Textile Chemicals Market Size, Share, and Trends Analysis Report

CAGR :

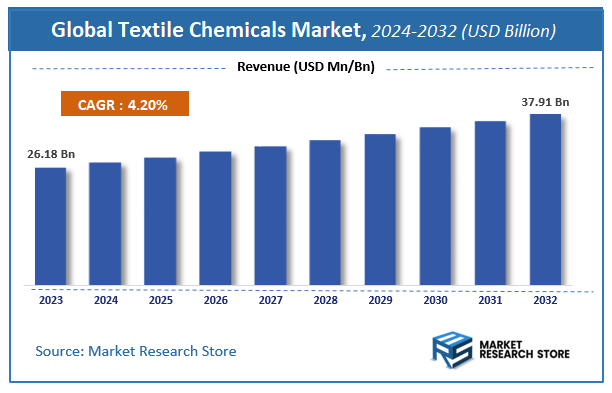

| Market Size 2023 (Base Year) | USD 26.18 Billion |

| Market Size 2032 (Forecast Year) | USD 37.91 Billion |

| CAGR | 4.2% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Textile Chemicals Market Insights

According to Market Research Store, the global textile chemicals market size was valued at around USD 26.18 billion in 2023 and is estimated to reach USD 37.91 billion by 2032, to register a CAGR of approximately 4.2% in terms of revenue during the forecast period 2024-2032.

The textile chemicals report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Textile Chemicals Market: Overview

Textile chemicals are specialized compounds used throughout the textile manufacturing process to enhance the appearance, performance, and functionality of fabrics and garments. These chemicals are applied during various stages such as pretreatment, dyeing, printing, finishing, and coating. Common types include surfactants, bleaching agents, softeners, wetting agents, dyes and pigments, flame retardants, water repellents, antimicrobials, and wrinkle-resistant agents. Each plays a specific role—for example, softeners improve fabric feel, while finishing agents can add attributes like stain resistance or UV protection.

The growth of the textile chemicals market is driven by increasing global demand for functional and fashionable textiles, rising disposable income, and evolving consumer preferences for high-performance fabrics. The industry is also responding to demands for sustainable and eco-friendly products, leading to innovations in bio-based and low-toxicity chemical formulations. Rapid developments in textile technologies, such as smart and technical textiles used in sportswear, medical textiles, and protective clothing, further expand the application scope. As fashion cycles accelerate and environmental regulations tighten, manufacturers are investing in advanced, compliant textile chemical solutions that balance performance with sustainability.

Key Highlights

- The textile chemicals market is anticipated to grow at a CAGR of 4.2% during the forecast period.

- The global textile chemicals market was estimated to be worth approximately USD 26.18 billion in 2023 and is projected to reach a value of USD 37.91 billion by 2032.

- The growth of the textile chemicals market is being driven by rising global demand for high-performance and functional textiles across a range of industries including apparel, home furnishings, technical textiles, and industrial applications.

- Based on the process, the pretreatment segment is growing at a high rate and is projected to dominate the market.

- On the basis of product, the coating & sizing chemicals segment is projected to swipe the largest market share.

- In terms of application, the apparel segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Textile Chemicals Market: Dynamics

Key Growth Drivers:

- Growing Global Textile and Apparel Production: The continuous increase in demand for textiles and apparel, driven by population growth, rising disposable incomes, and evolving fashion trends, is the primary driver for the textile chemicals market. As textile production rises, so does the consumption of chemicals needed for processing.

- Increasing Demand for Technical Textiles and Functional Fabrics: There's a significant surge in demand for technical textiles used in various industries like automotive, healthcare, sports, protective wear, and construction. These textiles require specialized chemicals to impart functionalities such as water repellence, flame retardancy, antimicrobial properties, UV protection, and enhanced durability, fuelling innovation in textile chemicals.

- Evolving Fashion Trends and Fast Fashion: The rapid pace of fashion cycles and the fast fashion phenomenon necessitate quick and efficient textile processing. Textile chemicals play a crucial role in achieving desired colors, finishes, and textures rapidly, supporting the industry's agility.

- Growing Awareness of Hygiene and Health: The COVID-19 pandemic significantly increased awareness about hygiene. This has boosted demand for antimicrobial and easy-care finishes in textiles for apparel, home furnishings, and medical applications, driving the market for related textile chemicals.

- Technological Advancements in Textile Processing: Innovations in dyeing, printing, and finishing technologies, including digital printing and sustainable processing methods, drive the demand for specialized and high-performance textile chemicals that can work efficiently with these new techniques.

- Increasing Disposable Income in Emerging Economies: Rising living standards and disposable incomes in developing countries, particularly in Asia Pacific, lead to higher consumption of textiles and apparel, thereby increasing the demand for textile chemicals in these regions.

Restraints:

- Strict Environmental Regulations and Sustainability Pressure: The textile industry is a significant polluter, and governments worldwide are implementing increasingly stringent environmental regulations concerning wastewater discharge, chemical usage, and VOC emissions. This puts pressure on manufacturers to use more eco-friendly (often more expensive) chemicals or invest in costly effluent treatment, acting as a restraint for conventional chemicals.

- Volatility of Raw Material Prices: Many textile chemicals are derived from petrochemicals, dyes, and other industrial chemicals whose prices are subject to fluctuations in the global commodity market. This volatility directly impacts the production costs of textile chemicals, affecting profit margins and market stability.

- Presence of Harmful Chemicals and Health Concerns: Historically, some textile chemicals have been linked to health issues for workers and end-users, or cause environmental pollution. Consumer awareness and advocacy for non-toxic, skin-friendly textiles can limit the use of certain chemicals.

- High Research and Development Costs: Developing new, more sustainable, and high-performance textile chemicals requires significant investment in R&D, which can be a barrier for smaller players and adds to the overall cost of product development.

- Water Scarcity and Management Challenges: Textile processing is highly water-intensive. In regions facing water scarcity, the industry faces pressure to reduce water consumption, which indirectly restrains the use of certain chemicals that require extensive washing or rinsing.

Opportunities:

- Development of Sustainable and Eco-Friendly Textile Chemicals: The strongest opportunity lies in the innovation and commercialization of bio-based, biodegradable, non-toxic, and low-impact textile chemicals. This includes enzymes, natural dyes, and greener finishing agents that meet stringent environmental standards and consumer demand.

- Focus on Smart Textiles and Wearable Technology: The emergence of smart textiles with integrated electronics or advanced functionalities (e.g., self-cleaning, temperature-regulating, health monitoring) creates a niche but high-value opportunity for specialized conductive, encapsulating, or responsive textile chemicals.

- Digitalization and Automation in Textile Processing: The adoption of Industry 4.0 principles in textile manufacturing, including digital printing and automated dyeing, requires specific chemicals optimized for these technologies. This presents an opportunity for manufacturers to develop highly compatible and efficient chemical solutions.

- Waterless Dyeing and Finishing Technologies: As the industry seeks to reduce water consumption, the development of chemicals compatible with waterless dyeing (e.g., CO2 dyeing) or low-water finishing processes offers a significant growth avenue.

- Customization and Specialization for Niche Applications: Opportunities exist in developing highly specialized textile chemicals for unique applications, such as medical textiles, geotextiles, or specific high-performance sportswear, catering to precise functional requirements.

- Recycling and Circular Economy Initiatives: As the textile industry moves towards a circular economy, there's an opportunity for chemicals that facilitate textile recycling processes, such as those that enable easier fiber separation or de-dyeing.

Challenges:

- Balancing Performance with Sustainability and Cost: The most significant challenge is to develop and commercialize sustainable textile chemicals that can match the performance and cost-effectiveness of conventional chemicals, which often means overcoming performance trade-offs or higher production costs.

- Complex and Evolving Regulatory Landscape: Navigating the patchwork of chemical regulations across different countries and regions (e.g., REACH, ZDHC, local environmental laws) is a complex and ongoing challenge for manufacturers operating globally.

- Supply Chain Disruptions and Raw Material Dependency: The reliance on a global supply chain for raw materials, many of which are petrochemicals, makes the market vulnerable to geopolitical events, trade barriers, and global economic fluctuations.

- Fragmented Market and Intense Competition: The textile chemicals market is highly fragmented with numerous global and regional players. This intense competition can lead to price pressure, making it challenging for manufacturers to maintain healthy profit margins.

- Technology Transfer and Adoption in Developing Regions: While developing regions are major textile producers, ensuring the effective transfer and adoption of advanced, sustainable textile chemical technologies to these regions, particularly among smaller players, can be a challenge.

- Quality Control and Consistency: Ensuring consistent quality and performance of textile chemicals across different batches and diverse processing conditions is crucial for textile manufacturers, posing a continuous challenge for chemical suppliers.

- Intellectual Property Protection: Protecting proprietary formulations and innovative chemical processes in a competitive and globalized market is an ongoing challenge, especially against counterfeiting or unauthorized replication.

Textile Chemicals Market: Report Scope

This report thoroughly analyzes the Textile Chemicals Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Textile Chemicals Market |

| Market Size in 2023 | USD 26.18 Billion |

| Market Forecast in 2032 | USD 37.91 Billion |

| Growth Rate | CAGR of 4.2% |

| Number of Pages | 140 |

| Key Companies Covered |

AB Enzymes, Archroma, BASF SE, BioTex Malaysia, Dow, Ethox Chemicals, LLC, Evonik Industries AG., Fibro Chem, LLC, German Chemicals Ltd., Govi N.V., Huntsman International LLC, Kemira Oyj, Kiri Industries Ltd., LANXESS, OMNOVA Solutions Inc., Omya United Chemicals, Organic Dyes and Pigments, Resil Chemicals Pvt. Ltd., Solvay S.A, The Lubrizol Corporation, Bayer Material Science AG, Lonsen, and others. |

| Segments Covered |

By Process ,By Product, By Application, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Textile Chemicals Market: Segmentation Insights

The global textile chemicals market is divided by process, product, application, and region.

Based on process, the global textile chemicals market is divided into pretreatment, coating, and treatment of finished products. Pretreatment is the dominant process segment in the textile chemicals market, primarily due to its critical role in preparing textiles for subsequent dyeing, printing, and finishing operations. This stage involves the removal of natural impurities, oils, waxes, and dirt from raw fibers and fabrics through processes like desizing, scouring, and bleaching. Chemicals used in pretreatment include wetting agents, detergents, emulsifiers, and alkaline agents, which ensure uniform absorbency and enhance the overall quality of the final product. North America holds a significant share in this segment, driven by a high demand for superior-quality textiles in the fashion, home furnishing, and industrial sectors. The increasing emphasis on fabric quality and dye uniformity across various end-use industries continues to boost the demand for pretreatment chemicals globally.

On the basis of product, the global textile chemicals market is bifurcated into coating & sizing chemicals, colorants & auxiliaries, finishing agents, surfactants, and denim finishing agents. Coating & Sizing Chemicals dominate the textile chemicals market by product type, as they play a pivotal role in improving fabric strength, resistance, and processability during weaving and finishing. Sizing chemicals, typically composed of starch, polyvinyl alcohol, or synthetic polymers, are applied to yarns to enhance their strength and reduce breakage during weaving. Coating chemicals, on the other hand, impart protective and functional layers to textiles, adding properties such as flame retardancy, waterproofing, and anti-microbial resistance. The segment is significantly driven by rising demand in the apparel, home textiles, and industrial fabrics markets, particularly in North America, where technological innovations in textile treatments and performance coatings are gaining traction. Additionally, regulatory shifts toward sustainable chemistry are encouraging the adoption of water-based and bio-based coating formulations.

On the basis of application, the global textile chemicals market is bifurcated into apparel, home furnishing, technical textiles, and other applications. Apparel is the dominant application segment in the textile chemicals market, driven by the vast global demand for clothing and fashion wear. Textile chemicals are extensively used throughout the apparel production process, from pretreatment and dyeing to finishing, to enhance the texture, durability, colorfastness, and functional properties of garments. This includes the use of softeners, wrinkle-resistance agents, water repellents, and anti-microbial finishes, especially in sportswear, casual wear, and professional clothing.

Textile Chemicals Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the textile chemicals market, driven by advanced textile manufacturing technologies, high demand for technical textiles, and a strong emphasis on sustainability. The United States leads regional consumption, particularly in applications such as protective clothing, sportswear, automotive textiles, and home furnishings. The region’s strict environmental regulations have accelerated the shift toward non-toxic, biodegradable, and low-VOC chemicals, particularly in finishing and dyeing processes. Innovation in functional textiles, such as antimicrobial, flame-retardant, and water-repellent fabrics, is further boosting demand for specialty textile chemicals. Key players, including Huntsman Corporation and Dow, are actively investing in R&D to develop green chemical alternatives. Additionally, the presence of a well-established textile recycling infrastructure and increasing preference for organic and sustainable textiles contribute to North America's leadership position.

Europe holds a significant share in the textile chemicals market, with Germany, Italy, France, and the United Kingdom as leading contributors. The region places strong emphasis on environmental protection and chemical safety under regulations such as REACH and the EU Ecolabel. This has encouraged the widespread adoption of eco-friendly textile processing chemicals, especially in dyeing, finishing, and coating applications. The region is also a hub for technical textiles, including those used in automotive, aerospace, medical, and construction sectors. Germany, in particular, has a robust industrial textile base with high demand for performance-enhancing textile chemicals. European textile manufacturers are increasingly adopting biobased and water-efficient chemical formulations to meet sustainability goals and consumer expectations. Although textile production volumes are lower than Asia-Pacific, the focus on high-value, high-performance textile applications keeps demand steady.

Textile Chemicals Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the textile chemicals market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global textile chemicals market include:

- AB Enzymes

- Archroma

- BASF SE

- BioTex Malaysia

- Dow

- Ethox Chemicals, LLC

- Evonik Industries AG.

- Fibro Chem, LLC

- German Chemicals Ltd.

- Govi N.V.

- Huntsman International LLC

- Kemira Oyj

- Kiri Industries Ltd.

- LANXESS

- OMNOVA Solutions Inc.

- Omya United Chemicals

- Organic Dyes and Pigments

- Resil Chemicals Pvt. Ltd.

- Solvay S.A

- The Lubrizol Corporation

- Bayer Material Science AG

- Lonsen

The global textile chemicals market is segmented as follows:

By Process

- Pretreatment

- Coating

- Treatment Of Finished Products

By Product

- Coating & Sizing Chemicals

- Colorants & Auxiliaries

- Finishing Agents

- Surfactants

- Denim Finishing Agents

By Application

- Apparel

- Home Furnishing

- Technical Textiles

- Other Applications

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

Inquiry For Buying

Textile Chemicals

Request Sample

Textile Chemicals