Reinsurance Market Size, Share, and Trends Analysis Report

CAGR :

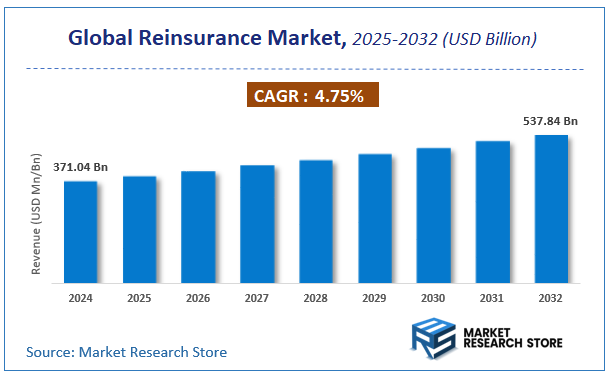

| Market Size 2024 (Base Year) | USD 371.04 Billion |

| Market Size 2032 (Forecast Year) | USD 537.84 Billion |

| CAGR | 4.75% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global reinsurance market, estimating its value at USD 371.04 Billion in 2024, with projections indicating it will reach USD 537.84 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 4.75% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the reinsurance industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Reinsurance Market: Overview

The growth of the reinsurance market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The reinsurance market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the reinsurance market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Product, Distribution Channel, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global reinsurance market is estimated to grow annually at a CAGR of around 4.75% over the forecast period (2025-2032).

- In terms of revenue, the global reinsurance market size was valued at around USD 371.04 Billion in 2024 and is projected to reach USD 537.84 Billion by 2032.

- The market is projected to grow at a significant rate due to Increasing need for risk management in the insurance sector, growing exposure to catastrophic events, and rising demand for capital optimization are driving the Reinsurance market.

- Based on the Type, the Facultative Reinsurance segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Product, the Property & Casualty Reinsurance segment is anticipated to command the largest market share.

- In terms of Distribution Channel, the Broker segment is projected to lead the global market.

- Based on region, Europe is projected to dominate the global market during the forecast period.

Reinsurance Market: Report Scope

This report thoroughly analyzes the reinsurance market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Reinsurance Market |

| Market Size in 2024 | USD 371.04 Billion |

| Market Forecast in 2032 | USD 537.84 Billion |

| Growth Rate | CAGR of 4.75% |

| Number of Pages | 224 |

| Key Companies Covered | Munich Re, Barents Re Inc., Berkshire Hathaway Inc., BMS Group Ltd., China (Group) Corporation, Everest Re Group Ltd., Swiss Re, Covea, Brookfield Reinsurance, Bluefire Insurance, SCOR SE, Hannover Re, AXA SA, Zurich Insurance Group |

| Segments Covered | By Type, By Product, By Distribution Channel, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Reinsurance Market: Dynamics

Key Growth Drivers :

The reinsurance market is being significantly driven by the increasing frequency and severity of natural catastrophes, such as hurricanes, wildfires, and floods. As climate change leads to more volatile weather patterns, primary insurers are turning to reinsurers to offload the mounting financial risks. This is further supported by the growing concentration of populations and assets in hazard-prone urban areas. The expansion of insurance markets in emerging economies is another major driver, as a rising middle class and rapid urbanization increase demand for primary insurance, which in turn necessitates reinsurance support to provide the necessary capital and stability. Finally, technological advancements, including the use of artificial intelligence, advanced data analytics, and predictive modeling, are improving the efficiency of risk assessment, underwriting, and claims processes, enabling reinsurers to offer more tailored and effective solutions.

Restraints :

The reinsurance market faces several notable restraints that can hinder its growth and profitability. The high capital requirements and regulatory constraints, such as the Solvency II framework in Europe, impose a significant compliance burden on reinsurers and can limit their operational flexibility. A "softening" of the market, where increased competition and an influx of capital from alternative sources like hedge funds and private equity lead to lower premium rates, can squeeze reinsurers' margins. Furthermore, the industry is vulnerable to economic and geopolitical uncertainties. Rising inflation can increase the cost of claims, while economic downturns can reduce demand for new insurance policies, indirectly impacting the reinsurance sector.

Opportunities :

The reinsurance market is presented with significant opportunities for innovation and expansion. The growing demand for coverage for new and emerging risks, such as cyber threats, pandemic-related business interruption, and liability from social inflation, offers a lucrative avenue for product development and market diversification. The expansion of insurance and reinsurance into previously underserved regions, particularly in Asia-Pacific and Latin America, represents a major long-term growth opportunity. Additionally, the increasing integration of the reinsurance market with capital markets through insurance-linked securities (ILS), such as catastrophe bonds, provides reinsurers with an alternative source of capital and allows for more efficient risk transfer.

Challenges :

The reinsurance market faces a number of complex challenges that require a strategic response. The most prominent challenge is the increasing unpredictability of global risks, including climate change and geopolitical conflicts, which makes accurate risk modeling and pricing more difficult. The rise of alternative capital sources, while an opportunity, also intensifies competition and puts pressure on traditional reinsurers to innovate or risk losing market share. Additionally, the industry must contend with the challenge of attracting and retaining a skilled workforce with expertise in data science, climate modeling, and other specialized areas. Finally, the growing "protection gap," or the difference between economic losses and insured losses from catastrophes, highlights a fundamental challenge for the industry to expand its relevance and offer solutions to a wider range of risks.

Reinsurance Market: Segmentation Insights

The global reinsurance market is segmented based on Type, Product, Distribution Channel, and Region. All the segments of the reinsurance market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global reinsurance market is divided into Facultative Reinsurance, Treaty Reinsurance.

On the basis of Product, the global reinsurance market is bifurcated into Property & Casualty Reinsurance, Life & Health Reinsurance.

In terms of Distribution Channel, the global reinsurance market is categorized into Broker, Direct Writing.

Reinsurance Market: Regional Insights

Europe is the dominant region in the global reinsurance market, with the largest premium volume concentrated in key hubs like Germany, Switzerland, and the United Kingdom. This leadership is anchored by the presence of the world's largest and longest-established reinsurance companies, notably Munich Re and Swiss Re. The region's dominance is driven by a mature insurance industry, the need to manage high-value risks across diverse European markets, and sophisticated capital management expertise.

While Bermuda is a specialist hub for catastrophe reinsurance and North America is the largest source of primary premiums, Europe's concentration of underwriting talent, financial stability, and global client base solidifies its position as the traditional and enduring center of the reinsurance industry.

Reinsurance Market: Competitive Landscape

The reinsurance market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Reinsurance Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Munich Re

- Barents Re Inc.

- Berkshire Hathaway Inc.

- BMS Group Ltd.

- China (Group) Corporation

- Everest Re Group Ltd.

- Swiss Re

- Covea

- Brookfield Reinsurance

- Bluefire Insurance

- SCOR SE

- Hannover Re

- AXA SA

- Zurich Insurance Group

The Global Reinsurance Market is Segmented as Follows:

By Type

- Facultative Reinsurance

- Treaty Reinsurance

By Product

- Property & Casualty Reinsurance

- Life & Health Reinsurance

By Distribution Channel

- Broker

- Direct Writing

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Reinsurance Market Share by Type (2020-2026) 1.5.2 Life 1.5.3 Non-life 1.6 Market by Application 1.6.1 Global Reinsurance Market Share by Application (2020-2026) 1.6.2 Agency 1.6.3 Broker 1.6.4 Bancassurance 1.6.5 Direct Writing 1.7 Reinsurance Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Reinsurance Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Reinsurance Market 3.1 Value Chain Status 3.2 Reinsurance Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Reinsurance 3.2.3 Labor Cost of Reinsurance 3.2.3.1 Labor Cost of Reinsurance Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 ConsiliumRe 4.1.1 ConsiliumRe Basic Information 4.1.2 Reinsurance Product Profiles, Application and Specification 4.1.3 ConsiliumRe Reinsurance Market Performance (2015-2020) 4.1.4 ConsiliumRe Business Overview 4.2 AFL 4.2.1 AFL Basic Information 4.2.2 Reinsurance Product Profiles, Application and Specification 4.2.3 AFL Reinsurance Market Performance (2015-2020) 4.2.4 AFL Business Overview 4.3 Liberty Mutual Reinsurance 4.3.1 Liberty Mutual Reinsurance Basic Information 4.3.2 Reinsurance Product Profiles, Application and Specification 4.3.3 Liberty Mutual Reinsurance Reinsurance Market Performance (2015-2020) 4.3.4 Liberty Mutual Reinsurance Business Overview 4.4 Charles Taylor Adjusting 4.4.1 Charles Taylor Adjusting Basic Information 4.4.2 Reinsurance Product Profiles, Application and Specification 4.4.3 Charles Taylor Adjusting Reinsurance Market Performance (2015-2020) 4.4.4 Charles Taylor Adjusting Business Overview 4.5 Swiss Re 4.5.1 Swiss Re Basic Information 4.5.2 Reinsurance Product Profiles, Application and Specification 4.5.3 Swiss Re Reinsurance Market Performance (2015-2020) 4.5.4 Swiss Re Business Overview 4.6 RGA Reinsurance Company 4.6.1 RGA Reinsurance Company Basic Information 4.6.2 Reinsurance Product Profiles, Application and Specification 4.6.3 RGA Reinsurance Company Reinsurance Market Performance (2015-2020) 4.6.4 RGA Reinsurance Company Business Overview 4.7 Argo Group International Holdings 4.7.1 Argo Group International Holdings Basic Information 4.7.2 Reinsurance Product Profiles, Application and Specification 4.7.3 Argo Group International Holdings Reinsurance Market Performance (2015-2020) 4.7.4 Argo Group International Holdings Business Overview 4.8 Berkley Re 4.8.1 Berkley Re Basic Information 4.8.2 Reinsurance Product Profiles, Application and Specification 4.8.3 Berkley Re Reinsurance Market Performance (2015-2020) 4.8.4 Berkley Re Business Overview 4.9 BMS 4.9.1 BMS Basic Information 4.9.2 Reinsurance Product Profiles, Application and Specification 4.9.3 BMS Reinsurance Market Performance (2015-2020) 4.9.4 BMS Business Overview 4.10 Coface 4.10.1 Coface Basic Information 4.10.2 Reinsurance Product Profiles, Application and Specification 4.10.3 Coface Reinsurance Market Performance (2015-2020) 4.10.4 Coface Business Overview 4.11 OdysseyRe 4.11.1 OdysseyRe Basic Information 4.11.2 Reinsurance Product Profiles, Application and Specification 4.11.3 OdysseyRe Reinsurance Market Performance (2015-2020) 4.11.4 OdysseyRe Business Overview 5 Global Reinsurance Market Analysis by Regions 5.1 Global Reinsurance Sales, Revenue and Market Share by Regions 5.1.1 Global Reinsurance Sales by Regions (2015-2020) 5.1.2 Global Reinsurance Revenue by Regions (2015-2020) 5.2 North America Reinsurance Sales and Growth Rate (2015-2020) 5.3 Europe Reinsurance Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Reinsurance Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Reinsurance Sales and Growth Rate (2015-2020) 5.6 South America Reinsurance Sales and Growth Rate (2015-2020) 6 North America Reinsurance Market Analysis by Countries 6.1 North America Reinsurance Sales, Revenue and Market Share by Countries 6.1.1 North America Reinsurance Sales by Countries (2015-2020) 6.1.2 North America Reinsurance Revenue by Countries (2015-2020) 6.1.3 North America Reinsurance Market Under COVID-19 6.2 United States Reinsurance Sales and Growth Rate (2015-2020) 6.2.1 United States Reinsurance Market Under COVID-19 6.3 Canada Reinsurance Sales and Growth Rate (2015-2020) 6.4 Mexico Reinsurance Sales and Growth Rate (2015-2020) 7 Europe Reinsurance Market Analysis by Countries 7.1 Europe Reinsurance Sales, Revenue and Market Share by Countries 7.1.1 Europe Reinsurance Sales by Countries (2015-2020) 7.1.2 Europe Reinsurance Revenue by Countries (2015-2020) 7.1.3 Europe Reinsurance Market Under COVID-19 7.2 Germany Reinsurance Sales and Growth Rate (2015-2020) 7.2.1 Germany Reinsurance Market Under COVID-19 7.3 UK Reinsurance Sales and Growth Rate (2015-2020) 7.3.1 UK Reinsurance Market Under COVID-19 7.4 France Reinsurance Sales and Growth Rate (2015-2020) 7.4.1 France Reinsurance Market Under COVID-19 7.5 Italy Reinsurance Sales and Growth Rate (2015-2020) 7.5.1 Italy Reinsurance Market Under COVID-19 7.6 Spain Reinsurance Sales and Growth Rate (2015-2020) 7.6.1 Spain Reinsurance Market Under COVID-19 7.7 Russia Reinsurance Sales and Growth Rate (2015-2020) 7.7.1 Russia Reinsurance Market Under COVID-19 8 Asia-Pacific Reinsurance Market Analysis by Countries 8.1 Asia-Pacific Reinsurance Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Reinsurance Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Reinsurance Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Reinsurance Market Under COVID-19 8.2 China Reinsurance Sales and Growth Rate (2015-2020) 8.2.1 China Reinsurance Market Under COVID-19 8.3 Japan Reinsurance Sales and Growth Rate (2015-2020) 8.3.1 Japan Reinsurance Market Under COVID-19 8.4 South Korea Reinsurance Sales and Growth Rate (2015-2020) 8.4.1 South Korea Reinsurance Market Under COVID-19 8.5 Australia Reinsurance Sales and Growth Rate (2015-2020) 8.6 India Reinsurance Sales and Growth Rate (2015-2020) 8.6.1 India Reinsurance Market Under COVID-19 8.7 Southeast Asia Reinsurance Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Reinsurance Market Under COVID-19 9 Middle East and Africa Reinsurance Market Analysis by Countries 9.1 Middle East and Africa Reinsurance Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Reinsurance Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Reinsurance Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Reinsurance Market Under COVID-19 9.2 Saudi Arabia Reinsurance Sales and Growth Rate (2015-2020) 9.3 UAE Reinsurance Sales and Growth Rate (2015-2020) 9.4 Egypt Reinsurance Sales and Growth Rate (2015-2020) 9.5 Nigeria Reinsurance Sales and Growth Rate (2015-2020) 9.6 South Africa Reinsurance Sales and Growth Rate (2015-2020) 10 South America Reinsurance Market Analysis by Countries 10.1 South America Reinsurance Sales, Revenue and Market Share by Countries 10.1.1 South America Reinsurance Sales by Countries (2015-2020) 10.1.2 South America Reinsurance Revenue by Countries (2015-2020) 10.1.3 South America Reinsurance Market Under COVID-19 10.2 Brazil Reinsurance Sales and Growth Rate (2015-2020) 10.2.1 Brazil Reinsurance Market Under COVID-19 10.3 Argentina Reinsurance Sales and Growth Rate (2015-2020) 10.4 Columbia Reinsurance Sales and Growth Rate (2015-2020) 10.5 Chile Reinsurance Sales and Growth Rate (2015-2020) 11 Global Reinsurance Market Segment by Types 11.1 Global Reinsurance Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Reinsurance Sales and Market Share by Types (2015-2020) 11.1.2 Global Reinsurance Revenue and Market Share by Types (2015-2020) 11.2 Life Sales and Price (2015-2020) 11.3 Non-life Sales and Price (2015-2020) 12 Global Reinsurance Market Segment by Applications 12.1 Global Reinsurance Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Reinsurance Sales and Market Share by Applications (2015-2020) 12.1.2 Global Reinsurance Revenue and Market Share by Applications (2015-2020) 12.2 Agency Sales, Revenue and Growth Rate (2015-2020) 12.3 Broker Sales, Revenue and Growth Rate (2015-2020) 12.4 Bancassurance Sales, Revenue and Growth Rate (2015-2020) 12.5 Direct Writing Sales, Revenue and Growth Rate (2015-2020) 13 Reinsurance Market Forecast by Regions (2020-2026) 13.1 Global Reinsurance Sales, Revenue and Growth Rate (2020-2026) 13.2 Reinsurance Market Forecast by Regions (2020-2026) 13.2.1 North America Reinsurance Market Forecast (2020-2026) 13.2.2 Europe Reinsurance Market Forecast (2020-2026) 13.2.3 Asia-Pacific Reinsurance Market Forecast (2020-2026) 13.2.4 Middle East and Africa Reinsurance Market Forecast (2020-2026) 13.2.5 South America Reinsurance Market Forecast (2020-2026) 13.3 Reinsurance Market Forecast by Types (2020-2026) 13.4 Reinsurance Market Forecast by Applications (2020-2026) 13.5 Reinsurance Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Reinsurance

Request Sample

Reinsurance