Detection Electronic Article Surveillance (EAS) Market Size, Share, and Trends Analysis Report

CAGR :

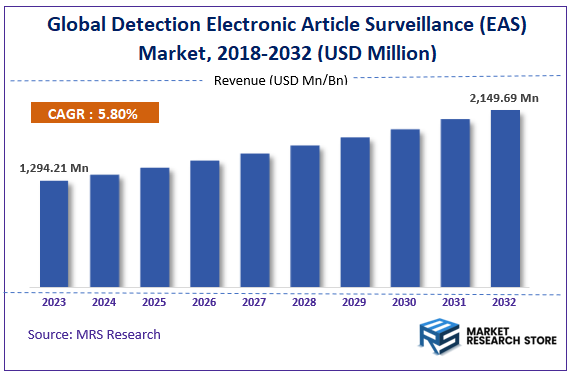

| Market Size 2023 (Base Year) | USD 1294.21 Million |

| Market Size 2032 (Forecast Year) | USD 2149.69 Million |

| CAGR | 5.8% |

| Forecast Period | 2024 - 2032 |

| Historical Period | 2018 - 2023 |

According to Market Research Store, the global detection electronic article surveillance (EAS) market size was valued at around USD 1294.21 million in 2023 and is estimated to reach USD 2149.69 million by 2032, to register a CAGR of approximately 5.80% in terms of revenue during the forecast period 2024-2032.

To Get more Insights, Request a Free Sample

The detection electronic article surveillance (EAS) report provides a comprehensive analysis of the market, including its size, share, growth trends, revenue details, and other crucial information regarding the target market. It also covers the drivers, restraints, opportunities, and challenges till 2032.

Global Detection Electronic Article Surveillance (EAS) Market: Overview

Electronic Article Surveillance (EAS) is a security technology commonly used in retail environments to prevent shoplifting by detecting the unauthorized removal of items from stores. EAS systems typically consist of three components: tags or labels attached to merchandise, detection systems positioned at store exits, and deactivators or detachers at checkout points. When a tagged item passes through the detection system without deactivation, an alarm is triggered, alerting store personnel to potential theft. The technology works on various mechanisms, including radio-frequency (RF), acousto-magnetic (AM), electromagnetic, and microwave systems, each with specific applications based on store requirements and merchandise type.

Key Highlights

- The detection electronic article surveillance (EAS) market is anticipated to grow at a CAGR of 5.80% during the forecast period.

- The global detection electronic article surveillance (EAS) market was estimated to be worth approximately USD 1294.21 million in 2023 and is projected to reach a value of USD 2149.69 million by 2032.

- The growth of the detection electronic article surveillance (EAS) market is being driven by increasing retail theft concerns, technological advancements, and the rise of organized retail crime.

- Based on the type, the radio frequency identification (RFID) system segment is growing at a high rate and is projected to dominate the market.

- On the basis of application, the clothing & fashion accessories segment is projected to swipe the largest market share.

- By region, North America is expected to dominate the global market during the forecast period.

Detection Electronic Article Surveillance (EAS) Market: Dynamics

Key Growth Drivers:

- Rising Retail Theft: Increasing incidents of shoplifting and organized retail crime are driving the need for effective security solutions like EAS.

- Advancements in EAS Technology: The development of advanced EAS systems with enhanced detection capabilities and reduced false alarms is boosting market growth.

- Expansion of Retail Sector: The global expansion of retail chains and the growth of e-commerce are creating new opportunities for EAS solutions.

Restraints:

- High Initial Investment Costs: The installation and maintenance of EAS systems can be expensive, particularly for small and medium-sized retailers.

- False Alarms: Ineffective system calibration or outdated technology can lead to false alarms, frustrating customers and impacting store operations.

Opportunities:

- Integration with RFID Technology: Combining EAS with RFID can provide enhanced inventory management and loss prevention capabilities.

- Emergence of Smart Retail: The adoption of smart store technologies, such as AI-powered analytics, can further optimize EAS systems and improve security.

Challenges:

- Complex Installation and Maintenance: EAS systems require specialized installation and ongoing maintenance, which can be challenging for retailers without technical expertise.

- Evolving Retail Landscape: The rapid evolution of retail trends, such as omnichannel retailing, can pose challenges in adapting EAS solutions to changing business models.

Detection Electronic Article Surveillance (EAS) Market: Report Scope

0 , , ,

| Report Attributes | Report Details |

|---|---|

| Report Name | Detection Electronic Article Surveillance (EAS) Market |

| Market Size in 2023 | USD 1,294.21 Million |

| Market Forecast in 2032 | USD 2,149.69 Million |

| Growth Rate | CAGR of 5.80% |

| Number of Pages | 140 |

| Key Companies Covered | Checkpoint Systems, Tyco Retail Solutions, Nedap, Hangzhou Century Co. Ltd, Gunnebo Gateway, WGSPI, Ketec, All Tag, Universal Surveillance Systems, and others. |

| Segments Covered | By Type, By Application, and By Region |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Base Year | 2023 |

| Historical Year | 2018 to 2022 |

| Forecast Year | 2024 - 2032 |

| Customization Scope | Avail customized purchase options to meet your exact research needs. Request For Customization |

Detection Electronic Article Surveillance (EAS) Market: Segmentation Insights

The global detection electronic article surveillance (EAS) market is divided by type, application, and region.

Segmentation Insights by Type

Based on type, the global detection electronic article surveillance (EAS) market is divided into radio frequency identification (RFID) system, acoustic magnetic (AM) anti-theft system, radio frequency (RF) system, electromagnetic wave (EM) anti-theft system, and other.

The detection electronic article surveillance (EAS) market offers various anti-theft solutions, categorized by distinct system types. Among these, the Radio Frequency Identification (RFID) System holds a dominant position due to its advanced tracking capabilities and widespread adoption across various retail sectors. RFID systems provide a reliable and efficient way to monitor and identify products through the use of radio waves. This system allows for real-time tracking of inventory and facilitates enhanced theft prevention by notifying store personnel of any unauthorized removal of tagged items. Its compatibility with existing point-of-sale (POS) systems and versatility in integration make RFID a highly preferred option for both inventory management and theft prevention.

Following RFID, the Acoustic Magnetic (AM) Anti-Theft System is a popular choice, especially for retailers dealing in high-value items or environments prone to frequent theft attempts. AM systems function using a magnetic field that detects tag disturbances, alerting staff to potential theft. This system’s high detection rate and ability to cover large store areas with minimal interference make it ideal for stores where consistent and reliable surveillance is essential. The durability of AM tags, combined with their resistance to interference from metallic items, further bolsters its demand in sectors such as electronics and clothing retail.

The Radio Frequency (RF) System is another significant segment in the detection electronic article surveillance (EAS) market, favored for its affordability and ease of use. RF systems employ radio frequency waves to identify tags attached to merchandise. Although generally less advanced than RFID, RF systems offer effective basic protection against theft, making them a popular choice among smaller retailers and budget-conscious establishments. Their cost-effectiveness and efficiency in preventing shoplifting make RF systems a practical choice for businesses with straightforward surveillance needs.

Electromagnetic Wave (EM) Anti-Theft Systems hold a niche yet essential role in the market, particularly in applications requiring discreet tagging. EM systems utilize magnetic fields to detect the presence of tags and are especially useful in environments like libraries and pharmacies, where small tags can be easily concealed within products. EM systems are also valued for their reusability and adaptability, enabling efficient tracking of small items while maintaining an unobtrusive setup.

Segmentation Insights by Application

On the basis of application, the global detection electronic article surveillance (EAS) market is bifurcated into clothing & fashion accessories, cosmetics/pharmacy, supermarkets & large grocery, and others.

In the application-based segmentation of the detection electronic article surveillance (EAS) market, Clothing & Fashion Accessories represents the largest and most prominent sector. Retailers in this industry face significant losses from shoplifting, making EAS systems crucial for minimizing theft and improving inventory management. EAS tags on apparel and accessories are easy to apply and remove at the point of sale, and the technology is widely accepted by consumers. RFID and AM systems, in particular, are popular in this sector due to their effectiveness in monitoring high-value items and providing real-time stock data, making them indispensable in modern retail environments.

The Cosmetics/Pharmacy sector is another vital application area, driven by the high-value and compact nature of many products, which are prone to theft. EAS solutions, including EM and RFID systems, are frequently used in this sector because they can be embedded in small and concealed products without compromising functionality or consumer experience. These systems allow pharmacies and cosmetics stores to efficiently monitor inventory while ensuring that products are easily accessible to customers. Additionally, some pharmacies integrate EAS with inventory management systems to track prescription medications and prevent unauthorized removal, enhancing both security and customer service.

Supermarkets & Large Grocery Stores also rely heavily on EAS systems, though the application is more complex given the broad range of items that need to be monitored. These stores often employ RF systems for affordability and broad-area coverage, tagging high-value items or frequently stolen products. With EAS systems, supermarkets and grocery stores can reduce shrinkage from shoplifting, contributing to lower inventory losses and improved operational efficiency. Some stores are increasingly adopting RFID for higher-value categories, such as alcohol and electronics, to provide seamless inventory tracking alongside theft prevention.

Detection Electronic Article Surveillance (EAS) Market: Regional Insights

- North America is expected to dominates the global market

North America leads the EAS market due to the region's extensive adoption of advanced retail security technologies and its large retail sector. High awareness of shrinkage issues, coupled with major retailers investing in cutting-edge EAS systems, bolsters North America's dominance. The U.S. contributes significantly, with major players and consistent demand for effective loss prevention solutions. Retailers here prioritize customer satisfaction and reduced theft, driving innovation in RFID and magnetic-based EAS technologies.

Europe ranks as the second most dominant region in the EAS market, propelled by its robust retail industry and strict regulations surrounding retail security. Western Europe, especially countries like Germany, France, and the UK, drives growth with retailers adopting EAS to minimize losses and comply with stringent security standards. The widespread use of RFID-based EAS systems in retail and department stores reflects a preference for advanced technologies that offer precise detection and improved inventory management.

The Asia-Pacific region is rapidly expanding in the EAS market, largely driven by its growing retail sector in emerging economies like China, India, and Southeast Asia. As urbanization and consumer spending increase, so does the need for efficient security solutions to combat rising instances of shoplifting. Local and international retailers in densely populated markets are increasingly implementing EAS systems to protect assets and enhance customer trust, with RFID and acoustomagnetic technologies gaining traction due to their affordability and reliability.

Latin America is witnessing steady growth in the EAS market, led by countries such as Brazil and Mexico, where retailers are increasingly focusing on minimizing losses due to shoplifting. Economic challenges have historically limited investment in retail security; however, recent shifts toward organized retail and an uptick in disposable income are prompting retailers to adopt affordable EAS solutions. The demand for robust yet cost-effective systems, especially in mid-sized retail chains, supports the market in this region.

The Middle East and Africa, though the smallest regional market for EAS systems, show potential for growth due to the expansion of the retail sector and an increasing awareness of theft prevention. The UAE, Saudi Arabia, and South Africa are leading in EAS adoption as modern retail formats develop and security awareness grows. While adoption remains limited to high-value retail segments, gradual economic development and investments in modern retail infrastructure may increase EAS demand in the future.

Detection Electronic Article Surveillance (EAS) Market: Competitive Landscape

The report provides an in-depth analysis of companies operating in the detection electronic article surveillance (EAS) market, including their geographic presence, business strategies, product offerings, market share, and recent developments. This analysis helps to understand market competition.

Some of the major players in the global detection electronic article surveillance (EAS) market include:

- Checkpoint Systems

- Tyco Retail Solutions

- Nedap

- Hangzhou Century Co. Ltd

- Gunnebo Gateway

- WGSPI

- Ketec

- All Tag

- Universal Surveillance Systems

The global detection electronic article surveillance (EAS) market is segmented as follows:

By Type

- Radio Frequency Identification (RFID) System

- Acoustic Magnetic (AM) Anti-Theft System

- Radio Frequency (RF) System

- Electromagnetic Wave (EM) Anti-Theft System

- Other

By Application

- Clothing &Fashion Accessories

- Cosmetics/Pharmacy

- Supermarkets & Large Grocery

- Others

By Region

- North America

- U.S.

- Canada

- Europe

- U.K.

- France

- Germany

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Rest of Latin America

- The Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East Africa

Frequently Asked Questions

Based on statistics from the Market Research Store, the global detection electronic article surveillance (EAS) market size was projected at approximately US$ 1294.21 million in 2023. Projections indicate that the market is expected to reach around US$ 2149.69 million in revenue by 2032.

The global detection electronic article surveillance (EAS) market is expected to grow at a Compound Annual Growth Rate (CAGR) of around 5.80% during the forecast period from 2024 to 2032.

North America is expected to dominate the global detection electronic article surveillance (EAS) market.

The global detection electronic article surveillance (EAS) market is driven by the rising need to prevent retail theft, technological advancements in detection and tagging, and the increasing adoption of EAS systems by major retailers.

Some of the prominent players operating in the global detection electronic article surveillance (EAS) market are; Checkpoint Systems, Tyco Retail Solutions, Nedap, Hangzhou Century Co. Ltd, Gunnebo Gateway, WGSPI, Ketec, All Tag, Universal Surveillance Systems, and others.

The global detection electronic article surveillance (EAS) market report provides a comprehensive analysis of market definitions, growth factors, opportunities, challenges, geographic trends, and competitive dynamics.

Table Of Content

Inquiry For Buying

Detection Electronic Article Surveillance (EAS)

Request Sample

Detection Electronic Article Surveillance (EAS)