by product, 2014 – 2020 , (USD Million)

- 7.2.3. North America medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.2.4. North America medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.2.5. U.S.

- 7.2.5.1. U.S. medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.2.5.2. U.S. medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.2.5.3. U.S. medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.2.5.4. U.S. medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.3. Europe

- 7.3.1. Europe medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.3.2. Europe medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.3. Europe medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.3.4. Europe medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.3.5. Germany

- 7.3.5.1. Germany medium-chain triglycerides market volume, by product, 2014 – 2020, (Kilo Tons)

- 7.3.5.2. Germany medium-chain triglycerides market revenue, by product, 2014 – 2020, (USD Million)

- 7.3.5.3. Germany medium-chain triglycerides market volume, by application, 2014 – 2020, (Kilo Tons)

- 7.3.5.4. Germany medium-chain triglycerides market revenue, by application, 2014 – 2020, (USD Million)

- 7.3.6. France

- 7.3.6.1. France medium-chain triglycerides market volume, by product, 2014 – 2020, (Kilo Tons)

- 7.3.6.2. France medium-chain triglycerides market revenue, by product, 2014 – 2020, (USD Million)

- 7.3.6.3. France medium-chain triglycerides market volume, by application, 2014 – 2020, (Kilo Tons)

- 7.3.6.4. France medium-chain triglycerides market revenue, by application, 2014 – 2020, (USD Million)

- 7.3.7. UK

- 7.3.7.1. UK medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.3.7.2. UK medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.7.3. UK medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.3.7.4. UK medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.4.2. Asia Pacific medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.3. Asia Pacific medium-chain triglycerides market volume, by application, 2014 – 2020, (Kilo Tons)

- 7.4.4. Asia Pacific medium-chain triglycerides market revenue, by application, 2014 – 2020, (USD Million)

- 7.4.5. China

- 7.4.5.1. China medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.4.5.2. China medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.5.3. China medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.4.5.4. China medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.6. Japan

- 7.4.6.1. Japan medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.4.6.2. Japan medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.6.3. Japan medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.4.6.4. Japan medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.4.7. India

- 7.4.7.1. India medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.4.7.2. India medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.7.3. India medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.4.7.4. India medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.5.2. Latin America medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.3. Latin America medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.5.4. Latin America medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.5.5. Brazil

- 7.5.5.1. Brazil medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.5.5.2. Brazil medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.5.3. Brazil medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.5.5.4. Brazil medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa medium-chain triglycerides market volume, by product, 2014 – 2020 (Kilo Tons)

- 7.6.2. Middle East and Africa medium-chain triglycerides market revenue, by product, 2014 – 2020 (USD Million)

- 7.6.3. Middle East and Africa medium-chain triglycerides market volume, by application, 2014 – 2020 (Kilo Tons)

- 7.6.4. Middle East and Africa medium-chain triglycerides market revenue, by application, 2014 – 2020 (USD Million)

- 7.1. Global medium-chain triglycerides market: Regional overview

- Chapter 8. Company Profile

- 8.1. Croda

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Product portfolio

- 8.1.4. Business strategy

- 8.1.5. Recent developments

- 8.2. Stepan Company

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Product portfolio

- 8.2.4. Business strategy

- 8.2.5. Recent developments

- 8.3. Klk Oleo

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Product portfolio

- 8.3.4. Business strategy

- 8.3.5. Recent developments

- 8.4. BASF

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Product portfolio

- 8.4.4. Business strategy

- 8.4.5. Recent developments

- 8.5. Acme-Hardesty,

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Product portfolio

- 8.5.4. Business strategy

- 8.5.5. Recent developments

- 8.6. DR.STRAETMANS

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Product portfolio

- 8.6.4. Business strategy

- 8.6.5. Recent developments

- 8.7. LONZA

- 8.7.1. Overview

- 8.7.2. Financials

- 8.7.3. Product portfolio

- 8.7.4. Business strategy

- 8.7.5. Recent developments

- 8.8. Avicpharmaceutical

- 8.8.1. Overview

- 8.8.2. Financials

- 8.8.3. Product portfolio

- 8.8.4. Business strategy

- 8.8.5. Recent developments

- 8.9. Wumei

- 8.9.1. Overview

- 8.9.2. Financials

- 8.9.3. Product portfolio

- 8.9.4. Business strategy

- 8.9.5. Recent developments

- 8.10. Musim Mas

- 8.10.1. Overview

- 8.10.2. Financials

- 8.10.3. Product portfolio

- 8.10.4. Business strategy

- 8.10.5. Recent developments

- 8.1. Croda

Inquiry For Buying

Medium-chain Triglycerides

Request Sample

Medium-chain Triglycerides