Bunker Fuel Market Size, Share, and Trends Analysis Report

CAGR :

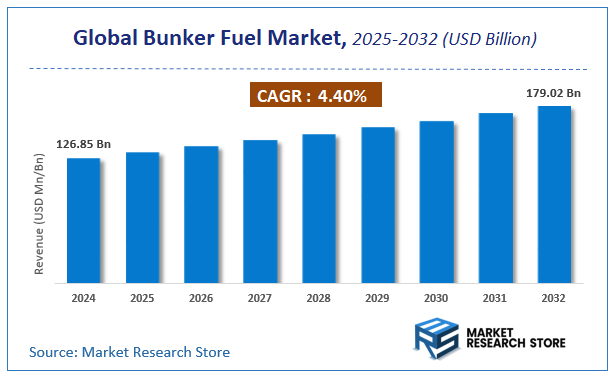

| Market Size 2024 (Base Year) | USD 126.85 Billion |

| Market Size 2032 (Forecast Year) | USD 179.02 Billion |

| CAGR | 4.4% |

| Forecast Period | 2025 - 2032 |

| Historical Period | 2020 - 2024 |

Market Research Store has published a report on the global bunker fuel market, estimating its value at USD 126.85 Billion in 2024, with projections indicating it will reach USD 179.02 Billion by the end of 2032. The market is expected to expand at a compound annual growth rate (CAGR) of around 4.4% over the forecast period. The report examines the factors driving market growth, the obstacles that could hinder this expansion, and the opportunities that may emerge in the bunker fuel industry. Additionally, it offers a detailed analysis of how these elements will affect demand dynamics and market performance throughout the forecast period.

To Get more Insights, Request a Free Sample

Bunker Fuel Market: Overview

The growth of the bunker fuel market is fueled by rising global demand across various industries and applications. The report highlights lucrative opportunities, analyzing cost structures, key segments, emerging trends, regional dynamics, and advancements by leading players to provide comprehensive market insights. The bunker fuel market report offers a detailed industry analysis from 2024 to 2032, combining quantitative and qualitative insights. It examines key factors such as pricing, market penetration, GDP impact, industry dynamics, major players, consumer behavior, and socio-economic conditions. Structured into multiple sections, the report provides a comprehensive perspective on the market from all angles.

Key sections of the bunker fuel market report include market segments, outlook, competitive landscape, and company profiles. Market Segments offer in-depth details based on Type, Commercial Distributor, Application, and other relevant classifications to support strategic marketing initiatives. Market Outlook thoroughly analyzes market trends, growth drivers, restraints, opportunities, challenges, Porter’s Five Forces framework, macroeconomic factors, value chain analysis, and pricing trends shaping the market now and in the future. The Competitive Landscape and Company Profiles section highlights major players, their strategies, and market positioning to guide investment and business decisions. The report also identifies innovation trends, new business opportunities, and investment prospects for the forecast period.

Key Highlights:

- As per the analysis shared by our research analyst, the global bunker fuel market is estimated to grow annually at a CAGR of around 4.4% over the forecast period (2025-2032).

- In terms of revenue, the global bunker fuel market size was valued at around USD 126.85 Billion in 2024 and is projected to reach USD 179.02 Billion by 2032.

- The market is projected to grow at a significant rate due to Growing global shipping and transportation activities, rising demand for cost-effective marine fuels, and increasing international trade are driving the Bunker Fuel market.

- Based on the Type, the High Sulfur Fuel Oil segment is growing at a high rate and will continue to dominate the global market as per industry projections.

- On the basis of Commercial Distributor, the Oil Majors segment is anticipated to command the largest market share.

- In terms of Application, the Bulk Carrier segment is projected to lead the global market.

- Based on region, Asia Pacific is projected to dominate the global market during the forecast period.

Bunker Fuel Market: Report Scope

This report thoroughly analyzes the bunker fuel market, exploring its historical trends, current state, and future projections. The market estimates presented result from a robust research methodology, incorporating primary research, secondary sources, and expert opinions. These estimates are influenced by the prevailing market dynamics as well as key economic, social, and political factors. Furthermore, the report considers the impact of regulations, government expenditures, and advancements in research and development on the market. Both positive and negative shifts are evaluated to ensure a comprehensive and accurate market outlook.

| Report Attributes | Report Details |

|---|---|

| Report Name | Bunker Fuel Market |

| Market Size in 2024 | USD 126.85 Billion |

| Market Forecast in 2032 | USD 179.02 Billion |

| Growth Rate | CAGR of 4.4% |

| Number of Pages | 202 |

| Key Companies Covered | Hindustan Petroleum Corporation Limited, Shell plc, BP p.l.c., TotalEnergies, Indian Oil Corporation Ltd., Exxon Mobil Corporation, Vitol Bunkers, LUKOIL, Petroliam Nasional Berhad (PETRONAS), Neste, Chevron Corporation, Bunker Holding A/S |

| Segments Covered | By Type, By Commercial Distributor, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, The Middle East and Africa (MEA) |

| Base Year | 2024 |

| Historical Year | 2018 to 2024 |

| Forecast Year | 2025 to 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Bunker Fuel Market: Dynamics

Key Growth Drivers :

The Bunker Fuel market is primarily driven by the robust expansion of global trade and maritime shipping activities. As international commerce continues to grow, so does the demand for the transportation of goods by sea, directly increasing the need for bunker fuel to power these vessels. The modernization and expansion of global shipping fleets, including the construction of larger container ships and specialized carriers, further contribute to this demand. Another significant driver is the relatively low cost of sea freight compared to other modes of transportation, which encourages its continued dominance for long-distance cargo movement. Additionally, the increasing exploration and production of offshore oil and gas necessitate the use of support vessels, tugs, and supply ships, all of which consume bunker fuel. The stability of crude oil prices, when favorable, also plays a role in supporting the demand for bunker fuel by making shipping more economically viable.

Restraints :

Despite the foundational demand from global trade, the Bunker Fuel market faces several significant restraints. A primary restraint is the stringent environmental regulations imposed by international bodies like the International Maritime Organization (IMO). The IMO 2020 sulfur cap, which limits sulfur content in marine fuels, has forced shippers to invest in compliant fuels (like VLSFO or MGO) or exhaust gas cleaning systems (scrubbers), which can be costly. This shift creates uncertainty and significant operational adjustments for ship operators. Volatility in crude oil prices is another major restraint; sudden price spikes or drops directly impact bunker fuel costs, affecting shipping companies' profitability and potentially leading to delayed voyages or reduced freight activity. Geopolitical tensions and trade wars can also disrupt global trade flows, consequently reducing demand for shipping and, by extension, bunker fuel. Furthermore, the push towards decarbonization in the shipping industry, with long-term goals for zero-emission vessels, creates an existential threat to traditional bunker fuels, as ship owners explore alternative fuels like LNG, methanol, ammonia, and even hydrogen.

Opportunities :

The Bunker Fuel market presents several key opportunities amidst its challenges. The ongoing global economic recovery and projected growth in emerging economies are expected to stimulate international trade, thereby boosting demand for maritime shipping and bunker fuels. The growing trend of digitalization and data analytics in the shipping industry offers opportunities for optimized fuel consumption through route planning, weather routing, and engine performance monitoring, which, while reducing overall consumption, can lead to more efficient bunker fuel procurement and management. The development and increasing availability of compliant fuels, such as Very Low Sulfur Fuel Oil (VLSFO) and Marine Gas Oil (MGO), as well as alternative fuels like Liquefied Natural Gas (LNG), methanol, and eventually ammonia and hydrogen, represent new market segments and opportunities for bunker fuel suppliers to diversify their offerings. Investment in bunkering infrastructure for these new fuels, especially in strategic ports, is a significant growth area. Furthermore, the expansion of global supply chains and the increasing complexity of logistics continue to rely heavily on maritime transport, securing a foundational demand for bunker fuels in the medium term.

Challenges :

The Bunker Fuel market is confronted with several critical challenges that require strategic navigation. The most significant challenge is the accelerating pace of decarbonization within the shipping industry. The IMO's ambitious greenhouse gas reduction targets are pushing for a rapid transition away from fossil fuels, compelling ship owners and operators to invest in future-proof technologies and alternative fuels, which will fundamentally change the composition of the bunker fuel market. The high cost and limited availability of alternative fuels and the necessary bunkering infrastructure for them pose immediate logistical and economic challenges. Ensuring compliance with evolving and increasingly stringent environmental regulations, not just concerning sulfur but also greenhouse gas emissions, demands continuous investment in research, development, and operational adjustments. Additionally, managing the price volatility of crude oil and its derivatives, which directly impacts bunker fuel costs, remains a perennial challenge for both suppliers and consumers, requiring sophisticated hedging strategies. The fragmented nature of the global bunkering industry, with numerous suppliers and varying quality standards, also presents challenges in ensuring consistent fuel quality and reliable supply chains across different ports.

Bunker Fuel Market: Segmentation Insights

The global bunker fuel market is segmented based on Type, Commercial Distributor, Application, and Region. All the segments of the bunker fuel market have been analyzed based on present & future trends and the market is estimated from 2024 to 2032.

Based on Type, the global bunker fuel market is divided into High Sulfur Fuel Oil, Low Sulfur Fuel Oil, Marine Gas Oil, Bio-LNG, Methanol, Ammonia, Hydrogen, Others.

On the basis of Commercial Distributor, the global bunker fuel market is bifurcated into Oil Majors, Large Independent, Small Independent.

In terms of Application, the global bunker fuel market is categorized into Bulk Carrier, Oil Tanker, General Cargo, Container Lines, Chemical Tanker, Fishing Vessels, Gas Tankers, Others.

Bunker Fuel Market: Regional Insights

The Asia-Pacific region overwhelmingly dominates the global bunker fuel market, with the ports of Singapore and Fujairah (UAE) being the world's largest bunkering hubs. This dominance is driven by the region's strategic location along major global shipping lanes, its role as the primary manufacturer and exporter of goods, and the high volume of container and bulk carrier traffic. While Europe and North America are key markets, Asia-Pacific's control of maritime trade routes and its massive port infrastructure solidify its leading position and influence in global bunker fuel pricing and consumption.

Bunker Fuel Market: Competitive Landscape

The bunker fuel market report offers a thorough analysis of both established and emerging players within the market. It includes a detailed list of key companies, categorized based on the types of products they offer and other relevant factors. The report also highlights the market entry year for each player, providing further context for the research analysis.

The "Global Bunker Fuel Market" study offers valuable insights, focusing on the global market landscape, with an emphasis on major industry players such as;

- Hindustan Petroleum Corporation Limited

- Shell plc

- BP p.l.c.

- TotalEnergies

- Indian Oil Corporation Ltd.

- Exxon Mobil Corporation

- Vitol Bunkers

- LUKOIL

- Petroliam Nasional Berhad (PETRONAS)

- Neste

- Chevron Corporation

- Bunker Holding A/S

The Global Bunker Fuel Market is Segmented as Follows:

By Type

- High Sulfur Fuel Oil

- Low Sulfur Fuel Oil

- Marine Gas Oil

- Bio-LNG

- Methanol

- Ammonia

- Hydrogen

- Others

By Commercial Distributor

- Oil Majors

- Large Independent

- Small Independent

By Application

- Bulk Carrier

- Oil Tanker

- General Cargo

- Container Lines

- Chemical Tanker

- Fishing Vessels

- Gas Tankers

- Others

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Frequently Asked Questions

Table Of Content

Table of Content 1 Bunker Fuel Market - Research Scope 1.1 Study Goals 1.2 Market Definition and Scope 1.3 Key Market Segments 1.4 Study and Forecasting Years 2 Bunker Fuel Market - Research Methodology 2.1 Methodology 2.2 Research Data Source 2.2.1 Secondary Data 2.2.2 Primary Data 2.2.3 Market Size Estimation 2.2.4 Legal Disclaimer 3 Bunker Fuel Market Forces 3.1 Global Bunker Fuel Market Size 3.2 Top Impacting Factors (PESTEL Analysis) 3.2.1 Political Factors 3.2.2 Economic Factors 3.2.3 Social Factors 3.2.4 Technological Factors 3.2.5 Environmental Factors 3.2.6 Legal Factors 3.3 Industry Trend Analysis 3.4 Industry Trends Under COVID-19 3.4.1 Risk Assessment on COVID-19 3.4.2 Assessment of the Overall Impact of COVID-19 on the Industry 3.4.3 Pre COVID-19 and Post COVID-19 Market Scenario 3.5 Industry Risk Assessment 4 Bunker Fuel Market - By Geography 4.1 Global Bunker Fuel Market Value and Market Share by Regions 4.1.1 Global Bunker Fuel Value ($) by Region (2015-2020) 4.1.2 Global Bunker Fuel Value Market Share by Regions (2015-2020) 4.2 Global Bunker Fuel Market Production and Market Share by Major Countries 4.2.1 Global Bunker Fuel Production by Major Countries (2015-2020) 4.2.2 Global Bunker Fuel Production Market Share by Major Countries (2015-2020) 4.3 Global Bunker Fuel Market Consumption and Market Share by Regions 4.3.1 Global Bunker Fuel Consumption by Regions (2015-2020) 4.3.2 Global Bunker Fuel Consumption Market Share by Regions (2015-2020) 5 Bunker Fuel Market - By Trade Statistics 5.1 Global Bunker Fuel Export and Import 5.2 United States Bunker Fuel Export and Import (2015-2020) 5.3 Europe Bunker Fuel Export and Import (2015-2020) 5.4 China Bunker Fuel Export and Import (2015-2020) 5.5 Japan Bunker Fuel Export and Import (2015-2020) 5.6 India Bunker Fuel Export and Import (2015-2020) 5.7 ... 6 Bunker Fuel Market - By Type 6.1 Global Bunker Fuel Production and Market Share by Types (2015-2020) 6.1.1 Global Bunker Fuel Production by Types (2015-2020) 6.1.2 Global Bunker Fuel Production Market Share by Types (2015-2020) 6.2 Global Bunker Fuel Value and Market Share by Types (2015-2020) 6.2.1 Global Bunker Fuel Value by Types (2015-2020) 6.2.2 Global Bunker Fuel Value Market Share by Types (2015-2020) 6.3 Global Bunker Fuel Production, Price and Growth Rate of Distillate Fuel Oil (2015-2020) 6.4 Global Bunker Fuel Production, Price and Growth Rate of Residual Fuel Oil (2015-2020) 6.5 Global Bunker Fuel Production, Price and Growth Rate of LNG (2015-2020) 7 Bunker Fuel Market - By Application 7.1 Global Bunker Fuel Consumption and Market Share by Applications (2015-2020) 7.1.1 Global Bunker Fuel Consumption by Applications (2015-2020) 7.1.2 Global Bunker Fuel Consumption Market Share by Applications (2015-2020) 7.2 Global Bunker Fuel Consumption and Growth Rate of Tanker Fleet (2015-2020) 7.3 Global Bunker Fuel Consumption and Growth Rate of Container Fleet (2015-2020) 7.4 Global Bunker Fuel Consumption and Growth Rate of Bulk and General Cargo Fleet (2015-2020) 7.5 Global Bunker Fuel Consumption and Growth Rate of Others (2015-2020) 8 North America Bunker Fuel Market 8.1 North America Bunker Fuel Market Size 8.2 United States Bunker Fuel Market Size 8.3 Canada Bunker Fuel Market Size 8.4 Mexico Bunker Fuel Market Size 8.5 The Influence of COVID-19 on North America Market 9 Europe Bunker Fuel Market Analysis 9.1 Europe Bunker Fuel Market Size 9.2 Germany Bunker Fuel Market Size 9.3 United Kingdom Bunker Fuel Market Size 9.4 France Bunker Fuel Market Size 9.5 Italy Bunker Fuel Market Size 9.6 Spain Bunker Fuel Market Size 9.7 The Influence of COVID-19 on Europe Market 10 Asia-Pacific Bunker Fuel Market Analysis 10.1 Asia-Pacific Bunker Fuel Market Size 10.2 China Bunker Fuel Market Size 10.3 Japan Bunker Fuel Market Size 10.4 South Korea Bunker Fuel Market Size 10.5 Southeast Asia Bunker Fuel Market Size 10.6 India Bunker Fuel Market Size 10.7 The Influence of COVID-19 on Asia Pacific Market 11 Middle East and Africa Bunker Fuel Market Analysis 11.1 Middle East and Africa Bunker Fuel Market Size 11.2 Saudi Arabia Bunker Fuel Market Size 11.3 UAE Bunker Fuel Market Size 11.4 South Africa Bunker Fuel Market Size 11.5 The Influence of COVID-19 on Middle East and Africa Market 12 South America Bunker Fuel Market Analysis 12.1 South America Bunker Fuel Market Size 12.2 Brazil Bunker Fuel Market Size 12.3 The Influence of COVID-19 on South America Market 13 Company Profiles 13.1 GAC 13.1.1 GAC Basic Information 13.1.2 GAC Product Profiles, Application and Specification 13.1.3 GAC Bunker Fuel Market Performance (2015-2020) 13.2 World Fuel Services 13.2.1 World Fuel Services Basic Information 13.2.2 World Fuel Services Product Profiles, Application and Specification 13.2.3 World Fuel Services Bunker Fuel Market Performance (2015-2020) 13.3 Glander 13.3.1 Glander Basic Information 13.3.2 Glander Product Profiles, Application and Specification 13.3.3 Glander Bunker Fuel Market Performance (2015-2020) 13.4 Gazpromneft 13.4.1 Gazpromneft Basic Information 13.4.2 Gazpromneft Product Profiles, Application and Specification 13.4.3 Gazpromneft Bunker Fuel Market Performance (2015-2020) 13.5 Chemoil 13.5.1 Chemoil Basic Information 13.5.2 Chemoil Product Profiles, Application and Specification 13.5.3 Chemoil Bunker Fuel Market Performance (2015-2020) 13.6 Lukoil-Bunker 13.6.1 Lukoil-Bunker Basic Information 13.6.2 Lukoil-Bunker Product Profiles, Application and Specification 13.6.3 Lukoil-Bunker Bunker Fuel Market Performance (2015-2020) 13.7 Aegean Marine Petroleum 13.7.1 Aegean Marine Petroleum Basic Information 13.7.2 Aegean Marine Petroleum Product Profiles, Application and Specification 13.7.3 Aegean Marine Petroleum Bunker Fuel Market Performance (2015-2020) 13.8 Lonyer Fuels 13.8.1 Lonyer Fuels Basic Information 13.8.2 Lonyer Fuels Product Profiles, Application and Specification 13.8.3 Lonyer Fuels Bunker Fuel Market Performance (2015-2020) 13.9 Bomin 13.9.1 Bomin Basic Information 13.9.2 Bomin Product Profiles, Application and Specification 13.9.3 Bomin Bunker Fuel Market Performance (2015-2020) 13.10 ChinaMarine Bunker Supply 13.10.1 ChinaMarine Bunker Supply Basic Information 13.10.2 ChinaMarine Bunker Supply Product Profiles, Application and Specification 13.10.3 ChinaMarine Bunker Supply Bunker Fuel Market Performance (2015-2020) 13.11 Bunker Holding 13.11.1 Bunker Holding Basic Information 13.11.2 Bunker Holding Product Profiles, Application and Specification 13.11.3 Bunker Holding Bunker Fuel Market Performance (2015-2020) 13.12 Petro China 13.12.1 Petro China Basic Information 13.12.2 Petro China Product Profiles, Application and Specification 13.12.3 Petro China Bunker Fuel Market Performance (2015-2020) 13.13 Sentek 13.13.1 Sentek Basic Information 13.13.2 Sentek Product Profiles, Application and Specification 13.13.3 Sentek Bunker Fuel Market Performance (2015-2020) 13.14 BP 13.14.1 BP Basic Information 13.14.2 BP Product Profiles, Application and Specification 13.14.3 BP Bunker Fuel Market Performance (2015-2020) 13.15 Shell 13.15.1 Shell Basic Information 13.15.2 Shell Product Profiles, Application and Specification 13.15.3 Shell Bunker Fuel Market Performance (2015-2020) 13.16 Shanghai Longer 13.16.1 Shanghai Longer Basic Information 13.16.2 Shanghai Longer Product Profiles, Application and Specification 13.16.3 Shanghai Longer Bunker Fuel Market Performance (2015-2020) 13.17 KPI Bridge Oil 13.17.1 KPI Bridge Oil Basic Information 13.17.2 KPI Bridge Oil Product Profiles, Application and Specification 13.17.3 KPI Bridge Oil Bunker Fuel Market Performance (2015-2020) 13.18 Dan-Bunkering 13.18.1 Dan-Bunkering Basic Information 13.18.2 Dan-Bunkering Product Profiles, Application and Specification 13.18.3 Dan-Bunkering Bunker Fuel Market Performance (2015-2020) 13.19 Exxon Mobil 13.19.1 Exxon Mobil Basic Information 13.19.2 Exxon Mobil Product Profiles, Application and Specification 13.19.3 Exxon Mobil Bunker Fuel Market Performance (2015-2020) 13.20 Gulf 13.20.1 Gulf Basic Information 13.20.2 Gulf Product Profiles, Application and Specification 13.20.3 Gulf Bunker Fuel Market Performance (2015-2020) 14 Market Forecast - By Regions 14.1 North America Bunker Fuel Market Forecast (2020-2025) 14.2 Europe Bunker Fuel Market Forecast (2020-2025) 14.3 Asia-Pacific Bunker Fuel Market Forecast (2020-2025) 14.4 Middle East and Africa Bunker Fuel Market Forecast (2020-2025) 14.5 South America Bunker Fuel Market Forecast (2020-2025) 15 Market Forecast - By Type and Applications 15.1 Global Bunker Fuel Market Forecast by Types (2020-2025) 15.1.1 Global Bunker Fuel Market Forecast Production and Market Share by Types (2020-2025) 15.1.2 Global Bunker Fuel Market Forecast Value and Market Share by Types (2020-2025) 15.2 Global Bunker Fuel Market Forecast by Applications (2020-2025)

Inquiry For Buying

Bunker Fuel

Request Sample

Bunker Fuel