Synthetic Dye and Pigment Market Size, Share, and Trends Analysis Report

CAGR :

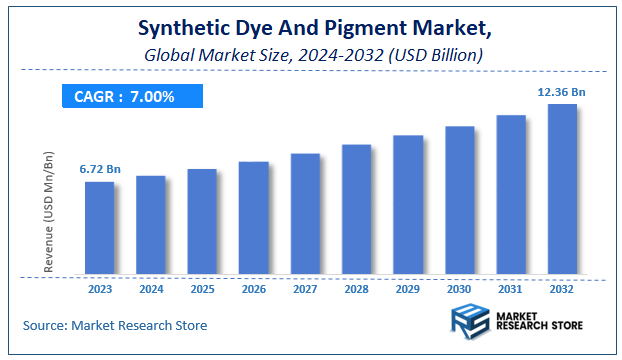

| Market Size 2023 (Base Year) | USD 6.72 Billion |

| Market Size 2032 (Forecast Year) | USD 12.36 Billion |

| CAGR | 7% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Synthetic Dye And Pigment Market Insights

According to Market Research Store, the global synthetic dye and pigment market size was valued at around USD 6.72 billion in 2023 and is estimated to reach USD 12.36 billion by 2032, to register a CAGR of approximately 7% in terms of revenue during the forecast period 2024-2032.

The synthetic dye and pigment report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Synthetic Dye and Pigment Market: Overview

Synthetic dye and pigment are artificially manufactured colorants used across a wide range of industries to impart vivid, consistent, and long-lasting color to materials and products. Unlike natural colorants derived from plants, minerals, or animals, synthetic dyes and pigments are created through complex chemical processes, allowing for a broader spectrum of colors, improved stability, and enhanced performance under varying environmental conditions. Synthetic dyes are typically soluble substances used to color textiles, paper, leather, and plastics by penetrating the material and bonding with it. In contrast, synthetic pigments are insoluble and are commonly used in paints, inks, coatings, cosmetics, and plastics, where they remain suspended within a binder to provide surface coloration.

The market for synthetic dye and pigment is growing steadily due to several key factors. Increasing demand from end-use industries such as textiles, automotive, construction, and packaging has driven the need for high-performance colorants that offer better lightfastness, wash resistance, and chemical stability. Rapid industrialization and urban development are further propelling the use of synthetic pigments in paints and coatings for infrastructure and consumer goods. Technological advancements have enabled the development of environment-friendly and regulatory-compliant formulations, addressing concerns over toxicity and environmental impact. Additionally, the rise of fashion and interior design trends that favor bright and durable colors continues to support demand. As manufacturing processes evolve and sustainability initiatives gain importance, the synthetic dyes and pigments industry is also seeing growth in biodegradable and low-VOC (volatile organic compound) alternatives.

Key Highlights

- The synthetic dye and pigment market is anticipated to grow at a CAGR of 7% during the forecast period.

- The global synthetic dye and pigment market was estimated to be worth approximately USD 6.72 billion in 2023 and is projected to reach a value of USD 12.36 billion by 2032.

- The growth of the synthetic dye and pigment market is being driven by the consistently rising demand for vibrant and long-lasting colors across a multitude of industries.

- Based on the type, the synthetic dye segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the industrial segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Synthetic Dye and Pigment Market: Dynamics

Key Growth Drivers

- Growing Demand from End-Use Industries: The global textile industry, particularly in developing economies like India and China, is a major consumer of synthetic dyes for vibrant colors and colorfastness in apparel, home textiles, and technical textiles. Rapid fashion trends and increasing disposable incomes contribute significantly. The booming construction and automotive sectors drive demand for synthetic pigments for durable, weather-resistant, and aesthetically pleasing paints and coatings.

- Technological Advancements: Innovations in dye and pigment chemistry, such as the development of high-performance pigments with improved colorfastness, thermal stability, and UV resistance, are expanding application possibilities and meeting stringent quality requirements.

- Product Diversification and Customization: Manufacturers are offering a wider array of synthetic colors and specialized formulations to meet specific application needs and aesthetic preferences across various industries.

- Cost-Effectiveness and Performance Consistency: Compared to many natural alternatives, synthetic dyes and pigments generally offer superior performance characteristics, including consistent color reproduction, better lightfastness, and higher tinting strength, often at a more competitive price point.

- Urbanization and Industrialization in Emerging Economies: Rapid urbanization and industrial growth in countries like India are leading to increased manufacturing activities across various sectors, consequently boosting the demand for synthetic dyes and pigments.

Restraints

- Stringent Environmental Regulations: Governments worldwide, including in India, are implementing stricter regulations regarding the production, use, and disposal of synthetic dyes and pigments due to concerns over hazardous chemicals, wastewater discharge, and environmental pollution. This can lead to increased compliance costs, plant closures, or the need for significant capital investment in eco-friendly processes. Regulations like REACH in Europe and similar norms globally restrict or ban certain harmful azo dyes and heavy metal-containing pigments.

- Rising Competition from Natural and Bio-Based Dyes: Growing consumer awareness and a shift towards sustainable and eco-friendly products are increasing the demand for natural and bio-based dyes and pigments, posing a competitive threat to synthetic alternatives, especially in segments like food, cosmetics, and textiles.

- Volatility in Raw Material Prices: The synthetic dye and pigment industry is dependent on petroleum-based raw materials, and fluctuations in crude oil prices can impact production costs and profit margins.

- Challenges in Effluent Treatment: The complex chemical nature of synthetic dye wastewater makes its treatment challenging and expensive, a significant operational hurdle for manufacturers.

- Economic Slowdowns and Impact on End-Use Industries: Economic downturns can affect key end-use industries like textiles, automotive, and construction, leading to reduced demand for dyes and pigments.

Opportunities

- Development of Sustainable and Eco-Friendly Synthetic Dyes and Pigments: Significant opportunity lies in R&D and commercialization of synthetic dyes and pigments with reduced environmental footprints, including low-VOC (Volatile Organic Compound) formulations, water-saving dyes, and non-toxic alternatives.

- Growth in Digital Printing: The increasing adoption of digital printing technologies across textiles, packaging, and advertising drives demand for specialized, high-performance synthetic dyes and pigments compatible with digital processes.

- Expansion in Specialty Applications: Niche markets requiring high-performance colorants, such as automotive coatings with enhanced durability, high-definition displays, and advanced materials, offer lucrative growth avenues.

- Increased Focus on R&D for Novel Formulations: Investment in developing new chemical structures and formulations that offer unique properties, improved performance, and compliance with evolving regulations can create competitive advantages.

- Market Penetration in Untapped Emerging Regions: While established in major emerging economies, there are still opportunities for market expansion in less developed regions with growing industrialization and consumer markets.

- Cross-Industry Collaboration: Partnerships between dye and pigment manufacturers and end-use industries can lead to the development of tailored solutions and drive innovation.

Challenges

- Intense Price Competition: The market is highly fragmented with numerous global and regional players, leading to intense price competition, especially for commodity-grade products.

- Compliance with Evolving Global Regulatory Landscape: Constantly adapting to and complying with diverse and often evolving environmental, health, and safety regulations across different countries is a continuous and complex challenge.

- Managing Supply Chain Vulnerabilities: Geopolitical tensions, trade wars, and global health crises can disrupt raw material supply chains and logistics, impacting production and delivery.

- Negative Public Perception: The historical environmental impact of the synthetic dye industry has led to a negative public perception, requiring companies to invest in transparent sustainable practices and strong PR.

- Technological Shift Towards Natural Alternatives: While synthetic dyes dominate, the increasing R&D into natural and bio-based dyes, coupled with consumer demand, poses a long-term challenge to the synthetic market's dominance.

- Investment in Greener Technologies: The substantial capital investment required for adopting cleaner production technologies and waste treatment facilities to meet environmental norms can be a significant hurdle, especially for smaller players.

Synthetic Dye And Pigment Market: Report Scope

This report thoroughly analyzes the Synthetic Dye And Pigment Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Synthetic Dye And Pigment Market |

| Market Size in 2023 | USD 6.72 Billion |

| Market Forecast in 2032 | USD 12.36 Billion |

| Growth Rate | CAGR of 7% |

| Number of Pages | 196 |

| Key Companies Covered | Archroma (Switzerland), Lanxess (Germany), Zhejiang Longsheng Group Co. Ltd (Dystar) (China), Heubach GmbH (Germany), Kiri Industries (India), Atul Ltd (India), Bodal Chemicals (India), Chromascape (US), Henkel AG & Co (Germany), Kemira Oyj (Finland), Milliken & Company (US), Solenis LLC (US), Zhejiang Jihua Group (China), and Zhejiang Runtu Co. Ltd (China) |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Synthetic Dye and Pigment Market: Segmentation Insights

The global synthetic dye and pigment market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global synthetic dye and pigment market is divided into synthetic dye and synthetic pigment.

Synthetic Dye dominates the Synthetic Dye and Pigment Market, driven by its extensive use across industries such as textiles, paper, leather, and personal care. These dyes are chemically engineered to provide a broad spectrum of vibrant, consistent, and long-lasting colors, making them ideal for applications that require strong tinting strength and durability under light and washing conditions. Synthetic dyes are especially vital in the textile industry, where they are used in mass-scale dyeing of natural and synthetic fabrics due to their cost-effectiveness and wide color range. Additionally, their fastness properties—resistance to fading, bleeding, and environmental conditions—enhance their applicability in demanding manufacturing environments. Innovations in dye chemistry have also led to the development of eco-friendly and low-impact dyes that meet regulatory and sustainability requirements, further solidifying their market dominance. The ease of synthesis and standardization in production make synthetic dyes a preferred option where precise color matching is critical, particularly in fashion, automotive fabrics, and industrial coatings.

Synthetic Pigment, while a strong and growing segment, is more commonly used in applications where opacity, color stability, and resistance to heat and chemicals are essential. Synthetic pigments are widely used in paints and coatings, plastics, inks, and construction materials. They are engineered to be insoluble in the medium in which they are used, making them ideal for surface coloration and applications requiring long-term performance. Synthetic pigments offer excellent lightfastness and weather resistance, which is crucial in architectural coatings, automotive paints, and packaging inks. The increasing demand for high-performance colorants in industrial and consumer goods is expected to support steady growth in this segment, particularly for specialty pigments such as metallics, fluorescents, and high-chroma types.

Segmentation Insights by Application

On the basis of application, the global synthetic dye and pigment market is bifurcated into industrial, manufacture, and others.

Industrial applications dominate the Synthetic Dye and Pigment Market, accounting for the largest share due to the widespread use of colorants in sectors such as textiles, printing inks, paints and coatings, and plastics. In these industries, synthetic dyes and pigments are critical for achieving color consistency, durability, and resistance to fading, chemical exposure, and UV radiation. For example, in the textile industry—which remains a primary consumer of synthetic dyes—colorants are used in bulk processing of garments, fabrics, and upholstery materials. In the coatings and construction industries, synthetic pigments are essential for architectural paints, industrial finishes, and decorative materials, offering not only color but also functional properties such as heat reflectivity, corrosion resistance, and improved surface appearance. Additionally, the use of synthetic pigments in printing inks for packaging, publications, and labeling supports the segment’s continued growth, particularly with the expansion of the global e-commerce and consumer goods sectors.

Manufacture is another key application segment, encompassing the production of goods where synthetic colorants are integrated into the formulation of final products. This includes the manufacture of plastics, personal care items, cosmetics, automotive components, and household goods. In these applications, synthetic dyes and pigments provide vibrant, stable colors that can withstand heat, moisture, and mechanical stress during both processing and end-use. For instance, in plastic manufacturing, pigments are blended into polymers to create consistent coloration in packaging, containers, and molded parts. In cosmetics and toiletries, synthetic dyes are used for lipsticks, shampoos, and lotions where uniformity, safety, and visual appeal are critical. The growing demand for consumer-ready and aesthetically appealing products across global markets continues to drive the adoption of synthetic colorants in manufacturing processes.

Synthetic Dye and Pigment Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the Synthetic Dye and Pigment Market, driven by strong demand from the textile, automotive, packaging, and construction industries. The United States and Canada have well-established manufacturing and industrial sectors that require high-performance dyes and pigments for applications ranging from paints and coatings to plastics, printing inks, and cosmetics. Technological advancements and stringent environmental regulations in the region are pushing companies toward the development of more sustainable and high-efficiency synthetic colorants. Additionally, the presence of major players, advanced R&D facilities, and a strong focus on product innovation further supports market leadership in North America.

Asia-Pacific region is witnessing the fastest growth in the Synthetic Dye and Pigment Market, with China, India, Japan, and South Korea leading the demand. This growth is fueled by the rapid expansion of the textile, construction, plastic, and automotive industries. China and India are among the world’s largest producers and consumers of dyes and pigments, offering cost advantages, abundant raw materials, and a large labor force. Rising consumer demand, increasing exports of textiles and manufactured goods, and expanding urban infrastructure are key growth drivers. However, environmental concerns and regulatory scrutiny over pollutant discharge from dye manufacturing plants are prompting stricter controls and greater investment in cleaner production technologies.

Europe holds a significant share of the Synthetic Dye and Pigment Market, led by countries such as Germany, France, the UK, and Italy. The region has a mature chemical industry and is a global hub for premium automotive and fashion markets, both of which are heavy consumers of dyes and pigments. The demand is also supported by robust packaging, coatings, and printing industries. Strict environmental and safety regulations under REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals) are encouraging manufacturers to innovate and develop environmentally friendly and low-VOC (volatile organic compound) alternatives. Moreover, rising demand for specialty pigments in cosmetics and personal care products is contributing to market expansion.

Latin America presents moderate growth potential in the Synthetic Dye and Pigment Market, with countries such as Brazil, Mexico, and Argentina showing increasing industrial activity. Demand for dyes and pigments is mainly driven by the textiles, printing, and packaging industries, along with rising construction projects. As consumer preferences shift toward more colorful and durable products, manufacturers in the region are investing in better-quality synthetic colorants. Although economic fluctuations and limited domestic production capabilities pose challenges, trade relationships with North American and European markets are aiding technological transfer and import of higher-grade products.

Middle East and Africa region is a growing market for Synthetic Dye and Pigments, particularly in Saudi Arabia, the UAE, and South Africa. The demand is largely concentrated in the packaging, automotive, and building materials sectors, driven by urbanization, infrastructure development, and growing consumer product industries. The cosmetics and personal care sector is also expanding, increasing the need for high-purity pigments. While local production remains limited, rising imports and strategic partnerships with global manufacturers are helping to improve product availability and diversity. Sustainability and quality compliance remain growing areas of focus as environmental awareness increases across the region.

Synthetic Dye and Pigment Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the synthetic dye and pigment market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global synthetic dye and pigment market include:

- Archroma (Switzerland)

- Lanxess (Germany)

- Zhejiang Longsheng Group Co. Ltd (Dystar) (China)

- Heubach GmbH (Germany)

- Kiri Industries (India)

- Atul Ltd (India)

- Bodal Chemicals (India)

- Chromascape (US)

- Henkel AG & Co (Germany)

- Kemira Oyj (Finland)

- Milliken & Company (US)

- Solenis LLC (US)

- Zhejiang Jihua Group (China)

- and Zhejiang Runtu Co. Ltd (China)

The global synthetic dye and pigment market is segmented as follows:

By Type

- Synthetic Dye

- Synthetic Pigment

By Application

- Industrial

- Manufacture

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Synthetic Dye And Pigment Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Synthetic Dye And Pigment Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Synthetic Dye And Pigment Overall Market Size 2.1 Global Synthetic Dye And Pigment Market Size: 2021 VS 2028 2.2 Global Synthetic Dye And Pigment Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Synthetic Dye And Pigment Sales: 2017-2028 3 Company Landscape 3.1 Top Synthetic Dye And Pigment Players in Global Market 3.2 Top Global Synthetic Dye And Pigment Companies Ranked by Revenue 3.3 Global Synthetic Dye And Pigment Revenue by Companies 3.4 Global Synthetic Dye And Pigment Sales by Companies 3.5 Global Synthetic Dye And Pigment Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Synthetic Dye And Pigment Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Synthetic Dye And Pigment Product Type 3.8 Tier 1, Tier 2 and Tier 3 Synthetic Dye And Pigment Players in Global Market 3.8.1 List of Global Tier 1 Synthetic Dye And Pigment Companies 3.8.2 List of Global Tier 2 and Tier 3 Synthetic Dye And Pigment Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Synthetic Dye And Pigment Market Size Markets, 2021 & 2028 4.1.2 Synthetic Dye 4.1.3 Synthetic Pigment 4.2 By Type - Global Synthetic Dye And Pigment Revenue & Forecasts 4.2.1 By Type - Global Synthetic Dye And Pigment Revenue, 2017-2022 4.2.2 By Type - Global Synthetic Dye And Pigment Revenue, 2023-2028 4.2.3 By Type - Global Synthetic Dye And Pigment Revenue Market Share, 2017-2028 4.3 By Type - Global Synthetic Dye And Pigment Sales & Forecasts 4.3.1 By Type - Global Synthetic Dye And Pigment Sales, 2017-2022 4.3.2 By Type - Global Synthetic Dye And Pigment Sales, 2023-2028 4.3.3 By Type - Global Synthetic Dye And Pigment Sales Market Share, 2017-2028 4.4 By Type - Global Synthetic Dye And Pigment Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Synthetic Dye And Pigment Market Size, 2021 & 2028 5.1.2 Industrial 5.1.3 Manufacture 5.1.4 Others 5.2 By Application - Global Synthetic Dye And Pigment Revenue & Forecasts 5.2.1 By Application - Global Synthetic Dye And Pigment Revenue, 2017-2022 5.2.2 By Application - Global Synthetic Dye And Pigment Revenue, 2023-2028 5.2.3 By Application - Global Synthetic Dye And Pigment Revenue Market Share, 2017-2028 5.3 By Application - Global Synthetic Dye And Pigment Sales & Forecasts 5.3.1 By Application - Global Synthetic Dye And Pigment Sales, 2017-2022 5.3.2 By Application - Global Synthetic Dye And Pigment Sales, 2023-2028 5.3.3 By Application - Global Synthetic Dye And Pigment Sales Market Share, 2017-2028 5.4 By Application - Global Synthetic Dye And Pigment Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Synthetic Dye And Pigment Market Size, 2021 & 2028 6.2 By Region - Global Synthetic Dye And Pigment Revenue & Forecasts 6.2.1 By Region - Global Synthetic Dye And Pigment Revenue, 2017-2022 6.2.2 By Region - Global Synthetic Dye And Pigment Revenue, 2023-2028 6.2.3 By Region - Global Synthetic Dye And Pigment Revenue Market Share, 2017-2028 6.3 By Region - Global Synthetic Dye And Pigment Sales & Forecasts 6.3.1 By Region - Global Synthetic Dye And Pigment Sales, 2017-2022 6.3.2 By Region - Global Synthetic Dye And Pigment Sales, 2023-2028 6.3.3 By Region - Global Synthetic Dye And Pigment Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Synthetic Dye And Pigment Revenue, 2017-2028 6.4.2 By Country - North America Synthetic Dye And Pigment Sales, 2017-2028 6.4.3 US Synthetic Dye And Pigment Market Size, 2017-2028 6.4.4 Canada Synthetic Dye And Pigment Market Size, 2017-2028 6.4.5 Mexico Synthetic Dye And Pigment Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Synthetic Dye And Pigment Revenue, 2017-2028 6.5.2 By Country - Europe Synthetic Dye And Pigment Sales, 2017-2028 6.5.3 Germany Synthetic Dye And Pigment Market Size, 2017-2028 6.5.4 France Synthetic Dye And Pigment Market Size, 2017-2028 6.5.5 U.K. Synthetic Dye And Pigment Market Size, 2017-2028 6.5.6 Italy Synthetic Dye And Pigment Market Size, 2017-2028 6.5.7 Russia Synthetic Dye And Pigment Market Size, 2017-2028 6.5.8 Nordic Countries Synthetic Dye And Pigment Market Size, 2017-2028 6.5.9 Benelux Synthetic Dye And Pigment Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Synthetic Dye And Pigment Revenue, 2017-2028 6.6.2 By Region - Asia Synthetic Dye And Pigment Sales, 2017-2028 6.6.3 China Synthetic Dye And Pigment Market Size, 2017-2028 6.6.4 Japan Synthetic Dye And Pigment Market Size, 2017-2028 6.6.5 South Korea Synthetic Dye And Pigment Market Size, 2017-2028 6.6.6 Southeast Asia Synthetic Dye And Pigment Market Size, 2017-2028 6.6.7 India Synthetic Dye And Pigment Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Synthetic Dye And Pigment Revenue, 2017-2028 6.7.2 By Country - South America Synthetic Dye And Pigment Sales, 2017-2028 6.7.3 Brazil Synthetic Dye And Pigment Market Size, 2017-2028 6.7.4 Argentina Synthetic Dye And Pigment Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Synthetic Dye And Pigment Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Synthetic Dye And Pigment Sales, 2017-2028 6.8.3 Turkey Synthetic Dye And Pigment Market Size, 2017-2028 6.8.4 Israel Synthetic Dye And Pigment Market Size, 2017-2028 6.8.5 Saudi Arabia Synthetic Dye And Pigment Market Size, 2017-2028 6.8.6 UAE Synthetic Dye And Pigment Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 BASF 7.1.1 BASF Corporate Summary 7.1.2 BASF Business Overview 7.1.3 BASF Synthetic Dye And Pigment Major Product Offerings 7.1.4 BASF Synthetic Dye And Pigment Sales and Revenue in Global (2017-2022) 7.1.5 BASF Key News 7.2 Clariant International 7.2.1 Clariant International Corporate Summary 7.2.2 Clariant International Business Overview 7.2.3 Clariant International Synthetic Dye And Pigment Major Product Offerings 7.2.4 Clariant International Synthetic Dye And Pigment Sales and Revenue in Global (2017-2022) 7.2.5 Clariant International Key News 7.3 Flint 7.3.1 Flint Corporate Summary 7.3.2 Flint Business Overview 7.3.3 Flint Synthetic Dye And Pigment Major Product Offerings 7.3.4 Flint Synthetic Dye And Pigment Sales and Revenue in Global (2017-2022) 7.3.5 Flint Key News 7.4 Huntsman 7.4.1 Huntsman Corporate Summary 7.4.2 Huntsman Business Overview 7.4.3 Huntsman Synthetic Dye And Pigment Major Product Offerings 7.4.4 Huntsman Synthetic Dye And Pigment Sales and Revenue in Global (2017-2022) 7.4.5 Huntsman Key News 7.5 Dic 7.5.1 Dic Corporate Summary 7.5.2 Dic Business Overview 7.5.3 Dic Synthetic Dye And Pigment Major Product Offerings 7.5.4 Dic Synthetic Dye And Pigment Sales and Revenue in Global (2017-2022) 7.5.5 Dic Key News 8 Global Synthetic Dye And Pigment Production Capacity, Analysis 8.1 Global Synthetic Dye And Pigment Production Capacity, 2017-2028 8.2 Synthetic Dye And Pigment Production Capacity of Key Manufacturers in Global Market 8.3 Global Synthetic Dye And Pigment Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Synthetic Dye And Pigment Supply Chain Analysis 10.1 Synthetic Dye And Pigment Industry Value Chain 10.2 Synthetic Dye And Pigment Upstream Market 10.3 Synthetic Dye And Pigment Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Synthetic Dye And Pigment Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Synthetic Dye and Pigment

Request Sample

Synthetic Dye and Pigment