mHealth Devices and Services Market Size, Share, and Trends Analysis Report

CAGR :

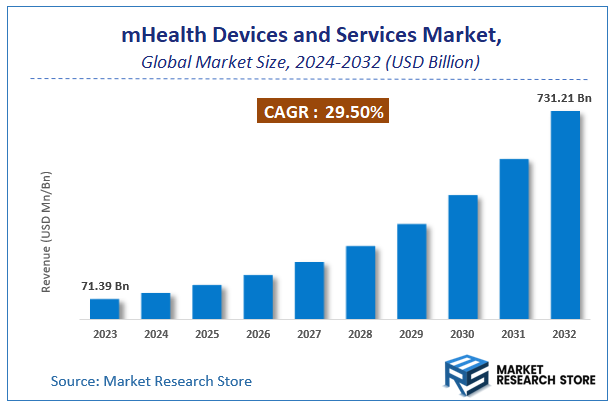

| Market Size 2023 (Base Year) | USD 71.39 Billion |

| Market Size 2032 (Forecast Year) | USD 731.21 Billion |

| CAGR | 29.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

mHealth Devices and Services Market Insights

According to Market Research Store, the global mHealth Devices and Services market size was valued at around USD 71.39 billion in 2023 and is estimated to reach USD 731.21 billion by 2032, to register a CAGR of approximately 29.5% in terms of revenue during the forecast period 2024-2032.

The mHealth Devices and Services report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global mHealth Devices and Services Market: Overview

mHealth Devices and Services refer to the use of mobile and wireless technologies to support medical and public health practices. These include wearable devices like fitness trackers, smartwatches, mobile ECG monitors, glucometers, and portable blood pressure monitors, as well as smartphone apps and cloud-based platforms that enable health tracking, diagnostics, treatment adherence, remote consultations, and real-time health data sharing. mHealth tools empower users to monitor their own health and support healthcare providers in delivering personalized, data-driven care outside traditional clinical settings.

The growth of the mHealth devices and services market is driven by increasing smartphone penetration, rising awareness of preventive healthcare, and the global shift toward digital health solutions. These technologies offer improved access to healthcare in remote and underserved regions, enable chronic disease management, and support healthy lifestyle habits. Integration with telehealth platforms, electronic health records (EHRs), and AI-powered analytics further enhances the effectiveness of mHealth by enabling early diagnosis, continuous monitoring, and timely interventions. As healthcare systems strive for more cost-effective, patient-centered models of care, mHealth is playing a critical role in transforming how health services are accessed, delivered, and managed globally.

Key Highlights

- The mHealth Devices and Services market is anticipated to grow at a CAGR of 29.5% during the forecast period.

- The global mHealth Devices and Services market was estimated to be worth approximately USD 71.39 billion in 2023 and is projected to reach a value of USD 731.21 billion by 2032.

- The growth of the mHealth Devices and Services market is being driven by increasing demand for remote healthcare solutions, rising prevalence of chronic diseases, and widespread adoption of smartphones and wearable devices.

- Based on the product, the glucose monitors segment is growing at a high rate and is projected to dominate the market.

- On the basis of service, the remote monitoring segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

mHealth Devices and Services Market: Dynamics

Key Growth Drivers:

- Increasing Smartphone Penetration and Connectivity: The widespread global adoption of smartphones and the increasing availability of high-speed internet (including 5G) provide the fundamental infrastructure for mHealth solutions, enabling greater accessibility and seamless data exchange.

- Rising Prevalence of Chronic Diseases and Aging Population: The growing global burden of chronic conditions (e.g., diabetes, heart disease) and the expanding geriatric population necessitate continuous monitoring and remote care solutions, which mHealth devices and services are uniquely positioned to provide.

- Growing Focus on Patient-Centric Care and Self-Health Management: There's a significant shift towards empowering patients to take an active role in managing their own health, driven by mHealth apps and devices that facilitate self-monitoring, medication adherence, and direct communication with healthcare providers.

- Cost Containment and Efficiency in Healthcare Delivery: Healthcare systems are increasingly adopting mHealth solutions to reduce costs by minimizing hospital visits, improving adherence to treatment plans, and enhancing the overall efficiency of healthcare service delivery.

Restraints:

- Data Security and Privacy Concerns: The transmission and storage of highly sensitive patient health information on mobile devices and cloud platforms raise significant cybersecurity risks and privacy concerns, potentially leading to data breaches and eroding user trust.

- Regulatory Complexities and Lack of Standardization: The fragmented and often inconsistent regulatory landscape across different regions for mHealth devices and apps, coupled with a lack of standardized guidelines for data formats and interoperability, creates compliance challenges and hinders widespread adoption.

- Limited Reimbursement Policies and High Costs: In many healthcare systems, established reimbursement models for mHealth services are still evolving or limited, making it challenging for healthcare providers to sustain these services, while the high cost of advanced mHealth devices can be a barrier for some users.

- Digital Literacy and Connectivity Gaps: A significant portion of the population, particularly in certain demographics or rural areas, may lack the digital literacy, access to reliable internet, or suitable devices required to effectively utilize mHealth solutions, leading to an exacerbated digital divide.

Opportunities:

- Integration with Advanced Technologies (AI, IoT, Wearables): The convergence of mHealth with Artificial Intelligence (AI) for personalized insights, the Internet of Things (IoT) for connected devices, and increasingly sophisticated wearable technology (e.g., smartwatches with advanced sensors) offers immense opportunities for innovative solutions and predictive healthcare.

- Expansion into Specialized and Remote Patient Monitoring: mHealth is increasingly being adopted for specialized care areas like telepsychiatry, telerehabilitation, and, most notably, remote patient monitoring (RPM) for chronic disease management, enabling continuous tracking and early intervention.

- Growth in Home-Based Care and Independent Aging Solutions: The rising preference for care at home, coupled with the needs of an aging population, creates a significant opportunity for mHealth solutions that support independent living, remote assistance, and virtual care delivery in the comfort of one's residence.

- New Business Models and Public-Private Partnerships: The market presents opportunities for innovative business models (e.g., subscription-based services, value-based care payments) and strategic collaborations between tech companies, healthcare providers, and governments to expand access and improve healthcare outcomes.

Challenges:

- Ensuring Clinical Validation and Efficacy: A critical challenge is rigorously validating the clinical efficacy and diagnostic accuracy of mHealth devices and apps, especially for medical-grade applications, to build trust among healthcare professionals and ensure positive patient outcomes.

- Interoperability with Existing Healthcare IT Systems: Seamlessly integrating diverse mHealth platforms and data from various devices into existing Electronic Health Records (EHRs) and other hospital information systems (HIS) remains a significant technical and architectural challenge.

- User Engagement and Adherence: While initial adoption may be high, a key challenge is maintaining sustained user engagement and adherence to mHealth apps and device protocols, which is crucial for long-term health management and data collection.

- Addressing Misinformation and Ensuring Quality Control: The proliferation of mHealth apps, some lacking scientific validation or proper quality control, poses a challenge in ensuring that users receive accurate, safe, and beneficial health information and services.

mHealth Devices and Services Market: Report Scope

This report thoroughly analyzes the mHealth Devices and Services Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | mHealth Devices and Services Market |

| Market Size in 2023 | USD 71.39 Billion |

| Market Forecast in 2032 | USD 731.21 Billion |

| Growth Rate | CAGR of 29.5% |

| Number of Pages | 150 |

| Key Companies Covered | AT&T, Inc., Bayer HealthCare AG, BioTelemetry, Inc., Boston Scientific Corporation, DexCom, Inc., Dräger AG, F. Hoffmann La-Roche Ltd., Johnson & Johnson, LifeWatch AG, Masimo Corporation, Medtronic, Inc. and Omron Healthcare. |

| Segments Covered | By Product, By Service, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

mHealth Devices and Services Market: Segmentation Insights

The global mHealth Devices and Services market is divided by product, service, and region.

Based on product, the global mHealth Devices and Services market is divided into glucose monitors, blood pressure monitors, cardiac monitors, pulse oximeters, sleep apnea monitors, multi-parameter monitors, and others. Glucose Monitors are the dominant product segment in the mHealth Devices and Services Market, driven by the global rise in diabetes prevalence and the growing demand for continuous blood sugar monitoring. These devices include both traditional glucometers and continuous glucose monitors (CGMs), many of which are Bluetooth-enabled for real-time data transmission to mobile health apps. Glucose monitors allow patients to track their glucose levels conveniently, enabling better self-management and improved treatment adherence. Their compatibility with smartphones and integration with digital health platforms makes them highly valuable in both clinical and remote settings. Governments and healthcare providers are increasingly supporting the use of glucose monitors as part of chronic disease management programs, further boosting this segment's dominance.

On the basis of service, the global mHealth Devices and Services market is bifurcated into remote monitoring, fitness and wellness, diagnosis and consultation, and others. Remote Monitoring is the dominant service segment in the mHealth Devices and Services Market, driven by the increasing demand for continuous, real-time patient data and the global shift toward value-based care. This service involves the use of connected health devices to track vital signs such as blood pressure, glucose levels, heart rate, and oxygen saturation from the comfort of a patient’s home. Remote monitoring has become an essential component of chronic disease management, elderly care, and post-discharge recovery, helping healthcare providers detect complications early, reduce hospital readmissions, and personalize treatment plans. Its adoption was significantly accelerated during the COVID-19 pandemic and remains high due to cost efficiency, improved patient outcomes, and the widespread availability of mobile health platforms. Insurers and governments increasingly support remote monitoring services through reimbursements and public health initiatives, further strengthening its dominance.

mHealth Devices and Services Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the mHealth devices and services market, supported by widespread smartphone penetration, high healthcare expenditure, and strong adoption of digital health technologies. The United States leads due to a well-established ecosystem of telehealth, remote monitoring, and health-related mobile apps integrated with wearable devices such as smartwatches, fitness bands, glucometers, ECG monitors, and blood pressure trackers. The region benefits from a growing elderly population, rising chronic disease prevalence, and patient-centric healthcare reforms encouraging home-based monitoring. Major tech companies and healthcare providers collaborate to offer end-to-end mobile health solutions, including data analytics and AI-driven insights. The strong regulatory support from agencies like the FDA and favorable reimbursement policies further reinforce growth. Canada is also contributing significantly, especially in rural telehealth, chronic disease management, and digital patient engagement platforms.

Europe holds a significant share in the mHealth devices and services market, driven by progressive healthcare digitization, a strong regulatory framework, and increasing demand for remote healthcare solutions. Countries such as Germany, the UK, France, and the Netherlands lead the region with national health systems adopting mHealth tools for preventive care, remote diagnosis, and chronic condition management. The European Commission promotes cross-border health data exchange and integration of digital health platforms, enhancing patient access and care coordination. Devices such as remote heart monitors, mobile spirometers, and connected diagnostic kits are widely used in public health initiatives and personal wellness programs. GDPR compliance and stringent data security measures also play a pivotal role in shaping the market landscape across the continent.

Asia-Pacific is the fastest-growing region in the mHealth devices and services market, driven by expanding mobile connectivity, a large patient base, and increasing healthcare accessibility challenges. China, India, Japan, and South Korea are key contributors. In China, state-driven digital health infrastructure and high smartphone adoption support extensive use of mobile platforms for teleconsultation, prescription services, and health tracking. In India, mHealth is growing rapidly due to the wide use of mobile devices for managing diabetes, hypertension, and maternal health, particularly in rural and semi-urban areas. Japan and South Korea, with aging populations and advanced technology integration, are deploying wearable monitors and health management apps in elder care. Despite challenges such as regulatory variability and uneven infrastructure, investment in health tech startups and public-private partnerships continues to accelerate regional market expansion.

Latin America is an emerging market for mHealth devices and services, with Brazil, Mexico, Argentina, and Chile showing growing adoption. Rising healthcare costs, limited access to medical facilities in rural areas, and the increasing burden of chronic diseases have led to the development of mobile-based health platforms. Brazil is leading with mobile-enabled diagnostic services, fitness tracking apps, and virtual consultations. Mexico is expanding its use of wearable devices in wellness programs and home-based monitoring. Regional governments are increasingly supporting mHealth initiatives to improve healthcare access and efficiency. However, barriers such as low digital literacy, infrastructure limitations, and lack of standardized regulations still affect the pace of growth.

Middle East & Africa are developing regions in the mHealth devices and services market, with growing demand for mobile health solutions to address provider shortages and healthcare access gaps. In the Middle East, the UAE and Saudi Arabia are investing in telemedicine platforms, mobile diagnostics, and remote monitoring to support national healthcare transformation agendas. These services are increasingly integrated into public and private healthcare systems. In Africa, countries like South Africa, Kenya, and Nigeria are adopting mobile health solutions to reach underserved populations, particularly in maternal health, infectious disease tracking, and chronic care. Although challenges such as infrastructure deficits, affordability, and inconsistent regulation remain, rising mobile penetration and global health collaborations are steadily improving regional adoption and implementation of mHealth technologies.

mHealth Devices and Services Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the mHealth Devices and Services market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global mHealth Devices and Services market include:

- AT&T, Inc.

- Bayer HealthCare AG

- BioTelemetry, Inc.

- Boston Scientific Corporation

- DexCom, Inc.

- Dräger AG

- F. Hoffmann La-Roche Ltd.

- Johnson & Johnson

- LifeWatch AG

- Masimo Corporation

- Medtronic, Inc. and

- Omron Healthcare

The global mHealth Devices and Services market is segmented as follows:

By Product

- Glucose Monitors

- Blood Pressure Monitors

- Cardiac Monitors

- Pulse Oximeters

- Sleep Apnea Monitors

- Multi-parameter Monitors

- Others

By Service

- Remote Monitoring

- Fitness and wellness

- Diagnosis and Consultation

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global mHealth devices and services market, 2014 - 2020 (USD Million)

- 2.2. Global mHealth devices and services market : Snapshot

- Chapter 3. mHealth devices and services– Market dynamics

- 3.1. Introduction

- 3.2. Market drivers

- 3.2.1. Global mHealth devices and services market drivers: Impact analysis

- 3.2.2. Growing prevalence of chronic diseases and population

- 3.2.3. Increasing use of smart phone

- 3.3. Market restraints

- 3.3.1. Global mHealth devices and services market restraints: Impact analysis

- 3.3.2. Rules and regulations

- 3.4. Opportunities

- 3.4.1. Government supports

- 3.5. Porter’s five forces analysis

- 3.5.1. Bargaining power of suppliers

- 3.5.2. Bargaining power of buyers

- 3.5.3. Threat from new entrants

- 3.5.4. Threat from new substitutes

- 3.5.5. Degree of competition

- 3.6. Market attractiveness analysis

- 3.6.1. Market attractiveness analysis, by product segment

- 3.6.2. Market attractiveness analysis, by service segment

- 3.6.3. Market attractiveness analysis, by regional segment

- Chapter 4. Global mHealth devices and services market – Competitive landscape

- 4.1. Company market share, 2014

- 4.2. Price trend analysis

- Chapter 5. Global mHealth devices and services market – Product segment analysis

- 5.1. Global mHealth devices and services market: Product overview

- 5.1.1. Global mHealth devices and services market revenue share, by service, 2014 and 2020

- 5.2. Glucose Monitors

- 5.2.1. Global glucose monitors market , 2014 – 2020 (USD Million)

- 5.3. Blood Pressure Monitors

- 5.3.1. Global blood pressure monitors market , 2014 – 2020 (USD Million)

- 5.4. Cardiac Monitors

- 5.4.1. Global cardiac monitors market , 2014 – 2020 (USD Million)

- 5.5. Pulse Oximeters

- 5.5.1. Global pulse oximeters market , 2014 – 2020 (USD Million)

- 5.6. Sleep Apnea Monitors

- 5.6.1. Global sleep apnea monitors market , 2014 – 2020 (USD Million)

- 5.7. Multi-parameter Monitors

- 5.7.1. Global multi-parameter monitors market , 2014 – 2020 (USD Million)

- 5.8. Others

- 5.8.1. Global other mHealth devices and services market , 2014 – 2020 (USD Million)

- 5.1. Global mHealth devices and services market: Product overview

- Chapter 6. Global mHealth devices and services market – Service segment analysis

- 6.1. Global mHealth devices and services market: service overview

- 6.1.1. Global mHealth devices and services market revenue share, by application, 2014 and 2020

- 6.2. Remote Monitoring

- 6.2.1. Global mHealth devices and services market for remote monitoring, 2014 - 2020(USD Million)

- 6.3. Fitness and Wellness

- 6.3.1. Global mHealth devices and services market for fitness and wellness, 2014 - 2020(USD Million)

- 6.4. Diagnosis and Consultation

- 6.4.1. Global mHealth devices and services market for diagnosis and consultation, 2014 - 2020(USD Million)

- 6.5. Others

- 6.5.1. Global mHealth devices and services market for other applications, 2014 - 2020(USD Million)

- 6.1. Global mHealth devices and services market: service overview

- Chapter 7. Global mHealth devices and services market – Regional segment analysis

- 7.1. Global mHealth devices and services market: Regional overview

- 7.1.1. Global mHealth devices and services market revenue share, by region, 2014 and 2020

- 7.2. North America

- 7.2.1. North America mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.2.2. North America mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.2.3. U.S.

- 7.2.3.1. U.S. mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.2.3.2. U.S. mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.3. Europe

- 7.3.1. Europe mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.2. Europe mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.3.3. Germany

- 7.3.3.1. Germany mHealth devices and services market revenue, by product, 2014 – 2020, (USD Million)

- 7.3.3.2. Germany mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.3.4. France

- 7.3.4.1. France mHealth devices and services market revenue, by product, 2014 – 2020, (USD Million)

- 7.3.4.2. France mHealth devices and services market revenue, by service, 2014 – 2020, (USD Million)

- 7.3.5. UK

- 7.3.5.1. UK mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.3.5.2. UK mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.4. Asia Pacific

- 7.4.1. Asia Pacific mHealth devices and services market revenue, by a product, 2014 – 2020, (USD Million)

- 7.4.2. Asia Pacific mHealth devices and services market revenue, by service, 2014 – 2020, (USD Million)

- 7.4.3. China

- 7.4.3.1. China mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.3.2. China mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.4.4. Japan

- 7.4.4.1. Japan mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.4.2. Japan mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.4.5. India

- 7.4.5.1. India mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.4.5.2. India mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.5. Latin America

- 7.5.1. Latin America mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.2. Latin America mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.5.3. Brazil

- 7.5.3.1. Brazil mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.5.3.2. Brazil mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.6. Middle East and Africa

- 7.6.1. Middle East and Africa mHealth devices and services market revenue, by product, 2014 – 2020 (USD Million)

- 7.6.2. Middle East and Africa mHealth devices and services market revenue, by service, 2014 – 2020 (USD Million)

- 7.1. Global mHealth devices and services market: Regional overview

- Chapter 8. Company Profile

- 8.1. AT&T, Inc.

- 8.1.1. Overview

- 8.1.2. Financials

- 8.1.3. Product portfolio

- 8.1.4. Business strategy

- 8.1.5. Recent developments

- 8.2. Bayer HealthCare AG

- 8.2.1. Overview

- 8.2.2. Financials

- 8.2.3. Product portfolio

- 8.2.4. Business strategy

- 8.2.5. Recent developments

- 8.3. BioTelemetry, Inc.

- 8.3.1. Overview

- 8.3.2. Financials

- 8.3.3. Product portfolio

- 8.3.4. Business strategy

- 8.3.5. Recent developments

- 8.4. Boston Scientific Corporation

- 8.4.1. Overview

- 8.4.2. Financials

- 8.4.3. Product portfolio

- 8.4.4. Business strategy

- 8.4.5. Recent developments

- 8.5. DexCom, Inc.

- 8.5.1. Overview

- 8.5.2. Financials

- 8.5.3. Product portfolio

- 8.5.4. Business strategy

- 8.5.5. Recent developments

- 8.6. Dräger AG

- 8.6.1. Overview

- 8.6.2. Financials

- 8.6.3. Product portfolio

- 8.6.4. Business strategy

- 8.6.5. Recent developments

- 8.7. Hoffmann La-Roche Ltd.

- 8.7.1. Overview

- 8.7.2. Financials

- 8.7.3. Product portfolio

- 8.7.4. Business strategy

- 8.7.5. Recent developments

- 8.8. Johnson & Johnson

- 8.8.1. Overview

- 8.8.2. Financials

- 8.8.3. Product portfolio

- 8.8.4. Business strategy

- 8.8.5. Recent developments

- 8.9. LifeWatch AG

- 8.9.1. Overview

- 8.9.2. Financials

- 8.9.3. Product portfolio

- 8.9.4. Business strategy

- 8.9.5. Recent developments

- 8.10. Masimo Corporation

- 8.10.1. Overview

- 8.10.2. Financials

- 8.10.3. Product portfolio

- 8.10.4. Business strategy

- 8.10.5. Recent developments

- 8.11. Medtronic, Inc

- 8.11.1. Overview

- 8.11.2. Financials

- 8.11.3. Product portfolio

- 8.11.4. Business strategy

- 8.11.5. Recent developments

- 8.1. AT&T, Inc.

Inquiry For Buying

mHealth Devices and Services

Request Sample

mHealth Devices and Services