Smoke Ingredients for Food Market Size, Share, and Trends Analysis Report

CAGR :

| Market Size 2023 (Base Year) | USD 956.94 Million |

| Market Size 2032 (Forecast Year) | USD 1658.39 Million |

| CAGR | 6.3% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Smoke Ingredients for Food Market Insights

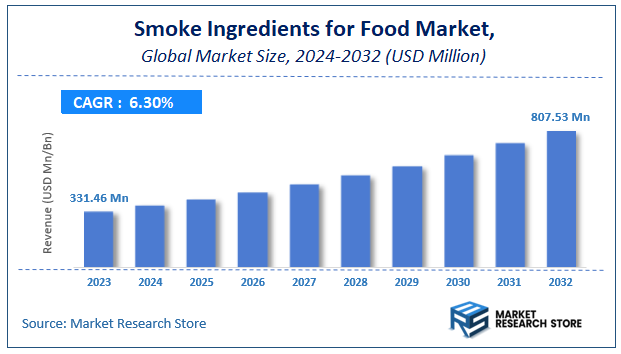

According to Market Research Store, the global smoke ingredients for food market size was valued at around USD 956.94 million in 2023 and is estimated to reach USD 1658.39 million by 2032, to register a CAGR of approximately 6.3% in terms of revenue during the forecast period 2024-2032.

The smoke ingredients for food report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Smoke Ingredients for Food Market: Overview

Smoke ingredients for food are natural or synthetic substances used to impart smoky flavor, aroma, and in some cases, preservative qualities to food products without traditional smoking methods. These ingredients are derived from controlled combustion or pyrolysis of hardwoods (such as hickory, oak, or maple), and are processed into liquid, powder, or paste forms for easier application in industrial food production or home cooking. Smoke ingredients are commonly used in processed meats, cheeses, sauces, snacks, and ready-to-eat meals to replicate the desirable sensory attributes of wood smoking while improving production efficiency and safety.

The use of smoke ingredients for food is growing due to several key factors. Modern food manufacturers are increasingly favoring smoke flavoring over traditional smoking techniques to achieve consistent flavor profiles, reduce processing time, and minimize harmful byproducts like polycyclic aromatic hydrocarbons (PAHs). Additionally, consumer demand for convenient, flavorful, and clean-label products is driving innovation in natural and organic smoke ingredients. Advances in smoke distillation and filtration technologies are also enabling the production of purified, food-safe smoke condensates with customizable flavor intensity. As demand rises for barbecued, grilled, and smoked flavor experiences across global cuisines, the smoke ingredients market is expected to expand, particularly in snack foods, plant-based meat alternatives, and marinades.

Key Highlights

- The smoke ingredients for food market is anticipated to grow at a CAGR of 6.3% during the forecast period.

- The global smoke ingredients for food market was estimated to be worth approximately USD 956.94 million in 2023 and is projected to reach a value of USD 1658.39 million by 2032.

- The growth of the smoke ingredients for food market is being driven by a rising global consumer preference for the distinct and appealing flavors of smoked foods across a wide range of culinary applications.

- Based on the type, the liquid segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the meat and seafood segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Smoke Ingredients for Food Market: Dynamics

Key Growth Drivers:

- Consumer Demand for Smoky Flavors: Smoky notes are a popular flavor profile in various cuisines and food categories, including meats, cheeses, sauces, snacks, and beverages, driving the demand for convenient smoke ingredients.

- Food Safety Concerns Regarding Traditional Smoking: Traditional wood smoking can produce potentially harmful byproducts like polycyclic aromatic hydrocarbons (PAHs). Smoke ingredients offer a safer alternative with controlled levels of these compounds.

- Need for Consistent Flavor and Quality: Smoke ingredients provide manufacturers with a consistent and reproducible smoky flavor profile, unlike traditional smoking which can be variable.

- Cost-Effectiveness and Efficiency in Food Production: Using smoke ingredients can be more cost-effective and time-efficient than traditional smoking methods, streamlining production processes.

- Versatility in Application: Smoke ingredients can be easily incorporated into a wide range of food products and processing methods, offering flexibility to food manufacturers.

- Growing Demand for Processed and Convenience Foods: The increasing consumption of processed and convenience foods, where consistent flavor is crucial, boosts the demand for smoke ingredients.

- Clean Label Trends: Some smoke ingredients derived from natural sources align with the clean label trend, appealing to consumers seeking simpler and more recognizable ingredients.

Restraints:

- Consumer Perception and "Naturalness" Concerns: Some consumers may perceive smoke ingredients as artificial or less "natural" compared to traditionally smoked foods, potentially limiting their acceptance.

- Regulatory Scrutiny and PAH Limits: Regulations regarding the levels of PAHs in smoke ingredients and smoked foods can be stringent and vary across regions, requiring careful monitoring and compliance.

- Flavor Authenticity and Complexity: Achieving the full depth and complexity of traditionally smoked flavors can be a challenge with some smoke ingredients.

- Potential for Off-Flavors if Not Used Correctly: Overuse or improper application of smoke ingredients can result in undesirable or artificial-tasting products.

- Competition from Traditional Smoking Methods: Despite the advantages of smoke ingredients, traditional smoking remains a preferred method for certain premium or artisanal food products.

- Price Sensitivity in Some Applications: In cost-sensitive food categories, manufacturers may opt for cheaper flavoring alternatives over higher-quality smoke ingredients.

- Labeling Requirements and Consumer Transparency: Clear and accurate labeling of smoke ingredients is crucial to maintain consumer trust and comply with regulations.

Opportunities:

- Development of Natural and Clean Label Smoke Ingredients: Innovations in extraction and processing of natural smoke sources can lead to ingredients that better align with clean label trends.

- Tailored Flavor Profiles for Specific Applications: Creating smoke ingredients with specific flavor nuances and intensities designed for different food categories and culinary styles.

- Encapsulation and Delivery Systems: Developing advanced encapsulation technologies to improve the stability, dispersibility, and controlled release of smoke flavors in food products.

- Expansion into Plant-Based Meat Alternatives: Smoke flavors are crucial for enhancing the palatability and mimicking the taste of traditionally smoked meats in plant-based alternatives.

- Use in Seasonings, Sauces, and Marinades: The demand for ready-to-use seasonings, sauces, and marinades with smoky notes presents a significant opportunity for smoke ingredient manufacturers.

- Growth in Global Culinary Exploration: As consumers become more adventurous with international cuisines that feature smoky flavors, the demand for authentic smoke ingredients will likely increase.

- Integration with Smart Manufacturing and Automation: Utilizing advanced technologies to optimize the production and quality control of smoke ingredients.

Challenges:

- Balancing Flavor Authenticity with Safety Requirements: Achieving a genuine smoky flavor profile while adhering to strict regulations regarding PAH levels.

- Overcoming Negative Consumer Perceptions: Educating consumers about the safety and potential benefits of high-quality smoke ingredients derived from natural sources.

- Ensuring Consistent Quality and Supply Chain Reliability: Maintaining consistent flavor and quality across different batches and ensuring a stable supply of raw materials.

- Adapting to Evolving Regulatory Landscapes: Staying informed about and complying with changing food safety regulations related to smoke flavorings.

- Providing Cost-Effective Solutions Without Compromising Quality: Offering smoke ingredients that meet both the flavor and budgetary requirements of food manufacturers.

- Developing Accurate and Reliable Detection Methods for PAHs: Continuously improving analytical methods for monitoring and controlling PAH levels in smoke ingredients and food products.

- Educating Food Manufacturers on Optimal Usage: Providing technical support and guidance to food manufacturers on the proper application and dosage of different smoke ingredients to achieve desired results.

Smoke Ingredients for Food Market: Report Scope

This report thoroughly analyzes the Smoke Ingredients for Food Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Smoke Ingredients for Food Market |

| Market Size in 2023 | USD 956.94 Million |

| Market Forecast in 2032 | USD 1658.39 Million |

| Growth Rate | CAGR of 6.3% |

| Number of Pages | 193 |

| Key Companies Covered | MSK, FRUTAROM Savory Solutions GmbH, Redbrook Ingredients Services, Besmoke, Red Arrow, Dempsey Corporation, Azelis, Kerry Ingredients, Associated British Foods Plc., Others |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Smoke Ingredients for Food Market: Segmentation Insights

The global smoke ingredients for food market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global smoke ingredients for food market is divided into liquid, powder, and others.

Liquid smoke ingredients hold a dominant position in the Smoke Ingredients for Food Market, driven by their adaptability, superior flavor penetration, and high demand across the processed food industry. Liquid smoke is created through the controlled pyrolysis of wood, followed by condensation and filtration to remove harmful components like tar and ash. The resulting product captures the desired flavor and aroma compounds, which can be easily integrated into food products. It is extensively used in meat processing—such as for hams, sausages, hot dogs, and deli meats—to simulate traditional smoking while significantly reducing processing time and equipment costs. Additionally, liquid smoke is used in barbecue sauces, marinades, cheese, tofu, and even plant-based meat alternatives, aligning with the growing demand for smoke-flavored vegetarian and vegan products. Manufacturers prefer liquid form for its ease of dosage in automated systems, better adherence to food surfaces, and lower carbon footprint compared to conventional smoking methods. Furthermore, regulatory approval in many regions for liquid smoke products has bolstered their market share, as they meet food safety and clean-label requirements when properly processed and applied.

Powder smoke ingredients, although a smaller market segment, are experiencing notable growth due to their unique benefits in certain applications. These ingredients are typically produced by spray-drying or encapsulating liquid smoke, resulting in a dry, flowable product that can be mixed directly with spice blends, seasonings, and dry rubs. Powdered smoke is highly favored in snack foods such as chips, popcorn, roasted nuts, and jerky, where dry processing is essential. It is also gaining traction in pre-packaged meal kits and instant food products that require flavor stability over long shelf lives. The powder form allows precise formulation control, ease of transport and storage, and minimal moisture introduction—important factors in maintaining the quality of dry or shelf-stable products. While not as widely adopted as liquid smoke, the growing demand for convenience foods and seasonings with complex flavor profiles is steadily expanding the powder segment’s presence in the market.

Segmentation Insights by Application

On the basis of application, the global smoke ingredients for food market is bifurcated into meat and seafood, snacks & sauces, bakery & confectionery, dairy products, and others.

Meat and Seafood represent the dominant application segment in the Smoke Ingredients for Food Market, accounting for the largest share due to the long-standing tradition and demand for smoked flavors in protein-based foods. Liquid and powdered smoke ingredients are extensively used in processed meats like sausages, bacon, ham, jerky, and deli meats to replicate the flavor of traditional smoking while reducing preparation time, cost, and the presence of harmful residues. In seafood, such as smoked salmon and shellfish, smoke ingredients enhance both preservation and taste. The rise of convenience foods and the need for shelf-stable, ready-to-eat meat products further drive this segment’s growth. Moreover, with the expansion of plant-based meat alternatives, manufacturers are incorporating smoke flavors to mimic the traditional profile of grilled or smoked meats, thereby widening the application base within this category.

Snacks & Sauces form a growing and dynamic segment of the market, driven by increasing consumer preference for bold, smoky flavors in products like potato chips, roasted nuts, barbecue sauces, and spicy dips. Smoke ingredients, particularly in powdered form, are widely used to season snacks and create flavor-rich sauces that offer the essence of grilled or flame-cooked foods. The rise in global snack consumption, demand for ethnic and regional flavor profiles, and clean-label seasoning trends are accelerating adoption. This segment is expected to witness robust growth as consumers continue to seek out smoky, savory profiles in packaged and convenience foods.

Bakery & Confectionery is an emerging application area where smoke ingredients are used more selectively. In baked goods, smoke flavoring may be applied to items such as artisanal breads or specialty crackers to enhance their sensory appeal. In confectionery, although less common, smoked vanilla or caramel flavors are gaining niche popularity in gourmet chocolates and upscale dessert items. While this segment currently holds a smaller market share, it is expected to grow moderately with increasing innovation in high-end and experimental bakery products.

Dairy Products also represent a niche yet expanding application for smoke ingredients, especially in products like smoked cheeses, butter, and spreads. Liquid smoke is particularly effective in delivering a consistent smoked profile to dairy without requiring traditional smokehouses. With growing consumer interest in gourmet and specialty dairy products, particularly in Western markets, this segment is witnessing gradual growth. Additionally, plant-based dairy alternatives such as smoked vegan cheese are contributing to demand as producers seek to replicate traditional flavors in non-dairy formats.

Smoke Ingredients for Food Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Smoke Ingredients for Food Market, driven by a long-standing culinary tradition of smoked and barbecue-style foods, especially in the United States and Canada. The region benefits from a high demand for natural and clean-label smoke flavors across processed meats, snacks, sauces, and ready-to-eat meals. Regulatory approvals for liquid smoke products, the growth of foodservice sectors, and the rising popularity of meat alternatives have also supported innovation in smoke ingredient formulations. Leading manufacturers in this region are focusing on advanced technologies for smoke capture, filtration, and purification to meet evolving consumer preferences for health and sustainability.

Europe holds a substantial share of the Smoke Ingredients for Food Market, with key countries like Germany, France, Italy, and the UK driving demand. The preference for traditionally smoked foods, coupled with stricter food safety and environmental regulations, is prompting food producers to shift from conventional smoking methods to cleaner alternatives like liquid smoke and smoke powders. The growing popularity of organic and preservative-free products is boosting the use of smoke ingredients as natural preservatives. Additionally, innovation in plant-based and gourmet food categories is expanding applications for smoke flavors in cheeses, seafood, and plant-based meats.

Asia-Pacific region is witnessing rapid growth in the Smoke Ingredients for Food Market, led by countries such as China, India, Japan, and South Korea. Rising urbanization, changes in dietary habits, and increasing consumption of processed and convenience foods are creating a strong market for smoke flavorings. Traditional Asian cuisines that utilize smoked meats and sauces are now being adapted into packaged formats, increasing the use of liquid and powdered smoke ingredients. The region is also investing in domestic food processing capabilities and expanding international exports of value-added food products, further driving market growth.

Latin America is an emerging market for Smoke Ingredients for Food, with countries like Brazil, Argentina, and Mexico incorporating smoke flavors into their regional cuisines. Demand is rising for smoked seasonings, marinades, and meat products within both retail and foodservice channels. The growing middle-class population and expanding meat processing industry are encouraging the adoption of smoke ingredients, especially those that offer shelf-life extension and cost efficiency. As global food safety standards influence local production practices, there's also a shift toward cleaner and safer smoking alternatives, boosting the market for refined smoke ingredients.

Middle East and Africa region is gradually expanding in the Smoke Ingredients for Food Market, with South Africa, UAE, and Saudi Arabia showing increasing demand. A strong tradition of grilled and smoked meat dishes in the region aligns with the adoption of smoke ingredients in packaged and restaurant-prepared foods. The growing demand for premium and international food products, along with the expansion of modern retail and foodservice infrastructure, is creating new opportunities. While adoption is still limited in some parts due to regulatory and awareness barriers, rising investments in the food processing sector are expected to support future growth.

Smoke Ingredients for Food Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the smoke ingredients for food market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global smoke ingredients for food market include:

- MSK

- FRUTAROM Savory Solutions GmbH

- Redbrook Ingredients Services

- Besmoke

- Red Arrow

- Dempsey Corporation

- Azelis

- Kerry Ingredients

- Associated British Foods Plc.

The global smoke ingredients for food market is segmented as follows:

By Type

- Liquid

- Powder

- Others

By Application

- Meat and Seafood

- Snacks & Sauces

- Bakery & Confectionery

- Dairy Products

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Smoke Ingredients for Food Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Smoke Ingredients for Food Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Smoke Ingredients for Food Overall Market Size 2.1 Global Smoke Ingredients for Food Market Size: 2021 VS 2028 2.2 Global Smoke Ingredients for Food Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Smoke Ingredients for Food Sales: 2017-2028 3 Company Landscape 3.1 Top Smoke Ingredients for Food Players in Global Market 3.2 Top Global Smoke Ingredients for Food Companies Ranked by Revenue 3.3 Global Smoke Ingredients for Food Revenue by Companies 3.4 Global Smoke Ingredients for Food Sales by Companies 3.5 Global Smoke Ingredients for Food Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Smoke Ingredients for Food Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Smoke Ingredients for Food Product Type 3.8 Tier 1, Tier 2 and Tier 3 Smoke Ingredients for Food Players in Global Market 3.8.1 List of Global Tier 1 Smoke Ingredients for Food Companies 3.8.2 List of Global Tier 2 and Tier 3 Smoke Ingredients for Food Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Smoke Ingredients for Food Market Size Markets, 2021 & 2028 4.1.2 Liquid 4.1.3 Powder 4.1.4 Others 4.2 By Type - Global Smoke Ingredients for Food Revenue & Forecasts 4.2.1 By Type - Global Smoke Ingredients for Food Revenue, 2017-2022 4.2.2 By Type - Global Smoke Ingredients for Food Revenue, 2023-2028 4.2.3 By Type - Global Smoke Ingredients for Food Revenue Market Share, 2017-2028 4.3 By Type - Global Smoke Ingredients for Food Sales & Forecasts 4.3.1 By Type - Global Smoke Ingredients for Food Sales, 2017-2022 4.3.2 By Type - Global Smoke Ingredients for Food Sales, 2023-2028 4.3.3 By Type - Global Smoke Ingredients for Food Sales Market Share, 2017-2028 4.4 By Type - Global Smoke Ingredients for Food Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Smoke Ingredients for Food Market Size, 2021 & 2028 5.1.2 Meat and Seafood 5.1.3 Snacks & Sauces 5.1.4 Bakery & Confectionery 5.1.5 Dairy Products 5.1.6 Others 5.2 By Application - Global Smoke Ingredients for Food Revenue & Forecasts 5.2.1 By Application - Global Smoke Ingredients for Food Revenue, 2017-2022 5.2.2 By Application - Global Smoke Ingredients for Food Revenue, 2023-2028 5.2.3 By Application - Global Smoke Ingredients for Food Revenue Market Share, 2017-2028 5.3 By Application - Global Smoke Ingredients for Food Sales & Forecasts 5.3.1 By Application - Global Smoke Ingredients for Food Sales, 2017-2022 5.3.2 By Application - Global Smoke Ingredients for Food Sales, 2023-2028 5.3.3 By Application - Global Smoke Ingredients for Food Sales Market Share, 2017-2028 5.4 By Application - Global Smoke Ingredients for Food Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Smoke Ingredients for Food Market Size, 2021 & 2028 6.2 By Region - Global Smoke Ingredients for Food Revenue & Forecasts 6.2.1 By Region - Global Smoke Ingredients for Food Revenue, 2017-2022 6.2.2 By Region - Global Smoke Ingredients for Food Revenue, 2023-2028 6.2.3 By Region - Global Smoke Ingredients for Food Revenue Market Share, 2017-2028 6.3 By Region - Global Smoke Ingredients for Food Sales & Forecasts 6.3.1 By Region - Global Smoke Ingredients for Food Sales, 2017-2022 6.3.2 By Region - Global Smoke Ingredients for Food Sales, 2023-2028 6.3.3 By Region - Global Smoke Ingredients for Food Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Smoke Ingredients for Food Revenue, 2017-2028 6.4.2 By Country - North America Smoke Ingredients for Food Sales, 2017-2028 6.4.3 US Smoke Ingredients for Food Market Size, 2017-2028 6.4.4 Canada Smoke Ingredients for Food Market Size, 2017-2028 6.4.5 Mexico Smoke Ingredients for Food Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Smoke Ingredients for Food Revenue, 2017-2028 6.5.2 By Country - Europe Smoke Ingredients for Food Sales, 2017-2028 6.5.3 Germany Smoke Ingredients for Food Market Size, 2017-2028 6.5.4 France Smoke Ingredients for Food Market Size, 2017-2028 6.5.5 U.K. Smoke Ingredients for Food Market Size, 2017-2028 6.5.6 Italy Smoke Ingredients for Food Market Size, 2017-2028 6.5.7 Russia Smoke Ingredients for Food Market Size, 2017-2028 6.5.8 Nordic Countries Smoke Ingredients for Food Market Size, 2017-2028 6.5.9 Benelux Smoke Ingredients for Food Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Smoke Ingredients for Food Revenue, 2017-2028 6.6.2 By Region - Asia Smoke Ingredients for Food Sales, 2017-2028 6.6.3 China Smoke Ingredients for Food Market Size, 2017-2028 6.6.4 Japan Smoke Ingredients for Food Market Size, 2017-2028 6.6.5 South Korea Smoke Ingredients for Food Market Size, 2017-2028 6.6.6 Southeast Asia Smoke Ingredients for Food Market Size, 2017-2028 6.6.7 India Smoke Ingredients for Food Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Smoke Ingredients for Food Revenue, 2017-2028 6.7.2 By Country - South America Smoke Ingredients for Food Sales, 2017-2028 6.7.3 Brazil Smoke Ingredients for Food Market Size, 2017-2028 6.7.4 Argentina Smoke Ingredients for Food Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Smoke Ingredients for Food Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Smoke Ingredients for Food Sales, 2017-2028 6.8.3 Turkey Smoke Ingredients for Food Market Size, 2017-2028 6.8.4 Israel Smoke Ingredients for Food Market Size, 2017-2028 6.8.5 Saudi Arabia Smoke Ingredients for Food Market Size, 2017-2028 6.8.6 UAE Smoke Ingredients for Food Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 Besmoke 7.1.1 Besmoke Corporate Summary 7.1.2 Besmoke Business Overview 7.1.3 Besmoke Smoke Ingredients for Food Major Product Offerings 7.1.4 Besmoke Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.1.5 Besmoke Key News 7.2 Kerry 7.2.1 Kerry Corporate Summary 7.2.2 Kerry Business Overview 7.2.3 Kerry Smoke Ingredients for Food Major Product Offerings 7.2.4 Kerry Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.2.5 Kerry Key News 7.3 Frutarom Savory Solutions 7.3.1 Frutarom Savory Solutions Corporate Summary 7.3.2 Frutarom Savory Solutions Business Overview 7.3.3 Frutarom Savory Solutions Smoke Ingredients for Food Major Product Offerings 7.3.4 Frutarom Savory Solutions Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.3.5 Frutarom Savory Solutions Key News 7.4 Redbrook Ingredient Services 7.4.1 Redbrook Ingredient Services Corporate Summary 7.4.2 Redbrook Ingredient Services Business Overview 7.4.3 Redbrook Ingredient Services Smoke Ingredients for Food Major Product Offerings 7.4.4 Redbrook Ingredient Services Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.4.5 Redbrook Ingredient Services Key News 7.5 Red Arrow 7.5.1 Red Arrow Corporate Summary 7.5.2 Red Arrow Business Overview 7.5.3 Red Arrow Smoke Ingredients for Food Major Product Offerings 7.5.4 Red Arrow Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.5.5 Red Arrow Key News 7.6 WIBERG 7.6.1 WIBERG Corporate Summary 7.6.2 WIBERG Business Overview 7.6.3 WIBERG Smoke Ingredients for Food Major Product Offerings 7.6.4 WIBERG Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.6.5 WIBERG Key News 7.7 B&G Foods 7.7.1 B&G Foods Corporate Summary 7.7.2 B&G Foods Business Overview 7.7.3 B&G Foods Smoke Ingredients for Food Major Product Offerings 7.7.4 B&G Foods Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.7.5 B&G Foods Key News 7.8 Associated British Foods 7.8.1 Associated British Foods Corporate Summary 7.8.2 Associated British Foods Business Overview 7.8.3 Associated British Foods Smoke Ingredients for Food Major Product Offerings 7.8.4 Associated British Foods Smoke Ingredients for Food Sales and Revenue in Global (2017-2022) 7.8.5 Associated British Foods Key News 8 Global Smoke Ingredients for Food Production Capacity, Analysis 8.1 Global Smoke Ingredients for Food Production Capacity, 2017-2028 8.2 Smoke Ingredients for Food Production Capacity of Key Manufacturers in Global Market 8.3 Global Smoke Ingredients for Food Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Smoke Ingredients for Food Supply Chain Analysis 10.1 Smoke Ingredients for Food Industry Value Chain 10.2 Smoke Ingredients for Food Upstream Market 10.3 Smoke Ingredients for Food Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Smoke Ingredients for Food Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Smoke Ingredients for Food

Request Sample

Smoke Ingredients for Food