Shave Foam Market Size, Share, and Trends Analysis Report

CAGR :

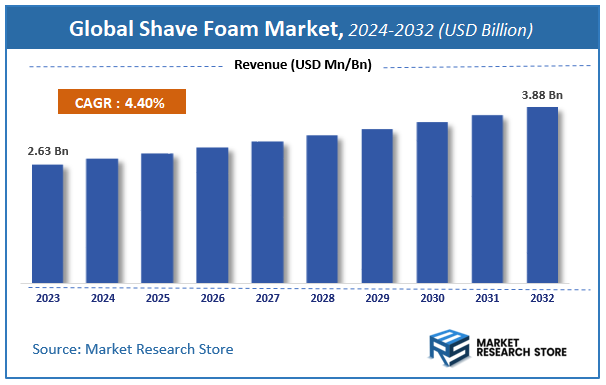

| Market Size 2023 (Base Year) | USD 2.63 Billion |

| Market Size 2032 (Forecast Year) | USD 3.88 Billion |

| CAGR | 4.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Shave Foam Market Insights

According to Market Research Store, the global shave foam market size was valued at around USD 2.63 billion in 2023 and is estimated to reach USD 3.88 billion by 2032, to register a CAGR of approximately 4.4% in terms of revenue during the forecast period 2024-2032.

The shave foam report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Shave Foam Market: Overview

Shave foam is a cosmetic product primarily used during shaving to facilitate smooth razor glide and reduce irritation on the skin. It is typically composed of a combination of water, surfactants, emollients, and sometimes moisturizers, which work together to create a rich lather. The foam softens facial hair, making it easier for razors to cut through, while providing a barrier between the razor blade and the skin to minimize the risk of nicks, cuts, and razor burns. Shave foam is often preferred for its convenience as it is easy to apply and requires minimal effort to generate a creamy lather.

Key Highlights

- The shave foam market is anticipated to grow at a CAGR of 4.4% during the forecast period.

- The global shave foam market was estimated to be worth approximately USD 2.63 billion in 2023 and is projected to reach a value of USD 3.88 billion by 2032.

- The growth of the shave foam market is being driven by increasing grooming awareness, the rise in male grooming products, and the growing demand for high-quality shaving accessories.

- Based on the product type, the aerosol shave segment is growing at a high rate and is projected to dominate the market.

- On the basis of end user, the men segment is projected to swipe the largest market share.

- In terms of distribution channel, the offline retail segment is expected to dominate the market.

- Based on the packaging type, the aerosol cans segment is expected to dominate the market.

- In terms of price range, the low-priced products segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Shave Foam Market: Dynamics

- Many shave foams come in aerosol cans, which can have a negative environmental impact due to propellants and packaging, potentially reducing their attractiveness to eco-conscious consumers.

- Substitute Products and Changing Consumer Preferences: Alternatives like shaving gels, creams, and electric razors are gaining popularity, posing a challenge to the traditional shave foam market.

Opportunities:

- Organic and Natural Shaving Foam Products: There is growing demand for organic, chemical-free, and natural products among consumers who are becoming more conscious of the ingredients in their grooming products. Brands can capitalize on this trend by offering eco-friendly and natural shave foam options.

- Product Innovation and Customization: Innovating with shaving foam formulations that target specific skin types or preferences (e.g., sensitive skin, moisturizing, anti-aging properties) offers opportunities for differentiation and expansion into niche markets.

- Expanding Male Grooming Segment in Emerging Markets: As grooming habits in regions such as Asia-Pacific, Latin America, and the Middle East continue to evolve, brands can tap into new customer bases by offering products tailored to local preferences.

- Sustainability Initiatives and Eco-friendly Packaging: There is an opportunity for brands to introduce sustainable packaging (like recyclable or biodegradable containers) to appeal to environmentally conscious consumers and differentiate themselves in the market.

Challenges:

- Fluctuations in Raw Material Prices: The cost of key raw materials for shaving foam production, such as chemicals and packaging materials, can be volatile, which may affect pricing and profitability for manufacturers.

- Regulatory Challenges and Ingredient Restrictions: Shaving foam manufacturers must comply with a range of regulations regarding product ingredients and safety standards. Changes in regulations may lead to product reformulations or delays in market entry.

- Consumer Sensitivity to Fragrances and Chemicals: Many shave foams contain fragrances or chemicals that may irritate sensitive skin. Meeting the demand for hypoallergenic, fragrance-free, or dermatologist-tested options while maintaining product efficacy can be a challenge.

- Pressure from Local and Regional Brands: In various regions, local and regional brands may offer lower-priced alternatives that challenge the dominance of established global brands, especially in price-sensitive markets.

Shave Foam Market: Report Scope

This report thoroughly analyzes the Shave Foam Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Shave Foam Market |

| Market Size in 2023 | USD 2.63 Billion |

| Market Forecast in 2032 | USD 3.88 Billion |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 165 |

| Key Companies Covered | Gillette, Beiersdorf, Unilever, L'Oreal, Colgate-Palmolive, Energizer Holdings, Godrej, Johnson & Johnson, Perio |

| Segments Covered | By Product Type, By End User, By Distribution Channel, By Packaging Type, By Price Range, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Shave Foam Market: Segmentation Insights

The global shave foam market is divided by product type, end user, distribution channel, packaging type, price range, and region.

Segmentation Insights by Product Type

Based on product type, the global shave foam market is divided into classic shave foam, aerosol shave foam, gel shave foam, natural & organic shave foam, and sensitive skin shave foam.

Aerosol Shave Foam is the most dominant segment, widely recognized for its ease of use and quick application. Aerosol foams are favored due to their convenient spray mechanism, offering smooth and even application without much effort. This type is often preferred by both consumers looking for an efficient shave and by those seeking products with added convenience.

Following Aerosol Shave Foam, Classic Shave Foam is a traditional favorite that has stood the test of time. It's typically sold in cans but is dispensed manually, requiring the user to lather it with their hands before application. Despite its somewhat old-fashioned appeal, it remains popular for its simple, non-aerosol formula and is preferred by individuals who value a more hands-on, ritualistic approach to shaving.

Gel Shave Foam comes next in terms of market dominance. Known for its dense texture, gel shave foam offers a rich lather that allows for a smoother and more comfortable shave. It’s often favored by people with sensitive skin as it provides added moisture and protection, preventing razor burn and nicks. The gel format can be slightly more expensive, but many consumers find its superior performance worth the extra cost.

Natural & Organic Shave Foam has been gaining traction recently, driven by the growing consumer demand for eco-friendly and skin-safe products. This segment includes shave foams made from plant-based ingredients and free from synthetic chemicals. Although still a niche market, it appeals primarily to health-conscious consumers or those with allergies to synthetic ingredients, making it a smaller yet rapidly growing segment.

Lastly, Sensitive Skin Shave Foam is a segment designed specifically for individuals with more delicate skin that reacts poorly to harsh chemicals or fragrances. While it is a necessary product for those with specific skin sensitivities, it remains a smaller segment compared to the others. However, as awareness about skin care grows, this segment is projected to see gradual expansion.

Segmentation Insights by End User

On the basis of end user, the global shave foam market is bifurcated into men and women.

In the shave foam market, segmentation by end user Men being the dominant segment. This dominance is driven by the larger and more established consumer base in the male grooming market. Men’s shaving products, including shave foam, have been a staple in personal care routines for decades. The majority of products are designed for men's skin, which is generally thicker and requires more lubrication for a close shave. As a result, many brands focus on developing and marketing shave foams specifically tailored to men, offering features like thicker lather, moisture, and protection against razor burn.

Women, while a smaller segment in comparison to men, represent a growing and evolving market for shave foam products. Women's grooming routines often include shaving for areas such as legs, underarms, and the bikini line, creating a demand for products that offer smooth application and gentle formulas. The rise of women’s shaving and grooming products has led to the development of more specialized shave foams catering to female preferences, such as lighter scents, moisturizing ingredients, and a focus on skin sensitivity. As more women engage in shaving as part of their regular grooming routine, this segment is steadily growing, though it still remains secondary to the male segment.

Segmentation Insights by Distribution Channel

Based on distribution channel, the global shave foam market is divided into online retail and offline retail.

Offline Retail holds a larger share of the shave foam market, mainly due to the traditional nature of purchasing personal care products. Physical stores, such as supermarkets, pharmacies, and department stores, are the primary distribution channels for shave foam products. Consumers often prefer the tactile experience of seeing, testing, and purchasing shaving products in-store. Additionally, offline retail provides the immediate gratification of buying and using the product right away, which remains a significant factor, particularly for products that are used on a daily basis. This segment benefits from widespread accessibility and convenience, as many consumers still make routine trips to these stores for their everyday personal care needs.

On the other hand, Online Retail is growing rapidly, driven by the increasing trend of e-commerce and changing shopping behaviors. Online platforms like Amazon, eBay, and dedicated brand websites are becoming increasingly popular for purchasing shaving products due to the ease of shopping from home, the availability of product reviews, and often better pricing. The convenience of home delivery, along with the ability to purchase in bulk or subscribe for regular deliveries, has also contributed to the rise in online purchases. Additionally, many consumers are drawn to online shopping for niche products, like natural or organic shave foams, which may not always be available in physical stores.

Segmentation Insights by Packaging Type

On the basis of packaging type, the global shave foam market is bifurcated into foam dispensers, aerosol cans, tubes, and refill packs.

Aerosol Cans dominate the shave foam market due to their convenience and ease of use. Aerosol cans are the most popular form of packaging because they allow for a quick, mess-free application of shave foam with just a simple spray. This packaging type is especially favored for its portability and the fact that it dispenses the foam in a consistent manner, making it ideal for those who seek efficiency in their shaving routine. The convenience of carrying these cans for travel or quick use also adds to their popularity.

Foam Dispensers are also a popular packaging choice, second only to aerosol cans. Unlike aerosol cans, foam dispensers use a pump to release the foam, often requiring manual effort to lather the product. These dispensers are more environmentally friendly as they do not use propellants, making them an appealing option for eco-conscious consumers. They often come in reusable bottles, which can be refilled, adding to their appeal in terms of sustainability. Foam dispensers are particularly favored by consumers who appreciate a more controlled and personalized shaving experience.

Tubes are typically smaller in size and are often seen as a more traditional option. Shave foam in tubes can be squeezed out manually and tends to be thicker than the foam dispensed from aerosol cans or dispensers. Although this packaging type is less convenient compared to aerosol cans, it appeals to consumers looking for a more controlled, cost-effective, and often longer-lasting product. Tubes are also portable and easy to carry, though they are less popular in the mass market compared to other packaging options.

Refill Packs are a growing segment, especially for environmentally conscious consumers who prefer to reduce packaging waste. These packs are designed to refill foam dispensers or aerosol cans and offer an eco-friendly option by reducing the need for new containers. Refill packs are often priced lower, making them an attractive option for consumers who want to save money in the long term. However, they are less convenient than pre-packaged products and are typically only chosen by those specifically seeking to reduce their environmental impact.

Segmentation Insights by Price Range

On the basis of price range, the global shave foam market is bifurcated into low-priced products, mid-range products, premium products, and luxury products.

Low-priced Products are the most dominant segment in the shave foam market. These products cater to a wide consumer base, offering affordability and accessibility. They are often found in large retail chains and are mass-produced, typically in larger quantities to meet the demand for budget-friendly options. Low-priced shave foams are usually sold in basic packaging like aerosol cans or tubes, focusing on value for money. These products may lack the advanced ingredients or features found in higher-priced options but still perform adequately for everyday shaving needs. The affordability of these products makes them popular, especially among budget-conscious consumers or those who prefer to buy in bulk.

Mid-range Products hold a significant portion of the market, striking a balance between price and quality. These shave foams are typically marketed as offering better formulations, more refined packaging, and added benefits like moisturization or enhanced skin protection. Mid-range products are often found in mainstream retail outlets and appeal to consumers who are willing to pay a little more for higher quality without moving into premium pricing. They cater to the majority of consumers looking for a good shaving experience without the higher cost associated with luxury or premium products. Brands in this range often offer a variety of scents and formulations, catering to different skin types and preferences.

Premium Products are the next dominant segment, catering to consumers who prioritize high-quality ingredients, added skincare benefits, and a more luxurious shaving experience. Premium shave foams often contain advanced moisturizers, vitamins, and natural ingredients that promise superior skin care. They are typically marketed as offering an elevated experience, often in upscale packaging. These products tend to be priced higher than mid-range options and are sold in specialized stores or through online channels targeting consumers who view shaving as a grooming ritual and are willing to invest in top-tier products for optimal results. The growing trend of personal care and self-pampering has contributed to the rise of premium products.

Luxury Products represent the smallest segment in the shave foam market but are associated with the highest-end offerings. These products are crafted with premium ingredients, often including rare or organic substances like essential oils, and are presented in sophisticated packaging. Luxury shave foams are often marketed as part of an indulgent grooming experience and target consumers who are willing to spend significantly more for exclusivity, superior quality, and a high-end experience. These products are typically sold through high-end retail outlets, department stores, or specialty boutiques and appeal to niche consumers who treat shaving as a luxury experience rather than a daily routine.

Shave Foam Market: Regional Insights

- North America is expected to dominates the global market

North America remains the most dominant region in the shave foam market. With a highly developed economy, a robust retail infrastructure, and increasing demand for personal grooming products, North America sees widespread adoption of shaving foam. The region's demand is driven by higher disposable incomes and a preference for premium products, with a strong presence of global and local brands catering to the diverse needs of consumers.

Europe follows as a significant market for shave foam, with a notable focus on quality and sustainability. European consumers are highly inclined towards eco-friendly and dermatologically tested products. This demand is amplified by the increasing awareness of self-care and grooming trends. The market is supported by several prominent manufacturers and innovative formulations that appeal to the health-conscious consumer base in this region.

Asia Pacific (APAC), while not the largest in terms of overall market share, is one of the fastest-growing regions for shave foam. The rising middle class in countries like China, India, and Japan has led to an increase in grooming habits. Traditional wet shaving continues to dominate in many APAC countries, contributing to the growth of shaving foam products. The market growth is further fueled by a shift towards western-style grooming in urban areas and an expanding retail market.

Latin America presents moderate growth in the shave foam market. The region is gradually adopting grooming products due to a shift in lifestyle and increased exposure to international brands. However, economic constraints in certain countries limit the widespread use of premium products, with consumers showing a preference for more affordable shaving solutions. The market is still developing, and demand is increasing, particularly in urban areas.

Middle East sees steady demand for shave foam, primarily driven by the growing influence of grooming trends among men. While the market remains somewhat niche, affluent consumer segments, especially in countries like the UAE and Saudi Arabia, are contributing to the market’s growth. The region also has a growing demand for high-end grooming products, with a focus on luxury brands and premium formulations.

Africa (MEA) has the smallest market share for shave foam, but the market is growing slowly. In regions like North Africa and South Africa, the demand is increasing due to the rising middle class and changing grooming habits. However, challenges like lower disposable incomes, limited access to premium products, and less market penetration in rural areas still hinder rapid growth.

Recent Developments

- In March 2024, Gillette partnered with the National Basketball Youth Mentorship Program (NBYMP) in Canada to support young boys' personal development by promoting mentorship and boosting self-esteem through basketball.

- In May 2023, Beiersdorf's Leipzig-Seehausen facility began producing NIVEA and Hidrofugal deodorants, hair sprays, and shaving foams for the European market.

Shave Foam Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the shave foam market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global shave foam market include:

- Gillette

- Beiersdorf

- Unilever

- L'Oreal

- Colgate-Palmolive

- Energizer Holdings

- Godrej

- Johnson & Johnson

- Perio

The global shave foam market is segmented as follows:

By Product Type

- Classic Shave Foam

- Aerosol Shave Foam

- Gel Shave Foam

- Natural and Organic Shave Foam

- Sensitive Skin Shave Foam

By End User

- Men

- Women

By Distribution Channel

- Online Retail

- Offline Retail

By Packaging Type

- Foam Dispensers

- Aerosol Cans

- Tubes

- Refill Packs

By Price Range

- Low-priced Products

- Mid-range Products

- Premium Products

- Luxury Products

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Shave Foam Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Shave Foam Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Shave Foam Overall Market Size 2.1 Global Shave Foam Market Size: 2021 VS 2028 2.2 Global Shave Foam Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Shave Foam Sales: 2017-2028 3 Company Landscape 3.1 Top Shave Foam Players in Global Market 3.2 Top Global Shave Foam Companies Ranked by Revenue 3.3 Global Shave Foam Revenue by Companies 3.4 Global Shave Foam Sales by Companies 3.5 Global Shave Foam Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Shave Foam Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Shave Foam Product Type 3.8 Tier 1, Tier 2 and Tier 3 Shave Foam Players in Global Market 3.8.1 List of Global Tier 1 Shave Foam Companies 3.8.2 List of Global Tier 2 and Tier 3 Shave Foam Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Shave Foam Market Size Markets, 2021 & 2028 4.1.2 Aftershave 4.1.3 Pre-shave 4.2 By Type - Global Shave Foam Revenue & Forecasts 4.2.1 By Type - Global Shave Foam Revenue, 2017-2022 4.2.2 By Type - Global Shave Foam Revenue, 2023-2028 4.2.3 By Type - Global Shave Foam Revenue Market Share, 2017-2028 4.3 By Type - Global Shave Foam Sales & Forecasts 4.3.1 By Type - Global Shave Foam Sales, 2017-2022 4.3.2 By Type - Global Shave Foam Sales, 2023-2028 4.3.3 By Type - Global Shave Foam Sales Market Share, 2017-2028 4.4 By Type - Global Shave Foam Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Shave Foam Market Size, 2021 & 2028 5.1.2 Stores 5.1.3 Online Retail 5.2 By Application - Global Shave Foam Revenue & Forecasts 5.2.1 By Application - Global Shave Foam Revenue, 2017-2022 5.2.2 By Application - Global Shave Foam Revenue, 2023-2028 5.2.3 By Application - Global Shave Foam Revenue Market Share, 2017-2028 5.3 By Application - Global Shave Foam Sales & Forecasts 5.3.1 By Application - Global Shave Foam Sales, 2017-2022 5.3.2 By Application - Global Shave Foam Sales, 2023-2028 5.3.3 By Application - Global Shave Foam Sales Market Share, 2017-2028 5.4 By Application - Global Shave Foam Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Shave Foam Market Size, 2021 & 2028 6.2 By Region - Global Shave Foam Revenue & Forecasts 6.2.1 By Region - Global Shave Foam Revenue, 2017-2022 6.2.2 By Region - Global Shave Foam Revenue, 2023-2028 6.2.3 By Region - Global Shave Foam Revenue Market Share, 2017-2028 6.3 By Region - Global Shave Foam Sales & Forecasts 6.3.1 By Region - Global Shave Foam Sales, 2017-2022 6.3.2 By Region - Global Shave Foam Sales, 2023-2028 6.3.3 By Region - Global Shave Foam Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Shave Foam Revenue, 2017-2028 6.4.2 By Country - North America Shave Foam Sales, 2017-2028 6.4.3 US Shave Foam Market Size, 2017-2028 6.4.4 Canada Shave Foam Market Size, 2017-2028 6.4.5 Mexico Shave Foam Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Shave Foam Revenue, 2017-2028 6.5.2 By Country - Europe Shave Foam Sales, 2017-2028 6.5.3 Germany Shave Foam Market Size, 2017-2028 6.5.4 France Shave Foam Market Size, 2017-2028 6.5.5 U.K. Shave Foam Market Size, 2017-2028 6.5.6 Italy Shave Foam Market Size, 2017-2028 6.5.7 Russia Shave Foam Market Size, 2017-2028 6.5.8 Nordic Countries Shave Foam Market Size, 2017-2028 6.5.9 Benelux Shave Foam Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Shave Foam Revenue, 2017-2028 6.6.2 By Region - Asia Shave Foam Sales, 2017-2028 6.6.3 China Shave Foam Market Size, 2017-2028 6.6.4 Japan Shave Foam Market Size, 2017-2028 6.6.5 South Korea Shave Foam Market Size, 2017-2028 6.6.6 Southeast Asia Shave Foam Market Size, 2017-2028 6.6.7 India Shave Foam Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Shave Foam Revenue, 2017-2028 6.7.2 By Country - South America Shave Foam Sales, 2017-2028 6.7.3 Brazil Shave Foam Market Size, 2017-2028 6.7.4 Argentina Shave Foam Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Shave Foam Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Shave Foam Sales, 2017-2028 6.8.3 Turkey Shave Foam Market Size, 2017-2028 6.8.4 Israel Shave Foam Market Size, 2017-2028 6.8.5 Saudi Arabia Shave Foam Market Size, 2017-2028 6.8.6 UAE Shave Foam Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 Gillette 7.1.1 Gillette Corporate Summary 7.1.2 Gillette Business Overview 7.1.3 Gillette Shave Foam Major Product Offerings 7.1.4 Gillette Shave Foam Sales and Revenue in Global (2017-2022) 7.1.5 Gillette Key News 7.2 Beiersdorf 7.2.1 Beiersdorf Corporate Summary 7.2.2 Beiersdorf Business Overview 7.2.3 Beiersdorf Shave Foam Major Product Offerings 7.2.4 Beiersdorf Shave Foam Sales and Revenue in Global (2017-2022) 7.2.5 Beiersdorf Key News 7.3 Unilever 7.3.1 Unilever Corporate Summary 7.3.2 Unilever Business Overview 7.3.3 Unilever Shave Foam Major Product Offerings 7.3.4 Unilever Shave Foam Sales and Revenue in Global (2017-2022) 7.3.5 Unilever Key News 7.4 L'Oreal 7.4.1 L'Oreal Corporate Summary 7.4.2 L'Oreal Business Overview 7.4.3 L'Oreal Shave Foam Major Product Offerings 7.4.4 L'Oreal Shave Foam Sales and Revenue in Global (2017-2022) 7.4.5 L'Oreal Key News 7.5 Colgate-Palmolive 7.5.1 Colgate-Palmolive Corporate Summary 7.5.2 Colgate-Palmolive Business Overview 7.5.3 Colgate-Palmolive Shave Foam Major Product Offerings 7.5.4 Colgate-Palmolive Shave Foam Sales and Revenue in Global (2017-2022) 7.5.5 Colgate-Palmolive Key News 7.6 Energizer Holdings 7.6.1 Energizer Holdings Corporate Summary 7.6.2 Energizer Holdings Business Overview 7.6.3 Energizer Holdings Shave Foam Major Product Offerings 7.6.4 Energizer Holdings Shave Foam Sales and Revenue in Global (2017-2022) 7.6.5 Energizer Holdings Key News 7.7 Godrej 7.7.1 Godrej Corporate Summary 7.7.2 Godrej Business Overview 7.7.3 Godrej Shave Foam Major Product Offerings 7.7.4 Godrej Shave Foam Sales and Revenue in Global (2017-2022) 7.7.5 Godrej Key News 7.8 Johnson & Johnson 7.8.1 Johnson & Johnson Corporate Summary 7.8.2 Johnson & Johnson Business Overview 7.8.3 Johnson & Johnson Shave Foam Major Product Offerings 7.8.4 Johnson & Johnson Shave Foam Sales and Revenue in Global (2017-2022) 7.8.5 Johnson & Johnson Key News 7.9 Perio 7.9.1 Perio Corporate Summary 7.9.2 Perio Business Overview 7.9.3 Perio Shave Foam Major Product Offerings 7.9.4 Perio Shave Foam Sales and Revenue in Global (2017-2022) 7.9.5 Perio Key News 8 Global Shave Foam Production Capacity, Analysis 8.1 Global Shave Foam Production Capacity, 2017-2028 8.2 Shave Foam Production Capacity of Key Manufacturers in Global Market 8.3 Global Shave Foam Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Shave Foam Supply Chain Analysis 10.1 Shave Foam Industry Value Chain 10.2 Shave Foam Upstream Market 10.3 Shave Foam Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Shave Foam Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Shave Foam

Request Sample

Shave Foam