Cloud Security Market Size, Share, and Trends Analysis Report

CAGR :

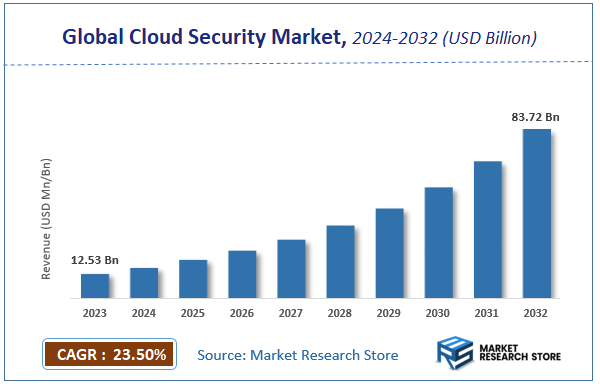

| Market Size 2023 (Base Year) | USD 12.53 Billion |

| Market Size 2032 (Forecast Year) | USD 83.72 Billion |

| CAGR | 23.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Cloud Security Market Insights

According to Market Research Store, the global cloud security market size was valued at around USD 43.96 billion in 2023 and is estimated to reach USD 97.06 billion by 2032, to register a CAGR of approximately 9.2% in terms of revenue during the forecast period 2024-2032.

The cloud security report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Cloud Security Market: Overview

Cloud security refers to the broad set of policies, technologies, controls, and services designed to protect data, applications, and infrastructure associated with cloud computing. It encompasses various aspects of IT security, including data privacy, network security, identity and access management (IAM), threat detection, and compliance enforcement. Cloud security solutions are vital for organizations that rely on cloud service providers (CSPs) like Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP), as they help secure sensitive data and ensure continuity in the face of cyber threats, misconfigurations, and insider risks. Cloud security also includes mechanisms for secure authentication, encryption of data at rest and in transit, and continuous monitoring for suspicious activities.

The cloud security market is experiencing rapid growth driven by the global adoption of cloud computing across sectors such as finance, healthcare, retail, and government. As more businesses migrate to public, private, or hybrid cloud models, the need for robust security solutions has intensified. Major growth factors include the surge in remote work, escalating cyberattacks, regulatory requirements, and the increasing complexity of IT environments. Innovations such as zero-trust architectures, AI-driven threat intelligence, and security automation are also gaining traction, enabling organizations to better detect and respond to evolving threats while maintaining compliance and operational efficiency in the cloud ecosystem.

Key Highlights

- The cloud security market is anticipated to grow at a CAGR of 9.2% during the forecast period.

- The global cloud security market was estimated to be worth approximately USD 43.96 billion in 2023 and is projected to reach a value of USD 97.06 billion by 2032.

- The growth of the cloud security market is being driven by the increasing regulatory focus on data protection and compliance.

- Based on the end-user industry, the manufacturing segment is growing at a high rate and is projected to dominate the market.

- On the basis of enterprise size, the small & medium enterprises (SMEs) segment is projected to swipe the largest market share.

- In terms of security type, the business continuity & disaster recovery segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Cloud Security Market: Dynamics

Key Growth Drivers

- Accelerated Cloud Adoption and Digital Transformation: The widespread migration of businesses, from large enterprises to Small & Medium Enterprises (SMEs), to public, private, and hybrid cloud environments is the primary catalyst. This shift is driven by the desire for scalability, flexibility, cost-effectiveness, and support for remote/hybrid work models, directly necessitating robust cloud security solutions. India's rapid digitalization initiatives are a significant contributor to this.

- Escalating Cyber Threats and Data Breaches: The increasing frequency and sophistication of cyberattacks, including ransomware, phishing, and data breaches, compel organizations to invest heavily in cloud security. The sheer volume of sensitive data stored in the cloud makes it a prime target for cybercriminals, driving demand for advanced protective measures.

- Stringent Regulatory Compliance and Data Privacy Laws: A growing body of global and regional regulations, such as GDPR, CCPA, HIPAA, and India's upcoming data protection laws, mandates strict data protection and privacy measures for cloud-stored data. Organizations are compelled to adopt comprehensive cloud security solutions to avoid hefty fines, legal repercussions, and reputational damage.

Restraints

- High Costs of Implementation and Maintenance: Advanced cloud security solutions, especially those offering comprehensive features, can involve substantial initial investment and ongoing operational costs. This can be a significant barrier for SMEs with limited budgets, particularly in price-sensitive markets like India, despite the growing need.

- Complexity and Management of Cloud Security: Managing security across complex multi-cloud or hybrid cloud environments can be challenging. Different cloud providers have varying security models, configurations, and tools, leading to potential misconfigurations, alert fatigue, and a lack of unified visibility for security teams.

- Lack of Skilled Cybersecurity Professionals: There is a global shortage of cybersecurity professionals with expertise in cloud security. This talent gap makes it difficult for organizations to effectively implement, manage, and monitor sophisticated cloud security solutions, leading to potential vulnerabilities and reliance on external managed security services.

Opportunities

- Rise of AI and Machine Learning in Cloud Security: The integration of Artificial Intelligence (AI) and Machine Learning (ML) into cloud security solutions offers immense opportunities for enhanced threat detection, automated incident response, predictive analytics, and intelligent anomaly detection, making security more proactive and efficient.

- Growth in Managed Security Services (MSSPs) for Cloud: The complexity of cloud security and the shortage of in-house expertise are driving organizations to outsource their cloud security needs to Managed Security Service Providers (MSSPs). This presents a significant opportunity for security vendors to offer comprehensive, end-to-end managed cloud security services.

- Expansion of Cloud-Native Security Solutions: The demand for security tools specifically designed for cloud environments (cloud-native security) is growing. Solutions for container security, serverless function security, API security, and Cloud Native Application Protection Platforms (CNAPP) are key areas of opportunity.

Challenges

- Rapidly Evolving Threat Landscape: Cybercriminals constantly develop new attack vectors and techniques, making it challenging for cloud security providers to keep pace with the evolving threats and develop effective countermeasures in real-time.

- Cloud Misconfigurations: Despite robust security tools, human error and misconfigurations remain a leading cause of cloud security breaches. The sheer volume and complexity of cloud service configurations make it difficult for organizations to ensure continuous adherence to security best practices.

- Visibility Gaps in Multi-Cloud Environments: Gaining comprehensive and unified visibility across multiple cloud providers and on-premises infrastructure is a major challenge. Lack of centralized monitoring can lead to blind spots, making it difficult to detect and respond to threats effectively.

Cloud Security Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Cloud Security Market |

| Market Size in 2023 | USD 12.53 Billion |

| Market Forecast in 2032 | USD 83.72 Billion |

| Growth Rate | CAGR of 23.5% |

| Number of Pages | 140 |

| Key Companies Covered | CA Technologies, Fortinet, Inc., Intel Security Group, IBM Corporation, Panda Security, Symantec Corporation, Symplified, Inc., Sophos Ltd., Cisco Systems, Inc., and Trend Micro |

| Segments Covered | By Type, By Service, By, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Cloud Security Market: Segmentation Insights

The global cloud security market is divided by end-user industry, enterprise size, security type, and region.

Based on end-user industry, the global cloud security market is divided into manufacturing, retail, healthcare & life sciences, it & telecommunications, energy & utilities, government, and others. Manufacturing is the leading end-user industry in the cloud security market, primarily due to the widespread adoption of digital technologies such as Industrial IoT (IIoT), advanced robotics, digital twins, and cloud-based enterprise resource planning (ERP) systems. As smart manufacturing evolves, the sector increasingly depends on cloud computing for process automation, production monitoring, and supply chain optimization. However, these digital operations expose manufacturers to vulnerabilities including intellectual property theft, ransomware, and industrial espionage. Consequently, there is high demand for cloud security tools such as intrusion detection systems (IDS), secure access controls, and network segmentation strategies. Compliance with standards like ISO/IEC 27001 and NIST cybersecurity frameworks further drives adoption of enterprise-grade cloud security protocols across the manufacturing landscape.

On the basis of enterprise size, the global cloud security market is bifurcated into small & medium enterprises (SMES) and large enterprises. Small & Medium Enterprises (SMEs) dominate the cloud security market segmentation by enterprise size due to their rapid adoption of cloud-based infrastructure to enhance scalability, reduce capital expenditure, and improve operational agility. SMEs increasingly rely on public and hybrid cloud environments for core applications such as customer relationship management (CRM), financial systems, collaboration tools, and e-commerce platforms. However, their relatively limited IT budgets and lack of in-house cybersecurity expertise make them prime targets for cyberattacks such as ransomware, phishing, and business email compromise (BEC). As a result, SMEs are investing in affordable, cloud-native security solutions that include managed detection and response (MDR), endpoint protection, multi-factor authentication (MFA), and secure web gateways. The availability of pay-as-you-go cloud security models and the integration of AI-driven threat prevention have further fueled SME demand for comprehensive and scalable protection.

Based on security type, the global cloud security market is divided into business continuity & disaster recovery, security information & event management (SIEM), data loss prevention (DLP), identity and access management, and others. Business Continuity & Disaster Recovery dominates the cloud security market by security type due to its critical role in maintaining uninterrupted operations amidst growing threats of cyberattacks, system failures, and natural disasters. As organizations migrate mission-critical workloads to cloud environments, ensuring data availability and rapid recovery becomes a top priority. Cloud-based disaster recovery solutions offer scalability, reduced downtime, and lower upfront infrastructure costs, making them particularly attractive for enterprises of all sizes. The increasing frequency of ransomware attacks and the risk of data center outages have led to a surge in demand for cloud-native business continuity strategies, including automated backups, failover systems, and replication services across multiple geographic zones. Industries such as finance, healthcare, and government exhibit strong adoption, driven by the need to meet stringent compliance requirements and maintain public trust.

Cloud Security Market: Regional Insights

- North America is expected to dominates the global market

North America leads the cloud security market, primarily driven by the rapid adoption of cloud computing technologies across major industries including banking, healthcare, retail, and government. The region benefits from the presence of global cloud service providers and cybersecurity leaders, such as Microsoft, AWS, Google, Palo Alto Networks, and IBM, who continually invest in advanced cloud protection frameworks. High-profile data breaches and stringent regulatory environments like HIPAA, CCPA, and others have compelled enterprises in the United States and Canada to prioritize robust cloud security strategies. The widespread integration of remote work environments and hybrid cloud deployments further accelerates demand for identity and access management, encryption, secure cloud configurations, and threat intelligence solutions. Organizations in North America also exhibit early adoption of zero-trust architectures and AI-powered security tools, making it the most mature and advanced market for cloud security solutions.

Asia-Pacific region is experiencing rapid growth in the cloud security market due to the rising adoption of cloud services by SMEs and large enterprises across countries such as China, India, Japan, South Korea, and Australia. The expansion of 5G networks, growing internet penetration, and government-led digital economy programs are fueling cloud migration. As a result, organizations are investing in cloud-native security tools to manage vulnerabilities and mitigate risks associated with data localization and cyber threats. Despite relatively lower maturity compared to North America and Europe, increased investment in cloud infrastructure and growing awareness of regulatory compliance are pushing the adoption of cloud security services across the region.

Europe holds a significant share in the global cloud security market, supported by growing cloud adoption across public and private sectors, combined with strict data protection regulations such as the General Data Protection Regulation (GDPR). Countries including Germany, the United Kingdom, France, and the Netherlands are leading in enterprise-grade cloud infrastructure and demanding strong compliance-based security frameworks. European enterprises are increasingly investing in secure access service edge (SASE), cloud workload protection, and multi-cloud security solutions to safeguard mission-critical applications. Ongoing digital transformation initiatives in sectors like BFSI, energy, and manufacturing further stimulate the need for advanced cloud cybersecurity measures.

Cloud Security Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the cloud security market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global cloud security market include:

- CrowdStrike

- Palo Alto Networks

- Amazon Web Services (AWS Security)

- Proofpoint

- Google Cloud Platform (GCP Security)

- Check Point Software

- Akamai

- Qualys

- Zscaler

- Tenable

- Fortinet Inc.

- CA Technologies Inc.

- Panda Security

- Sophos Ltd.

- Symantec Corporation

- Trend Micro Inc.

- IBM Corporation

- Cisco Systems Inc.

- McAfee Inc.

- Hewlett-Packard (HP) Company

- Microsoft Corporation

- Kaspersky Labs

- Dell Inc.

- Intel Security Group

The global cloud security market is segmented as follows:

By End-User Industry

- Manufacturing

- Retail

- Healthcare & Life Sciences

- IT & Telecommunications

- Energy & Utilities

- Government

- Others

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Security Type

- Business Continuity & Disaster Recovery

- Security Information & Event Management (SIEM)

- Data Loss Prevention (DLP)

- Identity and Access Management

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description and scope

- 1.2. Research scope

- 1.3. Research methodology

- 1.3.1. Market research process

- 1.3.2. Market research methodology

- Chapter 2. Executive Summary

- 2.1. Global market revenue, 2014 - 2020 (USD Million)

- 2.2. Global cloud security market: Snapshot

- Chapter 3. Cloud Security Market – Global and Industry Analysis

- 3.1. Cloud security: Market dynamics

- 3.2. Market drivers

- 3.2.1. Drivers of global cloud security market: Impact analysis

- 3.2.2. Enhanced and simplified IT management due to cloud security

- 3.2.3. Increasing popularity of cloud computing

- 3.2.4. Increasing demand of SMB cloud computing

- 3.3. Market restraints

- 3.3.1. Restraints of global cloud security market: Impact analysis

- 3.3.2. Lack of awareness about adoption of cloud computing

- 3.4. Opportunities

- 3.4.1. Increasing need for cloud application adoption and maintaining security, compliance and IT governance.

- 3.5. Porter’s five forces analysis

- 3.6. Market Attractiveness Analysis

- 3.6.1. Market attractiveness analysis by type segment

- 3.6.2. Market attractiveness analysis by service type segment

- 3.6.3. Market attractiveness analysis by application segment

- 3.6.4. Market attractiveness analysis by regional segment

- Chapter 4. Global Cloud Security Market - Competitive Landscape

- 4.1. Company market share, 2014

- 4.2. Production capacity (subject to data availability)

- Chapter 5. Global Cloud Security Market – Type Segment Analysis

- 5.1. Global cloud security market: Type overview

- 5.1.1. Global cloud security market share, by type, 2014 and 2020

- 5.2. Public Cloud

- 5.2.1. Global public cloud security market, by type, 2014 – 2020 (USD Million)

- 5.3. Private Cloud

- 5.3.1. Global private cloud security market, by type, 2014 – 2020 (USD Million)

- 5.4. Hybrid Cloud

- 5.4.1. Global hybrid cloud market, by type, 2014 – 2020 (USD Million)

- 5.1. Global cloud security market: Type overview

- Chapter 6. Global Cloud Security Market – Service Type Segment Analysis

- 6.1. Global cloud security market: Service type overview

- 6.1.1. Global cloud security market share, by service type, 2014 and 2020

- 6.2. Data Loss Prevention

- 6.2.1. Global cloud security market, for data loss prevention, 2014 – 2020 (USD Million)

- 6.3. Email and Web Security

- 6.3.1. Global cloud security market, for email and web security, 2014 – 2020 (USD Million)

- 6.4. Cloud IAM

- 6.4.1. Global cloud security market, for cloud IAM, 2014 – 2020 (USD Million)

- 6.5. Cloud Database Security

- 6.5.1. Global cloud security market, for cloud database security, 2014 – 2020 (USD Million)

- 6.6. Others

- 6.6.1. Global cloud security market, for other services, 2014 – 2020 (USD Million)

- 6.1. Global cloud security market: Service type overview

- Chapter 7. Global Cloud Security Market – Application Segment Analysis

- 7.1. Global cloud security market: Application overview

- 7.1.1. Global cloud security market share by application, 2014 and 2020

- 7.2. Government and Public Utilities

- 7.2.1. Global cloud security market for government and public utilities, 2014 – 2020 (USD Million)

- 7.3. BFSI

- 7.3.1. Global cloud security market for BFSI, 2014 – 2020 (USD Million)

- 7.4. IT and Telecommunication

- 7.4.1. Global cloud security market for IT and telecommunication, 2014 – 2020 (USD Million)

- 7.5. Healthcare

- 7.5.1. Global cloud security market for healthcare, 2014 – 2020 (USD Million)

- 7.6. Others

- 7.6.1. Global cloud security market for other applications, 2014 – 2020 (USD Million)

- 7.1. Global cloud security market: Application overview

- Chapter 8. Global Cloud Security Market – Regional Segment Analysis

- 8.1. Global cloud security market: Regional overview

- 8.1.1. Global cloud security market share by region, 2014 and 2020

- 8.2. North America

- 8.2.1. North America cloud security market, by type, 2014 – 2020 (USD Million)

- 8.2.2. North America cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.2.3. North America cloud security market, by application, 2014 – 2020 (USD Million)

- 8.2.4. U.S.

- 8.2.4.1. U.S. cloud security market, by type, 2014 – 2020 (USD Million)

- 8.2.4.2. U.S. cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.2.4.3. U.S. cloud security market, by application, 2014 – 2020 (USD Million)

- 8.3. Europe

- 8.3.1. Europe cloud security market, by type, 2014 – 2020 (USD Million)

- 8.3.2. Europe cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.3.3. Europe cloud security market, by application, 2014 – 2020 (USD Million)

- 8.3.4. Germany

- 8.3.4.1. Germany cloud security market, by type, 2014 – 2020 (USD Million)

- 8.3.4.2. Germany cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.3.4.3. Germany cloud security market, by application, 2014 – 2020 (USD Million)

- 8.3.5. France

- 8.3.5.1. France cloud security market, by type, 2014 – 2020 (USD Million)

- 8.3.5.2. France cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.3.5.3. France cloud security market, by application, 2014 – 2020 (USD Million)

- 8.3.6. UK

- 8.3.6.1. UK cloud security market, by type, 2014 – 2020 (USD Million)

- 8.3.6.2. UK cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.3.6.3. UK cloud security market, by application, 2014 – 2020 (USD Million)

- 8.4. Asia Pacific

- 8.4.1. Asia Pacific cloud security market, by type, 2014 – 2020 (USD Million)

- 8.4.2. Asia Pacific cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.4.3. Asia Pacific cloud security market, by application, 2014 – 2020 (USD Million)

- 8.4.4. China

- 8.4.4.1. China cloud security market, by type, 2014 – 2020 (USD Million)

- 8.4.4.2. China cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.4.4.3. China cloud security market, by application, 2014 – 2020 (USD Million)

- 8.4.5. Japan

- 8.4.5.1. Japan cloud security market, by type, 2014 – 2020 (USD Million)

- 8.4.5.2. Japan cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.4.5.3. Japan cloud security market, by application, 2014 – 2020 (USD Million)

- 8.4.6. India

- 8.4.6.1. India cloud security market, by type, 2014 – 2020 (USD Million)

- 8.4.6.2. India cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.4.6.3. India cloud security market, by application, 2014 – 2020 (USD Million)

- 8.5. Latin America

- 8.5.1. Latin America cloud security market, by type, 2014 – 2020 (USD Million)

- 8.5.2. Latin America cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.5.3. Latin America cloud security market, by application, 2014 – 2020 (USD Million)

- 8.5.4. Brazil

- 8.5.4.1. Brazil cloud security market, by type, 2014 – 2020 (USD Million)

- 8.5.4.2. Brazil cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.5.4.3. Brazil cloud security market, by application, 2014 – 2020 (USD Million)

- 8.6. Middle East and Africa

- 8.6.1. Middle East & Africa cloud security market, by type, 2014 – 2020 (USD Million)

- 8.6.2. Middle East & Africa cloud security market, by service type, 2014 – 2020 (USD Million)

- 8.6.3. Middle East & Africa cloud security market, by application, 2014 – 2020 (USD Million)

- 8.1. Global cloud security market: Regional overview

- Chapter 9. Company Profile

- 9.1. CA Technologies

- 9.1.1. Overview

- 9.1.2. Financials

- 9.1.3. Product portfolio

- 9.1.4. Business strategy

- 9.1.5. Recent developments

- 9.2. Fortinet, Inc.

- 9.2.1. Overview

- 9.2.2. Financials

- 9.2.3. Product portfolio

- 9.2.4. Business strategy

- 9.2.5. Recent developments

- 9.3. Intel Security Group

- 9.3.1. Overview

- 9.3.2. Financials

- 9.3.3. Product portfolio

- 9.3.4. Business strategy

- 9.3.5. Recent developments

- 9.4. IBM Corporation

- 9.4.1. Overview

- 9.4.2. Financials

- 9.4.3. Product portfolio

- 9.4.4. Business strategy

- 9.4.5. Recent developments

- 9.5. Panda Security

- 9.5.1. Overview

- 9.5.2. Financials

- 9.5.3. Product portfolio

- 9.5.4. Business strategy

- 9.5.5. Recent developments

- 9.6. Symantec Corporation

- 9.6.1. Overview

- 9.6.2. Financials

- 9.6.3. Product portfolio

- 9.6.4. Business strategy

- 9.6.5. Recent developments

- 9.7. Symplified, Inc.

- 9.7.1. Overview

- 9.7.2. Financials

- 9.7.3. Product portfolio

- 9.7.4. Business strategy

- 9.7.5. Recent developments

- 9.8. Sophos Ltd.

- 9.8.1. Overview

- 9.8.2. Financials

- 9.8.3. Product portfolio

- 9.8.4. Business strategy

- 9.8.5. Recent developments

- 9.9. Cisco Systems, Inc.

- 9.9.1. Overview

- 9.9.2. Financials

- 9.9.3. Product portfolio

- 9.9.4. Business strategy

- 9.9.5. Recent developments

- 9.10. Trend Micro

- 9.10.1. Overview

- 9.10.2. Financials

- 9.10.3. Product portfolio

- 9.10.4. Business strategy

- 9.10.5. Recent developments

- 9.1. CA Technologies

Inquiry For Buying

Cloud Security

Request Sample

Cloud Security