Organic Personal Care Products Market Size, Share, and Trends Analysis Report

CAGR :

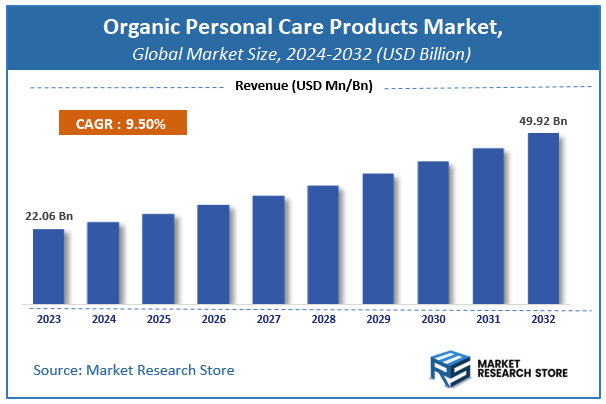

| Market Size 2023 (Base Year) | USD 22.06 Billion |

| Market Size 2032 (Forecast Year) | USD 49.92 Billion |

| CAGR | 9.5% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Organic Personal Care Products Market Insights

According to Market Research Store, the global organic personal care products market size was valued at around USD 22.06 billion in 2023 and is estimated to reach USD 49.92 billion by 2032, to register a CAGR of approximately 9.5% in terms of revenue during the forecast period 2024-2032.

The organic personal care products report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Organic Personal Care Products Market: Overview

Organic personal care products are health and beauty items formulated with naturally derived ingredients that are cultivated without the use of synthetic pesticides, genetically modified organisms (GMOs), or harmful chemicals. These products typically include skincare, haircare, oral care, and hygiene items made with plant-based oils, herbal extracts, essential oils, and minerals, and are free from synthetic fragrances, parabens, sulfates, and phthalates. Often certified by recognized standards (such as USDA Organic or COSMOS Organic), these products cater to consumers seeking safer, environmentally friendly, and ethically produced alternatives to conventional personal care goods.

The growth of the organic personal care products market is driven by rising consumer awareness about health and wellness, increasing demand for clean-label and sustainable products, and growing concerns over the long-term effects of synthetic chemicals on skin and overall health. Millennials and Gen Z consumers, in particular, are influencing market trends by prioritizing transparency, cruelty-free testing, biodegradable packaging, and social responsibility. Advances in green chemistry, wider availability of certified organic raw materials, and innovation in botanical formulations are further fueling product development. As lifestyle preferences shift toward holistic and eco-conscious living, organic personal care products continue to gain popularity across global beauty and wellness markets.

Key Highlights

- The organic personal care products market is anticipated to grow at a CAGR of 9.5% during the forecast period.

- The global organic personal care products market was estimated to be worth approximately USD 22.06 billion in 2023 and is projected to reach a value of USD 49.92 billion by 2032.

- The growth of the organic personal care products market is being driven by increasing consumer awareness regarding the potential harmful effects of synthetic chemicals and artificial additives in conventional personal care products is a fundamental driver.

- Based on the product type, the skin care segment is growing at a high rate and is projected to dominate the market.

- On the basis of distribution channel, the store-based segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Organic Personal Care Products Market: Dynamics

Key Growth Drivers:

- Growing Consumer Awareness of Harmful Chemicals: A significant driver is the increasing awareness among consumers about the potential adverse effects of synthetic chemicals (e.g., parabens, sulfates, phthalates, synthetic fragrances) found in conventional personal care products on human health (allergies, skin irritation, hormonal disruptions) and the environment. This drives a shift towards safer, natural, and organic alternatives.

- Rising Demand for Natural and Clean Label Products: Consumers are increasingly seeking transparency and "clean label" products across all categories, including personal care. This translates to a preference for products with simple ingredient lists, derived from natural sources, and free from artificial additives, boosting the organic segment.

- Influence of Social Media and Online Reviews: Social media platforms, beauty bloggers, and online review sites play a crucial role in educating consumers about product ingredients, ethical sourcing, and sustainable practices. Positive reviews and endorsements of organic products drive their adoption.

Restraints:

- Higher Cost Compared to Conventional Products: Organic ingredients and certified organic production processes typically incur higher costs than synthetic alternatives. This translates to a higher retail price for organic personal care products, which can be a significant barrier for price-sensitive consumers.

- Limited Shelf Life: Many organic personal care products rely on natural preservatives or have fewer synthetic stabilizers, leading to a shorter shelf life compared to conventional products. This can pose challenges for manufacturers, retailers, and consumers (e.g., increased waste, need for quicker consumption).

- Lack of Universal Certification and "Greenwashing" Concerns: The absence of a single, globally harmonized standard for "organic" in personal care can lead to confusion among consumers and allows for "greenwashing" – brands making misleading claims about their products' natural or organic content without proper certification.

Opportunities:

- Innovation in Bio-based Ingredients and Formulations: Significant opportunities lie in research and development of novel bio-based ingredients, natural preservatives, and advanced organic formulations that offer superior performance, stability, and sensory experiences, bridging the gap with conventional products.

- Customization and Personalization: Leveraging digital platforms and consumer data to offer personalized organic skincare and haircare solutions based on individual skin/hair types, concerns, and preferences can be a lucrative niche.

- Expansion into Emerging Markets: As disposable incomes and health awareness grow in developing countries (e.g., Southeast Asia, Latin America, parts of Africa), there's a vast untapped market for organic personal care products, requiring localized product development and marketing strategies.

Challenges:

- Maintaining Product Stability and Shelf Life without Synthetic Additives: The primary technical challenge for manufacturers is to formulate organic products that are stable, effective, and have a reasonable shelf life without relying on synthetic preservatives, emulsifiers, or stabilizers, which are often excluded from organic certifications.

- Educating Consumers and Combating Greenwashing: A significant challenge is to effectively educate consumers on what "organic" truly means in personal care, differentiate genuine certified organic products from "natural" or "eco-friendly" claims that may be misleading, and build trust in the face of widespread greenwashing.

- Securing Consistent Supply of Certified Organic Raw Materials: Scaling up production requires a reliable and consistent supply of certified organic ingredients, which can be challenging due to agricultural factors (weather, seasonality) and the rigorous certification process for suppliers.

Organic Personal Care Products Market: Report Scope

This report thoroughly analyzes the Organic Personal Care Products Market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Organic Personal Care Products Market |

| Market Size in 2023 | USD 22.06 Billion |

| Market Forecast in 2032 | USD 49.92 Billion |

| Growth Rate | CAGR of 9.5% |

| Number of Pages | 150 |

| Key Companies Covered | Aveda Corporation, The Body Shop, Burt’s Bee, Estee Lauder, The Hain Celestial Group, Yves Rocher, Amway, Bare Escentuals, Arbonne International, Kiehl’s, Natura Cosméticos S.A, L'Occitane en Provence etc |

| Segments Covered | By Product Type, By Distribution Channel, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Organic Personal Care Products Market: Segmentation Insights

The global organic personal care products market is divided by product type, application, and region.

Based on product type, the global organic personal care products market is divided into skin care, hair care, oral care, nail care, fragrances, and others. Skin Care is the dominant product type in the organic personal care products market, accounting for the largest share due to rising consumer demand for clean, plant-based, and non-toxic formulations that promote skin health without harmful side effects. This segment includes products such as moisturizers, cleansers, lotions, sunscreens, anti-aging creams, and serums made with organic ingredients like aloe vera, shea butter, green tea, and essential oils. Consumers, especially in North America, are increasingly choosing organic alternatives to avoid parabens, sulfates, and synthetic fragrances. The growth is further supported by social media influence, dermatological endorsements, and a shift toward holistic beauty routines that prioritize sustainability and skin microbiome safety.

On the basis of distribution channel, the global organic personal care products market is bifurcated into store-based and non-store-based. Store-Based distribution is the dominant channel in the organic personal care products market, driven by consumer preference for in-person product inspection, immediate availability, and the ability to test or sample products before purchase. This channel includes supermarkets, hypermarkets, specialty beauty and wellness stores, pharmacies, and department stores. Store-based retail offers a tactile shopping experience, brand visibility through shelf placement, and the opportunity for personal consultation, which is especially important for products like organic skin care and hair care. Leading retailers in North America and Europe have expanded their organic product sections in response to consumer demand for clean beauty solutions.

Organic Personal Care Products Market: Regional Insights

- North America is expected to dominate the global market

North America dominates the organic personal care products market due to high consumer awareness, increasing demand for clean-label products, and strong retail infrastructure. The United States is the key contributor, driven by a growing shift toward natural ingredients, sustainability, and chemical-free alternatives in skincare, haircare, cosmetics, and oral care. Consumers are actively seeking products free from parabens, sulfates, synthetic fragrances, and petrochemicals. The region benefits from a well-established base of leading brands such as The Honest Company, Burt’s Bees, Dr. Bronner’s, and several indie clean beauty startups. E-commerce platforms, natural product retailers, and health-conscious supermarkets (like Whole Foods) have played a significant role in product visibility and accessibility. Regulatory support through USDA Organic and clean beauty certifications further strengthens market trust and consumer loyalty. High disposable income, media influence, and transparency demands have made North America the most mature and innovation-driven region in this market.

Europe holds a substantial share of the organic personal care products market, with strong demand from countries such as Germany, France, the United Kingdom, and Italy. The region has long supported the use of herbal and plant-based formulations in cosmetics and is highly responsive to eco-labels and sustainability claims. The COSMOS-standard (Cosmetic Organic and Natural Standard) and Ecocert certifications have given credibility to organic product offerings, encouraging widespread consumer acceptance. The market is driven by rising awareness of ethical sourcing, cruelty-free manufacturing, and biodegradable packaging. Germany, in particular, has a strong demand for organic skincare and baby care products, while French brands lead in botanical-based luxury formulations. Despite being slightly more fragmented than North America, Europe maintains a steady growth trajectory due to high regulatory oversight and consumer demand for ingredient transparency.

Asia-Pacific is the fastest-growing region in the organic personal care products market, led by rising incomes, increasing awareness of health and environmental impacts, and urbanization in countries like China, Japan, South Korea, and India. South Korea and Japan are innovation hubs in skincare and cosmetics, with a growing trend toward natural and fermented ingredients that align with organic beauty principles. In China and India, the expanding middle class and increasing focus on wellness are driving demand for herbal-based, non-toxic, and Ayurveda-inspired formulations. The preference for local ingredients such as green tea, turmeric, aloe vera, and ginseng supports the rise of indigenous brands. While the region is experiencing strong growth, consumer education, price sensitivity, and regulatory inconsistencies present challenges. Nonetheless, global brands and local startups alike are rapidly expanding in this region through online channels and clean beauty retail formats.

Latin America is an emerging market for organic personal care products, with Brazil, Mexico, Chile, and Argentina as key contributors. The region is rich in biodiversity, which has fueled the use of natural oils, plant extracts, and indigenous botanicals in personal care formulations. Brazil, with its strong cosmetics industry, leads in demand for organic haircare, skincare, and body care products. Increasing environmental concerns, a growing health-conscious population, and influence from international clean beauty trends are encouraging consumers to move toward natural and organic options. However, economic constraints, limited consumer education, and the dominance of conventional mass-market products slow market penetration. Expansion is gradually occurring through specialty stores, green salons, and online platforms.

Middle East & Africa represent a developing market for organic personal care products, with growing demand in the UAE, Saudi Arabia, South Africa, and Egypt. In the Middle East, high-income consumers and expats are driving interest in luxury organic skincare and wellness brands. Retailers and pharmacies are increasingly stocking international natural beauty products. The African market is gaining traction through local manufacturing and the use of traditional ingredients like shea butter, marula oil, and baobab, which are integrated into organic formulations. However, consumer awareness is still in early stages in many parts of the region. Regulatory development and import reliance pose challenges, but urbanization and a rising interest in natural lifestyles are likely to spur long-term growth.

Organic Personal Care Products Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the organic personal care products market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global organic personal care products market include:

- The Estée Lauder Companies Inc.

- Revlon Inc.

- Unilever PLC

- Shiseido Company Limited

- Mary Kay Inc.

- The Procter & Gamble Company

- L’Oréal S.A.

- Coty Inc.

- Beiersdorf AG

- Kao Corporation

The global organic personal care products market is segmented as follows:

By Product Type

- Skin Care

- Hair Care

- Oral Care

- Nail Care

- Fragrances

- Others

By Distribution Channel

- Store-Based

- Non-Store-Based

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1. Introduction

- 1.1. Report description

- 1.2. Market segmentation

- 1.2.1. Global organic personal care products market segmentation, type and geography

- 1.3. Research scope

- 1.4. Research methodology

- Chapter 2. Executive Summary

- 2.1. Global organic personal care product market revenue, 2014 - 2020 (USD Million)

- 2.2. Global organic personal care products market snapshot

- Chapter 3. Organic Personal Care Products – Industry Analysis

- 3.1. Organic personal care products: Market dynamics

- 3.1.1. Segmentation of organic personal care product

- 3.2. Value chain analysis

- 3.2.1. Value chain analysis of global organic personal care market

- 3.3. Market drivers

- 3.3.1. Drivers for organic personal care products market: Impact analysis

- 3.3.2. Increasing health awareness among consumers

- 3.3.3. Widening distribution channels

- 3.3.3.1. Global organic personal care market, distribution channel share, 2014

- 3.3.4. New product launches

- 3.4. Restraints

- 3.4.1. Restraints for organic personal care products market: Impact analysis

- 3.4.2. Short shelf life

- 3.4.3. Expensive product line

- 3.5. Opportunities

- 3.5.1. Developing convention supporting the organic way of life

- 3.6. Porter’s five forces analysis

- 3.7. Market attractiveness analysis

- 3.1. Organic personal care products: Market dynamics

- Chapter 4. Global organic personal care products Market - Competitive landscape

- 4.1. Company market share

- 4.2. Production capacity (subject to data availability)

- 4.3. Raw material analysis

- 4.4. Price trend analysis

- Chapter 5. Organic Personal Care Products- Product Segment Analysis

- 5.1. Global organic personal care products market, by product type: Overview

- 5.1.1. Global organic personal care products market revenue share, by product type, 2014 and 2020

- 5.2. Organic skin care products

- 5.2.1. Global organic skin care products market, 2014 – 2020 (USD Million)

- 5.3. Organic hair care products

- 5.3.1. Global organic hair care products market, 2014 – 2020 (USD Million)

- 5.4. Organic oral care products

- 5.4.1. Global organic oral care products market, 2014 – 2020 (USD Million)

- 5.5. Organic cosmetics

- 5.5.1. Global organic cosmetics market, 2014 – 2020 (USD Million)

- 5.6. Other organic personal care products

- 5.6.1. Global other organic personal care products market, 2014– 2020 (USD Million)

- 5.1. Global organic personal care products market, by product type: Overview

- Chapter 6. Organic Personal Care Products Market- Regional Analysis

- 6.1. Global organic personal care products market: geographical overview

- 6.1.1. Global organic personal care products market, revenue share by geography, 2014 and 2020

- 6.2. North America

- 6.2.1. U.S. organic personal care products market, 2014 – 2020 (USD Million)

- 6.3. Europe

- 6.3.1. Germany organic personal care products market revenue, 2011 – 2018 (USD Million)

- 6.3.2. France organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.3.3. UK organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.4. Asia Pacific

- 6.4.1. Japan organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.4.2. China organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.4.3. India organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.5. Latin America

- 6.5.1. Brazil organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.6. Middle East and Africa

- 6.6.1. Middle East and Africa organic personal care products market revenue, 2014 – 2020 (USD Million)

- 6.1. Global organic personal care products market: geographical overview

- Chapter 7. Company Profile

- 7.1. Aveda Corporation

- 7.1.1. Overview

- 7.1.2. Financials

- 7.1.3. Product portfolio

- 7.1.4. Business strategy

- 7.1.5. Recent developments

- 7.2. The Body Shop

- 7.2.1. Overview

- 7.2.2. Financials

- 7.2.3. Product portfolio

- 7.2.4. Business strategy

- 7.2.5. Recent developments

- 7.3. Burt’s Bee

- 7.3.1. Overview

- 7.3.2. Financials

- 7.3.3. Product portfolio

- 7.3.4. Business strategy

- 7.3.5. Recent developments

- 7.4. Estee Lauder

- 7.4.1. Overview

- 7.4.2. Financials

- 7.4.3. Product portfolio

- 7.4.4. Business strategy

- 7.4.5. Recent developments

- 7.5. The Hain Celestial Group

- 7.5.1. Overview

- 7.5.2. Financials

- 7.5.3. Product portfolio

- 7.5.4. Business strategy

- 7.5.5. Recent developments

- 7.6. Yves Rocher

- 7.6.1. Overview

- 7.6.2. Financials

- 7.6.3. Product portfolio

- 7.6.4. Business strategy

- 7.6.5. Recent developments

- 7.7. Amway

- 7.7.1. Overview

- 7.7.2. Financials

- 7.7.3. Product portfolio

- 7.7.4. Business strategy

- 7.7.5. Recent developments

- 7.8. Bare Escentuals

- 7.8.1. Overview

- 7.8.2. Financials

- 7.8.3. Product portfolio

- 7.8.4. Business strategy

- 7.8.5. Recent developments

- 7.9. Arbonne International

- 7.9.1. Overview

- 7.9.2. Financials

- 7.9.3. Product portfolio

- 7.9.4. Business strategy

- 7.9.5. Recent developments

- 7.10. Kiehl’s

- 7.10.1. Overview

- 7.10.2. Financials

- 7.10.3. Product portfolio

- 7.10.4. Business strategy

- 7.10.5. Recent developments

- 7.11. Natura Cosméticos S.A

- 7.11.1. Overview

- 7.11.2. Financials

- 7.11.3. Product portfolio

- 7.11.4. Business strategy

- 7.11.5. Recent developments

- 7.12. L'Occitane en Provence

- 7.12.1. Overview

- 7.12.2. Financials

- 7.12.3. Product portfolio

- 7.12.4. Business strategy

- 7.12.5. Recent developments

- 7.1. Aveda Corporation

Inquiry For Buying

Organic Personal Care Products

Request Sample

Organic Personal Care Products