Aerospace Materials Market Size, Share, and Trends Analysis Report

CAGR :

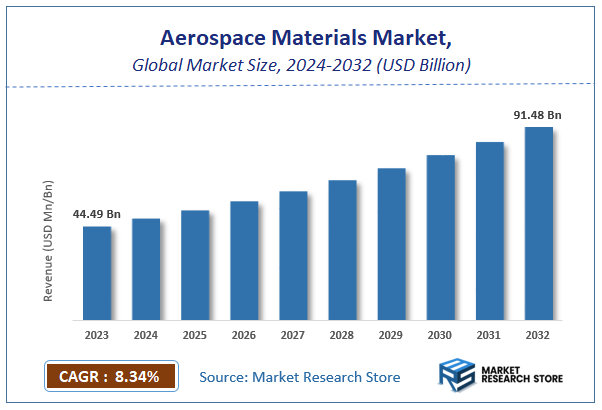

| Market Size 2023 (Base Year) | USD 44.49 Billion |

| Market Size 2032 (Forecast Year) | USD 91.48 Billion |

| CAGR | 8.34% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

Aerospace Materials Market Insights

According to Market Research Store, the global aerospace materials market size was valued at around USD 44.49 billion in 2023 and is estimated to reach USD 91.48 billion by 2032, to register a CAGR of approximately 8.34% in terms of revenue during the forecast period 2024-2032.

The aerospace materials report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

To Get more Insights, Request a Free Sample

Global Aerospace Materials Market: Overview

Aerospace materials are specialized materials used in the manufacture of aircraft, spacecraft, satellites, and missiles. These materials are selected for their high-performance characteristics such as strength-to-weight ratio, heat resistance, corrosion resistance, durability, and fatigue resistance. Common aerospace materials include aluminum alloys, titanium alloys, high-strength steels, carbon fiber composites, ceramics, and advanced polymers. These materials play a crucial role in ensuring safety, fuel efficiency, and overall performance in extreme conditions such as high altitudes, varying pressures, and intense heat.

Key Highlights

- The aerospace materials market is anticipated to grow at a CAGR of 8.34% during the forecast period.

- The global aerospace materials market was estimated to be worth approximately USD 44.49 billion in 2023 and is projected to reach a value of USD 91.48 billion by 2032.

- The growth of the aerospace materials market is being driven by rising air passenger traffic, increased defense spending, advancements in space exploration, and a shift toward lightweight and fuel-efficient aircraft.

- Based on the type, the composite materials segment is growing at a high rate and is projected to dominate the market.

- On the basis of composite type, the carbon fiber segment is projected to swipe the largest market share.

- In terms of aircraft type, the commercial aircraft segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Aerospace Materials Market: Dynamics

Key Growth Drivers:

- Rising Demand for Fuel-Efficient Aircraft: Due to increasing fuel costs and emission regulations, aircraft manufacturers are using lightweight materials to improve fuel efficiency.

- Growing Commercial Aviation Sector: The increase in passenger traffic, especially in developing countries, is driving new aircraft production and boosting demand for aerospace materials.

- Technological Advancements in Material Science: Continuous R&D is leading to the development of innovative materials like carbon composites and titanium alloys for better performance and durability.

- Increase in Military Aircraft Procurement: Defense modernization programs across countries are resulting in higher demand for high-strength, corrosion-resistant materials.

Restraints:

- High Cost of Advanced Materials: Premium materials such as carbon fiber and titanium come at a higher cost, limiting their adoption in price-sensitive markets.

- Complex Manufacturing and Processing Requirements: The production of aerospace-grade materials involves advanced processes that are time-consuming and require specialized equipment.

- Supply Chain Disruptions: Unstable global supply chains due to geopolitical or pandemic-related issues are affecting the availability of key raw materials.

Opportunities:

- Emerging Markets and Low-Cost Carriers (LCCs): The expansion of budget airlines in regions like Asia-Pacific is spurring aircraft demand, creating a growth opportunity for aerospace materials.

- Sustainable and Green Aviation Trends: Environmental concerns are pushing the adoption of recyclable and low-emission materials in aircraft production.

- Additive Manufacturing (3D Printing) Integration: The rising adoption of 3D printing in aerospace allows for the use of novel materials with custom properties, opening new market segments.

Challenges:

- Strict Regulatory Compliance: The aerospace industry is highly regulated, requiring materials to pass rigorous safety and quality tests, which slows down market entry.

- Material Availability and Resource Scarcity: Some aerospace materials rely on rare or geopolitically sensitive resources, making consistent supply a challenge.

- Integration with Existing Systems: Transitioning to newer materials often demands re-engineering of aircraft systems, increasing time and costs for adoption.

Aerospace Materials Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Aerospace Materials Market |

| Market Size in 2023 | USD 44.49 Billion |

| Market Forecast in 2032 | USD 91.48 Billion |

| Growth Rate | CAGR of 8.34% |

| Number of Pages | 188 |

| Key Companies Covered | Cytec, Toray Industries, Inc., Du Pont, Solvay Group., Teijin Limited, Alcoa Corporation., Constellium N.V, ATI Metals., Aleris, Kobe Steel Limited, Hexcel Corporation, AMG N.V, Materion Corporation, Koninklijke Ten Cate NV, Thyssenkrupp Aerospace, Sofitec, Tata Advanced Materials Limited, AMI Metals, Inc., Renegade Materials Corporation, Hindalco-Almex Aerospace Limited, Park Electrochemical Corporation., LEE Aerospace Inc., SGL Group, Kaiser Aluminum, Avdel Private Limited, Vsmpo Avisma Corporation, and among others |

| Segments Covered | By Type, By Composite Type, By Aircraft Type, And By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2023 |

| Forecast Year | 2024 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Aerospace Materials Market: Segmentation Insights

The global aerospace materials market is divided by type, composite type, aircraft type, and region.

Based on type, the global aerospace materials market is divided into aluminum alloys, steel alloys, titanium alloys, super alloys, composite materials, and others. Composite materials have emerged as the most dominant segment due to their exceptional strength-to-weight ratio, corrosion resistance, and fuel efficiency advantages. Widely used in both commercial and military aircraft, composites like carbon fiber-reinforced polymers and glass fiber composites are integral to manufacturing fuselage sections, wings, and interior structures. As aircraft manufacturers aim to reduce weight for better fuel efficiency and lower emissions, the demand for composite materials continues to rise, especially in next-generation aircraft models like the Boeing 787 and Airbus A350. Aluminum alloys rank just behind composites and have long been the backbone of aerospace manufacturing. Known for their lightweight and high strength, aluminum alloys are extensively used in aircraft structures, including frames, wings, and skin panels. Their excellent machinability, cost-effectiveness, and well-understood performance characteristics make them a preferred material, especially for smaller aircraft and components where advanced composites may be cost-prohibitive.

On the basis of composite type, the global aerospace materials market is bifurcated into glass fiber, carbon fiber, aramid fiber, and others. Carbon fiber composites dominate due to their superior mechanical properties and widespread adoption in both commercial and defense aviation. Carbon fiber offers high tensile strength, low weight, excellent fatigue resistance, and high stiffness, making it ideal for critical components such as aircraft fuselage, wings, tail sections, and interior panels. Major aircraft programs, such as the Boeing 787 Dreamliner and Airbus A350, rely heavily on carbon fiber composites to reduce weight and improve fuel efficiency, driving continued demand and technological advancement in this segment. Glass fiber composites follow as the second most significant segment. While not as strong or lightweight as carbon fiber, glass fiber is significantly more cost-effective and easier to manufacture, making it suitable for less structurally demanding applications. It is commonly used in interior components, secondary structures, and some rotorcraft parts.

Based on aircraft type, the global aerospace materials market is divided into military aircraft, commercial aircraft, helicopters, business & general aviation, and others. Commercial aircraft represent the most dominant segment, driven by the massive global demand for passenger and cargo transportation. With increasing focus on fuel efficiency, sustainability, and lightweighting, commercial aviation relies heavily on advanced materials such as carbon fiber composites, titanium alloys, and aluminum-lithium alloys. Major OEMs like Boeing and Airbus are investing heavily in next-generation aircraft that incorporate higher percentages of composite materials, pushing the segment's growth further. The demand is also fueled by airline fleet expansion, especially in Asia and the Middle East. Military aircraft follow as the second leading segment, supported by substantial defense budgets, ongoing modernization programs, and the development of advanced fighter jets, UAVs, and transport aircraft. Military platforms require materials that offer a combination of strength, heat resistance, radar absorption, and survivability. Titanium alloys, super alloys, and high-performance composites are critical for these high-performance applications.

Aerospace Materials Market: Regional Insights

- North America is expected to dominates the global market

North America leads the aerospace materials market due to its strong defense budget, well-established aerospace manufacturing base, and presence of major industry players. The region’s focus on fleet modernization, especially in the U.S., along with ongoing developments in space exploration and next-generation fighter jets, creates consistent demand for advanced composites, titanium alloys, and high-performance aluminum. Commercial aviation recovery, defense procurement programs, and strategic collaborations further enhance the market's momentum.

Europe follows closely behind, supported by countries like France, Germany, and the UK, which are key contributors to both civil and military aviation sectors. The region benefits from high research and development investments, a robust aerospace supply chain, and strong collaboration across borders, especially within the EU. The presence of Airbus and other tier-one suppliers drives innovation in lightweight, fuel-efficient materials, including carbon fiber and hybrid composites. Sustainability goals are also shaping material selection and innovation, contributing to steady market growth.

Asia Pacific is rapidly emerging as a high-growth region, largely fueled by increasing air passenger traffic, domestic aircraft production programs, and growing defense spending. China and India are at the forefront, investing heavily in indigenous aircraft manufacturing and space missions. The region is also becoming a major hub for Maintenance, Repair, and Overhaul (MRO) activities, which boosts demand for aerospace-grade materials. Additionally, the rising involvement of private aerospace firms is driving further innovation and capacity expansion.

Middle East shows moderate activity, driven by strong investments in aviation infrastructure, national airline expansions, and military procurement. Countries like the UAE and Saudi Arabia are emphasizing aerospace as a strategic sector to diversify their economies beyond oil. Africa remains the least dominant region in this market, largely due to minimal aerospace manufacturing infrastructure and limited commercial aviation penetration. While, Latin America’s aerospace materials market is relatively smaller but growing gradually, supported by the presence of aircraft manufacturers like Embraer and increasing regional air travel demand. The market is still developing, with limited local production capabilities and a greater reliance on imports.

Recent Developments:

- In June 2023, Allegheny Technologies Inc. secured around $1.2 billion in new sales commitments for nickel and titanium materials from major aerospace and defense firms.

- In June 2023, DuPont de Nemours Inc. showcased a range of next-generation advanced aerospace materials at the 54th International Paris Air Show.

Aerospace Materials Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the aerospace materials market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global aerospace materials market include:

- Cytec

- Toray Industries, Inc.

- Du Pont

- Solvay Group.

- Teijin Limited

- Alcoa Corporation.

- Constellium N.V

- ATI Metals.

- Aleris

- Kobe Steel Limited

- Hexcel Corporation

- AMG N.V

- Materion Corporation

- Koninklijke Ten Cate NV

- Thyssenkrupp Aerospace

- Sofitec

- Tata Advanced Materials Limited

- AMI Metals, Inc.

- Renegade Materials Corporation

- Hindalco-Almex Aerospace Limited

- Park Electrochemical Corporation.

- LEE Aerospace Inc.

- SGL Group

- Kaiser Aluminum

- Avdel Private Limited

- Vsmpo Avisma Corporation

The global aerospace materials market is segmented as follows:

By Type

- Aluminum Alloys

- Steel Alloys

- Titanium Alloys

- Super Alloys

- Composite Materials

- Others

By Composite Type

- Glass Fiber

- Carbon Fiber

- Aramid Fiber

- Others

By Aircraft Type

- Military Aircraft

- Commercial Aircraft

- Helicopters

- Business & General Aviation

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Table Of Content

- Chapter 1 Executive Summary

- 1.1. Introduction of Aerospace Materials

- 1.2. Global Aerospace Materials Market, 2019 & 2026 (USD Million)

- 1.3. Global Aerospace Materials Market, 2016 – 2026 (USD Million) (Kilo Tons)

- 1.4. Global Aerospace Materials Market Absulute Revenue Opportunity, 2016 – 2026 (USD Million)

- 1.5. Global Aerospace Materials Market Incremental Revenue Opportunity, 2020 – 2026 (USD Million)

- Chapter 2 Aerospace Materials Market – Type Analysis

- 2.1. Global Aerospace Materials Market – Type Overview

- 2.2. Global Aerospace Materials Market Share, by Type, 2019 & 2026 (USD Million)

- 2.3. Global Aerospace Materials Market share, by Type, 2019 & 2026 (Kilo Tons)

- 2.4. Aluminum Alloys

- 2.4.1. Global Aluminum Alloys Aerospace Materials Market, 2016 – 2026 (USD Million)

- 2.4.2. Global Aluminum Alloys Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 2.5. Steel Alloys

- 2.5.1. Global Steel Alloys Aerospace Materials Market, 2016 – 2026 (USD Million)

- 2.5.2. Global Steel Alloys Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 2.6. Titanium Alloys

- 2.6.1. Global Titanium Alloys Aerospace Materials Market, 2016 – 2026 (USD Million)

- 2.6.2. Global Titanium Alloys Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 2.7. Super Alloys

- 2.7.1. Global Super Alloys Aerospace Materials Market, 2016 – 2026 (USD Million)

- 2.7.2. Global Super Alloys Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 2.8. Composite Materials

- 2.8.1. Global Composite Materials Aerospace Materials Market, 2016 – 2026 (USD Million)

- 2.8.2. Global Composite Materials Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 2.9. Others

- 2.9.1. Global Others Aerospace Materials Market, 2016 – 2026 (USD Million)

- 2.9.2. Global Others Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- Chapter 3 Aerospace Materials Market – Composite Type Analysis

- 3.1. Global Aerospace Materials Market – Composite Type Overview

- 3.2. Global Aerospace Materials Market Share, by Composite Type, 2019 & 2026 (USD Million)

- 3.3. Global Aerospace Materials Market share, by Composite Type, 2019 & 2026 (Kilo Tons)

- 3.4. Glass Fiber

- 3.4.1. Global Glass Fiber Aerospace Materials Market, 2016 – 2026 (USD Million)

- 3.4.2. Global Glass Fiber Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 3.5. Carbon Fiber

- 3.5.1. Global Carbon Fiber Aerospace Materials Market, 2016 – 2026 (USD Million)

- 3.5.2. Global Carbon Fiber Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 3.6. Aramid Fiber

- 3.6.1. Global Aramid Fiber Aerospace Materials Market, 2016 – 2026 (USD Million)

- 3.6.2. Global Aramid Fiber Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 3.7. Others

- 3.7.1. Global Others Aerospace Materials Market, 2016 – 2026 (USD Million)

- 3.7.2. Global Others Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- Chapter 4 Aerospace Materials Market – Aircraft Type Analysis

- 4.1. Global Aerospace Materials Market – Aircraft Type Overview

- 4.2. Global Aerospace Materials Market Share, by Aircraft Type, 2019 & 2026 (USD Million)

- 4.3. Global Aerospace Materials Market share, by Aircraft Type, 2019 & 2026 (Kilo Tons)

- 4.4. Military Aircraft

- 4.4.1. Global Military Aircraft Aerospace Materials Market, 2016 – 2026 (USD Million)

- 4.4.2. Global Military Aircraft Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 4.5. Commercial Aircraft

- 4.5.1. Global Commercial Aircraft Aerospace Materials Market, 2016 – 2026 (USD Million)

- 4.5.2. Global Commercial Aircraft Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 4.6. Helicopters

- 4.6.1. Global Helicopters Aerospace Materials Market, 2016 – 2026 (USD Million)

- 4.6.2. Global Helicopters Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 4.7. Business & General Aviation

- 4.7.1. Global Business & General Aviation Aerospace Materials Market, 2016 – 2026 (USD Million)

- 4.7.2. Global Business & General Aviation Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 4.8. Others

- 4.8.1. Global Others Aerospace Materials Market, 2016 – 2026 (USD Million)

- 4.8.2. Global Others Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- Chapter 5 Aerospace Materials Market – Regional Analysis

- 5.1. Global Aerospace Materials Market Regional Overview

- 5.2. Global Aerospace Materials Market Share, by Region, 2019 & 2026 (USD Million)

- 5.3. Global Aerospace Materials Market Share, by Region, 2019 & 2026 (Kilo Tons)

- 5.4. North America

- 5.4.1. North America Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.4.1.1. North America Aerospace Materials Market, by Country, 2016 – 2026 (USD Million)

- 5.4.2. North America Market, 2016 – 2026 (Kilo Tons)

- 5.4.2.1. North America Aerospace Materials Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.4.3. North America Aerospace Materials Market, by Type, 2016 – 2026

- 5.4.3.1. North America Aerospace Materials Market, by Type, 2016 – 2026 (USD Million)

- 5.4.3.2. North America Aerospace Materials Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.4.4. North America Aerospace Materials Market, by Composite Type, 2016 – 2026

- 5.4.4.1. North America Aerospace Materials Market, by Composite Type, 2016 – 2026 (USD Million)

- 5.4.4.2. North America Aerospace Materials Market, by Composite Type, 2016 – 2026 (Kilo Tons)

- 5.4.5. North America Aerospace Materials Market, by Aircraft Type, 2016 – 2026

- 5.4.5.1. North America Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 5.4.5.2. North America Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 5.4.6. U.S.

- 5.4.6.1. U.S. Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.4.6.2. U.S. Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.4.7. Canada

- 5.4.7.1. Canada Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.4.7.2. Canada Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.4.1. North America Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5. Europe

- 5.5.1. Europe Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.1.1. Europe Aerospace Materials Market, by Country, 2016 – 2026 (USD Million)

- 5.5.2. Europe Market, 2016 – 2026 (Kilo Tons)

- 5.5.2.1. Europe Aerospace Materials Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.5.3. Europe Aerospace Materials Market, by Type, 2016 – 2026

- 5.5.3.1. Europe Aerospace Materials Market, by Type, 2016 – 2026 (USD Million)

- 5.5.3.2. Europe Aerospace Materials Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.5.4. Europe Aerospace Materials Market, by Composite Type, 2016 – 2026

- 5.5.4.1. Europe Aerospace Materials Market, by Composite Type, 2016 – 2026 (USD Million)

- 5.5.4.2. Europe Aerospace Materials Market, by Composite Type, 2016 – 2026 (Kilo Tons)

- 5.5.5. Europe Aerospace Materials Market, by Aircraft Type, 2016 – 2026

- 5.5.5.1. Europe Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 5.5.5.2. Europe Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 5.5.6. Germany

- 5.5.6.1. Germany Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.6.2. Germany Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.5.7. France

- 5.5.7.1. France Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.7.2. France Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.5.8. U.K.

- 5.5.8.1. U.K. Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.8.2. U.K. Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.5.9. Italy

- 5.5.9.1. Italy Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.9.2. Italy Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.5.10. Spain

- 5.5.10.1. Spain Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.10.2. Spain Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.5.11. Rest of Europe

- 5.5.11.1. Rest of Europe Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.5.11.2. Rest of Europe Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.5.1. Europe Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6. Asia Pacific

- 5.6.1. Asia Pacific Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.1.1. Asia Pacific Aerospace Materials Market, by Country, 2016 – 2026 (USD Million)

- 5.6.2. Asia Pacific Market, 2016 – 2026 (Kilo Tons)

- 5.6.2.1. Asia Pacific Aerospace Materials Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.6.3. Asia Pacific Aerospace Materials Market, by Type, 2016 – 2026

- 5.6.3.1. Asia Pacific Aerospace Materials Market, by Type, 2016 – 2026 (USD Million)

- 5.6.3.2. Asia Pacific Aerospace Materials Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.6.4. Asia Pacific Aerospace Materials Market, by Composite Type, 2016 – 2026

- 5.6.4.1. Asia Pacific Aerospace Materials Market, by Composite Type, 2016 – 2026 (USD Million)

- 5.6.4.2. Asia Pacific Aerospace Materials Market, by Composite Type, 2016 – 2026 (Kilo Tons)

- 5.6.5. Asia Pacific Aerospace Materials Market, by Aircraft Type, 2016 – 2026

- 5.6.5.1. Asia Pacific Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 5.6.5.2. Asia Pacific Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 5.6.6. China

- 5.6.6.1. China Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.6.2. China Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.6.7. Japan

- 5.6.7.1. Japan Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.7.2. Japan Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.6.8. India

- 5.6.8.1. India Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.8.2. India Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.6.9. South Korea

- 5.6.9.1. South Korea Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.9.2. South Korea Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.6.10. South-East Asia

- 5.6.10.1. South-East Asia Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.10.2. South-East Asia Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.6.11. Rest of Asia Pacific

- 5.6.11.1. Rest of Asia Pacific Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.6.11.2. Rest of Asia Pacific Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.6.1. Asia Pacific Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.7. Latin America

- 5.7.1. Latin America Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.7.1.1. Latin America Aerospace Materials Market, by Country, 2016 – 2026 (USD Million)

- 5.7.2. Latin America Market, 2016 – 2026 (Kilo Tons)

- 5.7.2.1. Latin America Aerospace Materials Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.7.3. Latin America Aerospace Materials Market, by Type, 2016 – 2026

- 5.7.3.1. Latin America Aerospace Materials Market, by Type, 2016 – 2026 (USD Million)

- 5.7.3.2. Latin America Aerospace Materials Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.7.4. Latin America Aerospace Materials Market, by Composite Type, 2016 – 2026

- 5.7.4.1. Latin America Aerospace Materials Market, by Composite Type, 2016 – 2026 (USD Million)

- 5.7.4.2. Latin America Aerospace Materials Market, by Composite Type, 2016 – 2026 (Kilo Tons)

- 5.7.5. Latin America Aerospace Materials Market, by Aircraft Type, 2016 – 2026

- 5.7.5.1. Latin America Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 5.7.5.2. Latin America Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 5.7.6. Brazil

- 5.7.6.1. Brazil Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.7.6.2. Brazil Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.7.7. Mexico

- 5.7.7.1. Mexico Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.7.7.2. Mexico Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.7.8. Rest of Latin America

- 5.7.8.1. Rest of Latin America Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.7.8.2. Rest of Latin America Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.7.1. Latin America Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.8. The Middle-East and Africa

- 5.8.1. The Middle-East and Africa Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.8.1.1. The Middle-East and Africa Aerospace Materials Market, by Country, 2016 – 2026 (USD Million)

- 5.8.2. The Middle-East and Africa Market, 2016 – 2026 (Kilo Tons)

- 5.8.2.1. The Middle-East and Africa Aerospace Materials Market, by Country, 2016 – 2026 (Kilo Tons)

- 5.8.3. The Middle-East and Africa Aerospace Materials Market, by Type, 2016 – 2026

- 5.8.3.1. The Middle-East and Africa Aerospace Materials Market, by Type, 2016 – 2026 (USD Million)

- 5.8.3.2. The Middle-East and Africa Aerospace Materials Market, by Type, 2016 – 2026 (Kilo Tons)

- 5.8.4. The Middle-East and Africa Aerospace Materials Market, by Composite Type, 2016 – 2026

- 5.8.4.1. The Middle-East and Africa Aerospace Materials Market, by Composite Type, 2016 – 2026 (USD Million)

- 5.8.4.2. The Middle-East and Africa Aerospace Materials Market, by Composite Type, 2016 – 2026 (Kilo Tons)

- 5.8.5. The Middle-East and Africa Aerospace Materials Market, by Aircraft Type, 2016 – 2026

- 5.8.5.1. The Middle-East and Africa Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (USD Million)

- 5.8.5.2. The Middle-East and Africa Aerospace Materials Market, by Aircraft Type, 2016 – 2026 (Kilo Tons)

- 5.8.6. GCC Countries

- 5.8.6.1. GCC Countries Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.8.6.2. GCC Countries Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.8.7. South Africa

- 5.8.7.1. South Africa Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.8.7.2. South Africa Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.8.8. Rest of Middle-East Africa

- 5.8.8.1. Rest of Middle-East Africa Aerospace Materials Market, 2016 – 2026 (USD Million)

- 5.8.8.2. Rest of Middle-East Africa Aerospace Materials Market, 2016 – 2026 (Kilo Tons)

- 5.8.1. The Middle-East and Africa Aerospace Materials Market, 2016 – 2026 (USD Million)

- Chapter 6 Aerospace Materials Production, Consumption, Export, Import by Regions

- 6.1. Global Aerospace Materials Production and Consumption, 2016 – 2026 (Kilo Tons)

- 6.2. Global Import and Export Analysis, by Region

- Chapter 7 Aerospace Materials Market – Competitive Landscape

- 7.1. Competitor Market Share – Revenue

- 7.2. Market Concentration Rate Analysis, Top 3 and Top 5 Players

- 7.3. Competitor Market Share – Vulume

- 7.4. Strategic Developments

- 7.4.1. Acquisitions and Mergers

- 7.4.2. New Products

- 7.4.3. Research & Development Activities

- Chapter 8 Company Profiles

- 8.1. Toray Industries, Inc.

- 8.1.1. Company Overview

- 8.1.2. Product/Service Portfulio

- 8.1.3. Toray Industries, Inc. Sales, Revenue, Price, and Gross Margin

- 8.1.4. Toray Industries, Inc. Revenue and Growth Rate

- 8.1.5. Toray Industries, Inc. Market Share

- 8.1.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.2. Cytec Sulvay Group.

- 8.2.1. Company Overview

- 8.2.2. Product/Service Portfulio

- 8.2.3. Cytec Sulvay Group. Sales, Revenue, Price, and Gross Margin

- 8.2.4. Cytec Sulvay Group. Revenue and Growth Rate

- 8.2.5. Cytec Sulvay Group. Market Share

- 8.2.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.3. Du Pont

- 8.3.1. Company Overview

- 8.3.2. Product/Service Portfulio

- 8.3.3. Du Pont Sales, Revenue, Price, and Gross Margin

- 8.3.4. Du Pont Revenue and Growth Rate

- 8.3.5. Du Pont Market Share

- 8.3.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.4. Alcoa Corporation.

- 8.4.1. Company Overview

- 8.4.2. Product/Service Portfulio

- 8.4.3. Alcoa Corporation. Sales, Revenue, Price, and Gross Margin

- 8.4.4. Alcoa Corporation. Revenue and Growth Rate

- 8.4.5. Alcoa Corporation. Market Share

- 8.4.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.5. Teijin Limited

- 8.5.1. Company Overview

- 8.5.2. Product/Service Portfulio

- 8.5.3. Teijin Limited Sales, Revenue, Price, and Gross Margin

- 8.5.4. Teijin Limited Revenue and Growth Rate

- 8.5.5. Teijin Limited Market Share

- 8.5.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.6. ATI Metals.

- 8.6.1. Company Overview

- 8.6.2. Product/Service Portfulio

- 8.6.3. ATI Metals. Sales, Revenue, Price, and Gross Margin

- 8.6.4. ATI Metals. Revenue and Growth Rate

- 8.6.5. ATI Metals. Market Share

- 8.6.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.7. Constellium N.V

- 8.7.1. Company Overview

- 8.7.2. Product/Service Portfulio

- 8.7.3. Constellium N.V Sales, Revenue, Price, and Gross Margin

- 8.7.4. Constellium N.V Revenue and Growth Rate

- 8.7.5. Constellium N.V Market Share

- 8.7.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.8. Kobe Steel Limited

- 8.8.1. Company Overview

- 8.8.2. Product/Service Portfulio

- 8.8.3. Kobe Steel Limited Sales, Revenue, Price, and Gross Margin

- 8.8.4. Kobe Steel Limited Revenue and Growth Rate

- 8.8.5. Kobe Steel Limited Market Share

- 8.8.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.9. Aleris

- 8.9.1. Company Overview

- 8.9.2. Product/Service Portfulio

- 8.9.3. Aleris Sales, Revenue, Price, and Gross Margin

- 8.9.4. Aleris Revenue and Growth Rate

- 8.9.5. Aleris Market Share

- 8.9.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.10. AMG N.V

- 8.10.1. Company Overview

- 8.10.2. Product/Service Portfulio

- 8.10.3. AMG N.V Sales, Revenue, Price, and Gross Margin

- 8.10.4. AMG N.V Revenue and Growth Rate

- 8.10.5. AMG N.V Market Share

- 8.10.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.11. Hexcel Corporation

- 8.11.1. Company Overview

- 8.11.2. Product/Service Portfulio

- 8.11.3. Hexcel Corporation Sales, Revenue, Price, and Gross Margin

- 8.11.4. Hexcel Corporation Revenue and Growth Rate

- 8.11.5. Hexcel Corporation Market Share

- 8.11.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.12. Koninklijke Ten Cate NV

- 8.12.1. Company Overview

- 8.12.2. Product/Service Portfulio

- 8.12.3. Koninklijke Ten Cate NV Sales, Revenue, Price, and Gross Margin

- 8.12.4. Koninklijke Ten Cate NV Revenue and Growth Rate

- 8.12.5. Koninklijke Ten Cate NV Market Share

- 8.12.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.13. Materion Corporation

- 8.13.1. Company Overview

- 8.13.2. Product/Service Portfulio

- 8.13.3. Materion Corporation Sales, Revenue, Price, and Gross Margin

- 8.13.4. Materion Corporation Revenue and Growth Rate

- 8.13.5. Materion Corporation Market Share

- 8.13.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.14. Sofitec

- 8.14.1. Company Overview

- 8.14.2. Product/Service Portfulio

- 8.14.3. Sofitec Sales, Revenue, Price, and Gross Margin

- 8.14.4. Sofitec Revenue and Growth Rate

- 8.14.5. Sofitec Market Share

- 8.14.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.15. Thyssenkrupp Aerospace

- 8.15.1. Company Overview

- 8.15.2. Product/Service Portfulio

- 8.15.3. Thyssenkrupp Aerospace Sales, Revenue, Price, and Gross Margin

- 8.15.4. Thyssenkrupp Aerospace Revenue and Growth Rate

- 8.15.5. Thyssenkrupp Aerospace Market Share

- 8.15.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.16. AMI Metals, Inc.

- 8.16.1. Company Overview

- 8.16.2. Product/Service Portfulio

- 8.16.3. AMI Metals, Inc. Sales, Revenue, Price, and Gross Margin

- 8.16.4. AMI Metals, Inc. Revenue and Growth Rate

- 8.16.5. AMI Metals, Inc. Market Share

- 8.16.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.17. Tata Advanced Materials Limited

- 8.17.1. Company Overview

- 8.17.2. Product/Service Portfulio

- 8.17.3. Tata Advanced Materials Limited Sales, Revenue, Price, and Gross Margin

- 8.17.4. Tata Advanced Materials Limited Revenue and Growth Rate

- 8.17.5. Tata Advanced Materials Limited Market Share

- 8.17.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.18. Hindalco-Almex Aerospace Limited

- 8.18.1. Company Overview

- 8.18.2. Product/Service Portfulio

- 8.18.3. Hindalco-Almex Aerospace Limited Sales, Revenue, Price, and Gross Margin

- 8.18.4. Hindalco-Almex Aerospace Limited Revenue and Growth Rate

- 8.18.5. Hindalco-Almex Aerospace Limited Market Share

- 8.18.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.19. Renegade Materials Corporation

- 8.19.1. Company Overview

- 8.19.2. Product/Service Portfulio

- 8.19.3. Renegade Materials Corporation Sales, Revenue, Price, and Gross Margin

- 8.19.4. Renegade Materials Corporation Revenue and Growth Rate

- 8.19.5. Renegade Materials Corporation Market Share

- 8.19.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.20. LEE Aerospace Inc.

- 8.20.1. Company Overview

- 8.20.2. Product/Service Portfulio

- 8.20.3. LEE Aerospace Inc. Sales, Revenue, Price, and Gross Margin

- 8.20.4. LEE Aerospace Inc. Revenue and Growth Rate

- 8.20.5. LEE Aerospace Inc. Market Share

- 8.20.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.21. Park Electrochemical Corporation.

- 8.21.1. Company Overview

- 8.21.2. Product/Service Portfulio

- 8.21.3. Park Electrochemical Corporation. Sales, Revenue, Price, and Gross Margin

- 8.21.4. Park Electrochemical Corporation. Revenue and Growth Rate

- 8.21.5. Park Electrochemical Corporation. Market Share

- 8.21.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.22. Avdel Private Limited

- 8.22.1. Company Overview

- 8.22.2. Product/Service Portfulio

- 8.22.3. Avdel Private Limited Sales, Revenue, Price, and Gross Margin

- 8.22.4. Avdel Private Limited Revenue and Growth Rate

- 8.22.5. Avdel Private Limited Market Share

- 8.22.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.23. SGL Group

- 8.23.1. Company Overview

- 8.23.2. Product/Service Portfulio

- 8.23.3. SGL Group Sales, Revenue, Price, and Gross Margin

- 8.23.4. SGL Group Revenue and Growth Rate

- 8.23.5. SGL Group Market Share

- 8.23.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.24. Kaiser Aluminum

- 8.24.1. Company Overview

- 8.24.2. Product/Service Portfulio

- 8.24.3. Kaiser Aluminum Sales, Revenue, Price, and Gross Margin

- 8.24.4. Kaiser Aluminum Revenue and Growth Rate

- 8.24.5. Kaiser Aluminum Market Share

- 8.24.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.25. Vsmpo Avisma Corporation

- 8.25.1. Company Overview

- 8.25.2. Product/Service Portfulio

- 8.25.3. Vsmpo Avisma Corporation Sales, Revenue, Price, and Gross Margin

- 8.25.4. Vsmpo Avisma Corporation Revenue and Growth Rate

- 8.25.5. Vsmpo Avisma Corporation Market Share

- 8.25.6. Recent Initiatives, Funding/VC Activities, and Technulogical Innovations

- 8.1. Toray Industries, Inc.

- Chapter 9 Aerospace Materials — Industry Analysis

- 9.1. Introduction and Taxonomy

- 9.2. Aerospace Materials Market – Key Trends

- 9.2.1. Market Drivers

- 9.2.2. Market Restraints

- 9.2.3. Market Opportunities

- 9.3. Value Chain Analysis

- 9.4. Key Mandates and Regulations

- 9.5. Technulogy Roadmap and Timeline

- 9.6. Aerospace Materials Market – Attractiveness Analysis

- 9.6.1. By Type

- 9.6.2. By Composite Type

- 9.6.3. By Aircraft Type

- 9.6.4. By Region

- Chapter 10 Raw Material Analysis

- 10.1. Aerospace Materials Key Raw Material Analysis

- 10.1.1. Key Raw Materials

- 10.1.2. Price Trend of Key Raw Materials

- 10.2. Key Suppliers of Raw Materials

- 10.3. Proportion of Manufacturing Cost Structure

- 10.3.1. Raw Materials Cost

- 10.3.2. Labor Cost

- 10.3.3. Manufacturing Expenses

- 10.3.4. Miscellaneous Expenses

- 10.4. Manufacturing Cost Analysis of Aerospace Materials

- 10.1. Aerospace Materials Key Raw Material Analysis

- Chapter 11 Industrial Chain, Sourcing Strategy, and Downstream Buyers

- 11.1. Aerospace Materials Industrial Chain Analysis

- 11.2. Upstream Raw Materials Sourcing

- 11.2.1. Risk Mitigation:

- 11.2.2. Supplier Relationships:

- 11.2.3. Business Processes:

- 11.2.4. Securing the Product:

- 11.3. Raw Materials Sources of Aerospace Materials Major Manufacturers

- 11.4. Downstream Buyers

- 11.5. Distributors/Traders List

- Chapter 12 Marketing Strategy Analysis, Distributors

- 12.1. Marketing Channel

- 12.2. Direct Marketing

- 12.3. Indirect Marketing

- 12.4. Marketing Channel Development Trends

- 12.5. Economic/Pulitical Environmental Change

- Chapter 13 Report Conclusion & Key Insights

- 13.1. Key Insights from Primary Interviews & Surveys Respondents

- 13.2. Key Takeaways from Analysts, Consultants, and Industry Leaders

- Chapter 14 Research Approach & Methodulogy

- 14.1. Report Description

- 14.2. Research Scope

- 14.3. Research Methodulogy

- 14.3.1. Secondary Research

- 14.3.2. Primary Research

- 14.3.3. Statistical Models

- 14.3.3.1. Company Share Analysis Model

- 14.3.3.2. Revenue Based Modeling

- 14.3.4. Research Limitations

Inquiry For Buying

Aerospace Materials

Request Sample

Aerospace Materials