Position Sensors Market Size, Share, and Trends Analysis Report

CAGR :

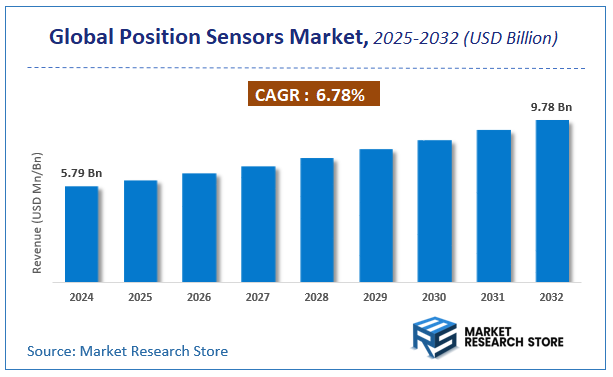

| Market Size 2024 (Base Year) | USD 5.79 Billion |

| Market Size 2032 (Forecast Year) | USD 9.78 Billion |

| CAGR | 6.78% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

According to a recent study by Market Research Store, the global position sensors market size was valued at approximately USD 5.79 Billion in 2024. The market is projected to grow significantly, reaching USD 9.78 Billion by 2032, growing at a compound annual growth rate (CAGR) of 6.78% during the forecast period from 2024 to 2032. The report highlights key growth drivers such as rising demand, technological advancements, and expanding applications. It also outlines potential challenges like regulatory changes and market competition, while emphasizing emerging opportunities for innovation and investment in the position sensors industry.

Position Sensors Market: Overview

The growth of the position sensors market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The position sensors market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the position sensors market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Application, End-use, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global position sensors market is estimated to grow annually at a CAGR of around 6.78% over the forecast period (2025-2032).

- In terms of revenue, the global position sensors market size was valued at around USD 5.79 Billion in 2024 and is projected to reach USD 9.78 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing adoption of automation in manufacturing, increasing demand in automotive and consumer electronics, and rising applications in industrial robotics are fueling the Position Sensors market.

- Based on the Application, the Photoelectric segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of End-use, the Automotive segment is anticipated to command the largest market share.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Position Sensors Market: Report Scope

This report thoroughly analyzes the position sensors market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Position Sensors Market |

| Market Size in 2024 | USD 5.79 Billion |

| Market Forecast in 2032 | USD 9.78 Billion |

| Growth Rate | CAGR of 6.78% |

| Number of Pages | 237 |

| Key Companies Covered | Honeywell International Inc., TE Connectivity, SICK AG, ams-OSRAM AG., MTS System, Infineon Technologies AG, STMicroelectronics, Balluff Inc, Vishay Intertechnology Inc, Baumer |

| Segments Covered | By Application, By End-use, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Position Sensors Market: Dynamics

Key Growth Drivers :

The Position Sensors market is experiencing robust growth, primarily driven by the accelerating demand for automation, precision control, and smart devices across a multitude of industries. The burgeoning automotive sector is a major catalyst, with the rapid expansion of electric vehicles (EVs), autonomous driving systems, and advanced driver-assistance systems (ADAS), all requiring highly accurate position sensing for components like steering, braking, throttle, and suspension. The increasing adoption of industrial automation and robotics in manufacturing (Industry 4.0) further fuels demand, as position sensors are crucial for precise motion control, feedback loops, and safety systems in robotic arms, machine tools, and assembly lines. Furthermore, the proliferation of consumer electronics, including smartphones, wearables, and smart home devices, leverages miniaturized position sensors for user interface, gesture recognition, and device functionality. The demand for energy efficiency also drives the use of position sensors in optimizing motor control and actuator performance.

Restraints :

Despite the strong growth drivers, the Position Sensors market faces several significant restraints. Intense competition from a vast array of sensor technologies, including optical, magnetic, inductive, capacitive, and ultrasonic sensors, each with its own advantages and disadvantages, can lead to price erosion and compressed profit margins, especially in commoditized segments. The technical complexity and cost associated with integrating highly accurate position sensors into complex systems, often requiring specialized calibration and compensation for environmental factors like temperature, vibration, and electromagnetic interference, can be a deterrent for some applications. Furthermore, the rapid pace of technological advancements, while an opportunity, also poses a restraint as existing sensor designs can quickly become obsolete, necessitating continuous investment in research and development and potentially leading to shorter product lifecycles for manufacturers. The lack of standardized communication protocols and data formats for various position sensors can also create integration challenges.

Opportunities :

The Position Sensors market presents numerous opportunities for innovation and expansion. The increasing demand for miniaturized, high-precision position sensors suitable for space-constrained applications, such as medical devices (e.g., surgical robotics, prosthetics), micro-robotics, and advanced wearables, offers a significant avenue for growth. Opportunities exist in developing smart position sensors integrated with edge computing capabilities, artificial intelligence (AI), and machine learning (ML) for enhanced data processing, predictive maintenance, and autonomous decision-making in industrial IoT applications. The expansion into harsh environments, such as high temperatures, radiation, or corrosive atmospheres, for applications in aerospace, oil & gas, and renewable energy, drives the development of robust and durable sensor designs. Furthermore, the integration of multiple sensing functionalities onto a single chip or module, combining position with other parameters like temperature or pressure, can offer more comprehensive solutions and reduce system complexity for end-users. The growth of augmented reality (AR) and virtual reality (VR) also creates demand for highly accurate positional tracking.

Challenges :

The Position Sensors market is confronted with several critical challenges that require strategic navigation. Ensuring high accuracy, repeatability, and long-term stability of position sensors under various operating conditions and environmental stressors (e.g., temperature changes, humidity, vibration) is paramount, as even slight inaccuracies can lead to system failures in critical applications. Managing the balance between performance, cost, and power consumption is a continuous challenge, particularly for battery-powered or mass-market devices. Furthermore, the cybersecurity risks associated with networked position sensors, especially in industrial control systems and autonomous vehicles, require robust security measures to prevent tampering or unauthorized access that could compromise safety and functionality. The need for continuous research and development to keep pace with evolving industry standards, communication protocols, and new application requirements is also a persistent challenge for manufacturers. Lastly, the talent gap for engineers with expertise in sensor design, material science, and embedded systems can hinder innovation and product development.

Position Sensors Market: Segmentation Insights

The global position sensors market is segmented based on Application, End-use, and Region. All the segments of the position sensors market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Application, the global position sensors market is divided into Photoelectric, Linear, Proximity, Rotary, Others.

On the basis of End-use, the global position sensors market is bifurcated into Automotive, Military & Aerospace, Electronic & Semiconductor, Packaging, Others.

Position Sensors Market: Regional Insights

The Asia-Pacific region is the dominant force in the global position sensors market, accounting for the largest revenue share, estimated at over 45% as of 2023. This leadership is propelled by the region's massive manufacturing base for automotive, consumer electronics, and industrial automation, particularly in China, Japan, and South Korea. The rapid expansion of electric vehicle production, industrial robotics, and smart device assembly lines—all of which rely heavily on position sensors for precision and feedback—serves as the primary driver. While North America remains a critical market for high-performance sensors in aerospace and defense, Asia-Pacific's unparalleled manufacturing scale and its central role in global electronics and automotive supply chains cement its position as the market leader.

Position Sensors Market: Competitive Landscape

The position sensors market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Position Sensors Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Honeywell International Inc.

- TE Connectivity

- SICK AG

- ams-OSRAM AG.

- MTS System

- Infineon Technologies AG

- STMicroelectronics

- Balluff Inc

- Vishay Intertechnology Inc

- Baumer

The Global Position Sensors Market is Segmented as Follows:

By Application

- Photoelectric

- Linear

- Proximity

- Rotary

- Others

By End-use

- Automotive

- Military & Aerospace

- Electronic & Semiconductor

- Packaging

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Position Sensors Market Share by Type (2020-2026) 1.5.2 Linear position sensors 1.5.3 Rotary position sensors 1.5.4 Photoelectric 1.5.5 Proximity 1.5.6 Others 1.6 Market by Application 1.6.1 Global Position Sensors Market Share by Application (2020-2026) 1.6.2 Test equipment 1.6.3 Material handling 1.6.4 Motion system 1.6.5 Machine tool 1.6.6 Robotics 1.7 Position Sensors Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Position Sensors Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Position Sensors Market 3.1 Value Chain Status 3.2 Position Sensors Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Position Sensors 3.2.3 Labor Cost of Position Sensors 3.2.3.1 Labor Cost of Position Sensors Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Sick AG 4.1.1 Sick AG Basic Information 4.1.2 Position Sensors Product Profiles, Application and Specification 4.1.3 Sick AG Position Sensors Market Performance (2015-2020) 4.1.4 Sick AG Business Overview 4.2 Balluff Inc. 4.2.1 Balluff Inc. Basic Information 4.2.2 Position Sensors Product Profiles, Application and Specification 4.2.3 Balluff Inc. Position Sensors Market Performance (2015-2020) 4.2.4 Balluff Inc. Business Overview 4.3 Vishay Intertechnology, Inc. (U.S.) 4.3.1 Vishay Intertechnology, Inc. (U.S.) Basic Information 4.3.2 Position Sensors Product Profiles, Application and Specification 4.3.3 Vishay Intertechnology, Inc. (U.S.) Position Sensors Market Performance (2015-2020) 4.3.4 Vishay Intertechnology, Inc. (U.S.) Business Overview 4.4 Ams AG (Austria) 4.4.1 Ams AG (Austria) Basic Information 4.4.2 Position Sensors Product Profiles, Application and Specification 4.4.3 Ams AG (Austria) Position Sensors Market Performance (2015-2020) 4.4.4 Ams AG (Austria) Business Overview 4.5 Hans TURCK GmbH & Co. KG 4.5.1 Hans TURCK GmbH & Co. KG Basic Information 4.5.2 Position Sensors Product Profiles, Application and Specification 4.5.3 Hans TURCK GmbH & Co. KG Position Sensors Market Performance (2015-2020) 4.5.4 Hans TURCK GmbH & Co. KG Business Overview 4.6 Heidenhain Corporation 4.6.1 Heidenhain Corporation Basic Information 4.6.2 Position Sensors Product Profiles, Application and Specification 4.6.3 Heidenhain Corporation Position Sensors Market Performance (2015-2020) 4.6.4 Heidenhain Corporation Business Overview 4.7 Emerson Electric Co. 4.7.1 Emerson Electric Co. Basic Information 4.7.2 Position Sensors Product Profiles, Application and Specification 4.7.3 Emerson Electric Co. Position Sensors Market Performance (2015-2020) 4.7.4 Emerson Electric Co. Business Overview 4.8 TE Connectivity Ltd. (Switzerland) 4.8.1 TE Connectivity Ltd. (Switzerland) Basic Information 4.8.2 Position Sensors Product Profiles, Application and Specification 4.8.3 TE Connectivity Ltd. (Switzerland) Position Sensors Market Performance (2015-2020) 4.8.4 TE Connectivity Ltd. (Switzerland) Business Overview 4.9 Allegro MicroSystems, LLC (U.S.) 4.9.1 Allegro MicroSystems, LLC (U.S.) Basic Information 4.9.2 Position Sensors Product Profiles, Application and Specification 4.9.3 Allegro MicroSystems, LLC (U.S.) Position Sensors Market Performance (2015-2020) 4.9.4 Allegro MicroSystems, LLC (U.S.) Business Overview 4.10 Ametek Inc. 4.10.1 Ametek Inc. Basic Information 4.10.2 Position Sensors Product Profiles, Application and Specification 4.10.3 Ametek Inc. Position Sensors Market Performance (2015-2020) 4.10.4 Ametek Inc. Business Overview 4.11 MTS System Corporation 4.11.1 MTS System Corporation Basic Information 4.11.2 Position Sensors Product Profiles, Application and Specification 4.11.3 MTS System Corporation Position Sensors Market Performance (2015-2020) 4.11.4 MTS System Corporation Business Overview 4.12 Honeywell International Inc. (U.S.) 4.12.1 Honeywell International Inc. (U.S.) Basic Information 4.12.2 Position Sensors Product Profiles, Application and Specification 4.12.3 Honeywell International Inc. (U.S.) Position Sensors Market Performance (2015-2020) 4.12.4 Honeywell International Inc. (U.S.) Business Overview 4.13 Renishaw Plc. (U.K.) 4.13.1 Renishaw Plc. (U.K.) Basic Information 4.13.2 Position Sensors Product Profiles, Application and Specification 4.13.3 Renishaw Plc. (U.K.) Position Sensors Market Performance (2015-2020) 4.13.4 Renishaw Plc. (U.K.) Business Overview 4.14 Sensata Technologies, Inc. 4.14.1 Sensata Technologies, Inc. Basic Information 4.14.2 Position Sensors Product Profiles, Application and Specification 4.14.3 Sensata Technologies, Inc. Position Sensors Market Performance (2015-2020) 4.14.4 Sensata Technologies, Inc. Business Overview 5 Global Position Sensors Market Analysis by Regions 5.1 Global Position Sensors Sales, Revenue and Market Share by Regions 5.1.1 Global Position Sensors Sales by Regions (2015-2020) 5.1.2 Global Position Sensors Revenue by Regions (2015-2020) 5.2 North America Position Sensors Sales and Growth Rate (2015-2020) 5.3 Europe Position Sensors Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Position Sensors Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Position Sensors Sales and Growth Rate (2015-2020) 5.6 South America Position Sensors Sales and Growth Rate (2015-2020) 6 North America Position Sensors Market Analysis by Countries 6.1 North America Position Sensors Sales, Revenue and Market Share by Countries 6.1.1 North America Position Sensors Sales by Countries (2015-2020) 6.1.2 North America Position Sensors Revenue by Countries (2015-2020) 6.1.3 North America Position Sensors Market Under COVID-19 6.2 United States Position Sensors Sales and Growth Rate (2015-2020) 6.2.1 United States Position Sensors Market Under COVID-19 6.3 Canada Position Sensors Sales and Growth Rate (2015-2020) 6.4 Mexico Position Sensors Sales and Growth Rate (2015-2020) 7 Europe Position Sensors Market Analysis by Countries 7.1 Europe Position Sensors Sales, Revenue and Market Share by Countries 7.1.1 Europe Position Sensors Sales by Countries (2015-2020) 7.1.2 Europe Position Sensors Revenue by Countries (2015-2020) 7.1.3 Europe Position Sensors Market Under COVID-19 7.2 Germany Position Sensors Sales and Growth Rate (2015-2020) 7.2.1 Germany Position Sensors Market Under COVID-19 7.3 UK Position Sensors Sales and Growth Rate (2015-2020) 7.3.1 UK Position Sensors Market Under COVID-19 7.4 France Position Sensors Sales and Growth Rate (2015-2020) 7.4.1 France Position Sensors Market Under COVID-19 7.5 Italy Position Sensors Sales and Growth Rate (2015-2020) 7.5.1 Italy Position Sensors Market Under COVID-19 7.6 Spain Position Sensors Sales and Growth Rate (2015-2020) 7.6.1 Spain Position Sensors Market Under COVID-19 7.7 Russia Position Sensors Sales and Growth Rate (2015-2020) 7.7.1 Russia Position Sensors Market Under COVID-19 8 Asia-Pacific Position Sensors Market Analysis by Countries 8.1 Asia-Pacific Position Sensors Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Position Sensors Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Position Sensors Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Position Sensors Market Under COVID-19 8.2 China Position Sensors Sales and Growth Rate (2015-2020) 8.2.1 China Position Sensors Market Under COVID-19 8.3 Japan Position Sensors Sales and Growth Rate (2015-2020) 8.3.1 Japan Position Sensors Market Under COVID-19 8.4 South Korea Position Sensors Sales and Growth Rate (2015-2020) 8.4.1 South Korea Position Sensors Market Under COVID-19 8.5 Australia Position Sensors Sales and Growth Rate (2015-2020) 8.6 India Position Sensors Sales and Growth Rate (2015-2020) 8.6.1 India Position Sensors Market Under COVID-19 8.7 Southeast Asia Position Sensors Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Position Sensors Market Under COVID-19 9 Middle East and Africa Position Sensors Market Analysis by Countries 9.1 Middle East and Africa Position Sensors Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Position Sensors Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Position Sensors Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Position Sensors Market Under COVID-19 9.2 Saudi Arabia Position Sensors Sales and Growth Rate (2015-2020) 9.3 UAE Position Sensors Sales and Growth Rate (2015-2020) 9.4 Egypt Position Sensors Sales and Growth Rate (2015-2020) 9.5 Nigeria Position Sensors Sales and Growth Rate (2015-2020) 9.6 South Africa Position Sensors Sales and Growth Rate (2015-2020) 10 South America Position Sensors Market Analysis by Countries 10.1 South America Position Sensors Sales, Revenue and Market Share by Countries 10.1.1 South America Position Sensors Sales by Countries (2015-2020) 10.1.2 South America Position Sensors Revenue by Countries (2015-2020) 10.1.3 South America Position Sensors Market Under COVID-19 10.2 Brazil Position Sensors Sales and Growth Rate (2015-2020) 10.2.1 Brazil Position Sensors Market Under COVID-19 10.3 Argentina Position Sensors Sales and Growth Rate (2015-2020) 10.4 Columbia Position Sensors Sales and Growth Rate (2015-2020) 10.5 Chile Position Sensors Sales and Growth Rate (2015-2020) 11 Global Position Sensors Market Segment by Types 11.1 Global Position Sensors Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Position Sensors Sales and Market Share by Types (2015-2020) 11.1.2 Global Position Sensors Revenue and Market Share by Types (2015-2020) 11.2 Linear position sensors Sales and Price (2015-2020) 11.3 Rotary position sensors Sales and Price (2015-2020) 11.4 Photoelectric Sales and Price (2015-2020) 11.5 Proximity Sales and Price (2015-2020) 11.6 Others Sales and Price (2015-2020) 12 Global Position Sensors Market Segment by Applications 12.1 Global Position Sensors Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Position Sensors Sales and Market Share by Applications (2015-2020) 12.1.2 Global Position Sensors Revenue and Market Share by Applications (2015-2020) 12.2 Test equipment Sales, Revenue and Growth Rate (2015-2020) 12.3 Material handling Sales, Revenue and Growth Rate (2015-2020) 12.4 Motion system Sales, Revenue and Growth Rate (2015-2020) 12.5 Machine tool Sales, Revenue and Growth Rate (2015-2020) 12.6 Robotics Sales, Revenue and Growth Rate (2015-2020) 13 Position Sensors Market Forecast by Regions (2020-2026) 13.1 Global Position Sensors Sales, Revenue and Growth Rate (2020-2026) 13.2 Position Sensors Market Forecast by Regions (2020-2026) 13.2.1 North America Position Sensors Market Forecast (2020-2026) 13.2.2 Europe Position Sensors Market Forecast (2020-2026) 13.2.3 Asia-Pacific Position Sensors Market Forecast (2020-2026) 13.2.4 Middle East and Africa Position Sensors Market Forecast (2020-2026) 13.2.5 South America Position Sensors Market Forecast (2020-2026) 13.3 Position Sensors Market Forecast by Types (2020-2026) 13.4 Position Sensors Market Forecast by Applications (2020-2026) 13.5 Position Sensors Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Position Sensors

Request Sample

Position Sensors