Calorie Counter Software Market Size, Share, and Trends Analysis Report

CAGR :

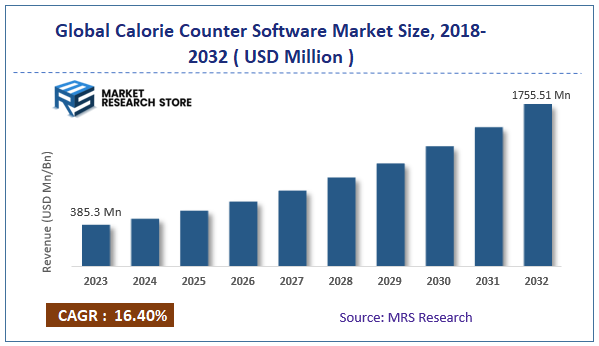

| Market Size 2023 (Base Year) | USD 385.3 Million |

| Market Size 2032 (Forecast Year) | USD 1755.51 Million |

| CAGR | 16.4% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global calorie counter software market size was valued at around USD 385.3 million in 2023 and is estimated to reach USD 1755.51 million by 2032, to register a CAGR of approximately 16.40% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The calorie counter software report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Calorie Counter Software Market: Overview

Calorie counter software is a digital tool designed to help individuals track and manage their daily calorie intake, typically as part of a broader health or fitness routine. This software allows users to log the foods they eat, estimate portion sizes, and calculate the calories consumed throughout the day.

Many calorie counter apps or platforms also provide nutritional breakdowns, including macronutrients like fats, proteins, and carbohydrates, helping users maintain balanced diets. Advanced versions may offer features like barcode scanning, personalized diet plans, progress tracking, and integration with wearable fitness devices.

Key Highlights

- The calorie counter software market is anticipated to grow at a CAGR of 16.40% during the forecast period.

- The global calorie counter software market was estimated to be worth approximately USD 385.3 million in 2023 and is projected to reach a value of USD 1755.51 million by 2032.

- The growth of the calorie counter software market is being driven by growing health awareness, the rising adoption of fitness applications, and the increasing number of individuals seeking to manage weight or improve their nutrition.

- Based on the type, the mobile applications segment is growing at a high rate and is projected to dominate the market.

- On the basis of platform, the android segment is projected to swipe the largest market share.

- In terms of end user, the individual user’s segment is expected to dominate the market.

- By region, North America is expected to dominate the global market during the forecast period.

Calorie Counter Software Market: Dynamics

Key Growth Drivers

- Rising health consciousness: Increasing awareness about the importance of healthy eating and weight management is driving the demand for calorie counter software.

- Technological advancements: Advancements in mobile technology and cloud computing have made it easier to develop and access calorie counter apps.

- Busy lifestyles: People with busy lifestyles are seeking convenient tools to track their calorie intake and make healthier food choices.

- Personalized nutrition plans: Calorie counter software can provide personalized nutrition plans based on individual goals and dietary needs.

Restraints

- Limited accuracy: The accuracy of calorie counting apps can vary depending on the quality of the food database and user input.

- User engagement: Maintaining consistent use of calorie counter apps can be challenging for some individuals.

- Data privacy concerns: Concerns about data privacy and security can deter users from sharing personal information with calorie counter apps.

- Cost: Some premium calorie counter apps may have subscription fees, which can be a barrier for budget-conscious users.

Opportunities

- Integration with wearable devices: Integrating calorie counter software with fitness trackers and smartwatches can provide a more comprehensive view of health and fitness data.

- Expansion into emerging markets: There is significant potential for growth in emerging markets with growing middle classes and increasing health awareness.

- Development of specialized features: Calorie counter apps can be tailored to specific dietary needs, such as vegan, vegetarian, or gluten-free diets.

- Partnerships with healthcare providers: Collaborations with healthcare providers can help promote the use of calorie counter software and integrate it into personalized health plans.

Challenges

- Competition: The calorie counter software market is highly competitive, with numerous players offering similar products.

- Regulatory compliance: Adherence to data privacy regulations, such as GDPR and CCPA, can be a challenge for software developers.

- User experience: Creating a user-friendly and engaging interface can be difficult, especially for users who may not be tech-savvy.

- Monetization: Finding sustainable revenue models, such as in-app purchases or subscriptions, can be a challenge for many calorie counter app developers.

Calorie Counter Software Market: Segmentation Insights

The global calorie counter software market is divided by type, platform, end-user, and region.

Segmentation Insights by Type

Based on type, the global calorie counter software market is divided into mobile applications, web-based software, and desktop applications.

In the calorie counter software market, mobile applications are the most dominant segment. Their popularity stems from the widespread use of smartphones and the convenience they offer. These apps allow users to track their daily caloric intake easily, providing features like barcode scanning, meal plan customization, and integration with fitness devices. The on-the-go accessibility of mobile apps makes them highly favored by users looking for real-time updates and a personalized experience, driving their dominance in the market.

Web-based software comes next, appealing to users who prefer using desktops or laptops for a more detailed and comprehensive approach to calorie tracking. These platforms often provide advanced tools for meal planning and nutrition analysis, making them popular with professionals such as nutritionists and fitness experts.

Desktop applications, though less common, are still significant, especially among users who prefer offline access or more feature-rich, stable solutions. These programs cater to users who value privacy or need advanced analytics, making them a preferred choice for niche markets.

Segmentation Insights by Platform

On the basis of platform, the global calorie counter software market is bifurcated into android, iOS, and windows.

In the calorie counter software market, Android is the most dominant platform. Its widespread adoption, particularly in developing regions, along with the affordability of Android devices, drives its prominence in this market.

The open-source nature of Android allows developers to create a wide variety of calorie counter apps, catering to different user preferences and needs. Android apps are accessible to a broad user base, offering features like barcode scanning, food logging, and integration with fitness wearables, which makes it the most popular platform for calorie tracking.

iOS follows closely, with its appeal largely rooted in its premium user base and high-quality apps. iOS apps often provide more polished user interfaces, seamless integration with other Apple devices like the Apple Watch, and secure data synchronization across devices.

iOS users are typically more inclined to spend on premium features, giving developers an incentive to offer subscription-based or premium versions of calorie tracking apps on this platform. The overall user experience on iOS makes it highly favored among fitness enthusiasts seeking a refined and efficient solution.

Windows, while not as dominant as Android or iOS, still has a presence in the market, particularly in the form of desktop applications. Windows-based calorie counter software caters to users who prefer tracking their health and nutrition on larger screens or in a more stable, offline environment.

Windows apps are often favored by users who require advanced features, in-depth reports, and the ability to manage their health data without relying on mobile devices. Though less common, Windows platforms provide a niche solution for users seeking desktop-based calorie tracking.

Segmentation Insights by End User

In terms of end-user, the global calorie counter software market is categorized into individual users, fitness centre’s & gyms, healthcare providers, and nutritionists & dieticians.

In the calorie counter software market, individual users represent the most dominant end-user segment. These users seek personal health and fitness management tools that allow them to track daily caloric intake, set fitness goals, and monitor progress conveniently.

The rising awareness of health and fitness, coupled with the accessibility of calorie counting apps on smartphones, has driven widespread adoption among individual users. These apps offer tailored features like meal planning, exercise logging, and progress tracking, making them popular for both casual fitness enthusiasts and those aiming for weight management.

Fitness centers & gyms form the next significant segment. Many gyms and fitness centers incorporate calorie counting software as part of their overall wellness programs. These facilities use such apps to help clients track their dietary habits, sync with workout plans, and optimize their training routines.

Integration with gym-specific fitness programs and wearable devices further enhances the appeal of these platforms for fitness centers, as they offer a more comprehensive approach to personal training and health management.

Healthcare providers, such as doctors and nutritionists, also utilize calorie counter software, albeit to a lesser extent. Healthcare providers use these tools to monitor patients' nutritional intake, especially those managing conditions like diabetes, obesity, or other dietary-related health issues.

Calorie tracking apps help healthcare professionals design personalized dietary recommendations and keep track of patient progress remotely, enabling more efficient and ongoing patient care.

Nutritionists & dieticians rely on calorie counter software as part of their professional practice. These professionals use the software to create personalized diet plans for their clients, track their food intake, and adjust their nutrition plans based on ongoing progress.

The ability to provide detailed nutrient analysis and offer customized dietary advice makes this software an essential tool in managing their clients' nutritional needs.

Calorie Counter Software Market: Report Scope

| Report Attributes | Report Details |

|---|---|

| Report Name | Calorie Counter Software Market |

| Market Size in 2023 | USD 385.3 Million |

| USD 1755.51 Million | |

| Growth Rate | CAGR of 16.40% |

| Number of Pages | 223 |

| Key Companies Covered | Cronometer, FatSecret, LIVESTRONG, MyFitnessPal, MyNetDiary, SubAssistant, Virtuagym, YAZIO, Lose It!, SparkPeople, Lifesum, My Diet Coach, Noom, Carb Manager, Fooducate, Dietsensor, Nutritionix Track, Fitbit, Samsung Health, HealthifyMe, and others. |

| Segments Covered | By Type, By Platform, By End-User, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Calorie Counter Software Market: Regional Insights

- North America is expected to dominates the global market

North America leads the calorie counter software market due to the widespread adoption of health and fitness apps in countries like the U.S. and Canada. The region's high smartphone usage, along with a strong focus on health and wellness, drives the demand for such apps.

The availability of advanced digital health ecosystems, coupled with a growing emphasis on personalized nutrition and fitness tracking, makes North America the dominant region in this market. Additionally, the presence of several key market players contributes to its leadership.

Europe is the second-largest market for calorie counter software, particularly in countries like the U.K., Germany, and France. The region’s growing focus on fitness, healthy eating habits, and lifestyle-related disease prevention is propelling the adoption of these applications.

Government initiatives promoting health awareness and the availability of localized calorie databases are supporting the growth in Europe. Moreover, consumers' increasing preference for mobile health solutions to track their diet and fitness routines contributes to the market's expansion.

Asia-Pacific is emerging as a significant player in the calorie counter software market, driven by the rising health consciousness among the middle-class population in countries such as China, India, Japan, and Australia. The growing penetration of smartphones, coupled with increasing urbanization and disposable income, is encouraging more people to adopt health and fitness apps.

Moreover, cultural shifts toward fitness and wellness in these countries are boosting the adoption of calorie counter software. Local developers are also creating apps tailored to regional dietary habits, which enhances market growth in the region.

Latin America is witnessing moderate growth in the calorie counter software market. Countries like Brazil and Mexico are key contributors, where the rising prevalence of obesity and lifestyle diseases is pushing people to adopt health-tracking apps. The region's growing mobile user base and increasing interest in fitness and wellness are driving demand.

However, compared to North America and Europe, the adoption rate is slower due to economic constraints and lesser awareness of digital health solutions in some parts of the region.

The Middle East and Africa represent the smallest share of the calorie counter software market. Adoption in this region is limited due to lower smartphone penetration, economic challenges, and limited awareness of digital health solutions.

However, there is potential for growth as smartphone usage increases and health awareness campaigns gain traction, particularly in more developed parts of the region like the UAE and South Africa. As the fitness trend grows and mobile health infrastructure improves, the region may see gradual uptake in the coming years.

Calorie Counter Software Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the calorie counter software market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global calorie counter software market include:

- Cronometer

- FatSecret

- LIVESTRONG

- MyFitnessPal

- MyNetDiary

- SubAssistant

- Virtuagym

- YAZIO

- Lose It!

- SparkPeople

- Lifesum

- My Diet Coach

- Noom

- Carb Manager

- Fooducate

- Dietsensor

- Nutritionix Track

- Fitbit

- Samsung Health

- HealthifyMe

The global calorie counter software market is segmented as follows:

By Type

- Mobile Applications

- Web-based Software

- Desktop Applications

By Platform

- Android

- iOS

- Windows

By End-User

- Individual Users

- Fitness Centers and Gyms

- Healthcare Providers

- Nutritionists and Dieticians

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global calorie counter software market size was projected at approximately US$ 385.3 million in 2023. Projections indicate that the market is expected to reach around US$ 1755.51 million in revenue by 2032.

The global calorie counter software market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 16.40% during the forecast period from 2024 to 2032.

North America is expected to dominate the global calorie counter software market.

The significant factors driving the global calorie counter software market include rising health awareness, increasing adoption of fitness and wellness apps, and the growing prevalence of smartphones, which facilitate easy access to digital health management tools.

Some of the prominent players operating in the global calorie counter software market are; Cronometer, FatSecret, LIVESTRONG, MyFitnessPal, MyNetDiary, SubAssistant, Virtuagym, YAZIO, Lose It!, SparkPeople, Lifesum, My Diet Coach, Noom, Carb Manager, Fooducate, Dietsensor, Nutritionix Track, Fitbit, Samsung Health, HealthifyMe, and others.

Table Of Content

Inquiry For Buying

Calorie Counter Software

Request Sample

Calorie Counter Software