Water Treatment Systems Market Size, Share, and Trends Analysis Report

CAGR :

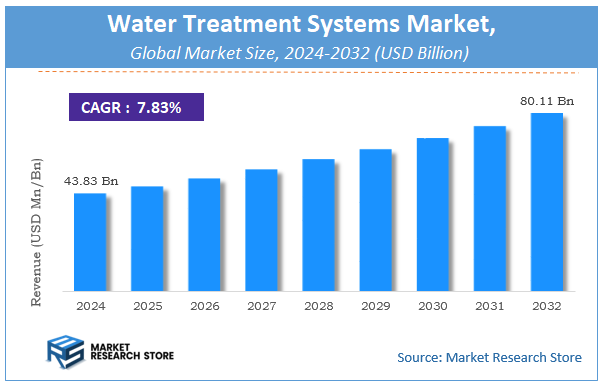

| Market Size 2024 (Base Year) | USD 43.83 Billion |

| Market Size 2032 (Forecast Year) | USD 80.11 Billion |

| CAGR | 7.83% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global water treatment systems market, estimating its value at USD 43.83 Billion in 2024, with projections indicating it will reach USD 80.11 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 7.83% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the water treatment systems industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

Water Treatment Systems Market: Overview

The growth of the water treatment systems market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The water treatment systems market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the water treatment systems market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Technology, Application, Capacity, Installation Type, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global water treatment systems market is estimated to grow annually at a CAGR of around 7.83% over the forecast period (2025-2032).

- In terms of revenue, the global water treatment systems market size was valued at around USD 43.83 Billion in 2024 and is projected to reach USD 80.11 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing demand for safe and clean water, increasing industrial and municipal wastewater treatment needs, and rising adoption of advanced filtration technologies are boosting the Water Treatment Systems market.

- Based on the Technology, the Membrane Filtration segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Application, the Residential segment is anticipated to command the largest market share.

- In terms of Capacity, the 100 segment is projected to lead the global market.

- By Installation Type, the Under-sink segment is predicted to dominate the global market.

- Based on region, North America is projected to dominate the global market during the forecast period.

Water Treatment Systems Market: Report Scope

This report thoroughly analyzes the water treatment systems market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Water Treatment Systems Market |

| Market Size in 2024 | USD 43.83 Billion |

| Market Forecast in 2032 | USD 80.11 Billion |

| Growth Rate | CAGR of 7.83% |

| Number of Pages | 250 |

| Key Companies Covered | 3M, Honeywell International Inc., DuPont, Panasonic, Pentair plc, BWT Aktiengesellschaft, Culligan, Watts Water Technologies Inc., Aquasana Inc, Calgon Carbon Corp., Pure Aqua Inc, EcoWater Systems LLC, Aquaphor, FilterSmart, WCC (Water Control Corp.) |

| Segments Covered | By Technology, By Application, By Capacity, By Installation Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2020 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Water Treatment Systems Market: Dynamics

Key Growth Drivers :

The market is primarily driven by the increasing demand for clean water due to rapid population growth and urbanization. As cities expand, the strain on existing water supplies intensifies, necessitating more effective treatment and recycling methods. Furthermore, stringent government regulations for water quality and wastewater discharge are compelling industries and municipalities to invest in advanced treatment systems to ensure compliance. Growing public awareness of waterborne diseases and health risks associated with contaminated water is also fueling demand for point-of-use and point-of-entry purification systems for homes and businesses. Finally, continuous technological advancements, such as more efficient membrane filtration (like reverse osmosis) and the integration of smart technologies like IoT and AI, are making water treatment more accessible and cost-effective.

Restraints :

Despite the strong growth drivers, the market faces significant restraints. A major obstacle is the high capital and operational costs associated with installing and maintaining advanced water treatment technologies. This can be a significant barrier, especially for developing regions and small-scale industries with limited budgets. Additionally, a lack of awareness and inadequate infrastructure in many rural and underdeveloped areas hinders the adoption of these systems. The energy-intensive nature of certain treatment processes, like desalination, adds to operational costs and raises environmental concerns. Finally, managing the environmental impact of waste products, such as the disposal of brine from reverse osmosis systems or sludge from industrial treatment, presents a continuous challenge and requires further investment in sustainable disposal methods.

Opportunities :

The water treatment market is full of opportunities for innovation and expansion. The increasing need for wastewater recycling and reuse creates a major opportunity, particularly in industries and agriculture, where treated wastewater can be used for non-potable applications. The development of smart water systems, which use sensors and data analytics for real-time monitoring and predictive maintenance, can significantly improve efficiency and reduce operational costs. This also paves the way for decentralized, small-scale treatment solutions. Furthermore, the global water crisis is driving a surge in interest in desalination technology, especially in arid regions, offering a lucrative market for advanced, energy-efficient desalination systems. The use of sustainable and eco-friendly treatment methods, like bio-filtration and solar-powered systems, also presents a growing opportunity as environmental concerns become more prominent.

Challenges :

The market faces a number of persistent challenges. Ensuring consistent water quality in the face of variable source water composition (e.g., due to seasonal changes or pollution events) is a significant technical challenge. Maintaining aging infrastructure and upgrading outdated treatment plants requires substantial and ongoing investment, which can be difficult for public utilities to secure. Regulatory and compliance complexities vary by region, making it difficult for international companies to navigate the market and requiring a deep understanding of local laws. Lastly, there's a constant need for skilled labor to operate and maintain these increasingly complex and high-tech systems, and a shortage of trained professionals can impact the efficiency and reliability of water treatment operations.

Water Treatment Systems Market: Segmentation Insights

The global water treatment systems market is segmented based on Technology, Application, Capacity, Installation Type, and Region. All the segments of the water treatment systems market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Technology, the global water treatment systems market is divided into Membrane Filtration, Granular Activated Carbon (GAC), Ion Exchange, Ultraviolet (UV) Disinfection, Distillation.

On the basis of Application, the global water treatment systems market is bifurcated into Residential, Commercial, Industrial, Municipal, Contaminant Removal Chlorine, Fluoride, Heavy Metals, Bacteria, Viruses.

In terms of Capacity, the global water treatment systems market is categorized into = 100,000 liters per day (LPD), 100,000 - 500,000 LPD, 500,000 - 1,000,000 LPD, > 1,000,000 LPD.

Based on Installation Type, the global water treatment systems market is split into Under-sink, Whole-house, Commercial, Industrial .

Water Treatment Systems Market: Regional Insights

The Asia-Pacific region is the dominant and fastest-growing market for water treatment systems globally. This leadership is driven by severe water scarcity, rapid industrialization, and stringent government regulations in countries like China and India.

Rising public awareness about water-borne diseases and increasing investments in municipal water infrastructure further fuel demand. While North America and Europe are mature markets with high replacement demand for advanced technologies, Asia-Pacific holds the largest market share, accounting for over 40% of the global revenue, with its growth rate significantly outpacing other regions.

Water Treatment Systems Market: Competitive Landscape

The water treatment systems market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Water Treatment Systems Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- 3M

- Honeywell International Inc.

- DuPont

- Panasonic

- Pentair plc

- BWT Aktiengesellschaft

- Culligan

- Watts Water Technologies Inc.

- Aquasana Inc

- Calgon Carbon Corp.

- Pure Aqua Inc

- EcoWater Systems LLC

- Aquaphor

- FilterSmart

- WCC (Water Control Corp.)

The Global Water Treatment Systems Market is Segmented as Follows:

By Technology

- Membrane Filtration

- Granular Activated Carbon (GAC)

- Ion Exchange

- Ultraviolet (UV) Disinfection

- Distillation

By Application

- Residential

- Commercial

- Industrial

- Municipal

- Contaminant Removal Chlorine

- Fluoride

- Heavy Metals

- Bacteria

- Viruses

By Capacity

- 100,000 liters per day (LPD)

- 100,000 - 500,000 LPD

- 500,000 - 1,000,000 LPD

- 1,000,000 LPD

By Installation Type

- Under-sink

- Whole-house

- Commercial

- Industrial

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Report Overview 1.1 Study Scope 1.2 Key Market Segments 1.3 Regulatory Scenario by Region/Country 1.4 Market Investment Scenario Strategic 1.5 Market Analysis by Type 1.5.1 Global Water Treatment Systems Market Share by Type (2020-2026) 1.5.2 Point of Use 1.5.3 Point of Entry 1.6 Market by Application 1.6.1 Global Water Treatment Systems Market Share by Application (2020-2026) 1.6.2 Residential 1.6.3 Non-residential 1.7 Water Treatment Systems Industry Development Trends under COVID-19 Outbreak 1.7.1 Global COVID-19 Status Overview 1.7.2 Influence of COVID-19 Outbreak on Water Treatment Systems Industry Development 2. Global Market Growth Trends 2.1 Industry Trends 2.1.1 SWOT Analysis 2.1.2 Porter’s Five Forces Analysis 2.2 Potential Market and Growth Potential Analysis 2.3 Industry News and Policies by Regions 2.3.1 Industry News 2.3.2 Industry Policies 2.4 Industry Trends Under COVID-19 3 Value Chain of Water Treatment Systems Market 3.1 Value Chain Status 3.2 Water Treatment Systems Manufacturing Cost Structure Analysis 3.2.1 Production Process Analysis 3.2.2 Manufacturing Cost Structure of Water Treatment Systems 3.2.3 Labor Cost of Water Treatment Systems 3.2.3.1 Labor Cost of Water Treatment Systems Under COVID-19 3.3 Sales and Marketing Model Analysis 3.4 Downstream Major Customer Analysis (by Region) 3.5 Value Chain Status Under COVID-19 4 Players Profiles 4.1 Calgon Carbon Corporation 4.1.1 Calgon Carbon Corporation Basic Information 4.1.2 Water Treatment Systems Product Profiles, Application and Specification 4.1.3 Calgon Carbon Corporation Water Treatment Systems Market Performance (2015-2020) 4.1.4 Calgon Carbon Corporation Business Overview 4.2 The Dow Chemical Company 4.2.1 The Dow Chemical Company Basic Information 4.2.2 Water Treatment Systems Product Profiles, Application and Specification 4.2.3 The Dow Chemical Company Water Treatment Systems Market Performance (2015-2020) 4.2.4 The Dow Chemical Company Business Overview 4.3 Danaher Corporation 4.3.1 Danaher Corporation Basic Information 4.3.2 Water Treatment Systems Product Profiles, Application and Specification 4.3.3 Danaher Corporation Water Treatment Systems Market Performance (2015-2020) 4.3.4 Danaher Corporation Business Overview 4.4 Culligan International 4.4.1 Culligan International Basic Information 4.4.2 Water Treatment Systems Product Profiles, Application and Specification 4.4.3 Culligan International Water Treatment Systems Market Performance (2015-2020) 4.4.4 Culligan International Business Overview 4.5 Pentair plc 4.5.1 Pentair plc Basic Information 4.5.2 Water Treatment Systems Product Profiles, Application and Specification 4.5.3 Pentair plc Water Treatment Systems Market Performance (2015-2020) 4.5.4 Pentair plc Business Overview 4.6 General Electric 4.6.1 General Electric Basic Information 4.6.2 Water Treatment Systems Product Profiles, Application and Specification 4.6.3 General Electric Water Treatment Systems Market Performance (2015-2020) 4.6.4 General Electric Business Overview 4.7 3M Company 4.7.1 3M Company Basic Information 4.7.2 Water Treatment Systems Product Profiles, Application and Specification 4.7.3 3M Company Water Treatment Systems Market Performance (2015-2020) 4.7.4 3M Company Business Overview 4.8 Honeywell International 4.8.1 Honeywell International Basic Information 4.8.2 Water Treatment Systems Product Profiles, Application and Specification 4.8.3 Honeywell International Water Treatment Systems Market Performance (2015-2020) 4.8.4 Honeywell International Business Overview 5 Global Water Treatment Systems Market Analysis by Regions 5.1 Global Water Treatment Systems Sales, Revenue and Market Share by Regions 5.1.1 Global Water Treatment Systems Sales by Regions (2015-2020) 5.1.2 Global Water Treatment Systems Revenue by Regions (2015-2020) 5.2 North America Water Treatment Systems Sales and Growth Rate (2015-2020) 5.3 Europe Water Treatment Systems Sales and Growth Rate (2015-2020) 5.4 Asia-Pacific Water Treatment Systems Sales and Growth Rate (2015-2020) 5.5 Middle East and Africa Water Treatment Systems Sales and Growth Rate (2015-2020) 5.6 South America Water Treatment Systems Sales and Growth Rate (2015-2020) 6 North America Water Treatment Systems Market Analysis by Countries 6.1 North America Water Treatment Systems Sales, Revenue and Market Share by Countries 6.1.1 North America Water Treatment Systems Sales by Countries (2015-2020) 6.1.2 North America Water Treatment Systems Revenue by Countries (2015-2020) 6.1.3 North America Water Treatment Systems Market Under COVID-19 6.2 United States Water Treatment Systems Sales and Growth Rate (2015-2020) 6.2.1 United States Water Treatment Systems Market Under COVID-19 6.3 Canada Water Treatment Systems Sales and Growth Rate (2015-2020) 6.4 Mexico Water Treatment Systems Sales and Growth Rate (2015-2020) 7 Europe Water Treatment Systems Market Analysis by Countries 7.1 Europe Water Treatment Systems Sales, Revenue and Market Share by Countries 7.1.1 Europe Water Treatment Systems Sales by Countries (2015-2020) 7.1.2 Europe Water Treatment Systems Revenue by Countries (2015-2020) 7.1.3 Europe Water Treatment Systems Market Under COVID-19 7.2 Germany Water Treatment Systems Sales and Growth Rate (2015-2020) 7.2.1 Germany Water Treatment Systems Market Under COVID-19 7.3 UK Water Treatment Systems Sales and Growth Rate (2015-2020) 7.3.1 UK Water Treatment Systems Market Under COVID-19 7.4 France Water Treatment Systems Sales and Growth Rate (2015-2020) 7.4.1 France Water Treatment Systems Market Under COVID-19 7.5 Italy Water Treatment Systems Sales and Growth Rate (2015-2020) 7.5.1 Italy Water Treatment Systems Market Under COVID-19 7.6 Spain Water Treatment Systems Sales and Growth Rate (2015-2020) 7.6.1 Spain Water Treatment Systems Market Under COVID-19 7.7 Russia Water Treatment Systems Sales and Growth Rate (2015-2020) 7.7.1 Russia Water Treatment Systems Market Under COVID-19 8 Asia-Pacific Water Treatment Systems Market Analysis by Countries 8.1 Asia-Pacific Water Treatment Systems Sales, Revenue and Market Share by Countries 8.1.1 Asia-Pacific Water Treatment Systems Sales by Countries (2015-2020) 8.1.2 Asia-Pacific Water Treatment Systems Revenue by Countries (2015-2020) 8.1.3 Asia-Pacific Water Treatment Systems Market Under COVID-19 8.2 China Water Treatment Systems Sales and Growth Rate (2015-2020) 8.2.1 China Water Treatment Systems Market Under COVID-19 8.3 Japan Water Treatment Systems Sales and Growth Rate (2015-2020) 8.3.1 Japan Water Treatment Systems Market Under COVID-19 8.4 South Korea Water Treatment Systems Sales and Growth Rate (2015-2020) 8.4.1 South Korea Water Treatment Systems Market Under COVID-19 8.5 Australia Water Treatment Systems Sales and Growth Rate (2015-2020) 8.6 India Water Treatment Systems Sales and Growth Rate (2015-2020) 8.6.1 India Water Treatment Systems Market Under COVID-19 8.7 Southeast Asia Water Treatment Systems Sales and Growth Rate (2015-2020) 8.7.1 Southeast Asia Water Treatment Systems Market Under COVID-19 9 Middle East and Africa Water Treatment Systems Market Analysis by Countries 9.1 Middle East and Africa Water Treatment Systems Sales, Revenue and Market Share by Countries 9.1.1 Middle East and Africa Water Treatment Systems Sales by Countries (2015-2020) 9.1.2 Middle East and Africa Water Treatment Systems Revenue by Countries (2015-2020) 9.1.3 Middle East and Africa Water Treatment Systems Market Under COVID-19 9.2 Saudi Arabia Water Treatment Systems Sales and Growth Rate (2015-2020) 9.3 UAE Water Treatment Systems Sales and Growth Rate (2015-2020) 9.4 Egypt Water Treatment Systems Sales and Growth Rate (2015-2020) 9.5 Nigeria Water Treatment Systems Sales and Growth Rate (2015-2020) 9.6 South Africa Water Treatment Systems Sales and Growth Rate (2015-2020) 10 South America Water Treatment Systems Market Analysis by Countries 10.1 South America Water Treatment Systems Sales, Revenue and Market Share by Countries 10.1.1 South America Water Treatment Systems Sales by Countries (2015-2020) 10.1.2 South America Water Treatment Systems Revenue by Countries (2015-2020) 10.1.3 South America Water Treatment Systems Market Under COVID-19 10.2 Brazil Water Treatment Systems Sales and Growth Rate (2015-2020) 10.2.1 Brazil Water Treatment Systems Market Under COVID-19 10.3 Argentina Water Treatment Systems Sales and Growth Rate (2015-2020) 10.4 Columbia Water Treatment Systems Sales and Growth Rate (2015-2020) 10.5 Chile Water Treatment Systems Sales and Growth Rate (2015-2020) 11 Global Water Treatment Systems Market Segment by Types 11.1 Global Water Treatment Systems Sales, Revenue and Market Share by Types (2015-2020) 11.1.1 Global Water Treatment Systems Sales and Market Share by Types (2015-2020) 11.1.2 Global Water Treatment Systems Revenue and Market Share by Types (2015-2020) 11.2 Point of Use Sales and Price (2015-2020) 11.3 Point of Entry Sales and Price (2015-2020) 12 Global Water Treatment Systems Market Segment by Applications 12.1 Global Water Treatment Systems Sales, Revenue and Market Share by Applications (2015-2020) 12.1.1 Global Water Treatment Systems Sales and Market Share by Applications (2015-2020) 12.1.2 Global Water Treatment Systems Revenue and Market Share by Applications (2015-2020) 12.2 Residential Sales, Revenue and Growth Rate (2015-2020) 12.3 Non-residential Sales, Revenue and Growth Rate (2015-2020) 13 Water Treatment Systems Market Forecast by Regions (2020-2026) 13.1 Global Water Treatment Systems Sales, Revenue and Growth Rate (2020-2026) 13.2 Water Treatment Systems Market Forecast by Regions (2020-2026) 13.2.1 North America Water Treatment Systems Market Forecast (2020-2026) 13.2.2 Europe Water Treatment Systems Market Forecast (2020-2026) 13.2.3 Asia-Pacific Water Treatment Systems Market Forecast (2020-2026) 13.2.4 Middle East and Africa Water Treatment Systems Market Forecast (2020-2026) 13.2.5 South America Water Treatment Systems Market Forecast (2020-2026) 13.3 Water Treatment Systems Market Forecast by Types (2020-2026) 13.4 Water Treatment Systems Market Forecast by Applications (2020-2026) 13.5 Water Treatment Systems Market Forecast Under COVID-19 14 Appendix 14.1 Methodology 14.2 Research Data Source

Inquiry For Buying

Water Treatment Systems

Request Sample

Water Treatment Systems