Public Safety Wireless Module Market Size, Share, and Trends Analysis Report

CAGR :

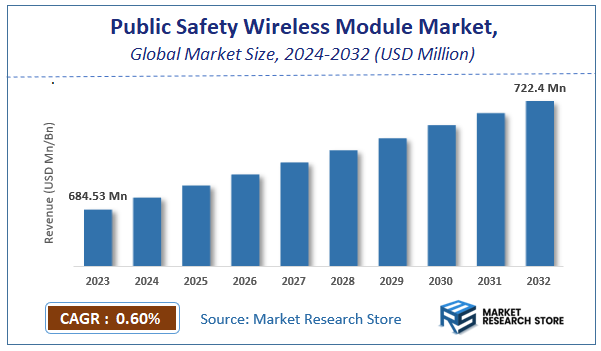

| Market Size 2023 (Base Year) | USD 684.53 Million |

| Market Size 2032 (Forecast Year) | USD 722.4 Million |

| CAGR | 0.6% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Public Safety Wireless Module Market Insights

According to Market Research Store, the global public safety wireless module market size was valued at around USD 684.53 million in 2023 and is estimated to reach USD 722.4 million by 2032, to register a CAGR of approximately 11.2% in terms of revenue during the forecast period 2024-2032.

The public safety wireless module report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Public Safety Wireless Module Market: Overview

The Public Safety Wireless Module Market is a critical segment within the broader mission-critical communications industry, providing the technological backbone for emergency response systems worldwide. These specialized wireless modules serve as the communication lifeline for first responders, enabling seamless connectivity across a wide array of devices including body-worn cameras, in-vehicle routers, drones, and IoT sensors deployed in smart city infrastructure. The market has evolved significantly from traditional narrowband systems (like TETRA and P25) to embrace advanced broadband technologies including LTE, 5G, and hybrid networks that support high-bandwidth applications such as real-time video streaming, augmented reality for situational awareness, and AI-driven analytics for emergency response optimization.

The growing adoption of 3GPP-based standards for public safety communications has further standardized module development, enabling interoperability across different agencies and regions. Geographically, North America leads in adoption due to FirstNet's nationwide deployment, while Europe and Asia-Pacific are catching up with their own dedicated public safety networks (like ESN in the UK and SDRN in South Korea). Emerging applications such as connected emergency vehicles, smart wearables for firefighters, and AI-powered predictive policing systems are creating new growth avenues.

Key Highlights

- The public safety wireless module market is anticipated to grow at a CAGR of 11.2% during the forecast period.

- The global public safety wireless module market was estimated to be worth approximately USD 684.53 million in 2023 and is projected to reach a value of USD 722.4 million by 2032.

- The growth of the public safety wireless module market is being driven by the increasing need for reliable and secure communication in critical situations for first responders and public safety agencies.

- Based on the type, the communication module segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the law enforcement segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Public Safety Wireless Module Market: Dynamics

Key Growth Drivers

- Increasing Demand for Real-Time Data and Situational Awareness: First responders need immediate access to critical information like maps, building plans, suspect details, and real-time video feeds to make informed decisions and enhance safety, driving the need for reliable wireless modules.

- Government Initiatives and Funding for Public Safety Communication Upgrades: Governments worldwide are investing in modernizing public safety communication infrastructure, including the deployment of advanced wireless technologies and devices, creating a strong demand for embedded modules.

- Growing Adoption of LTE and 5G Networks for Public Safety: The evolution towards broadband technologies like LTE and 5G offers higher data rates, lower latency, and increased capacity, enabling richer applications for public safety and necessitating compatible wireless modules.

- Need for Interoperability and Seamless Communication: Ensuring seamless communication between different public safety agencies (police, fire, EMS) and across various devices requires standardized and interoperable wireless modules.

- Rising Use of Body-Worn Cameras and Mobile Data Terminals: The increasing deployment of body-worn cameras for law enforcement and mobile data terminals in emergency vehicles necessitates reliable wireless modules for data transmission and connectivity.

- Integration of IoT Devices and Sensors in Public Safety: The growing use of IoT devices like smart sensors for environmental monitoring, traffic management, and gunshot detection in public safety applications requires robust wireless connectivity provided by these modules.

- Demand for Secure and Encrypted Communication: Public safety communication requires high levels of security and encryption to protect sensitive information, driving the demand for wireless modules with advanced security features.

- Advancements in Wireless Module Technology: Continuous innovation in wireless module design, including smaller form factors, lower power consumption, and enhanced performance, makes them more suitable for integration into diverse public safety devices.

Restraints

- High Cost of Deployment and Infrastructure Upgrades: Implementing advanced wireless networks and devices for public safety can involve significant upfront costs for infrastructure upgrades and module integration.

- Interoperability Challenges Across Different Networks and Devices: Achieving seamless interoperability between legacy narrowband systems and newer broadband networks, as well as across different manufacturers' devices, remains a challenge.

- Security Concerns and Vulnerabilities: Wireless communication is inherently susceptible to security threats, and ensuring the security and integrity of public safety networks and data transmitted through these modules is paramount.

- Coverage Limitations in Rural and Remote Areas: Extending reliable wireless coverage to all geographical areas, especially rural and remote regions, can be challenging and costly.

- Power Consumption Constraints in Portable Devices: Wireless modules integrated into battery-powered devices like radios and body-worn cameras need to have low power consumption to maximize battery life.

- Regulatory Hurdles and Spectrum Allocation: Obtaining necessary spectrum allocations and navigating regulatory requirements for public safety wireless communication can be complex and time-consuming.

- Resistance to Adoption of New Technologies: Some public safety agencies may be hesitant to adopt new wireless technologies due to concerns about reliability, cost, or training requirements.

- Dependence on Network Availability and Reliability: The effectiveness of wireless modules relies on the availability and reliability of the underlying network infrastructure.

Opportunities

- Development of Multi-Mode and Interoperable Modules: Creating wireless modules that support multiple communication standards (e.g., LTE, 5G, narrowband) and facilitate seamless interoperability between different networks and devices.

- Integration of Advanced Security Features: Incorporating robust security protocols, encryption algorithms, and authentication mechanisms into wireless modules to ensure secure communication.

- Development of Low-Power Wide Area Network (LPWAN) Modules for IoT Devices: Tailoring wireless modules specifically for low-power, long-range communication needs of IoT sensors and devices used in public safety.

- Customized Module Solutions for Specific Public Safety Applications: Designing wireless modules optimized for the unique requirements of different public safety devices and applications (e.g., drones, robots, vehicle systems).

- Leveraging Edge Computing Capabilities in Modules: Integrating edge computing functionalities into wireless modules to enable local data processing and faster response times.

- Expansion of Private LTE and 5G Networks for Public Safety: The deployment of dedicated private LTE and 5G networks for public safety agencies creates a significant market for compatible wireless modules.

- Integration with Location-Based Services (LBS) and Mapping Technologies: Enhancing wireless modules with precise location tracking capabilities for improved situational awareness and responder safety.

- Development of Ruggedized and Reliable Modules for Harsh Environments: Creating durable wireless modules that can withstand the demanding environmental conditions encountered by first responders.

Challenges

- Ensuring Seamless Interoperability Across Diverse Systems: Achieving true interoperability between different generations of communication systems, network technologies, and device manufacturers remains a significant technical and logistical challenge.

- Maintaining Security and Preventing Cyber Threats: Continuously adapting security measures in wireless modules to counter evolving cyber threats and protect sensitive public safety data.

- Providing Reliable Connectivity in Congested and Disaster-Struck Areas: Ensuring consistent and reliable wireless communication during emergencies and in areas with high user density.

- Managing the Transition from Narrowband to Broadband Technologies: Facilitating a smooth and cost-effective transition from legacy narrowband systems to modern broadband networks.

- Addressing Coverage Gaps in Rural and Remote Regions: Developing cost-effective solutions to extend reliable wireless coverage to underserved areas.

- Balancing Performance with Power Consumption in Portable Devices: Designing wireless modules that offer high data rates and low latency without significantly impacting the battery life of portable devices.

- Navigating the Complex Regulatory Landscape and Spectrum Management: Effectively managing spectrum allocation and complying with evolving regulations for public safety communication.

- Ensuring the Long-Term Reliability and Durability of Modules in Critical Applications: Wireless modules used in public safety devices must be highly reliable and durable to ensure consistent performance during critical situations.

Public Safety Wireless Module Market: Report Scope

This report thoroughly analyzes the Public Safety Wireless Module Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Public Safety Wireless Module Market |

| Market Size in 2023 | USD 684.53 Million |

| Market Forecast in 2032 | USD 722.4 Million |

| Growth Rate | CAGR of 11.2% |

| Number of Pages | 182 |

| Key Companies Covered | Sierra Wireless, Gemalto (Thales Group), Quectel, Telit, Huawei, Sunsea Group, LG Innotek, U-blox, Fibocom wireless Inc., Neoway |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Public Safety Wireless Module Market: Segmentation Insights

The global public safety wireless module market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global public safety wireless module market is divided into communication module and positioning module.

The Communication Module segment holds the dominant share in the Public Safety Wireless Module Market. These modules are critical for enabling real-time voice and data communication among emergency responders, law enforcement, and disaster management teams. Their widespread use in mission-critical systems such as emergency call boxes, mobile command centers, and public alert systems underscores their importance. Communication modules support a range of wireless technologies, including LTE, 5G, and public safety broadband networks, which are essential for reliable, low-latency, and secure connectivity in high-pressure scenarios. The increasing integration of IoT in public safety operations further boosts demand for these modules, reinforcing their leading position in the market.

The Positioning Module segment also plays a vital role, particularly in tracking personnel, vehicles, and assets in real-time during emergencies. These modules utilize GNSS (Global Navigation Satellite Systems) to provide precise location data, which is indispensable for coordinating rapid response and ensuring the safety of field operatives. Although essential, their role is more supportive compared to the core communication function, making this segment secondary in terms of market dominance.

Segmentation Insights by Application

On the basis of application, the global public safety wireless module market is bifurcated into law enforcement, medical, firefighting, transportation, and others.

Law Enforcement remains the most dominant application segment in the Public Safety Wireless Module Market. The increasing reliance on real-time data communication for surveillance, patrol, and tactical response has significantly driven demand for advanced wireless modules. These modules are integrated into devices like body cameras, police radios, mobile data terminals (MDTs), and location trackers to ensure uninterrupted and secure communication. The shift toward smart policing, crime prediction tools, and integrated command-and-control centers further reinforces the demand for highly reliable wireless technology that ensures officers stay connected in the field, even during high-stakes or remote operations.

Medical applications of wireless modules in public safety focus on emergency response coordination and mobile healthcare services. Ambulances, paramedic units, and on-site medical teams depend on wireless-enabled equipment to transmit patient vitals, access medical records, and coordinate with hospital emergency departments before arrival. These modules play a vital role in enabling remote diagnostics and video consultations during crisis situations, especially in disaster relief zones where conventional communication infrastructure might be compromised.

Firefighting units utilize wireless modules in rugged and fire-resistant devices such as two-way radios, helmet cameras, drones, and wearable sensors that monitor temperature and oxygen levels. These modules are essential for managing team coordination, hazard assessment, and tracking the real-time position of firefighters inside buildings. With an increasing focus on firefighter safety and automation of firefighting operations, the demand for high-performance, latency-free wireless communication is on the rise.

Transportation systems use wireless modules primarily in public transit surveillance, emergency incident detection, and fleet tracking systems. Modules embedded in buses, subways, and emergency response vehicles allow for efficient communication with traffic management centers. These help ensure quick rerouting during emergencies, faster deployment of aid, and enhanced safety for both passengers and operators. Intelligent Transportation Systems (ITS) with integrated wireless communication are becoming increasingly common in urban infrastructure planning to boost public safety efficiency.

Public Safety Wireless Module Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Public Safety Wireless Module Market, driven by extensive public safety infrastructure in the United States and Canada. High adoption of LTE and FirstNet (a nationwide broadband network dedicated to public safety), as well as early 5G deployments, reinforce the region’s leadership. Investments in modernizing communication systems for first responders, alongside government support and cybersecurity compliance requirements, are key factors. Major players in the U.S. also collaborate with OEMs and software providers to deliver integrated modules with high security and network resiliency.

Europe holds a substantial market share, supported by EU-funded digital transformation initiatives and standardized emergency communication protocols. Countries like Germany, the UK, and France are leading deployments of mission-critical broadband networks and integrating AI-powered analytics for emergency response optimization. Public safety modernization is increasingly centered around cross-border communication, centralized data access, and the use of wireless modules in drones, surveillance systems, and mobile command units.

Asia Pacific is the fastest-growing region in the Public Safety Wireless Module Market. Rapid urbanization, increasing smart city initiatives, and rising occurrences of natural disasters are major drivers in countries such as China, India, Japan, and South Korea. Governments are heavily investing in disaster preparedness systems, AI-based surveillance, and LTE/5G-enabled field communication platforms. The growth of local module manufacturers and expansion of 5G infrastructure are making wireless modules more accessible for both public and private emergency services.

Latin America is witnessing steady growth, particularly in Brazil, Mexico, and Argentina, where urban crime rates and vulnerability to natural disasters are driving the upgrade of emergency communication networks. Adoption of wireless modules is increasing in applications such as mobile video surveillance, vehicle telematics for emergency fleets, and real-time data streaming in ambulance services. International collaborations and public-private partnerships are also contributing to system integration and modernization.

Middle East and Africa is an emerging region in this market, with growing emphasis on homeland security, infrastructure protection, and disaster response. Countries such as the United Arab Emirates, Saudi Arabia, and South Africa are investing in centralized command and control systems integrated with wireless modules for data communication and coordination. Projects in smart city security and national emergency networks are gradually increasing the demand for secure, scalable wireless communication modules.

Public Safety Wireless Module Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the public safety wireless module market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global public safety wireless module market include:

- Sierra Wireless

- Gemalto (Thales Group)

- Quectel

- Telit

- Huawei

- Sunsea Group

- LG Innotek

- U-blox

- Fibocom wireless Inc.

- Neoway

The global public safety wireless module market is segmented as follows:

By Type

- Communication Module

- Positioning Module

By Application

- Law Enforcement

- Medical

- Firefighting

- Transportation

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Table of content

Inquiry For Buying

Public Safety Wireless Module

Request Sample

Public Safety Wireless Module