Tire Derived Fuel Market Size, Share, and Trends Analysis Report

CAGR :

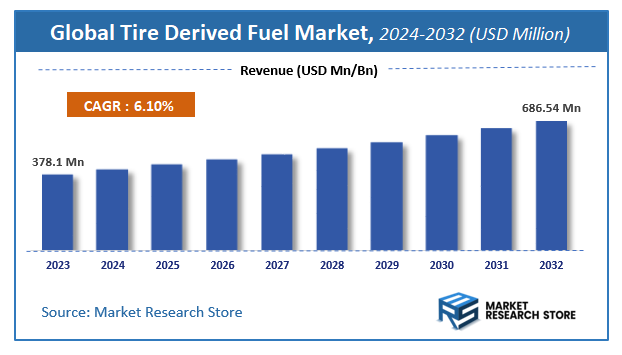

| Market Size 2023 (Base Year) | USD 378.1 Million |

| Market Size 2032 (Forecast Year) | USD 686.54 Million |

| CAGR | 6.1% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Tire Derived Fuel Market Insights

A latest report by Market Research Store estimates that the Global Tire Derived Fuel Market was valued at USD 378.1 Million in 2023 and is expected to reach USD 686.54 Million by 2032, with a CAGR of 6.1% during the forecast period 2024-2032. The report Tire Derived Fuel Market overview, growth factors, restraints, opportunities, segmentation, key developments, competitive landscape, consumer insights, and market growth forecast in terms of value or volume. These structured details offer an all-inclusive market overview, providing valuable insights for investment decisions, business decisions, strategic planning, and competitive analysis.

Tire Derived Fuel Market: Overview

The growth of the tire derived fuel market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The tire derived fuel market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the tire derived fuel market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Tire Source, Type, Application, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global tire derived fuel market is estimated to grow annually at a CAGR of around 6.1% over the forecast period (2024-2032).

- In terms of revenue, the global tire derived fuel market size was valued at around USD 378.1 Million in 2023 and is projected to reach USD 686.54 Million by 2032.

- The market is projected to grow at a significant rate due to increasing demand for alternative fuels, rising waste tire recycling initiatives, growing adoption in cement, pulp & paper, and power generation industries, and stringent environmental regulations on waste management.

- Based on the Tire Source, the Light Motor Vehicles segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Type, the Shredded Tire segment is anticipated to command the largest market share.

- In terms of Application, the Cement Industry segment is projected to lead the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Tire Derived Fuel Market: Report Scope

This report thoroughly analyzes the tire derived fuel market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Tire Derived Fuel Market |

| Market Size in 2023 | USD 378.1 Million |

| Market Forecast in 2032 | USD 686.54 Million |

| Growth Rate | CAGR of 6.1% |

| Number of Pages | 168 |

| Key Companies Covered | Ragn-Sells Group, Liberty Tire Recycling, ResourceCo Pty, Lakin Tire West Inc., L&S Tire Company, Probio Energy International, Renelux Cyprus Ltd., Globarket Tire Recycling LLC, ETR Group and Emanuel Tire LLC |

| Segments Covered | By Tire Source, By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Tire Derived Fuel Market: Dynamics

Key Growth Drivers

The tire-derived fuel (TDF) market is experiencing growth primarily due to the increasing demand for alternative and sustainable fuel sources across various industries, including cement manufacturing, pulp and paper, and power generation. TDF, derived from recycled tires, presents a cost-effective and environmentally conscious substitute for traditional fossil fuels, aiding energy-intensive processes in reducing their carbon footprint. The escalating emphasis on effective waste management and the principles of a circular economy further propels the adoption of TDF. With a rise in tire waste generation coupled with stringent environmental regulations, governments and industries are increasingly turning to TDF as a viable solution to minimize landfill waste and lower emissions. The high calorific value of TDF makes it an appealing option for energy recovery, offering both economic and ecological advantages. Moreover, the growing focus on energy security and the diversification of energy sources are contributing to the heightened demand for TDF as a cleaner energy alternative.

Restraints

Despite the promising growth, the TDF market faces certain restraints. One significant challenge is the inconsistent quality of TDF, which can vary due to differences in tire composition and processing methods, raising concerns among potential users. Fluctuations in the prices of raw materials, particularly scrap tires, can also hinder stable market growth. Furthermore, the lack of well-established and efficient TDF collection and logistics infrastructure in many regions poses a considerable obstacle to market expansion. Environmental concerns and stringent regulations, especially regarding emissions from TDF combustion, also act as restraints, necessitating the use of advanced combustion technologies and emission control systems. Public perception and occasional opposition to using tires as fuel, sometimes due to concerns about potential emissions or a preference for higher-value recycling methods, can also impede market growth.

Opportunities

The TDF market holds substantial opportunities for expansion. The increasing focus on sustainable waste management and the need to find alternatives to landfilling used tires create a significant demand for TDF. The high heating value of TDF compared to other fuels like coal and wood makes it an attractive and cost-effective energy source for industries with high energy consumption. Technological advancements in tire recycling and TDF production, such as pyrolysis and cryogenic grinding, are enhancing efficiency and the quality of TDF, making it more appealing for a wider range of applications. Growing environmental awareness and stricter regulations aimed at reducing carbon emissions are also driving industries to adopt cleaner fuel alternatives like TDF. Moreover, the increasing prices of conventional fossil fuels further enhance the economic competitiveness of TDF. The potential for TDF to support a circular economy by repurposing waste tires into a valuable energy resource also presents a significant opportunity for market growth and development.

Challenges

The TDF market faces several challenges that could impede its growth. Ensuring a consistent and reliable supply of high-quality tire feedstock can be challenging due to variations in waste tire collection and processing. The capital investment required for upgrading facilities to handle TDF and implement advanced combustion and emission control technologies can be a significant barrier for some potential users. Addressing public concerns and ensuring compliance with increasingly stringent environmental regulations regarding emissions remain critical challenges. Competition from other alternative fuels and the development of more advanced tire recycling technologies that prioritize material recovery over energy recovery could also pose challenges to the TDF market. Furthermore, the lack of standardized regulations and quality specifications for TDF across different regions can create uncertainty and hinder market development. Overcoming these challenges through technological innovation, infrastructure development, and clear regulatory frameworks will be crucial for the sustained growth of the tire-derived fuel market.

Tire Derived Fuel Market: Segmentation Insights

The global tire derived fuel market is segmented based on Tire Source, Type, Application, and Region. All the segments of the tire derived fuel market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Tire Source, the global tire derived fuel market is divided into Light Motor Vehicles, Heavy Duty Vehicles, Motorcycles, Aircrafts, Bicycles, Others.

On the basis of Type, the global tire derived fuel market is bifurcated into Shredded Tire, Whole Tire.

In terms of Application, the global tire derived fuel market is categorized into Cement Industry, Power Plants, Pulp & paper mills, Utility Boilers.

Tire Derived Fuel Market: Regional Insights

The Tire Derived Fuel (TDF) market is experiencing significant regional variations, with North America emerging as the dominant region due to its well-established waste management infrastructure, high adoption of alternative fuels, and stringent environmental regulations promoting sustainable waste-to-energy solutions. According to recent industry reports, North America holds the largest market share, driven by the U.S., where cement kilns and power plants extensively use TDF as a cost-effective and eco-friendly coal alternative.

Europe follows closely, supported by strong EU waste diversion policies and growing industrial demand for renewable energy sources. Meanwhile, the Asia-Pacific region is witnessing rapid growth, fueled by increasing tire waste generation and rising energy demands in countries like China and India. However, North America remains the leader due to higher regulatory support and advanced recycling technologies, making it the most dominant region in the global TDF market.

Tire Derived Fuel Market: Competitive Landscape

The tire derived fuel market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Tire Derived Fuel Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Ragn-Sells Group

- Liberty Tire Recycling

- ResourceCo Pty

- Lakin Tire West Inc.

- L&S Tire Company

- Probio Energy International

- Renelux Cyprus Ltd.

- Globarket Tire Recycling LLC

- ETR Group and Emanuel Tire LLC

The Global Tire Derived Fuel Market is Segmented as Follows:

By Tire Source

- Light Motor Vehicles

- Heavy Duty Vehicles

- Motorcycles

- Aircrafts

- Bicycles

- Others

By Type

- Shredded Tire

- Whole Tire

By Application

- Cement Industry

- Power Plants

- Pulp & paper mills

- Utility Boilers

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Evolution

This section evaluates the market position of the product or service by examining its development pathway and competitive dynamics. It provides a detailed overview of the product's growth stages, including the early (historical) phase, the mid-stage, and anticipated future advancements influenced by innovation and emerging technologies.

Porter’s Analysis

Porter’s Five Forces framework offers a strategic lens for assessing competitor behavior and the positioning of key players in the tire derived fuel industry. This section explores the external factors shaping competitive dynamics and influencing market strategies in the years ahead. The analysis focuses on five critical forces:

- Competitive Rivalry

- Threat of New Entrants

- Threat of Substitutes

- Supplier Bargaining Power

- Buyer Bargaining Power

Value Chain & Market Attractiveness Analysis

The value chain analysis helps businesses optimize operations by mapping the product flow from suppliers to end consumers, identifying opportunities to streamline processes and gain a competitive edge. Segment-wise market attractiveness analysis evaluates key dimensions like product categories, demographics, and regions, assessing growth potential, market size, and profitability. This enables businesses to focus resources on high-potential segments for better ROI and long-term value.

PESTEL Analysis

PESTEL analysis is a powerful tool in market research reports that enhances market understanding by systematically examining the external macro-environmental factors influencing a business or industry. The acronym stands for Political, Economic, Social, Technological, Environmental, and Legal factors. By evaluating these dimensions, PESTEL analysis provides a comprehensive overview of the broader context within which a market operates, helping businesses identify potential opportunities and threats.

- Political factors assess government policies, stability, trade regulations, and political risks that could impact market operations.

- Economic factors examine variables like inflation, exchange rates, economic growth, and consumer spending power to determine market viability.

- Social factors explore cultural trends, demographics, and lifestyle changes that shape consumer behavior and preferences.

- Technological factors evaluate innovation, R&D, and technological advancements affecting product development and operational efficiencies.

- Environmental factors focus on sustainability, climate change impacts, and eco-friendly practices shaping market trends.

- Legal factors address compliance requirements, industry regulations, and intellectual property laws impacting market entry and operations.

Import-export Analysis & Pricing Analysis

An import-export analysis is vital for market research, revealing global trade dynamics, trends, and opportunities. It examines trade volumes, product categories, and regional competitiveness, offering insights into supply chains and market demand. This section also analyzes past and future pricing trends, helping businesses optimize strategies and enabling consumers to assess product value effectively.

Tire Derived Fuel Market: Company Profiles

The report identifies key players in the tire derived fuel market through a competitive landscape and company profiles, evaluating their offerings, financial performance, strategies, and market positioning. It includes a SWOT analysis of the top 3-5 companies, assessing strengths, weaknesses, opportunities, and threats. The competitive landscape highlights rankings, recent activities (mergers, acquisitions, partnerships, product launches), and regional footprints using the Ace matrix. Customization is available to meet client-specific needs.

Regional & Industry Footprint

This section details the geographic reach, sales networks, and market penetration of companies profiled in the tire derived fuel report, showcasing their operations and distribution across regions. It analyzes the alignment of companies with specific industry verticals, highlighting the industries they serve and the scope of their products and services within those sectors.

Ace Matrix

This section categorizes companies into four distinct groups—Active, Cutting Edge, Innovator, and Emerging—based on their product and business strategies. The evaluation of product strategy focuses on aspects such as the range and depth of offerings, commitment to innovation, product functionalities, and scalability. Key elements like global reach, sector coverage, strategic acquisitions, and long-term growth plans are considered for business strategy. This analysis provides a detailed view of companies' position within the market and highlights their potential for future growth and development.

Research Methodology

The qualitative and quantitative insights for the tire derived fuel market are derived through a multi-faceted research approach, combining input from subject matter experts, primary research, and secondary data sources. Primary research includes gathering critical information via face-to-face or telephonic interviews, surveys, questionnaires, and feedback from industry professionals, key opinion leaders (KOLs), and customers. Regular interviews with industry experts are conducted to deepen the analysis and reinforce the existing data, ensuring a robust and well-rounded market understanding.

Secondary research for this report was carried out by the Market Research Store team, drawing on a variety of authoritative sources, such as:

- Official company websites, annual reports, financial statements, investor presentations, and SEC filings

- Internal and external proprietary databases, as well as relevant patent and regulatory databases

- Government publications, national statistical databases, and industry-specific market reports

- Media coverage, including news articles, press releases, and webcasts about market participants

- Paid industry databases for detailed market insights

Market Research Store conducted in-depth consultations with various key opinion leaders in the industry, including senior executives from top companies and regional leaders from end-user organizations. This effort aimed to gather critical insights on factors such as the market share of dominant brands in specific countries and regions, along with pricing strategies for products and services.

To determine total sales data, the research team conducted primary interviews across multiple countries with influential stakeholders, including:

- Distributors

- Marketing, Brand, and Product Managers

- Procurement and Production Managers

- Sales and Regional Sales Managers, Country Managers

- Technical Specialists

- C-Level Executives

These subject matter experts, with their extensive industry experience, helped validate and refine the findings. For secondary research, data was sourced from a wide range of materials, including online resources, company annual reports, industry publications, research papers, association reports, and government websites. These various sources provide a comprehensive and well-rounded perspective on the market.

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Tire Derived Fuel Market Share by Type (2020-2026) 1.5.2 Shredded Tire 1.5.3 Whole Tire 1.6 Market by Application 1.6.1 Global Tire Derived Fuel Market Share by Application (2020-2026) 1.6.2 Pulp and Paper Mills 1.6.3 Cement Manufacturing 1.6.4 Utility Boiler 1.6.5 Others 1.7 Tire Derived Fuel Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Tire Derived Fuel Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Tire Derived Fuel Market 3.1 Value Chain Status 3.2 Tire Derived Fuel Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Tire Derived Fuel 3.2.3 Labor Cost of Tire Derived Fuel 3.2.3.1 Labor Cost of Tire Derived Fuel Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 ResourceCo Pty Ltd. 4.1.1 ResourceCo Pty Ltd. Basic Information 4.1.2 Tire Derived Fuel Product Profiles, Application and Specification 4.1.3 ResourceCo Pty Ltd. Tire Derived Fuel Market Performance (2015-2020) 4.1.4 ResourceCo Pty Ltd. Business Overview 4.2 Lakin Tire West Inc. 4.2.1 Lakin Tire West Inc. Basic Information 4.2.2 Tire Derived Fuel Product Profiles, Application and Specification 4.2.3 Lakin Tire West Inc. Tire Derived Fuel Market Performance (2015-2020) 4.2.4 Lakin Tire West Inc. Business Overview 4.3 Liberty Tire Whole Tire 4.3.1 Liberty Tire Whole Tire Basic Information 4.3.2 Tire Derived Fuel Product Profiles, Application and Specification 4.3.3 Liberty Tire Whole Tire Tire Derived Fuel Market Performance (2015-2020) 4.3.4 Liberty Tire Whole Tire Business Overview 4.4 ETR Group 4.4.1 ETR Group Basic Information 4.4.2 Tire Derived Fuel Product Profiles, Application and Specification 4.4.3 ETR Group Tire Derived Fuel Market Performance (2015-2020) 4.4.4 ETR Group Business Overview 4.5 Emanuel Tire 4.5.1 Emanuel Tire Basic Information 4.5.2 Tire Derived Fuel Product Profiles, Application and Specification 4.5.3 Emanuel Tire Tire Derived Fuel Market Performance (2015-2020) 4.5.4 Emanuel Tire Business Overview 4.6 West Coast Rubber Whole Tire Inc. 4.6.1 West Coast Rubber Whole Tire Inc. Basic Information 4.6.2 Tire Derived Fuel Product Profiles, Application and Specification 4.6.3 West Coast Rubber Whole Tire Inc. Tire Derived Fuel Market Performance (2015-2020) 4.6.4 West Coast Rubber Whole Tire Inc. Business Overview 4.7 Renelux Cyprus Ltd 4.7.1 Renelux Cyprus Ltd Basic Information 4.7.2 Tire Derived Fuel Product Profiles, Application and Specification 4.7.3 Renelux Cyprus Ltd Tire Derived Fuel Market Performance (2015-2020) 4.7.4 Renelux Cyprus Ltd Business Overview 4.8 Reliable Tire Disposal 4.8.1 Reliable Tire Disposal Basic Information 4.8.2 Tire Derived Fuel Product Profiles, Application and Specification 4.8.3 Reliable Tire Disposal Tire Derived Fuel Market Performance (2015-2020) 4.8.4 Reliable Tire Disposal Business Overview 4.9 Front Range Tire Recycle Inc. 4.9.1 Front Range Tire Recycle Inc. Basic Information 4.9.2 Tire Derived Fuel Product Profiles, Application and Specification 4.9.3 Front Range Tire Recycle Inc. Tire Derived Fuel Market Performance (2015-2020) 4.9.4 Front Range Tire Recycle Inc. Business Overview 4.10 Ragn-Sells Group 4.10.1 Ragn-Sells Group Basic Information 4.10.2 Tire Derived Fuel Product Profiles, Application and Specification 4.10.3 Ragn-Sells Group Tire Derived Fuel Market Performance (2015-2020) 4.10.4 Ragn-Sells Group Business Overview 4.11 Scandinavian Enviro Systems AB 4.11.1 Scandinavian Enviro Systems AB Basic Information 4.11.2 Tire Derived Fuel Product Profiles, Application and Specification 4.11.3 Scandinavian Enviro Systems AB Tire Derived Fuel Market Performance (2015-2020) 4.11.4 Scandinavian Enviro Systems AB Business Overview 4.12 Globarket Tire Whole Tire LLC 4.12.1 Globarket Tire Whole Tire LLC Basic Information 4.12.2 Tire Derived Fuel Product Profiles, Application and Specification 4.12.3 Globarket Tire Whole Tire LLC Tire Derived Fuel Market Performance (2015-2020) 4.12.4 Globarket Tire Whole Tire LLC Business Overview 4.13 L & S Tire Company 4.13.1 L & S Tire Company Basic Information 4.13.2 Tire Derived Fuel Product Profiles, Application and Specification 4.13.3 L & S Tire Company Tire Derived Fuel Market Performance (2015-2020) 4.13.4 L & S Tire Company Business Overview 4.14 Tire Disposal & Whole Tire Inc. 4.14.1 Tire Disposal & Whole Tire Inc. Basic Information 4.14.2 Tire Derived Fuel Product Profiles, Application and Specification 4.14.3 Tire Disposal & Whole Tire Inc. Tire Derived Fuel Market Performance (2015-2020) 4.14.4 Tire Disposal & Whole Tire Inc. Business Overview 5 Global Tire Derived Fuel Market Analysis by Regions 5.1 Global Tire Derived Fuel Sales, Revenue and Market Share by Regions 5.1.1 Global Tire Derived Fuel Sales by Regions (2015-2020) 5.1.2 Global Tire Derived Fuel Revenue by Regions (2015-2020) 5.2 North America Tire Derived Fuel Sales and Growth Rate (2015-2020) 5.3 Europe Tire Derived Fuel Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Tire Derived Fuel Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Tire Derived Fuel Sales and Growth Rate (2015-2020) 5.6 South America Tire Derived Fuel Sales and Growth Rate (2015-2020) 6 North America Tire Derived Fuel Market Analysis by Countries 6.1 North America Tire Derived Fuel Sales, Revenue and Market Share by Countries 6.1.1 North America Tire Derived Fuel Sales by Countries (2015-2020) 6.1.2 North America Tire Derived Fuel Revenue by Countries (2015-2020) 6.1.3 North America Tire Derived Fuel Market Under COVID-19 6.2 United States Tire Derived Fuel Sales and Growth Rate (2015-2020) 6.2.1 United States Tire Derived Fuel Market Under COVID-19 6.3 Canada Tire Derived Fuel Sales and Growth Rate (2015-2020) 6.4 Mexico Tire Derived Fuel Sales and Growth Rate (2015-2020) 7 Europe Tire Derived Fuel Market Analysis by Countries 7.1 Europe Tire Derived Fuel Sales, Revenue and Market Share by Countries 7.1.1 Europe Tire Derived Fuel Sales by Countries (2015-2020) 7.1.2 Europe Tire Derived Fuel Revenue by Countries (2015-2020) 7.1.3 Europe Tire Derived Fuel Market Under COVID-19 7.2 Germany Tire Derived Fuel Sales and Growth Rate (2015-2020) 7.2.1 Germany Tire Derived Fuel Market Under COVID-19 7.3 UK Tire Derived Fuel Sales and Growth Rate (2015-2020) 7.3.1 UK Tire Derived Fuel Market Under COVID-19 7.4 France Tire Derived Fuel Sales and Growth Rate (2015-2020) 7.4.1 France Tire Derived Fuel Market Under COVID-19 7.5 Italy Tire Derived Fuel Sales and Growth Rate (2015-2020) 7.5.1 Italy Tire Derived Fuel Market Under COVID-19 7.6 Spain Tire Derived Fuel Sales and Growth Rate (2015-2020) 7.6.1 Spain Tire Derived Fuel Market Under COVID-19 7.7 Russia Tire Derived Fuel Sales and Growth Rate (2015-2020) 7.7.1 Russia Tire Derived Fuel Market Under COVID-19 8 Asia-Pacific Tire Derived Fuel Market Analysis by Countries 8.1 Asia-Pacific Tire Derived Fuel Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Tire Derived Fuel Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Tire Derived Fuel Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Tire Derived Fuel Market Under COVID-19 8.2 China Tire Derived Fuel Sales and Growth Rate (2015-2020) 8.2.1 China Tire Derived Fuel Market Under COVID-19 8.3 Japan Tire Derived Fuel Sales and Growth Rate (2015-2020) 8.3.1 Japan Tire Derived Fuel Market Under COVID-19 8.4 South Korea Tire Derived Fuel Sales and Growth Rate (2015-2020) 8.4.1 South Korea Tire Derived Fuel Market Under COVID-19 8.5 Australia Tire Derived Fuel Sales and Growth Rate (2015-2020) 8.6 India Tire Derived Fuel Sales and Growth Rate (2015-2020) 8.6.1 India Tire Derived Fuel Market Under COVID-19 8.7 Southeast Asia Tire Derived Fuel Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Tire Derived Fuel Market Under COVID-19 9 Middle East and Africa Tire Derived Fuel Market Analysis by Countries 9.1 Middle East and Africa Tire Derived Fuel Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Tire Derived Fuel Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Tire Derived Fuel Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Tire Derived Fuel Market Under COVID-19 9.2 Saudi Arabia Tire Derived Fuel Sales and Growth Rate (2015-2020) 9.3 UAE Tire Derived Fuel Sales and Growth Rate (2015-2020) 9.4 Egypt Tire Derived Fuel Sales and Growth Rate (2015-2020) 9.5 Nigeria Tire Derived Fuel Sales and Growth Rate (2015-2020) 9.6 South Africa Tire Derived Fuel Sales and Growth Rate (2015-2020) 10 South America Tire Derived Fuel Market Analysis by Countries 10.1 South America Tire Derived Fuel Sales, Revenue and Market Share by Countries 10.1.1 South America Tire Derived Fuel Sales by Countries (2015-2020) 10.1.2 South America Tire Derived Fuel Revenue by Countries (2015-2020) 10.1.3 South America Tire Derived Fuel Market Under COVID-19 10.2 Brazil Tire Derived Fuel Sales and Growth Rate (2015-2020) 10.2.1 Brazil Tire Derived Fuel Market Under COVID-19 10.3 Argentina Tire Derived Fuel Sales and Growth Rate (2015-2020) 10.4 Columbia Tire Derived Fuel Sales and Growth Rate (2015-2020) 10.5 Chile Tire Derived Fuel Sales and Growth Rate (2015-2020) 11 Global Tire Derived Fuel Market Segment by Types 11.1 Global Tire Derived Fuel Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Tire Derived Fuel Sales and Market Share by Types (2015-2020) 11.1.2 Global Tire Derived Fuel Revenue and Market Share by Types (2015-2020) 11.2 Shredded Tire Sales and Price (2015-2020) 11.3 Whole Tire Sales and Price (2015-2020) 12 Global Tire Derived Fuel Market Segment by Applications 12.1 Global Tire Derived Fuel Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Tire Derived Fuel Sales and Market Share by Applications (2015-2020) 12.1.2 Global Tire Derived Fuel Revenue and Market Share by Applications (2015-2020) 12.2 Pulp and Paper Mills Sales, Revenue and Growth Rate (2015-2020) 12.3 Cement Manufacturing Sales, Revenue and Growth Rate (2015-2020) 12.4 Utility Boiler Sales, Revenue and Growth Rate (2015-2020) 12.5 Others Sales, Revenue and Growth Rate (2015-2020) 13 Tire Derived Fuel Market Forecast by Regions (2020-2026) 13.1 Global Tire Derived Fuel Sales, Revenue and Growth Rate (2020-2026) 13.2 Tire Derived Fuel Market Forecast by Regions (2020-2026) 13.2.1 North America Tire Derived Fuel Market Forecast (2020-2026) 13.2.2 Europe Tire Derived Fuel Market Forecast (2020-2026) 13.2.3 Asia-Pacific Tire Derived Fuel Market Forecast (2020-2026) 13.2.4 Middle East and Africa Tire Derived Fuel Market Forecast (2020-2026) 13.2.5 South America Tire Derived Fuel Market Forecast (2020-2026) 13.3 Tire Derived Fuel Market Forecast by Types (2020-2026) 13.4 Tire Derived Fuel Market Forecast by Applications (2020-2026) 13.5 Tire Derived Fuel Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Tire Derived Fuel

Request Sample

Tire Derived Fuel