Oilfield Equipment Rental Market Size, Share, and Trends Analysis Report

CAGR :

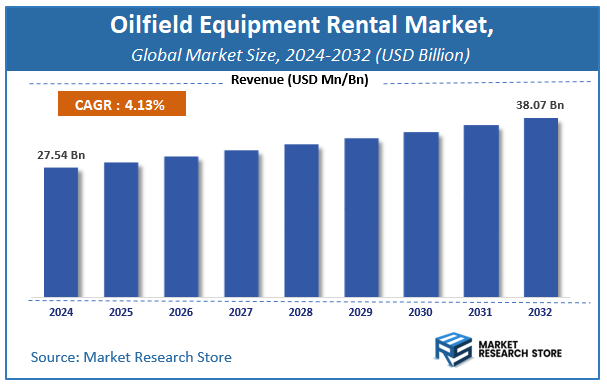

| Market Size 2024 (Base Year) | USD 27.54 Billion |

| Market Size 2032 (Forecast Year) | USD 38.07 Billion |

| CAGR | 4.13% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global oilfield equipment rental market size was valued at approximately USD 27.54 Billion in 2024. The market is projected to grow significantly, reaching USD 38.07 Billion by 2032, growing at a compound annual growth rate (CAGR) of 4.13% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the oilfield equipment rental industry.

Oilfield Equipment Rental Market: Overview

The growth of the oilfield equipment rental market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The oilfield equipment rental market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the oilfield equipment rental market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type , Application, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global oilfield equipment rental market is estimated to grow annually at a CAGR of around 4.13% over the forecast period (2025-2032).

- In terms of revenue, the global oilfield equipment rental market size was valued at around USD 27.54 Billion in 2024 and is projected to reach USD 38.07 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for cost-effective oilfield operations, increasing exploration and drilling activities, and rising need for flexible equipment solutions are fueling the Oilfield Equipment Rental market.

- Based on the Type , the Drilling Equipment (Drill Pipe segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Onshore segment is anticipated to command the largest market share.

- Based on region, North America is projected to dominate the global market during the forecast period.

Oilfield Equipment Rental Market: Report Scope

This report thoroughly analyzes the oilfield equipment rental market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Oilfield Equipment Rental Market |

| Market Size in 2024 | USD 27.54 Billion |

| Market Forecast in 2032 | USD 38.07 Billion |

| Growth Rate | CAGR of 4.13% |

| Number of Pages | 229 |

| Key Companies Covered | Schlumberger, Baker Hughes, GE company, Halliburton, Weatherford, Technip, Superior Energy Services, Transocean, BJ Services, Petrofac, COSL - China Oilfield Services Limited, Worley, McDermott International Inc., Bechtel Corporation, National Oilwell Varco |

| Segments Covered | By Type , By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Oilfield Equipment Rental Market: Dynamics

Key Growth Drivers :

The oilfield equipment rental market is primarily driven by the need for capital efficiency and operational flexibility within a volatile industry. With fluctuating crude oil prices, oil and gas companies are increasingly opting to rent specialized and high-cost equipment rather than purchasing it, which allows them to reduce significant upfront capital expenditures and mitigate financial risk. The shift towards unconventional and deep hydrocarbon reservoirs, such as shale and deepwater fields, requires technologically advanced and specialized equipment that is often too expensive to own outright. Renting allows operators to access these state-of-the-art tools and technologies, including advanced drilling and pressure control systems, without a long-term financial commitment. The growing global energy demand and subsequent increase in exploration and production (E&P) activities also fuel the market, as companies need to rapidly scale their operations and deploy equipment in a cost-effective manner.

Restraints :

Despite the strong drivers, the oilfield equipment rental market faces several restraints. The high initial cost of the equipment itself makes it a capital-intensive business for rental providers, which can be a barrier for new entrants. The cyclical and volatile nature of the oil and gas industry means that periods of low oil prices can lead to significant project delays or cancellations, reducing demand for rental equipment and impacting the profitability of rental companies. Furthermore, the complexity and remote nature of many oilfield operations present logistical challenges for the transportation, maintenance, and servicing of rented equipment. The risk of equipment damage or failure, particularly in harsh operating environments, is also a concern for both the rental provider and the end-user, requiring strict maintenance protocols and clear liability agreements.

Opportunities :

The market offers significant opportunities, especially through technological integration and a focus on sustainability. The integration of IoT, AI, and data analytics into rental equipment presents a major opportunity for providers to offer "smart" solutions that enable real-time performance monitoring, predictive maintenance, and optimized usage. This not only enhances operational efficiency but also allows for premium pricing. The growing global emphasis on reducing carbon emissions and improving environmental performance is creating demand for more eco-friendly and energy-efficient equipment. Rental companies can capitalize on this by upgrading their fleets to include newer, compliant technologies. Additionally, the increasing demand for specialized equipment for non-conventional applications like enhanced oil recovery, geothermal energy, and carbon capture initiatives opens up new and diversified revenue streams beyond traditional oil and gas.

Challenges :

The oilfield equipment rental market is subject to several key challenges. The intense competition among rental providers can lead to price pressures, eroding profit margins. Maintaining and managing a diverse and technologically advanced fleet of equipment is a significant operational challenge, requiring continuous investment in maintenance, repairs, and technical expertise. Ensuring the reliability and safety of rented equipment is paramount, as any failure can lead to catastrophic accidents and significant financial and reputational damage. The industry also faces the challenge of a skills gap, as specialized knowledge is required to operate and service sophisticated equipment, which can make it difficult for companies to find and retain qualified personnel. Finally, the need to comply with a patchwork of global and regional safety, environmental, and operational regulations adds another layer of complexity and cost.

Oilfield Equipment Rental Market: Segmentation Insights

The global oilfield equipment rental market is segmented based on Type , Application, and Region. All the segments of the oilfield equipment rental market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type , the global oilfield equipment rental market is divided into Drilling Equipment (Drill Pipe, Drill Collar, Hevi-Wate, Others), Pressure & Flow Control, (Blow Out Preventer, Valves & Manifolds, Others), Fishing Equipment, Others .

On the basis of Application, the global oilfield equipment rental market is bifurcated into Onshore, Offshore .

Oilfield Equipment Rental Market: Regional Insights

North America, led by the United States, is the dominant region in the global oilfield equipment rental market. This leadership is driven by the high volume of shale oil and gas drilling activities, which heavily rely on rented equipment like drilling rigs, pressure pumping equipment, and well completion tools to optimize costs and operational flexibility.

The presence of numerous independent oil and gas operators and a mature, competitive rental industry further supports market dominance. While the Middle East is a significant market due to large-scale conventional oil production, North America's dynamic shale sector and cost-conscious operational model solidify its position as the largest and most influential regional market for oilfield equipment rentals.

Oilfield Equipment Rental Market: Competitive Landscape

The oilfield equipment rental market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Oilfield Equipment Rental Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Schlumberger

- Baker Hughes

- GE company

- Halliburton

- Weatherford

- Technip

- Superior Energy Services

- Transocean

- BJ Services

- Petrofac

- COSL - China Oilfield Services Limited

- Worley

- McDermott International Inc.

- Bechtel Corporation

- National Oilwell Varco

The Global Oilfield Equipment Rental Market is Segmented as Follows:

By Type

- Drilling Equipment (Drill Pipe

- Drill Collar

- Hevi-Wate

- Others)

- Pressure & Flow Control

- (Blow Out Preventer

- Valves & Manifolds

- Others)

- Fishing Equipment

- Others

By Application

- Onshore

- Offshore

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Oilfield Equipment Rental Market Share by Type (2020-2026) 1.5.2 Drilling Equipment 1.5.3 Pressure & Flow Control Equipment 1.5.4 Fishing Equipment 1.5.5 Other Equipment 1.6 Market by Application 1.6.1 Global Oilfield Equipment Rental Market Share by Application (2020-2026) 1.6.2 Onshore 1.6.3 Offshore 1.7 Oilfield Equipment Rental Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Oilfield Equipment Rental Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Oilfield Equipment Rental Market 3.1 Value Chain Status 3.2 Oilfield Equipment Rental Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Oilfield Equipment Rental 3.2.3 Labor Cost of Oilfield Equipment Rental 3.2.3.1 Labor Cost of Oilfield Equipment Rental Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Halliburton Company 4.1.1 Halliburton Company Basic Information 4.1.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.1.3 Halliburton Company Oilfield Equipment Rental Market Performance (2015-2020) 4.1.4 Halliburton Company Business Overview 4.2 Knight Oil Tools 4.2.1 Knight Oil Tools Basic Information 4.2.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.2.3 Knight Oil Tools Oilfield Equipment Rental Market Performance (2015-2020) 4.2.4 Knight Oil Tools Business Overview 4.3 Oil States International, Inc. 4.3.1 Oil States International, Inc. Basic Information 4.3.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.3.3 Oil States International, Inc. Oilfield Equipment Rental Market Performance (2015-2020) 4.3.4 Oil States International, Inc. Business Overview 4.4 Schlumberger Limited 4.4.1 Schlumberger Limited Basic Information 4.4.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.4.3 Schlumberger Limited Oilfield Equipment Rental Market Performance (2015-2020) 4.4.4 Schlumberger Limited Business Overview 4.5 RPC 4.5.1 RPC Basic Information 4.5.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.5.3 RPC Oilfield Equipment Rental Market Performance (2015-2020) 4.5.4 RPC Business Overview 4.6 Parker Drilling Company 4.6.1 Parker Drilling Company Basic Information 4.6.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.6.3 Parker Drilling Company Oilfield Equipment Rental Market Performance (2015-2020) 4.6.4 Parker Drilling Company Business Overview 4.7 Weatherford International, PLC 4.7.1 Weatherford International, PLC Basic Information 4.7.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.7.3 Weatherford International, PLC Oilfield Equipment Rental Market Performance (2015-2020) 4.7.4 Weatherford International, PLC Business Overview 4.8 Basic Energy Services 4.8.1 Basic Energy Services Basic Information 4.8.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.8.3 Basic Energy Services Oilfield Equipment Rental Market Performance (2015-2020) 4.8.4 Basic Energy Services Business Overview 4.9 AOS ORWELL 4.9.1 AOS ORWELL Basic Information 4.9.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.9.3 AOS ORWELL Oilfield Equipment Rental Market Performance (2015-2020) 4.9.4 AOS ORWELL Business Overview 4.10 IOT GROUP 4.10.1 IOT GROUP Basic Information 4.10.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.10.3 IOT GROUP Oilfield Equipment Rental Market Performance (2015-2020) 4.10.4 IOT GROUP Business Overview 4.11 KIT Oil & Gas 4.11.1 KIT Oil & Gas Basic Information 4.11.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.11.3 KIT Oil & Gas Oilfield Equipment Rental Market Performance (2015-2020) 4.11.4 KIT Oil & Gas Business Overview 4.12 Superior Energy Services, Inc. 4.12.1 Superior Energy Services, Inc. Basic Information 4.12.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.12.3 Superior Energy Services, Inc. Oilfield Equipment Rental Market Performance (2015-2020) 4.12.4 Superior Energy Services, Inc. Business Overview 4.13 Certified Oilfield Rentals, LLC 4.13.1 Certified Oilfield Rentals, LLC Basic Information 4.13.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.13.3 Certified Oilfield Rentals, LLC Oilfield Equipment Rental Market Performance (2015-2020) 4.13.4 Certified Oilfield Rentals, LLC Business Overview 4.14 Bois B.V. 4.14.1 Bois B.V. Basic Information 4.14.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.14.3 Bois B.V. Oilfield Equipment Rental Market Performance (2015-2020) 4.14.4 Bois B.V. Business Overview 4.15 Key Energy Services 4.15.1 Key Energy Services Basic Information 4.15.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.15.3 Key Energy Services Oilfield Equipment Rental Market Performance (2015-2020) 4.15.4 Key Energy Services Business Overview 4.16 Ensign Energy Services 4.16.1 Ensign Energy Services Basic Information 4.16.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.16.3 Ensign Energy Services Oilfield Equipment Rental Market Performance (2015-2020) 4.16.4 Ensign Energy Services Business Overview 4.17 FMC Technologies 4.17.1 FMC Technologies Basic Information 4.17.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.17.3 FMC Technologies Oilfield Equipment Rental Market Performance (2015-2020) 4.17.4 FMC Technologies Business Overview 4.18 Precision Drilling 4.18.1 Precision Drilling Basic Information 4.18.2 Oilfield Equipment Rental Product Profiles, Application and Specification 4.18.3 Precision Drilling Oilfield Equipment Rental Market Performance (2015-2020) 4.18.4 Precision Drilling Business Overview 5 Global Oilfield Equipment Rental Market Analysis by Regions 5.1 Global Oilfield Equipment Rental Sales, Revenue and Market Share by Regions 5.1.1 Global Oilfield Equipment Rental Sales by Regions (2015-2020) 5.1.2 Global Oilfield Equipment Rental Revenue by Regions (2015-2020) 5.2 North America Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 5.3 Europe Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 5.6 South America Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 6 North America Oilfield Equipment Rental Market Analysis by Countries 6.1 North America Oilfield Equipment Rental Sales, Revenue and Market Share by Countries 6.1.1 North America Oilfield Equipment Rental Sales by Countries (2015-2020) 6.1.2 North America Oilfield Equipment Rental Revenue by Countries (2015-2020) 6.1.3 North America Oilfield Equipment Rental Market Under COVID-19 6.2 United States Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 6.2.1 United States Oilfield Equipment Rental Market Under COVID-19 6.3 Canada Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 6.4 Mexico Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7 Europe Oilfield Equipment Rental Market Analysis by Countries 7.1 Europe Oilfield Equipment Rental Sales, Revenue and Market Share by Countries 7.1.1 Europe Oilfield Equipment Rental Sales by Countries (2015-2020) 7.1.2 Europe Oilfield Equipment Rental Revenue by Countries (2015-2020) 7.1.3 Europe Oilfield Equipment Rental Market Under COVID-19 7.2 Germany Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7.2.1 Germany Oilfield Equipment Rental Market Under COVID-19 7.3 UK Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7.3.1 UK Oilfield Equipment Rental Market Under COVID-19 7.4 France Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7.4.1 France Oilfield Equipment Rental Market Under COVID-19 7.5 Italy Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7.5.1 Italy Oilfield Equipment Rental Market Under COVID-19 7.6 Spain Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7.6.1 Spain Oilfield Equipment Rental Market Under COVID-19 7.7 Russia Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 7.7.1 Russia Oilfield Equipment Rental Market Under COVID-19 8 Asia-Pacific Oilfield Equipment Rental Market Analysis by Countries 8.1 Asia-Pacific Oilfield Equipment Rental Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Oilfield Equipment Rental Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Oilfield Equipment Rental Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Oilfield Equipment Rental Market Under COVID-19 8.2 China Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 8.2.1 China Oilfield Equipment Rental Market Under COVID-19 8.3 Japan Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 8.3.1 Japan Oilfield Equipment Rental Market Under COVID-19 8.4 South Korea Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 8.4.1 South Korea Oilfield Equipment Rental Market Under COVID-19 8.5 Australia Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 8.6 India Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 8.6.1 India Oilfield Equipment Rental Market Under COVID-19 8.7 Southeast Asia Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Oilfield Equipment Rental Market Under COVID-19 9 Middle East and Africa Oilfield Equipment Rental Market Analysis by Countries 9.1 Middle East and Africa Oilfield Equipment Rental Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Oilfield Equipment Rental Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Oilfield Equipment Rental Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Oilfield Equipment Rental Market Under COVID-19 9.2 Saudi Arabia Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 9.3 UAE Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 9.4 Egypt Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 9.5 Nigeria Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 9.6 South Africa Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 10 South America Oilfield Equipment Rental Market Analysis by Countries 10.1 South America Oilfield Equipment Rental Sales, Revenue and Market Share by Countries 10.1.1 South America Oilfield Equipment Rental Sales by Countries (2015-2020) 10.1.2 South America Oilfield Equipment Rental Revenue by Countries (2015-2020) 10.1.3 South America Oilfield Equipment Rental Market Under COVID-19 10.2 Brazil Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 10.2.1 Brazil Oilfield Equipment Rental Market Under COVID-19 10.3 Argentina Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 10.4 Columbia Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 10.5 Chile Oilfield Equipment Rental Sales and Growth Rate (2015-2020) 11 Global Oilfield Equipment Rental Market Segment by Types 11.1 Global Oilfield Equipment Rental Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Oilfield Equipment Rental Sales and Market Share by Types (2015-2020) 11.1.2 Global Oilfield Equipment Rental Revenue and Market Share by Types (2015-2020) 11.2 Drilling Equipment Sales and Price (2015-2020) 11.3 Pressure & Flow Control Equipment Sales and Price (2015-2020) 11.4 Fishing Equipment Sales and Price (2015-2020) 11.5 Other Equipment Sales and Price (2015-2020) 12 Global Oilfield Equipment Rental Market Segment by Applications 12.1 Global Oilfield Equipment Rental Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Oilfield Equipment Rental Sales and Market Share by Applications (2015-2020) 12.1.2 Global Oilfield Equipment Rental Revenue and Market Share by Applications (2015-2020) 12.2 Onshore Sales, Revenue and Growth Rate (2015-2020) 12.3 Offshore Sales, Revenue and Growth Rate (2015-2020) 13 Oilfield Equipment Rental Market Forecast by Regions (2020-2026) 13.1 Global Oilfield Equipment Rental Sales, Revenue and Growth Rate (2020-2026) 13.2 Oilfield Equipment Rental Market Forecast by Regions (2020-2026) 13.2.1 North America Oilfield Equipment Rental Market Forecast (2020-2026) 13.2.2 Europe Oilfield Equipment Rental Market Forecast (2020-2026) 13.2.3 Asia-Pacific Oilfield Equipment Rental Market Forecast (2020-2026) 13.2.4 Middle East and Africa Oilfield Equipment Rental Market Forecast (2020-2026) 13.2.5 South America Oilfield Equipment Rental Market Forecast (2020-2026) 13.3 Oilfield Equipment Rental Market Forecast by Types (2020-2026) 13.4 Oilfield Equipment Rental Market Forecast by Applications (2020-2026) 13.5 Oilfield Equipment Rental Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Oilfield Equipment Rental

Request Sample

Oilfield Equipment Rental