Welding Flux Market Size, Share, and Trends Analysis Report

CAGR :

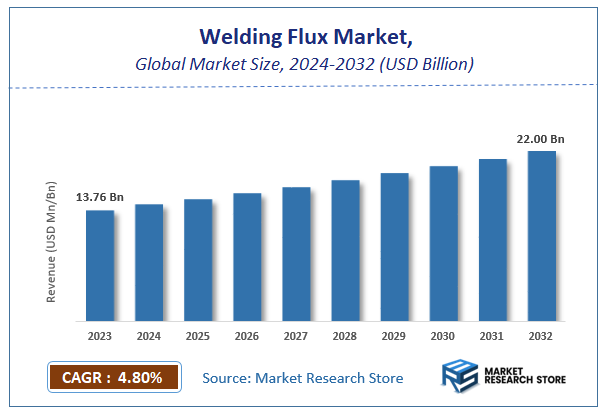

| Market Size 2023 (Base Year) | USD 13.76 Billion |

| Market Size 2032 (Forecast Year) | USD 22.00 Billion |

| CAGR | 4.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Welding Flux Market Insights

According to Market Research Store, the global welding flux market size was valued at around USD 13.76 billion in 2023 and is estimated to reach USD 22.00 billion by 2032, to register a CAGR of approximately 4.8% in terms of revenue during the forecast period 2024-2032.

The welding flux report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Welding Flux Market: Overview

Welding flux is a chemical cleaning agent, flowing agent, or purifying agent used in welding processes to facilitate the joining of metals. It primarily serves to prevent the oxidation of the weld pool by forming a protective barrier against atmospheric gases such as oxygen and nitrogen. In addition, welding flux helps in removing impurities from the metal surface, stabilizing the arc, and improving weld quality by ensuring cleaner and stronger weld joints. It is commonly used in various welding methods, including submerged arc welding (SAW), shielded metal arc welding (SMAW), and flux-cored arc welding (FCAW), with different compositions tailored to specific applications and materials.

Key Highlights

- The welding flux market is anticipated to grow at a CAGR of 4.8% during the forecast period.

- The global welding flux market was estimated to be worth approximately USD 13.76 billion in 2023 and is projected to reach a value of USD 22.00 billion by 2032.

- The growth of the welding flux market is being driven by rising demand across diverse industries such as construction, automotive, shipbuilding, and oil & gas.

- Based on the product type, the consumable flux segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the submerged arc welding (SAW) segment is projected to swipe the largest market share.

- In terms of end-user industry, the construction industry segment is expected to dominate the market.

- Based on the composition, the mineral-based flux segment is expected to dominate the market.

- In terms of packaging type, the bulk packaging segment is expected to dominate the market.

- By region, Asia Pacific is expected to dominate the global market during the forecast period.

Welding Flux Market: Dynamics

Key Growth Drivers:

- Growing Demand from Construction and Infrastructure: Increasing infrastructure projects and urban development across emerging economies are driving the need for welding flux in large-scale metal joining operations.

- Rising Automotive and Shipbuilding Activities: The expansion of automotive and shipbuilding industries requires efficient welding processes, boosting demand for flux to ensure strong and durable welds.

- Technological Advancements in Welding Techniques: Innovations in welding technologies, including submerged arc and flux-cored arc welding, are increasing the efficiency and adoption of welding flux.

- Industrialization in Emerging Economies: Rapid industrialization in countries like India, China, and Brazil is creating a higher demand for metal fabrication, thereby driving the welding flux market.

Restraints:

- Health and Safety Concerns: Fumes and residues generated during welding may pose health risks, which can limit the use of certain flux types without proper ventilation and safety measures.

- Fluctuation in Raw Material Prices: Price volatility of raw materials such as ferrous and non-ferrous components affects production costs and profitability for manufacturers.

- Environmental Regulations: Strict environmental rules regarding emissions and waste management can restrict the use of certain chemical-based fluxes, impacting market growth.

Opportunities:

- Emerging Applications in Renewable Energy: Growth in wind and solar energy infrastructure demands high-quality welding, offering new avenues for welding flux application in green energy projects.

- Expansion of Automated and Robotic Welding: Rising adoption of automation in welding operations boosts demand for compatible and high-efficiency flux materials.

- Custom Flux Development: Increasing demand for customized flux solutions tailored to specific industries and alloys creates new business opportunities for manufacturers.

Challenges:

- Lack of Skilled Labor: Shortage of experienced welders in both developed and developing regions limits the efficiency of flux usage and overall welding operations.

- Competition from Alternative Joining Techniques: The adoption of non-welding joining methods like adhesives and mechanical fastening in some industries may limit the demand for welding flux.

- Low Awareness in Small-Scale Industries: Many small and medium enterprises (SMEs) still rely on traditional welding methods without optimized flux use, limiting market penetration.

Welding Flux Market: Report Scope

This report thoroughly analyzes the Welding Flux Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Welding Flux Market |

| Market Size in 2023 | USD 13.76 Billion |

| Market Forecast in 2032 | USD 22.00 Billion |

| Growth Rate | CAGR of 4.8% |

| Number of Pages | 165 |

| Key Companies Covered | Umicore, Kobelco, Special Metals, Dengfeng, Lincoln Electric, Voestalpine, Sweco, Indium Corporation, NIHON SUPERIOR, Weitexinda Technology, Gaofeng Technology, Yatong Welding Materials, Solder Coat |

| Segments Covered | By Product Type, By Application, By End-User Industry, By Composition, By Packaging Type, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Welding Flux Market: Segmentation Insights

The global welding flux market is divided by product type, application, end-user industry, composition, packaging type, and region.

Segmentation Insights by Product Type

Based on product type, the global welding flux market is divided into consumable flux, non-consumable flux, solid flux, powder flux, and liquid flux.

In the welding flux market, consumable flux stands out as the most dominant product type. Consumable flux is primarily used in submerged arc welding (SAW) and similar techniques where the flux not only shields the weld pool from contaminants but also becomes part of the weld itself. Its widespread adoption is driven by its ability to provide deep weld penetration, higher deposition rates, and enhanced mechanical properties of the weld. These characteristics make consumable flux the preferred choice in heavy industries such as shipbuilding, construction, and pipeline welding, where strong, high-quality welds are critical.

Following consumable flux, solid flux holds a significant market share due to its consistent composition and controlled welding environment. Solid fluxes are typically used in processes like electroslag and some submerged arc welding operations. They offer advantages such as minimal spatter, smooth arc stability, and good weld bead appearance. These features are particularly valued in automated and semi-automated welding applications where precision and uniformity are key.

Powder flux comes next in terms of dominance. This type of flux is appreciated for its versatility and its ability to be custom-formulated for specific welding needs. It is often used in surfacing applications and hard facing operations, where wear resistance or surface properties are more critical than structural strength. The ability to blend different powders for targeted outcomes makes this segment attractive for niche applications in mining, aerospace, and oil & gas.

Liquid flux is comparatively less dominant but still plays a vital role in applications that require minimal slag residue and cleaner weld zones, such as brazing and soldering in electronics and precision equipment. Its ease of application and ability to penetrate small crevices make it suitable for delicate or detailed welding tasks, though it is less suitable for high-strength industrial welding.

Lastly, non-consumable flux is the least dominant segment, primarily used in tungsten inert gas (TIG) and similar processes where the flux does not melt or become part of the weld. Its limited role and application scope result in a smaller market share compared to other flux types. However, it is essential in scenarios where utmost weld purity and control are required, such as in aerospace and high-grade stainless-steel welding.

Segmentation Insights by Application

On the basis of application, the global welding flux market is bifurcated into shielded metal arc welding (SMAW), gas metal arc welding (GMAW), gas tungsten arc welding (GTAW), flux-cored arc welding (FCAW), and submerged arc welding (SAW).

In the welding flux market, Submerged Arc Welding (SAW) is the most dominant application segment. This process heavily relies on flux to shield the weld zone and provide high deposition rates, making it ideal for thick material welding in industries such as shipbuilding, structural steel fabrication, and large-diameter pipeline construction. SAW utilizes consumable flux that not only protects the weld pool but also influences weld composition and mechanical properties, contributing to its dominance in high-productivity, large-scale industrial applications.

Next in line is Shielded Metal Arc Welding (SMAW), commonly known as stick welding. This process uses flux-coated electrodes that release protective gases and slag during welding. SMAW remains widely used due to its simplicity, portability, and adaptability to various environments, especially in construction, repair, and maintenance. Its minimal equipment requirements and strong performance in outdoor or remote settings support its strong market position.

Flux-Cored Arc Welding (FCAW) follows closely, offering a blend of performance and convenience. FCAW uses a tubular wire filled with flux, combining the advantages of both SMAW and GMAW. It is valued for its high productivity, especially in structural steel and heavy equipment manufacturing. The self-shielded variant enables outdoor welding without external shielding gas, enhancing its flexibility and usage in field applications.

Gas Metal Arc Welding (GMAW), also known as MIG welding, is another notable application. Although it typically uses shielding gas rather than flux, some variations, especially those used for dual-shield welding, incorporate flux-cored wires. GMAW is appreciated for its high speed and ease of use in automotive and general fabrication, though its reliance on shielding gas somewhat limits the role of flux in this process, placing it lower in dominance compared to the others.

Lastly, Gas Tungsten Arc Welding (GTAW) or TIG welding is the least dominant in terms of flux application. GTAW is known for producing high-quality, precise welds using a non-consumable tungsten electrode and an inert shielding gas, with little or no flux involved. While it excels in applications requiring fine detail and clean welds—such as aerospace, food-grade equipment, and pressure vessels—it contributes minimally to the demand for welding flux, hence its position at the bottom of the hierarchy.

Segmentation Insights by End-User Industry

Based on end-user industry, the global welding flux market is divided into aerospace, automotive, construction, shipbuilding, and pipeline.

In the welding flux market, the construction industry emerges as the most dominant end-user segment. This sector extensively uses welding for structural frameworks, bridges, and infrastructure projects, all of which require strong, durable joints. Fluxes play a vital role in ensuring weld quality, especially in Shielded Metal Arc Welding (SMAW) and Submerged Arc Welding (SAW), which are commonly used in construction due to their reliability in diverse environmental conditions. The high volume of projects and stringent safety standards in this sector drive substantial demand for welding flux.

Following construction, the shipbuilding industry holds a prominent position. Shipbuilding heavily relies on Submerged Arc Welding, a process that demands large quantities of consumable flux. Flux contributes significantly to producing strong, corrosion-resistant welds that can withstand marine conditions. With ships requiring thick metal sections and extensive weld seams, the consumption of welding flux in this industry is substantial and consistent, making it a major end-user.

The pipeline industry also accounts for a significant share of the welding flux market. Pipelines, particularly those used for oil and gas transmission, often span long distances and involve thick-wall materials that require deep-penetration welds. Processes like SAW and FCAW are widely used here, both of which require or benefit from flux. The growing demand for energy infrastructure continues to support steady flux consumption in this sector.

The automotive industry ranks next in the hierarchy. While MIG and spot welding are more commonly used in automotive manufacturing—processes that do not heavily rely on flux—certain components and applications, such as the welding of axles, chassis, and exhaust systems, still require flux-based processes. As the industry shifts toward electric vehicles and lightweight materials, the demand for precision welding continues, though flux use remains more limited compared to heavier industries.

Lastly, the aerospace industry represents the least dominant segment in terms of welding flux demand. Aerospace manufacturing prioritizes precision and high-quality welds, often using Gas Tungsten Arc Welding (GTAW), which typically does not require flux. Moreover, the use of specialized alloys and the need for clean welds with minimal contamination reduce the relevance of traditional fluxes. Despite the high value of the aerospace sector, its contribution to the overall welding flux market remains relatively small due to these specific welding requirements.

Segmentation Insights by Composition

On the basis of composition, the global welding flux market is bifurcated into mineral-based flux, organic flux, inorganic flux, low hydrogen flux, and high-fusion flux.

In the welding flux market, mineral-based flux holds the position as the most dominant segment by composition. These fluxes are primarily composed of silicates, oxides, and other naturally occurring minerals that provide excellent slag formation, arc stability, and weld bead appearance. They are widely used in heavy-duty welding applications such as Submerged Arc Welding (SAW) and Shielded Metal Arc Welding (SMAW), particularly in construction, shipbuilding, and pipeline industries. Their versatility and high thermal resistance make them the go-to choice for high-strength welding applications requiring consistent performance.

Next in dominance is low hydrogen flux, which is specifically formulated to reduce hydrogen-induced cracking in weld metal. These fluxes are vital in welding high-strength steels and thick materials, making them highly valued in critical applications such as pressure vessels, pipelines, and structural engineering. By minimizing hydrogen absorption, low hydrogen flux ensures weld integrity and prevents cold cracking, especially in environments with varying temperatures and stress loads.

High-fusion flux follows, used primarily in applications that require deep weld penetration and strong joint strength. These fluxes are engineered to produce high fluidity in the slag, facilitating full fusion between base metals and filler materials. They are commonly utilized in submerged arc welding for heavy steel sections in shipbuilding and offshore structures. Although they are less common than mineral or low hydrogen fluxes, their specialized performance characteristics maintain their relevance in niche industrial applications.

Inorganic flux ranks next, comprising compounds like borates, fluorides, and other non-carbon-based chemicals. These fluxes are often used in high-temperature applications and where strong chemical cleaning action is needed during welding. They are suitable for processes requiring clean welds and good electrical conductivity, such as brazing and some specialty arc welding techniques. However, their use is more limited due to the specific conditions required for optimal performance.

Lastly, organic flux is the least dominant segment. Made from carbon-based substances, including resins, acids, and other organic compounds, these fluxes are typically used in low-temperature applications such as soldering and brazing rather than heavy-duty welding. Their lower thermal stability limits their use in high-temperature welding environments, confining their application to electronics, fine metalwork, and precision repairs. As a result, their contribution to the overall welding flux market remains minimal.

Segmentation Insights by Packaging Type

On the basis of packaging type, the global welding flux market is bifurcated into bulk packaging, bagged flux, cylindrical containers, drum packaging, and retail packaging.

In the welding flux market, bulk packaging stands as the most dominant packaging type. It is extensively used in large-scale industrial operations such as shipbuilding, pipeline construction, and structural steel fabrication where high volumes of flux are consumed continuously. Bulk packaging—typically supplied in large containers, sacks, or super sacks—offers cost efficiency, reduced packaging waste, and ease of storage and handling for facilities with dedicated material handling systems. This format supports uninterrupted operations in high-throughput welding environments.

Next in dominance is bagged flux, which is commonly used in both medium-scale industrial and commercial welding settings. Usually available in 20–50 kg bags, this type of packaging strikes a balance between portability and volume, making it ideal for mobile operations or medium-sized workshops. Bagged flux also allows for better control over usage quantities, reducing waste and enabling precise handling without the infrastructure needed for bulk material storage.

Drum packaging follows, offering a robust solution for storing and transporting larger quantities of flux, typically in sealed metal or plastic drums. This format is often preferred where protection against moisture and contamination is critical. Drum packaging is popular in environments with automated welding processes or centralized supply systems, offering easy dispensing and storage while maintaining the quality of the flux over time.

Cylindrical containers rank next and are generally used for specialty or high-value flux products where controlled usage and extended shelf life are important. These containers are usually made of plastic or metal and provide excellent sealing to protect the flux from moisture, making them suitable for storage in varied environments. They are favored in aerospace and automotive sectors where smaller quantities of high-performance flux are used.

Lastly, retail packaging is the least dominant segment. Designed for small-scale, DIY, or repair-shop use, retail packages usually contain minimal quantities of flux in sealed pouches or small jars. While this format offers convenience and accessibility for hobbyists and light-duty users, its market share is relatively small compared to the industrial-scale needs of larger sectors.

Welding Flux Market: Regional Insights

- Asia Pacific is expected to dominates the global market

The Asia Pacific region is the most dominant in the global welding flux market. This dominance is attributed to rapid industrialization, a strong manufacturing base, and robust infrastructure development across countries such as China, India, South Korea, and Japan. Key sectors including automotive, construction, and shipbuilding drive the demand for welding flux, while the region's competitive production costs and the presence of numerous domestic manufacturers further strengthen its market position. Government investments in large-scale infrastructure and energy projects continue to fuel sustained demand for welding consumables.

North America holds the second-largest share in the welding flux market, led by the United States, where strong activity in the automotive, oil & gas, and construction sectors drives consistent demand. The region benefits from the integration of automation in welding processes and a strong focus on technological innovation. Ongoing infrastructure upgrades and pipeline construction projects support the need for advanced welding materials. The presence of major welding equipment companies and investments in R&D continue to bolster North America's market position.

Europe follows closely, supported by its advanced industrial base and high demand from sectors such as automotive, machinery, and aerospace. Countries like Germany, Italy, and France lead the regional market with a focus on precision welding and adherence to strict safety and environmental regulations. The adoption of energy-efficient and high-performance welding technologies contributes to stable demand for quality welding flux. Though the market is mature, continued innovation and modernization efforts maintain steady growth.

Latin America is experiencing moderate growth in the welding flux market, largely driven by infrastructure development and the energy and mining industries. Brazil and Mexico are the primary contributors, with increasing construction activities and oil & gas operations requiring a steady supply of welding consumables. However, challenges such as economic instability, import dependence, and limited technological advancement slow the pace of growth compared to more developed regions.

Middle East and Africa represent the least dominant region but show promising potential due to expanding infrastructure and energy-related projects, especially in the Gulf Cooperation Council countries. The oil & gas industry plays a central role in driving welding flux demand, particularly for pipeline welding and refinery maintenance. While industrialization in Africa remains limited, growing investments in mining and construction projects are gradually increasing the need for welding materials. The region continues to rely on imports due to limited local manufacturing capabilities.

Welding Flux Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the welding flux market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global welding flux market include:

- Umicore

- Kobelco

- Special Metals

- Dengfeng

- Lincoln Electric

- Voestalpine

- Sweco

- Indium Corporation

- NIHON SUPERIOR

- Weitexinda Technology

- Gaofeng Technology

- Yatong Welding Materials

- Solder Coat

The global welding flux market is segmented as follows:

By Product Type

- Consumable Flux

- Non-Consumable Flux

- Solid Flux

- Powder Flux

- Liquid Flux

By Application

- Shielded Metal Arc Welding (SMAW)

- Gas Metal Arc Welding (GMAW)

- Gas Tungsten Arc Welding (GTAW)

- Flux-Cored Arc Welding (FCAW)

- Submerged Arc Welding (SAW)

By End-User Industry

- Aerospace

- Automotive

- Construction

- Shipbuilding

- Pipeline

By Composition

- Mineral-Based Flux

- Organic Flux

- Inorganic Flux

- Low Hydrogen Flux

- High-Fusion Flux

By Packaging Type

- Bulk Packaging

- Bagged Flux

- Cylindrical Containers

- Drum Packaging

- Retail Packaging

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

1 Introduction to Research & Analysis Reports 1.1 Welding Flux Market Definition 1.2 Market Segments 1.2.1 Market by Type 1.2.2 Market by Application 1.3 Global Welding Flux Market Overview 1.4 Features & Benefits of This Report 1.5 Methodology & Sources of Information 1.5.1 Research Methodology 1.5.2 Research Process 1.5.3 Base Year 1.5.4 Report Assumptions & Caveats 2 Global Welding Flux Overall Market Size 2.1 Global Welding Flux Market Size: 2021 VS 2028 2.2 Global Welding Flux Revenue, Prospects & Forecasts: 2017-2028 2.3 Global Welding Flux Sales: 2017-2028 3 Company Landscape 3.1 Top Welding Flux Players in Global Market 3.2 Top Global Welding Flux Companies Ranked by Revenue 3.3 Global Welding Flux Revenue by Companies 3.4 Global Welding Flux Sales by Companies 3.5 Global Welding Flux Price by Manufacturer (2017-2022) 3.6 Top 3 and Top 5 Welding Flux Companies in Global Market, by Revenue in 2021 3.7 Global Manufacturers Welding Flux Product Type 3.8 Tier 1, Tier 2 and Tier 3 Welding Flux Players in Global Market 3.8.1 List of Global Tier 1 Welding Flux Companies 3.8.2 List of Global Tier 2 and Tier 3 Welding Flux Companies 4 Sights by Product 4.1 Overview 4.1.1 By Type - Global Welding Flux Market Size Markets, 2021 & 2028 4.1.2 Organic 4.1.3 Inorganic 4.1.4 Resin 4.2 By Type - Global Welding Flux Revenue & Forecasts 4.2.1 By Type - Global Welding Flux Revenue, 2017-2022 4.2.2 By Type - Global Welding Flux Revenue, 2023-2028 4.2.3 By Type - Global Welding Flux Revenue Market Share, 2017-2028 4.3 By Type - Global Welding Flux Sales & Forecasts 4.3.1 By Type - Global Welding Flux Sales, 2017-2022 4.3.2 By Type - Global Welding Flux Sales, 2023-2028 4.3.3 By Type - Global Welding Flux Sales Market Share, 2017-2028 4.4 By Type - Global Welding Flux Price (Manufacturers Selling Prices), 2017-2028 5 Sights By Application 5.1 Overview 5.1.1 By Application - Global Welding Flux Market Size, 2021 & 2028 5.1.2 Instrument and Meter 5.1.3 Household Appliances 5.1.4 Electronic Products 5.1.5 Others 5.2 By Application - Global Welding Flux Revenue & Forecasts 5.2.1 By Application - Global Welding Flux Revenue, 2017-2022 5.2.2 By Application - Global Welding Flux Revenue, 2023-2028 5.2.3 By Application - Global Welding Flux Revenue Market Share, 2017-2028 5.3 By Application - Global Welding Flux Sales & Forecasts 5.3.1 By Application - Global Welding Flux Sales, 2017-2022 5.3.2 By Application - Global Welding Flux Sales, 2023-2028 5.3.3 By Application - Global Welding Flux Sales Market Share, 2017-2028 5.4 By Application - Global Welding Flux Price (Manufacturers Selling Prices), 2017-2028 6 Sights by Region 6.1 By Region - Global Welding Flux Market Size, 2021 & 2028 6.2 By Region - Global Welding Flux Revenue & Forecasts 6.2.1 By Region - Global Welding Flux Revenue, 2017-2022 6.2.2 By Region - Global Welding Flux Revenue, 2023-2028 6.2.3 By Region - Global Welding Flux Revenue Market Share, 2017-2028 6.3 By Region - Global Welding Flux Sales & Forecasts 6.3.1 By Region - Global Welding Flux Sales, 2017-2022 6.3.2 By Region - Global Welding Flux Sales, 2023-2028 6.3.3 By Region - Global Welding Flux Sales Market Share, 2017-2028 6.4 North America 6.4.1 By Country - North America Welding Flux Revenue, 2017-2028 6.4.2 By Country - North America Welding Flux Sales, 2017-2028 6.4.3 US Welding Flux Market Size, 2017-2028 6.4.4 Canada Welding Flux Market Size, 2017-2028 6.4.5 Mexico Welding Flux Market Size, 2017-2028 6.5 Europe 6.5.1 By Country - Europe Welding Flux Revenue, 2017-2028 6.5.2 By Country - Europe Welding Flux Sales, 2017-2028 6.5.3 Germany Welding Flux Market Size, 2017-2028 6.5.4 France Welding Flux Market Size, 2017-2028 6.5.5 U.K. Welding Flux Market Size, 2017-2028 6.5.6 Italy Welding Flux Market Size, 2017-2028 6.5.7 Russia Welding Flux Market Size, 2017-2028 6.5.8 Nordic Countries Welding Flux Market Size, 2017-2028 6.5.9 Benelux Welding Flux Market Size, 2017-2028 6.6 Asia 6.6.1 By Region - Asia Welding Flux Revenue, 2017-2028 6.6.2 By Region - Asia Welding Flux Sales, 2017-2028 6.6.3 China Welding Flux Market Size, 2017-2028 6.6.4 Japan Welding Flux Market Size, 2017-2028 6.6.5 South Korea Welding Flux Market Size, 2017-2028 6.6.6 Southeast Asia Welding Flux Market Size, 2017-2028 6.6.7 India Welding Flux Market Size, 2017-2028 6.7 South America 6.7.1 By Country - South America Welding Flux Revenue, 2017-2028 6.7.2 By Country - South America Welding Flux Sales, 2017-2028 6.7.3 Brazil Welding Flux Market Size, 2017-2028 6.7.4 Argentina Welding Flux Market Size, 2017-2028 6.8 Middle East & Africa 6.8.1 By Country - Middle East & Africa Welding Flux Revenue, 2017-2028 6.8.2 By Country - Middle East & Africa Welding Flux Sales, 2017-2028 6.8.3 Turkey Welding Flux Market Size, 2017-2028 6.8.4 Israel Welding Flux Market Size, 2017-2028 6.8.5 Saudi Arabia Welding Flux Market Size, 2017-2028 6.8.6 UAE Welding Flux Market Size, 2017-2028 7 Manufacturers & Brands Profiles 7.1 Umicore 7.1.1 Umicore Corporate Summary 7.1.2 Umicore Business Overview 7.1.3 Umicore Welding Flux Major Product Offerings 7.1.4 Umicore Welding Flux Sales and Revenue in Global (2017-2022) 7.1.5 Umicore Key News 7.2 Kobelco 7.2.1 Kobelco Corporate Summary 7.2.2 Kobelco Business Overview 7.2.3 Kobelco Welding Flux Major Product Offerings 7.2.4 Kobelco Welding Flux Sales and Revenue in Global (2017-2022) 7.2.5 Kobelco Key News 7.3 Special Metals 7.3.1 Special Metals Corporate Summary 7.3.2 Special Metals Business Overview 7.3.3 Special Metals Welding Flux Major Product Offerings 7.3.4 Special Metals Welding Flux Sales and Revenue in Global (2017-2022) 7.3.5 Special Metals Key News 7.4 Dengfeng 7.4.1 Dengfeng Corporate Summary 7.4.2 Dengfeng Business Overview 7.4.3 Dengfeng Welding Flux Major Product Offerings 7.4.4 Dengfeng Welding Flux Sales and Revenue in Global (2017-2022) 7.4.5 Dengfeng Key News 7.5 Lincoln Electric 7.5.1 Lincoln Electric Corporate Summary 7.5.2 Lincoln Electric Business Overview 7.5.3 Lincoln Electric Welding Flux Major Product Offerings 7.5.4 Lincoln Electric Welding Flux Sales and Revenue in Global (2017-2022) 7.5.5 Lincoln Electric Key News 7.6 Voestalpine 7.6.1 Voestalpine Corporate Summary 7.6.2 Voestalpine Business Overview 7.6.3 Voestalpine Welding Flux Major Product Offerings 7.6.4 Voestalpine Welding Flux Sales and Revenue in Global (2017-2022) 7.6.5 Voestalpine Key News 7.7 Sweco 7.7.1 Sweco Corporate Summary 7.7.2 Sweco Business Overview 7.7.3 Sweco Welding Flux Major Product Offerings 7.7.4 Sweco Welding Flux Sales and Revenue in Global (2017-2022) 7.7.5 Sweco Key News 7.8 Indium Corporation 7.8.1 Indium Corporation Corporate Summary 7.8.2 Indium Corporation Business Overview 7.8.3 Indium Corporation Welding Flux Major Product Offerings 7.8.4 Indium Corporation Welding Flux Sales and Revenue in Global (2017-2022) 7.8.5 Indium Corporation Key News 7.9 NIHON SUPERIOR 7.9.1 NIHON SUPERIOR Corporate Summary 7.9.2 NIHON SUPERIOR Business Overview 7.9.3 NIHON SUPERIOR Welding Flux Major Product Offerings 7.9.4 NIHON SUPERIOR Welding Flux Sales and Revenue in Global (2017-2022) 7.9.5 NIHON SUPERIOR Key News 7.10 Weitexinda Technology 7.10.1 Weitexinda Technology Corporate Summary 7.10.2 Weitexinda Technology Business Overview 7.10.3 Weitexinda Technology Welding Flux Major Product Offerings 7.10.4 Weitexinda Technology Welding Flux Sales and Revenue in Global (2017-2022) 7.10.5 Weitexinda Technology Key News 7.11 Gaofeng Technology 7.11.1 Gaofeng Technology Corporate Summary 7.11.2 Gaofeng Technology Welding Flux Business Overview 7.11.3 Gaofeng Technology Welding Flux Major Product Offerings 7.11.4 Gaofeng Technology Welding Flux Sales and Revenue in Global (2017-2022) 7.11.5 Gaofeng Technology Key News 7.12 Yatong Welding Materials 7.12.1 Yatong Welding Materials Corporate Summary 7.12.2 Yatong Welding Materials Welding Flux Business Overview 7.12.3 Yatong Welding Materials Welding Flux Major Product Offerings 7.12.4 Yatong Welding Materials Welding Flux Sales and Revenue in Global (2017-2022) 7.12.5 Yatong Welding Materials Key News 7.13 Solder Coat 7.13.1 Solder Coat Corporate Summary 7.13.2 Solder Coat Welding Flux Business Overview 7.13.3 Solder Coat Welding Flux Major Product Offerings 7.13.4 Solder Coat Welding Flux Sales and Revenue in Global (2017-2022) 7.13.5 Solder Coat Key News 8 Global Welding Flux Production Capacity, Analysis 8.1 Global Welding Flux Production Capacity, 2017-2028 8.2 Welding Flux Production Capacity of Key Manufacturers in Global Market 8.3 Global Welding Flux Production by Region 9 Key Market Trends, Opportunity, Drivers and Restraints 9.1 Market Opportunities & Trends 9.2 Market Drivers 9.3 Market Restraints 10 Welding Flux Supply Chain Analysis 10.1 Welding Flux Industry Value Chain 10.2 Welding Flux Upstream Market 10.3 Welding Flux Downstream and Clients 10.4 Marketing Channels Analysis 10.4.1 Marketing Channels 10.4.2 Welding Flux Distributors and Sales Agents in Global 11 Conclusion 12 Appendix 12.1 Note 12.2 Examples of Clients 12.3 Disclaimer

Inquiry For Buying

Welding Flux

Request Sample

Welding Flux