Natural Rubber for Medical Market Size, Share, and Trends Analysis Report

CAGR :

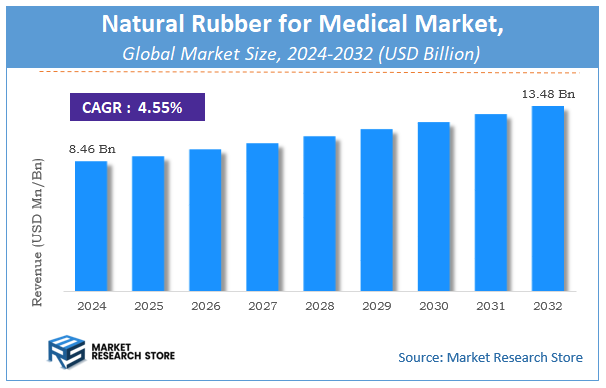

| Market Size 2024 (Base Year) | USD 8.46 Billion |

| Market Size 2032 (Forecast Year) | USD 13.48 Billion |

| CAGR | 4.55% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global natural rubber for medical market size was valued at approximately USD 8.46 Billion in 2024. The market is projected to grow significantly, reaching USD 13.48 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.55% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the natural rubber for medical industry.

Natural Rubber for Medical Market: Overview

The growth of the natural rubber for medical market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The natural rubber for medical market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the natural rubber for medical market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Products, Applications, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global natural rubber for medical market is estimated to grow annually at a CAGR of around 4.55% over the forecast period (2025-2032).

- In terms of revenue, the global natural rubber for medical market size was valued at around USD 8.46 Billion in 2024 and is projected to reach USD 13.48 Billion by 2032.

- The market is projected to grow at a significant rate due to rising demand for hypoallergenic gloves, surgical supplies, and sustainable raw materials in healthcare applications.

- Based on the Products, the Ribbed Smoked Sheet (RSS) segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Applications, the Surgical gloves segment is anticipated to command the largest market share.

- Based on region, Asia-Pacific is projected to dominate the global market during the forecast period.

Natural Rubber for Medical Market: Report Scope

This report thoroughly analyzes the natural rubber for medical market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Natural Rubber for Medical Market |

| Market Size in 2024 | USD 8.46 Billion |

| Market Forecast in 2032 | USD 13.48 Billion |

| Growth Rate | CAGR of 4.55% |

| Number of Pages | 206 |

| Key Companies Covered | Guangdong Guangken Rubber Group, Bakrie Sumatera Plantations, Von Bundit, Enghuat Industries, China Hainan Rubber Industry Group, Tong Thai Rubber Group, Kurian Abraham, Feltex, Sri Trang Agro-Industry, Yunnan State Farms Group, Thai Rubber Latex Corporation, Vietnam Rubber Group, Sinochem International Corporation (Halcyon Agri), Kuala Lumpur Kepong Berhad, Southland Holding, Tradewinds Plantation Berhad, Unitex Rubber |

| Segments Covered | By Products, By Applications, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Natural Rubber for Medical Market: Dynamics

Key Growth Drivers :

The natural rubber for medical market is experiencing significant growth, primarily driven by its superior properties and a rising focus on health and hygiene. Natural rubber is highly valued in the healthcare industry for its excellent elasticity, tensile strength, and biocompatibility, making it an ideal material for a wide range of medical products, including gloves, catheters, seals, and surgical supplies. A key driver is the increasing global emphasis on infection control and personal protective equipment (PPE), which was particularly amplified by recent global health crises. This has led to a surge in demand for medical gloves. Furthermore, the growing prevalence of chronic diseases and an aging population are contributing to an increased need for medical devices that rely on high-quality rubber components for diagnostic and therapeutic purposes.

Restraints :

The market faces several significant restraints, with a major one being natural rubber latex allergy. This is a well-documented and growing concern in the healthcare community, which has led to a shift towards synthetic rubber alternatives like nitrile and silicone. Another significant restraint is the volatility of raw material prices, as the price of natural rubber is susceptible to fluctuations due to weather patterns, geopolitical tensions, and disease outbreaks in rubber plantations. This unpredictability can impact production costs and affect the profitability of manufacturers. Additionally, the industry is subject to stringent regulatory requirements for medical devices, which include extensive testing for biocompatibility and durability, leading to prolonged approval processes and higher compliance costs.

Opportunities :

The natural rubber for medical market presents several key opportunities for future growth. A major opportunity lies in the development of low-protein and allergen-free natural rubber latex products. Ongoing research and technological advancements in processing and purification techniques are aimed at creating safer, more biocompatible products that retain the benefits of natural rubber while mitigating allergy risks. The rising global demand for eco-friendly and sustainable materials also provides a significant opportunity for natural rubber, as it is a renewable and biodegradable resource. Manufacturers can capitalize on this trend by implementing sustainable sourcing practices, such as agroforestry, and promoting transparency in their supply chains to appeal to environmentally conscious consumers and regulatory bodies.

Challenges :

Despite the opportunities, the market is not without its challenges. The primary one is the supply chain vulnerability due to the concentration of natural rubber production in a few regions, primarily Southeast Asia. This makes the global supply susceptible to a variety of threats, including plant diseases, labor scarcity, and climate change-related weather events. Another challenge is the intense competitive pressure from synthetic rubber alternatives. While natural rubber has unique properties, continuous innovation in synthetic materials has enabled them to meet many of the functional requirements of medical devices at a more stable price point. Finally, the high initial investment required for sustainable and technologically advanced processing methods can be a significant barrier for smaller producers, limiting their ability to compete in the high-value medical-grade segment.

Natural Rubber for Medical Market: Segmentation Insights

The global natural rubber for medical market is segmented based on Products, Applications, and Region. All the segments of the natural rubber for medical market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Products, the global natural rubber for medical market is divided into Ribbed Smoked Sheet (RSS), Technically Specified Rubber (TSR), Latex, Others.

On the basis of Applications, the global natural rubber for medical market is bifurcated into Surgical gloves, Tubes, Condoms, Breathing bags, Medical Stoppers, Cushioning or supporting materials, Implants and catheters, Others.

Natural Rubber for Medical Market: Regional Insights

The Asia-Pacific (APAC) region, with Thailand, Indonesia, and Malaysia as the core producers, is the dominant force in the global natural rubber market for medical applications. This dominance is rooted in the region's ideal climatic conditions for Hevea brasiliensis trees, which account for the vast majority of medical-grade latex. According to data from the Association of Natural Rubber Producing Countries (ANRPC) and the International Rubber Study Group (IRSG), these three countries collectively supply over 70% of the world's natural rubber.

While North America and Europe are the largest consumers of high-purity, medical-grade rubber products (like gloves and catheters) due to stringent FDA and CE regulations, their domestic production is minimal. The entire global medical supply chain is therefore dependent on raw material exports from Southeast Asia. The region's control over cultivation, primary processing, and export volumes solidifies its irreplaceable position as the market's volume leader, despite consuming a smaller portion of the finished, high-value goods.

Natural Rubber for Medical Market: Competitive Landscape

The natural rubber for medical market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Natural Rubber for Medical Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Guangdong Guangken Rubber Group

- Bakrie Sumatera Plantations

- Von Bundit

- Enghuat Industries

- China Hainan Rubber Industry Group

- Tong Thai Rubber Group

- Kurian Abraham

- Feltex

- Sri Trang Agro-Industry

- Yunnan State Farms Group

- Thai Rubber Latex Corporation

- Vietnam Rubber Group

- Sinochem International Corporation (Halcyon Agri)

- Kuala Lumpur Kepong Berhad

- Southland Holding

- Tradewinds Plantation Berhad

- Unitex Rubber

The Global Natural Rubber for Medical Market is Segmented as Follows:

By Products

- Ribbed Smoked Sheet (RSS)

- Technically Specified Rubber (TSR)

- Latex

- Others

By Applications

- Surgical gloves

- Tubes

- Condoms

- Breathing bags

- Medical Stoppers

- Cushioning or supporting materials

- Implants and catheters

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Natural Rubber for Medical Market Share by Type (2020-2026) 1.5.2 Ribbed Smoked Sheet (RSS) 1.5.3 Technically Specified Rubber (TSR) 1.5.4 Latex 1.5.5 Others 1.6 Market by Application 1.6.1 Global Natural Rubber for Medical Market Share by Application (2020-2026) 1.6.2 Surgical gloves 1.6.3 Tubes 1.6.4 Condoms 1.6.5 Breathing bags 1.6.6 Medical Stoppers 1.6.7 Cushioning or supporting materials 1.6.8 Implants and catheters 1.6.9 Others 1.7 Natural Rubber for Medical Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Natural Rubber for Medical Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Natural Rubber for Medical Market 3.1 Value Chain Status 3.2 Natural Rubber for Medical Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Natural Rubber for Medical 3.2.3 Labor Cost of Natural Rubber for Medical 3.2.3.1 Labor Cost of Natural Rubber for Medical Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Guangdong Guangken Rubber Group 4.1.1 Guangdong Guangken Rubber Group Basic Information 4.1.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.1.3 Guangdong Guangken Rubber Group Natural Rubber for Medical Market Performance (2015-2020) 4.1.4 Guangdong Guangken Rubber Group Business Overview 4.2 Bakrie Sumatera Plantations 4.2.1 Bakrie Sumatera Plantations Basic Information 4.2.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.2.3 Bakrie Sumatera Plantations Natural Rubber for Medical Market Performance (2015-2020) 4.2.4 Bakrie Sumatera Plantations Business Overview 4.3 Von Bundit 4.3.1 Von Bundit Basic Information 4.3.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.3.3 Von Bundit Natural Rubber for Medical Market Performance (2015-2020) 4.3.4 Von Bundit Business Overview 4.4 Enghuat Industries 4.4.1 Enghuat Industries Basic Information 4.4.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.4.3 Enghuat Industries Natural Rubber for Medical Market Performance (2015-2020) 4.4.4 Enghuat Industries Business Overview 4.5 China Hainan Rubber Industry Group 4.5.1 China Hainan Rubber Industry Group Basic Information 4.5.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.5.3 China Hainan Rubber Industry Group Natural Rubber for Medical Market Performance (2015-2020) 4.5.4 China Hainan Rubber Industry Group Business Overview 4.6 Tong Thai Rubber Group 4.6.1 Tong Thai Rubber Group Basic Information 4.6.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.6.3 Tong Thai Rubber Group Natural Rubber for Medical Market Performance (2015-2020) 4.6.4 Tong Thai Rubber Group Business Overview 4.7 Kurian Abraham 4.7.1 Kurian Abraham Basic Information 4.7.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.7.3 Kurian Abraham Natural Rubber for Medical Market Performance (2015-2020) 4.7.4 Kurian Abraham Business Overview 4.8 Feltex 4.8.1 Feltex Basic Information 4.8.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.8.3 Feltex Natural Rubber for Medical Market Performance (2015-2020) 4.8.4 Feltex Business Overview 4.9 Sri Trang Agro-Industry 4.9.1 Sri Trang Agro-Industry Basic Information 4.9.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.9.3 Sri Trang Agro-Industry Natural Rubber for Medical Market Performance (2015-2020) 4.9.4 Sri Trang Agro-Industry Business Overview 4.10 Yunnan State Farms Group 4.10.1 Yunnan State Farms Group Basic Information 4.10.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.10.3 Yunnan State Farms Group Natural Rubber for Medical Market Performance (2015-2020) 4.10.4 Yunnan State Farms Group Business Overview 4.11 Thai Rubber Latex Corporation 4.11.1 Thai Rubber Latex Corporation Basic Information 4.11.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.11.3 Thai Rubber Latex Corporation Natural Rubber for Medical Market Performance (2015-2020) 4.11.4 Thai Rubber Latex Corporation Business Overview 4.12 Vietnam Rubber Group 4.12.1 Vietnam Rubber Group Basic Information 4.12.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.12.3 Vietnam Rubber Group Natural Rubber for Medical Market Performance (2015-2020) 4.12.4 Vietnam Rubber Group Business Overview 4.13 Sinochem International Corporation (Halcyon Agri) 4.13.1 Sinochem International Corporation (Halcyon Agri) Basic Information 4.13.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.13.3 Sinochem International Corporation (Halcyon Agri) Natural Rubber for Medical Market Performance (2015-2020) 4.13.4 Sinochem International Corporation (Halcyon Agri) Business Overview 4.14 Kuala Lumpur Kepong Berhad 4.14.1 Kuala Lumpur Kepong Berhad Basic Information 4.14.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.14.3 Kuala Lumpur Kepong Berhad Natural Rubber for Medical Market Performance (2015-2020) 4.14.4 Kuala Lumpur Kepong Berhad Business Overview 4.15 Southland Holding 4.15.1 Southland Holding Basic Information 4.15.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.15.3 Southland Holding Natural Rubber for Medical Market Performance (2015-2020) 4.15.4 Southland Holding Business Overview 4.16 Tradewinds Plantation Berhad 4.16.1 Tradewinds Plantation Berhad Basic Information 4.16.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.16.3 Tradewinds Plantation Berhad Natural Rubber for Medical Market Performance (2015-2020) 4.16.4 Tradewinds Plantation Berhad Business Overview 4.17 Unitex Rubber 4.17.1 Unitex Rubber Basic Information 4.17.2 Natural Rubber for Medical Product Profiles, Application and Specification 4.17.3 Unitex Rubber Natural Rubber for Medical Market Performance (2015-2020) 4.17.4 Unitex Rubber Business Overview 5 Global Natural Rubber for Medical Market Analysis by Regions 5.1 Global Natural Rubber for Medical Sales, Revenue and Market Share by Regions 5.1.1 Global Natural Rubber for Medical Sales by Regions (2015-2020) 5.1.2 Global Natural Rubber for Medical Revenue by Regions (2015-2020) 5.2 North America Natural Rubber for Medical Sales and Growth Rate (2015-2020) 5.3 Europe Natural Rubber for Medical Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Natural Rubber for Medical Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Natural Rubber for Medical Sales and Growth Rate (2015-2020) 5.6 South America Natural Rubber for Medical Sales and Growth Rate (2015-2020) 6 North America Natural Rubber for Medical Market Analysis by Countries 6.1 North America Natural Rubber for Medical Sales, Revenue and Market Share by Countries 6.1.1 North America Natural Rubber for Medical Sales by Countries (2015-2020) 6.1.2 North America Natural Rubber for Medical Revenue by Countries (2015-2020) 6.1.3 North America Natural Rubber for Medical Market Under COVID-19 6.2 United States Natural Rubber for Medical Sales and Growth Rate (2015-2020) 6.2.1 United States Natural Rubber for Medical Market Under COVID-19 6.3 Canada Natural Rubber for Medical Sales and Growth Rate (2015-2020) 6.4 Mexico Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7 Europe Natural Rubber for Medical Market Analysis by Countries 7.1 Europe Natural Rubber for Medical Sales, Revenue and Market Share by Countries 7.1.1 Europe Natural Rubber for Medical Sales by Countries (2015-2020) 7.1.2 Europe Natural Rubber for Medical Revenue by Countries (2015-2020) 7.1.3 Europe Natural Rubber for Medical Market Under COVID-19 7.2 Germany Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7.2.1 Germany Natural Rubber for Medical Market Under COVID-19 7.3 UK Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7.3.1 UK Natural Rubber for Medical Market Under COVID-19 7.4 France Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7.4.1 France Natural Rubber for Medical Market Under COVID-19 7.5 Italy Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7.5.1 Italy Natural Rubber for Medical Market Under COVID-19 7.6 Spain Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7.6.1 Spain Natural Rubber for Medical Market Under COVID-19 7.7 Russia Natural Rubber for Medical Sales and Growth Rate (2015-2020) 7.7.1 Russia Natural Rubber for Medical Market Under COVID-19 8 Asia-Pacific Natural Rubber for Medical Market Analysis by Countries 8.1 Asia-Pacific Natural Rubber for Medical Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Natural Rubber for Medical Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Natural Rubber for Medical Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Natural Rubber for Medical Market Under COVID-19 8.2 China Natural Rubber for Medical Sales and Growth Rate (2015-2020) 8.2.1 China Natural Rubber for Medical Market Under COVID-19 8.3 Japan Natural Rubber for Medical Sales and Growth Rate (2015-2020) 8.3.1 Japan Natural Rubber for Medical Market Under COVID-19 8.4 South Korea Natural Rubber for Medical Sales and Growth Rate (2015-2020) 8.4.1 South Korea Natural Rubber for Medical Market Under COVID-19 8.5 Australia Natural Rubber for Medical Sales and Growth Rate (2015-2020) 8.6 India Natural Rubber for Medical Sales and Growth Rate (2015-2020) 8.6.1 India Natural Rubber for Medical Market Under COVID-19 8.7 Southeast Asia Natural Rubber for Medical Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Natural Rubber for Medical Market Under COVID-19 9 Middle East and Africa Natural Rubber for Medical Market Analysis by Countries 9.1 Middle East and Africa Natural Rubber for Medical Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Natural Rubber for Medical Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Natural Rubber for Medical Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Natural Rubber for Medical Market Under COVID-19 9.2 Saudi Arabia Natural Rubber for Medical Sales and Growth Rate (2015-2020) 9.3 UAE Natural Rubber for Medical Sales and Growth Rate (2015-2020) 9.4 Egypt Natural Rubber for Medical Sales and Growth Rate (2015-2020) 9.5 Nigeria Natural Rubber for Medical Sales and Growth Rate (2015-2020) 9.6 South Africa Natural Rubber for Medical Sales and Growth Rate (2015-2020) 10 South America Natural Rubber for Medical Market Analysis by Countries 10.1 South America Natural Rubber for Medical Sales, Revenue and Market Share by Countries 10.1.1 South America Natural Rubber for Medical Sales by Countries (2015-2020) 10.1.2 South America Natural Rubber for Medical Revenue by Countries (2015-2020) 10.1.3 South America Natural Rubber for Medical Market Under COVID-19 10.2 Brazil Natural Rubber for Medical Sales and Growth Rate (2015-2020) 10.2.1 Brazil Natural Rubber for Medical Market Under COVID-19 10.3 Argentina Natural Rubber for Medical Sales and Growth Rate (2015-2020) 10.4 Columbia Natural Rubber for Medical Sales and Growth Rate (2015-2020) 10.5 Chile Natural Rubber for Medical Sales and Growth Rate (2015-2020) 11 Global Natural Rubber for Medical Market Segment by Types 11.1 Global Natural Rubber for Medical Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Natural Rubber for Medical Sales and Market Share by Types (2015-2020) 11.1.2 Global Natural Rubber for Medical Revenue and Market Share by Types (2015-2020) 11.2 Ribbed Smoked Sheet (RSS) Sales and Price (2015-2020) 11.3 Technically Specified Rubber (TSR) Sales and Price (2015-2020) 11.4 Latex Sales and Price (2015-2020) 11.5 Others Sales and Price (2015-2020) 12 Global Natural Rubber for Medical Market Segment by Applications 12.1 Global Natural Rubber for Medical Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Natural Rubber for Medical Sales and Market Share by Applications (2015-2020) 12.1.2 Global Natural Rubber for Medical Revenue and Market Share by Applications (2015-2020) 12.2 Surgical gloves Sales, Revenue and Growth Rate (2015-2020) 12.3 Tubes Sales, Revenue and Growth Rate (2015-2020) 12.4 Condoms Sales, Revenue and Growth Rate (2015-2020) 12.5 Breathing bags Sales, Revenue and Growth Rate (2015-2020) 12.6 Medical Stoppers Sales, Revenue and Growth Rate (2015-2020) 12.7 Cushioning or supporting materials Sales, Revenue and Growth Rate (2015-2020) 12.8 Implants and catheters Sales, Revenue and Growth Rate (2015-2020) 12.9 Others Sales, Revenue and Growth Rate (2015-2020) 13 Natural Rubber for Medical Market Forecast by Regions (2020-2026) 13.1 Global Natural Rubber for Medical Sales, Revenue and Growth Rate (2020-2026) 13.2 Natural Rubber for Medical Market Forecast by Regions (2020-2026) 13.2.1 North America Natural Rubber for Medical Market Forecast (2020-2026) 13.2.2 Europe Natural Rubber for Medical Market Forecast (2020-2026) 13.2.3 Asia-Pacific Natural Rubber for Medical Market Forecast (2020-2026) 13.2.4 Middle East and Africa Natural Rubber for Medical Market Forecast (2020-2026) 13.2.5 South America Natural Rubber for Medical Market Forecast (2020-2026) 13.3 Natural Rubber for Medical Market Forecast by Types (2020-2026) 13.4 Natural Rubber for Medical Market Forecast by Applications (2020-2026) 13.5 Natural Rubber for Medical Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Natural Rubber for Medical

Request Sample

Natural Rubber for Medical